Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

NPV or IRR - Why Not Both

Caricato da

minerito2211Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

NPV or IRR - Why Not Both

Caricato da

minerito2211Copyright:

Formati disponibili

NPV or IRR?

Why not both?

T.F.TnRRlES

tiple root problems as does IRR.

The merit measures most com'T.F. Torries, member SME,is prolessor with ihe Uivision 01

Consequently, there is no reason

monly used by industry financial ariaAEsOUI

C

~

Mana~tment.

West

Virginia

University,

Moroanlown.WV.

not

to

use both NPV and IRR.

lysts to determine investment feasiThese conclusions do not in any

bility include net present value Preprinl91-034, presented at the !ME Annual Meeting, feb. 24-27.

1997. Oenver, En. Aevised m a n ~ ~ c received

t i ~ t lor prlblication

way denigrate the use and impor(NPV) and internal rate of return

(IRR), plus the derivatives of these March 1998. Oiscussion 01 this peer-reviewed and auuroved paper tance of NPV as a merit measure.

is invited and must be submitted 10 SME prior 10 Jan. 31.1999

They simply suggest that it is not imtwo measures such as net future value

proper and that it is sometimes useful

(NFV) and benefit t o cost ratio. All

to use IRR as a merit measure as well.

engineering economics textbooks acIt is important to note that IRR is one of the most frecept that either NPV or IRR can be used to select the

quently used and misused measures of project feasibility

most economically desirable projects under conditions

and is also one that is explained in the most confusing

of budgetary constraints or where the projects are mutumanner by academicians. Consequently, the purpose of

ally exclusive. This is accomplished by choosing the mix

this paper is to clarify the usefulness of IRR relative to

of projects wit11 the highest NPV or IRR, as long as:

NPV.

budgetary constraints are met,

Definitions of NPV and IRR

IRR is greater than the minimum acceptable rate of

NPV and I R R are related, but they are different

return (UMARR) and

merit measures of investment feasibility. IRR is a meaIRR is determined correctly.

sure of the rate at which capital is accumulated, as opposed to NPV, which is a measure of a stock of wealth.

Most engineering economics textbooks also suggest

Each measures a different aspect of the desirability of a

that NPV is a preferred merit measure over I R R beproject, i.e., return on capital invested and amount of

cause maximizing NPV is more consistent with economic

wealth accumulated. IRR and NPV are related in that, as

theory and because IRR has problems associated with

the discount rate increases for a specific cash flow, NPV

multiple root solutions and reinvestment assumptions.

of the cash flow decreases. This leads

Also, texts propose that a complex

methodology called incremental

t o the definition of IRR as that disanalysis is necessary to correctly de- Abstract

count rate that makes NPV equal

The primary criteria used by zero. An alternative definition of IRR

termine IRR.

This paper questions the premise the mining industry to judge the is the rate that equates the initial inthat NPV is always the preferred merit of aproject is internal rate oj vestment with the future value of the

merit measure over I R R and con- return (IRR) rather than net resulting cash flows. The higher the

cludes that, while NPV does give suf- present value (NPV), although IRR, the more profitable is the

ficient information to make financial NPV is favored by academicians. project in terms of return on invested

decisions:

This paper discusses the problems capital. IRR is, therefore, determined

of IRR and NPVand compares the internally as compared to the disI R R gives investors additional multigoal nature of the decision- count rate for NPV, which is deteruseful information that NPV makers and their needfor informa- mined externally.

does not,

tion having the characteristics oj

Maximization of utility or wealth,

more information is preferred by NPV and IRR. The conclusions as represented by NPV, is the theodecision-makers rather than less, reached are that both NPV and retically correct investment-ranking

I R R is sometimes the more ap- I R R can be used for investment criteria from an economic perspecpropriate merit measure,

ranking, that NPVsujffers the same tive. However, there are three addithe reinvestment or ranking char- multiple root problem as does tional considerations. First, investors

acteristics of NPV and I R R d o IRR, and the use of conventional usually have more than a single goal,

not make one merit measure su- incremental I R R to reach NPV- as described in Baumo1(1965), Evans

perior to the other and

consistent project ranking is mis- (1984), Walls (1995) and Walls and

NPV suffers from the same mul- lead in^.

Eggert (1996). Second, NPV does not

Introduction

~~

~-~

This page of SME-AIME 'bansactions follows page 76. The intervening

non-'bansactions pages appeared in MINING ENGINEERING.

MINING ENGINEERING

OCTOBER 1998

69

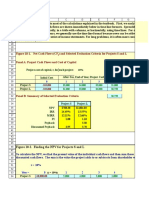

FIGURE 1

on NPV maximization will lead to the proper results?

The simple answer is yes. However, it is quite possible for

an investor to obtain more insight about an investment

opportunity by using rate of return rather than NPV. For

example, consider Fig. 1,which shows the rate of growth

of a tree or forest and two cyclical harvest schemes.Trees

typically experience low but increasing growth rates

when they are small, then an increasing growth rate for

a period, decreasing growth rates until they reach maturity and negative growth rates thereafter. The classic

forester's problem is when to harvest the trees.

