Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chap 4

Caricato da

mrinalbohraTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chap 4

Caricato da

mrinalbohraCopyright:

Formati disponibili

CHAPTER 4

RECONSTITUTION OF A PARTNERSHIP FIRM

RETIREMENT AND DEATH OF A PARTNER

LEARNING OBJECTIVES

After studying this chapter you will

be able to :

l

Calculate new profit-sharing

ratio and gaining ratio.

Describe the accounting

treatment of goodwill in the

event of retirement/death of a

partner;

Explain the accounting

treatment for revaluation of

assets and reassessment of

liabilities;

Explain the accounting

treatment with respect to the

joint life policy;

Ascertain

the

retiring/

deceased partner's share in the

firm and its settlement;

Prepare the retiring/deceased

partner's loan account;

Prepare the Balance Sheet of

the reconstituted firm.

On the retirement or death of a partner,

the existing partnership deed comes to

an end. In its place the new partnership

deed needs to be framed, i.e. the firm

requires reconstitution. The remaining

partners shall continue to do their

business but on the different terms and

conditions. There is not much difference

in the accounting treatment at the time

of retirement or in the event of death as

retiring/deceased partner will no longer

be a partner of the reconstituted firm.

In both cases, we are required to

determine the sum due to the retiring

partner (in case of retirement) and to the

legal representatives in case of deceased

partner. The retirement may take place

with the consent of all other partners,

in accordance with terms of the deed

(i.e. there may be express agreement to

that effect) or in case of retirement at

will or by giving notice in writing by a

partner desiring to do so.

RETIREMENT AND DEATH OF A PARTNER

139

4.1 Ascertaining the amount of sum due to

Retiring/Deceased Partner

The sum payable to the retiring/deceased partner includes

l

Balance in his capital/current account;

Share of accumulated profits (losses) and reserves;

Share in the gain/loss on revaluation of assets and reassessment of

liabilities;

Share of goodwill;

Share in the profits of current year;

Share in joint life policy;

Interest on capital, salary, etc. from the date of last balance sheet to

the date of death/retirement (if applicable) will be credited to him,

drawings and interest on drawings will also be debited for the required

time period to the concerned partner's capital account.

At the time of retirement or death of a partner, we need to compute the

new profit sharing ratio and gaining ratio among the continuing partners.

This will enable us to carry out the following adjustments :

l

Goodwill

Revaluation of assets and reassessment of liabilities

Distribution of accumulated profits (losses) and reserves

Capital adjustments (if any).

The above adjustments will help us to ascertain the amount due to retiring/

deceased partner.

4.1.1 Calculation of New Profit Sharing Ratio

New profit sharing ratio is the ratio in which the remaining partners will share

profits (excluding retiring/deceased partner). The new share of each of the

remaining partners will consist of his own share in the firm plus share acquired

from the retiring/deceased partner. At the time of retirement or death of a

partner, the share of retiring/deceased partner is acquired by existing partners,

on the basis of agreement among them. If the continuing partners decide to

acquire the share of retiring/deceased partner in old profit sharing ratio, then

ACCOUNTANCY

140

there is no need to compute the new profit sharing ratio, since it will be

same as the old profit sharing ratio among them.

In the absence of any information regarding profit sharing ratio in which

the continuing partners will share in profit of the retiring/deceased partner,

it is assumed that they will acquire his share in old profit sharing ratio (as

shown in illustration 1).

If the continuing partners acquire the share in profits of the retiring/

deceased partner in a proportion other than their old ratio, then we need to

compute the new profit sharing ratio. In this case, the new share of a continuing

partners, in profits will be total of their respective old share and share acquired

from the retiring/deceased partner.

New share of the continuing partner = Their respective old share + Share acquired

from outgoing partner

l

Gaining Ratio

The ratio in which the continuing partner have acquired the share from the

retiring/deceased partner is called gaining ratio.

Gain of continuing partner = New share Old share

It is to be noted that the continuing partners may also sacrifice on

retirement/death of a partner if the partner sells his share to any of the

continuing partner. In that situation the gaining ratio of that partner will have

minus sign, thereby indicating that he has also sacrificed a part of his profit.

If continuing partners decide to acquire the share of retiring/deceased

partner in their old profit sharing ratio, then the gaining ratio will be same as

their old profit sharing ratio among them. (as shown in illustration 1). If the

ratio in which the continuing partners will share the profits is given then the

gaining ratio will be computed by subtracting the old share from the new

share of the partner. If the continuing partners acquire the share of the retiring/

deceased partner in a proportion other than their old profit sharing, then the

ratio in which they have acquired the share of profit from the retiring/deceased

partner is the gaining ratio.

Illustration 1 (Calculation of new profit sharing ratio and gaining ratio)

Sita, Rita and Raj are partners sharing profits in the ratio of 5:3:2. Calculate

new profit sharing ratio and gaining ratio if : (i) Sita retires, (ii) Raj retires, and

(iii) Rita retires.

RETIREMENT AND DEATH OF A PARTNER

141

Solution

I.

Calculation of New Profit Sharing Ratio

(i)

New share of Rita and Raj (If Sita retires) :

In order to calculate new ratio of Rita and Raj, it is assumed that Sita's share of

5

will be taken up by Rita and Raj in their old profit sharing ratio inter se.

10

Rita's new share

3

5

3

3

15

30

+(

)=

+

=

10

10

5

10

50

50

Raj's new share

2

5

2

2

10

20

+(

)=

+

=

10

10

5

10

50

50

Therefore, New profit sharing ratio = 3 : 2

(ii)

New share of Sita and Rita (If Raj retires) :

In this case it is assumed that Raj's share of

2

will be taken up by Sita and Rita

10

in their old profit sharing ratio.

Sita's new share

5

2

5

5

10

50

+(

)=

+

)=

10

10

8

10

80

80

Rita's new share

3

2

3

3

6

30

+(

)=

+

)=

10

10

8

10

80

80

Therefore New profit sharing ratio

5:3

(iii) New share of Sita and Raj (If Rita retires) :

In this case, it is assumed that Rita's share of

3

will be taken up by Sita and

10

Raj in their old profit sharing ratio.

Sita's new share =

5

3

5

5

15

50

+(

)=

+

=

10

10

7

10

70

70

Raj's new share =

2

3

2

2

6

20

+(

)=

+

=

10

10

7

10

70

70

Therefore new sharing ratio is 5 : 2

ACCOUNTANCY

142

II.

Calculation of Gaining Ratio

(i)

Gaining ratio of Rita and Raj :

Rita's gain = New share Old share

3

3

3

=

5

10

10

Raj's gain = New share Old share

2

2

2

=

5

10

10

Therefore, the gaining ratio of Rita and Raj will be 3: 2

(ii)

Gaining ratio of Sita and Rita :

Sita's gain = New share Old share

5

5

20 - 25

5

=

=

8

10

40

40

Rita's gain

3

3

3

=

8 10

40

Therefore, the gaining ratio of Sita & Rita will be 5 : 3

(iii) Gaining ratio of Sita and Raj :

Sita's gain = New share Old share

5

15

5

=

10

70

7

Raj's gain = New share Old share

2

2

=

7 10

6

70

Therefore, gaining ratio of Sita and Raj will be 5 : 2.

Illustration 2 (Calculation of new profit sharing ratio)

Ajay, Vijay and Veena are partners sharing profits in the ratio of 3:2:1. Ajay

retires and his share is taken up by Vijay and Veena : (i) equally, (ii) in the ratio

of 3 : 2. Calculate the new profit sharing ratio.

RETIREMENT AND DEATH OF A PARTNER

143

Solution

(i)

When Ajay's share is taken up equally by Vijay and Veena

Vijay's share in profit

2

6

Share acquired from Ajay

3

3 1

=

6 2 12

New share of Vijay

2

3

7

+

=

6 12

12

Veena's share in profit

1

6

Share acquired from Ajay

3 1

3

=

6 2 12

Veena's new share

3

1

5

+

=

6

12 12

Therefore, Ratio of Vijay and Veena 7 : 5

(ii)

When Ajay's share is taken up in 3 : 2 ratio

Vijay's share in profit

2

6

Share acquired from Ajay

3 3

9

=

5 6 30

Vijay New share

9 19

2

=

= +

6

30

30

Veena's share

Share acquired from Ajay

2

3

6

=

5

6 30

Veena's new share

1 6

11

+

=

6 30 30

1

6

Therefore, Ratio of Vijay and Veena 19 :11

ACCOUNTANCY

144

Illustration 3 (Calculation of new profit sharing ratio and gaining ratio)

Mahesh, Naresh and Onkar are partners sharing profits in the ratio of 3/8,

1/2 and 1/8. Mahesh retires and surrenders 2/3 of his share in favour of

Naresh and remaining in favour of Onkar. Calculate new ratio and gaining

ratio.

