Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Pds BSN An Naim Home - Bi

Caricato da

Mohd NizamuddinTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Pds BSN An Naim Home - Bi

Caricato da

Mohd NizamuddinCopyright:

Formati disponibili

PRODUCT DISCLOSURE SHEET

BANK SIMPANAN NASIONAL

(Read this Product Disclosure Sheet before you

decide to take out the BSN AN NAIM Home

Financing-i Packages Floating Rates.

Be sure to also read the terms and conditions in the

letter of offer.

Seek clarification from Bank Simpanan Nasional if

you do not understand any part of this document or

the general terms).

BSN AN NAIM Home Financing-i

Packages- Floating Rates

Date :

(To be completed in by Sales / Branch Personnel)

1. What is this product about?

This facility is offered for financing a purchase of property either completed/under construction, refinancing or sub-sale.

The selling price of the property shall be calculated at a Contracted Profit Rate (CPR) and repayable by deferred

payment. However you are eligible to enjoy rebate (Ibra).

The monthly installment of this facility will fluctuate and vary depending on the Effective Profit Rate (EPR) however the

instalment shall not exceed the selling price that has been agreed upon upfront.

Ibra will be given upon full settlement.

2. What is the Shariah concept applicable?

The Shariah concept applicable is Bai Bithaman Ajil (BBA).

This refers to the sale of goods on deferred payment basis or by periodic installments at a price that is agreed by both

parties. The sale price includes a profit margin agreed upon by the parties.

3. What do I get from this product?

The maximum facility is based on assessment of your financial standing provided that it matches with your eligibility or

repayment capability.

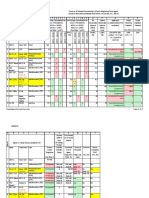

Profit rate

Effective Profit Rate (EPR)

No

Financing

Amount

Tenure

RM 100,000

and

below

Whole Tenure

> RM 100,000

Year 1 - 2

Under Construction

Zero Moving

Cost (ZMC)

Non Zero Moving

Cost (NZMC)

Zero Moving

Cost (ZMC)

Non Zero Moving

Cost (NZMC)

NIL

BR + 2.85%

NIL

BR + 2.85%

BR + 0.40%

BR + 0.30%

Thereafter

BR + 0.65%

BR + 0.55%

Year 1 - 2

BR + 0.30%

BR + 0.30%

BR + 0.60%

BR + 0.45%

until

< RM 300,000

Completed Property

BR + 0.65%

RM 300,000

and above

BR +0.60%

Thereafter

BR + 0.55%

BR-+ 0.45%

Minimum Financing tenure is 5 years and maximum 35 years (or age 65 years or age 70 years*, whichever is earlier).

Note: * Terms and conditions apply.

Your Tenure

:

years

Margin of financing

Total selling price

: RM

Contracted Profit Rate (CPR)

Current BSN Base Rate (BR) is 4.00%* (*subject to change)

4. What are my obligations?

Your monthly installments :

Year [

]-[

]

: RM [

] if any

Year [

]-[

]

: RM [

] if any

Thereafter

: RM [

]

Total repayment amount at the end of [

] years is RM [

]

If applicable , rebate may be granted to the customer for the difference between the Contracted Profit Rate (CPR) and

the Effective Profit Rate (EPR).

EPR Rate

Monthly instalment

Today (BR= 4.00%)

RM

Total profit at the end of

[

] years

RM

Total repayment amount at

the end of [

] years

RM

If BR goes up 1%

If BR goes 2%

Note: For property under constructions, monthly installment shall be subjected to the actual amount released to the

developer.

5. What other charges do I have to pay?

a)

Stamp Duties

As per the Stamp Act 1949 (Revised 1989)

b)

Disbursement Fee

c)

Legal Fees Pertaining to

Securities Documentations

Include but not limited to stamping fees, registration of charge, lodgement

and withdrawal of caveats and other related charges)

All legal fees and incidental expenses in connection with the preparation of

the security documents for Banking Facility.

d)

Valuation Fee

Valuer fees for preparation of formal valuation report (applicable to

completed property only)

e)

Processing Fees

Waived

6. What if I fail to fulfil my obligations?

Late Payment Charges which comprise of Tawidh (compensation) and Gharamah (penalty) will be imposed. Gharamah

shall be channeled by the Bank to the approved charitable organizations.

