Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Supply Chain Performance Final Project

Caricato da

pktunCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Supply Chain Performance Final Project

Caricato da

pktunCopyright:

Formati disponibili

DONE BY: SALMAN A ASAD

SUBMITTED

TO:MR HARIS ASLAM

STUDENT ID:13048005-030

DONE

BY: SALMAN

ASADASLAM

SUBMITTED

TO:MR AHARIS

STUDENT ID:13048005-030

PEPSICO SUPPLY CHAIN

PERFORMANCE

TABLE OF CONTENTS

ACKNOWLEDGEMENT:............................................................................................ 4

EXECUTIVE SUMMARY............................................................................................ 5

BRIEF HISTORY....................................................................................................... 5

The Early Years................................................................................................... 6

PepsiCo in Pakistan............................................................................................. 6

PEPSICO OPERATIONS IN PAKISTAN........................................................................6

PEPSICO MAIN SUPPLIERS IN PAKISTAN..............................................................6

PEPSICO PRODUCTS........................................................................................... 7

SIZE IN TERMS OF EMPLOYEES AND TURNOVER.................................................8

MAJOR MARKETS SERVED................................................................................... 9

QUALITY MANAGEMENT SYSTEMS.......................................................................9

KEY RAW MATERIALS AND SUPPLIERS.................................................................9

SUPPLY CHAIN STRATEGY AND DESIGN..................................................................9

COMPETITIVE STRATEGY................................................................................... 10

SUPPLY CHAIN STRATEGY.................................................................................. 10

SUPPLY CHAIN DESIGN...................................................................................... 13

MANUFACTURING........................................................................................... 13

MARKETS SUPPLIED....................................................................................... 14

STORAGE....................................................................................................... 14

DISTRIBUTION................................................................................................ 14

OTHER MEASURES......................................................................................... 15

OUTSOURCED ACTIVITES.................................................................................. 15

SIPOC MODEL PEPSICO..................................................................................... 15

SUPPLY CHAIN PERFORMANCE............................................................................. 16

FLEXIBILITY....................................................................................................... 16

PRODUCT INNOVATION............................................................................16

DEMAND VARIATIONS.............................................................................. 16

POOR MANUFACTURING PERFORMANCE.................................................16

POOR SUPPLIER PERFORMANCE..............................................................16

POOR DELIVERY PERFORMANCE..............................................................16

2|Page

PEPSICO SUPPLY CHAIN

PERFORMANCE

OUTPUT............................................................................................................ 17

SALES...................................................................................................... 17

ORDER FILL RATE.................................................................................... 17

ON TIME DELIVERIES............................................................................... 17

CUSTOMER RESPONSE TIME....................................................................17

SHIPPING ERRORS................................................................................... 17

CUSTOMER COMPLAINT HANDLING.........................................................17

RESOURCES...................................................................................................... 18

MANUFACTURING COST...........................................................................18

INVENTORY HOLDING COST....................................................................18

DISTRIBUTION COST................................................................................ 18

STRATEGIC FIT..................................................................................................... 19

CHALLENGES AND RECOMMENDATIONS..............................................................21

THE CHALLENGE OF BENCHMARKING...............................................................21

IMPROVING THE METRICS PERFORMANCE........................................................22

CONCLUSION FINDING A SOLUTION TO OUR PROBLEM..................................23

3|Page

PEPSICO SUPPLY CHAIN

PERFORMANCE

ACKNOWLEDGEMENT:

I would like to take this opportunity to express my profound gratitude and deep regards to my

Resource Person, Mr. Haris Aslam for his mentoring, monitoring and constant encouragement

throughout the course of this project.

I am indebted to him for his sincere help and guidance that allowed me to understand the

supply chain dynamics of performance measurement and how companies use performance

metrics to achieve higher supplier chain profits.

I would also like to acknowledge Mr. Khalid Bhatti, Business Unit Manager Key Accounts at

Riaz Bottlers who took out time from his busy schedule and put in enough energy and effort

to engage in discussions and answer my questions. I thank Mr Haris Aslam and Mr Khalid

Bhatti for their patience and effort.

4|Page

PEPSICO SUPPLY CHAIN

PERFORMANCE

EXECUTIVE SUMMARY

This report provides an analysis and evaluation of the supply chain performance of PepsiCo

and its operations and bottling units in Lahore. The purpose of this report is to provide a brief

understanding of the supply chain dynamics of performance measurement and how PepsiCo

uses performance metrics to achieve higher supply chain profits

The company is described in terms of its product portfolio and other descriptions like number

of employees, annual turnover, major suppliers and major markets catered to. I also included

a small section on a few quality management systems used by PepsiCo Lahore. Then the

major strategies employed by PepsiCo internationally and in Pakistan have also been

discussed.

The first step to analyze PepsiCo was to interview a person who was knowledgeable about

the operations. I was supposed to interview the chosen person using a questionnaire based on

Benita Beamon model which uses three primary measures of flexibility, resources and output.

Methods of analysis used are comparisons between stated strategies and actual performances

according to the Beamon model. A simple scoring formula is used to find out the percentages

of each of the Beamon measures and the metrics used in each measure respectively.

A strategic fit is described as to indicate how and in what segment PepsiCo is more

responsive and where it is more efficient and how demand uncertainty s handled. The

findings confirmed that PepsiCo was facing intermittent delivery issues in Lahore which has

to be looked at further.

Finally a recommendation section tries giving a solution to our problem metrics by

highlighting root causes and possible solutions. The conclusion gives details about what tools

are used by supply chain executives and in what manner to achieve strategic goals. Finally, it

is shown how the top supply chain companies use performance measurement tools and

metrics to achieve a supply chain that achieves profitable perfect order, balancing service

with end-to-end cost.

5|Page

PEPSICO SUPPLY CHAIN

PERFORMANCE

INTRODUCTION A BRIEF HISTORY

THE EARLY YEARS

Caleb Bradham, a pharmacist, is credited with having invented a soft carbonated drink which

boosted energy levels and aided in digestion as well. He invented this drink in 1893. The

recipe contained the digestive enzyme pepsin and kola nuts. Thus he named his drink Pepsi

Cola. Pepsi was sold at his drugstore from where he moved to a bottling warehouse and as

they say the rest is history.

