Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Demo - Nism 8 - Equity Derivatives Module

Caricato da

Bhupat127Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Demo - Nism 8 - Equity Derivatives Module

Caricato da

Bhupat127Copyright:

Formati disponibili

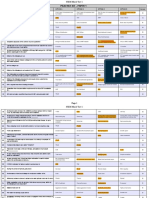

NISM SERIES VIII EQUITY DERIVATIVES CERTIFICATION

DEMO TEST

NISM SERIES VIII EQUITY DERIVATIVES CERTIFICATION

DEMO TEST

Question 1

(a)

(b)

(c)

(d)

Question 2

(a)

(b)

(c)

(d)

Correct Answer 1

Answer

Explanation

Correct Answer 2

If one makes does a calendar spread contract in index futures, then it attracts_________

Lower margin than sum of two independent legs of futures contract

No margin need to be paid for calendar spread positions

Higher margin than sum of two independent legs of futures contract

Same margin as sum of two independent legs of futures contract

An exchange traded option after maturity __________ .

Can be traded in the spot market

Can be traded for next 7 days

Cannot be traded

None of the above

Lower margin than sum of two independent legs of futures contract

Calendar spread position is a combination of two positions in futures on the same underlying long on one maturity contract and short on a different maturity contract.

When the market fluctuates, if there is a loss in the long position then there will be an almost

equal profit in short postion.

So Calendar spreads carry no market risk - hence lower margins are adequate.

Calendar spread carries on only basis risk. Basis risk means both the contracts will not

fluctuate identically.

Cannot be traded

NISM SERIES VIII EQUITY DERIVATIVES CERTIFICATION

DEMO TEST

Question 3

(a)

(b)

(c)

(d)

Question 4

(a)

(b)

(c)

(d)

Correct Answer 3

Answer

Explanation

Correct Answer 4

Answer

Explanation

A trader Mr. Raj wants to sell 10 contracts of June series at Rs.5200 and

a trader Mr. Rahul wants to buy 5 contracts of July series at Rs. 5250.

Lot size is 50 for both these contracts. The Initial Margin is fixed at 10%.

They both have their accounts with the same broker. How much Initial

Margin is required to be collected from both these investors by the

broker ?

Rs 2,60,000

Rs 1,31,250

Rs 3,91,250

Rs 1,28,750

The Spot Price of ABC Stock is Rs. 347. Rs. 325 strike call is quoted at Rs. 39. What is the

Intrinsic Value?

0

22

39

61

Rs 3,91,250

Payment of Initial Margin by a broker cannot be netted against two or more

clients. So he will have to pay the margin for the open position of each of his

clients.

So margin payable for Mr. Raj is : 10 x 5200 x 50 at 10% = Rs 2,60,000

Margin payable for Mr. Rahul is : 5 x 5250 x 50 at 10% = Rs 1,31,250

Total = Rs 3,91,250.

22

When the Strike Price is below the Spot Price, the Call Option is 'In the Money' ie. profitable.

Intrinsic Value for a such a Call Option = Spot Price - Strike Price

= 347 - 325

= 22

NISM SERIES VIII EQUITY DERIVATIVES CERTIFICATION

DEMO TEST

Question 5

(a)

(b)

(c)

(d)

Question 6

(a)

(b)

Correct Answer 5

Answer

Explanation

Correct Answer 6

Answer

Explanation

Tick size depends on

The Delta of the security

Its fixed by the exchange

Volume in that security

The Interest rates

When compared to cash market, there are more chances that an investor

does not properly understand the risks involved in the derivatives

market. True or False ?

TRUE

FALSE

Its fixed by the exchange

Tick size is the minimum move allowed in the price quotations. Exchanges decide the tick

sizes on traded contracts as part of contract specification. Tick size for Nifty futures is 5 paisa.

TRUE

Derivatives market and mainly the options market are difficult to understand

when compared to cash markets.

NISM SERIES VIII EQUITY DERIVATIVES CERTIFICATION

DEMO TEST

Question 7

(a)

(b)

(c)

(d)

Question 8

(a)

(b)

(c)

(d)

Correct Answer 7

Answer

Explanation

Correct Answer 8

Answer

Explanation

Mr R wants to sell 17 contracts of January series at Rs.4550 and Mr S wants to sell 20

contracts of February series at Rs. 4500. Lot size is 50. The Initial Margin is fixed at

9%. How much Initial Margin is required to be collected from both these investors by

the broker?

