Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Boeing Stock Analysis Report

Caricato da

InvestingSidekickCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Boeing Stock Analysis Report

Caricato da

InvestingSidekickCopyright:

Formati disponibili

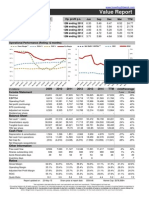

Boeing Co.

(The)

www.InvestingSidekick.com

BA

Value Report

I.S.Q. Score: 9/10

TTM EPS:

Next year EPS estimate:

Net cash* / (debt) p.s:

Net debt EBITDA:

Net debt Equity:

8.41

9.30

0.86

-

Op. profit p.s.

Jun

Sep

Dec

Mar

TTM

12M ending 2015

12M ending 2014

12M ending 2013

12M ending 2012

12M ending 2011

2.39

2.22

2.00

1.93

1.65

2.84

2.32

1.92

2.24

1.77

2.78

1.94

2.07

2.04

1.40

2.80

2.03

1.93

2.04

1.27

10.81

8.51

7.92

8.24

6.09

Operational Performance (Rolling 12 months)

Gross Margin**

SG&A %

R&D %

Net Debt / EBITDA**

Op Margin

9%

25%

8%

20%

ROE

ROIC

180%

0.7

160%

0.6

140%

7%

0.5

120%

6%

15%

5%

0.4

100%

4%

0.3

80%

10%

3%

60%

0.2

40%

2%

5%

1%

0%

0%

2009

$ millions

2010

2011

0.1

20%

0%

2012

2013

2014

TTM

Income Statement

Revenue

EBITDA

Operating Profit

Net profit (continuing)

EPS (continuing)

Adjusted net income

Dividend per share

CAGR/average

5 year

10 year

68,281

3,499

1,871

1,335

1.74

1,335

1.68

64,306

6,502

4,698

3,311

4.50

3,311

1.68

68,735

7,288

5,542

4,011

5.40

4,011

1.70

81,698

7,916

6,039

3,903

5.16

3,903

1.81

86,623

8,248

6,328

4,586

6.13

4,586

2.19

90,762

9,089

7,196

5,446

7.71

5,446

3.10

92,446

9,536

7,652

5,817

8.41

5,815

3.28

6%

21%

31%

32%

35%

32%

13%

6%

9%

14%

12%

13%

12%

14%

(1,701)

2,128

(5,068)

(6.70)

(1,904)

2,766

(5,150)

(7.00)

(1,099)

3,515

(4,474)

(6.01)

3,149

5,867

(2,279)

(3.02)

5,623

14,875

6,780

9.07

4,022

8,665

677

0.96

593

7,906

(8)

(0.01)

-219%

32%

-167%

-168%

#NUM!

-3%

-22%

-21%

1,678

5,603

(1,159)

(639)

1,746

2,952

(1,062)

(932)

1,675

4,023

(1,619)

(42)

1,811

7,508

(1,606)

(124)

1,844

8,179

(2,047)

(26)

1,906

8,858

(2,202)

(163)

1,917

7,834

(2,328)

-

3%

10%

14%

-24%

2%

10%

-1%

#NUM!

4,444

756

31

109

1,890

735

31

171

2,404

745

31

211

5,902

756

25

201

6,132

747

28

214

6,656

707

31

222

5,506

692

32

227

8%

-1%

29

204

10%

-2%

31

143

17.2%

19.4%

18.7%

16.0%

15.4%

15.4%

15.7%

17.0%

17.3%

2.7%

7.3%

8.1%

7.4%

7.3%

7.9%

8.3%

7.6%

6.4%

Balance Sheet

Net cash* / (debt)

Shareholders equity

Tangible book value

TBV per share

Cash Flow

Depreciation & amortization

Net cash from operations

Net Cap Ex

Net Disposals (acquisitions)

Other Information

Free cash flow

Shares outstanding (mil)

Accts Receivable days

Inventory days

Ratios

Gross Margin

Operating Margin

Adjusted Net Profit Margin

ROIC

Quick Ratio

2.0%

5.1%

5.8%

4.8%

5.3%

6.0%

6.3%

5.4%

4.8%

40.3%

77.2%

92.9%

149.1%

51.9%

119.5%

81.3%

98.1%

72.7%

0.4

0.4

0.5

Report updated on:

23-May-15

0.5

0.4

0.4

Share price at report date:

0.4

$147.26

0.4

0.3

Market Cap: $101,833m

*Net cash/debt is total debt offset by cash, cash equivalents and short term investments. **Plotted against Left hand axis

Investing Sidekick Ltd. All rights reserved. This report is for information purposes only and accuracy is not guaranteed. Certain financial information included in Investing Sidekick is proprietary to

Mergent, Inc. (Mergent) Copyright 2015. Reproduction of such information in any form is prohibited. Because of the possibility of human or mechanical error by Mergents sources, Mergent or

others, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results obtained from the use of such information.

