Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Free BCG Potential Test

Caricato da

KenCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Free BCG Potential Test

Caricato da

KenCopyright:

Formati disponibili

Boston Consulting Group Potential Test

Free Practice Test

igotanoer.com

Free BCG Potential Test

Copyright 2015 IGotAnOffer Ltd.

Candidate briefing

Online case. During your recruiting process with BCG you will have to go through an online case.

The purpose of this exercise is to test your analytical and logic skills as well as your business sense.

Sample. This document is a sample of 10 questions put together by IGotAnOffer. Its purpose is to

help you prepare for the actual online exercise you will have to complete. We recommend you take

no more than 20 minutes to take this test.

Each question is divided into 2 parts:

on the left, you will find the question itself

on the right, you will find the information you need to answer the question

No calculator. We recommend you complete this sample test without using a calculator.

Scoring system. You should select one or more answers for each question. During the actual test

you will be able to move onwards and backwards and change your prior answers so you should feel

free to do the same here. For each right answer you will get +3 points, 0 points for no answer and -1

point for a wrong answer.

Copyright 2015 IGotAnOffer Ltd.

IGotAnOffer disclaimer

Process followed. BCG only makes four questions available to candidates preparing for its online

test. The free sample test you are reading is inspired by these questions as well as conversations

with past BCG candidates and other consulting recruitment tests. Although this free sample test is

unlikely to be a perfect representation of the actual test, we believe it should help significantly in

your preparation.

Remaining uncertainties. There are a few uncertainties regarding the BCG potential test that you

should be aware of:

Number of questions and time: In its four-question sample BCG mentions that the online

test includes 23 questions and needs to be completed in 45 minutes. However, past

candidates have also reported slightly varying numbers of questions and time limits.

Maths vs. logic questions: Given the limited number of questions made available by

BCG, the balance of maths and logic questions in the actual test is not known at this

stage.

Future improvements. Despite these uncertainties we believe the materials we put together will

enable you to develop the right skills. Your feedback on the actual test would be very valuable to us

and would significantly help us further improve these materials. You can contact us at

contactus@igotanoffer.com.

Copyright 2015 IGotAnOffer Ltd.

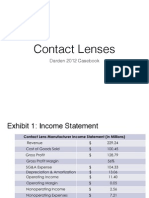

BCG Potential Test Olympian Airways

Question 1

Based on the market research,

what is the average ticket

price Olympian Airways

should charge for a flight from

London to Paris?

1.

2.

3.

4.

102

136

125

116

Doc 1

Doc 2

Doc 3

Doc 4

Pricing strategy

Case Overview

Market Research

Due to the increasing number of low-cost

airlines entering the market, the worlds

major carriers are forced to revisit their

pricing strategies in order to preserve

their market share.

5,000 people were asked how much they

would pay for a flight from London to

Paris.

Olympian Airways is one of the largest

airlines in Europe and is revamping its

Question

x / for

23international shortpricing strategy

haul flights.

Number of respondents and price points:

200

1,100

In order to do so, it decided to carry out

market research to find out how much

passengers would be willing to pay for

different routes.

100

1,500

150

Copyright 2015 IGotAnOffer Ltd.

50

500

BCG Potential Test Olympian Airways

Question 2

What ticket price should

Olympian Airways charge to

maximise gross profit per

day?

1.

2.

3.

4.

100

125

150

None of the above / we

lack sufficient information

at this stage

Doc 1

Doc 2

Doc 3

Maximise gross profit

Customer segments

After conducting market research in ticket

prices the company puts together two

different scenarios. Scenario A is a low

price high volume strategy and Scenario

B is a high price low volume strategy.

In addition to ticket revenues, Olympian

Airways also sells products (perfumes,

Question

x / 23 electronics, etc.) to

alcoholic beverages,

passengers during flights.

The company classifies customers into

three income bands: C1, C2 and C3. C1

passengers have got the lowest income

and C3 the highest.

C1 customers are price elastic across

ticket prices and likely to spend less on

goods purchased on board.

Olympian Airways aircrafts all have the

same number of seats.

Copyright 2015 IGotAnOffer Ltd.

Doc 4

Scenario analysis

Scenario

Flight cost and tickets revenue

Avg cost per flight

15,000

15,000

30

20

Ticket price

100

150

# passengers /

flight

200

150

# flights / day

Distribution of passengers

C1

50%

30%

C2

30%

30%

C3

20%

40%

Avg duty free spending per passenger

C1

C2

10

C3

15

BCG Potential Test Olympian Airways

Question 3

Which of the factors listed

below would not affect the

gross profit difference

between scenarios A and B?