From a pharmacy in Delaware to becoming a multinational, PepsiCo, Inc is a leading global

food and beverages manufacturing company with well established brands that have become

regular household names throughout the world. PepsiCo manufactures, markets, sells and

distributes a huge portfolio of grain-based snack foods, beverages, and other products, using

authorized bottlers, contract manufacturers and other third party partners.

With its global headquarters in New York, United States of America, PepsiCo operates in

more than 200 countries and in 45 languages, selling more than 500 products, employing

100,000 routes worldwide, serving 10 million outlets around the world. PepsiCos local level

management has a very strong grip of the markets it covers, the needs it fulfills and this is

what basically tells PepsiCo what to do, how to do and when to do, thus effectively building

PepsiCos worldwide strategy.

PEPSICO IN PAKISTAN

Several Pakistani people hold key executive positions in PepsiCo, one of them being Mr.

Qasim Khan. Mr. Qasim Khan heads PepsiCos North Asia South Asia business unit. NASA

is a geographical based business unit which includes Pakistan, Indonesia, Malaysia, Korea,

Japan, Thailand, Philippines and Singapore. Another highly distinguished name in PepsiCo is

Dr. Mehmood Khan, who holds two key positions, Executive Vice President or EVP and

more importantly, Chief Scientific Officer or CSO. As CSO, he is responsible for research

and development work in PepsiCo, with emphasis on research.

PepsiCo was one of the first multinationals to start operations in Pakistan. Establishing its

operations in 1967, it has become the largest food and beverage company in Pakistan in terms

of annual retail turnover beating the revenues of 65 billion rupees generated by Unilever as of

financial year 2012.

6|Page

PEPSICO SUPPLY CHAIN

PERFORMANCE

PEPSICO OPERATIONS IN PAKISTAN

PEPSICO MAIN SUPPLIERS IN PAKISTAN

PepsiCo has setup, through franchising, 14 bottling plants across different sites in 11 cities for

production of their beverages. One of these is the PepsiCo concentrate plant setup in Hattar

which was a first for Pakistan as it brought in a lot of Foreign Direct Investment. PepsiCo

operates in the following cities with its headquarters located in Gulberg, Lahore:

Hattar

Islamabad

Lahore

Faisalabad

Multan

Sahiwal

Dera Ghazi Khan

Quetta

Hydrabad

Sukkar

Karachi

Each of these cities has a bottling plant and Hattar also serves as central concentrate

production site. The five of its biggest franchised bottlers are listed along with their cities

below:

Pakistan Beverages, Karachi

Hydri Bottlers, Islamabad

Punjab Beverages, Faisalabad

Riaz Bottlers, Lahore

Shamim and Company, Multan

Together these five franchises from a major chunk of the total production of beverages in for

PepsiCo in Pakistan.

7|Page

PEPSICO SUPPLY CHAIN

PERFORMANCE

PEPSICO PRODUCTS

PepsiCo produces a vast portfolio in Pakistan with power brands Pepsi and 7up leading the

market share. Other brands include Mirinda, Sting, Slice and Aquafina.

Tetrapa

k

200

ml

Pepsi

Cola

SSRB

250

ml

7up

Pepsi

Diet

Mountain

Dew

Tin

250

ml

7up

Diet

PET

250/30

0

ml

Sting

Strawberr

y

PET

1000

ml

PET

1500

ml

PET

2250

ml

21

Liter

7up

Lemonade

Mirinda

Orange

PET

500

ml

8|Page

PEPSICO SUPPLY CHAIN

PERFORMANCE

Sting

Gold Rush

Slice

Mango

Slice

Orange

Aquafina

Water

In Lahore, Riaz Bottlers alone produces up to a 100,000 bottles of product each day. It

produces CSDs or carbonated soft drinks in SSRBs or standard size returnable bottles, PET

or Polyethylene Teraphthalate and Tin Can packaging. It produces Juices in Tetrapak and PET

bottles. It also produces stale drinks like Aquafina Water in PET and Sting in PET, SSRB and

Tin Can packaging.

Cases can be summarized as:

24 SSRB per case,

12 250/500 ml PET per case,

24 200ml tetrapak per case,

6 1500 and 2250 ml PET per case.

SIZE IN TERMS OF EMPLOYEES AND TURNOVER

The size of PepsiCo in Pakistan in terms of number of employees is 20000 employees. In

terms of annual turnover, PepsiCo generated annual turnover of more than 66 billion rupees

in 2011 and that is their benchmark figure as of 2013. PepsiCo has so far invested more than

1 $Billion in Pakistan as of 2013.

MAJOR MARKETS SERVED

PepsiCo is available all over Pakistan, in all major cities and most urban and rural areas. It is

the preferred choice of most people living in rural areas. PepsiCo also owns KFC and Pizza

Hut fast food chains and also acts as their choice CSD supplier so that all branches of these

fast food restaurants have ample stock of Pepsi, Pepsi Diet, 7up, Mirinda and Aquafina water.

9|Page

PEPSICO SUPPLY CHAIN

PERFORMANCE

QUALITY MANAGEMENT SYSTEMS

In terms of implementation of quality management systems, PepsiCo has yet to implement

the lean/six sigma protocols in Pakistan which have helped in changeovers in other

countries, improving changeover time from 65 minutes to 25 minutes among other important

measures. But most of PepsiCo bottlers in Pakistan are ISO 9000 certified and have or are in

the process of being certified ISO 14000.

ISO 9000 is a quality management standard that helps in increasing business efficiency and

customer satisfaction. ISO 14000 help in systemizing and improving environment

management.

PepsiCo had also asked its bottler in Lahore to implement a Pre Sales Order Booking

System to streamline order fulfillment which it has successfully implemented.

KEY RAW MATERIALS AND SUPPLIERS

The major raw materials PepsiCo requires for packaging include plastic resins like

polyethylene terephthalate from which PET bottles are made, polypropylene, plastics for

cases, film packaging and labeling material, aluminum used for cans, glass bottles, closures

cardboard and paperboard cartons.