Samuelson (1976) and other economists discuss this

problem.

The correct answer is to cut in a manner that maximizes NPV, but the actions the forester should take using

this criterion are not obvious. Cutting the trees when

they achieve maximum growth (achieve maximum NPV

for one cycle) is not the correct strategy. Samuelson

shows that harvesting at the time of maximum growth

results in the greatest accumulation of wealth in the case

of such cyclical investments. The dotted curves in Fig. 1

show this cyclical harvest pattern.This pattern results in

twice as many cycles as harvesting at maximum growth.

Another correct answer is to sell the trees for cutting

when the rate of increase in wealth caused by tree

growth falls below the owner's opportunity cost of capital.

In this case, it is clear that maximizing based on rate

of growth yields the greatest wealth. While the result is

wealth maximization, this example shows that it may be

theoretically correct and preferred to make investment

and operating decisions on the rate of growth of wealth

rather than the amount of wealth.This suggests that both

the rate of return and NPV can be important to an investor.

Forest example showing two cyclic

harvesting schemes.

Value

Harvest at

indicate the return per invested dollar. which may be of

critical interest to an investor. Many investors are interested in the return on investment, and IRR is one of the

most popular investment criteria used by the mining industry to assess investments (Bhappu and Guzman,

1994). Lastly, certain investment and operating decisions

may be easier to make if based on rate of return rather

than simple profit maximization.

Because NPV and I R R are related. either merit

measure yields the same investment ranking if IRR is

correctly calculated. However, one merit measure may

be preferred over the other by an investor, depending

upon the type of project and the goals of the investor.

Is IRR always theoretically preferred?

Apparent ranking conflict

Assuming the maximization of wealth is the goal of

an investor, is it always true that making decisions based

A criticism is that, for mutually exclusive investment

TABLE 1

Ranking of projects with NPV and IRR with unequal investment or project life.

Years:

Case (a): Unequal project life

CFl*

CF2

NPV

IRR

-100

-100

50

65

50

65

50

65

50

0

50

0

80.24

56.12

41.04

42.57

-100

-50

50

35

50

35

50

35

50

35

50

35

80.24

76.17

41.04

64.12

Calculation of CFZ*

CF2

CFr

CF2"

Case (b): Unequal initial investment

CFl*

CF2

Calculation of CF2'

CF2

CFa

CF2"

Notes:

CFr = reinvested cash flow.

CFa = cash flow from alternative (opportunity) investment.

CFl* and CF2* = the t w o cash flows used to compare NPVs and IRRs.

MARR = Minimum acceptable rate of return = OCC = Opportunity cost of capital = 12.00%.

70

OCTOBER 1998

MINING ENGINEERING

opportunities, I R R may give different rankings than

NPV.Table 1 gives an example of the ranking characteristics of NPV and IRR for two cases involving two cash

flows with unequal project lives and unequal initial investments. A third case, not shown, is one of unequal

project lives and unequal investment.

In all cases, a comparison of CFl* and CF2 shows

that C F l * has the higher NPV but the lower IRR. All

cash flows are discounted at the same minimum acceptable rate of return (MARR), which equals the opportunity cost of capital (OCC).

The difficulty here is that it is possible to select a

project with the highest NPV but with the lowest return

o n investment. The problem faced by the decisionmaker, as it is usually stated, is which ranking "system"

should be used? The answer given by engineering texts is

that either criterion can be used, but a mathematical process termed incremental analysis is required to calculate

an NPV-consistent IRR. Examples of this are given in

Au and Au (1988), Newnan (1988), Steiner (1992), and

Stermole and Stermole (1993). The incremental IRR is

determined by using a step-wise pairing comparison of

the rates of return and results in the creation of an index

that ranks projects in the same order as does NPV

The ranking problem illustrated in Table 1 is caused

by violations of two of the five theoretical requirements

when using NPV and IRR as merit measures. These requirements are that:

all projects to be compared must have equal equivalent economic lives,

all projects to be compared must have equal initial

investments,

all values must be known with certainty,

all projects to be compared must have comparable

discount rates that reflect the risk-free opportunity

cost of capital and

all projects to be compared must have comparable

tax structures.

In practice, few projects to be compared have equal

economic lives. A correct ranking can be made of

projects having unequal lives using NPV. However, a correct ranking cannot be made using IRR unless the IRR

is calculated correctly. As shown in Case (a) in Table 1,

what must be compared are the total cash flows that result from the two investments over the same length of

time. Although CF2 ends in Year 3, an account must be

made for income that would be received in Years 4 and

5 as a result of investing in CF2. For example, if the $65

obtained in Year 3 is reinvested at the OCC for an additional two years. CF2* is obtained, which can then be

correctly compared with CFl*. The relevant IRR is the

rate of return over the five-year period. In this case, the

IRR for CFl* is greater than the IRR for CF2*, which is

the same ranking as obtained using NPV. Note that it

might be possible to reinvest in a third project for the

two-year period with different cash flows and a different

OCC. What is important is that the reinvestment in the

two-year period be included in the two cash flow comparisons, whatever the reinvestment opportunities may

be.

