Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

11022720-074 (Internship NBP)

Caricato da

Zainab ArbabTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

11022720-074 (Internship NBP)

Caricato da

Zainab ArbabCopyright:

Formati disponibili

INTERNSHIP REPORT ON

NATIONAL BANK OF PAKISTAN

Internship Report Submitted to the Faculty of Management

&Administrative Sciences in Partial Fulfillment of Requirements for

the Degree of Master of Business Administration

Submitted By

Name of Student: Sohail Yousaf

Role Number

: 11022720-074

Program& Session: MBA (3.5 years), 2011-2015

UNIVVERSITY OF GUJRAT

Date of Submission

Name of Program Coordinator ___________________________

Signature of Program Coordinator ___________________________

Acknowledgement

IN THE NAME OF ALLAH, THE MOST MERCIFUL, THE BENEFICENT

National Bank of Pakistan

First of all I would like to bend over my head in front of ALMIGHTY ALLAH. It was ALMIGHTY

ALLAH who direct me in every stage of my life, and who bestow me with capability to

accomplish the best and helped me to conquer every attempt and difficulty I faced during my

journey of getting professional Training at National Bank of Pakistan Rahwali Branch.

My report will remain incomplete if I do not mention the people who helped me in completing

this work but honestly speaking there is an unending list of persons who helped me in

completion of my professional education and I think it would be a great injustice on my part if I

not thank full to them for provided me required information moral support and cooperation.

I extremely thank full to all those people who helped me to complete my report as it is

compulsory part of the Master in Business Administration because perhaps I would not be

able to write such a report without their help and cooperation.

Especially I am very thankful to the Mr. Naveed Ali Khan, who organized my internship

program and he organized it in such a way that sufficient time was given to each department

according to its importance. Besides I appreciate the staff of Rahwali Branch of NBP, which

provided me with all the information I needed.

Finally, I am very thankful to my family and my sweet friends for their prayers, love and

encouragement and their faith in my abilities. This completion of my internship is the result of

their co-operation and moral support. Without their co-operation and support a project like this

is difficult at best

Dedication

Sohail Yousaf (11022720-074) FMAS

Page 2

National Bank of Pakistan

This humble effort is dedicated

To my beloved parents,

Respectable teachers,

And my loving friends,

Whose love and effort

Can never be forgotten.

National Bank of Pakistan

1. Title Page

2. Acknowledgement

3. Dedication.

4. Executive Summary

Sohail Yousaf (11022720-074) FMAS

1-7

1

2

3

7

Page 3

National Bank of Pakistan

5.1 Introduction and Overview of the Organization (Part-I)

8 - 33

5.1 Introduction

5.1.1 Scope

8

5.1.2 Aim

5.1.3 Objective of Studying the organization

5.2 Over view of the Organization

5.2.1 Brief History

5.2.2 Nature of the Organization

5.2.3 Vision

5.2.4 Mission

5.2.5 Core Values

5.2.6 Goals

5.2.7 Business Volume

5.2.8 Award & Achievement

16

5.2.9Product and Service Lines

Premium Aamdani Scheme

Premium Saver Scheme

NBP Saibaan

NBP Advance Salary

NBP Cash N Card

NBP Investor Advantage

NBP Cash n Gold

24

NBP Kisan Taqat

NBP Kisan Dost

25

NBP Pak Remit

NBP Protection Shield

5.2.10 Services lines of NBP

28

5.2.11 Pest Analysis

5.2.12Contribution of the Organization towards Economic Development

5.3 Organizational Structure

5.3.1 Organizational Hierarchy Chart

5.3.2 Number of Employees

5.3.3 Main Offices

5.3.4 Introduction of all Departments

5.3.5 Comment on the Organizational Structure

5.4 Internees Work (Part-II)

5.4.1 Brief Introduction of the Branch

5.4.1.2 Branch Profile

5.4.1.3 Branch Hierarchy

Sohail Yousaf (11022720-074) FMAS

8

9

9

9

11

13

13

14

14

15

17

18

19

20

20

21

23

24

26

27

32

33

3442

34

35

36

39

42

43 - 45

43

44

45

Page 4

National Bank of Pakistan

5.4.2 Detail of Supervisors

5.4.3 Weekly Timetable

45

46 -52

First Week

46

Second Week

48

Third Week

49

Fourth Week

50

Fifth Week

51

Sixth Week

52

5.4.4 Working Department Description and Operations Performed

53 - 65

Bill Department

53

Deposit Department

54

Cash Department

58

Government and pensions

59

Credit and advances

61

E-Remittance and Finance against Pledge of Gold

64

5.4.5 Description of the tasks assigned to us

5.4.6 Summary of Learning

65

65 - 68

Skills and Qualifications gained

66

Responsibilities Under taken

67

Influence of Internship on our future career

68

Internship activities and our Classroom activities

69

6.0Conclusion

69 - 75

Conclusion of the Report

69

SWOT Analysis

71

Strengths

71

Weaknesses

72

Opportunities

74

Threats

75

7.0 Recommendations and References

Sohail Yousaf (11022720-074) FMAS

75 - 77

Page 5

National Bank of Pakistan

Recommendations

75

References

77

Executive Summary:

National bank of Pakistan (NBP) was developed in 1949. It served as the central

regulatory bank of Pakistan till the time State Bank of Pakistan was established in 1949.

National bank of Pakistan is the complete government bank and it undertook government

treasury operations. The two major competitors of national bank of Pakistan are United Bank

limited (UBL) and Habib Bank limited (HBL) of Pakistan. The first branch was open in

Chandigarh road Karachi. And after, they make it the head office of the bank. The bank's

Sohail Yousaf (11022720-074) FMAS

Page 6

National Bank of Pakistan

history is divided into many phases. During 25 years of united Pakistan the bank advanced

forward in all areas of its activities. 1970s were a difficult decade for all Banks of Pakistan. In

1971 East Pakistan was separated and Australasia Bank lost its 50 branches and a lot of

capital as well. Nevertheless the growth remained steady. The National Bank Ltd. is playing a

vital role in the national economy through mobilization of until now the unused local

resources, promoting savings and providing funds for investments. Attractive rates of profit on

all types of deposits, opening of Foreign Currency Accounts and handling of Foreign

Exchange business such as Imports, Exports and Remittances, Financing, Trade and Industry

for working capital requirements and money market operations are some facilities being

provided by the Bank. There are various products offered by the NBP to their customer. There

has been a continuous improvement in the performances of the banks, which is clearly shown

by business volume and at the end PESTL and SWOT analysis and recommendations is

beneficial for the NBP as well as for the students.

This report covers the experience, which I have gained during my stay at the National

Bank of Pakistan Rahwali Branch, Gujranwala, working as an internee.

5.1. INTRODUCTION TO REPORT:The primary purpose of this study is to fulfillment of the requirements for the

degree of MBA (Specialization in Finance).For this connection each student of this particular

course is required to undertake training in a relevant organization selected by them, for a

period of 6-8weeks.

The secondary purpose of this internship is to understand how the theoretical knowledge can

be applied to the practical situations and examine an organizations financial issues and

identify its opportunities & problems and also suggest corrective measures. This internship is

also very necessary to gain confidence and become aware of the mechanism of an

organization.

Sohail Yousaf (11022720-074) FMAS

Page 7

National Bank of Pakistan

This report is about the National bank of Pakistan, Rahwali branch Gujranwala, where I learn

different things during the period of internship about banking sector that will discuss in soon

after in the other portion of this report.

1.1scope

During the internship in national bank of Pakistan civil lines branch my main focus in on

learning the all operation that is performed in banking. Scope of internship for me is that it will

be very useful for me in future during the job in any kind of bank.

