Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Icc 112 4e Consumption Asia

Caricato da

JoshMooreCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Icc 112 4e Consumption Asia

Caricato da

JoshMooreCopyright:

Formati disponibili

ICC

112-4

27 February 2014

Original: English

International Coffee Council

112th Session

3 7 March 2014

London, United Kingdom

Coffee consumption in East and

Southeast Asia: 1990 2012

Background

In accordance with Article 34 of the International Coffee Agreement 2007, the

International Coffee Organization is required to provide Members with studies and reports

on relevant aspects of the coffee sector. This document contains a report on coffee

consumption in East and Southeast Asia since 1990, looking at the dynamics of regional and

national markets and prospects for future growth.

Action

The Council is requested to take note of this document.

COFFEE CONSUMPTION IN EAST AND SOUTHEAST ASIA: 1990 2012

INTRODUCTION

1.

The hot drinks market in Asia has traditionally been dominated by tea consumption,

rather than coffee. However, in recent years, the Asian coffee market has increasingly

become the focus of the world coffee industry. Since 1990, Asia has experienced the most

dynamic growth in coffee consumption in the world (see Figure 1), growing by an average

rate of 4% per annum, increasing to 4.9% since the year 2000. As such, the region is of

increasing interest to the coffee sector, both for producers and consumers, and represents a

significant potential market for the coffee industry.

Figure 1: Growth in coffee consumption by region (1990 - 2012)

300

Index: 1990=100

250

200

150

100

50

Asia

South America

Africa

Central America

North America

Europe

2.

This study focuses specifically on the dynamics of coffee consumption in East and

Southeast Asia since 1990, and expands on the study Coffee in China (ICC-111-8), published

in August 2013. It gives an overview of coffee demand growth in the region 1 as a whole,

before giving a brief summary of developments in selected individual markets, specifically

Japan, Indonesia, South Korea, the Philippines, Vietnam, Thailand, China (including Macao

and Hong Kong), Taiwan, Malaysia, Laos and Myanmar. The remaining markets of Brunei,

North Korea, Cambodia, Mongolia and Timor-Leste are discussed in less detail, as the overall

volumes involved are still very low. Finally, due to the lack of consistent data, coffee

consumption in Singapore is not included in this analysis, although external sources suggest

there is a relatively strong coffee culture present.

This study refers to the geographical region of Eastern and Southeastern Asia, as defined by the United

Nations Statistics Division, with the addition of Taiwan. Furthermore, the term country is used in a broad

sense for what are officially classed as customs territories, but which may not be countries in the usual sense

of the word. The denomination and classification used herein do not imply, on the part of the ICO, any

judgement as to the legal or other status of any territory, or any endorsement or acceptance of any boundary.

-2-

3.

Out of the sixteen countries in East and Southeast Asia, only Indonesia, the

Philippines, Thailand, Timor-Leste and Vietnam are currently Members of the ICO. As such,

data availability for many of the remaining countries can be limited in some cases, with the

result being that the accuracy of the information contained in this report may vary.

Indonesia, Laos, the Philippines, Thailand, Timor-Leste and Vietnam are all coffee-exporting

countries, while Brunei, Cambodia, China, Japan, North and South Korea, Malaysia,

Mongolia, Myanmar, Singapore, and Taiwan are classed as coffee importers.

4.

This study covers total consumption since 1990, including where possible data on

per capita consumption, trade data and market composition. However, there are still

several aspects missing from this analysis. Although total coffee consumption generally

increases with income, it would be useful to observe more detailed trends, such as the

relationship between consumption, gender and age, or the effect of an existing preference

for tea consumption. Furthermore, it would be interesting to break down the national and

regional markets further, to observe trends in fresh coffee compared to instant, the

development of single-serve pods, or patterns of at-home compared to out-of-home

consumption. More detailed data on such aspects are not currently publicly available, but

would certainly merit further study.

-3-

Regional Summary

5.