1.

2.

3.

4.

Ticket prices

Aircrafts seat capacity

Fuel costs

None of the above

Doc 1

Doc 2

Doc 3

Maximise gross profit

Customer segments

After conducting market research in ticket

prices the company puts together two

different scenarios. Scenario A is a low

price high volume strategy and Scenario

B is a high price low volume strategy.

In addition to ticket revenues, Olympian

Airways also sells products (perfumes,

Question

x / 23 electronics, etc.) to

alcoholic beverages,

passengers during flights.

The company classifies customers into

three income bands: C1, C2 and C3. C1

passengers have got the lowest income

and C3 the highest.

C1 customers are price elastic across

ticket prices and likely to spend less on

goods purchased on board.

Olympian Airways aircrafts all have the

same number of seats.

Copyright 2015 IGotAnOffer Ltd.

Doc 4

Scenario analysis

Scenario

Flight cost and tickets revenue

Avg cost per flight

15,000

15,000

30

20

Ticket price

100

150

# passengers /

flight

200

150

# flights / day

Distribution of passengers

C1

50%

30%

C2

30%

30%

C3

20%

40%

Avg duty free spending per passenger

C1

C2

10

C3

15

BCG Potential Test Olympian Airways

Question 4

Given the data you are

provided with, what is the

maximum number of points

one can earn by buying a

single ticket?

1.

2.

3.

4.

59,700

62,300

5,970

6,230

Doc 1

Doc 2

Doc 3

New customer loyalty programme

Miles & Bonus

In addition to reviewing its pricing

strategy, Olympian Airways has also

decided to launch a new loyalty

programme called Miles & Bonus.

In this programme customers are

awarded points based on the distance

they travel with either the airline or one of

Question

its partners.x / 23

The points earned vary depending on the

travel class (i.e. first, business or

economy), the destination and the

season.

For instance, peak season business

tickets in non-popular destinations are

awarded the most points.

Copyright 2015 IGotAnOffer Ltd.

Doc 4

Data

There are 60 different types of tickets (10

destinations, 3 travel classes and 2

seasons) with an average of 2,000 points

awarded per ticket.

None of these tickets earns less than 500

points and exactly 15 of them earn less

than 1,200 points.

BCG Potential Test Olympian Airways

Question 5

Assuming only 5% of

economy customers use Wi-Fi

all the time, what are the

expected revenues from a

flight to a popular destination

using a new aircraft at its full

capacity?

1.

2.

3.

4.

56,048

56,016

56,480

56,160

Doc 1

Doc 2

Doc 3

Upgraded fleet of aircrafts

New aircrafts

Data

Olympian Airways is considering

upgrading its fleet. The new aircrafts will

use technologies such as touch screens

and Wi-Fi on board.

The ratio of first class, business and

economy seats in the new aircrafts will be

1 to 3 to 8 and the total number of seats

will be 240.

The company has decided that the new

aircrafts will have three different types of

seats: first, business and economy.

Average ticket prices for popular

destinations are expected to be 700 for

first class, 300 for business and 150 for

economy. The average duration of these

flights is 3 hours.

Question x / 23

First class seats will have leather heated

chair beds, business seats will have

leather seats with extra leg space and

economy seats will have standard seats.

Copyright 2015 IGotAnOffer Ltd.

Doc 4

First and business customers get free WiFi on board but economy customers need

to pay 2 / hour for using it.

BCG Potential Test PayCo

Question 6

What is the current cost per

sale for PayCo assuming all

lead sources have the same

conversion rate?

1.

2.

3.

4.

$39 / sale

$44 / sale

$49 / sale

$54 / sale

Doc 1

Doc 2

Doc 3

Doc 4

Cost per sale

Case overview

PayCo is a payments company that

processes debit card and credit card

transactions in the United States.

Current situation

PayCo purchases lists of leads at

different prices from Alma Bank, Bingo

Bank and Com Bank.

PayCos clients are shops such as

restaurants, bars, apparel shops,

supermarkets, petrol stations, etc.

Share of

total mix of

leads (%)

Question

x rents

/ 23 debit and credit card

The company

Alma Bank

$5

30%

machines to its clients. It earns a rental

fee for the card machines as well as a

small fee for each card transaction

processed by their client.

Bingo Bank

$3

60%

Com Bank

$6

10%

The company works with banks to acquire

new clients. It purchases lists of

businesses from them and calls them to

sell card machines and services.

