Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Defination All

Caricato da

rajib4560 valutazioniIl 0% ha trovato utile questo documento (0 voti)

67 visualizzazioni3 paginesome of the definition is here .that is the important definition.

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentosome of the definition is here .that is the important definition.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

67 visualizzazioni3 pagineDefination All

Caricato da

rajib456some of the definition is here .that is the important definition.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

DEFINITION of 'Commercial Paper'

An unsecured, short-term debt instrument issued by a corporation, typically for the

financing of accounts receivable, inventories and meeting short-term liabilities. Maturities

on commercial paper rarely range any longer than 270 days. The debt is usually issued

at a discount, reflecting prevailing market interest rates.

DEFINITION of 'Fixed Cost'

A cost that does not change with an increase or decrease in the amount of goods or

services produced. Fixed costs are expenses that have to be paid by a company,

independent of any business activity. It is one of the two components of the total cost of

a good or service, along with variable cost.

DEFINITION of 'Circuit Breaker'

Refers to any of the measures used by stock exchanges during large sell-offs to avert

panic selling. Sometimes called a "collar."

DEFINITION of 'Crowding Out Effect'

An economic concept where increased public sector spending replaces, or drives down,

private sector spending. Crowding out refers to when government must finance its

spending with taxes and/or with deficit spending, leaving businesses with less money

and effectively "crowding them out."

DEFINITION of 'Dividend Discount Model - DDM'

A procedure for valuing the price of a stock by using predicted dividends and discounting

them back to present value. The idea is that if the value obtained from the DDM is higher

than what the shares are currently trading at, then the stock is undervalued.

DEFINITION of 'Capital Asset Pricing Model - CAPM'

A model that describes the relationship between risk and expected return and that is

used in the pricing of risky securities.

DEFINITION of 'Market Segmentation Theory'

A modern theory pertaining to interest rates stipulating that there is no necessary

relationship between long and short-term interest rates. Furthermore, short and longterm markets fall into two different categories. Therefore, the yield curve is shaped

according to the supply and demand of securities within each maturity length.

DEFINITION of 'Over-The-Counter Market'

A decentralized market, without a central physical location, where market participants

trade with one another through various communication modes such as the telephone,

email and proprietary electronic trading systems. An over-the-counter (OTC) market and

an exchange market are the two basic ways of organizing financial markets. In an OTC

market, dealers act as market makers by quoting prices at which they will buy and sell a

security or currency. A trade can be executed between two participants in an OTC

market without others being aware of the price at which the transaction was effected. In

general, OTC markets are therefore less transparent than exchanges and are also

subject to fewer regulations.

DEFINITION of 'Repurchase Agreement - Repo'

A form of short-term borrowing for dealers in government securities. The dealer sells the

government securities to investors, usually on an overnight basis, and buys them back

the following day.

DEFINITION of 'Price-Earnings Ratio - P/E Ratio'

A valuation ratio of a company's current share price compared to its per-share earnings.

Calculated as:

Market Value per Share / Earnings per Share (EPS)

DEFINITION of 'Margin'

1. Borrowed money that is used to purchase securities. This practice is referred to as

"buying on margin".

2. The amount of equity contributed by a customer as a percentage of the current market

value of the securities held in a margin account.

3. In a general business context, the difference between a product's (or service's) selling

price and the cost of production.

Potrebbero piacerti anche

- Session 7 CommDocumento16 pagineSession 7 Commrajib456Nessuna valutazione finora

- Juvenile Delinquency Prevention and Youth CrimeDocumento24 pagineJuvenile Delinquency Prevention and Youth Crimerajib456Nessuna valutazione finora

- Juvenile DelinquencyDocumento24 pagineJuvenile DelinquencyWilliam TanNessuna valutazione finora

- Tofail Asks Saudi Investors To Invest More in BD: Published: 23 May 2016, 20:35:34 - Updated: 23 May 2016, 20:48:10Documento1 paginaTofail Asks Saudi Investors To Invest More in BD: Published: 23 May 2016, 20:35:34 - Updated: 23 May 2016, 20:48:10rajib456Nessuna valutazione finora

- Chapter 7 An Introduction To Portfolio ManagementDocumento10 pagineChapter 7 An Introduction To Portfolio ManagementFahad AliNessuna valutazione finora

- Grameen Phone Marketing MixDocumento34 pagineGrameen Phone Marketing MixBright Costa94% (17)

- Grameen Phone Marketing MixDocumento34 pagineGrameen Phone Marketing MixBright Costa94% (17)

- Ch7 CXCDocumento35 pagineCh7 CXCrajib456Nessuna valutazione finora

- Some Bank Financial AnalysisDocumento58 pagineSome Bank Financial Analysisrajib456Nessuna valutazione finora

- Chapter 7 An Introduction To Portfolio ManagementDocumento10 pagineChapter 7 An Introduction To Portfolio ManagementFahad AliNessuna valutazione finora

- Surplus Deficit Spending UnitsDocumento2 pagineSurplus Deficit Spending Unitsrajib456Nessuna valutazione finora

- Mps Juldec2015Documento14 pagineMps Juldec2015rajib456Nessuna valutazione finora