1.2 AIM

My main aim of internship in national bank in Pakistan is learned the procedure and

operation of the banking sector working in Pakistan and get complete knowledge and

information that can be help in preparation of my internship report.

1.3 OBJECTIVES

As an internee I have achieved following objectives during my internship and

organization study:

To apply the theory in practical situations.

Good work habits and sense of responsibility is produced.

To develop my attitude supportive to valuable interpersonal affairs.

To recognize how the key business method are carried out in business.

To know how of the information that is used in an organization for decision making at

diverse stages.

To get professional know-how in an actual testing situation.

To develop my learning experience by application of theory in practice.

To increase my knowledge about the banking sector

2.0OVERVIEW OF THE ORGANIZATIONAL:

Sohail Yousaf (11022720-074) FMAS

Page 8

National Bank of Pakistan

3.1 Brief History:

After the devalued of its currency, In (September) 1949by the U.K, India followed suit

but Pakistan did not follow any suit. India said we had contravened the agreement of keeping

both currencies at par. We said we dont do this. India had done it randomly without

communicating us. On October 3, 1949 the both India and Pakistan banks were to announce

the new par value of both currencies but India denied a day earlier. India also stops our trade

- balance surplus that is still an unsettled clash.

National Bank of Pakistan was established on November 9, 1949 under the National

Bank of Pakistan Ordinance 1949, in order to deal with the crisis circumstances which were

developed after the devaluation of Indian Rupee in 1949. Initially the Bank was established

with the objective to expand credit for the agriculture sector. The Bank starts its operations

from November 20; 1949.Karachi and Lahore offices of the bank were afterward opened in

December 1949. The temperament of tasks of the national Bank is different and distinctive

from other banks/financial institutions. Initially the NBP acts as the negotiator of the State

Bank of Pakistan for managing Government Receipts at provincial and federal levels and

Payments on its behalf.

In today's competitive business environment, NBP needed to redefine its role and shed the

public sector bank image, for a modern commercial bank. It has offloaded 23.2 percent share

in the stock market, and while it has not been completely privatized like the other three public

sector banks, partial privatization has taken place. It is now listed on the Karachi/ Islamabad/

Lahore Stock Exchanges.

The bank has implemented special credit schemes like small finance for agriculture, business

and industries, administrator to Qarz-e-Hasna loans to students, self-employment scheme for

unemployed persons, public transport scheme. The Bank has expanded its range of products

and services to include Shariah Compliant Islamic Banking products. For the promotion of

literature, NBP recently initiated the Annual Awards for Excellence in Literature. NBP will

confer annual awards to the best books in Urdu and in all prominent regional languages

published during the defined period. Patronage from NBP would help creative work in the field

Sohail Yousaf (11022720-074) FMAS

Page 9

National Bank of Pakistan

of literature. The Bank is also the largest sponsor of sports in Pakistan. And performing

different functions as follow

Accepting of deposits of money on current, fixed, saving, term deposit and profit and

loss sharing accounts.

Borrowing money and arranging finance from other banks and advancing and lending

money to its clients.

Buying, selling, dealing, including entering into forward contracts of foreign exchange.

Financing of seasonal crops like cotton, wheat, rice, sugar cane, tobacco, etc.

Carrying on agency business of any description other than managing agent, on behalf

of clients including Government and local authorities.

Generating, undertaking, promoting, etc. of issue of shares and, bonds, etc.

Transacting guarantee and indemnity business.

Undertaking and executing trusts.

Joint venturing with foreign dealers, agents and companies for its representation

abroad.

Participating in "World Bank" and "Asian Development Bank's" lines of credit.

Handling of treasury transactions for the Government of Pakistan as agent to the State

Bank of Pakistan.

Purchased lot of commercial land for business.

Sohail Yousaf (11022720-074) FMAS

Page 10

National Bank of Pakistan

2.2 NATURE OF THE ORGANIZATION

Different business has different nature, the nature of the organization where I did

internship is banking sector (NBP). Banking sector is one of the major types of business on

which our economy is based. It is possible that without banking sector our economy will

default.

National Bank of Pakistan (NBP) is 100% own by government and the largest commercial

bank operating in Pakistan. National bank balance sheet size surpasses that of any of the

other banks working locally. It has redefined its role and has shift from a public sector

organization into a modern commercial bank. Bank provides service to all; either it is

individuals, corporate entities and government. National bank also act as trustee of public

funds and as the agent to the State Bank of Pakistan where SBP is not present, it has

diversified its business portfolio and now a days, play a very important role in the debt equity

market, corporate investment banking, retail and consumer banking, agricultural financing,

treasury services and is presenting rising interest in promoting and increasing the country's

small businesses.

National Bank of Pakistan is today a competent and customer focused organization.

National bank provides a wide variety of customer product to boost business and provide to

the different segments of society.

Sohail Yousaf (11022720-074) FMAS

Page 11

National Bank of Pakistan

To be recognized as a leader and a

brand Synonymous with trust, highest

standards of service quality, international

best practices and social responsibility

NBP will aspire to the values that

make NBP truly

the Nations Bank, by:

Institutionalizing a merit and

performance culture

Creating a distinctive brand identity by

providing the highest standards of

services

Adopting the best international

management practices

Maximizing stakeholders value

Discharging our responsibility as a

good corporate citizen of Pakistan and

in countries where we operate.

Sohail Yousaf (11022720-074) FMAS

Page 12

National Bank of Pakistan

Highest standards of Integrity

Institutionalizing team work and

performance culture

Excellence in service

Advancement of skills for tomorrows

challenges

Awareness of social and community

responsibility

Value creation for all stakeholders

Sohail Yousaf (11022720-074) FMAS

Page 13

National Bank of Pakistan

To enhance profitability and maximization

of NBP share through increasing leverage

of existing customer base and diversified

Range of products.

To provide all sort of banking service.

To Maximize the profit.

To serve Pakistan better in order to give

Socio-economic uplift.

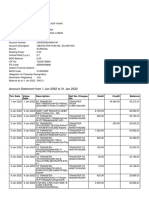

2.3 BUSINESS V0LUME

Rupees in Millions

Year

2008

2009

2010

2011

2012

Total Assets

817,758

944,582

1,035,02

1,114,57

8

1,166,78

Deposits

624,939

727,465

832,152

927,421

889,654

Advances

412,987

475,243

477,507

525,046

583,685

Reserves

19,941

22,682

24,450

25,343

27,587

Investments

170,822

217,643

301,324

319,531

305,586

All amounts in billion

Sohail Yousaf (11022720-074) FMAS

Page 14

National Bank of Pakistan

These are the Award and achievement of National Bank of Pakistan.

3rd Global Human Resource Excellence Award - 2012" administered by Global

Media Links in collaboration with Better Pakistan.

"Listed in top 1000 banks of the world for the year 2012" by the world

renowned The Banker magazine owned by the Financial Times Group, London.

2nd Global Human Resource Excellence Award - 2011" administered by Global

Media Links in collaboration with Better Pakistan.

Pakistan: Transaction of the Year Award - 2011, awarded by Islamic Finance

News, for two wind farm projects of 50MW each in which the bank acted as

international inter-creditor agent (for the Islamic Development Bank, the Asian

Development Bank and syndicates of local banks).

Transaction of the Year Award - 2011, awarded by CFA Association of

Pakistan for the private placement and offer-for-sale of Engro Foods Limited.

Bank of the Year" awarded for the year 2011 by the world renowned "The

Banker" magazine owned by the Financial Times Group, London.

"Top Corporate Finance House (Fixed Income) Award of the Year

Sohail Yousaf (11022720-074) FMAS

Page 15

National Bank of Pakistan

2011", awarded by the "CFA Association of Pakistan".