Copyright 2015 IGotAnOffer Ltd.

Cost per

lead ($)

It then calls the leads to try and sell them

card machines and services. The average

conversion rate from lead to actual

customer is about 10%.

BCG Potential Test PayCo

Question 7

What is the maximum

conversion rate that can be

achieved by PayCo using the

the three banks as a lead

source?

Doc 1

Doc 2

Doc 3

Maximise conversion rate

Bank by bank analysis

1.

2.

3.

4.

10.5%

11.2%

11.8%

12.3%

Doc 4

Alma Bank is a large commercial bank

from the East Coast of the US. Its clients

are mainly restaurants and shops.

Com Bank has got a similar list of clients

to Alma Bank but is established on the

West Coast of the US.

Conversion rate results

After carrying out some research, your

team finds out that the conversion rate

between the three banks is actually

different.

PayCo needs to achieve its sales target

by using 300,000 leads per year.

Question

23

Bingo Bank x

is /established

in the Midwest

Conversion

rate

# of leads

available

per year

Alma Bank

12%

100,000

Bingo Bank

8%

600,000

Com Bank

15%

80,000

and primarily serves Mom and Pop

businesses.

The team at PayCo has always assumed

a similar conversion rate of 10% across

all three banks.

Copyright 2015 IGotAnOffer Ltd.

BCG Potential Test PayCo

Question 8

What is the minimum cost per

sale PayCo can achieve by

using Alma Bank, Bingo Bank

and Com Bank as sources of

leads?

Doc 1

Doc 2

Doc 3

Maximise conversion rate

Bank by bank analysis

1.

2.

3.

4.

$35.0 / sale

$37.5 / sale

$40.0 / sale

None of the above / we

lack sufficient information

at this stage

Doc 4

Alma Bank is a large commercial bank

from the East Coast of the US. Its clients

are mainly restaurants and shops.

Com Bank has got a similar list of clients

to Alma Bank but is established on the

West Coast of the US.

Conversion rate results

After carrying out some research, your

team finds out that the conversion rate

between the three banks is actually

different.

PayCo needs to achieve its sales target

by using 300,000 leads per year.

Question

23

Bingo Bank x

is /established

in the Midwest

Conversion

rate

# of leads

available

per year

Alma Bank

12%

100,000

Bingo Bank

8%

600,000

Com Bank

15%

80,000

and primarily serves Mom and Pop

businesses.

The team at PayCo has always assumed

a similar conversion rate of 10% across

all three banks.

Copyright 2015 IGotAnOffer Ltd.

BCG Potential Test PayCo

Question 9

Which of the following

statements would NOT

increase the motivation of

sellers handling leads from

Bingo Bank?

Doc 1

Doc 2

Doc 3

Sellers incentives

Day to day

1.

2.

3.

4.

Work with Bingo Bank to

increase the quality of the

leads purchased from

them by PayCo

Group sellers handling

different banks in a single

team and randomise the

distribution of leads

between them

Keep sellers in different

teams but rotate lead

sources between them

Increase bonuses to $200

per sale for all sellers

PayCos sellers work from 9am to 5pm

from Monday to Friday 47 weeks a year.

Sellers are divided into three teams. Each

team deals with one of the following lead

sources: Alma Bank, Bingo Bank and

Com Bank.

Question

x / 23receive a list of 85

Every day, sellers

Sellers compensation

The sellers base salary starts at $40k

and increases by about 5% per year for

each additional year they stay with the

company.

In addition, sellers can receive $100 for

each sale they make.

leads from their respective bank and work

through the list during the day.

The Head of Sales has noticed that

sellers for Bingo Bank are much less

motivated than their peers on average.

The list of leads they get are newly setup

businesses which are likely to require

debit and credit card payment processing

services.

After investigating, his initial conclusion is

that they have been consistently making

less sales and getting lower bonuses than

their peers.

Sellers simply cold-call the leads and try

to convince them to sign up for PayCo

services.

Copyright 2015 IGotAnOffer Ltd.

Doc 4

BCG Potential Test PayCo

Question 10

Which of the following

measures would best help the

company to fully prevent

sellers from agreeing

unprofitable prices with future

customers?

1.

2.

3.

4.

Train sellers to negotiate

better prices with leads

Fine sellers when they

give unprofitable prices

Incentivise sellers to sell

at higher prices with a

different bonus system

Set up an audit team that

would check prices and

validate contracts before

they count towards

sellers total sales

Doc 1

Doc 2

Doc 3

Doc 4

Incentive structure

Current issue

Pricing

Sellers are currently only incentivised

based on the number of customers they

manage to sell to.