Coffee consumption in the region has been growing strongly over time, more than

doubling from 8.4 million 60kg bags in 1990 to 19.5 million bags in 2012. This represents an

average growth rate of 3.9% per annum. Furthermore, the share of East and Southeast Asia

in world coffee consumption has also been increasing, accounting for 13.8% of the world

total in 2012, up from 9.4% in 1990 and 10.9% in 2000 (see Figure 2).

Figure 2: Coffee consumption in East and Southeast Asia and % share in world consumption (1990 2012)

25 000

Thousand bags

20 000

15 000

10 000

5 000

0

9.4%

1990

10.9%

2000

13.8%

2012

6.

Consumption growth in many Asian countries has been driven primarily by demand

for Robusta coffee, which is used in soluble coffee and ready-to-drink products such as

3-in-1 mixes (coffee with whitener and sweetener) or 4-in-1 preparations (coffee with

whitener, sugar and flavourings or dietary additions). This is particularly true in several

Southeastern markets such as Indonesia, the Philippines, Thailand and Malaysia, which tend

to have large populations and a low but increasing per capita consumption. More developed

markets tend to exhibit a higher percentage of Arabica consumption and specialty coffee

industry, as can be seen in Japan, Taiwan and South Korea.

-4-

7.

Japan is by far the largest coffee market in the region, consuming 7.1 million bags in

2012, and nearly twice the size of Indonesia. Relatively significant consumption can also be

found in the Philippines, South Korea, Vietnam and Thailand, while China is also emerging as

a major consumer. In terms of per capita consumption, the situation is slightly different.

Japan is still one of the most significant markets, consuming 3.4kg per person, but behind

Brunei which consumed 4.3kg. South Korea is also a fairly developed market, with 2.1kg per

person, while Laos, the Philippines, Vietnam and Taiwan also consume over 1kg per person

(see Figure 3).

Figure 3: Coffee consumption in 2012 in East and Southeast Asia

a. Total coffee consumption

Japan

Indonesia

Philippines

South Korea

Vietnam

China

Thailand*

Taiwan

Malaysia*

Myanmar

Laos

Brunei

Cambodia

North Korea

Mongolia

Timor-Leste

2 175

1 714

1 583

1 071

1 052

396

393

253

150

30

28

25

16

0

0

2 000

7 131

3 584

4 000

Thousand bags

b. Per capita consumption

6 000

8 000

Brunei

Japan

South Korea

Laos

Philippines

Vietnam

Taiwan

Thailand*

Indonesia

Malaysia*

Mongolia

Myanmar

Cambodia

North Korea

China

Timor-Leste

0.3

0.3

0.1

0.1

0.0

0.0

0

2.1

1.4

1.3

1.1

1.0

0.9

0.9

0.8

4.3

3.4

kg per capita

*Estimated

8.

The region as a whole certainly exhibits significant potential for future growth in

coffee consumption, both in terms of volume and value. The total population of East and

Southeast Asia comes to 2.2 billion people, which gives an average per capita consumption

of just over 0.5kg, whereas the European Union averages nearly 5kg and North America

4.4kg. Disposable income is generally growing, and several multinational coffee companies

are increasingly investing to expand their presence in the area.

9.

The next section gives a brief summary of individual markets since 1990.

Japan

10.

Coffee consumption in Japan grew rapidly in the second half of the 20th century,

recording double-digit growth rates in the 1960s and 1970s. However, this growth has

slowed over time, as the Japanese market becomes more mature and saturated. Average

-5-

annual growth rates fell to 4.4% in the 1980s, 2.4% in the 1990s and just 0.6% since 2000. In

2012, coffee consumption was 7.1 million bags, making it by far the largest coffee drinker in

the region, and behind only the USA, Brazil and Germany in the world. Per capita

consumption was around 3.4kg per person, and has remained relatively unchanged since

2000.

11.