Boeing Co. (The)

www.InvestingSidekick.com

BA

Value Report

EV/OP trading range

Conservative model value

Aggressive model value

Current EV/OP (TTM)

Current EV/OP 13.2

(Enterprise Value / Operating Profit)

Return on Invested Capital

Free Cash ROIC

34.3

98.1%

106.1%

(5 year average)

Free Cash Flow Operating Profit

104%

15 years

97%

10 years

77%

5 years

29.3

24.3

19.3

% spending of FCF on

14.3

Net Acquisitions/(divestitures)

9.3

Share buybacks / (issues)

7%

28%

34%

21%

2%

Dividends

Decrease/(increase) of net debt

4.3

Other spending/(asset sales)

(cumulative last 10 years)

P/B trading range

P/B = 1

Book value p.s. 11.43

Current P/B

Tangible Book (TBV) p.s.

Net Net Curr. Assets p.s.

Net cash* / (debt) p.s.

25.9

20.9

Average annual change in

Book Value p.s.

TBV p.s.

13.3%

15 years

15 years (51.9%)

18.5%

10 years

10 years (124.4%)

48.3%

5 years

5 years

15.9

10.9

Compounded annual growth in

Book Value p.s.

TBV p.s.

15 years (0.2%)

15 years (12.9%)

10 years (1.3%)

10 years (23.2%)

34.4%

5 years

5 years #NUM!

0.9

Book Value per share

Quick Ratio (Acid test)

Accounts receivable days

10,000

25

8,000

20

15

6,000

10

4,000

5

2,000

(5)

Inventory days

60%

(2,000)

(10)

(4,000)

(15)

250.0

50%

Quick Ratio

Free Cash Flow

Tangible Book Value per share

Book Value per share ($)

Operating Income

200.0

40%

150.0

30%

100.0

20%

50.0

10%

0%

0.0

Inventory/Accounts receivable days

5.9

Operating Profit / FCF ($mil)

(0.01)

(33.73)

0.86

(Seasonally adjusted data)

Report updated on: 23-May-15

Share price at report date:

$147.26

Market Cap: $101,833m

*Net cash/debt is total debt offset by cash, cash equivalents and short term investments.

Investing Sidekick Ltd. All rights reserved. This report is for information purposes only and accuracy is not guaranteed. Certain financial information included in Investing Sidekick is proprietary to

Mergent, Inc. (Mergent) Copyright 2015. Reproduction of such information in any form is prohibited. Because of the possibility of human or mechanical error by Mergents sources, Mergent or

others, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results obtained from the use of such information.

Potrebbero piacerti anche

- QuizDocumento3 pagineQuizInvestingSidekickNessuna valutazione finora

- Cisco Stock Analysis ReportDocumento2 pagineCisco Stock Analysis ReportInvestingSidekickNessuna valutazione finora

- Berkshire Hathaway Equity ResearchDocumento2 pagineBerkshire Hathaway Equity ResearchInvestingSidekickNessuna valutazione finora

- IBM Stock Analysis ReportDocumento2 pagineIBM Stock Analysis ReportInvestingSidekick100% (1)

- Oracle Stock Analysis ReportDocumento2 pagineOracle Stock Analysis ReportInvestingSidekickNessuna valutazione finora

- Johnson Johnson Stock Analysis ReportDocumento2 pagineJohnson Johnson Stock Analysis ReportInvestingSidekickNessuna valutazione finora

- Verizon Stock Analysis ReportDocumento2 pagineVerizon Stock Analysis ReportInvestingSidekickNessuna valutazione finora

- Microsoft Stock Analysis ReportDocumento2 pagineMicrosoft Stock Analysis ReportInvestingSidekickNessuna valutazione finora

- Customer Solutions ModelDocumento8 pagineCustomer Solutions ModelInvestingSidekick0% (1)

- Apple Stock Analysis ReportDocumento2 pagineApple Stock Analysis ReportInvestingSidekickNessuna valutazione finora

- Netflix Stock Analysis ReportDocumento2 pagineNetflix Stock Analysis ReportInvestingSidekickNessuna valutazione finora

- House Buying Vs RentingDocumento14 pagineHouse Buying Vs RentingInvestingSidekickNessuna valutazione finora

- Google Stock Analysis ReportDocumento2 pagineGoogle Stock Analysis ReportInvestingSidekickNessuna valutazione finora

- EAM Solar ProspectusDocumento178 pagineEAM Solar ProspectusInvestingSidekickNessuna valutazione finora

- EAM Solar ProspectusDocumento178 pagineEAM Solar ProspectusInvestingSidekickNessuna valutazione finora

- IBM 10 Year FinancialsDocumento1 paginaIBM 10 Year FinancialsInvestingSidekickNessuna valutazione finora