When selling PayCos services, sellers

negotiate a share of their customers

future revenue.

The head of finance of the group has

noticed that the prices at which sellers

agreed to provide PayCos services have

decreased in the past few months.

For debit cards, they usually agree a price

of about 15 cents per future transaction

processed for the client. For instance, if

PayCo processes a debit card transaction

for a sandwich at $5, they will receive 15

cents from the sandwich shop in

exchange for their service.

Question x / 23

The head of sales suspects that this

might be due to sellers selling at

increasingly lower prices to increase their

bonus.

For credit cards, the price agreed is a

percentage of the transaction instead of a

fixed fee. This percentage is usually

around 1.5%.

Lately, sellers have been found to sell

PayCos services at increasingly less

profitable prices.

Copyright 2015 IGotAnOffer Ltd.

Answer key

Question 1

Question 2

Correct answer: 2

Correct answer: 1

The ticket price can be calculated as follows:

1. Calculate the number of respondents for the 150

price segment: 5,000 - 1,100 - 500 - 1,500 = 1,900

2. Calculate the weighted average by multiplying the

prices by the number of people per price segment

and then dividing by 5,000: (500 x 50 + 1,500 x

100 + 1,900 x 150 + 1,100 x 200) / 5,000 = 136

You are asked to determine which of the two

scenarios maximises gross profit. The gross profit for

each scenario can be calculated as follows:

Answer 2 is therefore the correct answer.

Scenario A:

- Revenues from tickets: 100 x 200 = 20,000

- Revenues from duty free: (50% x 5 + 30% x 10 +

20% x 15) x 200 = 1,700

- Gross profit per day: (Total Revenues Cost per

Flight) x Number of Flights per Day = (20,000 +

1,700 15,000) x 30 = 201,000

Scenario B:

- Revenues from tickets: 150 x 150 = 22,500

- Revenues from duty free: (30% x 5 + 30% x 10 +

40% x 15) x 150 = 1,575

- Gross profit per day: (Total Revenues Cost per

Flight) x Number of Flights per Day = 22,500 +

1,575 15,000) x 20 = 181,500

Scenario A maximises gross profit per day. Therefore,

answer 1 (100) is the correct answer.

Copyright 2015 IGotAnOffer Ltd.

Answer key

Question 3

Question 4

Correct answer: 4

Correct answer: 1

Ticket prices will affect revenues for each scenario

and will therefore affect the gross profit difference

between them.

There are 60 different types of tickets with an average

of 2,000 points each. The total number of points from

all types of tickets is therefore 60 x 2,000 = 120,000.

Fuel costs will affect the cost of the flight, and since

the number of flights is different for each scenario, this

will affect the gross profit difference as well.

In order to find the maximum number of points that

could be earned with a single type of ticket, the points

of all the other types of tickets need to be minimised.

The total number of seats per aircraft could affect the

gross profit difference. For example, if it was 300 then

the number of passengers per flight and the number

of flights per day for scenario A might increase.

None of the tickets have less than 500 points and

exactly 15 have less than 1,200 points. At a minimum,

we can have 15 tickets with 500 points. This leaves

44 tickets (60-15-1) with more than 1,200 points.

In order to maximise the points of one ticket the

remaining 44 should carry 1,200 points each.

Therefore, all of the factors listed could affect the

difference in gross profit. Notice that you are asked to

identify which factors would NOT affect the difference

in gross profit, hence answer 4 is correct.

Therefore, out of the 120,000 points, there are

120,000 (15 x 500) (44 x 1,200) = 59,700 points

for the remaining ticket.

The correct answer is therefore answer 1.

Copyright 2015 IGotAnOffer Ltd.

Answer key

Question 5

Question 6

Correct answer: 1

Correct answer: 1

The expected revenues can be calculated as follows:

1. Calculate the number of passengers per category

1y + 3y + 8y = 240 => 12y = 240 => y = 20:

First class passengers: 20

Business class passengers: 60

Economy class passengers: 160

2. Calculate the revenues from tickets: 20 x 700 + 60

x 300 + 160 x 150 = 56,000

3. Calculate the revenues from Wi-Fi purchases: 5% x

160 x 2 x 3 = 48

This calculation can be broken down into two steps:

1. Calculate cost per lead

2. Calculate cost per sale

The cost per lead needs to be calculated across all

three banks, taking into account their total share of

mix: $5 x 30% + $3 x 60% + $6 x 10% = $3.9 / lead

The cost per sale can be calculated by dividing the

cost per lead by the conversion rate: $3.9 / 10% =

$39.0.