Concerning the second requirement, few projects to

be compared have equal initial investments. A correct

ranking can be made of projects with unequal initial in-

vestments using NPV but not IRR, unless IRR is calculated correctly. What must be compared again are the

total cash flows that result from the two investments

over the same length of time. If $100 is available for investment and only $50 is placed into CF2, then an account must be made of the earnings of the remaining $50

not invested in CF2.The combined cash flow of CF2 plus

the alternative investment yields CF2*, which is the cash

flow that must be compared with CFl*. Again, what is

important is that the investment of the unspent $50 be

included in the two cash-flow comparisons, regardless of

how the $50 is invested.

The result of having both unequal project lives and

unequal initial investments combines Cases (a) and (b),

and the same principles apply. Again, what is important

is that the investment of the unspent capital and the reinvestment in the remaining two years be included in the

two cash flow comparisons, however these two items are

invested.

The three additional requirements mentioned above

are discussed in Torries (1998).The solution to the ranking problems associated with unequal project lives and

initial investments is to simply comply with the theoretical requirements of NPV and IRR. If the comparisons of

cash flows are handled properly, no conflicts exist, and an

incremental I R R need not be calculated. There is no

theoretical reason not to use I R R as a measure of

project feasibility.

Multiple root problems

A problem associated with I R R involves the possible existence of multiple roots, which means that there

may be more than one IRR for a single cash flow. IRR is

criticized as a merit measure because the existence of

multiple roots prevents the identification of the unique

I R R to be used to rank the project in question. Some

engineering economics textbooks suggest that NPV is a

superior measure to IRR because multiple solutions are

associated only with IRR. This suggestion is misguided.

Multiple IRRs may occur with projects in which

large capital expenditures are required in both initial

and later years. Under these conditions, the cash flow

patterns may first be negative (corresponding to the initial investment), then positive, then again negative (corresponding to the second investment) and then again

positive. In such a situation there are three specific discount rates at which NPV equals zero and, as a result,

three IRRs.

It is true that there will be only one NPV for any

MARR when there are multiple roots of IRR. However,

the selection of the MARR loses much of its meaning

when there are multiple roots of IRR. Remembering

that MARR is the minimum acceptable rate of return.

what does it mean when a higher NPV is obtained when

the discount rate is higher than the MARR? Using the

higher discount rate, which is supposed to be more constraining than a lower discount rate, results in a higher

NPV. Is it correct to make an investment decision based

on the NPV using MARR when a higher discount rate

gives a higher NPV?

All that can be determined in this case is that multiple IRRs exist and that some discount rates higher than

MARR give higher NPVs. These characteristics of the

cash flow are important to an investor. It would be incorrect to ignore the increase in NPV as the discount rate

MINING ENGINEERING H OCTOBER 1998

71

increases when multiple IRRs exist. Having a cash flow

with multiple IRRs causes problems in interpreting both

NPV and IRR. Therefore, NPV does not have an advantage over IRR because of the multiple root problem.

Because multiple roots affect both I R R and NPV,

they also affect all IRR and NPV derivatives such as the

net future value (NFV), which is directly related to NPV,

and all benefit-to-cost ratios as well as other rates of return, which are all related to IRR. All suffer the same

problems when multiple roots exist.

IRR reinvestment controversy

Another reason NPV is favored over IRR is that the

determination of IRR involves the implicit assumption

that cash-flow dividends are reinvested at the IRR rate.

The argument is that, if I R R requires the reinvestment of

dividends at the IRR rate, the reinvestment rate may be

so high as to be unrealistic. Obviously, reinvestment opportunities at very high rates do not usually exist, which

seems to make the absolute value of I R R inconsistent

when compared to the rates of return on invested capital

from alternative investment opportunities. A reinvestment assumption is also implicit in the determination of

NPV, but the reinvestment rate is equal to the opportunity cost of capital. which. by definition, is an attainable

alternative rate of return. For these reasons. it is argued,

NPV is preferred over IRR.

There is considerable argument in the literature regarding the IRR reinvestment assumption, but it can be

safely said that implicit reinvestment at the IRR rate is

required but that this assumption does not distract from

the usefulness of IRR. The I R R of a project is deter-

mined directly by its own cash-flow profile and is independent of any explicit reinvestment activities or rates.

