Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Leap Report: Options Research June 2, 2015

Caricato da

api-274468947Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Leap Report: Options Research June 2, 2015

Caricato da

api-274468947Copyright:

Formati disponibili

J.K.K.

Options Research

June 2nd, 2015

LEAP REPORT

Keeping tabs on some of the larger plays in 2016 and 2017

SPDR S&P 500 (SPY):

On 4/13/2015, 35,025 contracts traded in the January (2016) 235 Calls for 0.95.

Open Interest went from 11,530 to 46,095 the following day.

As of this writing, the Current Bid Ask is 0.52 x 0.61 and OI sits at 46,629

Lyondellbasell (LYB):

On 3/6/2015, 26,307 contracts traded in the January (2016) 100 Calls for 3.20.

Open Interest went from 1,130 to 27,322 the following day.

As of this writing, the Current Bid Ask is 8.60 x 9.30 and OI sits at 27,991

SPDR Select Consumer Discretionary (XLY):

On 3/6/2015, 54,423 contracts traded in the January (2016) 86 Calls. Most were bought for 0.65.

Open Interest went from 10 to 54,433 the following day.

As of this writing, the Current Bid Ask is 0.26 x 0.68 and OI sits at 83,937

Currencyshares Euro (FXE):

On 3/10/2015, a total of 200,437 and 200,545 contracts traded in the January (2016) 102/94

Puts respectively (Put Spread). These were done for a 1.96 Debit.

Open Interest went from 121 and 64 to 200,032 and 200,000 the following day.

As of this writing, the Current Bid Ask is 1.40 x 1.49 for the 102 Puts and 0.49 x 0.53 for the 94

Puts. OI sits at 204,421 and 200,780 respectively.

Verizon (VZ):

On 4/20/2015, a total of 133,301 and 127,766 contracts traded in the January (2016) 55/60 Calls

respectively (Call Spread). These were done for a 0.35 Debit.

Open Interest went from 10,737 and 3,243 to 140,276 and 129,787 the following day.

As of this writing, the Current Bid Ask is 0.31 x 0.34 for the 55 Calls and 0.05 x 0.08 for the 60

Calls. OI sits at 146,814 and 131,649 respectively.

1|Page

YPF Sociedad (YPF):

On 4/28/2015, a total of 31,232 and 31,102 contracts traded in the January (2016) 35/40 Calls

respectively (Call Spread). These were done for a 1.45 Debit.

Open Interest went from 4,105 and 585 to 35,333 and 31,676 the following day.

As of this writing, the Current Bid Ask 1.00 x 1.50 in the 35 Calls and 0.25 x 0.70 in the 40 Calls.

OI sits at 35,301 and 32,373 respectively.

SPDR Select Technology (XLK):

On 1/21/2015, 20,002 contracts traded in the January (2016) 42 Call for 2.25.

Open Interest went from 907 to 20,907 the following day.

As of this writing, the Current Bid Ask is 2.73 x 2.93 and OI sits at 21,799.

General Electric (GE):

On 2/27/2015, a total of 133,095 and 125,648 contracts traded in the January (2017) 30/35 Calls

respectively (Call Spread). These were done for a 0.52 Debit.

Open Interest went from 10,396 and 2,358 to 141,958 and 127,791 the following day.

As of this writing, the Current Bid Ask 1.06 x 1.15 in the 30 Calls and 0.30 x 0.36 in the 35 Calls.

OI sits at 190,639 and 136,227 respectively.

PMC Sierra (PMCS):

On 2/12/2015, 24,221 contracts traded in the January (2016) 10 Calls. Most were bought for

1.00.

Open Interest went from 25 to 24,164 the following day.

As of this writing, the Current Bid Ask is 0.40 x 0.55 and OI sits at 24,448.

Herbalife (HLF):

On 8/22/2014, 43,194 contracts traded in the January (2016) 50 Puts. Most were purchased for

15.55.

Open Interest went from 9,080 to 47,884 the following day.