Therefore total revenues are 56,048.

The correct answer is therefore answer 1.

A faster way to obtain the correct answer is to

calculate the revenues from Wi-Fi first (48). You

should then notice that ticket revenues can only

contribute towards the tens of the hundreds in the

result.

The right answer will therefore finish by 8. By doing

this, all answers can be eliminated except number 1.

Copyright 2015 IGotAnOffer Ltd.

Answer key

Question 7

Question 8

Correct answer: 2

Correct answer: 2

In order to maximise its conversion rate, PayCo

needs to rank lead sources from the highest to the

lowest conversion rates. It should then use as many

leads from the first source before considering the

second one:

1. Com bank 15%; 80,000 leads available

2. Alma bank 12%; 100,000 leads available

3. Bingo bank 8%; 600,000 leads available

Sufficient information is provided to calculate the cost

of sale for each lead source:

1. Alma bank: $5 per lead with a 12% conversion

2. Bingo bank: $3 per lead with a 8% conversion

3. Com bank: $6 per lead with a 15% conversion

PayCo needs 300,000 leads per year to meet its

target sales. To maximise the conversion rate, the

lead mix should then be:

1. Com bank: 80,000

2. Alma bank: 100,000

3. Bingo bank: 120,000

The maximum conversion rate achievable is then:

(15% x 80,000 + 12% x 100,000 + 8% x 120,000) /

300,000 = 11.2%

The correct answer is therefore answer 2.

Copyright 2015 IGotAnOffer Ltd.

For each bank, the cost per sale can be calculated by

dividing the cost per lead by the conversion rate:

1. Alma bank: $5 / 12% = $41.7

2. Bingo bank: $3 / 8% = $37.5

3. Com bank: $6 / 15% = $40.0

Bingo bank has got the lowest cost per sale. In

addition, it can provide 600,000 leads per year which

is sufficient to cover PayCos needs of 300,000.

The correct answer is therefore answer 2.

Answer key

Question 9

Question 10

Correct answer: 4

Correct answer: 4

The head of sales initial conclusion is that sellers

handling Bingo Bank leads have been consistently

making less sales and getting lower bonuses than

their peers.

Answers 1 to 3 would all help decrease sellers

tendency to sell at unprofitable prices. However, none

of them would completely stop the trend:

1. Training sellers to give better prices could still

result in sellers giving unprofitable prices in

practice.

2. Giving a fine to sellers, while a good incentive, is

not guaranteed to fully stop the trend.

3. Similarly, setting up a better incentives scheme is

also not guaranteed to halt the trend.

Indeed, the conversion rate for leads from Bingo Bank

is lower than that of other banks. The comment

implies that, to increase sellers satisfaction, their

bonus would need to be similar relative to their peers.

However, if bonuses increase to $200 per sale for all

sellers, the relative bonus obtained by sellers focused

on Bingo Bank will not increase.

Answer 4 would therefore not help solve the problem

and is the correct answer.

Copyright 2015 IGotAnOffer Ltd.

Answer 4 is the correct answer because it fully

prevents sellers from selling at unprofitable prices via

an external audit team.

Potrebbero piacerti anche

- Consulting Interview: How to Respond to TOP 28 Personal Experience Interview QuestionsDa EverandConsulting Interview: How to Respond to TOP 28 Personal Experience Interview QuestionsValutazione: 5 su 5 stelle5/5 (3)

- BCG Online Case ExampleDocumento8 pagineBCG Online Case ExampleMati100% (5)

- Strategy& PwC Booz Casebook Consulting Case Interview Book思略特 - 博斯 - 普华永道咨询案例面试Documento14 pagineStrategy& PwC Booz Casebook Consulting Case Interview Book思略特 - 博斯 - 普华永道咨询案例面试issac li100% (3)

- McKinsey PSTDocumento16 pagineMcKinsey PSTAlan Rozenberg88% (8)

- BCG Online Practice CaseDocumento16 pagineBCG Online Practice CaseLucky Yoh50% (2)

- BCG Potential Test #1Documento40 pagineBCG Potential Test #1Marijke MariaNessuna valutazione finora

- BCG InterviewingDocumento66 pagineBCG Interviewingernestdalphenbach100% (8)

- Case #2 - BCG - AirlinesDocumento4 pagineCase #2 - BCG - Airlinesakmanov86100% (4)

- Notes Potential Test BCG or PST McKinseyDocumento6 pagineNotes Potential Test BCG or PST McKinseyEdmund Belendier100% (1)