Consequently, IRR is a measure of growth of capital that

has the same characteristics as quoted savings rates. This

means it is correct to directly compare the two and to say

that a project with an I R R of 40% yields a return four

times greater than a savings account with an interest rate

of 10%.The reinvestment assumption required of IRR is

not a valid reason to prefer NPV as a merit measure. For

a history of the debate, see Solomon (1956). Renshaw

(1957), Dudly (1972). Grant (1982), Lohmann (1988) and

Beaves (1 988).

Inherent stren ths and weaknesses

of NPV and IR

The use of NPV and I R R as merit measures by

which to evaluate the feasibility of a project is well accepted by industry. In a recent survey of mining companies. Bhappu and Guzman (1994) found that 55% of the

companies used IRR and 40% of the companies used

NPV as merit measures.These ratios are only slightly different from two prior surveys of oil and gas producers, in

which one survey found 69% used I R R and 37% used

NPV (Boyle and Schenck, 1985), and the other survey

found 75% used I R R and 62% used NPV (Dougherty

and Sakar, 1993). IRR has been clearly the predominant

merit measure used by the mining industry, although this

position appears to be weakening. It appears that more

companies are using both IRR and NPV as merit measures. which is more logical since each measures a different aspect of value of a cash flow.

Although IRR has been a popular merit measure, its

TABLE 2

Summary comparison of IRR and NPV as merit measures.

NPV

1. Measures the stock of wealth, which is consistent

with economic theory, e.g., maximization of utility or

IVPV. However, NPV does not tell how efficiently

capital is used.

2. The size of NPV is dependent on the rate of return

as well as on the size of the initial investment. NPV

can be made larger by increasing the size of the

project.

IRR

1. Measures the rate of wealth accumulation or the

rate of change of wealth. This measure indicates the

efficiency of use of capital investments. However, IRR

does not indicate the value of a project.

2. IRR is independent of the size of the initial

investment. To make IRR larger, the investment must

earn a higher return

3. Requires price and cost forecasts.

3. Requires price and cost forecasts.

4. Requires the choice of an external discount rate.

Because choosing the proper discount rate is difficult,

this requirement is often cited as a weakness of NPV

that is not shared by IRR. This is not true when

multiple lRRs exist.

4. It is commonly claimed that a discount rate is not

needed, except for a MARR for comparison. This is

true only when there are no multiple roots for IRR.

When multiple lRRs exist, a specific discount rate must

be chosen for comparison, just as in the case of NPV.

5. Assumes reinvestment at the MARR.

5. Assumes reinvestment at the IRR

6. It is commonly claimed that NPV is a unique value

that does not have the multiple root problem that may

exist with IRR. However, if multiple IRRs exist,

multiple discount rates and multiple NPVs must also

be examined.

6. Multiple lRRs may exist and, if so, may complicate

the analysis. This is often incorrectly cited as a

weakness of IRR that is not shared by NPV.

7. hlPV correctly ranks mutually exclusive projects or

investment under conditions of budgetary constraints.

7. IRR correctly ranks mutually exclusive projects or

investment under conditions of budgetary constraints

if IRR is correctly determined.

8. Omits the option value of production and

investment flexibility.

8. Omits the option value of production and

investment flexibility.

72

OCTOBER 1998 W MINING ENGINEERING

meaning, problems and relationships with NPV have

been largely misunderstood. To help clarify the differences between NPV and IRR, a summary of a comparison of various characteristics of NPV and IRR is given in

Table 2. For further discussion of these topics, see Torries

(1998).

Conclusion

This paper demonstrates that both NPV and IRR

have valid uses as merit measures for practical application of investment evaluation methods. Because of the

multigoal nature of most investors, the differences in

perspective given by NPV and IRR should be considered a benefit rather than a fault to be corrected. This

paper also shows that IRR has no greater number of

faults than does NPV, even when multiple root problems

are included.

In addition to IRR and NPV, all other bits of information, such as expectations about the future and the

timing of the investment, must also be considered by the

decision-maker. Each investor has a particular set of investment goals and constraints. It is prudent to supply

the investor with as much information as possible and let

the individual investor use the information in a manner

appropriate for the situation. Each investor must then

integrate all project-feasibility information with the

investor's attitude toward risk to reach correct investment decisions.

References

Au. T., and Au. T.. 1992. Engineering Ecor~omicsfor Capital Investrnc7ntAncrlysis. 2"" Ed.. Prentice-Hall, Englewood Cliffs, NJ.

Baumol. W.. 1965, Economic Theory and Operatior~sAnalysis, 2nd

Ed., Prentice-Hall. Englewood Cliffs: NJ.

Beaves, R.G., 1988:'Net present value and rate of return: Implicit and explicit reinvestment assumptions." The Engineering Economist. Vol. 33. p. 275.

Bhappu, R., and Guzman: J.. 1994,"Mineral investment decision

making: A study of mining company practices," Proceedings, Third

Annual Meeting of the Mineral Economics and Marlagement Societj~

( M E M S ) , Houghton, MI, pp. 167-179.