The major raw materials PepsiCo requires for its beverages are juice concentrates like

mangoes and oranges, flavorings and aromas, corn starch, corn sweeteners, aspartame,

sucralose, sugar and carbon dioxide and most importantly, water.

Petrol, Diesel and Furnace Oil are also considered very important in PepsiCo operations for

boilers and in trucking and logistics. PepsiCo employs specialist personnel to ensure adequate

and nonstop supply of all these critical items. PepsiCo purchases many of its supplies in the

open market, minimizing risk through the usage fixed price contracts, purchase ordering and

pricing agreements. In certain raw material cases, risk is managed through procuring from

different geographical locations and suppliers.

SUPPLY CHAIN STRATEGY AND DESIGN

COMPETITIVE STRATEGY

PepsiCo focuses on innovation and strong go-to-market excellence. Because of such a

strategy, PepsiCo became the market leader in Pakistan 1982 and since then, has retained the

number 1 position. PepsiCo has the power to innovate and enter new markets with new

products through diversification which PepsiCos main strength. Matching customers

expectations with good quality, safe beverages is essential to satisfying our customers and

making them loyal.

10 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

Today, Pakistan is the 6th largest market for PepsiCo worldwide. PepsiCo has developed an

extensive beverage portfolio which not only competes with Coca Cola, its main rival on a

head to head basis, it leaves its rival behind in terms of volume contribution in sales. PepsiCo

is selling 11 beverage brands in Pakistan to date of which CSDs (carbonated soft drinks)

make up a large part.

What PepsiCo says regarding its competitive strategy?

Our beverage, snack and food brands compete on the basis of price, quality, product variety

and distribution. Success in this competitive environment is dependent on effective promotion

of existing products, introduction of new products and the effectiveness of our advertising

campaigns, marketing programs, product packaging, pricing, increased efficiency in

production techniques, new vending and dispensing equipment and brand and trademark

development and protection. We believe that the strength of our brands, innovation and

marketing, coupled with the quality of our products and flexibility of our distribution

network, allows us to compete effectively.

SUPPLY CHAIN STRATEGY

PERFORMANCE WITH PURPOSE

Performance with purpose is the overall strategy PepsiCo uses to satisfy customer needs. All

strategies come from Performance with Purpose. What is this strategy? According to

PepsiCo:

Performance with Purpose is our goal to deliver sustained value by providing a wide range

of foods and beverages, from treats to healthy eats; finding innovative ways to minimize our

impact on the environment and lower our costs through energy and water conservation as

well as reduce use of packaging material.

11 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

Supply chain strategy of PepsiCo stems from the above mentioned and described purpose.

There are two aspects to the PepsiCo supply chain strategy:

THE POWER OF ONE

DIRECT STORE DELIVERY

THE POWER OF ONE

The POWER OF ONE allows PepsiCo to operate its beverage and food businesses as one

company attaining critical competitive advantages. The Power of One begins with PepsiCos

unique ability to connect with consumers.

When customers buy a beverage, they also want to buy a snack, and when they buy a snack,

they also want a drink. Thus PepsiCo capitalizes on the idea of purchase of its two iconic

brands Pepsi Cola and Lays chips together by customers. This idea has become more

powerful as it has grown and caught on globally.

The significant attribute of POWER OF ONE strategy is that it extends to areas throughout

the value chain. PepsiCo aims to double its productivity by harnessing the full potential of

POWER OF ONE globally which includes Pakistan. It allows PepsiCo to increase

efficiencies and speed across the whole value chain while reducing costs.

DSD DIRECT STORE DELIVERY

PepsiCo markets its products through direct-store-delivery (DSD), customer warehouse and

distributor networks. The distribution system used depends on customer needs, product

characteristics and local trade practices.

Direct-Store-Delivery

PepsiCo, its independent bottlers and distributors operate through DSD systems. These

systems deliver snacks and beverages directly to retail stores where the products are sold and

stocked by PepsiCo bottlers. DSD allows for maximum visibility and appeal. DSD is

12 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

especially well-suited to products that are restocked often and respond to in-store promotion

and merchandising. A key component of DSD is the use of planograms which shows the

retailer the arrangement of the PepsiCo products in specific order. PepsiCo snacks for

example are supposed be stacked besides PepsiCo beverages on the same shelf space side by

side.

Customer Warehouse

Some of PepsiCo products are delivered directly from manufacturing plants and warehouses

to customer warehouses and retail stores. These less costly systems generally work best for

products that are less fragile and perishable, have lower turnover.

Distributor Networks

When PepsiCo needs to deliver products to its fast food eateries, other restaurants, schools

and stadiums, it distributes many of its products through third-party distributors. Third-party

distributors are effective when greater distribution reach can be achieved by including a wide

range of products on the same delivery vehicles.

SUPPLY CHAIN DESIGN

PepsiCo is one of the largest foods and beverages company in the world. Also, the products it

produces are fast moving so it can also be classified as a FMCG or fast moving consumer

goods company. Today, in a globalised world where competition is fierce and there are no

chances of making mistakes or being inefficient, consumers are more aware, they want their

13 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

products more quickly, conveniently and they require products which are durable and of

unprecedented quality.

Looking at the ever changing dynamics of consumer markets, PepsiCo needs to be very

efficient in its production while at the same has to be extremely responsive to meet consumer

demand and expectations. To do this, the supply chain model which has to be designed and

implemented has to keep in mind production and inventory efficiencies to reduce costs and

has to modify logistics, warehousing and distribution networks to gain responsiveness in

accordance with the markets it caters to.

I visited Riaz Bottlers, the franchised bottler of PepsiCo in Lahore and interviewed Mr.

Khalid Bhatti to gain an insight into the operations and supply chain performance of PepsiCo.

Mr. Bhatti was kind enough to provide me the key details which were required and he obliged

me to the best of his knowledge. There are certain trade secrets that employees of any

company are bound to protect but he gave me a clear understanding of how things are done in

PepsiCo Lahore.