National Bank of Pakistan Awarded Best Emerging Markets Bank 2011Awarded

By Global Finance Magazine.

Bank of the Year awarded for the year 2010 by the world renowned The

Banker magazine owned by the Financial Times Group, London.

"Runner up of Corporate Finance House (Fixed Income) Award of the Year

2010", awarded by the "CFA Association Pakistan".

NBP is awarded President of Pakistan Trophy, a top slot award by Federation of

Pakistan Chambers of Commerce and Industry in 2010.

NBP is awarded Prime Minister of Pakistan Trophy, a top slot award by Lahore

Chambers of Commerce and Industry in 2010

Among the global leading banks, NBP is the only Pakistani bank appearing in top

500 banks of the world in The Banker magazine owned by the Financial Times

Group, London

Bank of the Year awarded for the year 2008 by the world renowned The

Banker magazine owned by the Financial Times Group, London

Stable AAA/A-1+ (Triple A/A-One Plus) rating (Standalone Basis) by JCRVIS (July 2007).

Best Return on Capital for 2006 amongst all Banks in Asia. - Banker

Magazine in July 2007.

2.4 PRODUCT AND SERVICE LINES:

Following are the products offered by NBP Pakistan to their customers.

1.

2.

3.

4.

5.

6.

Premium Aamdani

Premium Saver

NBP Saibaan

NBP Advance Salary

NBP Cash Card

Investor Advantages

7. NBP Cash n Gold

8. NBP Kisan Taqat

9. NBP Kisan Dost

10. Pak Remit

11. Protection Shield.

Sohail Yousaf (11022720-074) FMAS

Page 16

National Bank of Pakistan

Premium Aamdani

Earn up to 12.25% p.a. +

Minimum deposit of Rs. 20,000/- with maximum balance of Rs. 10 million for 5 years

Free Demand Draft, Pay Order and Cheque Book*

Convenience of NBP online Aasan Banking (for

online banking customers)

Free NBP Cash Card (ATM+Debit)

Running finance facility up to 90%

Profit paid every month as follows

+ Profit rates are expected

Year**

Profit Rates (%) ***

1st

11.25

2nd

11.50

3rd

11.75

4th

12.00

5th

12.25

* Conditions Apply

Sohail Yousaf (11022720-074) FMAS

Page 17

National Bank of Pakistan

*** Expected rates are for the given year

Premium Saver

PLS Saving Account

Earn up to 8.50% p.a. +.

Minimum saving balance of Rs.

20,001/- & a maximum balance of Rs.

1 million*.

Free NBP Cash Card (ATM + Debit).

Convenience of NBP Online Aasan

Banking (for online banking

customers).

Two debit withdrawals allowed in a

month & no limit on number of deposit

transactions.

Profit calculated on monthly and paid

on half yearly basis.

NBP Saibaan(Home Finance)

NBP Saibaan provides the facility of their employee in the purchasing of new land for its

own home as well as in the construction of this house. The amount of NBP Saibaan can

use for following purpose.

Home Purchase

Sohail Yousaf (11022720-074) FMAS

Page 18

National Bank of Pakistan

Home Construction

Home Renovation

Purchase of Land + Construction

Balance Transfer Facility (BTF)

Advanced Salary

NBP Advance Salary, the leading personal loan product of the country, is maintaining its

inimitability ever since it was launched. This was only possible due to its swift growth and

remarkable loan disbursement of over 138 billion.

Employees can avail up to 20 net take home salaries with easy repayment installments. Its

hassle free acquisition with no prior formalities and easy availability in a short turn round

time is attributed as the most distinguishing features of the product. The product is offered

countrywide.

Sohail Yousaf (11022720-074) FMAS

Page 19

National Bank of Pakistan

Its salient features are;

Easy installments of 1 to 60 months at your choice.

No minimum income, collateral & insurance charges required.

Quick processing and fastest disbursement.

For permanent employees of Government, Semi Government and Autonomous

bodies receiving salaries through NBP.

Take upto 20 advance salaries (currently for NBP account holders of govt. or

related organization employees).

NBP Cash & Card

All thing in one card

ATM + Debit Card

Use it as an ATM in any of the ATMs in

Pakistan

Use it as Debit Card in any of the outlets with

ORIX POS machine across nationwide.

Cash withdrawal up to Rs. 20,000/- per day

Account Balance Enquiry

Mini Statement (Only at NBP ATM)

PIN Change facility (Only at NBP ATM)

Shop to your hearts Desire:NBP Cash Card is a 24/7 access ATM/Debit card

to your bank account, which is accepted to 4000

POS merchants nationwide where ORIX logo is

Displayed. Withdraw cash from NBP, 1-Link &

M-Net ATMs across nationwide. The NBP can

enable you to enjoy the convenience of cashless

Sohail Yousaf (11022720-074) FMAS

Page 20

National Bank of Pakistan

purchasing power without the fear of overdrawing

Your account.

Advantages of Cash Card

You won't need to carry a lot of cash with you every time you go out.

Secure and Safe transaction.

Account Information on tips (like: Mini Statement, Balance Inquiry, Utility Bill

Payment etc.)

Enable To Withdraw Cash From 1-Link ATMs / MNET ATMs.

Enable to Make Purchases from Around 4000 POS (Merchants) Countrywide

including 2500+ POS in Karachi.

No Card Issuance Fee for first 12 Months.

NBP Investor Advantage

Sohail Yousaf (11022720-074) FMAS

Page 21

National Bank of Pakistan

Financing Facility for Stock Investors

Comfortable environment for trading

No security requirement, except for the

customers equity

Customers equity freely available for

investment

Equity acceptable in cash or approve

shares.

Product Information

Financing Amount:

Rs.50,000/ - To Rs.10,000,000/-

Equity Requirement:

In the Form of Cash or Shares or Both (Currently Minimum

Rs. 215,000/- @ 30%)

Shares:

As per NBP Approved List Available. Shares In Physical Form

Not Acceptable.

Trading:

Allowed Only Through Trading Centers Created by NBP and

Operated by Taurus Securities Limited (A

NBP Cash & Gold

This product of NBP provides the facility to their valuable customer to get cash in the time

of need by pledge their gold into the bank.

Ready Cash Against Gold

Sohail Yousaf (11022720-074) FMAS

Page 22

National Bank of Pakistan

Facility of Rs. 40,000/- against each 10 gms of net

Weight of Gold Ornaments.

No maximum limit of cash.

Repayment after one year.

Roll over facility.

No penalty for each repayment.

No Penalty for early repayment.

NBP Kisan Taqat

As we know Pakistan is agriculture land and a largest part of it National income is

generated from agriculture. NBP understand the importance

of this sector and provide loans on very easy terms and

condition to the former of our country. NBP not provide

the loan to the former but also it experts train the former

how they can increase their productivity with minimum

sources.

NBP Kisan Dost

Agriculture Farming Program

Sohail Yousaf (11022720-074) FMAS

Page 23

National Bank of Pakistan

Competitive mark-up rate.

Quick & easy processing.

Provision of technical guidance to farmers at

their doorstep.

Wide range of financing schemes for farmers.

Finance facility up to Rs. 100,000/- for landless

farmers on personal guarantee.

Financing available against Pass Book, Residential / Commercial property, Gold

ornaments and paper security.

Loan facility on revolving basis for three years (renewable on yearly basis

Without obtention of fresh documentation and approval).

Pak remit

PakRemit is an internet based Home Remittance Service.

Pak Remit is an Internet based Home Remittance Service.

Sohail Yousaf (11022720-074) FMAS

Page 24

National Bank of Pakistan

This service is available to U.S. residents for sending money

to their family and friends in Pakistan. One must have a valid US Dollar account with a U.S.

bank or a US Dollar credit or debit card in order to remit funds through this channel.