Boyle, H., and Schenck, G., 1985, "Investment analysis: U.S. oil

and gas producers score high in university survey," Journal of Petroleum Technology, April, pp. 680-690.

Dougherty. E.L., and, Sakar, J., 1993, "Current investment practices and procedures: Results of a survey of U.S. Oil and gas producers and petroleum consultants," Paper 25824, presented at the 1993

SPE Hydrocarbon Economics and Evaluation Symposium, March 2930, Dallas, TX.

Dudly, C.L., Jr., 1972, "A note on reinvestment assumptions in

choosing between net present value and internal rate of return,"Jorrrno1 of Finance. Vol. 27, p. 907.

Evans, G., 1984, "An overview of techniques for solving

multiobjective mathematical programs," Mancrgement Science,Vol. 33,

NO.4, pp. 1268-1282.

Grant, E.L., Ireson. W.G., and Leavenworth. R.S.. 1982. Principles

' ~ John Wiley and Sons, New York.

of Engineering E c o n o r n ~ , 7 Ed.,

Lohmann, J.R., 1988,"The IRR, NPV and fallacy of the reinvestment rate assumptions," The Engineering Economist. Vol. 33, No. 10. p.

303.

Newnan, D.G., 1988, Engineering Econoti~icAnalysis. 3TdEd.,

Engineering Press, San Jose, CA.

Renshaw, E.. 1957, "A note on the arithmetic of capital budgeting,'' The Journal of Business, Vol. 30: p. 193.

Solomon, E., 1956. "The arithmetic of capital budgeting decisions," The Journal of Business. Vol. 29, p. 124.

Samuelson, P.. 1976, "Economics of forestry in an evolving society." Economic Inquiry, Vol. 14, No. J. pp. 446-492.

Steiner, H.M., 1992. Engineering Economic Principles, McGrawHill. New York.

Stermole. F.J.. and Stermole, J.M.. 1993. E c o n o n ~ i cEvaluation

and Investiiient Decision Methods, 81h Ed., Investment Evaluations

Corp.. Golden. CO.

Torries. T., 1988, Evrrluating Mineral Projects: Applications nncl

Misconceptior1.r. SME, Littleton. CO.

Walls. M., 1995."Integrating business strategy and capital allocation: An application of multi-objective decision making," Engineering

Economist. Vol. 40, No. 3: pp. 247-266.

Walls, M.. and Eggert, R.. 1996, "Managerial risk taking: A study

of mining CEOs," Mining Engineering, SME, March, pp. 61-70.

MINING ENGINEERING W OCTOBER 1998

73

Potrebbero piacerti anche

- Valuation of Mining Projects Using Option Pricing TechniquesDocumento8 pagineValuation of Mining Projects Using Option Pricing TechniquesgeyunboNessuna valutazione finora

- Cash Flow Analysis: Glim Dr. Manaswee K SamalDocumento29 pagineCash Flow Analysis: Glim Dr. Manaswee K SamalAnirbanRoychowdhuryNessuna valutazione finora

- PWC Asset Management 2020 A Brave New World FinalDocumento40 paginePWC Asset Management 2020 A Brave New World FinalKostas IordanidisNessuna valutazione finora

- Economics of Energy IndustriesDocumento272 pagineEconomics of Energy Industries121ads.com100% (2)

- Manual For Discounting Oil and Gas IncomeDocumento9 pagineManual For Discounting Oil and Gas IncomeCarlota BellésNessuna valutazione finora

- Case Study of Costs ConceptDocumento21 pagineCase Study of Costs ConceptHosanna AleyeNessuna valutazione finora

- OIL and GAS ASSIGNMENTDocumento3 pagineOIL and GAS ASSIGNMENTSourabha DehadraiNessuna valutazione finora

- Investment Appraisal MethodsDocumento31 pagineInvestment Appraisal MethodsDELGADO ZEVALLOS ANGIE MELISSANessuna valutazione finora

- Concept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainDocumento11 pagineConcept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainLeena SachdevaNessuna valutazione finora

- Calculate Break Even Cost Oil & GasDocumento6 pagineCalculate Break Even Cost Oil & GassultanthakurNessuna valutazione finora

- Economics of Mine Planning and Equipment SelectionDocumento9 pagineEconomics of Mine Planning and Equipment SelectionFrancisca MiguelNessuna valutazione finora

- Day 3 - BO.9.2 - A New Era of Risk and Uncertainty Analysis in Project Evaluation For Improved Decision MakingDocumento19 pagineDay 3 - BO.9.2 - A New Era of Risk and Uncertainty Analysis in Project Evaluation For Improved Decision Makingp-sampurno2855100% (1)

- Ch10 Tool Kit NPV Dan IRRDocumento23 pagineCh10 Tool Kit NPV Dan IRRSyarif Bin DJamalNessuna valutazione finora

- Pod SpeDocumento10 paginePod SpeBayuu KakandazesNessuna valutazione finora

- Eco-Elasticity of DD & SPDocumento20 pagineEco-Elasticity of DD & SPSandhyaAravindakshanNessuna valutazione finora