Rs 3,48,075

Rs 4,05,000

Rs 5,87,500

Rs 7,53,075

When you buy a put option on a stock you are owning, this strategy is

called _____________ .

Straddle

writing a covered call

calender spread

protective put

Rs 7,53,075

The Broker has to collect From Mr. R : 17 x 4550 x 50 x 9% = Rs 3,48,075

From Mr. S : 20 x 4500 x 50 x 9% = Rs 4,05,000

Therefore the total margin to be collected is 348075 + 405000 = Rs 7,53,075

protective put

Protective Put is a a risk-management strategy that investors can use to guard

against the loss of unrealized gains.

The put option acts like an insurance policy - it costs money, which reduces

the investor's potential gains from owning the security, but it also reduces his

risk of losing money if the security declines in value.

NISM SERIES VIII EQUITY DERIVATIVES CERTIFICATION

DEMO TEST

Question 9

(a)

(b)

Question 10

(a)

(b)

(c)

(d)

Correct Answer 9

Answer

Explanation

Correct Answer 10

Answer

Explanation

OTC derivative market is less regulated market because these

transactions occur in private among qualified counterparties, who are

supposed to be capable enough to take care of themselves. True or False

FALSE

TRUE

A member has two clients Rohit and Mohit. Rohit has purchased 100

contracts and Mohit has sold 300 contracts in March Tata Steel futures

series. What is the outstanding liability (open Position) of the member

towards Clearing Corporation in number of contracts?

100

300

400

200

TRUE

In an OTC market, no exchange is involved.

400

For a member ie. Stock Broker, the liability will be the sum of all the contracts

of all his clients. The contracts cannot be netted inbetween two clients. So in

this case the sum of contracts is 100 + 300 = 400 contracts.

TO GET THE FULL VERSION OF PASS4SURE QUESTION BANK WHICH

WILL CONTAIN THE V.V. IMP 400 TO 500 QUESTIONS, ANSWERS AND

THEIR EXPLAINATIONS, PLEASE BUY THE SAME FOR RS. 699.

THANK YOU AND ALL THE BEST.

NISM SERIES VIII EQUITY DERIVATIVES CERTIFICATION

DEMO TEST

Potrebbero piacerti anche

- Derivatives Dealers Content FeedDocumento42 pagineDerivatives Dealers Content FeedPravenGadi0% (1)

- BlockChain in Capital MarketsDocumento24 pagineBlockChain in Capital Marketsldhutch100% (1)

- Nism 8 Equity Derivatives Last Day Revision Test 1Documento54 pagineNism 8 Equity Derivatives Last Day Revision Test 1Nandi Grand83% (6)

- Nism 8 - Test-2 - Equity Derivatives - PracticeDocumento31 pagineNism 8 - Test-2 - Equity Derivatives - PracticeAbhijeet KumarNessuna valutazione finora

- Nism & Market News: NISM - 500 Question Bank - VA SeriesDocumento41 pagineNism & Market News: NISM - 500 Question Bank - VA Seriesrohit jainNessuna valutazione finora

- NISM SERIES XIII - COMMON DERIVATIVE CERTIFICATION EXAM LAST DAY REVISION TEST 1Documento54 pagineNISM SERIES XIII - COMMON DERIVATIVE CERTIFICATION EXAM LAST DAY REVISION TEST 1Vinoth Kumar50% (2)

- NISM Securities Operations and Risk Management Practice Test - NISM SORMDocumento22 pagineNISM Securities Operations and Risk Management Practice Test - NISM SORMSRINIVASAN100% (4)

- Mock 12Documento28 pagineMock 12Manan Sharma100% (1)

- 133 - Derivatives Market PDFDocumento38 pagine133 - Derivatives Market PDFwilmarNessuna valutazione finora

- Nism Viii Test 1Documento14 pagineNism Viii Test 1Ashish Singh100% (1)

- Derivatives and Risk ManagementDocumento64 pagineDerivatives and Risk Managementannafuentes100% (1)