Within the Facility Period :

Overdue instalment(s) x Average Financing Rate (AFR*) x No. of overdue day(s)

365

After the Facility Period :

Outstanding principal x Average Financing Rate (AFR*) x No. of overdue day(s)

365

Note :

*AFR (Average Financing Rate) refers to the average rate as determined by the Bank and will subject to change from

time to time.

The Bank has the right to set-off any credit balance in your account(s) maintained with the Bank against any

outstanding balance in this financing account which the Bank will notify you in 7 calendar days in advance.

Legal action will be taken if you fail to respond to reminder notices and the legal cost will be borne by you.

Legal action against you may affect your credit rating leading to credit being more difficult or expensive to you.

7. What if I fully settle the financing during the lock in period/maturity date?

The Bank shall grant Ibra to you for early settlement in the following events :

i. Early settlement or early redemption of the Facility; or

ii. Settlement of the original financing contract due to financing restructuring exercise; or

iii. Settlement by Customer in the case of default; or

iv. Settlement by Customer in the event of termination or cancellation of financing before the maturity date.

Zero Moving Cost (ZMC) package is subject to lock-in period of 3 years or 5 years subject to financing package. In the

event the early settlement is made during the lock-in period, the early settlement charges shall comprises of the legal

costs and other expenses that were paid by the Bank under ZMC package would be levied.

The applicable formula for Ibra = Deferred Profit - Early Settlement Charges (if any).

8. Do I need any Takaful coverage?

Mortgage reducing term takaful (MRTT) is required to protect your interest in the event of death or permanent disability

during the financing tenure.

Houseowners / fire / Takaful Rumahku - Long Term (TRLT), if necessary.

9. What are the major risks?

Should the profit rates go up?

The Effective Profit Rate (EPR) might change according to changes in the Base Rate (BR) (if any). Your monthly

installment may change accordingly based on the movement of BFR. However the total amount to be collected shall not

exceed the selling price.

What if your financial circumstances change?

If you have problems meeting your financing obligations, while you are in service or after retirement, please contact us

early to discuss repayment alternatives.

If your financing tenure exceed your retirement age, you can reduce your monthly instalment by exercising partial

redemption using your EPF or saving account. Therefore, your monthly instalment can be reduced.

10. What do I need to do if there are changes to my contact details?

It is important that you inform us of any changes in your contact details to ensure that all correspondences reach you in

a timely manner.

11. Where can I get assistance and redress?

If you have difficulties in making monthly payments, you should contact us earliest possible to discuss payment

alternatives.You may contact us at:

Bank Simpanan Nasional

Address :____________________

____________________

____________________

Tel

:____________________

Fax

:____________________

E-mail

:____________________

(To be filled in by Sales / Branch Personnel)

Alternatively, you may seek the services of Agensi Kaunseling dan Pengurusan Kredit (AKPK), an agency established by

Bank Negara Malaysia to provide free services on money management, credit counselling and debt restructuring for

individuals. You can contact AKPK at :

Address : Tingkat 8, Maju Junction Mall,

1001, Jalan Sultan Ismail,

50250 Kuala Lumpur.

Tel

:1800 88 2575

E-mail : enquiry@akpk.org.my

If you wish to complaint on the products or services provided by us, you may contact us at :

Address : Customer Service Center

Bank Simpanan Nasional,.

Tel

:1300 88 1900 / 603-2613 1900 (Overseas)

Fax

: 03-2613 1888

: servicemanager@bsn.com.my

If your query or complaint is not satisfactorily resolved by us, you may contact Bank Negara Malaysia LINK or TELELINK

at :

Address : Block D, Bank Negara Malaysia,

Jalan Dato Onn.