- Cost Estimation Total Product Cost: Malavika M R 2015-09-013Documento32 pagineCost Estimation Total Product Cost: Malavika M R 2015-09-013Roman BarboNessuna valutazione finora

- Sharing - Session - Petroleum Economic - 1 Page Back To BackDocumento34 pagineSharing - Session - Petroleum Economic - 1 Page Back To BacksidNessuna valutazione finora

- NPV Vs IRR MethodsDocumento4 pagineNPV Vs IRR MethodsRajesh K. PedhaviNessuna valutazione finora

- Energy EconomicsDocumento14 pagineEnergy EconomicsHarsh SinghNessuna valutazione finora

- Project Financial Risk AnalysisDocumento10 pagineProject Financial Risk AnalysisФранческо Леньяме100% (1)

- Investment Project AnalysisDocumento44 pagineInvestment Project AnalysisNgan Kim CaoNessuna valutazione finora

- Calculate Project ROI Using NPV, IRR and Packback PeriodDocumento5 pagineCalculate Project ROI Using NPV, IRR and Packback PeriodsapsrikaanthNessuna valutazione finora

- Marginal Costing: Subject: Submitted To Prof: Mms Semester-2 Div-BDocumento13 pagineMarginal Costing: Subject: Submitted To Prof: Mms Semester-2 Div-BBook wormNessuna valutazione finora

- Capital and Operating Cost EstimationDocumento48 pagineCapital and Operating Cost EstimationGaluizu00167% (3)

- Liquidity Preference As Behavior Towards Risk Review of Economic StudiesDocumento23 pagineLiquidity Preference As Behavior Towards Risk Review of Economic StudiesCuenta EliminadaNessuna valutazione finora

- Petroleum Profits Tax Computation and Capital Allowance Treatment - Firs June 2018 PDFDocumento18 paginePetroleum Profits Tax Computation and Capital Allowance Treatment - Firs June 2018 PDFObi MogboNessuna valutazione finora

- Investment 1Documento30 pagineInvestment 1Jessica TerryNessuna valutazione finora

- Petroleum Economics-Basic ConceptDocumento51 paginePetroleum Economics-Basic ConceptDajev100% (1)

- CH 9Documento79 pagineCH 9Manmeet Kaur AroraNessuna valutazione finora

- Short-Term Decision Making in Foundry Unit - A Case Study PDFDocumento6 pagineShort-Term Decision Making in Foundry Unit - A Case Study PDFDevendra TaradNessuna valutazione finora

- Collusive Oligopoly and OPEC. What Are The Possible Cartel Formation in Petroleum Companies in India?Documento24 pagineCollusive Oligopoly and OPEC. What Are The Possible Cartel Formation in Petroleum Companies in India?Suruchi GoyalNessuna valutazione finora

- Break Even Analysis of Mining ProjectsDocumento60 pagineBreak Even Analysis of Mining ProjectsAnil Kumar100% (1)

- Cost of CapitalDocumento55 pagineCost of CapitalSaritasaruNessuna valutazione finora

- Econ Base Vs Input-Output ModelsDocumento19 pagineEcon Base Vs Input-Output ModelsNiraj KumarNessuna valutazione finora

- Presented By:-Pankaj Smit Ojas Sayali Ishaan Dattaji Ashutosh Omkar MaheshDocumento11 paginePresented By:-Pankaj Smit Ojas Sayali Ishaan Dattaji Ashutosh Omkar MaheshOjas LeoNessuna valutazione finora

- Oil & Gas Accounting PrinciplesDocumento81 pagineOil & Gas Accounting PrinciplesEmilia Pop100% (3)

- Elasticity EconomicsDocumento14 pagineElasticity EconomicsYiwen LiuNessuna valutazione finora

- Energy EconomicsDocumento14 pagineEnergy EconomicsAns ahmedNessuna valutazione finora

- Discounted Cash Flow (DCF) ModellingDocumento43 pagineDiscounted Cash Flow (DCF) Modellingjasonccheng25Nessuna valutazione finora

- How Mining Companies Improve Share PriceDocumento17 pagineHow Mining Companies Improve Share PriceEric APNessuna valutazione finora

- Viewpoints Depletion of A Mine in The Production Phase Useful Life of The Mine August 2011Documento4 pagineViewpoints Depletion of A Mine in The Production Phase Useful Life of The Mine August 2011Norman AhernNessuna valutazione finora

- Sample Deal Discussions: Sell-Side Divestiture Discussion & AnalysisDocumento11 pagineSample Deal Discussions: Sell-Side Divestiture Discussion & AnalysisAnonymous 45z6m4eE7pNessuna valutazione finora

- Applications of Linear Programming in Oil Industry PDFDocumento25 pagineApplications of Linear Programming in Oil Industry PDFKhôi Nguyên50% (2)