MANUFACTURING

Single Central manufacturing factory located in Gulberg Lahore. Production is done batch

wise and the metric used for each product is the run time. Fast moving products have longer

run times looking at their utility and sales. There are five bottling units and a smaller water

bottling plant. Two units are dedicated to the SSRB (standard size returnable bottler) and it

runs continuously. 1 unit is dedicated to the 1.5 liter PET (polyethylene teraphthalate) which

has a major contribution in sales revenue. 1 unit is dedicated to other PET bottling runs.

Juices have their own manufacturing line as well as the Aquafina, which runs on a separate

line in the same plant. On a daily basis, almost 100,000 cases are produced of all packs.

MARKETS SUPPLIED

Key markets supplied from Lahore are Lahore city, its outskirts and Kasur.

14 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

STORAGE

The main PepsiCo owned central ware house is located in the Quaid E Azam Industrial

Estate. Its average capacity is 1 month of inventory or 3 million cases.

DISTRIBUTION

PepsiCo uses both direct and indirect types of distribution. In Direct distribution, PepsiCo

uses its own fleet of trucks to transport products from the bottling plant directly to the sub

warehouses of the distributors who then use their own trucks to deliver to retailers.

Using the Indirect distribution which PepsiCo prefers owing to its use of DSD or Direct Store

Delivery, the central warehouse is used where outsourced trucking is used to deliver directly

to the retailers.

The capacity of each truck is 6 to carry a minimum of 6 pellets. Each pellet can hold an

average of 50 cases. So on a given day, each truck carries 300 cases of PepsiCo beverages.

15 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

OTHER MEASURES

ANNUAL CAPACITY

36 40 million cases

CUSTOMIZATION

Fully automated bottling plant

LEAD TIME

24 hours average to retailer and distributor

PRODUCTION DELAYS

5 10 % increase in time on average when delayed.

Usually occur due to increased operating cost because of increasing energy prices.

OUTSOURCED ACTIVITES

All vehicles in the indirect distribution

Shelf loaders and pellet loaders

Market signage

Printing of labels

Freezers and coolers

SIPOC MODEL PEPSICO

16 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

SUPPLY CHAIN PERFORMANCE

FLEXIBILITY

The purpose of using this measure of supply chain performance is to gauge how responsive a

supply chain is in uncertain environments. The aim of this measure is to help achieve a high

responsiveness level.

PRODUCT INNOVATION

PepsiCo is far ahead in innovation. They have a high product range, have identified,

targeted and catered to every segment by maintaining a proper product portfolio in

every identified segment.

There are currently no competitors to Mountain Dew and Sting Brands in the market

which are the star products of PepsiCo, generating high sales figures revenues.

Coca Cola has an advantage over PepsiCo in structure and distribution. They employ

a single distributor which a Turkish logistic company. They have a single bottler

across Pakistan in 7 territories. Supply chain policies are uniform as they have a

single supply chain head. Coke started their invoicing before PepsiCo.

DEMAND VARIATIONS

Changes due to seasonality are one the most significant factors in ascertaining

demand. Off season sales are low but not very low. Below a certain threshold it is

never crossed even in winters. Seasonality does not offset the consolidated financial

results.

Employees are not laid off because it can cause quality depletion. Production is

curtailed through decreasing plant run and closing 1 of the 3 SSRB plants.

POOR MANUFACTURING PERFORMANCE

Faults can occur in batches. These faulty batches are lifted from the market as

PepsiCo does not compromise on quality.

POOR SUPPLIER PERFORMANCE

There are a minimum of 3 suppliers for every SKU. In case of fuel shortages, PSO

fulfills orders as PepsiCo is a major client. PSO obliges by providing a 15 days worth

of furnace oil.

17 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

POOR DELIVERY PERFORMANCE

It takes time, not very long, but takes time change as decision making is done on a

hierarchical basis. Information has to be passed up along the chain from the sales

team to higher executives.

OUTPUT

The purpose of using this measure of supply chain performance is to gauge the acceptable

level of output which maintains the customer base. The aim of this measure is to help achieve

a high customer service level.

SALES

25 % higher sales than rival Coca Cola

ORDER FILL RATE

PepsiCo used to have issues in fulfilling orders having a lower fill rate than Coca Cola

in Lahore. They changed their strategy by employing order booking before sales and

pre invoicing. This is done through the sales representative who gets the load demand

from the retailer and transfers the orders to the shipping department. PepsiCo is now

head to head in order fill rates according to Mr. Khalid Bhatti.

ON TIME DELIVERIES

PepsiCo uses the same day delivery benchmark. This means that an order has to be

fulfilled within 24 hours. And PepsiCo has achieved this to 95% level due pre order

booking. This is actually higher than Coca Cola.

CUSTOMER RESPONSE TIME

The same delivery benchmark has improved the average lead times to less than 24

hours.

SHIPPING ERRORS

During peak season, which is during the summers, a lot of shipping errors occur.

There are high pressures to meet demand through high production volume. Because of

this, dumping occurs and production starts to exceed demand. And routes are busy

due to heavy traffic; sometimes the orders are filled based on areas and not on order

priority.

During off season, in winters, very few errors occur. The ones that do occur are

because a retailer either buys more stock than he ordered, rendering the next retailer

order unfulfilled, creating a backlog or refusing to accept replenishment because of

space restrictions.

CUSTOMER COMPLAINT HANDLING

UAN number is available to all retailers and customers alike for any complaints.

Usually during peak season, record complaints of coolers and chiller units breaking

18 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

down which are duly fulfilled through maintenance teams who either repair or replace

the defective units.

RESOURCES

The purpose of using this measure of supply chain performance is to gauge how efficiently

resources are being managed such resources which are critical to profitability. The aim of this

measure is to help achieve a high level of efficiency.

MANUFACTURING COST

PepsiCos labor costs per case are 2 PKR. The total manufacturing cost per case of

SSRBs is 384 PKR per case. Our costs are lower than our competition.