Remitters in USA can log on to our user friendly website,

www.pakremit.com and easily remit funds to Pakistan from the comfort of their homes, in a

matter of minutes.

The service is fully secure with advance encryption application and is available for use 24

hours a day, 7 days a week. Fees and exchange rate have been set at competitive levels

and the remitters have the ability to track delivery of funds as well.

Process:

Remitters log on to www.pakremit.com and after completing the registration process,

are able to remit funds. The whole process takes a few minutes.

Funds in Pak Rupees can be sent to beneficiaries, having an account with any bank

in Pakistan, including NBP. While funds are credited directly to beneficiaries

maintaining accounts with NBP, a pay order or demand draft is couriered to other

banks for their customers. Pay order or demand draft can also be couriered directly

to the beneficiarys office or home, if requested by the remitter.

Funds in US Dollars can be sent only to a Beneficiary maintaining a US Dollar

account with one of NBPs Foreign Exchange Branches.

USPs (Unique Selling Propositions):

Convenient and Fast

Reliable and Secure

Available 24 x 7

NBP Protection shield

NBP know the value of their employee and the customers.

NBP worry about their life so due to this, NBP provides the

Sohail Yousaf (11022720-074) FMAS

Page 25

National Bank of Pakistan

protection shield to their customers personal accidental

insurance.

Personal Accident Insurance

No documentation

No medical required

Premium Auto Debit facility & choice of deactivation

Coverage includes death due to:

Natural Calamities e.g. Earthquake, Flood, Cyclone etc.

Accident

Riots*

Civil Commotion*

Strikes*

Acts of Terrorism*

NBP Protection Shield

NBP Protection Shield

(Life is Precious)

* Provided the insured is not actively involved in these activities

Services of NBP

Following are the Services offered by NBP Pakistan to their customers.

1. Demand Drafts8. Short Term Investments

2. Letters of Credit

3. swift System

9. National Income Daily Account

10.Equity Investments

4. Mail Transfers

11.Commercial Finance

5. Pay Order

12.Trade Finance Other Business Loans

6.Travelers Check

13.Corporate Finance

Sohail Yousaf (11022720-074) FMAS

Page 26

National Bank of Pakistan

7. Foreign Remittances

14.International Banking

Demand Drafts

If you are looking for a safe, speedy and reliable way to transfer money, you can now

purchase NBPs Demand Drafts at very reasonable rates. Any person whether an account

holder of the bank or not, can purchase a Demand Draft from a bank branch.

Letters of Credit

NBP is committed to offering its business customers the widest range of options in the area

of money transfer. If you are a commercial enterprise then our Letter of Credit service is

just what you are looking for. With competitive rates, security, and ease of transaction, NBP

Letters of Credit are the best way to do your business transactions

Swift System

The SWIFT system (Society for Worldwide Interbank Financial Telecommunication) has

been introduced for speedy services in the area of home remittances. The system has

built-in features of computerized test keys, which eliminates the manual application of tests

that often cause delay in the payment of home remittances. The SWIFT Center is

operational at National Bank of Pakistan with a universal access number NBP-APKKA. All

NBP overseas branches and overseas correspondents (over 450) are drawing remittances

through SWIFT.

Mail Transfers

Sohail Yousaf (11022720-074) FMAS

Page 27

National Bank of Pakistan

Move your money safely and quickly using NBP Mail Transfer service. And we also offer

the most competitive rates in the market.

Pay Order

NBP provides another reason to transfer your money using our facilities. Our pay orders

are a secure and easy way to move your money from one place to another. And, as usual,

our charges for this service are extremely competitive.

Travelers Check

Negotiability:

Pak Rupees Travelers Cheques are a negotiable instrument

Validity:

There is no restriction on the period of validity

Availability:

At 700 branches of NBP all over the country

Encashment:

At all 400 branches of NBP

Limitation:

No limit on purchase

Safety:

NBP Travelers Cheques are the safest way to carry our

money

Foreign Remittances

To facilitate its customers in the area of Home Remittances, National Bank of Pakistan has

taken a number of measures to:

Increase home remittances through the banking system

Meet the SBP directives/instructions for timely and prompt delivery of remittances to

the beneficiaries

New Features:

The existing system of home remittances has been revised/significantly improved and welltrained field functionaries are posted to provide efficient and reliable home remittance

services to nonresident Pakistanis at 15 overseas branches of the Bank besides Pakistan

Sohail Yousaf (11022720-074) FMAS

Page 28

National Bank of Pakistan

International Bank (UK) Ltd., and Bank Al-Jazira, Saudi Arabia.

Zero Tariffs: NBP is providing home remittance services without any charges.

Strict monitoring of the system is done to ensure the highest possible security.

Special courier services are hired for expeditious delivery of home remittances to the

beneficiaries.

Short Term Investments

NBP now offers excellent rates of profit on all its short term investment accounts. Whether

you are looking to invest for 3 months or 1 year, NBPs rates of profit are extremely

Equity Investments

NBP has accelerated its activities in the stock market to improve its economic base and

restore investor confidence. The bank is now regarded as the most active and dominant

player in the development of the stock market.

NBP is involved in the following:

Investment into the capital market

Introduction of capital market accounts (under process)

NBPs involvement in capital markets is expected to increase its earnings, which would

result in better returns offered to account holders.

National Income Daily Account(NIDA)

The scheme was launched in December 1995 to attract corporate customers. It is a

current account scheme and is part of the profit and loss system of accounts in operation

throughout the country. In this type of account NBP Facilitate their customers by paying

profit

on

daily

baseson

Sohail Yousaf (11022720-074) FMAS

their

deposited

amount.

Page 29

National Bank of Pakistan

2.5 PEST ANALYSIS:

Political:

Privatization policy and deregulation.

Impact of subsidized credit affecting and NCBs.

Employment practices, Unions, Associations.

Political Interference and harassment.

Incidents of high taxation on banking industry.

Economical:

Constraints in mobilization of public savings because of inflation.

Staff cost is high due to lack of latest technology used.

Operating cost is due to inefficient training of staff.

Bad debts which convert profit into loss.

Social & Cultural:

Inadequate human resources.

Cultural strain to savings.

Defaulters lobby.

Sohail Yousaf (11022720-074) FMAS

Page 30

National Bank of Pakistan

Declining education and work ethics.

Inadequate accountability.

Adequate empowerment.

Technological:

Inadequate communication infrastructure.

Inadequate computer facilities.

Inadequate IT training

2.6

CONTRIBUTION

DEVELOPMENT:

OF

THE

ORGANIZATION

TOWARDS

ECONOMIC

Banks play vital role in promoting the economic activities and economic development of a

country. Industry, agriculture, trade, commerce and many other economic activities are

highly dependent on banks. Banks help in mobilization of money. They also help in

promoting the growth of internal resources for development by attracting deposits into

productive loan and investment. Banks not only collects the savings of the people but also

give loans for the development of industry, trade and commerce.

NBP has been playing a major role in financing and developmental activities in Pakistan. It

helps in the growth of economy in all spheres of our national life. It has contributed

significantly to economic growth of the country and has served to trade and industry in a

wide sphere of operations.

The NBP was the first bank to introduce scheme of credit to small borrowers like farmers

etc, for the promotion of agriculture. The bank advances liberal credit for rural and

agricultural development. Small short-term loans are given to the farmers free of interest.

These advances can be in the shape of fertilizers, seeds and agricultural implements.