50480 Kuala Lumpur.

Tel

:1300 88 5465

Fax

: 03-2174 1515

E-mail : bnmtelelink@bnm.gov.my

12. Where can I get further information?

Should you require additional information on Islamic house financing, please refer to the bankinginfo booklet on House

Financing-i, available at all our branches and the www.bankinginfo.com.my website.

13. Other home financing packages available

Skim Khas Pembiayaan Rumah Pekerja Estet (SKRE - Islamic)

Hereby I have read and understand the terms and conditions above.

Signatures customer

IMPORTANT NOTE: YOUR HOUSE MAY BE FORECLOSED IF YOU DO NOT KEEP

UP REPAYMENTS ON YOUR HOME FINANCING-i.

The information provided in this Product Disclosure Sheet is valid as at or until ___________________

Potrebbero piacerti anche

- Product Disclosure Sheet: Personal Financing-I For Civil Sector Via AngkasaDocumento4 pagineProduct Disclosure Sheet: Personal Financing-I For Civil Sector Via Angkasageena1980Nessuna valutazione finora

- Personal Financing Product Disclosure SheetDocumento6 paginePersonal Financing Product Disclosure SheetMohd Naim Bin KaramaNessuna valutazione finora

- PDS PF-i PrivateDocumento8 paginePDS PF-i PrivateMuhammad FawwazNessuna valutazione finora

- Affin Home Flexi Plus: Product Disclosure SheetDocumento6 pagineAffin Home Flexi Plus: Product Disclosure SheetPoi 3647Nessuna valutazione finora

- ASB Fin PDS ENG June 2020-2Documento4 pagineASB Fin PDS ENG June 2020-2holaNessuna valutazione finora

- PDS Equity Home Financing-IDocumento8 paginePDS Equity Home Financing-IAlan BentleyNessuna valutazione finora

- Product Disclosure SheetDocumento7 pagineProduct Disclosure Sheetاحمد شهيرNessuna valutazione finora

- Bancassurance FAQs for EFU Life InsuranceDocumento7 pagineBancassurance FAQs for EFU Life InsuranceAzeem AnwarNessuna valutazione finora

- Personal Financing GuideDocumento2 paginePersonal Financing GuidekfaidzalNessuna valutazione finora

- Uni Flex 120922Documento12 pagineUni Flex 120922wilsonNessuna valutazione finora

- PropertyFinancing BaitiSingleTierDocumento5 paginePropertyFinancing BaitiSingleTierTaraqallah SalehNessuna valutazione finora

- Product Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving LoanDocumento4 pagineProduct Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving Loanthong_wheiNessuna valutazione finora

- PDS Revision Eng & BM Online (Final)Documento6 paginePDS Revision Eng & BM Online (Final)Faiziya BanuNessuna valutazione finora

- PDS - Personal Financing-I (Eng)Documento3 paginePDS - Personal Financing-I (Eng)Muhammad TaqiyuddinNessuna valutazione finora

- PDS PF-i PrivateDocumento4 paginePDS PF-i Privatekiki8894Nessuna valutazione finora

- Product Disclosure Sheet: V1.0 (03/16) PDS - Conv - Act - ENGDocumento3 pagineProduct Disclosure Sheet: V1.0 (03/16) PDS - Conv - Act - ENGMegat KamarulNessuna valutazione finora

- Product Disclosure Sheet: Customer'SDocumento2 pagineProduct Disclosure Sheet: Customer'SojoNessuna valutazione finora

- Property Financing IDocumento3 pagineProperty Financing IAmirul Ashraf MuhamadNessuna valutazione finora

- Experts Answer Personal Finance QueriesDocumento1 paginaExperts Answer Personal Finance QuerieskrjuluNessuna valutazione finora

- Product Disclosure StatementDocumento30 pagineProduct Disclosure StatementfunctioneightNessuna valutazione finora

- Kfs Secured Personal LoansDocumento6 pagineKfs Secured Personal Loansrealtestemail1Nessuna valutazione finora