Naresh

Onkar

(i)

Existing Share

1

2

1

8

(ii)

Share acquired by Naresh

2

3

3

8

(1

and Onkar from Mahesh

2

8

1

2

+

2

8

(iii) New Ratio = i + ii

6

8

2

3

)

3

8

1

8

1

1

+

8

8

2

8

i.e. 6 : 2

or 3 : 1

(IV) Gaining Ratio =

2 : 1 [As Calculated in (ii)]

Illustration 4 (Calculation of new profit sharing ratio)

Kamlesh, Lalit, Manoj and Naveen are partners sharing profits in the ratio of

3:2:1:4. Kamlesh retires and his share acquired by Lalit and Manoj in the ratio

of 3:2. Calculate new ratio and gaining ratio.

Solution

Calculation of new profit sharing ratio

(i)

Old share

Lalit

Manoj

Naveen

2

10

1

10

4

10

RETIREMENT AND DEATH OF A PARTNER

(ii)

Acquisition of Kamlesh's share

145

3

3

10

5

=

(iii) New Ratio (i) + (ii)

i.e. the new profit sharing ratio is :

Note :

9

50

3

2

10

5

--

6

50

9

2

+

10

50

1

6

+

10 50

4

10

19

15

11

50

20

50

19

11

:

:

20

Since Lalit and Manoj are acquiring Kamlesh's share of profit in the ratio 3:2, hence,

the gaining ratio will be 3:2 between Lalit and Manoj.

4.1.2 Treatment of Goodwill

The retiring/deceased partner is entitled to his share of goodwill at the time of

retirement/death because the goodwill has been earned by the firm with the

efforts of all the existing partners. At the time of retirement/death of a partner,

goodwill is valued as per agreement among the partners. Since the retiring/

deceased partner will not be sharing the future profits of the firm, a part of

which might be accruing because of the present value of goodwill. Therefore,

in all fairness, the retiring/deceased partner should be compensated for the

same by the continuing partners in their gaining ratio. For this purpose, the

retiring/deceased partner's capital will be credited. In this case the following

journal entry is recorded :

Continuing partner's capital a/c (in the gaining ratio)

Retiring/deceased partner's capital a/c

Dr.

(with his share of

goodwill)

The idea here is to credit retiring/deceased partner's capital account with

his share of goodwill and debit the capital accounts of continuing partner who

will gain on the retirement or death of partner, in their gaining ratio.

It is worthmentioning here that if any of the remaining partners has also

agreed to sacrifice some share in the profits of the firm on retirement/death of

a partner, his capital account will also be credited along with retiring partner's

capital with his proportion of sacrifice and continuing partner's capital are

ACCOUNTANCY

146

debited who have gained on retirement/death of a partner by recording the

following entry :

Continuing partner's capital a/c ( who have gained )

Retiring/deceased partner's capital a/c

Dr.

Continuing partner's capital ( who sacrificed )

The goodwill is valued for this purpose on the basis of agreement among

the existing partners. (This has been discussed in detail in Chapter 1).

l

Hidden Goodwill

If the firm has agreed to settle the account of retiring/deceased partner by

paying him a lump-sum amount, then amount paid to him in excess of his

capital and share in reserves/revaluation account etc. shall be treated as his

share of goodwill. For example, P,Q and R are partners. R retires, his capital

account, after making adjustments for reserves and profit on revaluation exists

at Rs. 64,000. P and Q have agreed to pay him Rs. 80,000 in full settlement of

his claim. It implies that Rs.16,000 is R's share in the goodwill of the firm. This

will be treated by debiting Rs.16,000 in P & Q's capital account in their gaining

ratio and crediting R's capital account.

Illustration 5 (Goodwill)

Om, Jai and Jagdish are partners sharing profits in the ratio 5:3:2. Om retires

and goodwill is valued at Rs. 50,000. New profit sharing ratio of continuing

partners will be equal. Record necessary journal entry.

Solution

Journal

Date

Particulars

Jai's Capital a/c

Dr.

Jagdish's Capital a/c

Dr.

Om's Capital a/c

(Om's share of goodwill credited to him)

L.F.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

10,000

15,000

25,000

RETIREMENT AND DEATH OF A PARTNER

147

Notes to the Solution

Gain of partner

New share Old share

Jai's old share

3

10

Jai's new share

1

2

Jai's gain

1

3

2

=

2

10

10

Jagdish's old share

2

10

Jagdish's new share

1

2

Jagdish's gain

1

2

3

=

2

10

10

Therefore, gaining ratio is 2 : 3.

Illustration 6 (Goodwill)

Shashi, Madhu, Usha and Renu are partners sharing profits in ratio of 3:2:3:2.

On the retirement of Usha, goodwill was valued at Rs. 1,20,000. Usha's share

of goodwill will be given to her by adjusting it into the capital accounts of

Shashi, Madhu and Renu. Record necessary entry for the treatment of goodwill

when new profit sharing ratio decided is 3 :1: 6.

Solution

In the Books of Shashi, Madhu, Usha and Renu

Journal

Date

Particulars

Renu's Capital a/c

Dr.

Madhu's Capital a/c

Usha's Capital a/c

(Madhu and Usha have sacrificed their share,

and Renu has gained on retirement of Usha)

L.F.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

48,000

12,0001

36,0002

ACCOUNTANCY

148

Notes to the Solution

(I)

Gain of a Partner = New share Old share

Shashi's gain =

3

3

= 0 (New share is same as old share)

10

10

Madhu's gain =

1

2

1

= (

) (sacrifice)

10

10

10

Renu's gain =

(II)

6

2

4

=

10

10

10

Transfer of goodwill to partners capital account

Rs. 1,20,000

1

= Rs. 12,0001

10

Rs. 1,20,000

3

= Rs. 36,0002

10

Illustration 7 (Goodwill)

Sangeeta, Usha and Rita are partners sharing profits in the ratio of 3:2:1.

Usha wants to retire due to her ill health. For this purpose goodwill is valued

at two years purchase of average super profits of last three years, The profit

for the last three years are as under :

First year

Second year

Third year

: Rs. 36,600

: Rs. 43,600

: Rs. 48,800

The normal profits for similar firms is Rs. 34,000.

Record necessary entry for goodwill on retirement of Usha.

Solution

Books of Sangeeta,Usha and Rita

Journal

Date

Particulars

Sangeeta's capital a/c

Dr.

Rita's capital a/c

Dr.

Usha's capital a/c

(Goodwill credited to her capital account)

L.F.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

4,500

1,500

6,000

RETIREMENT AND DEATH OF A PARTNER

149

Notes to the Solution

2

= Rs. 6,000

6

Usha's share of goodwill

Rs. 18,000

Average profits

Rs. (36,600 + 43,600 + 48,800)/3 = Rs. 43,000

Super profits

Average profits Normal profits

Rs. 43,000 Rs. 34,000= Rs. 9,000

Super profits No. of years purchase

Rs. 9,000 2= Rs. 18,000

Goodwill

4.1.3 Revaluation of Assets and Reassessment of Liabilities

At the time of retirement/death some of the assets may not have been shown

at their current values. Similarly, there may be certain liabilities which have

been shown at a value different from the obligation to be met by the firm.

Besides this, there may be unrecorded assets and liabilities which have to be

recorded. To ascertain net gain (loss) on revaluation of assets and/or

reassessment of liabilities, "Revaluation account" is prepared. This gain (loss)

is transferred to the capital account of all partners including retiring/deceased

partner in their old profit sharing ratio. For this purpose, the following journal

entries are recorded :

(i)

For increase in assets

Assets a/c

Revaluation a/c

(ii)

(individually)

Dr.