The NBP is able to attract large amount of deposits through its large number of branches

Sohail Yousaf (11022720-074) FMAS

Page 31

National Bank of Pakistan

3.0ORGANIZATIONAL STRUCTURE:

3.1 ORGANIZATIONAL HIERARCHY CHART:

The Organization hierarchy chart tells us how the command is being transferred from the

higher authority to the lower management and what the position that is present in the

organization is. There are two types of hierarchy in the organization that are

Vertical

Horizontal

Corporate hierarchy is vertical in NBP. Here is the Organizational Hierarchy Chart of National

Bank of Pakistan.

3.2 NUMBER OF EMPLOYEES:

Sohail Yousaf (11022720-074) FMAS

Page 32

National Bank of Pakistan

In 2010, there are 16429 numbers of employees in NBP all over Pakistan. An Executive

Board composed of nine Senior Executives of the Bank and the President who is also the

Chief Executive supervises the affairs and business of the Bank.

Qamar Hussain

Chairman and President

Mr. Tariq Kirmani

Director

Mr. Shahid Aziz Siddiqi

3.3 Main

Offices:

Director

Mrs. Haniya Shahid

Naseem

Syed Muhammad Ali

Zamin

Sohail Yousaf (11022720-074) FMAS

Mr. Aftab Anwar

Baloch

Mr. Zahid Hussain

Director

Page 33

National Bank of Pakistan

The Main and Head Office of the national Bank of Pakistan is situated in Karachi on

Chandigarh road. It has 29 regional offices all over Pakistan. National Bank also Provide its

service to all over the word. The details of Branches are as follow.

NBP has 1286 Domestic online Branches in all Pakistan.

NBP has 8 Islamic Branches

NBP has 203 Online Branches which provides the ATM service.

Overseas Branch 23 Branches Regional / Representative Office(s)

Swift Branch Finder 13 Branches

6 Customer Facilitation Center

Regional Domestic Offices

Sohail Yousaf (11022720-074) FMAS

Page 34

National Bank of Pakistan

Overseas Branches

Sohail Yousaf (11022720-074) FMAS

Page 35

National Bank of Pakistan

Internationally NBP is working in the four main regions, which are as under

America and Europe Region

1)

2)

3)

4)

Far East Region

USA

Canada

Germany

France

Middle East, Africa &

1)

2)

3)

4)

Hong Kong

Japan

South Korea

China

Central Asian Republics

South Asia Region

1)

2)

3)

4)

Bahrain

Egypt

Bangladesh

EPZ

1)

2)

3)

4)

5)

6)

Afghanistan

Turkmenistan

Kyrgyz Republic

Kazakhstan

Uzbekistan

Azerbaijan

Subsidiary Joint Venture Representative Offices

1) NBP Kazakhstan (Almaty)

2) United National Bank (UK)

Sohail Yousaf (11022720-074) FMAS

Page 36

National Bank of Pakistan

3)

4)

5)

6)

Canada (Toronto)

USA (Chicago)

China (Beijing)

Uzbekistan (Tashkent)

3.4 INTRODUCTION OF ALL DEPARTMENTS:

In National Bank of Pakistan there are following Departments that are work in the National

Bank of Pakistan.

1.

2.

3.

4.

5.

Deposit

Advances(Credit)

Government Payments

Government receipts

Remittances

6. Utilities Bills Department

7. Bills

8. Cash Department

9. FBR Collection Department

10. Online Banking

11. Now the Brief Introduction of all above Departments is as follows.

1.

Deposit Department

12. Its the main Department of any bank Customer can keep their cash in this department

and can get when they need for the cash. There are several accounts that NBP provide to its

Customers are as under.

Current Account

PLS Term

BBA

PLS Saving

Sohail Yousaf (11022720-074) FMAS

Premium Saver

Premium Aamdani

Call Deposit

NIDA

Page 37

National Bank of Pakistan

2.

Advances (Credit Department)

NBP give loans to the borrowers for different purposes. These loans are given

for various sectors for different periods...NBP mostly generate a large part of their

profit from this department NBP gives different types of loan that are as follows.

Small Finance

Cash Finance,

Agriculture Finance,

Cash & Gold Loan,

Personal Loans,

Demand Finance,

Running Finance,

Corporate Finance,

Export Import Financing,

House Building Finance (Saibaan)

NBP Karoo bar Scheme

3.

Governments Payments Department

As the National Bank of Pakistan is the bank of Government and work as the

agent of State Bank of Pakistan so it is provide facilities to Government to

facilitate their employees by this bank. Government payments include the

following.

4.

Pension, Salaries,

Grants, Zakat,

Benevolent Fund,

Treasury Refund

Taxes Refund proceeds through the bank.

Governments Receipts

This department is just like the previous department but the different is there

bank make payment according to the instruction and here bank make receipts

according to the instruction these receipts are as under.

Revenues,

Sohail Yousaf (11022720-074) FMAS

Taxes,

Page

National Bank of Pakistan

Agriculture Tax,

Government Fees,

5.

Utility Bills Collection

Bills Department

The great facility that the National Bank provides to the customers is the

remittance of cash from one city to another city and form one country to the other

country with nominal charges. The ways of remittances are as follow.

6.

Bank draft

Telegraphic Transfer,

Mail Transfer,

Coupons,

Govt. Draft and Western Union Money Transfer etc.

Utilities Department

This is the department that collects the utilities bills for the private and

government departments bank provide this service for the percentage of each

which is very nominal.

7.

Cash Department

National bank deals Government treasury on behalf of State Bank of

Pakistan. There are Chest, Sub-chest and Non-chest branches in the bank. SBP

supplies currency notes to the bank and monitors its cash flow which is transfer

to the needy branch and receives from that branch which has excess then their

need.

8.

FBR Collection Department

NBP is playing great role for collection of FBR (CBR) taxes/revenue. A

separate counter is established at branch level to facilitate the taxpayers.

9.

Online Banking

Today is the world of computer everybody want to complete his work as soon

as possible now all the banks are going to provide the online banking service to

its customer in order to achieve good repute in the eyes of their customer.

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

National bank of Pakistan is also providing online banking facilities to its

customers. But the branch where I worked is not online till now so there are

traditional banking practices up till now.

5.3.5 Comment on the Organizational Structure

NBP is an oldest bank of Pakistan. It is establish after the making of

Pakistan to support the economy of Pakistan under supervision of state bank of

Pakistan. It spent a time of 60 year with Pakistan economy. It made adjustments

and brought changes in their operation according to the change of time. It

became modernized with the passage of time.

Organizational structure of NBP is centralized in nature. All the rules and

regulation are made by competent authority. All the decisions are also made by

board of directors and lower level employees adopt it. It provides a competitive

environment to employees and worker by using their determination fulfill their

responsibilities in excellent manners. Due to centralized structure no dispute is

arise within the organization. So I think organizational structure is very well and it

is very efficient for the Bank.

(Part-II)

5.4 Internees job

5.4.1 Brief Introduction of Internees office/branch:

I select the G.T Road Rahwali Branch of NBP for completing my internship.

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

NBP Rahwali branch doing their working in old-fashioned flair and mostly

activities is done by hand, but due absence of wide means the branch is now

exasperating to create best of its working through compute.

This branch is recently become computerized in last year dated on 11 Nov,

2011. I will start my internship in this branch on 05 Sep, 2012 and my internship

will complete on 17 Oct, 2012.During the period of six weeks internship in the

branch I done effort in dissimilar sections per week. The administer of the bank

helps me and provides me all necessary obligatory material. I read main tasks,

intentions and upcoming forecasting of the NBP. I worked in different sections

during employed as an internee which shows to me very favorable and me able

to get basic concepts of banking operations in a practically manner.