- Equity Derivatives NISM Free Mock TestDocumento12 pagineEquity Derivatives NISM Free Mock Testsimplypaisa75% (8)

- NISM Series XA Level 1 Last Day Revision Exam 1 TitleDocumento42 pagineNISM Series XA Level 1 Last Day Revision Exam 1 Titleavik bose25% (4)

- 500 in One NismDocumento251 pagine500 in One NismPrasad Khati92% (13)

- Nism 8 - Equity Derivatives - Practice Test 3Documento19 pagineNism 8 - Equity Derivatives - Practice Test 3Mohit KundliaNessuna valutazione finora

- The World of CreditDocumento121 pagineThe World of Creditapi-24147782Nessuna valutazione finora

- NISM Paper 1 To 5 MOCK Test - Vry ImpDocumento26 pagineNISM Paper 1 To 5 MOCK Test - Vry ImpKumarGaurav50% (2)

- Nism 8 - Equity Derivatives - Last Day Revision Test 1Documento54 pagineNism 8 - Equity Derivatives - Last Day Revision Test 1vgvpplNessuna valutazione finora

- Nism XV - Research Analyst Exam - Last Day Test 1Documento54 pagineNism XV - Research Analyst Exam - Last Day Test 1roja14% (7)

- NISM SERIES XV - RESEARCH ANALYST CERTIFICATION EXAMDocumento40 pagineNISM SERIES XV - RESEARCH ANALYST CERTIFICATION EXAMjack75% (4)

- NISM XA - Investment Adviser 1 Short Notes PDFDocumento41 pagineNISM XA - Investment Adviser 1 Short Notes PDFSAMBIT SAHOO100% (1)

- Objective Type Questions On DerivativesDocumento5 pagineObjective Type Questions On DerivativesEknath Birari100% (1)

- Nism Equity Derivatives Study NotesDocumento27 pagineNism Equity Derivatives Study Notesshyamal saha100% (1)

- Unlock-NISM 8 - EQUITY DERIVATIVES - REAL FEEL MOCK TESTDocumento41 pagineUnlock-NISM 8 - EQUITY DERIVATIVES - REAL FEEL MOCK TESTAbhishek100% (1)

- NISM-Series-I: Currency Derivatives Certification ExaminationDocumento8 pagineNISM-Series-I: Currency Derivatives Certification Examinationshashank78% (9)

- Nism 8 - Equity Derivatives - Test-1 - Last Day RevisionDocumento54 pagineNism 8 - Equity Derivatives - Test-1 - Last Day RevisionAbhijeet Kumar100% (1)

- FREE NISM Mock Test - NISM Series VIII Equity Derivatives Certification Examination. NISM Study Material and NISM Workbooks Are Also Available at WWW - PrepCafe.in Free of Cost.Documento14 pagineFREE NISM Mock Test - NISM Series VIII Equity Derivatives Certification Examination. NISM Study Material and NISM Workbooks Are Also Available at WWW - PrepCafe.in Free of Cost.NISM PrepCafe - FREE NISM Mock Tests, Free NISM Study Material Download and much more100% (4)

- OilAndGasFinancialJournalOctober2008 EnergyTradingRiskManagementDocumento24 pagineOilAndGasFinancialJournalOctober2008 EnergyTradingRiskManagementjohnsm2010Nessuna valutazione finora

- Nism Series 15 Model PaperDocumento54 pagineNism Series 15 Model PaperRohit Shet50% (4)

- NISM Mock 4 PDFDocumento41 pagineNISM Mock 4 PDFnewbie194767% (3)

- NISM SORM Certification Question BankDocumento12 pagineNISM SORM Certification Question Banksimplypaisa67% (6)

- NISM SORM Certification Question BankDocumento12 pagineNISM SORM Certification Question Banksimplypaisa67% (6)

- Nism 8 - Equity Derivatives - Test-2 - Last Day RevisionDocumento54 pagineNism 8 - Equity Derivatives - Test-2 - Last Day RevisionAbhijeet Kumar50% (2)

- Nism Series XV - Research Analyst Certification ExamDocumento17 pagineNism Series XV - Research Analyst Certification ExamRohit ShetNessuna valutazione finora