(individually)

For decrease in liabilities

Liabilities a/c

Revaluation a/c

(v)

Dr.

For increase in liabilities

Revaluation a/c

Liabilities a/c

(iv)

(individually)

For decrease in assets :

Revaluation a/c

Assets a/c

(iii)

Dr.

Dr.

(individually)

For recording unrecorded assets

Unrecorded assets a/c

Revaluation a/c

Dr.

ACCOUNTANCY

150

(vi)

For recording unrecorded liabilities

Revaluation a/c

Unrecorded liabilities a/c

Dr.

(vii) For distribution of profit on revaluation

Revaluation a/c

Dr.

All partners' capital a/c (in old profit sharing ratio)

OR

for loss on revaluation

All Partners' Capital a/c

Revaluation a/c

Dr.

Note : Entries (i), (ii), (iii) and (iv) are to be recorded with the amount of increase or decrease

in assets and liabilities only.

All partners mean including retiring/deceased partner.

4.1.4 Distribution of Accumulated Profits (losses) and Reserves

Accumulated profits (losses) and reserves as shown in the Balance Sheet of

the firm on the retirement/death of a partner belongs to all the partners and is

transferred to their capital accounts in old profit sharing ratio. Similarly, at

times, the firm might have created some specific funds like workmen's

compensation fund or investment fluctuation fund to meet certain obligations

which may arise in future. At the time of retirement/death of a partner, this

fund may or may not be required to meet the obligation. The excess, if any,

that is not required is called "Surplus" and will be transferred to capital accounts

of all the partners in their old ratio. For the purpose, the following journal

entries are recorded :

(i)

For distributing Reserves and Accumulated Profits, etc.

Reserves a/c

Profit and loss a/c (Profits i.e. credit balance)

All partners' capital a/c (individually)

(ii)

Dr.

Dr.

For distributing losses among all partners in the old ratio

All Partners, Capital a/c

P&L a/c (accumulated losses, i.e. debit balance)

Deferred Revenue Expenditure a/c

Dr.

(iii) Surplus of specific funds transferred to partner's capital account

Workman's Compensation Fund a/c

Investment Fluctuation fund a/c

All Partners' capital a/c

Dr.

Dr.

RETIREMENT AND DEATH OF A PARTNER

151

Illustration 8 (Treatment for profit and loss)

M, K and A are partners sharing profits in proportion of 3/6, 2/6 and 1/6. M

decides to retire due to her marriage. On the date of her retirement, firm's

abstract Balance Sheet was as under. How will you treat the profit and loss

account shown in the Balance Sheet.

Balance Sheet as

Liabilities

Capitals :

M

K

A

Total

Amount

(Rs.)

10,000

6,000

4,000

at

Assets

Amount

(Rs.)

Cash

Profits and Loss

14,000

6,000

Total

20,000

20,000

20,000

Solution

Books of M, K and A

Journal

Date

Particulars

M's Capital a/c

Dr.

K's Capital a/c

Dr.

A's Capital a/c

Dr.

Profit and loss a/c

(Loss of Rs. 6,000 divided among all partners

in their profit sharing ratio i.e. 3:2:1)

L.F.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

3,000

2,000

1,000

6,000

Illustration 9 (Revaluation of assets and reassessment of liabilities)

Gita, Sunita and Shahnaaz are equal partners. Gita retire and the Balance

Sheet of this firm on that date is as under :

ACCOUNTANCY

152

Balance Sheet as

Liabilities

Amount

(Rs.)

Creditors

Reserve

Workman's Compensation

Fund (WCF)

Capitals :

Gita

10,000

Sunita

15,000

Shahnaaz

20,000

Profit and loss

5,500

3,000

45,000

6,000

Total

61,000

1,500

at

Assets

Amount

(Rs.)

Cash

Debtors

Furniture

Plant

Patents

4,000

16,000

15,000

20,000

6,000

Total

61,000

On retirement it was found that patents were valueless, furniture is to be

brought down to Rs.13,000 and plant is reduced by Rs. 4,000 and there was

no liability on account of workman's compensation fund. Record necessary

entries at the time of retirement.

Solution

Books of Gita Sunita and Shahnaaz

Journal

Date

Particulars

L.F.

Reserve a/c

Dr.

Workman conpensation fund a/c

Dr.

Profit and loss a/c

Dr.

Gita's capital a/c

Sunita's capital a/c

Shahnaaz' a/c

(Free reserves distributed among partners)

Revaluation a/c

Furniture a/c

Plant a/c

Patents a/c

(Decrease in assets recorded)

Dr.

Gita's capital a/c

Sunita's capital a/c

Shahnaaz's capital a/c

Revaluation a/c

(Loss on revaluation recorded in the

Dr.

Dr.

Dr.

capital accounts of partners)

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

3,000

1,500

6,000

3,500

3,500

3,500

12,000

2,000

4,000

6,000

4,000

4,000

4,000

12,000

RETIREMENT AND DEATH OF A PARTNER

153

4.1.5 Disposal of the amount due to the retiring/deceased partner

The outgoing partner's account is settled as per terms of partnership deed, i.e.

in lump sum immediately or in various installments with/without interest as

agreed or partly cash immediately and partly in instalments at the agreed

intervals.

In the absence of any agreement, section 37 of the Indian Partnership Act,

1932 is applicable, which says that outgoing partner is at liberty to receive

either interest @ 6% p.a. till the date of payment or the share of profits which

has been earned with his money.

A. Disposal of the amount due to retiring partner :

1.

Retiring partner may be paid cash in full and following entry will be

recorded.

Retiring partner's a/c

Dr.

Cash/Bank a/c

2.

When retiring partner is partly paid in cash and the remaining amount

will be treated as loan. The entry for the purpose is as under :

Retiring partner's/capital a/c

Cash/Bank a/c

Loan

3.

The loan account can now be settled by recording following

entries :

(i)

(ii)

For the interest becomes due on due date :

Interest on loan a/c

Loan

Dr.

For payment of instalment on due date

Loan

Cash/Bank a/c

B.

Dr.

Dr.

Disposal of the amount due to the deceased partner :

(a) The amount standing to the credit of deceased partner's capital is

transferred to his executor's account, by recording the following entry :

Deceased partner's capital a/c

Dr.

Deceased partner's executor's a/c

Deceased partner's executor's account will be settled as per the

agreement between the firm and executor's of the deceased partner.

ACCOUNTANCY

154

(b) When the full amount is paid in cash, following entry is recorded:

Executor's a/c

Dr.

Cash/Bank a/c

(c)

When the settlement is made in instalments, the following entries are

made :

(i)

For interest due :

Interest on executor's a/c

Executor's a/c

(ii)

Dr.

For payment of instalment on loan account

Executor's a/c

Cash/Bank a/c

Dr.

Partners' Capital Accounts

Dr.

Cr.

Date

Particulars

J.F.

Drawings

Interest on drawings

Profit & Loss (Loss)1

Revaluation (Loss)2

Balance c/f

(for retiring partner's

balance)

Executor's a/c

(For deceased

partner's balance)

Total

Amount

(Rs.)

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

****

****

Date

Particulars

Bal. b/f

Remaining partner's

Capital account

(compensation on

account of goodwill)

P and L (Profits)1

Reserve Fund

Interests on Capital

Joint Life Policy

Revaluation Profits2

Total

J.F.

Amount

(Rs.)

****

****

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

Format of the retiring/deceased partner's capital account.

4.1.6. Capital Adjustment

There is no binding on the partners to contribute in proportion to their profit

sharing ratio. But at the time of retirement/death of a partner, the remaining

partners may decide to keep their capital contributions in their profit sharing

ratio. In such a situation, the sum of balances in the capitals of continuing

partners will be worked out which will be the total capital of the new firm. To

ascertain the new capital of the continuing partners, total capital of the firm is

divided as per the new profit sharing ratio. The new capitals are then compared

1,2

There can either be gain or loss on account of these items.

RETIREMENT AND DEATH OF A PARTNER

155

with the balances in the capital accounts in order to work out surplus or

deficit in the individual capital account. Surplus or deficit to be withdrawn/

brought in cash as the case may be, the following entries will be recorded :

(i)

For surplus capital withdrawn by the partner :

Partners' capital a/c

Cash/Bank a/c

(ii)

Dr.

