Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Reflections On The Greek Crisis and The Level of Employment

Caricato da

Eduardo PetazzeTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Reflections On The Greek Crisis and The Level of Employment

Caricato da

Eduardo PetazzeCopyright:

Formati disponibili

Reflections on the Greek crisis and the level of employment

by Eduardo Petazze

29/06/15

Greece has a real growth potential of 30%. A traditional adjustment program, it is pointless to support growth and to honor financial commitments.

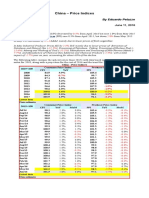

The following table summarizes the financial situation of the Greek government, the gross value added generated by the economy and employment data in the last four years.

Million euro

2011

Total economy

Gross domestic product at market prices

Gross national income at market prices

Employed (000) persons

General government

Net lending (+) /net borrowing (-)

Interest, payable

Government consolidated gross debt

Government consolidated gross debt at face value

Currency and deposits

Debt securities

Loans

Trade credits and advances - liabilities

Central government

Net lending (+) /net borrowing (-)

Consolidated gross debt

Per employed persons (euro per person)

GDP

Government consolidated gross debt

Central government consolidated gross debt

2012

2013

2014

207,752

202,142

4,043.6

194,204

195,430

3,687.3

182,438

182,379

3,507.8

179,081

178,868

3,527.0

-21,221

15,067

355,977

-16,871

9,743

304,714

-22,498

7,276

319,178

-6,356

6,986

317,094

820

251,799

103,358

2,772

774

93,499

210,441

3,120

819

79,206

239,153

1,512

995

70,850

245,249

1,416

-19,273

378,648

-15,938

312,149

-26,624

326,912

-7,836

326,317

51,378

88,035

93,641

52,668

82,639

84,655

52,009

90,990

93,194

50,774

89,904

92,519

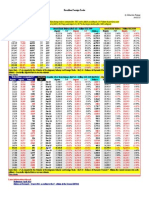

The level of activity and occupation of the Greeks has a real growth potential of around 30%, about 25 percentage points higher than the level of activity and occupation

achieved in 2008.

Population 15~74

years old

8,464.5

8,474.3

8,478.2

8,480.9

8,470.2

8,432.5

8,367.2

8,306.4

8,246.5

8,183.7

8,134.8

8,082.7

8,030.1

Latest data

Own estimate

Population 15~74

years old

8,158.6

8,155.1

8,150.4

8,145.8

8,141.3

8,136.9

8,132.5

8,128.1

8,123.8

8,119.4

8,115.1

8,110.7

8,106.0

8,102.4

8,098.8

8,094.4

8,089.8

8,085.4

8,080.4

8,075.8

8,071.6

8,067.3

8,062.8

8,058.2

Latest data

Own estimate

(000)

persons

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

(000)