According to export data, the majority of coffee consumption is Arabica, consistently

accounting for 70 to 80% of the market over the time period. However, Robusta has been

growing more quickly since 2000, at around 4% per annum, while Arabica use has stayed

relatively constant. The vast majority of Japans imports are of green coffee (see Figure 4),

at over 90% of the total every year since 1990, which indicates a very strong domestic

processing industry. Japan re-exports very little coffee, just 1 to 2% of its total imports, with

the remainder consumed domestically. Brazil is the single largest origin, accounting for

around 29% of total imports since 2000, followed by Colombia (19%), Indonesia (14%) and

Vietnam (10%). However, it is notable that imports from other East and Southeast Asian

countries have increased significantly since 2000, by 2.8% per year, while those from South

America have stagnated, and Central America and Africa have fallen. In terms of value,

Japan imported some US$1.8 billion in 2012, down slightly from $2.2 billion in 2011, making

it easily the most valuable market in the region.

Figure 4: Net imports by type of coffee in Japan

8 000

Thousand bags

6 000

4 000

2 000

Soluble

Roasted

Green

Indonesia

12.

With total consumption of 3.6 million bags in 2012, Indonesia is the second-largest

consumer in the region, after Japan, and the 8th largest in the world. Consumption has been

increasing quickly, averaging 6.6% growth since 2000, and 5% per annum going back to

1990. However, with a population of nearly 250 million, per capita consumption is less than

1kg per person, and shows significant potential for further growth.

-6-

13.

It can be assumed that the majority of consumption in Indonesia is of national

production, which is 80% Robusta. However, Indonesia also imports around 1 million bags of

coffee, predominantly from Vietnam, which further suggests that most consumption is of

Robusta coffee. Domestic consumption as a percentage of total coffee production has

increased from an average of 22% in the 1990s to around 33% over the last five years (see

Figure 5). If consumption in Indonesia continues to grow at current rates, the country could

reach nearly 6 million bags by 2020, exceeding the current consumption of France.

Figure 5: Domestic consumption as a share of total production by Indonesia

14

Million bags

12

10

8

6

Production

Consumption

4

2

0

Philippines

14.

Although the Philippines is a coffee producer, it is a net importer of coffee overall,

with domestic consumption as much as ten times higher than production. Most sources

indicate that consumption is predominantly of soluble coffee, particularly instant

preparations such as 3-in-1 ready-to-drink products, mostly imported from Indonesia. Total

coffee consumption is estimated at 2.2 million bags in 2012, and has increased significantly

in recent years. Per capita consumption is also one of the highest in the region, at an

estimated 1.3kg, and with a population of over 96 million people, the Philippines has a

significant potential market for coffee consumption (see Figure 6).

-7-

2 500

1.5

2 000

1.2

1 500

0.9

1 000

0.6

500

0.3

0.0

Per capita (kg)

Consumption (thousand bags)

Figure 6: Consumption and per capita consumption in the Philippines

Consumption

Per capita

South Korea

15.

Coffee consumption in South Korea has been increasing strongly over time,

averaging an annual growth rate of 3.3% since 1990. Total consumption was around

1.7 million bags in 2012, making it the 18th largest coffee drinker in the world. The slight

decline observed between 2011 and 2012 is likely due to unobserved changes in pipeline

stocks, as consumption has generally been on the rise. Per capita consumption is around

2.1kg per person, and has nearly doubled since 1990. Total net imports in 2012 amounted

to a value of around US$583 million, down from a high of US$701 million in 2011 as

international coffee prices declined.

16.

Based on export figures to South Korea, consumption is estimated to comprise

around two thirds Arabica coffee, compared to one third Robusta (see Figure 7). This

estimate further suggests that Arabica consumption has been growing at around 5% per

annum since 2000, while Robusta use has fallen slightly by 0.4%.

Figure 7: Coffee consumption in South Korea

Thousand bags

2 000

1 500

1 000

Robusta

Arabica

500

-8-

Vietnam

17.

