Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Report Dated 15.06.01-Motilaloswal

Caricato da

sdCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Report Dated 15.06.01-Motilaloswal

Caricato da

sdCopyright:

Formati disponibili

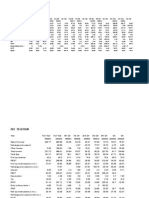

Update/Earnings Guide

SECTOR: ENGINEERING-ELECTRICALEQUIPMENT

Alstom Power India

ST O C KINF O.

B LO O M B E RG

BSE SENSEX: 3,373 NA

S&P CNX:

RE U T E RS C O D E

1,088 NA

Equity Shares (m)

52-Week Range

1/6/12 Rel. Perf. (%)

Buy

Previous Recommendation: Buy (28 February 2001)

41.4

Year

Net Sales

PAT

EPS*

45/15

End

(Rs m)

(Rs m)

(Rs)

EPS

Growth (%)

Rs36

P/E

PEG

RoE

RoCE

EV/

EV/

Ratio

(x)

(%)

(%)

Sales

EBDIT

12/00A

2,739

113

2.7

13.5

0.2

12.7

13.7

0.6

10.7

1.7

12/01E

4,700

214

5.2

89.1

7.2

19.4

22.8

0.3

6.3

1,490

12/02E

6,658

263

6.3

22.7

5.8

20.7

33.2

0.2

3.9

23/50/59

Price/BV (12/00)

M.Cap. (Rs m)

15 June 2001

* Adjusted for extra-ordinary items

Investment argument

With an order backlog of Rs99b, Alstom Power is comfortably placed

Operating margins are likely to improve in the medium term as existing projects near completion

n Concerns about the possible consolidation of the Alstom group companies in India have been suitably addressed

n A forthright and transparent management is a major positive

n

n

Recommendation

Based on the size of the order backlog and the execution cycle, the business outlook appears very promising. Alstom

Power has cash and cash equivalents worth Rs700m. The EV of this zero debt company net of cash equivalents will

be around Rs800m. At the current market price of Rs36, the stock is trading at 7x FY01E and 6x FY02E earnings. We

recommend a BUY.

Quarterly Performance

YEAR ENDING DECEMBER

Sales

Change (%)

Total Expenses

EBITDA

Change (%)

As % of Sales

Interest

Depreciation

Other Income

PBT

Tax

PAT

As % of Sales

(Rs Million)

1Q FY00

2Q FY00

3Q FY00

4Q FY00

1Q FY01

2Q FY01E

FY00

FY01E

367

450

517

1,404

1,315

1,122

2,739

4,700

258.3

149.1

124.4

71.6

396

466

512

1,288

1,308

1,114

2,662

4,537

(29)

(16)

116

76

163

(51.0)

(100.3)

(159.5)

112.9

3.5

(3.5)

1.0

8.2

0.5

0.6

2.8

(23)

15

15

15

19

17

17

63

67

16

29

22

40

37

40

106

151

(33)

(11)

160

27

30

119

245

31

(33)

(11)

154

24

27

113

214

(9.1)

(2.4)

0.5

11.0

1.9

2.4

4.1

4.6

Abhay Kantak +91 22 207 1379; abhay@motilaloswal.com

Motilal Oswal Securities Ltd., 81-82, Bajaj Bhawan, Nariman Point,

Mumbai 400 021. Tel: +91 22 281 2500 Fax: 281 6161

ABB Alstom Power India

Comfortable order book position

The order intake in 1QFY01 was Rs2.4b comprising two

key projects.

1. Ash handling equipment for NTPC

s Talcher project. This

project would be executed over a three-year period.

However, not much revenue would be booked in FY01.

2. NHPC's Dhauliganga hydel power project. The parent

and Alstom Power India would jointly execute the contract.

The entire contract size for the project is Rs1.81b in which

Alstom Power India

s scope of work is worth Rs700 m.

This order will be executed over a period of four years.

As a result a the order backlog as of March 2001 has

increased by 12% compared to the level as of Dec.2000.