For deficit brought in by the partner :

Cash/Bank a/c

Partners' capital a/c

Dr.

Illustration 10 (Capital Adjustment)

A, B and C are partners in a firm sharing profits in the ratio of 3 : 2 : 1. B

retires. After making all adjustments relating to revaluation, goodwill and

accumulated profits, etc. the capital account of A showed a credit balance of

Rs. 80,000 and that of C Rs. 40,000. It was decided to adjust the capitals of A

and C in their profit sharing ratio. You are required to calculate the new capital

of the partners and record necessary entry for surplus/deficit.

Solution

(I)

Calculation of new capital of partners

(i)

Balance in A's capital

Rs.

80,000

(ii)

Balance in B's capital

40,000

(iii) Total capital of the new firm (i + ii)

= 1,20,000

(iv)

A's new capital = 1,20,000

3

4

= 90,000

(v)

C's new capital = 1,20,000

1

4

= 30,000

(vi)

Cash to be brought in by 'A' (i - iv)

(vii) Cash to be paid to 'C' (ii - v)

= 80,000 90,000 = (10,000)

= 40,000 30,000 = 10,000

ACCOUNTANCY

156

(II)

Journal entries

Books of A, B and C

Journal

Date

Particulars

L.F.

Cash a/c

A's capital a/c

(For cash brought by A)

Dr.

C's capital a/c

Cash a/c

(For surplus capital withdrawn by C)

Dr.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

10,000

10,000

10,000

10,000

Sometimes the continuing partners may decide about the amount of total

capital of the reconstituted firm. For example on the retirement of Y, the

continuing partners X and Z decided that the capital of the new firm will be

Rs.1,50,000 and it will be in the new profit sharing ratio which will be 3 : 2.

After all adjustments on the retirement of Y the balances in the capitals of X

and Y were Rs. 85,000 and Rs. 60,000.

Now the new capital of X

= Rs. 1,50,000

3

=

5

Rs. 90,000

The new capital of Y

=Rs. 1,50,000

2

=

5

Rs. 60,000

Since existing capital of X is Rs. 85,000 after all adjustments and new

capital is Rs. 90,000, he will be required to bring Rs. 5,000 (i.e. Rs.90,000

Rs. 85,000). Z is not required to bring/withdraw any amount of capital since

his old capital is equal to that of his new capital in the new firm.

At times it may be decided that the amount payable to retiring partner will

be contributed by the continuing partners in such a way that their capitals

become proportionate to their new profit sharing ratio. First of all in such a

situation the total of the balances standing to the credit of the existing partner's

capital accounts (after adjustment on retirement)is computed. To this, the

amount payable to the retiring partner (which is to be brought by continuing

partners) is added to arrive at the total capital of the new firm. This total

capital is now divided in the new profit sharing ratio of the continuing partners

to ascertain their respective share of new capital. Now the amounts to be brought

RETIREMENT AND DEATH OF A PARTNER

157

in or withdrawn by the partners will be ascertained by comparing their new

capitals with balances in their capital accounts after all adjustments.

Illustration 11 (Capital Adjustment)

P, Q and R are partners sharing profits in ratio of 40%, 30% and 30%

respectively. After all adjustments, on P's retirement with respect to general

reserve, goodwill and revaluation the balances in their capital accounts stood

at Rs. 70,000, Rs. 60,000 and Rs. 50,000. It was decided that amount payable

to P will be brought in by Q & R in such a way so as to make their capitals in

proportionate to their profit sharing ratio. Calculate the amount to be brought

in by Q and R and record necessary journal entries for the same. Also record

necessary entry for payment to P.

Solution

(I) Calculation of new capital

Rs.

(i)

Balance in Q's capital account

(ii)

Balance in R's capital account

60,000

50,000

(iii) Amount payable to P

70,000

(iv)

Total capital of new firm

(i + ii + iii)

(v)

Q's new capital

= 1,80,000

1

= 90,000

2

(vi)

R's new capital

= 1,80,000

1

= 90,000

2

(vii) Amount to be brought by Q (i + v)

1,80,000

= 60,000 90,000

= (30,000)

(viii) Amount to be brought by R (ii + vi)

= 50,000 90,000

= (40,000)

ACCOUNTANCY

158

(II) Journal entries

Books of P, Q and R

Journal

Date

Particulars

L.F.

Cash a/c

Q's capital a/c

R's capital a/c

(Amount brought in by Q and R)

Dr.

P's capital a/c

Cash a/c

(Amount paid to P in full settlement)

Dr.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

70,000

30,000

40,000

70,000

70,000

4.2 Joint Life Policy

For the purpose of ensuring liquidity in the firm to settle the claim of the retiring/

deceased partner an assurance policy is taken up by the partners on their lives

collectively. The insurance company agrees to pay the sum assured (i.e., the

amount for which the policy has been taken) to the firm on the maturity date.

Maturity date is the date of death of any of the partners or the date on which the

term of the policy expires, whichever is earlier. The firm in turn agrees to pay to

the insurance company the amount of premium periodically. The amount of

premium payable will be same in each of the years.

Surrender Value (SV) is the amount payable by an insurance company on

the surrender/discontinuation of joint life policy before the date of maturity.

However, the surrender value keeps on increasing with the successive payment

of premium.

4.2.1 Accounting treatment for joint life policy

Joint Life Policy transactions by the firm can be dealt with any of the following

ways :

1.

Treated as an expense of firm

It implies that premium paid is treated as a business expense, it is chargeable

to the profit and loss account, thus reducing the distributable profits of the

RETIREMENT AND DEATH OF A PARTNER

159

partners. Year after year, the expense on account of premium on joint life

policy in recorded as an expense. In the event of death of a partner firm will

realise the sum assured and bonus, if any which will be distributed among the

partners. Consequently it obviates the need to exhibit insurance policy in the

Balance Sheet.

Following are the entries to record these transaction in the first and

subsequent years :

Year of obtaining and continuance of policy

l

For payment of premium:

Joint life policy premium

Bank a/c

Dr.

For transfer of premium paid to profit and loss account at the end of the year :

Profit and loss a/c

Joint life policy premium

Dr.

On the maturity of the policy

If the death takes place before the due date of the premium, the premium will

not be paid in the year of death. This would imply that entry for payment of

premium would not be recorded. On maturity, the insurance policy will be

surrendered to register the claim with the insurance company and sum assured

will be collected.

For this following entries are to be recorded :

(i)

On the death of partner, for making claim with the insurance company

Insurance Company/Insurance claim receivable a/c

Joint Life Policy

(ii)

Dr.

For Claim duly received from Insurance Co. on the date of receipt

Bank a/c

Insurance Co./Insurance claim receivable a/c

Dr.

(iii) Claim due will be distributed among existing partners (including outgoing)

Joint life policy

Dr.

All partner's capital a/c (individually)

2.

When premium paid is treated as an asset at an amount equal to the

surrender value of joint life policy.

ACCOUNTANCY

160

Here, joint life policy is shown at its surrender value in the Balance Sheet

of that date. Following accounting entries are to be recorded in this case :

(i)

First Year : On the date when policy is taken and premium is paid.

Joint Life Policy

Bank a/c

(ii)

Dr.

At the end of first year, the joint life policy account will show the balance which

is equal to its surrender value. The difference between the premium paid and

surrender value will be transferred to profit and loss account.

Profit and loss a/c

Joint Life Policy

Dr.

(Amount = surrender value in the previous year + premium paid during the current

year surrender value in the current year).

Second year and onwards, the entries (i) and (ii) shall be repeated until the last

year.

In the last year, i.e., the year of death, entry no. (i) will be recorded only if death

takes place after the due date of premium and entry no. (ii) will not be recorded

at all.

(iii) On maturity of policy or in the event of death, entry for making the insurance

claim will be :

Insurance company a/c

Joint Life Policy

(iv)

On the date of receipt when insurance company pays the insurance claim due :

Bank a/c

Insurance Company

(v)

Dr.

Dr.

Balance standing in Joint Life Policy account is distributed among all partners in

profit sharing ratio. Balance in Joint Life Policy account = [Total claim due

(Surrender value of the policy in the previous year + premium paid during the

current year).