Some of the most dynamic growth in coffee demand in the region has been

observed in Vietnam. Since 2000, domestic consumption has increased by an average of

13% per annum to an estimated 1.6 million bags in 2012. The vast majority of this

consumption is of domestic production, as Vietnam imports very little coffee. Vietnam is

home to a vibrant coffee drinking and caf culture, with a significant domestic and

multinational private sector presence. Per capita consumption is estimated at over 1kg per

person, and is also growing at over 10% per year. Furthermore, Vietnams demography is

conducive to further growth, as indicated below. With a total population of nearly

90 million, Vietnam has a growing base of young, well-educated consumers with disposable

income (see Figure 8).

Figure 8: Consumption and population trends in Vietnam

b. Population

1.2

100

1 500

0.9

75

1 000

0.6

500

0.3

0.0

Consumption

Per capita

Million people

2 000

Per capita (kg)

Consumption (thousand bags)

a. Coffee consumption

50

25

0

0 - 14

15 - 64

65 +

China

18.

Estimates of coffee consumption in China (including Hong Kong and Macao) are

hampered by a lack of reliable statistics. However, on the basis of the available information,

coffee consumption in 2012 is estimated at 1.1 million bags, and has been growing at over

10% per annum since 1998 (the first year for which data is available). With a total

population of 1.3 billion people, per capita consumption in China comes to just 47.6 grams,

although this is believed to be higher in urban areas. For example, per capita consumption

in the significantly more urbanized region of Hong Kong is estimated at around 2.2kg

19.

If these growth rates in China are maintained, total consumption could reach

2.8 million bags by 2020 (see Figure 9), roughly equivalent to current consumption in the

United Kingdom, which makes the Chinese market a particularly promising prospect for the

world coffee trade. For more information on the coffee industry in China, see document

ICC-111-8 Coffee in China.

-9-

Figure 9: Coffee consumption prospects in China

3 000

Thousand bags

2 500

2 000

1 500

1 000

500

0

Thailand

20.

Consumption data for Thailand are incomplete, with the most recent figure available

dating from 2001. However, external sources suggest that domestic consumption has been

growing at between 7% and 10% over the last decade. Applying a relatively conservative

rate of 7% per annum since 2001 would suggest that Thailand consumed just over 1 million

bags of coffee in 2012. Furthermore, with a population of nearly 67 million people, this

would equate to around 950 grams per capita (see Figure 10).

21.

The domestic market is mostly composed of instant coffee or 3-in-1 mixes, which

according to the International Trade Centre account for around 95% of coffee consumption.

Moreover, given Thailands production is around 90% Robusta, and coffee exports to

Thailand are an estimated 95% Robusta, the evidence suggests that the Thai market could

absorb over 1 million bags of Robusta yearly, and is showing strong signs of growth.

1 200

1 200

1 000

1 000

800

800

600

600

400

400

200

200

Per capita (g)

Consumption (thousand bags)

Figure 10: Consumption and per capita consumption in Thailand

Consumption

Estimated

(at 7% p.a.)

Per capita

- 10 -

Taiwan

22.

According to the net import data, coffee consumption in Taiwan has averaged

around 362,000 bags per year since 2000, more than double the yearly average of

178,000 bags consumed in the 1990s. Per capita consumption has also increased

significantly, from 0.4kg per person in 1990 to over 1kg in 2012. Taiwan has a relatively

developed coffee culture; according to media reports the number of cups consumed

quadrupled between 1999 and 2010, and the number of coffee establishments increased to

over 10,000. Taiwan also has an increasingly urbanized population, with one of the highest

population densities in the world, which is conducive to further growth in the market. Most

imports are of green coffee (67% in 2012), but soluble coffee played a key role in developing

the coffee market in the late 1990s (see Figure 11). Furthermore, the market share of

Arabica in the Taiwanese coffee market is one of the highest in the region, estimated to

have exceeded 60% on average since 2000.

Figure 11: Coffee market segmentation in Taiwan

Thousand bags

a. Net imports of coffee by Taiwan

b. Exports of coffee to Taiwan

500

100%

400

80%

300

60%

200

40%

100

20%

0%

Green

Roasted

Soluble

Arabica

Robusta

Malaysia

23.