- By: Ashish RazdanDocumento11 pagineBy: Ashish RazdanVishal GiradkarNessuna valutazione finora

- Valuation Methods Used in Mergers & Acquisition: Roshankumar S PimpalkarDocumento6 pagineValuation Methods Used in Mergers & Acquisition: Roshankumar S PimpalkarSharad KumarNessuna valutazione finora

- 7 Key Stages CAPEX ProcessDocumento9 pagine7 Key Stages CAPEX ProcessІрина ТурецькаNessuna valutazione finora

- Shale Oil and EffectsDocumento20 pagineShale Oil and EffectsDag AlpNessuna valutazione finora

- PTRL3025 Lecture NotesDocumento7 paginePTRL3025 Lecture NotesericpenhNessuna valutazione finora

- PWC Basics of Mining Accounting UsDocumento133 paginePWC Basics of Mining Accounting Ussharanabasappa baliger100% (1)

- Mining Industry ReportDocumento86 pagineMining Industry ReportanandvisNessuna valutazione finora

- Lecture+4+Investment+Appraisal+Mehtods+11 12Documento25 pagineLecture+4+Investment+Appraisal+Mehtods+11 12Mahajan AjayNessuna valutazione finora

- FM Notes PDFDocumento311 pagineFM Notes PDFhitmaaaccountNessuna valutazione finora

- Financial Discounting Techniques A Complete GuideDa EverandFinancial Discounting Techniques A Complete GuideNessuna valutazione finora

- Net Present Value A Complete Guide - 2021 EditionDa EverandNet Present Value A Complete Guide - 2021 EditionNessuna valutazione finora

- Operating Leverage A Complete Guide - 2020 EditionDa EverandOperating Leverage A Complete Guide - 2020 EditionNessuna valutazione finora

- Cost Of Capital A Complete Guide - 2020 EditionDa EverandCost Of Capital A Complete Guide - 2020 EditionValutazione: 4 su 5 stelle4/5 (1)

- Mining Capital: Methods, Best-Practices and Case Studies for Financing Mining ProjectsDa EverandMining Capital: Methods, Best-Practices and Case Studies for Financing Mining ProjectsNessuna valutazione finora

- Environmental Kuznets Curve (EKC): A ManualDa EverandEnvironmental Kuznets Curve (EKC): A ManualBurcu ÖzcanNessuna valutazione finora

- Beyond Crisis: The Financial Performance of India's Power SectorDa EverandBeyond Crisis: The Financial Performance of India's Power SectorNessuna valutazione finora

- Conveyor System at South BulgaDocumento5 pagineConveyor System at South Bulgaminerito2211Nessuna valutazione finora

- Application of Whittle 4D To Risk Manag. in OP OptimisationDocumento12 pagineApplication of Whittle 4D To Risk Manag. in OP Optimisationminerito22110% (1)

- Applying Risk Analysis To Asses Economic Viability To UG Golden Sunlight MineDocumento10 pagineApplying Risk Analysis To Asses Economic Viability To UG Golden Sunlight Mineminerito2211Nessuna valutazione finora

- Geostatistical Design of Infill Drilling ProgramsDocumento10 pagineGeostatistical Design of Infill Drilling Programsminerito2211Nessuna valutazione finora

- Application of Whittle 4D To Risk Manag. in OP OptimisationDocumento12 pagineApplication of Whittle 4D To Risk Manag. in OP Optimisationminerito22110% (1)

- Feasibility Studies - Scope and AccuracyDocumento8 pagineFeasibility Studies - Scope and Accuracyminerito2211Nessuna valutazione finora

- Planning and Design of Surface MinesDocumento6 paginePlanning and Design of Surface Minesminerito2211Nessuna valutazione finora

- Block Size Selection in OPDocumento8 pagineBlock Size Selection in OPminerito2211Nessuna valutazione finora

- Mining Grade ControlDocumento6 pagineMining Grade Controlminerito221175% (8)

- MisUse of MonteCarlo Simulation in NPV Analysis-DavisDocumento5 pagineMisUse of MonteCarlo Simulation in NPV Analysis-Davisminerito2211Nessuna valutazione finora

- 05 Strategic Mine Planning 1Documento39 pagine05 Strategic Mine Planning 1minerito22110% (1)

- Evolution of Strategic LTP at Anglo PlatinumDocumento6 pagineEvolution of Strategic LTP at Anglo Platinumminerito2211Nessuna valutazione finora

- Use of Monte Carlo Simluations For Operations ManagementDocumento4 pagineUse of Monte Carlo Simluations For Operations Managementminerito2211100% (1)

- Application of Conveyors For UG HaulageDocumento11 pagineApplication of Conveyors For UG Haulageminerito2211Nessuna valutazione finora

- Optimization of Shovel-Truck System in OPDocumento7 pagineOptimization of Shovel-Truck System in OPminerito2211100% (1)