- McKinsey PST Test PracticeDocumento6 pagineMcKinsey PST Test PracticeShan Vahora100% (4)

- BCG Potential Test 2 PDFDocumento40 pagineBCG Potential Test 2 PDFSebastian BernalNessuna valutazione finora

- BCG Case CollectionDocumento505 pagineBCG Case CollectionThiago Aires Mendes100% (5)

- BCG Potential Test SampleDocumento7 pagineBCG Potential Test Samplezee75% (4)

- 2016 CaseDocumento16 pagine2016 Casejan jan100% (1)

- BCG Case Interview Guide - 2 BCG Type CasesDocumento25 pagineBCG Case Interview Guide - 2 BCG Type CasesChristina Li Hsu71% (7)

- BCG Online CaseDocumento1 paginaBCG Online CaseCarlo100% (1)

- BCG Online Case Example PDFDocumento8 pagineBCG Online Case Example PDFQuynh Luong100% (1)

- Case - Bain Case - Asian Lubricants ProducerDocumento10 pagineCase - Bain Case - Asian Lubricants Producerwhitewitch67% (3)

- BCG Case 1-Increasing ProfitsDocumento4 pagineBCG Case 1-Increasing ProfitsAvid Boustani100% (1)

- BCG UK Online Case Sample 2010Documento7 pagineBCG UK Online Case Sample 2010MinhNessuna valutazione finora

- BCG PrepDocumento30 pagineBCG Prepapi-457232170100% (1)

- L.E.K. LEK Casebook Consulting Case Interview Book艾意凯咨询案例面试Documento10 pagineL.E.K. LEK Casebook Consulting Case Interview Book艾意凯咨询案例面试issac li100% (1)

- Bain Chicago Practice CasebookDocumento42 pagineBain Chicago Practice CasebookPrateek Janardhan100% (7)

- BCG Case Interview GuideDocumento32 pagineBCG Case Interview Guidenatalie100% (2)

- People & Ideas: Consulting Case Book and Tips For InterviewingDocumento35 paginePeople & Ideas: Consulting Case Book and Tips For InterviewingAriel Yu100% (1)

- Bain Casebook Consulting Case Interview Book贝恩咨询案例面试Documento13 pagineBain Casebook Consulting Case Interview Book贝恩咨询案例面试issac li100% (4)

- Esade BCG Casebook 2011Documento108 pagineEsade BCG Casebook 2011Shan Yi Tan100% (1)

- McKinsey Problem Solving Test - TOYO Piano PST CaseDocumento22 pagineMcKinsey Problem Solving Test - TOYO Piano PST CaseMConsultingPrep100% (8)

- Consulting Math DrillsDocumento15 pagineConsulting Math DrillsHashaam Javed50% (2)

- 445182728 Oliver Wyman OW Casebook Consulting Case Interview Book奥纬咨询案例面试 PDFDocumento19 pagine445182728 Oliver Wyman OW Casebook Consulting Case Interview Book奥纬咨询案例面试 PDFyaya100% (1)

- BCGDocumento17 pagineBCGRicky Ho50% (2)

- PSTDocumento8 paginePSThenreeoktaNessuna valutazione finora

- Mckinsey CaseDocumento13 pagineMckinsey CaseShatakshiTripathi100% (1)

- Consulting Math Drills - Chart Questions v5Documento50 pagineConsulting Math Drills - Chart Questions v5FTU Ngo Thi Van Anh100% (2)

- Consulting Interview Case Preparation: Frameworks and Practice CasesDa EverandConsulting Interview Case Preparation: Frameworks and Practice CasesNessuna valutazione finora

- London 2013 CasebookDocumento91 pagineLondon 2013 CasebookJinliang Zang100% (1)

- Quantum Corporation Streamlined Its Supply ChainDocumento4 pagineQuantum Corporation Streamlined Its Supply Chainrajpd28Nessuna valutazione finora

- f8 jUNE 2009 QuestionDocumento6 paginef8 jUNE 2009 QuestionPakistan DramasNessuna valutazione finora

- Accounting Textbook Solutions - 23Documento19 pagineAccounting Textbook Solutions - 23acc-expertNessuna valutazione finora

- f5 2013 Jun QDocumento8 paginef5 2013 Jun Qcatcat1122Nessuna valutazione finora

- Homework 2: Q1:: Is Should IncludeDocumento35 pagineHomework 2: Q1:: Is Should IncludeMichael MaNessuna valutazione finora