- Sila Masukkan Semua Maklumat Yang Berkenaan Dengan BetulDocumento8 pagineSila Masukkan Semua Maklumat Yang Berkenaan Dengan Betulmadir7712Nessuna valutazione finora

- CashOne Loan DetailsDocumento4 pagineCashOne Loan DetailsEsabell OliviaNessuna valutazione finora

- SME PDS STTF ENG v2 06102022 PDFDocumento4 pagineSME PDS STTF ENG v2 06102022 PDFAccounts DeptNessuna valutazione finora

- General Banking HeartDocumento24 pagineGeneral Banking HeartMD. JAHIDNessuna valutazione finora

- Credit Card Agreement For Consumer Cards in Capital One Bank (USA), N.ADocumento8 pagineCredit Card Agreement For Consumer Cards in Capital One Bank (USA), N.Ajeremywright100% (1)

- HL Personal Financing PDSDocumento4 pagineHL Personal Financing PDSKavita ManimaranNessuna valutazione finora

- AKPK Power - Chapter 3 - Wise Usage of Credit CardDocumento20 pagineAKPK Power - Chapter 3 - Wise Usage of Credit CardEncik AnifNessuna valutazione finora

- Walk Into Your Dream Home: #OnestepcloserDocumento13 pagineWalk Into Your Dream Home: #OnestepcloserMark Adam TevesNessuna valutazione finora

- Internship Report Internship Report: Our MissionDocumento30 pagineInternship Report Internship Report: Our MissionMaleeha YahyaNessuna valutazione finora

- RHB - PDS - OverdraftDocumento6 pagineRHB - PDS - OverdraftjoekaledaNessuna valutazione finora

- Form 1Documento11 pagineForm 1Kar Yan HNessuna valutazione finora

- Niyo Global SBM CC - T&C-QRDocumento19 pagineNiyo Global SBM CC - T&C-QRhardeep88013Nessuna valutazione finora

- PDS8011032797316937 FormDocumento4 paginePDS8011032797316937 FormSarawanan ArumugamNessuna valutazione finora

- Product Disclosure SheetDocumento10 pagineProduct Disclosure SheetIzzudin Nur Syahmie Shahrol AffendiNessuna valutazione finora

- Stanbic IBTC Bank Product Knowledge Assessment Test Study PackDocumento32 pagineStanbic IBTC Bank Product Knowledge Assessment Test Study PackMike TelkNessuna valutazione finora

- Revolving Credit - SME BankingDocumento5 pagineRevolving Credit - SME BankingYap HSNessuna valutazione finora

- 2 Yr Lock in SIBOR 0.70 Thru Out - CTBDocumento2 pagine2 Yr Lock in SIBOR 0.70 Thru Out - CTBWen ZhengNessuna valutazione finora

- Vanquis Credit Card Agreement and Full TermsDocumento9 pagineVanquis Credit Card Agreement and Full TermsAnonymous TpBLcskeypNessuna valutazione finora

- Accounting, Finance and Operations - Chapter 4Documento9 pagineAccounting, Finance and Operations - Chapter 4Biswajit MohantyNessuna valutazione finora

- TermLoanASBProductDisclosureSheet IDocumento8 pagineTermLoanASBProductDisclosureSheet IamirulNessuna valutazione finora

- Product Disclosure Sheet: What Is This Product About?Documento6 pagineProduct Disclosure Sheet: What Is This Product About?faisal_ahsan7919Nessuna valutazione finora

- SME Micro Financing PDS Conventional Jan 2019Documento8 pagineSME Micro Financing PDS Conventional Jan 2019Zul HilmiNessuna valutazione finora

- Credit Card PDS V42 (Eng) - CompressedDocumento4 pagineCredit Card PDS V42 (Eng) - Compressedrf_1238Nessuna valutazione finora

- Product Disclosure Sheet-Vehicle Financing-IDocumento4 pagineProduct Disclosure Sheet-Vehicle Financing-IZainurul Farah ZainolNessuna valutazione finora

- TOP-UP DEBT PROTECTION PLAN GUIDEDocumento11 pagineTOP-UP DEBT PROTECTION PLAN GUIDEhuliplayNessuna valutazione finora