4.2.2 Individual Life Policies

The firm may decide to take the insurance policy separately for each of the

partners on their lives. For such insurance policies, if premium is paid by the

firm, being a transaction of business, it becomes an asset of the firm. Whenever

death of any partner occurs, policy matures, the firm make a claim to the

insurance company and claim so received is distributed among all the partners

in the profit sharing ratio. The heir of deceased partner will be entitled to the

proportionate share in the policy of deceased. Further, surrender values of the

policies of other partners will be distributed among all the partners(including

RETIREMENT AND DEATH OF A PARTNER

161

heir of deseased) in their profit sharing ratio. The Joint Life Policy will be

shown in the Balance Sheet at its surrender value.

Illustration 12 (Joint Life Policy)

Pawan, Quber and Ramesh are partners in the ratio of 5:3:2. Pawan died on

14th Aug. 2002. The firm had taken insurance policies on the lives of the

partners, premium being charged to profit and loss account every year.

The Policy amount and surrender value (on 14.08.2002)

Particulars

Policy Amount

Rs.

Surrender Value

Rs.

60,000

90,000

60,000

25,000

35,000

15,000

Life Insurance Policies :

Pawan

Quber

Ramesh

Work out the amount payable to Pawan's legal representatives regarding

insurance policies. Record necessary journal entries.

Solution

Books of Pawan, Quber and Ramesh

Journal

Date

Particulars

L.F.

2002

Aug.14

Aug 14

Aug.14

Aug.14

Insurance Company a/c

Life Policy

(Claim for policy registered)

Dr.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

60,000

60,000

Bank a/c

Dr.

Insurance Company a/c

(Policy amount received on Pawan's death)

60,000

Life Policy

Pawan's Capital a/c

Quber's Capital a/c

Ramesh's Capital a/c

(Amount of Life policy transferred to

capital accounts)

Dr.

60,000

Quber's Capital a/c

Ramesh's Capital a/c

Pawan's Capital a/c

(Pawan's share credited to him in the

gaining ratio, i.e. 3 : 2)

Dr.

Dr.

60,000

30,000

18,000

12,000

15,000

10,000

25,000

ACCOUNTANCY

162

Notes to the Solution

1.

Surrender value of policies of Quber and Ramesh = Rs. 35,000 + Rs. 15,000 = Rs. 50,000

2.

Pawan's share = Rs. 50,000

5

= Rs. 25,000

10

Illustration 13 (Joint Life Policy)

Jatin, Gagan and Kiran are equal partners have taken a Joint Life Policy of

Rs. 60,000 on June 30, 1999 paying annual premium of Rs. 6,000. Surrender

values for : 1999- NIL ; 2000 - Rs. 3,000; 2001 - Rs. 6,000 ; 2002 - Rs. 10,000:

Gagan die on July 3, 2002 ;

Record necessary entries for the year 2002

(i)

If premium paid is transferred to profit and loss account every year

(ii) If premium paid is treated as an asset. Also prepare Joint Life Policy

account for 2002.

Solution (i)

Books of Jatin, Gagan and Kiran

Journal

Date

Particulars

L.F.

2002

Jun.30

Jul. 3

Jul. 3

Dec. 31

Joint Life Policy premium

Bank a/c

(Premium paid on due date)

Dr.

Insurance company a/c

Joint life policy

(On death, policy claim registered

with insurance company)

Dr.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

6,000

6,000

60,000

60,000

Joint Life Policy

Dr.

Jatin's capital a/c

Gagan's capital a/c

Kiran's capital a/c

(Policy claim received credited to partner in

their profit sharing ratio)

60,000

Profit and loss a/c

Dr.

Joint Life Policy premium

(Premium paid transferred to profit and loss

account)

6,000

20,000

20,000

20,000

6,000

Note : It is assumed that the claim registered with insurance company will be received in

due course of time.

RETIREMENT AND DEATH OF A PARTNER

163

(ii)

Books of Jatin, Gagan and Kiran

Journal

Date

2002

Particulars

Jun.30

July 3

July 3

L.F.

Joint Life Policy

Bank a/c

(Premium paid on due date)

Dr.

Insurance Company a/c

Joint Life Policy

(On death, policy claim registered

with insurance company)

Dr.

Joint Life Policy

Jatin's capital a/c

Gagan's capital a/c

Kiran's capital a/c

(Balance in joint life policy account

distributed to partners, i.e. 60,000

(6,000+6,000) in profit sharing ratio)

Dr.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

6,000

6,000

60,000

60,000

48,000

16,000

16,000

16,000

Joint Life Policy Account

Dr.

Date

2003

Cr.

Particulars

J.F. Amount Date

(Rs.) 2003

Jan. 1 Balance b/f

July 3 Bank

Jatin's capital

Gagan's capital

Kiran's capital

Total

Particulars

J.F.

Amount

(Rs.)

6,000* July 3 Insurance Co.

6,000

16,000

16,000

16,000

60,000

60,000

60,000

Total

* This amount is the balance of Joint Life policy account on the date of death , which is the

surrender value of Joint Life Policy of previous year to the death, i.e. year 2001.

Illustration 14 (Joint Life Policy)

Nita and Rita are partners in a business sharing profits in the ratio of 7:3. The

firm has taken a joint life insurance policy on the lives of partners for a sum of

Rs.1,00,000 with effect from 30-06-99. The annual premium is Rs. 10,000.

ACCOUNTANCY

164

On Jan 2, 2002, Nita died and amount of Rs. 1,20,000 (including bonus)

was received from the Life Insurance Company. The firm has charged the

premium to Profit and Loss Account each year on financial year basis. You are

required to make necessary journal entries assuming that the amount was

received on Feb.1, 2002.

Solution

Books of Nita and Rita

Journal

Date

1999

Jun.30

2000

Mar. 31

2000

Jun 30

2001

Jun 30

2001

Jun. 30

2001

Jan. 2

2002

Jan. 2

Particulars

L.F.

Debit

Amount

(Rs.)

Joint Life Policy Premium a/c

Dr.

Bank a/c

(Payment of premium on joint life policy)

10,000

Profit and Loss a/c

Dr.

Joint Life Policy Premium

a/c

(Premium charged to Profit and Loss a/c )

10,000

Joint Life Policy Premium a/c

Dr.

Bank a/c

(Payment of premium on joint life policy)

10,000

Profit and Loss a/c

Dr.

Joint Life Policy Premium a/c

(Premium charged to Profit and Loss a/c )

10,000

Joint Life Policy Premium a/c

Dr.

Bank a/c

(Payment of premium on joint life policy )

10,000

Life Insurance Company

Joint Life Policy a/c

(Maturity of claim on account of joint

life policy)

Dr.

Joint Life Policy a/c

Dr.

Nita's Capital a/c

Rita's Capital a/c

(Joint life policy a/c transferred to partners

capital a/c )

Credit

Amount

(Rs.)

10,000

10,000

10,000

10,000

10,000

1,20,000

1,20,000

1,20,000

84,000

36,000

RETIREMENT AND DEATH OF A PARTNER

2002

Feb. 2

2002

Mar. 31

165

Bank a/c

Dr.

Life Insurance Company

(Amount received against the policy on

Nita's death)

120,000

Profit and Loss a/c

Dr.

Joint Life Policy Premium a/c

(Premium charged to Profit and Loss a/c )

10.000

120,000

10,000

Illustration 15 (Joint Life Policy)

Madhu and Shyam who shared profits in the ratio of 3:2 took out a Joint Life

Policy on May 14, 1999 for Rs. 60,000. The annual premium was Rs. 8,500.

The surrender value of the policy was :

1999 - NIL ; 2000 - Rs.4,500 ; 2001- Rs.8,000; and 2002 - Rs. 12,000.

Madhu died on Nov 14, 2002 and the amount of the policy was received

on Dec.1, 2002. The books are closed on December 31 each year.

Give journal entries assuming that the firm treats premium paid as asset

and maintains a Joint Life Policy Account at its surrender value. Also prepare

Joint Life Policy account.

Solution

Books of Madhu and Shyam

Journal

Date

1999

May 14

Dec.31

2000

May 14

Particulars

Joint Life Policy

Bank a/c

(Premium paid on joint life policy)

L.F.

Dr.

Debit

Amount

(Rs.)

Credit

Amount

(Rs.)

8,500

8,500

Profit and Loss a/c

Dr.