INVENTORY HOLDING COST

PepsiCo looks at inventory from the perspective of fast moving goods and expiry

dates. SSRBs have a shelf life of 9 months but are very fast moving. PET bottles have

a shelf life of 6 months but are also fast moving. Aquafina water has a shelf life of a 1

year, that too to because the water requires ample storage time to develop its unique

taste.

In case of DSD, PepsiCos average holding cost is at the mid level because the

warehouses it uses are owned by the bottlers. The only added cost is handling which

is 2 PKR.

DISTRIBUTION COST

Distribution cost varies from channel to channel. Direct distribution has higher costs

because of maintaining the fleet and fuel purchases. Indirect distribution has lower

costs from 20 to 25 PKR per case. PepsiCo prefers to use indirect distribution because

of it DSD strategy and in Lahore uses it up to 65%.

19 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

STRATEGIC FIT

To analyze the performance of PepsiCo supply chain in Lahore market, which is a huge

potential for PepsiCo but which at the moment is not leading Coca Cola, we need to look at

the Strategies that PepsiCo uses for its competitiveness and supply chain and look at our

findings in the section above. We need to compare and reconcile what the strategies aim to

achieve and what is actually being achieved and how the supply chain is actually behaving.

Being a food and beverage company with most of its products like Pepsi, 7up and Mountain

Dew in the mature stages of their life cycle where the brand equity and awareness is firmly

established, PepsiCo understands the pressures of process innovation like it understands

product innovation. A mature functional produce has more certain demand and supply is

predictable. Margins are on the lower side due to stiff competition. Price is the deciding

factor when consumers make choice.

There is saturation in the market with new entrants facing stiff competition from the

established brands. Likewise giants like PepsiCo faceoff with giants like Coca Cola. The

competition is fierce and no stone is left unturned. But unlike Coca Cola, PepsiCo has

diversified much more than Coca Cola. And as Jack Welch has said: change or die PepsiCo

understands that theirs is a culture of challenging and questioning the status quo: constantly

improving, and then improving some more.

Pepsi produces functional products for which it needs to have an efficient supply chain. But a

highly efficient supply chain compromises responsiveness and a highly responsiveness eats

away the efficiency and cost leadership. Todays markets and consumers demand highly

responsive supply chains which make available a product quickly.

So there has to be a point where a strategic balance is achieved being where efficiency is not

compromised, neither is responsiveness. Identifying this point and achieving it is not easy.

ASSESSING THE STRATEGIES

For manufacturing, Pepsi needs to know that cost is the main lever and driver that matters

and that being efficient is the most important aspect of the segmented supply chain.

20 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

For distribution and delivery, Pepsi needs to know that lead time is the main lever and driver

and that being responsiveness is the most important aspect of this segment of the supply

chain.

This is exactly what their POWER OF ONE and DIRECT STORE DELIVERY strategies

state. POO says that through its implementation, PepsiCo increases its efficiencies and

reduces cost. Again, DSD says that delivering directly to the retailers with any intermediary

make the distribution aspect responsive.

ASSESSING AND ANALYZING THE PERFORMANCE

When we look the flexibility measure, we find that PepsiCo is:

Responsive in innovation and new product development.

Fairly responsive in demand variation

Flexibility in manufacturing performance

Flexibility in supplier performance

Fairly flexible in delivery performance

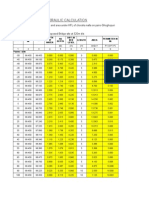

If each metric is scored out of 0, or 1 we have an aggregate score of 4 out 5 or 80%. This

result gives PepsiCo a flexible supply chain. (Exception in demand variation and delivery

performance.)

When we look at the output measure, we find that PepsiCo is:

High customer service level in sales

Medium customer service level in order fill rates

High customer service level in on time deliveries

High customer service level in customer response time

Medium customer service level in shipping errors

High customer service level in customer complaint handling

If each metric is scored out of 0, or 1we have an aggregate score of 5 out 6 or 83.3%. This

result shows that PepsiCo is very able in retaining its customers and is offering a high

customer service level. (Exception in order fill rates and shipping errors.)

When we look at the resource measure we find that PepsiCo is:

Manufacturing costs are low due to high efficiency in manufacturing

Inventory costs are low which again gives us a high efficiency.

Distribution costs are on the higher side which gives us a medium efficiency.

If each metric is scored out of 0, or 1we have an aggregate score of 2 out 3 or 83.3%.

This result shows that PepsiCo is achieving high efficiencies and a high profitability.

(Exception in distribution costs.)

Total score out of 14 metrics that PepsiCo is achieving is 11 which in terms of percentage

would give 82%.

This goes on to show that the overall performance of the supply chain is above satisfactory.

PepsiCo is successful in reconciling and achieving its supply chain strategy goals up to 82%.

21 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

Also, we can analyze from the above results that the demand uncertainty present in this

supply chain model is absorbed by PepsiCo as it needs to have a responsive distribution

network. The suppliers are absorbing lesser demand uncertainty and are efficient. The

retailers in this case are absorbing the least amount of demand uncertainty.

Therefore, Pepsi is successful in achieving its strategic fit between the strategies deployed

and the actual performance. The manufacturing efficiency is sufficiently high to say that the

strategy of POWER OF ONE is successfully working. It also safe to say that responsiveness

is being achieved through DIRECT STORE DELIVERY.

CHALLENGES AND RECOMMENDATIONS

THE CHALLENGE OF BENCHMARKING

The challenge for any supply chain is to meet a certain standard and/or achieve benchmark

levels of efficiency and responsiveness. Below is a diagram which shows the benchmarks that

are set for a supply chain in any situation and environment. Achieving 95% in the Perfect

Order Index is a phenomenal task. And PepsiCos overall and segmented supply chain score

is nowhere near this benchmark.

22 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

An average score of 82% is no doubt very high but room for improvement is much more. I

think PepsiCo should at least review its performance in 4 of the metrics found which were

under performing. Demand variation and delivery performance, order fill rates and shipping

errors, and distribution costs.