As of this writing, the Current Bid Ask is 8.15 x 8.60 and OI sits at 52,195.

Mondelez International (MDLZ):

On 10/3/2014, 10,052 contracts traded in the January (2016) 37 Calls. Most were purchased for

1.90.

Open Interest went from 2,854 to 12,844 the following day.

As of this writing, the Current Bid Ask is 4.55 x 4.90 and OI sits at 12,074.

2|Page

MetLife (MET):

On 12/23/2014, 20,014 contracts traded in the January (2016) 57.5 Calls. Most were purchased

for 3.10.

Open Interest went from 896 to 20,906 the following day.

As of this writing, the Current Bid Ask is 1.47 x 1.55 and OI sits at 25,107.

Calpine Corporation (CPN):

On 5/1/2015, 78,167 contracts traded in the January (2016) 19 Put for 1.05.

Open Interest went from 0 to 78,166 the next day.

As of this writing, the Current Bid Ask is 1.10 x 1.20 and OI sits at 78,175.

Vanguard FTSE Europe (VGK):

On 2/27/2015, 15,075 contracts traded in the January (2016) 60 Call for 1.20.

Open Interest went from 107 to 15,304 the next day.

As of this writing, the Current Bid Ask is 0.95 x 1.20 and OI sits at 15,876.

Kinder Morgan (KMI):

The January (2017) 50/60 Call Spreads have been active on numerous dates.

On 4/16, the 50/60 Spreads were bought for 1.00 Debit.

On 4/21, the 50/60 Spreads were bought for 1.05 Debit.

On 4/22, the 50/60 Spreads were bought for 1.05 Debit.

On 5/1, the 50/60 Spreads were bought for 1.00 Debit.

As of this writing, the Current Bid Ask is 0.91 x 0.99 in the 50 Calls and 0.15 x 0.27 in the 60 Calls.

OI sits at 398,035 and 387,828 respectively.

3|Page

Potrebbero piacerti anche

- Daringderivatives-Jan10 13Documento3 pagineDaringderivatives-Jan10 13balaji_resourceNessuna valutazione finora

- Equity Derivatives - Research: IndiaDocumento2 pagineEquity Derivatives - Research: IndiahdfcblgoaNessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- US Trading Note August 09 2016Documento3 pagineUS Trading Note August 09 2016robertoklNessuna valutazione finora

- Commodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Documento4 pagineCommodity Price of #Gold, #Sliver, #Copper, #Doller/rs and Many More. Narnolia Securities Limited Market Diary 03.03.2014Narnolia Securities LimitedNessuna valutazione finora

- Stock Market Today Before Opening Position As of 26th Dec 2013 With Top NEWS DetailsDocumento4 pagineStock Market Today Before Opening Position As of 26th Dec 2013 With Top NEWS DetailsNarnolia Securities LimitedNessuna valutazione finora

- Stock Tips - Equity Tips For 08 MayDocumento7 pagineStock Tips - Equity Tips For 08 MayTheequicom AdvisoryNessuna valutazione finora

- Commodity Price of Gold, Sliver, Copper, Doller/rs and Many More. Narnolia Securities Limited Market Diary 13.03.2014Documento5 pagineCommodity Price of Gold, Sliver, Copper, Doller/rs and Many More. Narnolia Securities Limited Market Diary 13.03.2014Narnolia Securities LimitedNessuna valutazione finora

- Auto Chartist5Documento7 pagineAuto Chartist5RudraMalhotraNessuna valutazione finora

- Index Options.: DOW FUT 34547 +90 (+0.26%)Documento3 pagineIndex Options.: DOW FUT 34547 +90 (+0.26%)Romelu MartialNessuna valutazione finora

- Karvy Weekly Snippets 26 Mar 2016Documento7 pagineKarvy Weekly Snippets 26 Mar 2016AdityaKumarNessuna valutazione finora