Some of the major orders that constitute part of the order

backlog as of January 1, 2001:

ORDER

PROJECT

Base Turnover

ORDER

ORDER

BACKLOG

SALES

INTAKE

BACKLOG

1/1/01

1QFY01A

1QFY01

1/4/01

1,626

232

290

1,689

EPC Projects

Some of the contracts that form part of the base turnover

as of January 1, 2001:

CLIENT

ORDER FOR

Tata Sponge

Industrial Turbine

NTPC, Talcher

Electrostatic Precipitators

134

Hindalco

Electrostatic Precipitators

218

Operating margins to improve

The base turnover comprises of short cycle contracts (3-12

months). These orders not only impart stability to the overall

revenues but also are inherently low-risk as far as cost

escalation is concerned. Thus, they increase overall

profitability. In contrast, the larger projects are bagged at

no-profit-no-loss basis.

3,658

700

2,958

2,063

83

1,980

PROJECT-WISE REVENUE MIX

- Hazira

1,523

300

1,223

Y/E DECEMBER

1,410

1,410

Base Turnover

Total

700

700

8,870

1,315

2,400

9,960

There are two to three project orders for gas turbines that

the management is aggressively pursuing.

n EPC contract for the second phase of IPP promoted

by GVK Power in Andhra Pradesh. This projected is

expected to achieve financial closure by September 2001.

The order size will be at least Rs. 2bn to executed over

a period of 24 months from the date of award of the

contract.

n Supply of gas turbines in Bangladesh. The order size

will be in the range Rs. 1.5bn to Rs. 1.75bn

n The other mega project that will be up for bidding in

October 2001 is NTPC

s coal-based 660 MWx3 project

at Sipat, Madhya Pradesh. Alstom Power will face stiff

competition from BHEL for this project.

n The company management also revealed that an order

worth Rs160m is expected shortly for a cogeneration

project. This order will part of the order intake in the

base turnover.

90

442

- Neyveli

Dhauliganga HEP

ORDER SIZE (RS M)

Total

- Korba

Talcher Ash Handling

The management is aware that the bigger projects have lot

of uncertainty surrounding them. The company has been

constantly trying to increase order intake from short-cycle

contracts to help free resources quickly and to impart

stability to the overall turnover. The order backlog as of

date from short-cycle contracts is around Rs1.69 or 17%

of the total order backlog.

(Rs Million)

Projects

1Q FY01

232

17.7

1,083

82.3

- Neyveli

700

53.2

- Hazira

300

22.8

- Korba

83

6.3

1,315

100.0

Total

Due to its superior project management and execution skills,

the company is able to ultimately record a reasonable margin

on the completion of the contract. All the bigger and longcycle projects are at the initial phase of execution. Margins

will therefore be low and it is only towards completion that

overall profitability of the project can be calculated.

REVENUE MODEL

Y/E DECEMBER

Base Turnover

% of Sales

EPC

- Neyveli

- Korba R&M

- Dhauliganga

- Hazira

- Talcher

- Others

Total

(Rs Million)

ORDER SIZE

FY00

FY01E

FY02E

1,340

49

1,650

35

1,750

26

4,800

2,210

700

1,638

1,600

1,142

142

115

1,800

350

50

750

100

4,700

1,858

1,250

200

800

300

500

6,658

2,739

15 June 2001

ABB Alstom Power India

EXPENDITURE BREAK UP

Y/E DECEMBER

1Q FY00

2Q FY00

3Q FY00

4Q FY00

1Q FY01

2Q FY01E

FY00

FY01E

270

308

372

1,138

1,151

970

2,088

3,826

As % of Sales

73.5

68.4

71.9

81.1

87.5

86.5

76.2

81.4

Personnel Exp.

44

57

61

57

57

58

219

265

As % of Sales

11.9

12.6

11.8

4.1

4.3

5.2

8.0

5.6

83

102

79

92

100

86

356

447

22.5

22.6

15.3

6.6

7.6

7.7

13.0

9.5

Consumption of RM

Other Expenditure

As % of Sales

In 1Q FY01, 83% of the sales booked comprised of bigger

and long-cycle projects. As a result margins were under

pressure. Going forward as the projects near completion

and contribution of base turnover as percentage of

sales increases, EBITDA margins will improve.

the next couple of months due to which it will receive

advances from customers. Typically 15% of the order size

is received upfront as advance money. We estimate that the

other income from such investments will be around Rs71m.