Joint Life Policy Premium

( Joint Life Policy a/c written off to bring it

down to surrender value )

8,500

Joint Life Policy

Bank a/c

(Premium paid on joint life policy)

8,500

Dr.

8,500

8,500

ACCOUNTANCY

166

Dec.31

2001

May14

Dec.31

2002

May14

Nov. 14

Dec. 1

Dec. 31

Profit & Loss a/c

Dr.

Joint Life Policy

(Joint Life Policy A/c written off to bring it

down to surrender value )

4,000

Joint Life Policy

Bank a/c

(Payment of premium paid on joint life

policy )

8,500

4,000

Dr.

8,500

Profit and loss Account

Dr.

Joint Life Policy

(Joint life policy a/c written off to bring it

down to surrender value )

5,000

Joint Life Policy a/c

Bank a/c

(Premium paid on joint life policy )

8,500

5,000

Dr.

8,500

Insurance Company a/c

Dr.

Joint Life Policy

(Insurance claim on account of joint life

policy on death of Madhu registered with

insurance company)

60,000

Bank a/c

Insurance Company's a/c

(Receipt of amount of policy on

Mahdu's death)

60,000

60,000

Dr.

60,000

Joint Life Policy a/c

Dr.

Madhu's Capital Account

Shyam's Capital Account

(Balance in Joint Life Policy transferred to

capital accounts of partners in the ratio of 3:2 )

43,500

26,100

17,400

Joint Life Policy Account

Dr.

Date

Cr.

Particulars

1999

May14 Bank

J.F.

Amount

(Rs.)

Date

Particulars

1999

8,500 Dec.31 Profit and Loss

Bal c/f

2000

Jan 1 Balance b/f

May 14 Bank

J.F.

Amount

(Rs.)

8,500

NIL

2000

Nil Dec.31 Profit and loss

8,500

Bal. c/f

4,000

4,500

8,500

8,500

RETIREMENT AND DEATH OF A PARTNER

2001

May14 Bal. b/f

Bank.

167

2001

4,500 Dec.31 Profit and loss

8,500 Dec.31 Bal. c/f

5,000

8,000

13,000

2002

Jan1

Bal b/f

Bank

May14 Madhu's

capital

Nov.14 Shyam's

capital

13,000

2002

8,000 Nov.14 Insurance Company

8,500

60,000

26,100

17,400

43,500

Total

60,000

Total

60,000

Illustration 16 (Joint Life Policy)

Mahesh and Raj sharing profit in the ratio of 2:3, took out a joint life policy on

July1, 1999 of Rs. 80,000 for paying annual premium of Rs. 8,000. The

surrender values were 1999-NIL ; 2000-Rs.4,200; 2001-Rs. 7,500;2002Rs. 12,000. Raj died on March 18, 2002 and claim was received. Books are

closed on calender year basis. Prepare Joint Life Policy Account,

Solution

Joint Life Policy Account

Dr.

Date

Cr.

Particulars

J.F.

Amount

(Rs.)

Date

Particulars

J.F.

Amount

(Rs.)

1999

Jul.1 Bank

1999

8,000 Dec.31 Profit and Loss

8,000

2000

Jul. 1 Bank

2000

8,000 Dec.31 Profit and loss

Balance c/f

3,800

4,200

8,000

8,000

2001

Jan.1 Balance b/f

Jul.1 Bank

2002

Jan1 Balance b/f

Mar.8 M's

29,000

capital

Mar.8 R's

43,500

capital

Total

4,200

8,000

12,200

2001

Dec.31 Profit and loss

Dec.31 Balance c/f

2002

7,500 Mar.18 Insurance Company

4,500

7,500

12,200

80,000

72,500

80,000

Total

80,000

ACCOUNTANCY

168

Illustration 17 (Retirement of partner)

Sita, Gita and Rita are partners sharing profits in the ratio of 2:2:1. Their

Balance Sheet as at March 31, 2002 as under :

Liabilities

Amount

(Rs.)

Assets

Sundry Creditors

Reserves

Capital : Sita

80,000

Gita

62,500

Rita

75,000

Employee's Provident Fund

49,000

14,500

2,17,500

4,000

Cash

Debtors

Stock

Machinery

Building

Patents

8,000

19,000

42,000

85,000

1,22,000

9,000

2,85,000

Total

2,85,000

Total

Amount

(Rs.)

As Gita got a very good break at MNC so she decided to retire on that date and

it was decided that Sita and Rita would share the profit in the ratio of 5:3. Goodwill

was valued at Rs. 70,000, machinery at Rs. 78,000, Building at Rs. 1,52,000,

stock at Rs. 30,000 and bad debts amounting to Rs. 1,550 be written off. Record

journal entries in the books of the firm and balance sheet of new firm.

Solution

Journal

Date

Particulars

L.F.

2002

Jan.1

Debit

Amount

(Rs.)

Revaluation a/c

Dr.

Machinery a/c

Stock a/c

Debtors a/c

(Loss on revaluation of assets recorded)

20,550

Building a/c

Revaluation a/c

(Appreciation in value of building)

30,000

Dr.

Revaluation a/c

Dr.

Sita's Capital a/c

Gita's Capital a/c

Rita's Capital a/c

(Profit on revaluation transferred to

partners' capital accounts in the ratio of 2:2:1)

Credit

Amount

(Rs.)

7,000

12,000

1,550

30,000

9,450

3,780

3,780

1,890

RETIREMENT AND DEATH OF A PARTNER

169

Reserve

Sita's Capital a/c

Gita's Capital a/c

Rita's Capital a/c

(Reserve transferred to partners)

Dr.

14,500

5,800

5,800

2,900

Sita's Capital a/c

Dr.

Rita's Capital a/c

Dr.

Gita's Capital

(Gita's share of goodwill given to her in

gaining ratio)

Gita's Capital a/c

Gita's Loan a/c

(Amount payable to retiring partner

transferred to his loan account)

Dr.

15,750

12,250

28,000

1,00,080

1,00,080

Balance Sheet as at March 31, 2002

Liabilities

Amount

(Rs.)

Assets

Sundry Creditors

Capitals

Sita

73,830

Rita

67,540

Gita's Loan

Employee's Provident Fund

49,000

Cash

Debtors

Stock

Machinery

Building

Patents

Total

1,41,370

1,00,080

4,000

2,94,450

Total

Notes to the Solution

Calculation of gaining ratio :

Sita =

5

2

9

=

8

5

40

Rita =

2

8

1

7

=

5

40

Therefore, gaining ratio of Sita and Rita will be 9 : 7.

Amount

(Rs.)

8,000

17,450

30,000

78,000

1,52,000

9,000

2,94,450

ACCOUNTANCY

170

Revaluation Account

Dr.

Cr.

Date

Particulars

J.F.

Machinery

Stock

Debtors

Profit:

Sita

3,780

Gita

3,780

Rita

1,890

Total

Amount

(Rs.)

Date

7,000

12,000

1,550

Particulars

J.F.

Building

Amount

(Rs.)

30,000

9,450

30,000

Total

30,000

Partner's Capital Accounts

Dr.

Cr.

Date Particulars

J.

F.

Sita

Rs.

Gita

Rs.

Rita Date

Rs.

Gita's Capital

Gita's Loan

Balance c/f

15,750

12,250

Total

89,580 1 ,0 0 ,0 8 0 79,790

1,00,080

73,830

67,540

Particulars

J.

F.

Sita

Rs.

Gita

Rs.

Rita

Rs.

Balance b/f

Revaluation

Reserve

Sita's Capital

Rita's Capital

80,000

3,780

5,800

62,500 75,000

3,780 1,890

5,800 2,900

15,750

12,250

Total

89,580 1,00,080 79,790

Illustration 18 (Retirement of partner)

K, L and M were carrying on partnership business sharing profits in the ratio

of 5:3:2 respectively. On March 31, 2002, the Balance Sheet of the firm stood

as follows :

Balance Sheet as at March 31, 2002

Liabilities

Amount

(Rs.)

Assets

Amount

(Rs.)

Creditors

Capitals :

K

L

M

35,000

Bank

Debtors

14,000

Less Provision

2,000

Stock

Building

Profit and Loss Account

22,000

Total

38,000

35,000

30,000

1,03,000

1,38,000

Total

12,000

27,400

73,000

3,600

1,38,000

RETIREMENT AND DEATH OF A PARTNER

171

L retired due to his transfer on the above date on the following terms :

(i) Buildings to be depreciated by Rs. 23,000.