Coffee consumption is very difficult to measure in Malaysia, as the available

international trade statistics suggest that the country is frequently a net coffee exporter,

implying negative domestic consumption. This discrepancy could be potentially explained by

changes in unobserved stock levels or unrecorded inflows of coffee.

24.

Figure 12 below shows an attempt to derive some more realistic information from

these contrary statistics. The solid line shows a rolling five-year average of net

disappearance (production + imports exports) from 1990 to 2012, which follows a very

volatile and inconsistent trend. The dotted line represents a least-squared regression of this

series, which indicates a clear upward trend overall. This regression suggests that coffee

consumption in Malaysia is currently around 400,000 to 500,000 bags, which would

- 11 -

correspond to some 800 grams per person, roughly equivalent to external estimates.

Furthermore, in terms of market composition, alternative sources suggest that consumption

is predominantly of soluble coffee, although an increasing out-of-home sector is promoting

consumption of fresh coffee.

Figure 12: Basic regression analysis of coffee consumption in Malaysia

800

600

400

y = 15.67x + 32.45

200

0

-200

-400

5-year average

Regression line

Myanmar

25.

Coffee consumption in Myanmar is relatively minor in world terms, estimated at

some 253,000 bags in 2011 (the last year for which data is available). However, it is growing

quickly, more than doubling since 2007 alone, up to some 290 grams per capita. According

to international trade statistics, the market is almost entirely composed of soluble coffee, as

indicated below. However, there is a small amount of coffee produced in Myanmar, both

Arabica and Robusta, so domestic consumption could actually be higher.

Figure 13: Coffee consumption in Myanmar

Thousand bags

400

300

200

100

0

Soluble

Green

Roasted

- 12 -

Laos

26.

Based on the information available, coffee consumption in Laos is estimated at

around 150,000 bags per year. However, this translates to a relatively high level of per

capita consumption of 1.4kg per person, one of the highest rates in the region. Most of this

consumption is thought to come from domestic production, which was 497,000 bags in

2012/13. Furthermore, external sources suggest that the highest quality coffee is

predominantly destined for export, while the rest is consumed locally. According to a 2007

study2, the strongest development in Laos has been in instant coffee consumption, although

there has been evidence of growing demand for roasted coffee in urban areas. Complete

data for Laos are not available, but consumption and per capita consumption since 2003 are

shown below.

180

2.0

160

1.8

140

1.6

120

1.4

100

1.2

80

2003

kg per capita

Thousand bags

Figure 14: Consumption and per capita consumption in Laos

1.0

2004

2005

2006

2007

Consumption

2008

2009

2010

2011

2012

Per capita

Other consuming countries

Brunei

27.

Due to its small population, Brunei has a very high per capita consumption, reaching

4.4kg in 2012. However, the overall market is very small, accounting for some 30,000 bags.

Consumption fluctuated heavily from the beginning of the period up until the early 2000s,

but has since increased consistently. However, due to its size, it does not seem likely that

Brunei will become a major coffee consumer on the international level.

North Korea

28.

Net imports for North Korea range from 3,000 to 30,000 bags per year since 2000,

with no clear trend. Taking an average of 19,000 bags since 2000 would give a per capita

Groupe de Travail Caf (2007) Participative analysis of coffee supply chain in Lao PDR.

- 13 -

consumption of around 50 grams per person. Average consumption since 2000 has been

considerably higher than in the 1990s, but remains exceedingly low. There are a handful of

Western-style coffee shops appearing in Pyongyang, although the potential market is

severely limited due to the cost.

Cambodia

29.

According to the data available, Cambodia has exhibited very low overall levels of

coffee consumption, amongst the lowest in the region. However, consumption has been

growing quickly, at over 10% per annum since 2000. Based on Cambodias import/export

statistics, the vast majority of this consumption is composed of imported soluble coffee,

made from Robusta beans, mostly from Thailand. Furthermore, there is mounting evidence

of increasing demand in Cambodia as the economy develops and a growing middle class

emerges. Though per capita consumption remains relatively low, at just over 100 grams per

person, there is certainly potential for growth.