- Nifty Snapshot and Derivative Research On Indian Stock Market. Narnolia Securities Limited Daily Dairy 31.12.2013Documento5 pagineNifty Snapshot and Derivative Research On Indian Stock Market. Narnolia Securities Limited Daily Dairy 31.12.2013Narnolia Securities LimitedNessuna valutazione finora

- Nigerian Stock Exchange Weekly Market Report For The Week Ended 14-03-2014Documento10 pagineNigerian Stock Exchange Weekly Market Report For The Week Ended 14-03-2014kelanio2002780Nessuna valutazione finora

- Market Outlook 30th September 2011Documento3 pagineMarket Outlook 30th September 2011Angel BrokingNessuna valutazione finora

- Market Outlook Market Outlook: Dealer's DiaryDocumento18 pagineMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Premarket MorningReport Dynamic 24.11.16Documento7 paginePremarket MorningReport Dynamic 24.11.16Rajasekhar Reddy AnekalluNessuna valutazione finora

- Auto Chartist 1Documento7 pagineAuto Chartist 1RudraMalhotraNessuna valutazione finora

- Financial Derivatives BasicsDocumento34 pagineFinancial Derivatives BasicsAnkit JainNessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento20 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Daily - 08 01 2015 PDFDocumento4 pagineDaily - 08 01 2015 PDFRandora LkNessuna valutazione finora

- 2013-4-22 Golden Agri Morning NoteDocumento15 pagine2013-4-22 Golden Agri Morning NotephuawlNessuna valutazione finora

- Daily Option News Letter: 02/july/2014Documento7 pagineDaily Option News Letter: 02/july/2014api-256777091Nessuna valutazione finora

- Commodity Price of Gold, Sliver, Copper, Doller/rs and Many More in Narnolia Securities Limited Market Diary 8.1.2014Documento5 pagineCommodity Price of Gold, Sliver, Copper, Doller/rs and Many More in Narnolia Securities Limited Market Diary 8.1.2014Narnolia Securities LimitedNessuna valutazione finora

- J STREET Volume 317Documento10 pagineJ STREET Volume 317JhaveritradeNessuna valutazione finora

- ValuEngine Weekly Newsletter July 27, 2012Documento9 pagineValuEngine Weekly Newsletter July 27, 2012ValuEngine.comNessuna valutazione finora

- Equity Tips and News For TradingDocumento9 pagineEquity Tips and News For TradingRahul SolankiNessuna valutazione finora

- Activity of Nifty (Jan Series) Strike and FIIs Activity in Daily Market Diary 10th Jan 2014Documento5 pagineActivity of Nifty (Jan Series) Strike and FIIs Activity in Daily Market Diary 10th Jan 2014Narnolia Securities LimitedNessuna valutazione finora

- Daily Option News Letter: 08/july/2014Documento7 pagineDaily Option News Letter: 08/july/2014api-256777091Nessuna valutazione finora

- Free Stock Market Tips Via MArket ExpertsDocumento9 pagineFree Stock Market Tips Via MArket ExpertsRahul SolankiNessuna valutazione finora

- Daily Option News LetterDocumento7 pagineDaily Option News Letterapi-256777091Nessuna valutazione finora

- FBM Klci - Daily: Near Term ConsolidationDocumento3 pagineFBM Klci - Daily: Near Term ConsolidationFaizal FazilNessuna valutazione finora

- Group 9 BF AssignmentDocumento9 pagineGroup 9 BF AssignmentSharadhi HlNessuna valutazione finora

- MOStMarketOutlook3rdMay2023 PDFDocumento10 pagineMOStMarketOutlook3rdMay2023 PDFLakhan SharmaNessuna valutazione finora

- R. Wadiwala: Morning NotesDocumento7 pagineR. Wadiwala: Morning NotesRWadiwala SecNessuna valutazione finora

- Markets: Market Snippet NiftyDocumento9 pagineMarkets: Market Snippet NiftyRahul SolankiNessuna valutazione finora