I enlist the Main departments of NBP Rahwali in which I have done worked

during my whole internship period:

Bill section

Deposit Section

Cash department

EBS/ Account open/CRO

Credit/Advances/Establishment

BRANCH PROFILE

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

Name of Branch

National Bank of Pakistan Rahwali branch

Region

Gujranwala

Branch Code

(0507)

Address

National Bank of Pakistan, G.T Road Rahwali,

Dist.: Gujranwala.

Phone Number

055-3885657

Name of Manager

Mr. Shahid Hussain Khulaar

Name of operation

manager

Mr. Irfan Rashid Warrich

Number of Working Staff

Branch category

2nd

Following are the staff of NBP Rahwali branch

Sr.

NO

1

2

3

4

5

6

7

Name

Mr. Shahid Hussain Khulaar

Mr. Rashid Irfan Warrich

Mr. Naveed Ali khan

Mr. Masood Afzal Cheema

Mr. Muhammad Nisar Cheema

Mr. Qasim Ali Shahibzada

Mr. Thair Abullah

Sohail Yousaf (11022720-074) FMAS

Designation

Branch Manager (OG-I)

Operation Manager(OG-II)

(OG-II)

(OG-II)

(OG-II)

(OG-II)

(OG-III)

Page

National Bank of Pakistan

8

9

Mr. Muhammad Arif

Mr. Perviaz Akhter

Godown. keeper / Chowkidar

Messenger (Record keeper)

BRANCH HIERARCHY

MANAGER

MANAGER OPERATION

OFFICER GRADE - I

OFFICER GRADE - II

OFFICER GRADE - III

MESSENGER

PEON

SWEEPER

5.4.2 Details of Supervisors:

I have done my training period under the direction of these people which is the

incharge of different department existing in the NBP Rahwali branch. Mr. Naveed

Ali Khan Supervise me in my internship whole period.

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

1.

2.

3.

4.

5.

Supervisor....Mr. Naveed Ali khan(OG-II)

Supervisor...Mr. Masood Afzal Cheema(OG-II)

Supervisor...Mr. Qasim Ali Shahibzada(OG-II)

Supervisor.. Mr. Thair Abullah (OG-III)

Supervisor.Mr. Muhammad Nisar Cheema(OG-II

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

5.4.3 Weekly Time Tables during Internship:

When I start my internship program Mr.Naveed Ali Khan who is the incharge of Internees at branch arrange my

weekly timetable in such a way that in a sufficient time I will learn the basic thing of the entire department in the

branch. My weekly time table in the branch is as fallows.

1st week of internship

Introduction to Banking Staff and Bill Department

Date

Wednesday

Day

05-09-2012

Details of Activities Performed

After arrive in to the boundary of NBP I was very jumbled about the working

procedure in the bank. Firstly I met the branch manager he ask some question

about me and regarding my studies. I take him answer of all the answer of the

question. After questioning and answer he familiarizes me with his staff

members then he refers me under the direction of Mr. Thair Abdullah in the Bill

Department. Mr. Thair Abdullah told me about some important rules and

regulations of the bank some of which are not to leak the confidential

information of bank to any outsider and not to operate the I.T system of the

bank without any permission & purpose.

Introduction to some different type of most regularly used banking vouchers e g:

debit/credit, F-15,F16 , deposited slip IBT-01

What make Demand Draft and Call Deposit (CDR).

Thursday

06-09-2012

National Bank of Pakistan

Starter the most regularly used banking stamps e g: Signature verification

stamp, Cheque posted stamp, Branch stamp, and payment stamp. Procedure

of creating Payment Order.

Also familiarizes with some important banking Books of record e g: different

types of ledger, Account opening register, Cash n Gold ledger, pension holder

ledger or etc. which is used in bank on daily basis.

Friday

07-09-2012

Start working practically on signature verification seat, after verifies the

signature then forward to Mr. Masood Afzal Cheema for further operation.

Making different type of voucher practically under the supervision of Mr. Thair

Abdullah such as Debit/Credit, IBT-01 and many other voucherss which is used

in daily routine banking.

It is certified that Mr. Sohail Yousaf had done their worked in this Department with fully Devotion and Dedication

and got training of almost everything in this Department.

Supervisor Name: MR. Thair Abdullah

Signature: ______________________

National Bank of Pakistan

2nd Week of internship

Deposit Section

Date

Day

Details of Actions Performed

Introduction toward Account Initial Form and different Category of

Monday

10-09-2012

Accounts accessible in NBP Rahwali, Necessary requirement of account

initial form.

Tuesday

11-09-2012

Wednesday

12-09-2012

Thursday

13-09-2012

Friday

14-09-2012

How new account is opened and what is procedure of NADRA

verification.

Which kind of Documents is required while opening accounts in case of

Individual and Minor

What are the cause of Dormancy, Suspension and Closing of and account

What is the procedure of Cheque book issuance and sending Cheque

Books request to NIFT? Entry and Reissuance of new Cheque Book

It is certified that Mr. Sohail Yousaf had done their worked in this Department with fully Devotion and Dedication

and got training of almost everything in this Department.

Supervisor Name: Mr. Masood Afzal Cheema

Signature: ________________________

National Bank of Pakistan

3rd Week of internship

Cash Section

Date

Day

Monday

17-09-2012

Tuesday

18-09-2012

Wednesday

19-09-2012

Thursday

20-09-2012

Friday

21-09-2012

Details of Actions Accomplished

What is the procedure of Fill up Cheque for the Customers,

Filling of cash Vouchers and receipts.

How Cheque and transfer voucher is fill up for the use of customer.

Learn the procedure of Demand Draft and how create Demand Draft

for the use of Customers.

What is Mail Transfer and Telegram Transfer, what are their function

and their procedure. Create these tools for the use of Customers.

Study the process of Payment order and create it for customers.

Procedure for making CDR and make it for customers.

It is certified that Mr. Sohail Yousaf had done their worked in this Department with fully Devotion and Dedication

and got training of almost everything in this Department.

Supervisor Name; Mr. Nisar Cheema

4rth Week of internship

Signature: _______________________

National Bank of Pakistan

Government & Pension Department

Date

Day

Details of Activities Performed

Monday

24-09-2012

What is the Functions of Collection Section?

Tuesday

25-09-2012

What is the Functions of Payment Section?

What is the procedure of filling Pension and various Government

Wednesday

26-09-2012

vouchers and forms and recording their entry in the relevant Books of

account. Provincial, central and Pakistan Railway pension.

Learnt about the Pension circulation process obligatory stamps on

Thursday

27-09-2012

pension voucher and recording of the pension in relevant ledger. How to

calculate the increase in the amount of pension.

Dissimilar categories of Government expenses e g: P1, P2, C1 and P-

Friday

28-09-2012

Tax. Entry of the daily transactions in the TRV Register and make Debit /

Credit Vouchers and sent Record to Main Branch.

It is certified that Mr. Sohail Yousaf had done their worked in this Department with fully Devotion and Dedication

and got training of almost everything in this Department.

Supervisor Name: Mr. Qasim Ali Shahibzada

5ht Week of internship

Credit and Advances Department

Signature: __________________________

National Bank of Pakistan

Date

Day

Details of Activities Performed

Monday

01-10-2012

Whatever is Clearing? Participation of NIFT in Clearing process.

Tuesday

02-10-2012

wednesday

03-10-2012

Learn about the LSC and SC in clearing.

Thursday

04-10-2012

Who is eligible for advances? Types of Advances.

Friday

05-10-2012

Kinds of Clearing and resending of Cheques with are not cleared by NIFT due to

some motive. Homegrown and Express Clearing.

What are the necessary requirement for getting advances and the terms and

condition of repayment of advances?

It is certified that Mr. Sohail Yousaf had done their worked in this Department with fully Devotion and Dedication

and got training of almost everything in this Department.