Mongolia

30.

Consumption in Mongolia has averaged some 13,000 bags since 2000 and there have

been clear signs of growth over time, reaching 25,000 bags in 2012. This gives a per capita

consumption of around 300 grams. With population of 2.8 million which is steadily

increasing there could be potential for a small increase in consumption, but it remains

unlikely to become a major market in the near future.

Timor-Leste

31.

Consumption data for Timor-Leste is currently unavailable; there is however some

evidence that rural producers consume some of their own domestic production.

Figure 15: Coffee consumption in other importing countries

60

Thousand bags

50

40

30

20

10

0

Brunei Darussalam

Cambodia

North Korea

Mongolia

- 14 -

CONCLUSION

32.

New and emerging markets tend to show a preference for Robusta-based products,

particularly soluble coffee and 3-in-1 or 4-in-1 ready-to-drink products. However, as the

coffee market develops, it undergoes a transition towards Arabica-based ground coffee

consumption. This transition is usually correlated with increasing GDP, as well as

urbanization and demographic evolution. Finally, as a market becomes more mature,

volume growth in consumption slows and is replaced by value augmentation, with a higher

preference for specialty coffee. In East and Southeast Asia, this is best exemplified by the

Japanese coffee market.

Nevertheless, consumption in East and Southeast Asia remains one of the most

dynamic and high potential markets for future coffee demand. With 31% of the worlds

population and 29% of world GDP, the sixteen countries in this report currently account for

just 14% of world coffee consumption. However, this share is rising, and if current trends

continue, the region could potentially consume 28 to 30 million bags of coffee by 2020.

33.