As the larger projects contributed to 83% of sales in 1Q

FY01, the raw material cost as percentage of sales

constituted 86.5% of sales. Going forward, this ratio will

come down to 81.4% because of two reasons:

n Increased contribution from the base turnover in which

raw material cost as percentage of sales will be lower.

n Secondly as the EPC contracts near completion profits

from these projects will be increasingly realised.

Loans and advances in the form of ICDs to group

companies as of March 31, 2001 stood at Rs520m. The

management is able to realize interest income at 250 to 300

basis points higher than the prevailing rates in commercial

banks. Since these monies are parked in the group companies,

the management has greater control over the funds deployed.

Tax rate to slacken PAT growth in FY02

The carry forward losses as at December 31, 2000 stood

at Rs155m. This has reduced the effective tax rate for

Alstom Power. The company has been paying minimum

alternative tax (MAT). As, it is very likely to wipe out its

losses in FY01, the effective tax rate will be 10% in FY01.

However, in FY02, though the growth in PBT will be 65%

PAT growth will only be 23%, as the company will be

paying tax at 35%.

Y/E DECEMBER

Profit before Tax

Change (%)

Tax

Effective Rate (%)

Profit after Tax

Change (%)

FY00

FY01

FY02

119

245

404

64.6

106.6

31

141

4.8

12.8

35.0

113

214

263

89.1

22.7

Non-business other income to increase in FY01

In FY00 interest income stood at Rs39m. As of March

2001, ICDs worth Rs520m were deployed with group

companies. At the AGM it was resolved that up to Rs900m

of surplus funds can be placed with group companies. The

management expects a couple of orders to be bagged over

15 June 2001

Loans to group companies

Consolidation blues?

Though the valuations are not demanding at all and

business holds a lot of promise in the Indian context,

there have been concerns about the possible consolidation

of the Alstom group companies in India for quite some

time now. At the annual general meeting of Alstom Power

India, Country President Dr. Krishna Pillai brushed aside

such concerns saying, There are no plans to consolidate

as of date.

n

An internal study group set up to examine the

fallouts

He admitted, however, that an internal study group has been

set up to look into the feasibility and viability of the

consolidation of 16 legal entities that the Alstom group runs

in India.

n

It is premature to make any comments on the

issue

At this juncture, we can only say that it is too premature to

make any comments on the issue. All that the management

is doing is taking an inventory of the activities of the various

group entities operating in India and examining whether it

makes sense to consolidate.

ABB Alstom Power India

We believe that the management will act in

the shareholders interest

Even if the consolidation were to happen, it would all done

to improve the business prospects of the Alstom group

and to increase shareholder value. The final decision of

consolidation will hinge on the following factors:

n Whether the combined entity will emerge stronger

n Whether the benefits would outweigh the costs of

consolidation

n

The management has clearly stated that it will

keep shareholders informed

The key thing to be observed at the AGM was the efforts

that the management took to explain the nitty-gritty of their

business to the all the shareholders present. We would also

to like to state that the management was extremely

transparent in its dealings with all the shareholders.

There are about 50,000 shareholders of Alstom Power and

45,000 shareholders of Alstom. The management clearly

stated that shareholder approval is most crucial before

any move for consolidation is taken. The management

s

transparent dealing with the ordinary shareholders present

at the AGM indicates that they are not just offering lip service

while talking of protecting shareholder interests.

Management initiatives

To mitigate imbalances developing between orders in hand

and resources, Alstom Power is establishing strong links with

other group companies abroad to allow effective utilization

of resources and to avoid break-up of core competencies.

In FY01, the company earned an income of Rs4.2m by

providing such global sourcing services.

Also, the designated project manager for the Videocon

Power Project has been deputed to a group company

abroad as the project has failed to close. This not only keeps

the key officials occupied but also gives them greater

exposure thus helping them to sharpen their project

management and execution skills.