- Derivative Question and AnswerDocumento15 pagineDerivative Question and AnswerPriyadarshini Sahoo65% (23)

- NISM-Series-VIII Equity Derivatives Solved Exam QuestionsDocumento21 pagineNISM-Series-VIII Equity Derivatives Solved Exam QuestionsHitisha agrawalNessuna valutazione finora

- NISM Series VIII Equity Derivatives Certification Question BankDocumento12 pagineNISM Series VIII Equity Derivatives Certification Question Banksimplypaisa76% (90)

- NISM Series VIII Equity Derivatives Exam Practice TestDocumento29 pagineNISM Series VIII Equity Derivatives Exam Practice TestAbhijeet Kumar0% (1)

- NISM Equity Derivatives MCQsDocumento4 pagineNISM Equity Derivatives MCQspearlksr81% (21)

- Nism 8Documento235 pagineNism 8Sohail Shaikh100% (3)

- Equity Derivatives Question BankDocumento3 pagineEquity Derivatives Question BankDishagyan.com70% (23)

- Edhec Publication Dynamic Ldi Strategies 0Documento124 pagineEdhec Publication Dynamic Ldi Strategies 0John ManciaNessuna valutazione finora

- NISM 8 - EQUITY DERIVATIVES - PRACTICE TEST 7 NewDocumento19 pagineNISM 8 - EQUITY DERIVATIVES - PRACTICE TEST 7 Newsumit3902100% (1)

- Nism X A - Investment Adviser Level 1 - Last Day Revision Test 3 PDFDocumento42 pagineNism X A - Investment Adviser Level 1 - Last Day Revision Test 3 PDFNupur Sharma25% (4)

- Stock and Commodity MarketsDocumento63 pagineStock and Commodity MarketsAryan SinghNessuna valutazione finora

- 3.00 - 61 Over 70 - TAKEDocumento38 pagine3.00 - 61 Over 70 - TAKEVon Andrei MedinaNessuna valutazione finora

- Equity Derivatives: Part A: Derivatives & Risk Management - Questions BankDocumento24 pagineEquity Derivatives: Part A: Derivatives & Risk Management - Questions Bankthomas Ed Horas100% (1)

- Nism Series ViiiDocumento11 pagineNism Series ViiiAnonymous tQKFAZvsvL80% (5)

- Nism 9Documento19 pagineNism 9newbie1947Nessuna valutazione finora

- Mock 1Documento10 pagineMock 1Manan SharmaNessuna valutazione finora

- Appendix A: Sample QuestionsDocumento9 pagineAppendix A: Sample QuestionsYashNessuna valutazione finora

- NISM Equity Derivatives Certification Free Mock TestDocumento23 pagineNISM Equity Derivatives Certification Free Mock TestAritra Kar100% (1)

- NISM Series-VIII Equity Derivatives Certification ExaminationDocumento2 pagineNISM Series-VIII Equity Derivatives Certification ExaminationIntelivisto Consulting India Private Limited50% (2)

- NISM SORM Free Mock TestDocumento12 pagineNISM SORM Free Mock TestsimplypaisaNessuna valutazione finora

- NISM Equity Derivatives Mock Test WWW - MODELEXAM.INDocumento1 paginaNISM Equity Derivatives Mock Test WWW - MODELEXAM.INSRINIVASAN50% (2)

- Model Test PaperDocumento49 pagineModel Test Papernagendrasingh4523Nessuna valutazione finora

- NISM Series VIII Equity DerivativesDocumento1 paginaNISM Series VIII Equity DerivativesKishore Steve AustinNessuna valutazione finora

- NISM Investment Adviser Study MaterialDocumento28 pagineNISM Investment Adviser Study MaterialSRINIVASAN100% (1)

- Nism Series 1 Currency - Real Feel Mock Test 2Documento54 pagineNism Series 1 Currency - Real Feel Mock Test 2Neeraj Kumar100% (1)

- Equity DerivativesDocumento5 pagineEquity Derivativessimplypaisa50% (2)

- Investment Adviser XB Level 2 Exam Study Material NotesDocumento20 pagineInvestment Adviser XB Level 2 Exam Study Material NotesSRINIVASAN100% (2)