- MF Report May 2010Documento6 pagineMF Report May 2010sid_maliya1Nessuna valutazione finora

- Stock Tips - Equity Market Report For 7 MayDocumento7 pagineStock Tips - Equity Market Report For 7 MayTheequicom AdvisoryNessuna valutazione finora

- Derivatives Report 19th April 2012Documento3 pagineDerivatives Report 19th April 2012Angel BrokingNessuna valutazione finora

- Market Outlook: Week of May 25, 2015Documento5 pagineMarket Outlook: Week of May 25, 2015api-274468947Nessuna valutazione finora

- Daily market update and analysisDocumento3 pagineDaily market update and analysisAyush JainNessuna valutazione finora

- ValuEngine Weekly Newsletter August 10, 2012Documento8 pagineValuEngine Weekly Newsletter August 10, 2012ValuEngine.comNessuna valutazione finora

- ValuEngine Weekly Newsletter April 20, 2012Documento10 pagineValuEngine Weekly Newsletter April 20, 2012ValuEngine.comNessuna valutazione finora

- Nifty Technical & Derivatives ReportDocumento5 pagineNifty Technical & Derivatives ReportRajasekhar Reddy AnekalluNessuna valutazione finora

- Stock Option Latest News by Theequicom For Today 09 September 2014Documento7 pagineStock Option Latest News by Theequicom For Today 09 September 2014Riya VermaNessuna valutazione finora

- ValuEngine Weekly Newsletter June 15, 2012Documento8 pagineValuEngine Weekly Newsletter June 15, 2012ValuEngine.comNessuna valutazione finora

- Makor Capital - Technical Summary European UtilitiesDocumento13 pagineMakor Capital - Technical Summary European UtilitiesH3NPHLONessuna valutazione finora

- ASPI Rallied Crossing 6,000 Amidst Heavyweights Leading TurnoverDocumento6 pagineASPI Rallied Crossing 6,000 Amidst Heavyweights Leading TurnoverRandora LkNessuna valutazione finora

- td140218 2Documento6 paginetd140218 2Joyce SampoernaNessuna valutazione finora

- Premarket MorningReport Dynamic 19.12.16Documento7 paginePremarket MorningReport Dynamic 19.12.16Rajasekhar Reddy AnekalluNessuna valutazione finora

- JSTREET Volume 323Documento10 pagineJSTREET Volume 323JhaveritradeNessuna valutazione finora

- Indian Stock Market TrendDocumento9 pagineIndian Stock Market TrendRahul SolankiNessuna valutazione finora

- Equity Market Trend of IndiaDocumento9 pagineEquity Market Trend of IndiaRahul SolankiNessuna valutazione finora

- Daily Trade Journal - 08.07.2013Documento6 pagineDaily Trade Journal - 08.07.2013Randora LkNessuna valutazione finora

- Equity Tips and Market Analysis For 11 JulyDocumento7 pagineEquity Tips and Market Analysis For 11 JulySurbhi JoshiNessuna valutazione finora

- Thriving in the Whirlwind: Four Insights to Grow Revenue NowDa EverandThriving in the Whirlwind: Four Insights to Grow Revenue NowNessuna valutazione finora

- How to Write Bids That Win Business: A guide to improving your bidding success rate and winning more tendersDa EverandHow to Write Bids That Win Business: A guide to improving your bidding success rate and winning more tendersNessuna valutazione finora

- Mongolia's Economic Prospects: Resource-Rich and Landlocked Between Two GiantsDa EverandMongolia's Economic Prospects: Resource-Rich and Landlocked Between Two GiantsNessuna valutazione finora

- Accounting, Auditing and Governance for Takaful OperationsDa EverandAccounting, Auditing and Governance for Takaful OperationsNessuna valutazione finora

- UntitledDocumento3 pagineUntitledapi-274468947Nessuna valutazione finora

- Market Outlook: Week of June 1, 2015Documento5 pagineMarket Outlook: Week of June 1, 2015api-274468947Nessuna valutazione finora