IMPROVING THE METRICS PERFORMANCE

To improve these metrics we will look at the Hierarchy of supply chain metrics which helps

us in deciding which way to travel and how.

Operational excellence includes delivering as promised to customers and keeping costs under

control. These metrics are relatively easy to measure and they are very clear as regards their

business value. We recommend a hierarchy of metrics, at the top of which are perfect order

rate and total supply chain costs, to monitor this dimension.

23 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

To further our understanding of this hierarchy, we start by identifying and ascertaining the

demand. On that demand forecast we then assess our perfect order rates which measures

responsiveness and SCM costs which measure efficiency. The next step is to analyze the cash

to cash cycle which gives a clear picture of total inventory, accounts payable and receivable.

The last step is correct any of the above 11 measures shown, from supplier quality to perfect

order detail, which could have issues.

Using these metrics effectively rather than focusing on one metric at a time, we understand

that what it really is; looking at the bigger picture through analyzing the relationships

between these metrics is what makes the metrics workable. I recommend PepsiCo in Lahore

to adopt this model of operational excellence to have a better understanding of what is going

on which needs to be changed and what performance metric is meeting the set benchmarks.

FINDING A SOLUTION TO OUR PROBLEM

To demonstrate how we will solve our problem, we wish to look at two of our metrics which

do not meet performance criteria.

Delivery performance

Shipping performance

Distribution cost performance

24 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

We need to find out the root causes for under performance for each metric independently.

Once this is done, then each identified root cause has set course of action. Lets analyze

delivery performance

DELIVERY PERFORMANCE ROOT CAUSE

Week scheduling, carrier selection and discipline are identified as issues.

COURSE OF ACTION

Parcel shipping systems or preparing shipment, rating and tracking.

For truckload, TL and less than truckload, LTL shipments, a truck management

system or TMS simplifies mode and carrier selection scheduling and in transit

tracking

SHIPPING ERROR ROOT CAUSE

Loading and carrier errors

Product identification

COURSE OF ACTION

Shipping errors can be minimized by implementation of Automatic Identification and

Data Capture or AIDC and Warehouse Management System or WMS

Outbound shipments must be RFID tagged and/or bar coded to facilitate internal and

eternal tracking.

DISTRIBUTION COST ROOT CAUSE

Ill planned logistics shipping.

COURSE OF ACTION

Locate facilities strategically.

TMS can reduce costs

A certain location may offer lower operating and labor costs.

25 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

CONCLUSION

The best supply chain performers of the past many years have understood that there are

different portfolios of metrics for different objectives and levels. They know and judge that

there has to be tight alignment across all these levels.

At the first level, supply chain executives need only a small number of metrics for

informational purposes and to assess the overall performance of their supply chains. In the

second tier are the mid-level, cross-supply chain metrics that allow managers to analyze the

performance of the end-to-end supply chain and make tradeoff decisions. The third level

contains the detailed functional-specific metrics such as procurement, manufacturing, and

logistics, allowing deeper root cause analysis and correction.

But what really makes a difference is to know how to align all the levels. To know and

understand that the goal of the supply chain is not just to have high efficiencies or high

responsiveness is also very important. The goal of the supply chain is a profitable perfect

order, balancing service with end-to-end cost.

26 | P a g e

PEPSICO SUPPLY CHAIN

PERFORMANCE

References:

SUPPLY CHAIN MANAGEMENT REVIEW

PEPSICO GRI AND ANNUAL REPORT 2013

GARNTNER

TRANSYSTEMS

RIAZ BOTTLERS

27 | P a g e

Potrebbero piacerti anche

- History of PepsiCo and its HR practicesDocumento23 pagineHistory of PepsiCo and its HR practicesSafdar Khan100% (1)

- Project Report On PepsiDocumento15 pagineProject Report On PepsiSumitGuhaNessuna valutazione finora

- Supply ChainDocumento18 pagineSupply ChainHizber Khan100% (1)

- Supply Chain Management at PepsiC1Documento4 pagineSupply Chain Management at PepsiC1AR RasheedNessuna valutazione finora

- PepsiCo SupplychainDocumento20 paginePepsiCo SupplychainVraj PatelNessuna valutazione finora

- Supply Chain of Pepsi CoDocumento19 pagineSupply Chain of Pepsi CoAnkit Sherawat60% (5)

- Pepsico Supply ChainDocumento16 paginePepsico Supply ChainGiang Nguyễn Đoàn QuỳnhNessuna valutazione finora

- PepsiCo Supply ChainDocumento17 paginePepsiCo Supply Chainbhavin_gupta16100% (5)

- Project Document - Supply ChainDocumento197 pagineProject Document - Supply Chainshab-i-tab78% (9)

- SCM Project - Group 5Documento47 pagineSCM Project - Group 5Prerna Sinha100% (1)

- GSK Pakistan Supply ChainDocumento12 pagineGSK Pakistan Supply ChainMuzammil Abdul QadirNessuna valutazione finora

- Professional Practices: Areeba Amin Hadiqua Nisar Touqeer Khan Umair Kasmani Mr. Azmat HafeezDocumento24 pagineProfessional Practices: Areeba Amin Hadiqua Nisar Touqeer Khan Umair Kasmani Mr. Azmat HafeezumairkasmaniNessuna valutazione finora

- Coca-Cola Company: World's Largest Beverage CompanyDocumento3 pagineCoca-Cola Company: World's Largest Beverage CompanySwapnil Nemade0% (2)

- PepsiCo Operations Management GuideDocumento15 paginePepsiCo Operations Management GuidezeeshanNessuna valutazione finora

- PepsiCo's ERP Systems for Equipment Services ManagementDocumento26 paginePepsiCo's ERP Systems for Equipment Services ManagementJegan Thangappandy0% (2)

- Supply Chain Management of Coca ColaDocumento5 pagineSupply Chain Management of Coca ColaRashmi Makwana50% (2)

- Introduction to Information Systems at PepsiCoDocumento13 pagineIntroduction to Information Systems at PepsiCosooriyampola100% (3)

- SCM in Pepsico PDFDocumento57 pagineSCM in Pepsico PDFHuong An100% (1)