- Derivative MKt. QuestionDocumento19 pagineDerivative MKt. Question26amit100% (1)

- NISM SERIES 1 – CURRENCY DERIVATIVES CERTIFICATION EXAM – PRACTICE TEST 1Documento19 pagineNISM SERIES 1 – CURRENCY DERIVATIVES CERTIFICATION EXAM – PRACTICE TEST 1Neeraj KumarNessuna valutazione finora

- NISM SERIES X-A Site Model PaperDocumento4 pagineNISM SERIES X-A Site Model Paperssk1972100% (2)

- PDF Derivative Question and Answer DDDocumento7 paginePDF Derivative Question and Answer DDSourav ChhabraNessuna valutazione finora

- Mutual Fund NISM Mock TestDocumento12 pagineMutual Fund NISM Mock Testsimplypaisa0% (1)

- Correct Answers Are Shown in GreenDocumento20 pagineCorrect Answers Are Shown in Greenvineetsukhija67% (6)

- Dokumen - Tips - Demo Nism 8 Equity Derivatives ModuleDocumento7 pagineDokumen - Tips - Demo Nism 8 Equity Derivatives ModuleArif QureshiNessuna valutazione finora

- Nism VIII Test 3Documento12 pagineNism VIII Test 3Ashish Singh50% (2)

- SEBI as a regulator of the capital marketDocumento25 pagineSEBI as a regulator of the capital marketraj vardhan agarwalNessuna valutazione finora

- Sridhar2 PDFDocumento18 pagineSridhar2 PDFSriram KodamanchiliNessuna valutazione finora

- PUSEQF Prospectus SC PDFDocumento43 paginePUSEQF Prospectus SC PDFIdo Firadyanie MarcelloNessuna valutazione finora

- Understanding Hedge Funds and Hedge Fund StrategiesDocumento8 pagineUnderstanding Hedge Funds and Hedge Fund Strategieshttp://besthedgefund.blogspot.com100% (1)

- Fixed Income Securities SyllabusDocumento5 pagineFixed Income Securities SyllabusplutozagNessuna valutazione finora

- Derivative Report: Nifty Vs OIDocumento3 pagineDerivative Report: Nifty Vs OIAngel BrokingNessuna valutazione finora

- Brochure January 05Documento22 pagineBrochure January 05Jamie EdwardsNessuna valutazione finora

- Wa0001.Documento6 pagineWa0001.ragnarlothbrok3901Nessuna valutazione finora

- Lecture 13 - Long-Term Debt FinancingDocumento7 pagineLecture 13 - Long-Term Debt FinancingTrương Ngọc Minh ĐăngNessuna valutazione finora

- Summer InternshipDocumento17 pagineSummer InternshipAnkit Pal100% (1)

- Indian Securities Market Handbook 2018Documento241 pagineIndian Securities Market Handbook 2018ishuch24Nessuna valutazione finora

- International Money MarketDocumento52 pagineInternational Money MarketAbhey BansalNessuna valutazione finora

- Evolution of Derivatives Markets in IndiaDocumento9 pagineEvolution of Derivatives Markets in IndiaHema Priya100% (1)

- Cement Sector Update - Dealer Interaction - Centrum 121213Documento4 pagineCement Sector Update - Dealer Interaction - Centrum 121213Rajesh KatareNessuna valutazione finora

- Derivatives: Types of Derivative ContractsDocumento20 pagineDerivatives: Types of Derivative ContractsXandarnova corpsNessuna valutazione finora

- Bodie Investments 12e IM CH01Documento4 pagineBodie Investments 12e IM CH01lexon_kbNessuna valutazione finora

- IFRS 7 Original PDFDocumento39 pagineIFRS 7 Original PDFImtiaz Rashid50% (2)

- Accenture Capital Markets Vision 2022Documento36 pagineAccenture Capital Markets Vision 2022manugeorgeNessuna valutazione finora

- DoneDocumento275 pagineDoneNeha TalwarNessuna valutazione finora

- WH LATAM 2023 BrochureDocumento29 pagineWH LATAM 2023 BrochureDiego Plana RobertNessuna valutazione finora

- Off Balance Sheet RiskDocumento23 pagineOff Balance Sheet RiskCamille de JesusNessuna valutazione finora