- MGT 602 More Than 1000 Solved MCQsDocumento96 pagineMGT 602 More Than 1000 Solved MCQschaterji_aNessuna valutazione finora

- Question and Answer - 45Documento30 pagineQuestion and Answer - 45acc-expertNessuna valutazione finora

- Week One Worksheet Assignment-6Documento3 pagineWeek One Worksheet Assignment-6Greg KaschuskiNessuna valutazione finora

- Seminar, Week Commencing 19 October 2020: Key Concepts This WeekDocumento3 pagineSeminar, Week Commencing 19 October 2020: Key Concepts This WeekYago GrandesNessuna valutazione finora

- Exercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnDocumento2 pagineExercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnMyunimintNessuna valutazione finora

- 20170721+exam Garrone+Latifi+Mrkajic+Version+B+SolutionsDocumento8 pagine20170721+exam Garrone+Latifi+Mrkajic+Version+B+SolutionsomerogolddNessuna valutazione finora

- 20170721+exam Garrone+Latifi+Mrkajic+Version+BDocumento7 pagine20170721+exam Garrone+Latifi+Mrkajic+Version+BomerogolddNessuna valutazione finora

- Managerial Economics Question PaperDocumento3 pagineManagerial Economics Question PaperMahima AgarwalNessuna valutazione finora

- On-Line Case: Example For DistributionDocumento7 pagineOn-Line Case: Example For DistributionDamien ForestNessuna valutazione finora

- Unit 1 Summary (For Posting Online)Documento63 pagineUnit 1 Summary (For Posting Online)Legogie Moses AnoghenaNessuna valutazione finora

- CMA2 P2 Practice Questions PDFDocumento12 pagineCMA2 P2 Practice Questions PDFMostafa Hassan100% (1)

- Accounting Textbook Solutions - 1Documento19 pagineAccounting Textbook Solutions - 1acc-expertNessuna valutazione finora

- AP Macro Unit 1 SummaryDocumento110 pagineAP Macro Unit 1 SummaryJonathan CarrollNessuna valutazione finora

- Economics Term Paper QuestionsDocumento5 pagineEconomics Term Paper Questionskish MishNessuna valutazione finora

- Questions AMADocumento4 pagineQuestions AMAEnat EndawokeNessuna valutazione finora

- Audit and Assurance June 2009 Past Paper (Question)Documento6 pagineAudit and Assurance June 2009 Past Paper (Question)Serena JainarainNessuna valutazione finora

- F5 PM Jun21 - Mock 1Documento18 pagineF5 PM Jun21 - Mock 1Lalan JaiswalNessuna valutazione finora

- Office Memorandum - Stanford University - Office MemorandumDocumento2 pagineOffice Memorandum - Stanford University - Office MemorandumKenNessuna valutazione finora

- D&T2 CaseDocumento3 pagineD&T2 CaseArjun PaulNessuna valutazione finora

- Pricwaterhousecoopers Case Business/Strategy: Telekenesis IncDocumento4 paginePricwaterhousecoopers Case Business/Strategy: Telekenesis IncKaya ToastNessuna valutazione finora

- Part 1: Overview of Case Interview Process: Long CasesDocumento12 paginePart 1: Overview of Case Interview Process: Long CasesKenNessuna valutazione finora

- Firm: A.T. Kearney Case Number: Case Setup (Facts Offered by Interviewer)Documento11 pagineFirm: A.T. Kearney Case Number: Case Setup (Facts Offered by Interviewer)guzman87Nessuna valutazione finora

- Case1 PWCDocumento5 pagineCase1 PWCmanish_kapoor_5Nessuna valutazione finora

- Preparation Guide Numerical Analysis NA INTEDocumento4 paginePreparation Guide Numerical Analysis NA INTERajiv MishraNessuna valutazione finora

- Free BCG Potential TestDocumento18 pagineFree BCG Potential TestKen88% (17)

- Contact LensesDocumento8 pagineContact LensesKenNessuna valutazione finora

- Lalit Resume-2023-LatestDocumento2 pagineLalit Resume-2023-LatestDrew LadlowNessuna valutazione finora

- RECYFIX STANDARD 100 Tipe 010 MW - C250Documento2 pagineRECYFIX STANDARD 100 Tipe 010 MW - C250Dadang KurniaNessuna valutazione finora

- WBCS 2023 Preli - Booklet CDocumento8 pagineWBCS 2023 Preli - Booklet CSurajit DasNessuna valutazione finora

- Manual de Operacion y MantenimientoDocumento236 pagineManual de Operacion y MantenimientoalexNessuna valutazione finora