Supervisor Name: Mr. Naveed Ali khan

Signature: __________________________

6th Week of internship

E-Remittance & Cash n Gold Section

Date

Day

Details of Actions Accomplished

What is Remittance? Types of Remittances available in NBP (Rahwali) Branch

National Bank of Pakistan

Monday

08-10-2012

for their customer such as western union and X press money.

Tuesday

09-10-2012

Perform it practically and making Vouchers of E- Remittances.

Wednesday

10-10-2012

Learn about the Gold Finance Procedure, Markup rate of its.

How fresh Gold Accounts is opened and perform Cash n Gold Finance

Thursday

11-10-2012

procedure for the clients.

Absorb knowledge of Renewal process and execute it for customers. Closing

Friday

12-10-2012

of Gold Accounts and types some letters for the Management and perform all

the routine activities.

It is certified that Mr. Sohail Yousaf had done their worked in this Department with fully Devotion and Dedication

and got training of almost everything in this Department.

Supervisor Name: Mr. Naveed Ali Khan

Signature: __________________________

National Bank of Pakistan

5.4.4 Detailed Description Department;Bill Department (1st Week):

I start my internship from 05-09-12 in the Bill department under the supervision

of Mr. Thair Abdullah (OG-III) in G.T Road Rahwali branch. In this department he

deals with all types of branch voucher regarding the bills. I felt during the period

of internship in this department is very important. The main function of this

department is that it deals in the transformation of money from bank to bank with

in the premises of our country.in NBP a customer can transfer their money by

four types.

DD, (Demand Draft)

Short credit.

Sohail Yousaf (11022720-074) FMAS

MT/TT

IBT-01

Page

National Bank of Pakistan

Procedure of making voucher;When we fill-up any kind of voucher, we should fallow the following step.

First enter the date the specific area mentioned in the voucher.

Enter the account number of customers.

Enter the amount in the figure and also mentioned in the narration.

Write a description for which purpose we will debit/credit the

account.

Deposit Department (2nd week):

After completion of my first weeks, Mr. Thair Abdullah

refers me under the supervision of Mr. Masood Cheema on dated 13-09-12. He

is CRO (Customer Relation officer) and deals in opening new account,

operates the EBS (Electronic Business system). He teaches me firstly about

Opening of new Account, secondly about EBS.

Opening New Account:

Recently NBP converted their account opening procedure from manual system to

online computerize system. Before computerized system a customer who is

willing for opening new account first get the form fill it and then submit to the

branch where he/she willing to open their account. This system takes a few days

time for opening a new account because it approval coming from RO (Regional

office) through online networking. The new procedure or Account opening is more

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

efficient and quickly than the manual and the record of new account is directly

kept by the RO (Regional Office).

NBP offer many types of account but this branch is under category-II so common

types of account are deal here.

This branch offers such type of account here.

1. PLS Account.

2. Current Account.

PLS Account:

PLS account is offered to public with the risk of sharing profit

and loss. This type of account mostly used by the general public. There are very

rare chances that bank suffer loss. Bank takes profit on such account with time to

time.

Current Account:

Current account is type of account in which the depositor can withdrawal their

sum at any time by offering the Cheque with in banking hours as per shown

on the term and condition of such type of account. The bank never pays and

interest on such type of account and never deducts and type of service

charges. Another facility that provides to these account holder is bank never

deduct the zakat from such kind of account. Such type of account used by the

businessman.

Requirements for opening an account:

Resulting is the necessary necessity for opening new account.

A make a copy of NICI ID card of customer and his mother.

Original ID card of customer for verification at the time of opening.

NADRA verification.

If customer is illiterate and use thumb impressions then his duty give his 3

recently passport size picture.

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

Customer must present in the bank while of opening of account

Utility bill of by name on person.

A copy of next kin (legal higher) in case of Account holder Death.

Terms and condition for opening account:

He essential be the citizen of that city where he want to open account.

A person who is blind also opens their account with his partner in term of

joint account and partner must be never blind.

Mad people are allowed to open their account in the bank.

A person who sometimes normal and sometime abnormal then he must

operate his account only when he is in normal condition.

Account opening procedure:

Customer fills the application account opening form during opening his

account in the bank.

Account opening form is properly filled there is no cutting made on it.

Banker takes customer signature on specimen card and keeps it in record

for future use.

After taking customer signature deposit money through credit vouchers.

Banker opens an account and allots an account number to customer.

Customer requests for Cheque book which is issued within fifteen days .

Account closing:

Here are many causes for closing account. It is bad symptom for the corporate of

bank. Some of the collective causes are following.

Account can be closed on the customer request.

Account will be closed if the account holder death occurs.

If the customer become Bankruptcy.

Closing of account due to bad conduct of account holder.

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

Account can be closed due to the order of Government.

Account can be closed Due to the Insanity of the customer.

Account will be closed if there is no transaction made by customer in the

duration of three years.

Before closing an account, the bank sends a letter of informing to account holder

that his account will be closed. Bank sends the informing letter three times. After

it if account holder never response, bank closed the account after full fillment of

legal requirement.

Issuance of Cheque book:

Cheque book is a instrument through which an account holder drawn Cheque

upon the bank and withdrawal his amount from the bank. After authentication by

the authorized officer on the Cheque book register, the Cheque book is hand

over to the account holder First time Cheque book is issued to customer when he

request for prescribed form. Empty Cheque book has requisition slip. Customer

can get a new Cheque book by giving that requisition slip of previously used

Cheque book to the banker. The issuance of new Cheque book will takes a time

of few days.

Passing and Cheque cancellation:

It is the process of checking and

verifying the sign of the customer on the Cheque, Duties of the passing person.

After it Cheque will be sent to the person who posted it.

A Cheque is cancelled due to insufficient Balance in Account.

Cheque is presented within 180 days after it, it will be expire or useless.

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

If the Cheque contain any error such as, mistake in date or amount,

narration does not Telly with figure amount than Cheque never pass and

return to the depositor.

A common reason of cancellation of Cheque is drawer signature error.

EBS (Electronic Business System)

It is the online system of NBP in all over the Pakistan. It is online software

through which the branches make online payment to the other branches of NBP

in all over the Pakistan without takes longer time due to the online connection

with RO (regional office). Its privacy is very high and internees are not allowed to

any work on this.

Every branch has its own User Id or login password through which it is connected

to the It Region. Mr. Masood Cheema briefs me about it. All kind of information of

the account holder is kept in this system. If any customer wants to know about

the balance in his/her account we can check with the help of EBS. If we want to

transfer amount from one Account to another Account or from one branch to

another branch we did it though EBS in few minutes. If we need statement of

account of any account holder we print it from EBS. In short EBS is online

system which consists of all the banking. Without EBS in NBP banking is unable

to working fast and efficient.

Cash Department (3rd Week):

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

After completion of my 2

nd

weeks, Mr.

Masood Afzal Cheema refers me under the supervision of Mr. Nisar Cheema on

dated 20-09-12. He is Head of Cash and deals in all transaction of the bank in

which cash included. He teaches me how Cheque is filling up, what are the types

of Cheque. What necessary requirement for encashment of the Cheque. All

payment are made by them to the customer and pension holder whose are come

to the bank for the purpose of withdrawal there amount. He also teaches me

about how to maintain the balances on daily, balances should be match and how

summary is made and then forward to the operation manager. Cash department

is very sensitive department in the branch internees are not allow for doing any

more activities in this type of department.

Government and Pension Department (4th week):

After completion of my 3rd week, Mr. Nisar

Cheema refers me under the supervision of Mr. Qasim Ali Shahibzada on dated

27-09-12. He is Deposit incharge and deals in all kind of deposit in the bank. He

is also the head of government section in the branch .He teaches me how

deposit is received by the bank and how to maintain deposit account on daily

basis.