(ii) New ratio of K and M will be 2:1.

(iii) Provision for doubtful debts to be made 20% on Debtors.

(iv) Salary outstanding Rs. 4,650 is to be recorded, and creditors of

6,000 will not be claimed.

(v)

Rs.

Goodwill of the firm is valued at Rs. 72,000.

(vi) L will be paid Rs. 12,000 through bank and balance in L's capital account

is to be transferred to his loan account.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance

Sheet after L's retirement.

Solution

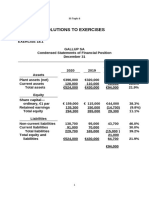

Revaluation Account

Dr.

Cr.

Date

Particulars

J.F.

Amount

(Rs.)

Building

Provision for

Doubtful Debts

Salary

outstanding

23,000

800

Total

28,450

Date

4,650

Particulars

J.F.

Amount

(Rs.)

Creditors

Loss:

K

11,225

L

6,735

M

4,490

6,000

22,450

Total

28,450

Partner's Capital Account

Dr.

Date

2003

Cr.

Particulars

J.F.

K

Rs.

L

Rs.

M

Rs.

Date

Particulars

J.F.

K

Rs.

L

Rs.

M

Rs.

Revaluation

P and L

L's Capital

L's Loan

Bank

Balance c/f

11,225 6,735

1,800 1,080

12,000

--- 36,785

-- 12,000

12,975

--

4,490

720

9,600

--15,190

Balance b/f

K's Capital

M's Capital

38,000

35,000 30,000

12,000

9,600

Total

38,000 56,600

30,000

Total

38,000 56,600 30,000

ACCOUNTANCY

172

Balance Sheet of K and M

(After Retirement)

Liabilities

Amount

(Rs.)

Creditors

Salary Outstanding

Capital:

K

12,975

M

15,190

L's Loan

Total

Assets

29,000

4,650

Amount

(Rs.)

Debtors

Less: Provision

Stock

Building

Bank

28,165

36,785

98,600

14,000

2,800

Total

11,200

27,400

50,000

10,000

98,600

Notes to the Solution

(a)

Gaining Ratio

New share old share

K=

2

5

5

=

3

10

30

M=

1

3

L's share of goodwill (Rs.) = 72,000

2

4

=

10

30

3

= 21,600

10

(b)

Bank Account

Dr.

Date

Cr.

Particulars

J.F.

Amount

(Rs.)

Date

Particulars

J.F.

Amount

(Rs.)

Balance b/f

22,000

L's Capital

Balance c/f

12,000

10,000

Total

22,000

Total

22,000

Illustration 19 (Retirement of the partner)

M, N and O are partners sharing profits in the ratio of 3:2:1. N retired from the

firm due to his illness. On that date the Balance Sheet of the firm was as follows :

RETIREMENT AND DEATH OF A PARTNER

173

Balance Sheet of K, M and O as at March 31, 2002

Liabilities

Amount

(Rs.)

Workmen's Compensation

Fund

Sundry Creditors

Bills Payable

Outstanding salary

Provision for legal damages

Capital:

M

46,000

N

30,000

O

20,000

Total

Assets

12,000

Amount

(Rs.)

Bank

Debtors

Less: Provision for

doubtful debts

Stock

Furniture

Premises

15,000

12,000

2,200

6,000

7,600

6,000

400

5,600

9,000

41,000

80,000

96,000

1,43,200

Total

1,43,200

The following is additional information :

(i)

Premises have appreciated by 20%. Stock depreciated by 10% and

Provision for doubtful debts was to be made 5% on debtors. Provision

for legal damages is to be made at Rs. 7,200 and furniture to be

brought upto Rs. 45,000.

(ii) Goodwill of the firm to be valued at Rs. 42,000.

(iii) Rs. 26,000 from N's capital account to be transferred to his loan

account and balance to be paid through bank, and loan be obtained

from bank for the purpose.

(iv) New profit sharing ratio of M and O is decided to be 5:1. Give the

necessary ledger accounts and the Balance Sheet of the firm after N's

retirement.

Solution

Revaluation Account

Dr.

Date

Cr.

Particulars

J.F.

Amount

(Rs.)

Stock

Provision for

legal damages

M's Capital 9,000

N's Capital 6,000

O's Capital 3,000

900

18,000

Total

20,100

1,200

Date

Particulars

J.F.

Amount

(Rs.)

Premises

Debtors

Furniture

16,000

100

4,000

Total

20,100

ACCOUNTANCY

174

Partner's Capital Account

Dr.

Cr.

Date

Particulars

J.F.

N's Capital

N's Loan

Bank

Balance c/f

M

Rs.

N

Rs.

O

Rs.

-26,000

28,000

--

---25,000

61,000 54,000

25,000

14,000

--47,000

Total

Date

Particulars

J.F.

Balance b/f

Revaluation

M's Capital

Workmen's

Comp. Fund

Total

M

Rs.

N

Rs.

46,000

9,000

-6,000

O

Rs.

30,000 20,000

6,000 3,000

14,000

-4,000 2,000

61,000 54,000 25,000

Notes for the Solution

1.

Gaining Ratio :

M=

5

6

O=

1

1

=0

6

6

3

2

=

6

6

It is to be noted that only M has acquired the share.

N's share of goodwill of Rs. 14,000 (42,000 2/6) is to be borne by M only, O is

not gaining anything.

Bank Account

Dr.

Date

Cr.

Particulars

J.F.

Amount

(Rs.)

Date

Particulars

Balance b/f

Bank Loan

7,600

28,000

N's Capital

Balance c/f

Total

35,600

Total

J.F.

Amount

(Rs.)

28,000

7,600

35,600

Note : Workmen's Compensation Fund is surplus on retirement as there is no liabilities

against this, hence distributed.

RETIREMENT AND DEATH OF A PARTNER

175

Balance Sheet as at March 31, 2002

(After N's retirement)

Liabilities

Amount

(Rs.)

Assets

Sundry Creditors

Bills Payable

Outstanding Salary

Provision for legal damages

N's loan

Bank Loan

Capital Account :

M

47,000

O

25,000

15,000

12,000

2,200

7,200

26,000

28,000

Bank

Debtors

Less : Provision for

doubtful debts

Stock

Furniture

Premises

Total

Amount

(Rs.)

7,600

6,000

300

5,700

8,100

45,000

96,000

72,000

1,62,400

Total

1,62,400

Illustration 20 (Retirement of partner)

L, M and N were partners sharing profits as 50% , 30% and 20% respectively.

On March 31, 1998, their Balance Sheet stood as follows :

Balance of L, M and N as at March 31, 1998

Liabilities

Amount

(Rs.)

Assets

Amount

(Rs.)

Creditors

Profit and Loss A/c

Investment Fluctuation

Fund (IIF)

General Reserve

Capitals :

L

50,000

M

40,000

N

20,000

21,000

15,000

10,000

Premises

Motor Vans

Investment

Plant

Stock

Debtors

Less : provision

Cash

62,000

20,000

19,000

12,000

15,000

Total

25,000

40,000

3,000

37,000

16,000

1,10,000

1,81,000

Total

1,81,000

On this date M retires and L and N agreed to continue on the following

terms :

1.

Firm's goodwill was valued at Rs. 51,000 and it was decided to adjust

M's goodwill into capital accounts of continuing partners.

2.

There is a claim for workmen's compensation to the extent of

Rs. 4,000. Investments are brought down to Rs. 15,000.

ACCOUNTANCY

176

3.

Provision for bad debts is to be reduced by Rs. 1,000.

4.

M will be paid Rs. 8,200 in cash and balance will be transferred to his

Loan Account which will be paid in 3 equal instalments together with

interest @ 10% p.a.

5.

L's and N's capital will be adjusted in their new profit sharing ratio i.e.

3 : 2 through cash accounts, prepare Capital Accounts and Balance

Sheet. Also prepare M's Loan Account.

Solution

Partner's Capital Account

Dr.

Date

Cr.

Particulars

J.F.

L

Rs.

M

Rs.

N

Rs.