- PDS Personal Financing IDocumento2 paginePDS Personal Financing IfireflydudeNessuna valutazione finora

- Intership ReportDocumento27 pagineIntership Reportzindani123456Nessuna valutazione finora

- DownloadDocumento3 pagineDownloadRavi Teja GarimellaNessuna valutazione finora

- PDS Vehicle Financing-I PDFDocumento8 paginePDS Vehicle Financing-I PDFakusuperNessuna valutazione finora

- HDFC SL CrestDocumento4 pagineHDFC SL CrestPreetinder Singh BrarNessuna valutazione finora

- Bank Pertanian Malaysia Berhad (811810-U) Hartani-IDocumento5 pagineBank Pertanian Malaysia Berhad (811810-U) Hartani-Iaisyah idrosNessuna valutazione finora

- PNB Doctor - S DelightDocumento18 paginePNB Doctor - S DelightNishesh KumarNessuna valutazione finora

- Credit AgreementDocumento25 pagineCredit AgreementSriskanda SivapragasamNessuna valutazione finora

- PersonalLoanIsl PDSDocumento4 paginePersonalLoanIsl PDSKhairul ArifNessuna valutazione finora

- Terms & Conditions – Insta Loan SummaryDocumento3 pagineTerms & Conditions – Insta Loan SummarypavanivinNessuna valutazione finora

- Personal loan details letterDocumento4 paginePersonal loan details letterchelladuraik25% (4)

- PDS Credit Card Auto Balance ConversionDocumento4 paginePDS Credit Card Auto Balance ConversionErda Wati Mohd SaidNessuna valutazione finora

- Credit Card Agreement For Consumer Cards in Capital One N.ADocumento8 pagineCredit Card Agreement For Consumer Cards in Capital One N.AChisom ChidiNessuna valutazione finora

- New Kiosk Top Up Closing Listing (0815)Documento108 pagineNew Kiosk Top Up Closing Listing (0815)Mohd NizamuddinNessuna valutazione finora

- MC Counter PDFDocumento16 pagineMC Counter PDFMohd NizamuddinNessuna valutazione finora

- Dokumen Technical Analisis PDFDocumento16 pagineDokumen Technical Analisis PDFMohd NizamuddinNessuna valutazione finora

- Technical Analysis Chart FormationsDocumento16 pagineTechnical Analysis Chart Formationsgalakavita100% (10)

- Technical Analysis Chart FormationsDocumento16 pagineTechnical Analysis Chart Formationsgalakavita100% (10)

- Technical Analysis Chart FormationsDocumento16 pagineTechnical Analysis Chart Formationsgalakavita100% (10)

- Ntu PBTBDocumento4 pagineNtu PBTBMohd NizamuddinNessuna valutazione finora

- TOPOLOGIDocumento18 pagineTOPOLOGIsuhainizaNessuna valutazione finora

- Design CostDocumento1 paginaDesign CostMohd NizamuddinNessuna valutazione finora

- Ict Form 2 Introduction of NetworksDocumento23 pagineIct Form 2 Introduction of NetworksMohd NizamuddinNessuna valutazione finora

- Aad1023-Set 1Documento6 pagineAad1023-Set 1Mohd NizamuddinNessuna valutazione finora

- Extensive Reading Involves Learners Reading Texts For Enjoyment and To Develop General Reading SkillsDocumento18 pagineExtensive Reading Involves Learners Reading Texts For Enjoyment and To Develop General Reading SkillsG Andrilyn AlcantaraNessuna valutazione finora

- JD - Software Developer - Thesqua - Re GroupDocumento2 pagineJD - Software Developer - Thesqua - Re GroupPrateek GahlanNessuna valutazione finora

- ASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsDocumento20 pagineASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsEng. Emílio DechenNessuna valutazione finora

- Scharlau Chemie: Material Safety Data Sheet - MsdsDocumento4 pagineScharlau Chemie: Material Safety Data Sheet - MsdsTapioriusNessuna valutazione finora