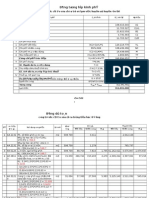

Table 1: Total coffee consumption

Brunei

Cambodia

China

Indonesia

Japan

Laos

Malaysia*

Mongolia

Myanmar

North Korea

Philippines

South Korea

Taiwan

Thailand*

Timor-Leste

Vietnam

ANNEX

FULL CONSUMPTION DATA FOR EAST AND SOUTHEAST ASIA

1990

8

1991

10

1992

8

0

1993

11

0

1994

9

6

1995

16

4

1996

20

8

1997

29

10

1 521

5 968

1998

20

8

199

1 567

6 052

1999

12

21

263

1 614

6 273

2000

18

6

326

1 664

6 626

2001

14

5

371

1 919

6 936

142

5

1

1

821

926

122

396

158

2

0

0

842

1 065

216

347

174

4

0

0

832

988

260

401

189

9

0

1

836

1 087

303

433

205

7

0

25

841

1 246

376

450

221

15

53

29

821

1 258

417

1 000

2002

22

4

426

1 834

6 875

40

236

13

52

27

825

1 306

446

535

1 236

5 060

1 271

5 809

1 309

5 132

1 349

5 740

1 390

5 973

1 432

6 116

1 475

5 838

48

64

0

0

710

842

122

172

0

0

735

801

141

196

79

0

1

0

750

942

95

0

0

2

760

975

223

237

111

1

1

1

780

1 095

108

258

126

1

2

2

800

1 009

152

317

113

170

235

254

267

1990

1 938

1991

2 337

1992

1 761

3

1993

2 258

2

418

2 464

423

2 819

429

2 481

159

8

0

0

682

1 176

359

183

205

0

1

690

1 108

410

206

102

151

2003 2004

24

21

5

3

462

474

1 820 1 958

6 770 7 117

144

111

252

268

9

14

57

76

8

27

873

969

1 305 1 401

459

340

572

613

2005

21

16

564

2 375

7 128

136

283

16

61

20

1 030

1 394

320

655

2006

26

16

607

2 750

7 268

140

299

19

81

9

1 050

1 437

290

701

2007

38

6

607

3 208

7 282

140

315

17

108

26

1 060

1 425

323

750

2008

33

20

619

3 333

7 065

143

330

10

158

3

1 390

1 665

262

803

2009

55

15

500

3 333

7 130

150

346

9

194

4

1 770

1 551

295

859

2010

34

21

706

3 333

7 192

150

362

11

313

16

1 973

1 666

388

919

2011

30

28

950

3 333

7 015

150

377

16

253

25

2 150

1 801

397

984

2012

30

28

1 071

3 584

7 131

150

393

16

253

25

2 175

1 714

396

1 052

271

286

302

318

336

363

416

475

541

629

722

829

922

959

1 068

1 302

1 583

1 583

1994

1 791

35

1995

3 160

19

1996

4 002

42

1997

5 617

49

435

2 764

442

2 866

449

2 925

456

2 785

463

2 841

1998

3 671

41

10

471

2 875

1999

2 218

103

13

478

2 975

2000

3 299

295

15

486

3 137

2001

2 539

213

17

553

3 279

248

5

2

1

688

1 293

290

2

0

4

681

1 329

232

245

329

24

2

2

684

1 483

307

265

366

23

3

5

686

1 355

426

322

401

140

1

2

689

1 234

341

399

434

42

0

0

692

1 408

596

346

466

112

0

1

669

1 296

711

395

496

220

0

2

659

1 414

823

422

525

182

280

65

650

1 696

1 013

433

553

362

687

77

621

1 616

1 117

951

2002

3 736

185

20

522

3 245

423

580

315

656

69

613

1 670

1 188

503

2003

4 149

222

21

544

3 215

1 544

607

224

690

20

634

1 682

1 218

533

2004

3 448

121

22

540

3 368

1 168

633

334

914

67

690

1 796

900

565

2005

3 424

737

26

635

3 369

1 412

658

376

733

51

721

1 779

844

600

2006

4 174

722

28

725

3 438

1 424

681

438

957

23

722

1 824

761

639

2007

5 998

259

27

833

3 434

1 398

704

425

127

64

716

1 798

844

681

2008

5 459

846

28

854

3 329

1 393

726

228

185

7

923

2 865

682

728

2009

8 388

637

22

843

3 359

1 435

747

197

226

11

1 156

1 932

767

778

2010

5 119

862

31

839

3 389

1 463

767

250

362

38

1 267

2 633

1 004

831

2011

4 354

115

42

823

3 358

1 384

787

338

290

61

1 357

2 217

1 025

886

2012

4 354

115

47

880

3 362

1 353

806

338

290

61

1 349

2 984

1 019

946

204

217

224

223

231

240

250

260

277

313

353

389

449

511

582

639

658

726

878

1 564

1 464

* Estimated

In thousand bags

Table 2: Per capita consumption

Brunei

Cambodia

China

Indonesia

Japan

Laos

Malaysia*

Mongolia

Myanmar

North Korea

Philippines

South Korea

Taiwan

Thailand*

Timor-Leste

Vietnam

* Estimated

In grams per capita

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Daftar 53 Jurnal Linguistik Di SINTA 2Documento5 pagineDaftar 53 Jurnal Linguistik Di SINTA 2Cak BoyNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Ulangan Harian - Bab 1 Permainan Bola Besar (1-26)Documento11 pagineUlangan Harian - Bab 1 Permainan Bola Besar (1-26)SHAFA MINDA MALIRANNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Three-Part EssayDocumento1 paginaThree-Part EssayLovely CastroNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Nationalist Interpretation of IndianizationDocumento8 pagineNationalist Interpretation of IndianizationJ SanglirNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 1-BC-Raiders of The Sulu Sea Revised PDFDocumento34 pagine1-BC-Raiders of The Sulu Sea Revised PDFEunice MangilayaNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- History and Influence of English in The PhilippinesDocumento1 paginaHistory and Influence of English in The PhilippinessuzuechiNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- SSB (Feb'08)Documento5 pagineSSB (Feb'08)api-3722789Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Studi Perbandingan Struktur Dan KonstruksiDocumento62 pagineStudi Perbandingan Struktur Dan KonstruksiArifinNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Khoai ChauDocumento67 pagineKhoai ChauHânNguyễnNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Atlas Customers List GADocumento82 pagineAtlas Customers List GANguyen Phi Long100% (1)