- PepsiCo's Global Supply Chain StrategyDocumento10 paginePepsiCo's Global Supply Chain StrategyHuong AnNessuna valutazione finora

- Assisginment – 1PL, 2PL, 3PL, 4PL, 5PLDocumento2 pagineAssisginment – 1PL, 2PL, 3PL, 4PL, 5PLUMAIR AFZALNessuna valutazione finora

- SCM - Chapter 2Documento35 pagineSCM - Chapter 2Talha6775Nessuna valutazione finora

- Supply Chain Management PepsiDocumento25 pagineSupply Chain Management Pepsipop_pop12121100% (1)

- PepsiCo's 10 Strategic OM Decisions for ProductivityDocumento2 paginePepsiCo's 10 Strategic OM Decisions for ProductivityNica JeonNessuna valutazione finora

- Sony Corporation in IndiaDocumento4 pagineSony Corporation in IndiaMuskaan Soni100% (1)

- Key Performance Indicators For The Food Supply Chain: Benchmarking GuideDocumento16 pagineKey Performance Indicators For The Food Supply Chain: Benchmarking GuideAnonymous PK9uwwMU4RNessuna valutazione finora

- Global Supply Chain ManagementDocumento11 pagineGlobal Supply Chain ManagementMohamed Fathy Abdelazim SorogyNessuna valutazione finora

- SCM PepsicoDocumento10 pagineSCM PepsicoGeorge KJNessuna valutazione finora

- Pepsi CoDocumento11 paginePepsi CoBrave Leo100% (1)

- SCLM ChecklistDocumento38 pagineSCLM ChecklistMayur GaidhaneNessuna valutazione finora

- Small and Medium Enterprises Development Authority (SMEDA) : Hailey College of CommerceDocumento12 pagineSmall and Medium Enterprises Development Authority (SMEDA) : Hailey College of CommerceZernish VirkNessuna valutazione finora

- Analysing Operations Management Problems in PepsiDocumento8 pagineAnalysing Operations Management Problems in PepsiAnnerlynn Solano100% (1)

- PepsiCo's Supply Chain Management StrategiesDocumento7 paginePepsiCo's Supply Chain Management Strategiesajay sharmaNessuna valutazione finora

- Pepsi Cola Internship ReportDocumento102 paginePepsi Cola Internship ReportShahid Mehmood90% (10)

- Pepsi PakDocumento12 paginePepsi PakShahxaib BilalNessuna valutazione finora

- Yunus Textile Mills Supply Chain ReportDocumento25 pagineYunus Textile Mills Supply Chain ReportAmeerAnasNessuna valutazione finora

- Coca-Cola vs. Pepsi outbound logistics analysis in IndiaDocumento21 pagineCoca-Cola vs. Pepsi outbound logistics analysis in IndiaJon100% (1)

- Supply Chain Management Project For MBA StudentsDocumento405 pagineSupply Chain Management Project For MBA StudentsAnil Kumar Goud PalleNessuna valutazione finora

- KFC's Supply Chain Management in PakistanDocumento17 pagineKFC's Supply Chain Management in PakistanRizky Ardani33% (3)

- Case Study No.4Documento1 paginaCase Study No.4sasiganthNessuna valutazione finora

- Inventory Management PepsicoDocumento45 pagineInventory Management PepsicoNitin Ramchandani79% (43)

- PepsiCo's Supply Chain Management in IndiaDocumento21 paginePepsiCo's Supply Chain Management in IndiarohitcshettyNessuna valutazione finora

- Lower Costs Common ComponentsDocumento19 pagineLower Costs Common Componentsshwes01Nessuna valutazione finora

- Chapter 2 - Purchase ManagementDocumento19 pagineChapter 2 - Purchase ManagementTehseen Baloch100% (2)

- Supply Chain Management of KFCDocumento5 pagineSupply Chain Management of KFCKiyan Sharma50% (2)

- Supply Chain Management of Pepsi Cola, PakistanDocumento16 pagineSupply Chain Management of Pepsi Cola, Pakistanmazuu97% (37)

- Toyota Supplier ManagementDocumento4 pagineToyota Supplier ManagementAdityaNanda100% (1)

- Pepsi CoDocumento13 paginePepsi CoFaisal Numan100% (1)

- Exaim McqsDocumento17 pagineExaim McqsFazal RaheemNessuna valutazione finora

- PepsiCo's Performance Appraisal ProcessDocumento18 paginePepsiCo's Performance Appraisal ProcessManish Kumar Lodha20% (5)

- Case Studies. Boeing Supplier EvaluationDocumento1 paginaCase Studies. Boeing Supplier EvaluationThiên TrangNessuna valutazione finora

- Logistics And Supply Chain Management System A Complete Guide - 2020 EditionDa EverandLogistics And Supply Chain Management System A Complete Guide - 2020 EditionNessuna valutazione finora

- Order Management A Complete Guide - 2021 EditionDa EverandOrder Management A Complete Guide - 2021 EditionNessuna valutazione finora

- Agile Supply Chain A Complete Guide - 2021 EditionDa EverandAgile Supply Chain A Complete Guide - 2021 EditionNessuna valutazione finora

- Pepsi Human Resource ManagementDocumento16 paginePepsi Human Resource Managementmamun_uu100% (2)

- Assignment Cover Sheet University of Sunderland Ba (Hons) Business ManagementDocumento16 pagineAssignment Cover Sheet University of Sunderland Ba (Hons) Business ManagementLin Mary MyintNessuna valutazione finora

- Arcade Business College: PatnaDocumento102 pagineArcade Business College: Patnasaur1Nessuna valutazione finora

- Pepsi Marketing Summer Training ReportDocumento99 paginePepsi Marketing Summer Training Reportumanggg100% (4)

- Pepsi Marketing Summer Training ReportDocumento100 paginePepsi Marketing Summer Training ReportRavi SharmaNessuna valutazione finora

- Dynamics 365 Service ComplianceDocumento3 pagineDynamics 365 Service Compliancevivekrajan3Nessuna valutazione finora