- Gencorp Annual Report 2013Documento177 pagineGencorp Annual Report 2013InvestingSidekickNessuna valutazione finora

- The Washington Post Company 1971 Annual ReportDocumento33 pagineThe Washington Post Company 1971 Annual ReportInvestingSidekickNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Product Portfolio ManagementDocumento4 pagineProduct Portfolio ManagementAna Maria Spasovska100% (1)

- GB922 InformationFramework Concepts R9 0 V7-14Documento57 pagineGB922 InformationFramework Concepts R9 0 V7-14youssef MCHNessuna valutazione finora

- TRACKING#:89761187821: BluedartDocumento2 pagineTRACKING#:89761187821: BluedartStone ColdNessuna valutazione finora

- Xerox Case StudyDocumento19 pagineXerox Case StudyPrachi Jain100% (2)

- Assignment1 10%Documento3 pagineAssignment1 10%Felicia ChinNessuna valutazione finora

- What Are Business CyclesDocumento40 pagineWhat Are Business CyclesShruti SaxenaNessuna valutazione finora

- Guidelines for Granting IT Course PermitsDocumento20 pagineGuidelines for Granting IT Course Permitsanislinek15Nessuna valutazione finora

- Modern Systems Analysis and Design: The Sources of SoftwareDocumento39 pagineModern Systems Analysis and Design: The Sources of SoftwareNoratikah JaharudinNessuna valutazione finora

- Business Practices of CommunitiesDocumento11 pagineBusiness Practices of CommunitiesKanishk VermaNessuna valutazione finora

- (En) 7-Wonders-Cities-RulebookDocumento12 pagine(En) 7-Wonders-Cities-RulebookAntNessuna valutazione finora

- Lean Webinar Series:: Metrics-Based Process MappingDocumento58 pagineLean Webinar Series:: Metrics-Based Process MappingRicardo Fernando DenoniNessuna valutazione finora

- PDF Created With Pdffactory Pro Trial Version: Sps1000 Schematic Ac - inDocumento1 paginaPDF Created With Pdffactory Pro Trial Version: Sps1000 Schematic Ac - inTiago RechNessuna valutazione finora

- Investors PerceptionDocumento30 pagineInvestors PerceptionAmanNagaliaNessuna valutazione finora

- ICCFA Magazine January 2016Documento116 pagineICCFA Magazine January 2016ICCFA StaffNessuna valutazione finora

- Braun - AG - Group 2 SEC BDocumento33 pagineBraun - AG - Group 2 SEC BSuraj KumarNessuna valutazione finora

- Economic Growth of Nepal and Its Neighbours PDFDocumento12 pagineEconomic Growth of Nepal and Its Neighbours PDFPrashant ShahNessuna valutazione finora

- Theresa Martin v. Shaw's Supermarkets, Inc., 105 F.3d 40, 1st Cir. (1997)Documento8 pagineTheresa Martin v. Shaw's Supermarkets, Inc., 105 F.3d 40, 1st Cir. (1997)Scribd Government DocsNessuna valutazione finora

- Trust and CommitmentDocumento11 pagineTrust and CommitmentdjumekenziNessuna valutazione finora

- StarbucksDocumento9 pagineStarbucksMeenal MalhotraNessuna valutazione finora

- Boost Your Profile in PrintDocumento45 pagineBoost Your Profile in PrintJaya KrishnaNessuna valutazione finora

- Energy Utility BillDocumento3 pagineEnergy Utility Billbob100% (1)

- TOA Quizzer With AnswersDocumento55 pagineTOA Quizzer With AnswersRussel100% (1)

- Mind Clutter WorksheetDocumento7 pagineMind Clutter WorksheetlisaNessuna valutazione finora

- Standard Operating Procedure For Customer ServiceDocumento8 pagineStandard Operating Procedure For Customer ServiceEntoori Deepak ChandNessuna valutazione finora

- Favelle FavcoDocumento5 pagineFavelle Favconurul syahiraNessuna valutazione finora

- Suvarna Paravanige - Sanction of Building Plan in a Sital AreaDocumento1 paginaSuvarna Paravanige - Sanction of Building Plan in a Sital AreaareddappaNessuna valutazione finora

- Brochure - B2B - Manufacturing - Urban CarnivalDocumento8 pagineBrochure - B2B - Manufacturing - Urban CarnivalGaurav GoyalNessuna valutazione finora

- American option pricing using binomial modelDocumento51 pagineAmerican option pricing using binomial modelrockstarliveNessuna valutazione finora

- Hitachi AMS 2500Documento2 pagineHitachi AMS 2500Nicholas HallNessuna valutazione finora

- Barangay Transmittal LetterDocumento3 pagineBarangay Transmittal LetterHge Barangay100% (3)