- Mechanics of Deformable BodiesDocumento21 pagineMechanics of Deformable BodiesVarun. hrNessuna valutazione finora

- Artificial IseminationDocumento6 pagineArtificial IseminationHafiz Muhammad Zain-Ul AbedinNessuna valutazione finora

- Application of ISO/IEC 17020:2012 For The Accreditation of Inspection BodiesDocumento14 pagineApplication of ISO/IEC 17020:2012 For The Accreditation of Inspection BodiesWilson VargasNessuna valutazione finora

- Vidura College Marketing AnalysisDocumento24 pagineVidura College Marketing Analysiskingcoconut kingcoconutNessuna valutazione finora

- Put The Items From Exercise 1 in The Correct ColumnDocumento8 paginePut The Items From Exercise 1 in The Correct ColumnDylan Alejandro Guzman Gomez100% (1)

- Clean Agent ComparisonDocumento9 pagineClean Agent ComparisonJohn ANessuna valutazione finora

- Environmental Technology Syllabus-2019Documento2 pagineEnvironmental Technology Syllabus-2019Kxsns sjidNessuna valutazione finora

- Human Resouse Accounting Nature and Its ApplicationsDocumento12 pagineHuman Resouse Accounting Nature and Its ApplicationsParas JainNessuna valutazione finora

- Jazan Refinery and Terminal ProjectDocumento3 pagineJazan Refinery and Terminal ProjectkhsaeedNessuna valutazione finora

- Cinema 4D ShortcutsDocumento8 pagineCinema 4D ShortcutsAnonymous 0lRguGNessuna valutazione finora

- The Teacher and The Community School Culture and Organizational LeadershipDocumento10 pagineThe Teacher and The Community School Culture and Organizational LeadershipChefandrew FranciaNessuna valutazione finora

- Henny Penny 500-561-600 TM - FINAL-FM06-009 9-08Documento228 pagineHenny Penny 500-561-600 TM - FINAL-FM06-009 9-08Discman2100% (2)

- For Coin & Blood (2nd Edition) - SicknessDocumento16 pagineFor Coin & Blood (2nd Edition) - SicknessMyriam Poveda50% (2)

- MMW FinalsDocumento4 pagineMMW FinalsAsh LiwanagNessuna valutazione finora

- Numerical Methods: Jeffrey R. ChasnovDocumento60 pagineNumerical Methods: Jeffrey R. Chasnov2120 sanika GaikwadNessuna valutazione finora

- SEO Design ExamplesDocumento10 pagineSEO Design ExamplesAnonymous YDwBCtsNessuna valutazione finora

- Paradigm Shift Essay 2Documento17 pagineParadigm Shift Essay 2api-607732716Nessuna valutazione finora

- PC November 2012Documento50 paginePC November 2012bartekdidNessuna valutazione finora

- Reflection Paper #1 - Introduction To Action ResearchDocumento1 paginaReflection Paper #1 - Introduction To Action Researchronan.villagonzaloNessuna valutazione finora

- 2007 Bomet District Paper 2Documento16 pagine2007 Bomet District Paper 2Ednah WambuiNessuna valutazione finora

- PWC Global Project Management Report SmallDocumento40 paginePWC Global Project Management Report SmallDaniel MoraNessuna valutazione finora

- Gi 007 Gerund InfinitiveDocumento2 pagineGi 007 Gerund Infinitiveprince husainNessuna valutazione finora

- Tender Notice and Invitation To TenderDocumento1 paginaTender Notice and Invitation To TenderWina George MuyundaNessuna valutazione finora

- Symmetry (Planes Of)Documento37 pagineSymmetry (Planes Of)carolinethami13Nessuna valutazione finora

- 'K Is Mentally Ill' The Anatomy of A Factual AccountDocumento32 pagine'K Is Mentally Ill' The Anatomy of A Factual AccountDiego TorresNessuna valutazione finora

- Elmeasure Solenoid Ates CatalogDocumento12 pagineElmeasure Solenoid Ates CatalogSEO BDMNessuna valutazione finora