- Microsoft Azure Compliance OfferingsDocumento77 pagineMicrosoft Azure Compliance OfferingspktunNessuna valutazione finora

- Dynamics 365 Service ComplianceDocumento3 pagineDynamics 365 Service Compliancevivekrajan3Nessuna valutazione finora

- Information Systems in Business Today: Session#2Documento29 pagineInformation Systems in Business Today: Session#2pktunNessuna valutazione finora

- Session 1Documento16 pagineSession 1pktunNessuna valutazione finora

- KM StrategiesDocumento35 pagineKM Strategiespktun100% (1)

- Assignment No. 1: Recommendations to Improve BEC's Organizational StructureDocumento5 pagineAssignment No. 1: Recommendations to Improve BEC's Organizational StructurepktunNessuna valutazione finora

- Lotus Framework in Knowledge ManagementDocumento7 pagineLotus Framework in Knowledge ManagementpktunNessuna valutazione finora

- Hydraulic CaculationDocumento66 pagineHydraulic CaculationgagajainNessuna valutazione finora

- TCS Case StudyDocumento21 pagineTCS Case StudyJahnvi Manek0% (1)

- Benefits of Group Discussion as a Teaching MethodDocumento40 pagineBenefits of Group Discussion as a Teaching MethodSweety YadavNessuna valutazione finora

- Endocrine System NotesDocumento14 pagineEndocrine System NotesSteven100% (1)

- Dialog+ 2016 - BrochureDocumento6 pagineDialog+ 2016 - BrochureirmaNessuna valutazione finora

- Chapter 26 STAINING OF MUSCLE AND BONE - Group3Documento6 pagineChapter 26 STAINING OF MUSCLE AND BONE - Group3Krizelle Vine RosalNessuna valutazione finora

- Radioactivity PhenomenonDocumento20 pagineRadioactivity PhenomenonNeetesh TiwariNessuna valutazione finora

- CLMD4A CaregivingG7 8Documento25 pagineCLMD4A CaregivingG7 8Antonio CaballeroNessuna valutazione finora

- Thermal Engineering Lesson Plan for Mechanical Engineering StudentsDocumento3 pagineThermal Engineering Lesson Plan for Mechanical Engineering StudentsblessyNessuna valutazione finora

- Stewart Paul Lucky Luke and Other Very Short Stories With ExDocumento111 pagineStewart Paul Lucky Luke and Other Very Short Stories With ExЕлена Сидлаковская100% (1)

- TDS - J TOWhead D60Documento1 paginaTDS - J TOWhead D60TahirNessuna valutazione finora

- Data Analytics, Data Visualization and Big DataDocumento25 pagineData Analytics, Data Visualization and Big DataRajiv RanjanNessuna valutazione finora

- Thursday: Dhaka Electric Supply Company Limited (DESCO) Load Shedding Schedule On 11 KV FeedersDocumento16 pagineThursday: Dhaka Electric Supply Company Limited (DESCO) Load Shedding Schedule On 11 KV FeedersaajahidNessuna valutazione finora

- Hubungan Kelimpahan Dan Keanekaragaman Fitoplankton Dengan Kelimpahan Dan Keanekaragaman Zooplankton Di Perairan Pulau Serangan, BaliDocumento12 pagineHubungan Kelimpahan Dan Keanekaragaman Fitoplankton Dengan Kelimpahan Dan Keanekaragaman Zooplankton Di Perairan Pulau Serangan, BaliRirisNessuna valutazione finora

- Dr.A.P.Sastri: Software Project Management Bob Hughes and Mike Cotterell: Book 1 Unit - 1 Page Nos: 1-36Documento30 pagineDr.A.P.Sastri: Software Project Management Bob Hughes and Mike Cotterell: Book 1 Unit - 1 Page Nos: 1-36Dr. A. Pathanjali Sastri0% (1)

- Chapter Seven: Activity Analysis, Cost Behavior, and Cost EstimationDocumento72 pagineChapter Seven: Activity Analysis, Cost Behavior, and Cost EstimationEka PubyNessuna valutazione finora

- Waves On A String Remote LabDocumento8 pagineWaves On A String Remote LabDanelle Espartero100% (1)

- List of CasesDocumento7 pagineList of CasesKersey BadocdocNessuna valutazione finora

- Infobasic - 3Documento64 pagineInfobasic - 3Kishore KumarNessuna valutazione finora

- DPBH Technical Bulletin 08-23-16 - Transfer of Medical RecordsDocumento5 pagineDPBH Technical Bulletin 08-23-16 - Transfer of Medical RecordsBlayne OsbornNessuna valutazione finora

- Software Customisation Reference ManualDocumento269 pagineSoftware Customisation Reference ManualTonthat QuangNessuna valutazione finora

- Who Would Think That Love - LyricDocumento1 paginaWho Would Think That Love - LyricNatália RamosNessuna valutazione finora

- Linux InstallationDocumento4 pagineLinux InstallationRayapudi LakshmaiahNessuna valutazione finora

- 5 Tower HardwareDocumento37 pagine5 Tower HardwareAhmed ElShoraNessuna valutazione finora

- A10 Thunder Series and AX Series: ACOS 2.7.2-P7-SP3 22 December 2015Documento360 pagineA10 Thunder Series and AX Series: ACOS 2.7.2-P7-SP3 22 December 2015huonz mrNessuna valutazione finora

- Indonesian RecipeDocumento2 pagineIndonesian RecipeJeremiah NayosanNessuna valutazione finora

- English Grammar: The differences between across, over and throughDocumento1 paginaEnglish Grammar: The differences between across, over and throughYuresh NadishanNessuna valutazione finora

- Tariffs Part IDocumento26 pagineTariffs Part IGudz NavoraNessuna valutazione finora

- Users Manual of Rdlc320 Control SystemDocumento36 pagineUsers Manual of Rdlc320 Control SystemriderbeeNessuna valutazione finora

- Minimal Preludes I & II - Jeroen Van VeenDocumento5 pagineMinimal Preludes I & II - Jeroen Van VeenErnesto HartmannNessuna valutazione finora