Valuation and view

Based on the size of the order backlog and the execution

cycle, the business outlook appears very promising. Alstom

Power has cash and cash equivalents worth Rs700m. The

EV of this zero debt company will be around Rs600m. At

the current market price of Rs36, the stock is trading at 7x

FY01E and 6x FY02E earnings. We recommend a BUY.

15 June 2001

ABB Alstom Power India

INCOME STATEMENT

Period Ending December

(Rs Million)

1999

2000

2001E

2002E

963

2,739

4,700

6,658

(6.8)

184.4

71.6

41.7

24

67

80

125

Total Income

987

2,805

4,780

6,783

Raw Material

670

2,111

3,826

5,480

Employee Cost

184

219

265

322

SG&A Expenses

283

299

394

499

21

33

53

87

(171)

143

243

395

34.3

69.7

63.0

Net Sales

Change (%)

Operating Other Income

Other Operating Expenses

Stock Adjustment

EBITDA

Change (%)

(17.7)

5.2

5.2

5.9

Depreciation

% of Net Sales

43

63

67

75

Interest & Finance Charges

15

39

71

84

(224)

119

245

404

31

141

4.8

12.8

35.0

Profit after Tax

(224)

113

214

263

Change (%)

23.5

89.1

22.7

(23.2)

4.1

4.6

3.9

1999

2000

2001E

2002E

414

364

778

6

784

414

477

891

1

892

414

691

1,105

1,105

414

854

1,268

1

1,270

1,036

212

824

41

1,113

274

839

19

1,117

341

776

25

1,107

416

927

50

1,643

107

761

456

319

1,724

557

1,166

(81)

2,647

211

1,243

155

1,038

2,613

1,343

1,270

35

3,395

416

1,500

129

1,350

3,090

1,850

1,240

305

4,143

730

1,713

250

1,450

3,850

2,150

1,550

150

293

784

892

1,106

1,269

Other Income

Profit before Tax

Tax

Effective Rate (%)

% of Net Sales

BALANCE SHEET

(Rs Million)

Period Ending December

Share Capital

Reserves

Networth

Loans

Capital Employed (CE)

Gross Fixed Assets

Less: Depreciation

Net Fixed Assets

Capital WIP

Investments

Curr. Assets, L & Adv.

Inventory

Debtors

Cash & Bank Balance

Loans & Advances

Current Liab. & Prov.

Creditors

Advances from Customers

Other Liabilities

Net Current Assets

RATIOS

Period Ending December

1999

2000

2001E

2002E

(6.5)

(5.4)

18.8

-

2.7

4.2

21.5

-

5.2

6.8

26.7

-

6.3

8.1

30.6

2.4

37.9

13.5

8.7

10.7

0.6

1.7

-

7.2

5.5

6.3

0.3

1.4

-

5.8

4.5

3.9

0.2

1.2

6.5

(28.7)

(28.1)

12.7

13.7

19.4

22.8

20.7

33.2

289

58

304

1.2

166

36

232

3.1

116

40

176

4.3

94

49

143

5.2

Period Ending December

1999

2000

2001E

2002E

Op. Profit/(Loss) before Tax

Interest/Dividends Received

(214)

6

80

39

176

71

320

84

Depreciation & Amortisation

43

63

67

75

Interest Paid

15

(6)

(31)

(141)

(Inc)/Dec in Working Capital

856

303

296

(134)

Cash Flow from Op. Activity

706

480

579

205

-

Basic (Rs)

EPS

Cash EPS

Book Value

DPS

Payout (incl. Div. Tax.)

Valuation

PE

Cash PE

EV/EBITDA

EV/Sales

Price/Book Value

Dividend Yield (%)

Profitability Ratios (%)

RoE

RoCE

Turnover Ratios

Debtors (Days)

Inventory (Days)

Creditors. (Days)

Asset Turnover (x)

Leverage Ratio

Debt/Equity (x)

CASH FLOW STATEMENT

Direct Taxes Paid

Extra-ordinary Items

Other Items

1,039

(783)

CF after Exceptional Items

1,745

(309)

579

205

(Inc)/Dec in FA + CWIP

(865)

(10)

(15)

CF from Investing Activity

(865)

(10)

(15)

Issue of Shares

(414)