- Morning Market Briefing: July 29, 2015Documento4 pagineMorning Market Briefing: July 29, 2015api-274468947Nessuna valutazione finora

- Market Outlook: Week of June 22, 2015Documento6 pagineMarket Outlook: Week of June 22, 2015api-274468947Nessuna valutazione finora

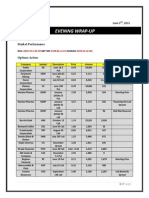

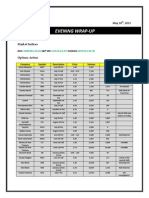

- Evening Wrap-UpDocumento4 pagineEvening Wrap-Upapi-274468947Nessuna valutazione finora

- UntitledDocumento4 pagineUntitledapi-274468947Nessuna valutazione finora

- UntitledDocumento5 pagineUntitledapi-274468947Nessuna valutazione finora

- Morning Market Briefing: June 17, 2015Documento4 pagineMorning Market Briefing: June 17, 2015api-274468947Nessuna valutazione finora

- Evening Wrap-Up: June 16, 2015Documento5 pagineEvening Wrap-Up: June 16, 2015api-274468947Nessuna valutazione finora

- Market Outlook: Week of June 8, 2015Documento5 pagineMarket Outlook: Week of June 8, 2015api-274468947Nessuna valutazione finora

- Evening Wrap-Up: June 12, 2015Documento4 pagineEvening Wrap-Up: June 12, 2015api-274468947Nessuna valutazione finora

- Educational & Training Services: Under The Radar Research May 25, 2015Documento4 pagineEducational & Training Services: Under The Radar Research May 25, 2015api-274468947Nessuna valutazione finora

- UntitledDocumento6 pagineUntitledapi-274468947Nessuna valutazione finora

- Evening Wrap-Up: June 9, 2015Documento5 pagineEvening Wrap-Up: June 9, 2015api-274468947Nessuna valutazione finora

- Evening Wrap-Up: June 5, 2015Documento5 pagineEvening Wrap-Up: June 5, 2015api-274468947Nessuna valutazione finora

- UntitledDocumento5 pagineUntitledapi-274468947Nessuna valutazione finora

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocumento4 pagineEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947Nessuna valutazione finora

- Market Outlook: Week of May 25, 2015Documento5 pagineMarket Outlook: Week of May 25, 2015api-274468947Nessuna valutazione finora

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocumento4 pagineEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947Nessuna valutazione finora

- Market Outlook: Week of May 18, 2015Documento5 pagineMarket Outlook: Week of May 18, 2015api-274468947Nessuna valutazione finora

- UntitledDocumento3 pagineUntitledapi-274468947Nessuna valutazione finora

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocumento4 pagineEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento3 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento3 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- 7.MMCR JuliDocumento5.281 pagine7.MMCR JuliAngga StwnNessuna valutazione finora

- PAES 233: Multicrop Washer-Peeler StandardDocumento16 paginePAES 233: Multicrop Washer-Peeler StandardFaroukNessuna valutazione finora

- Simon Dagher ProjectDocumento114 pagineSimon Dagher ProjectSimon DagherNessuna valutazione finora

- Encore 22 lb. Capacity Front Load DryerDocumento2 pagineEncore 22 lb. Capacity Front Load Dryermairimsp2003Nessuna valutazione finora

- Brine ZLD Process-GEDocumento7 pagineBrine ZLD Process-GEvijayendra100% (1)

- Lightweight Telescopic MastsDocumento39 pagineLightweight Telescopic MastspnsanatNessuna valutazione finora

- Gates em Ingles 2010Documento76 pagineGates em Ingles 2010felipeintegraNessuna valutazione finora

- Industrial Statistics Nepal 2069 70Documento84 pagineIndustrial Statistics Nepal 2069 70Koshish AcharyaNessuna valutazione finora