- Social Environment of The Philippines Is Being Classified in Culture and People, Wherein The Culture of The People Will Be Defined As FollowsDocumento2 pagineSocial Environment of The Philippines Is Being Classified in Culture and People, Wherein The Culture of The People Will Be Defined As FollowsAldrin ViloriaNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- 095 PDFDocumento260 pagine095 PDFAri MendlerNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Maritime Security Cooperation in The StraitDocumento99 pagineMaritime Security Cooperation in The StraitozgurNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Komunikasyon at Pananaliksik Sa Wika at Kulturang Pilipino Answer KeytokDocumento2 pagineKomunikasyon at Pananaliksik Sa Wika at Kulturang Pilipino Answer KeytokSaz Rob78% (127)

- Music and Arts (MUSIC) Teaching Guide 2nd Yr FIRST QUARTERDocumento11 pagineMusic and Arts (MUSIC) Teaching Guide 2nd Yr FIRST QUARTERDepEdResources100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Pengembangan Desa Wisata Berbasis Unggulan Dan Pemberdayaan Masyarakat (Kajian Pengembangan Unggulam Dan Talenta Budaya Masyarakat Karimunjawa Kabupaten Jepara)Documento22 paginePengembangan Desa Wisata Berbasis Unggulan Dan Pemberdayaan Masyarakat (Kajian Pengembangan Unggulam Dan Talenta Budaya Masyarakat Karimunjawa Kabupaten Jepara)armita ameliaNessuna valutazione finora

- "Education Is The Great Engine To Personal Development." - Nelson MandelaDocumento2 pagine"Education Is The Great Engine To Personal Development." - Nelson MandelaBernadette AcostaNessuna valutazione finora

- Hanthawaddy Kingdom: Hanthawaddy Pegu or Simply Pegu) Was The MonDocumento3 pagineHanthawaddy Kingdom: Hanthawaddy Pegu or Simply Pegu) Was The MonRQL83appNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Hinilawod EpicDocumento8 pagineHinilawod EpicEnihm OremlaNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Airasia - List of Sales OfficeDocumento20 pagineAirasia - List of Sales OfficeJohn Bell Rey SarsabaNessuna valutazione finora

- 859-Research Results-2479-1-10-20200429Documento10 pagine859-Research Results-2479-1-10-20200429Hartati 13Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Collective AP World Study Guide 2022-2023Documento54 pagineCollective AP World Study Guide 2022-2023kanthamneni01Nessuna valutazione finora

- 01 Ethnic Group in The PhilippinesDocumento36 pagine01 Ethnic Group in The Philippinesthelma olipasNessuna valutazione finora

- Assignment Read & Writing - Group 12Documento4 pagineAssignment Read & Writing - Group 12Ibhamuzzakia ZqyNessuna valutazione finora

- Thayer Consultancy Monthly Report November 2023Documento15 pagineThayer Consultancy Monthly Report November 2023Carlyle Alan ThayerNessuna valutazione finora

- Philippine Politics and Governance Quarter 1 - Module 5Documento12 paginePhilippine Politics and Governance Quarter 1 - Module 5Alyssa SarmientoNessuna valutazione finora

- Acknowledge ReceiptDocumento4 pagineAcknowledge ReceiptdimenmarkNessuna valutazione finora

- Wudang and Modernisation of DaoismDocumento17 pagineWudang and Modernisation of DaoismCentre Wudang Taichi-qigongNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Edited Home School Schedule Grade 6Documento7 pagineEdited Home School Schedule Grade 6Cortez del AiramNessuna valutazione finora

- Resource 1.1 Spanish Moro WarsDocumento6 pagineResource 1.1 Spanish Moro WarsMeilcah DemecilloNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)