Date

Particulars

J.

F.

L

Rs.

M

Rs.

40,000

4,500

7,500

5,100

10,200

-1,800

N

Rs.

Revaluation

M's capital

Cash

M's Loan

Cash

Balance c/f

1,500

900

5,100

--- 8,200

-- 60,000

15,520

-50,880

--

600

10,200

---33,920

Balance b/f

Profit and Loss

General Reserve

L's Capital

N's Capital

Workmen Compensetion Fund

Cash

50,000

7,500

12,500

---3,000

20,000

3,000

5,000

---1,200

15,520

Total

73,000 69,100

44,720

Total

73,000 69,100 44,720

Balance Sheet of L and N as at March 31, 1998

Liabilities

Amount

(Rs.)

Assets

Amount

(Rs.)

Creditor

Liability for Workmen's

Compansetion

M's Loan

Capitals :

L

50,880

N

33,920

21,000

4,000

Business Premises

Motor Vans

Investments

Plant

Stock

Debtors

Less : Provision

for bad debts

Cash

62,000

20,000

15,000

12,000

15,000

Total

60,000

84,800

1,69,800

Total

40,000

2000

38,000

7,800

1,69,800

RETIREMENT AND DEATH OF A PARTNER

177

M's Loan Account

Dr.

Cr.

Date

Particulars

J.F.

1999

Dec.31 Cash

(20,000+6,000)

Dec.1

Amount

(Rs.)

26,000

Balanced c/f

2000

Dec.31 Cash

(20,000+4,000)

Date

1999

Jan.1

Particulars

J.F.

Amount

(Rs.)

M's Capital

60,000

40,000 Dec.31 Interest

66,000

2000

24000 Jan.1 Balance b/f

Dec.31 Interest

6,000

66,000

40,000

4,000

Dec.31 Balance c/f

20,000

44,000

44,000

2001

Dec.31 Cash A/c

(20,000 +2,000)

2001

22,000 Jan.1 Balance b/f

Dec.31 Interest

20,000

2,000

22,000

22,000

Total

Total

Notes to the Solution

Journal entry :

Investment Fluctuating Fund a/c

Dr.

Investment a/c

(Decrease in Investment has to be met out of

Investment Fluctuating Fund)

(a)

Calculation of Gaining Ratio :

L=

3

5

1

=

5

10

10

N=

2

5

1

2

=

10

10

Hence gaining ratio = 1 : 2

(b)

Adjustment of L's and N's Capital :

Total capital of the firm after retirement of

M = Rs. 66,400 + Rs. 18,400 = Rs. 84,800

Rs. 4,000

Rs. 4,000

ACCOUNTANCY

178

Capital in new profit sharing ratio :

L = 84,800

3

= Rs. 50,880

5

N = 84,800

2

= Rs. 33,920

5

Revaluation Account

Dr.

Date

Cr.

Particulars

J.F.

Liability for

Workmen

Compensation

Amount

(Rs.)

Date

4,000

Total

4,000

Particulars

J.F.

Amount

(Rs.)

Provision for bad

debts

Loss :

L

1,500

M

900

N

600

1,000

3,000

Total

4,000

Cash Account

Dr.

Date

Cr.

Particulars

J.F.

Amount

(Rs.)

Date

Particulars

J.F.

Amount

(Rs.)

Balance b/f

N's Capital

16,000

15,520

M's Capital

L's Capital

Balance c/f

8,200

15,520

7,800

Total

31,520

Total

31,520

Retiring partner is to be paid through cash brought in by continuing

partners in such a way so as to make their capitals proportionate to their new

profit sharing ratio.

Illustration 21 (Retirement of Partner)

Fish, Goat and Hen are partners sharing profits in the ratio of 5:3:2 respectively.

Balance Sheet on March 31, 2003 was as follows :

RETIREMENT AND DEATH OF A PARTNER

179

Balance of Fish, Goat and Hen as at March 31, 2003

Liabilities

Amount

(Rs.)

Sundry Creditors

Bills Payable

Profit and Loss

Capital Accounts :

Fish

65,000

Goat

50,000

Hen

40,000

Total

22,000

8,000

15,000

Assets

Amount

(Rs.)

Fixed Assets

Stock

Debtors

Cash

1,00,000

45,000

45,000

10,000

Total

2,00,000

1,55,000

2,00,000

Fish retires on March 31, 2003 and for this purpose

Goodwill was valued at

Rs. 25,000

Fixed Assets were valued at

Rs. 1,25,000

Stock was considered worth

Rs. 40,000

Fish is to be paid in cash brought in by Goat and Hen in such a way so as

to make their capitals proportionate to their new profit sharing ratio, which is

3: 2 respectively. Minimum Cash Balance is to be maintained at Rs. 7,000.

Prepare Capital Accounts and the Balance Sheet of Goat and Hen.

Solution

Partner's Capital Account

Dr.

Date

Cr.

Particulars

J.F.

Fish

Rs.

Goat

Rs.

Hen

Rs.

Date

Particulars

J.F.

Fish

Rs.

Goat

Rs.

Hen

Rs.

Cash

Fish

Balance c/f

95,000

--4,500 3,000

-- 1,12,200 74,800

Balance b/f

Revaluation

Reserve

Goat

Hen

Cash

65,000

10,000

7,500

7,500

5,000

50,000 40,000

6,000

4,000

4,500

3,000

Total

95,000 1,16,700 77,800

Total

95,000 1,16,700 77,800

56,200 30,800

Balance Sheet as at December 31,2002

Liabilities

Goat's Capital

Hen's Capital

Sundry Creditors

Bills Payable

Total

Amount

(Rs.)

Assets

Amount

(Rs.)

1,12,200

74,800

22,000

8,000

Fixed Assets

Stock

Debtors

Bank

1,25,000

40,000

45,000

7,000

2,17,000

Total

2,17,000

ACCOUNTANCY

180

Notes to the Solution

A)

B)

Gaining Ratio :

Goat's gain

3

5

3

10

3

10

Hen's gain

2

5

2

10

2

10

Calculation of total capital of the firm after Fish's retirement :

(a)

Balance of Capital of the firm after Fish's retirement

(i)

Goat's Capital

=

Rs. 56,000

(ii) Hen's Capital

=

Rs. 44,000

Combined Capital

=

Rs. 1,00,000

(b)

Shortage of cash to be brought in by Goat and Hen in order to make payment

of Fish Rs. 95,000 Rs.3,000

= Rs. 92,000

Total Capital of New Firm (a+b) = Rs. 1,92,000

(2)

Calculation of actual cash to be paid off or brought in by Goat and Hen

Hen

Goat

(a)

(b)

(c)

New Capital

(Rs. 1,87,000 in the ratio of 3 : 2 )

Existing Capital

Cash to be brought in (ab)

Rs. 1,12,200

Rs. 56,000

Rs. 56,200

Rs. 74,800

Rs. 44,000

Rs. 30,800

Revaluation Account

Dr.

Date

Cr.

Particulars

J.F.

Amount

(Rs.)

Stock

Profit transferred

to :

Fish

10,000

Goat

6,000

Hen

4,000

5,000

20,000

Total

25,000

Date

Particulars

Fixed Assets

Total

J.F.

Amount

(Rs.)

25,000

25,000

RETIREMENT AND DEATH OF A PARTNER

181

Cash Account

Dr.

Cr.

Date

Particulars

Balance b/f

Goat's Capital

Hen's

Total

J.F.

Amount

(Rs.)

10,000

56,200

30,800

97,000

Date

Particulars

J.F.

Fish's Capital

Balance c/f

Amount

(Rs.)

90,000

7,000

Total

97,000

Illustration 22 (Retirement of partner)

A, B and C are in partnership sharing profits in the ratio of 5 : 3 : 2 .The Balance Sheet

of the firm as on April 1, 2002 was as follows :

Balance Sheet of A, B and C as at April 1, 2002

Liabilities

Capital Accounts :

A

40,000

B

61,000

C

24,000

Reserve

Sundry Creditors

Profit and Loss a/c

Bills Payable

Amount

(Rs.)

1,25,000

30,000

50,000

28,000

5,000

Assets

Bills Receivable

Machinery

Furniture

Sundry Debtors

Less : Provision for

Doubtful debts

Stock

Cash at Bank