- ADV P Application Information Fuse DescriptionsDocumento1 paginaADV P Application Information Fuse DescriptionsdipenkhandhediyaNessuna valutazione finora

- Troubleshooting KobelcoDocumento10 pagineTroubleshooting KobelcoPaijo100% (24)

- Power Generating Floor PDFDocumento3 paginePower Generating Floor PDFMeghjit MazumderNessuna valutazione finora

- Transistor and Thyristor (SCR) Replacement For 1336 Plus, Plus Ii, Force, Impact and REGEN DrivesDocumento6 pagineTransistor and Thyristor (SCR) Replacement For 1336 Plus, Plus Ii, Force, Impact and REGEN DrivesgeniunetNessuna valutazione finora

- Nissan Skyline R34 Workshop Manual EnglishDocumento401 pagineNissan Skyline R34 Workshop Manual Englishrecklessone0% (2)

- Physics Chap 3 F5 !!!!!!!!!!!Documento46 paginePhysics Chap 3 F5 !!!!!!!!!!!Ethan Dharshen100% (1)

- A4 G970 - G990 Product Brochure enDocumento17 pagineA4 G970 - G990 Product Brochure endalibor_bogdan100% (3)

- Reference List AW Offshore Installation SYS 2007-08-16Documento10 pagineReference List AW Offshore Installation SYS 2007-08-16Sugeng WahyudiNessuna valutazione finora

- Javan 1961 - POPULATION INVERSION AND CONTINUOUS OPTICAL MASER OSCILLATION IN A GAS DISCHARGE CONTAINING A He-Ne MIXTUREDocumento8 pagineJavan 1961 - POPULATION INVERSION AND CONTINUOUS OPTICAL MASER OSCILLATION IN A GAS DISCHARGE CONTAINING A He-Ne MIXTURECayo Julio CesarNessuna valutazione finora

- Electroanalytical Techniques for Studying Redox ReactionsDocumento3 pagineElectroanalytical Techniques for Studying Redox Reactionsjayapandis83Nessuna valutazione finora

- Electrical Machines DemystifiedDocumento6 pagineElectrical Machines DemystifiedRishiSunariya50% (2)

- Niven, Larry - at The Bottom of A HoleDocumento10 pagineNiven, Larry - at The Bottom of A Holehilly8Nessuna valutazione finora

- EPL 0006898 ArticleDocumento28 pagineEPL 0006898 ArticleGuillermo IdarragaNessuna valutazione finora

- Divorce Is Bad For The Environment: / O: Ai DZDocumento2 pagineDivorce Is Bad For The Environment: / O: Ai DZzaidaNessuna valutazione finora

- Optimized Skid Design For Compress Sor PackagesDocumento5 pagineOptimized Skid Design For Compress Sor Packagessantosh kumarNessuna valutazione finora

- Wave Nature of The Motor Cable and Voltage Stress of The Motor in Inverter DriveDocumento9 pagineWave Nature of The Motor Cable and Voltage Stress of The Motor in Inverter DrivealbertofgvNessuna valutazione finora

- Auto ElectricianDocumento3 pagineAuto Electricianmnrao62Nessuna valutazione finora

- Unit Startup ProcedureDocumento148 pagineUnit Startup ProcedureAmit Chauhan100% (9)

- TSSR 2g Grahafamily3 PKMDocumento43 pagineTSSR 2g Grahafamily3 PKMHaryo WNessuna valutazione finora

- Ref - No.IM-B086-01: Operating Instructions Rechargeable ShaverDocumento8 pagineRef - No.IM-B086-01: Operating Instructions Rechargeable ShaverrootermxNessuna valutazione finora

- Metrode E2209 (B-60) ElectrodeDocumento6 pagineMetrode E2209 (B-60) ElectrodeClaudia MmsNessuna valutazione finora

- Calculate Specific Heat of MetalDocumento2 pagineCalculate Specific Heat of MetalIsabelNessuna valutazione finora