persons

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Feb-15

Mar-15

Apr-15

May-15

Jun-15

Jul-15

Aug-15

Sep-15

Oct-15

Nov-15

Dec-15

Employed

4,381.8

4,435.7

4,518.5

4,554.5

4,599.4

4,545.2

4,378.5

4,043.6

3,687.3

3,507.8

3,527.0

3,552.4

3,576.0

Greece - Employed, Unemployed, for persons 15 - 74 years old

Unadjusted estimates

Seasonally adjusted estimates

Unemployed Inactives Activity Unemployment Employed Unemployed Inactives

Activity

Unemployment

519.9

3,562.9 57.91%

10.61%

4,382.2

518.7

3,563.6

57.90%

10.58%

493.4

3,545.1 58.17%

10.01%

4,434.8

494.2

3,545.3

58.16%

10.03%

448.2

3,511.5 58.58%

9.02%

4,520.7

446.6

3,510.8

58.59%

8.99%

418.3

3,508.0 58.64%

8.41%

4,553.5

417.9

3,509.5

58.62%

8.41%

387.9

3,482.9 58.88%

7.78%

4,598.4

388.7

3,483.0

58.88%

7.79%

484.7

3,402.6 59.65%

9.64%

4,544.2

485.1

3,403.2

59.64%

9.64%

639.4

3,349.4 59.97%

12.74%

4,379.8

638.2

3,349.2

59.97%

12.72%

881.8

3,381.0 59.30%

17.90%

4,045.5

881.7

3,379.3

59.32%

17.89%

1,195.1

3,364.1 59.21%

24.48%

3,686.1

1,199.5

3,360.9

59.24%

24.55%

1,330.3

3,345.5 59.12%

27.50%

3,507.7

1,331.6

3,344.4

59.13%

27.52%

1,269.6

3,338.2 58.96%

26.47%

3,528.1

1,275.3

3,331.5

59.05%

26.55%

1,181.7

3,348.7 58.57%

24.96%

3,552.4

1,181.7

3,348.7

58.57%

24.96%

1,094.2

3,360.0 58.16%

23.43%

3,576.0

1,094.2

3,360.0

58.16%

23.43%

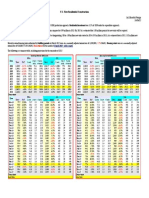

Employed

3,488.8

3,442.9

3,495.6

3,478.9

3,519.7

3,562.5

3,628.5

3,546.3

3,582.7

3,597.7

3,497.1

3,483.5

3,550.5

3,516.7

3,438.1

3,518.3

3,534.7

3,569.3

3,636.0

3,580.0

3,602.2

3,626.3

3,533.8

3,523.4

Unadjusted estimates

Seasonally adjusted estimates

Unemployed Inactives Activity Unemployment Employed Unemployed Inactives

Activity

Unemployment

1,316.7

3,353.1 58.90%

27.40%

3,496.5

1,308.5

3,354.2

58.90%

27.23%

1,366.7

3,345.4 58.98%

28.42%

3,493.3

1,303.1

3,358.2

58.81%

27.17%

1,343.4

3,311.3 59.37%

27.76%

3,504.8

1,290.9

3,354.5

58.84%

26.92%

1,299.8

3,367.1 58.66%

27.20%

3,496.5

1,296.6

3,352.6

58.84%

27.05%

1,307.2

3,314.4 59.29%

27.08%

3,523.3

1,301.1

3,317.0

59.26%

26.97%

1,249.2

3,325.2 59.13%

25.96%

3,546.8

1,288.4

3,301.7

59.42%

26.65%

1,207.3

3,296.8 59.46%

24.97%

3,558.9

1,272.1

3,301.6

59.40%

26.33%

1,203.8

3,378.1 58.44%

25.34%

3,549.0

1,261.1

3,317.8

59.18%

26.22%

1,219.1

3,322.0 59.11%

25.39%

3,551.9

1,256.5

3,315.3

59.19%

26.13%

1,219.8

3,301.9 59.33%

25.32%

3,541.7

1,252.2

3,325.4

59.04%

26.12%

1,224.4

3,393.5 58.18%

25.93%

3,536.7

1,238.3

3,340.2

58.84%

25.93%

1,277.3

3,350.0 58.70%

26.83%

3,537.2

1,234.2

3,339.2

58.83%

25.87%

1,248.5

3,307.0 59.20%

26.01%

3,534.3

1,225.0

3,346.8

58.71%

25.74%

1,225.9

3,359.8 58.53%

25.85%

3,534.9

1,215.8

3,351.6

58.63%

25.59%

1,299.4

3,361.2 58.50%

27.43%

3,518.9

1,211.5

3,368.4

58.41%

25.61%

1,215.0

3,361.1 58.48%

25.67%

3,512.6

1,200.3

3,381.5

58.22%

25.47%

1,206.5

3,348.6 58.61%

25.45%

3,530.8

1,204.1

3,354.9

58.53%

25.43%

1,157.3

3,358.8 58.46%

24.48%

3,555.7

1,198.6

3,331.1

58.80%

25.21%