In this department I learnt from Mr. Qasim Ali Shahibzada. He teaches me, there

is two different ways than an account holder deposit the amount in his/her

account. He also tell me about the IBT-1 service which is used for urgently

transfer the amount in another account of NBP in all over the Pakistan within few

minutes.

The first is amount deposited in cash.

The second is amount deposited by Cheque.

The third is amount receiving by IBT-1(Inter Branch Transaction).

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

Amount Deposited By Account Holder:

In this way there is simple procedure. The account holder only fill the voucher (F108) completely and then deposited the amount with voucher in cash into the

bank. After depositing the cash the deposit incharge can stamp the voucher and

takes slip return to the account for as evidence as cash is received by the bank

and transfer to his/her account. The amount is transferred in account holder

account within minutes after depositing the cash into the bank.

Amount Deposited By Cheque:

In this way through which an account holder can deposit amount in

his/her account by depositing Cheque of another person account which is drawn

on an account holder. An account holder first fills the Voucher (F-109) completely

and attached the Cheque and deposited into the bank. If Cheque which is

deposited is of the same bank means National Bank Pakistan than the amount

will be transfer within minutes, but if the Cheque is another bank and falls in LSC

(local short credit) than it will take time one days for transferring of amount into

the account. At last if the Cheque is fall in the SC (short credit) than it will takes

one to three days normally.

The NIFT is private institutions which collects the cheques from different banks

of different bank interpret the cheques and then debit or credit the account of

banks in the State bank. NIFT charge their commission per Cheque from the

bank to provide their services.

Amount Receiving through IBT-01:

This is new service which is recently

offer by NBP to their account holder for fastest transfer of amount from one

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

account to another account of NBP bank within few minutes. A person can get

IBT-01 from and fill it how much amount of money? Where it has been

transferred?

After filling person submit it to the deposit incharge with sum of money. Deposit

incharge receive the amount and signature on IBT-01 and then original return to

customer and carbon copy kept into the bank record. After receiving the amount

by deposit officer the amount is transferred within minutes into the desire account

.This service is only available into the online branches of NBP.

Government & Pension Section:

After learning about the deposit section. He

teaches me about the Government & pension section. How government pension

voucher are fill up, how these increases are calculated and different types of

Government pensions such as P1, C1 Railway or etc. what are the government

tax that are collected here such as P-Tax. Record the transaction on daily basis

in the TRV registered and make RBVs to the respondent branch.

Working of Government & Pension Department:

Verifies the pensioner payment voucher and kept the record in the

registered.

Making the summary of collected pensions voucher which are paid.

Telly the balances with cash department regarding such payment.

After finalizing the scrolls are sending to the regional branch by post.

Credit and Advances (5th Week & 6th):

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

After completion of my 4thd weeks, Mr.

Qasim Ali Shahibzada refers me under the supervision of Mr. Naveed Ali Khan on

dated 05-10-12. He is the in charge of advance, credit, Establishment Eremittance and finance. He also performs the duty of compliance officer in the

branch.

Clearing Department:

The first department I start working under the supervision of Mr. Naveed ali khan

is the clearing department.as shown from the name clearing, in this department

we separate the cheques of different bank and make summary of these cheques.

There are two types of cheques which are received by bank through their

customer. Local city cheques (LSC) and intercity (SC). Local city cheques are the

cheques of this bank which are located in the same city and clear with in one

day. Intercity or short credit is the cheques of that bank which are located in the

other cities and these cheques are cleared within three days. Before at the end of

the day a summary is prepaid regarding these cheques and then submitted to

NIFT for clearing. NIFT collector comes on daily basis and report about the

previous cheques and gets the new summary of the received cheques along with

cheques for clearing purpose.

Advance Salary:

Advance salary is facility which is provided by the NBP to the

people to get a lumsum amount of money in the time of need and return it in

easily installment with in the five years of time period. Some questions occur in

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

my mind during working in this department about advance salary. I ask these

questions to Mr. Naveed Ali khan, he answered me. My question is under fallows

Which people are eligible for availing the facility of advances salaries?

Ans: In reply of this question he told me a person who is the employee of

Government or Semi-Government and Independent bodies that getting salaries

concluded NBP can avail the facility of Advance salary and his salary account

must be in our branch.

What is the procedure of get it?

Ans: The procedure is that he must apply for advance salary and fill the form for

availing the facility of advances salary and his salary account must be present in

the NBP branch from where he want get the salaries in advances.

In how many time periods you will return it?

Ans: when any person can get advance salary loan it must be return it in the

maximum period of five years according to bank policy in equal installment. If he

wants to return loan before five years than he and Bank decide the amount of

installment by mutual co-operation and set the period of loan returning according

to the desire of the person who getting loan.

Requirement for advance salary

Following are the requirement for availing the facility of Advance salary.

N.I.C.I photocopy of a person.

Employee card photocopy.

ECIB (Electronic consumer information barrower).

Nadra verisys verification.

5 open cheques up to next date of ending time period.

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

Establishment:

After learning about the Advances salaries Mr. Naveed Ali

khan directed me into the Establishment department. In this department he deals

all kind of matter of the Branch Employees. The loan finance to branch staff,

medical bills of staff member, pay salaries to the staff of branch and deal all kind

of other matter of the staff member of the branch with Region according to their

circumstances. This department we can say HR department in category-II branch

of NBP. This branch also falls in Category-II.

E-Remittance:

This facility is also providing in G.T Road Rahwali branch

and this is also deal by Mr. Naveed Ali khan. In this department people can get

the money which is sending from the other country by their relatives to them.

Here we can make the payment of different companies such as Western Union,

Ria Money Transfer, and Xpress Money. Anyone who is the receiver of payment

just only takes the photocopy of his/her NICI and tells the secret Pin and get

easily amount from the NBP online branches all over in the Pakistan.

Compliance:

G.T Road Rahwali branch is falls in the category-II branch.

So due to this reason there is no Separate compliance Officer. Mr. Naveed Ali

Khan also performs the activities of a compliance officer. He daily check the all

working of the branch and point out the mistake if they occurs in the branch

working by the staff on daily basis.

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

Cash n Gold

The last thing which I have been learnt from Mr.Naveed Ali khan in 6th week is

Cash n Gold. It is a facility to general public to get the short term loan from any

branch NBP against the Gold security. A person who get loan must repay the

loan within one year. If person fail the bank allow him 3 month extra grace period

to repay and get his/her Gold .if he/she even fail the bank has right to auction the

Gold which he/she pledge. In this 15.50% markup charge on the amount which is

lend against the Gold. The bank can pay Rs.40, 000/- against every 10 gm. of

net weight of Gold.

Requirement for Cash n Gold:

Following are the requirement for open cash n Gold account in the NBP.

First weight the net weight of Gold from the Bank certified jeweler and get

certificate from jeweler.

A copy of NICI person who get the loan.

NADRA verisys verification.

ECIB report.

5.4.5 Explanation of the tasks assigned to you:

Such as a internee here are many different task assign to me by my supervisors

in the bank but one day the operational manager told me to count all the files

pension holders in the bank and prepare a separate list of all categories of

pension holders according to category (central, provisional, Pakistan railway) in

computer for the use of Branch record in Alphabetical manner, because it helps

us to finding the required file from the bank record of a particular person.

Sohail Yousaf (11022720-074) FMAS

Page

National Bank of Pakistan

When i start works in the office I saw the cheques book system of the bank was

very bad, all the cheques books were mixed with each other at a single place

without any sequence or any order due to the lack of management skill of the

employees, so I make a Microsoft Excel software and enters all the cheques