- StudyDocumento1 paginaStudyrajib456Nessuna valutazione finora

- Surplus Deficit Spending UnitsDocumento2 pagineSurplus Deficit Spending Unitsrajib456Nessuna valutazione finora

- Surplus Deficit Spending UnitsDocumento2 pagineSurplus Deficit Spending Unitsrajib456Nessuna valutazione finora

- TVM TablesDocumento2 pagineTVM Tablesanmol_sidNessuna valutazione finora

- Surplus Deficit Spending UnitsDocumento2 pagineSurplus Deficit Spending Unitsrajib456Nessuna valutazione finora

- Surplus Deficit Spending UnitsDocumento2 pagineSurplus Deficit Spending Unitsrajib456Nessuna valutazione finora

- Surplus Deficit Spending UnitsDocumento2 pagineSurplus Deficit Spending Unitsrajib456Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Bank LIBFCDocumento8 pagineBank LIBFCLancau CibaiNessuna valutazione finora

- Money Growth Inflation GuideDocumento2 pagineMoney Growth Inflation GuideQuy Nguyen QuangNessuna valutazione finora

- Finance areas interconnectionDocumento3 pagineFinance areas interconnectionCASTOR, Vincent PaulNessuna valutazione finora

- Zimsec - Nov - 2016 - Ms 3Documento9 pagineZimsec - Nov - 2016 - Ms 3Wesley KisiNessuna valutazione finora

- Sample Midterm Exam 2 Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkDocumento2 pagineSample Midterm Exam 2 Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkRick CortezNessuna valutazione finora

- National IncomeDocumento29 pagineNational Incomeshahidul0Nessuna valutazione finora

- APAC SME Banking Conference 2013Documento5 pagineAPAC SME Banking Conference 2013snazruliNessuna valutazione finora

- FCFE TemplateDocumento9 pagineFCFE TemplateSelva Bavani SelwaduraiNessuna valutazione finora

- Sir Osborne Smith 01-04-1935 To 30-06-1937Documento6 pagineSir Osborne Smith 01-04-1935 To 30-06-1937Chintan P. ModiNessuna valutazione finora

- Financial Regulatory Framework Multiple Choice QuestionsDocumento13 pagineFinancial Regulatory Framework Multiple Choice QuestionsNaziya TamboliNessuna valutazione finora

- CF (MBF131) Exam QDocumento13 pagineCF (MBF131) Exam QSai Set NaingNessuna valutazione finora

- Booking 1059985616Documento2 pagineBooking 1059985616Deni SetiawanNessuna valutazione finora

- Business Combination Lecture Notes. ACC 401Documento4 pagineBusiness Combination Lecture Notes. ACC 401Ugbah Chidinma LilianNessuna valutazione finora

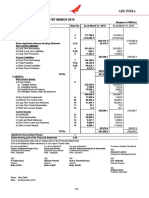

- Balance Sheet As at 31st March 2015Documento1 paginaBalance Sheet As at 31st March 2015Mrigul UppalNessuna valutazione finora

- Chapter 6Documento13 pagineChapter 6Princesskim MacapulayNessuna valutazione finora

- Hill Country CaseDocumento5 pagineHill Country CaseDeepansh Kakkar100% (1)

- EXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsDocumento37 pagineEXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsAnonymous Lih1laaxNessuna valutazione finora

- ITC Group Company ProfileDocumento19 pagineITC Group Company ProfileNeel ThobhaniNessuna valutazione finora

- Deposit Account AgreementDocumento23 pagineDeposit Account AgreementarayNessuna valutazione finora

- What Is A LOT in Forex Trading - Lot Sizes ExplainedDocumento23 pagineWhat Is A LOT in Forex Trading - Lot Sizes Explainedomar lakhrash100% (2)

- Interest Rates: Type Interest Rate Savings AccountDocumento16 pagineInterest Rates: Type Interest Rate Savings Accountrohanfyaz00Nessuna valutazione finora

- Impact of Money Supply On Economic Growth of BangladeshDocumento9 pagineImpact of Money Supply On Economic Growth of BangladeshSarabul Islam Sajbir100% (2)

- Revenue Code 2023Documento113 pagineRevenue Code 2023Mark Andrei GubacNessuna valutazione finora

- Receivable Financing: Pledge, Assignment and FactoringDocumento35 pagineReceivable Financing: Pledge, Assignment and FactoringMARY GRACE VARGASNessuna valutazione finora

- Use IGST credit for payment of IGSTDocumento10 pagineUse IGST credit for payment of IGSTD Y Patil Institute of MCA and MBANessuna valutazione finora

- Change Your Life PDF FreeDocumento51 pagineChange Your Life PDF FreeJochebed MukandaNessuna valutazione finora

- Bbs Credit RatingsDocumento25 pagineBbs Credit RatingsShivya GuptaNessuna valutazione finora

- Security Analysis and Portfolio Management, Bond Market in India.Documento26 pagineSecurity Analysis and Portfolio Management, Bond Market in India.Gagandeep Singh BangarNessuna valutazione finora

- Pre-Advice Swift Mt-799 Sblc/B.G. VerbiageDocumento2 paginePre-Advice Swift Mt-799 Sblc/B.G. Verbiagenavid kamravaNessuna valutazione finora

- HW Assignment 3Documento6 pagineHW Assignment 3Jeremiah Faulkner0% (1)