- Just in Time and TQMDocumento8 pagineJust in Time and TQMBhramadhathNessuna valutazione finora

- Cambridge IGCSE: CHEMISTRY 0620/42Documento12 pagineCambridge IGCSE: CHEMISTRY 0620/42Khairun nissaNessuna valutazione finora

- CUBE Dealer Book 2009Documento280 pagineCUBE Dealer Book 2009maikruetzNessuna valutazione finora

- Fortigate Firewall Version 4 OSDocumento122 pagineFortigate Firewall Version 4 OSSam Mani Jacob DNessuna valutazione finora

- Community Architecture Concept PDFDocumento11 pagineCommunity Architecture Concept PDFdeanNessuna valutazione finora

- Honda IzyDocumento16 pagineHonda IzyTerry FordNessuna valutazione finora

- Sainik School Balachadi: Name-Class - Roll No - Subject - House - Assigned byDocumento10 pagineSainik School Balachadi: Name-Class - Roll No - Subject - House - Assigned byPagalNessuna valutazione finora

- Gastroesophagea L of Reflux Disease (GERD)Documento34 pagineGastroesophagea L of Reflux Disease (GERD)Alyda Choirunnissa SudiratnaNessuna valutazione finora

- Loop Types and ExamplesDocumento19 pagineLoop Types and ExamplesSurendran K SurendranNessuna valutazione finora

- A Literary Nightmare, by Mark Twain (1876)Documento5 pagineA Literary Nightmare, by Mark Twain (1876)skanzeniNessuna valutazione finora

- Philhis 1blm Group 6 ReportDocumento19 paginePhilhis 1blm Group 6 Reporttaehyung trashNessuna valutazione finora

- Operating Instructions: HTL-PHP Air Torque PumpDocumento38 pagineOperating Instructions: HTL-PHP Air Torque PumpvankarpNessuna valutazione finora

- ET4254 Communications and Networking 1 - Tutorial Sheet 3 Short QuestionsDocumento5 pagineET4254 Communications and Networking 1 - Tutorial Sheet 3 Short QuestionsMichael LeungNessuna valutazione finora

- Exponential Smoothing - The State of The ArtDocumento28 pagineExponential Smoothing - The State of The ArtproluvieslacusNessuna valutazione finora

- William Hallett - BiographyDocumento2 pagineWilliam Hallett - Biographyapi-215611511Nessuna valutazione finora

- European Construction Sector Observatory: Country Profile MaltaDocumento40 pagineEuropean Construction Sector Observatory: Country Profile MaltaRainbootNessuna valutazione finora

- Test Bank For The Psychology of Health and Health Care A Canadian Perspective 5th EditionDocumento36 pagineTest Bank For The Psychology of Health and Health Care A Canadian Perspective 5th Editionload.notablewp0oz100% (37)

- Presenters: Horace M. Estrella Jay Mart A. Lazana Princess Camille R. HipolitoDocumento23 paginePresenters: Horace M. Estrella Jay Mart A. Lazana Princess Camille R. HipolitoHorace EstrellaNessuna valutazione finora

- The Rock Reliefs of Ancient IranAuthor (Documento34 pagineThe Rock Reliefs of Ancient IranAuthor (mark_schwartz_41Nessuna valutazione finora

- What You Need To Know About Your Drive TestDocumento12 pagineWhat You Need To Know About Your Drive TestMorley MuseNessuna valutazione finora

- Bossypants Autobiography and Womens SelvesDocumento26 pagineBossypants Autobiography and Womens SelvesCamila Paz GutiérrezNessuna valutazione finora

- Stucor Qp-Ec8095Documento16 pagineStucor Qp-Ec8095JohnsondassNessuna valutazione finora

- Beyond Models and Metaphors Complexity Theory, Systems Thinking and - Bousquet & CurtisDocumento21 pagineBeyond Models and Metaphors Complexity Theory, Systems Thinking and - Bousquet & CurtisEra B. LargisNessuna valutazione finora

- LLM Letter Short LogoDocumento1 paginaLLM Letter Short LogoKidMonkey2299Nessuna valutazione finora

- Amritsar Police StationDocumento5 pagineAmritsar Police StationRashmi KbNessuna valutazione finora

- Computer System Servicing 1 NC-II MODULE 8A (Second Semester: Week 6 - 7)Documento19 pagineComputer System Servicing 1 NC-II MODULE 8A (Second Semester: Week 6 - 7)Carl John GomezNessuna valutazione finora