- Chapter 20Documento70 pagineChapter 20minerito2211Nessuna valutazione finora

- Economic Modelling and Its Application in Strategic PlanningDocumento12 pagineEconomic Modelling and Its Application in Strategic Planningminerito2211100% (1)

- XPAC7 Autocheduler Training GuideDocumento64 pagineXPAC7 Autocheduler Training Guideminerito2211100% (8)

- Project Spring - Senior & MezzanineDocumento69 pagineProject Spring - Senior & MezzanineJasmeet BhatiaNessuna valutazione finora

- Cost Benefit AnalysisDocumento2 pagineCost Benefit AnalysisPrayush RajbhandariNessuna valutazione finora

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocumento7 pagine9706 Accounting: MARK SCHEME For The October/November 2013 SeriesCambridge Mathematics by Bisharat AliNessuna valutazione finora

- Formula For Intercompany TransactionsDocumento6 pagineFormula For Intercompany Transactionskonyatan100% (1)

- Private-Indian Funds: List of Vcs in India: Data As On July 28, 2007Documento7 paginePrivate-Indian Funds: List of Vcs in India: Data As On July 28, 2007Neha TayalNessuna valutazione finora

- Assignment: Financial Markets & InstitutionDocumento38 pagineAssignment: Financial Markets & InstitutionFaraz AamirNessuna valutazione finora

- Chapter c8Documento36 pagineChapter c8bobNessuna valutazione finora

- Examples of Credit InstrumentsDocumento35 pagineExamples of Credit Instrumentsjessica anne100% (1)

- Eicher Motors: PrintDocumento3 pagineEicher Motors: PrintAryan BagdekarNessuna valutazione finora

- FUNDAMENTALS OF CASUALTY ACTUARIAL SCIENCE - CHAPTER 5 - Casualty PDFDocumento120 pagineFUNDAMENTALS OF CASUALTY ACTUARIAL SCIENCE - CHAPTER 5 - Casualty PDFRafael Xavier Botelho0% (1)

- Limelight Magazine - March 2012 IssueDocumento68 pagineLimelight Magazine - March 2012 IssueKen MarshallNessuna valutazione finora

- 2015 Tax and Corporate Udpates Course OutlineDocumento10 pagine2015 Tax and Corporate Udpates Course OutlineReal TaberneroNessuna valutazione finora

- Modes of Project FinancingDocumento81 pagineModes of Project FinancingjasiaahmedNessuna valutazione finora

- SDPK Financial Position Project FinalDocumento33 pagineSDPK Financial Position Project FinalAmr Mekkawy100% (1)

- External Investors in The German FootballDocumento13 pagineExternal Investors in The German FootballBruno ToniniNessuna valutazione finora

- Efficient Capital MarketDocumento3 pagineEfficient Capital MarketTaimoorKhanNessuna valutazione finora

- BCA AR 2015 Eng PDFDocumento602 pagineBCA AR 2015 Eng PDFbildyNessuna valutazione finora

- KPIDocumento6 pagineKPIBujji RaviNessuna valutazione finora

- Conc Framework, Revisiting The Fasb Conc FrameworkDocumento14 pagineConc Framework, Revisiting The Fasb Conc Frameworkindri070589Nessuna valutazione finora

- Beginner's Guide To Become A Professional TraderDocumento9 pagineBeginner's Guide To Become A Professional TraderBir Bahadur MishraNessuna valutazione finora

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocumento1 paginaTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Bajaj Allianz Life Guaranteed Income Goal - PPTDocumento26 pagineBajaj Allianz Life Guaranteed Income Goal - PPTMOHAN MOHANTYNessuna valutazione finora

- Syllabus: Cambridge International AS and A Level AccountingDocumento34 pagineSyllabus: Cambridge International AS and A Level AccountingOttone Chipara NdlelaNessuna valutazione finora

- Nishant Trading System For Nse v27.1Documento96 pagineNishant Trading System For Nse v27.1Marcus James0% (3)

- Bajaj Finance - MOA and AOADocumento77 pagineBajaj Finance - MOA and AOAPrathikNessuna valutazione finora

- 4 - Sensitivity AnalysisDocumento6 pagine4 - Sensitivity AnalysismarcusforteNessuna valutazione finora

- CFASDocumento18 pagineCFASLyca CosaNessuna valutazione finora

- Beulah Hill Treasure Trove 1953: Edward I-III, 138 Coins, C. 1364 / (R.H.M. Dolley)Documento10 pagineBeulah Hill Treasure Trove 1953: Edward I-III, 138 Coins, C. 1364 / (R.H.M. Dolley)Digital Library Numis (DLN)Nessuna valutazione finora

- Chique PresentationDocumento7 pagineChique Presentationapi-282632105Nessuna valutazione finora

- Coursera IPO Financial Model WallstreetMojoDocumento45 pagineCoursera IPO Financial Model WallstreetMojoritzNessuna valutazione finora