1,129.1

3,315.3 58.97%

23.70%

3,578.2

1,178.9

3,323.3

58.87%

24.78%

1,127.3

3,368.6 58.29%

23.95%

3,573.4

1,158.6

3,343.9

58.59%

24.48%

1,127.1

3,342.3 58.59%

23.83%

3,582.1

1,155.1

3,334.4

58.69%

24.38%

1,129.0

3,312.0 58.94%

23.74%

3,580.9

1,150.7

3,335.7

58.65%

24.32%

1,146.6

3,382.3 58.05%

24.50%

3,570.6

1,133.6

3,358.6

58.34%

24.10%

1,168.0

3,366.9 58.22%

24.90%

3,556.8

1,147.9

3,353.6

58.38%

24.40%

An unconventional agreement between the international financial community and the Greek government could facilitate a program primarily to achieve in the short term the

level of potential economic growth and, secondly, fill in the greatest extent possible orderly and genuine payment to creditors, based on the higher level of economic activity

flow is reached.

Due to the level of the Greek government debt and structural issues affecting the activity of Greece, a traditional adjustment program (as he has been in force), it is a waste of

time and necessarily leads to frustration for both parties and failure to sustainability over time.

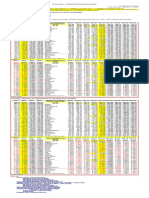

Addendum - Base Case with external support to sustainable development

The following table compares the performance of the Greek economy in the period 2011 / 2014 with its hypothetical potential based on the following premises:

An annual level of gross fixed capital formation similar to 2007 or 2008 level,

with emphasis on infrastructure and tourism,

mainly based on direct investments from the EA central countries.

Creating 1.1 million new jobs, mostly generated in the private sector

Reducing employers' social contributions by about four percentage points from the current level

The growth of wages and salaries of the population to real levels similar the years 2010 or 2011

The limitation in the tax rate on domestic / imported products

Limiting subsidies to the level of 2014

The greatest imbalance generated in the current account of the balance of payments is more than offset by the growth of foreign direct investment

Current prices, million euro NSA

Gross Value Added

Taxes less subsidies on products

Gross domestic product at market prices

Household and NPISH final consumption expenditure

Final consumption expenditure of households

Final consumption expenditure of NPISH

Final consumption expenditure of general government

Individual consumption expenditure of general government

Collective consumption expenditure of general government

Gross capital formation

Gross fixed capital formation

Changes in inventories and acquisitions less disposals of valuables

Exports of goods and services

Exports of goods

Exports of services

Imports of goods and services

Imports of goods

Imports of services

GDP

Compensation of employees

Wages and salaries

Employers' social contributions

Operating surplus and mixed income, gross

Taxes on production and imports

Subsidies

Taxes on production and imports less subsidies

memo:

Employed (000) persons

Wages and salaries per capita

Employers' social contributions / Wages and salaries

Operating surplus and mixed income / GDP

Taxes on production and imports / (GVA + Imports of Goods)