(5)

(1)

(15)

(1)

(1)

(1)

(99)

(423)

(5)

(2)

(99)

456

(307)

567

91

456

155

129

456

155

129

250

(Pur)/Sale of Investments

Inc/(Dec) in Debt

Interest Paid

Dividends Paid

CF from Financing Activity

Inc/(Dec) in Cash

Misc. Expenses

Application of Funds

(Rs Million)

Add: Beginning Balance

Closing Balance

E: Inquire Estimates

For more copies or other information, contact

Motilal Oswal - Inquire Phone: (91-22) 207 3809/1379 Fax: (91-22) 207 6686. E-mail: inquire@motilaloswal.com

Sales: (91-22) 281 2500 (Institutional: Navin Agarwal, Retail: Nischal Maheshwari)

This document is for information purposes only. In no circumstances should it be used or considered as an offer to sell or a solicitation of any offer to buy or sell the securities or commodities mentioned in it. The

information in this document has been obtained from sources believed reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such.

15 June 2001

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Eco 20092301Documento62 pagineEco 20092301sdNessuna valutazione finora

- 3month Mibor From NseDocumento1 pagina3month Mibor From NsesdNessuna valutazione finora

- Month-Wise Position of Trades Received by Ccil For Settlement For The Financial Year: 2007-2008Documento1 paginaMonth-Wise Position of Trades Received by Ccil For Settlement For The Financial Year: 2007-2008sdNessuna valutazione finora

- BHEL One PagerDocumento1 paginaBHEL One PagersdNessuna valutazione finora

- Budget at A Glance (In Crore of Rupees)Documento5 pagineBudget at A Glance (In Crore of Rupees)sdNessuna valutazione finora

- Simple Returns WorkingDocumento6 pagineSimple Returns WorkingsdNessuna valutazione finora

- Kaashyap Technology 1407Documento32 pagineKaashyap Technology 1407sdNessuna valutazione finora

- Simple Returns Returns Over Sensex Co - Name M.Cap 1 WK 1 Mon 3 Mon 6 Mon 1 Yr 1 WK 1 Mon 3 Mon MKT Cap Over 5000 CRDocumento4 pagineSimple Returns Returns Over Sensex Co - Name M.Cap 1 WK 1 Mon 3 Mon 6 Mon 1 Yr 1 WK 1 Mon 3 Mon MKT Cap Over 5000 CRsdNessuna valutazione finora

- Roto Pump - FinancialsDocumento8 pagineRoto Pump - FinancialssdNessuna valutazione finora

- Understanding Economic Systems and Business: The Future of BusinessDocumento65 pagineUnderstanding Economic Systems and Business: The Future of BusinesssdNessuna valutazione finora

- Bongaigaon Ref - FinanDocumento10 pagineBongaigaon Ref - FinansdNessuna valutazione finora

- Quarterly - Zee Telefilms LTDDocumento3 pagineQuarterly - Zee Telefilms LTDsdNessuna valutazione finora

- Annual Report 2005-06 Vindhya TeleDocumento64 pagineAnnual Report 2005-06 Vindhya TelesdNessuna valutazione finora

- PresentationDocumento36 paginePresentationsdNessuna valutazione finora

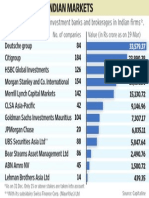

- No. of Companies Value (In Rs Crore As On 19 Mar)Documento1 paginaNo. of Companies Value (In Rs Crore As On 19 Mar)sdNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- InfoVista Xeus Pro 5 TMR Quick GuideDocumento76 pagineInfoVista Xeus Pro 5 TMR Quick GuideNguyen Dang KhanhNessuna valutazione finora

- Calcutta Bill - Abhimanyug@Documento2 pagineCalcutta Bill - Abhimanyug@abhimanyugirotraNessuna valutazione finora

- Children's Grace of Mary Tutorial and Learning Center, Inc: New Carmen, Tacurong CityDocumento4 pagineChildren's Grace of Mary Tutorial and Learning Center, Inc: New Carmen, Tacurong CityJa NeenNessuna valutazione finora