Subsidies / GVA

2011

182,302.4

25,449.4

207,751.9

145,063.9

140,658.1

4,405.8

44,085.5

22,484.3

21,601.0

32,833.1

31,997.2

836.1

52,879.6

26,825.6

26,054.1

67,110.3

52,933.8

14,176.6

207,751.9

73,465.9

56,758.8

16,707.1

110,749.6

27,550.8

4,014.3

23,536.4

2012

171,215.6

22,988.1

194,203.7

134,702.0

130,196.6

4,505.6

41,089.0

19,910.1

21,179.0

27,120.2

22,743.5

4,376.5

54,838.5

29,896.6

24,941.9

63,546.0

51,021.1

12,525.1

194,203.7

66,370.9

50,282.0

16,088.8

106,204.9

25,043.7

3,415.8

21,627.9

2013

160,544.5

21,893.7

182,438.3

129,908.3

125,447.8

4,460.5

36,472.3

17,394.4

19,078.0

21,465.7

20,452.2

1,013.5

55,147.3

30,026.1

25,121.3

60,555.5

49,412.6

11,142.8

182,438.3

59,305.7

44,943.2

14,362.4

102,202.0

24,115.1

3,184.6

20,930.6

2014

157,212.5

21,868.1

179,080.6

128,882.5

124,456.9

4,425.4

35,510.4

15,999.7

19,510.7

18,937.9

20,721.5

-1,783.6

59,024.4

31,011.0

28,013.4

63,274.4

51,880.6

11,393.8

179,080.6

59,886.8

45,543.9

14,342.9

95,038.2

27,190.8

3,034.9

24,155.6

4,043.6

14,037

29.44%

53.31%

11.71%

2.20%

3,687.3

13,637

32.00%

54.69%

11.27%

2.00%

3,507.8

12,812

31.96%

56.02%

11.49%

1.98%

3,527.0

12,913

31.49%

53.07%

13.00%

1.93%

base case

Base / 2014

214,500.0

36.44%

28,600.0

30.78%

243,100.0

35.75%

166,800.0

29.42%

162,300.0

30.41%

4,500.0

1.69%

40,000.0

12.64%

19,100.0

19.38%

20,900.0

7.12%

62,400.0

229.50%

62,400.0

201.14%

0.0

-100.00%

61,700.0

4.53%

31,700.0

2.22%

30,000.0

7.09%

87,800.0

38.76%

73,000.0

40.71%

14,800.0

29.90%

243,100.0

35.75%

86,000.0

43.60%

67,300.0

47.77%

18,700.0

30.38%

131,300.0

38.15%

28,800.0

5.92%

3,000.0

-1.15%

25,800.0

6.81%

4,607.2

14,608

27.79%

54.01%

10.02%

1.40%

30.62%

13.13%

Potrebbero piacerti anche

- China - Price IndicesDocumento1 paginaChina - Price IndicesEduardo PetazzeNessuna valutazione finora

- WTI Spot PriceDocumento4 pagineWTI Spot PriceEduardo Petazze100% (1)

- México, PBI 2015Documento1 paginaMéxico, PBI 2015Eduardo PetazzeNessuna valutazione finora

- Retail Sales in The UKDocumento1 paginaRetail Sales in The UKEduardo PetazzeNessuna valutazione finora

- Brazilian Foreign TradeDocumento1 paginaBrazilian Foreign TradeEduardo PetazzeNessuna valutazione finora

- U.S. New Residential ConstructionDocumento1 paginaU.S. New Residential ConstructionEduardo PetazzeNessuna valutazione finora

- Euro Area - Industrial Production IndexDocumento1 paginaEuro Area - Industrial Production IndexEduardo PetazzeNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Gains From International TradeDocumento51 pagineGains From International Tradeitsmeprim100% (1)

- Qatar Business GuideDocumento95 pagineQatar Business GuideJessie ColeNessuna valutazione finora

- Overview of International TradeDocumento6 pagineOverview of International TradeYzah CariagaNessuna valutazione finora

- Loan Disbursement PDFDocumento10 pagineLoan Disbursement PDFGemechu GuduNessuna valutazione finora

- O'Rourke, D., & Lollo, N. (2015)Documento29 pagineO'Rourke, D., & Lollo, N. (2015)gagoz23Nessuna valutazione finora

- Air Cargo Logistics Strategy PaperDocumento132 pagineAir Cargo Logistics Strategy Paperamal_millstone07@yahoo.comNessuna valutazione finora

- Slum Residents As Secondary Contributors in Market Economy - A Case Study of Hyderabad"Documento11 pagineSlum Residents As Secondary Contributors in Market Economy - A Case Study of Hyderabad"Sahrish ShabbierNessuna valutazione finora