- TreeAgePro 2013 ManualDocumento588 pagineTreeAgePro 2013 ManualChristian CifuentesNessuna valutazione finora

- Outbreaks Epidemics and Pandemics ReadingDocumento2 pagineOutbreaks Epidemics and Pandemics Readingapi-290100812Nessuna valutazione finora

- Awakening The Journalism Skills of High School StudentsDocumento3 pagineAwakening The Journalism Skills of High School StudentsMaricel BernalNessuna valutazione finora

- Mehta 2021Documento4 pagineMehta 2021VatokicNessuna valutazione finora

- CardiologyDocumento83 pagineCardiologyAshutosh SinghNessuna valutazione finora

- Sosa Ernest - Causation PDFDocumento259 pagineSosa Ernest - Causation PDFtri korne penal100% (1)

- Mount Athos Plan - Healthy Living (PT 2)Documento8 pagineMount Athos Plan - Healthy Living (PT 2)Matvat0100% (2)

- Appendix H Sample of Coded Transcript PDFDocumento21 pagineAppendix H Sample of Coded Transcript PDFWahib LahnitiNessuna valutazione finora

- Presentation On HR Department of Mobilink.Documento18 paginePresentation On HR Department of Mobilink.Sadaf YaqoobNessuna valutazione finora

- Q4-ABM-Business Ethics-12-Week-1Documento4 pagineQ4-ABM-Business Ethics-12-Week-1Kim Vpsae0% (1)

- Pemphigus Subtypes Clinical Features Diagnosis andDocumento23 paginePemphigus Subtypes Clinical Features Diagnosis andAnonymous bdFllrgorzNessuna valutazione finora

- Bibliography of Loyalist Source MaterialDocumento205 pagineBibliography of Loyalist Source MaterialNancyNessuna valutazione finora

- 2 Beginner 2nd GradeDocumento12 pagine2 Beginner 2nd GradesebNessuna valutazione finora

- 2018 UPlink NMAT Review Social Science LectureDocumento133 pagine2018 UPlink NMAT Review Social Science LectureFranchesca LugoNessuna valutazione finora

- Consumer Trend Canvas (CTC) Template 2022Documento1 paginaConsumer Trend Canvas (CTC) Template 2022Patricia DominguezNessuna valutazione finora

- The Old Man and The SeaDocumento6 pagineThe Old Man and The Seahomeless_heartNessuna valutazione finora

- Lost Secrets of Baseball HittingDocumento7 pagineLost Secrets of Baseball HittingCoach JPNessuna valutazione finora

- Early Pregnancy and Its Effect On The Mental Health of Students in Victoria Laguna"Documento14 pagineEarly Pregnancy and Its Effect On The Mental Health of Students in Victoria Laguna"Gina HerraduraNessuna valutazione finora

- MInor To ContractsDocumento28 pagineMInor To ContractsDakshita DubeyNessuna valutazione finora

- What Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsDocumento149 pagineWhat Does The Scripture Say - ' - Studies in The Function of Scripture in Early Judaism and Christianity, Volume 1 - The Synoptic GospelsCometa Halley100% (1)

- WatsuDocumento5 pagineWatsuTIME-TREVELER100% (1)

- Gian Lorenzo BerniniDocumento12 pagineGian Lorenzo BerniniGiulia Galli LavigneNessuna valutazione finora

- Presente Progresive TenseDocumento21 paginePresente Progresive TenseAriana ChanganaquiNessuna valutazione finora

- Personal Development: Quarter 2 - Module 2: Identifying Ways To Become Responsible in A RelationshipDocumento21 paginePersonal Development: Quarter 2 - Module 2: Identifying Ways To Become Responsible in A RelationshipTabada Nicky100% (2)

- LITERATURE MATRIX PLAN LastimosaDocumento2 pagineLITERATURE MATRIX PLAN LastimosaJoebelle LastimosaNessuna valutazione finora

- Lesson Plan in Science III ObservationDocumento2 pagineLesson Plan in Science III ObservationTrishaAnnSantiagoFidelNessuna valutazione finora

- BurnsDocumento80 pagineBurnsAlina IlovanNessuna valutazione finora