- SSRN Id3293275Documento42 pagineSSRN Id3293275humanbody22Nessuna valutazione finora

- Human Resource Management in The Hotel and Catering IndustryDocumento8 pagineHuman Resource Management in The Hotel and Catering Industrygentleken100% (1)

- Cement Industry Overview in BangladeshDocumento19 pagineCement Industry Overview in BangladeshSANIUL ISLAM91% (44)

- Trend Analysis To Observe The Movement of Share Prices: A Reference To BSE Cement IndustryDocumento11 pagineTrend Analysis To Observe The Movement of Share Prices: A Reference To BSE Cement IndustryBradley CombsNessuna valutazione finora

- Leather Agra - JD WelfareDocumento25 pagineLeather Agra - JD WelfareManjeet KumarNessuna valutazione finora

- International Remittance Inflows and Household Welfare: Empirical Evidence From NigeriaDocumento10 pagineInternational Remittance Inflows and Household Welfare: Empirical Evidence From NigeriaiisteNessuna valutazione finora

- Essay On Industrialization in IndiaDocumento14 pagineEssay On Industrialization in IndiaPragati UradeNessuna valutazione finora

- 12th Plan Report FMG22A Group1 PioneersDocumento15 pagine12th Plan Report FMG22A Group1 PioneersAayushi SinghNessuna valutazione finora

- FINAL QUIZ AnswersDocumento9 pagineFINAL QUIZ AnswersROHIT PATILNessuna valutazione finora

- Sales Report On White Good Company - LG ElectronicsDocumento41 pagineSales Report On White Good Company - LG ElectronicsNeeraj Chadawar100% (1)

- Pages From 2013 Susan Rose-Ackerman, Paul D. Carrington Eds. Anti-Corruption Policy Can International Actors Play A Constructive Role - 2Documento36 paginePages From 2013 Susan Rose-Ackerman, Paul D. Carrington Eds. Anti-Corruption Policy Can International Actors Play A Constructive Role - 2Carmen-Alexandra BalanNessuna valutazione finora

- Bai Gao China and Japan Ecodev PDFDocumento50 pagineBai Gao China and Japan Ecodev PDFAngela Torres100% (1)

- Understanding The Kelly Capital Growth Investment StrategyDocumento7 pagineUnderstanding The Kelly Capital Growth Investment Strategygforce_haterNessuna valutazione finora

- China Digital PDFDocumento24 pagineChina Digital PDFKETANNessuna valutazione finora

- Abundant Rarity: The Key To Luxury Growth: Jean-Noe L KapfererDocumento10 pagineAbundant Rarity: The Key To Luxury Growth: Jean-Noe L KapfererMuneeb VohraNessuna valutazione finora

- 03 Readings 2Documento7 pagine03 Readings 2qwertyNessuna valutazione finora

- Health Financing Strategy Period 2016-2025 - EN - Copy 1Documento47 pagineHealth Financing Strategy Period 2016-2025 - EN - Copy 1Indah ShofiyahNessuna valutazione finora

- Bollier David Helfrich Silke The Wealth of The Commons A WorldDocumento573 pagineBollier David Helfrich Silke The Wealth of The Commons A WorldЕвгений ВолодинNessuna valutazione finora

- It PestelDocumento17 pagineIt PestelIshaan DograNessuna valutazione finora

- K-12 (Articles For Ref)Documento18 pagineK-12 (Articles For Ref)Marjorie FloresNessuna valutazione finora

- 1 Publication2016Documento13 pagine1 Publication2016Irina AlexandraNessuna valutazione finora

- A Study On Competition Analysis Done For Zuari Cements LTDDocumento62 pagineA Study On Competition Analysis Done For Zuari Cements LTDbalki123Nessuna valutazione finora

- Zydus CadilaDocumento126 pagineZydus CadilaDisha Sharma0% (1)