Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Amazing Race

Caricato da

Justine Jay Casas LopeCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Amazing Race

Caricato da

Justine Jay Casas LopeCopyright:

Formati disponibili

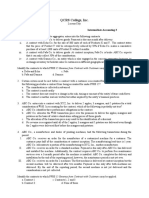

STATION 1

Classify if inventory or not.

1. An entity holds lubricants that are consumed by the entitys machinery in producing goods.

2. An entity holds a building to earn rentals under operating leases from independent third parties.

3. An entity trades in commercial property (ie it buys commercial property with a view to selling it at a profit in

the near term).

Cost Formula

An entity sells fibre cables. It measures the cost of inventories by using

in inventory occurred in 20X5. Determine COGS and ending inventory.

Date

Description

Units

1 January

Opening balance

1000

2 February

Sold

(200)

25 February

Purchased

400

2 March

Purchased

200

25 March

Sold

(900)

Closing Inventories

500

the FIFO method. The following movements

Total cost

10,000

?

6,000

4,000

?

Cost per unit

10

?

15

20

?

STATION 2

Financial Instruments- Impairment (Station 2)

An entity is concerned that one of its customers will not be able to make all principal and interest payments due on a

loan in a timely manner because the customer is experiencing financial difficulties. The entity and the customer

negotiate a restructuring of the loan. The entity expects that the customer will be able to meet its obligations under

the restructured terms. In which of the following cases (different restructuring scenarios) would the entity need to

recognise an impairment loss? (Hint: four answers)

(a) Customer B will pay the full principal amount of the original loan five years after the original due date, but none of

the interest due under the original terms.

(b) Customer B will pay the full principal amount of the original loan on the original due date, but none of the interest

due under the original terms.

(c) Customer B will pay the full principal amount of the original loan on the original due date but with interest at a

lower interest rate than the interest rate inherent in the original loan.

(d) Customer B will pay the full principal amount of the original loan five years after the original due date and all

interest accrued during the original loan term, but no interest for the extended term.

(e) Customer B will pay the full principal amount of the original loan five years after the original due date and all

interest, including interest for both the original term of the loan and the extended term.

STATION 3:

Determine the cost of inventory:

1.

A retailer buys a good priced at CU500 per unit. However, the supplier awards the retailer a 20 per cent

discount on orders of 100 units or more. The retailer buys 100 units in a single order.

2.

A retailer imported goods at a cost of CU130(1), including CU20 non-refundable import duties and CU10

refundable purchase taxes. The risks and rewards of ownership of the imported goods were transferred to

the retailer upon collection of the goods from the harbour warehouse. The retailer was required to pay for

the goods upon collection. The retailer incurred CU5 to transport the goods to its retail outlet and a further

CU2 in delivering the goods to its customer. Further selling costs of CU3 were incurred in selling the goods.

3.

An entity acquired an item of inventory for CU2,000,000 on two-year interest-free credit. The identical item is

available in the same market for CU1,654,000 if payment is made within 30 days of the date of purchase (ie

normal credit terms).

STATION 4

An entity enters into an arrangement with a third party under which the entity sells trade receivable assets with a

carrying amount of CU19,000 (CU20,000 gross amount less CU1,000 bad debt allowance) to the third party. The

third party pays the entity CU18,000 for the receivables. The entity and the third party estimate, on the basis of the

entitys experience, that CU19,000 of the CU20,000 trade receivables will be settled (ie bad debt losses are expected

to be CU1,000). However, the entity has not guaranteed to the third party that any particular amount will be collected.

The trade debtors will pay the entity and the entity will pass all receipts to the third party. Ultimately, because of one

customer going into liquidation, only CU17,000 of the trade receivables were actually settled. Therefore the entity

passed only CU17,000 to the third party.

Prepare journal entries.

STATION 5

On January 1, 2013, Fancy Company acquired P8,000,000 12% bonds to be held as financial assets at amortized

cost for P8,400,000 plus transaction costs of P198,400.

Interest is payable annually on December 31. The bonds mature on January 1, 2018.

The effective interest method of amortization is used. The bonds have a 10% effective yield.

Prepare journal entries for 2014.

Potrebbero piacerti anche

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeDa Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeValutazione: 1 su 5 stelle1/5 (1)

- T o R e C o R D C o S: Cases Revenue Recognition Case 1Documento3 pagineT o R e C o R D C o S: Cases Revenue Recognition Case 1Tio SuyantoNessuna valutazione finora

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Da EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Nessuna valutazione finora

- Ôn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Documento48 pagineÔn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Thương TrầnNessuna valutazione finora

- Consignments: Customers in Accounting For Revenues FromDocumento22 pagineConsignments: Customers in Accounting For Revenues FromVine AlparitoNessuna valutazione finora

- A Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsDa EverandA Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsValutazione: 3 su 5 stelle3/5 (1)

- Hand Out 2Documento6 pagineHand Out 2Layka ResorezNessuna valutazione finora

- Reading Material and ActivitiesDocumento2 pagineReading Material and ActivitiesErlyn Joyce CerillaNessuna valutazione finora

- Name: Date: Professor: Section: Score: Assynchronous Activity-Final TermDocumento14 pagineName: Date: Professor: Section: Score: Assynchronous Activity-Final TermkmarisseeNessuna valutazione finora

- IA3 - Mid-Term Examination PDFDocumento3 pagineIA3 - Mid-Term Examination PDFAilene Quinto75% (4)

- MODAUD2 Unit 10 Audit of Revenues T31516Documento6 pagineMODAUD2 Unit 10 Audit of Revenues T31516mimi96Nessuna valutazione finora

- Consignment Sales 2Documento22 pagineConsignment Sales 2Mhelka Tiodianco33% (3)

- Millan ConsignmentDocumento5 pagineMillan Consignmenttonyalmon0% (1)

- Concept of Installment SystemDocumento5 pagineConcept of Installment Systemshambhuling ShettyNessuna valutazione finora

- PFRS 15 HandoutDocumento4 paginePFRS 15 HandoutNye NyeNessuna valutazione finora

- DocxDocumento4 pagineDocxKimmy Shawwy0% (1)

- Finals Quiz 2Documento6 pagineFinals Quiz 2Soleil Sierra67% (3)

- Intermediate Examination: Group IiDocumento17 pagineIntermediate Examination: Group IisridharpenjarlaNessuna valutazione finora

- Abm General and Special JournalDocumento63 pagineAbm General and Special JournalEstelle Gammad33% (3)

- Case Study US CMA Revenue RecognitionDocumento6 pagineCase Study US CMA Revenue RecognitionG. DhanyaNessuna valutazione finora

- Receivable 1Documento2 pagineReceivable 1Laura OliviaNessuna valutazione finora

- Tan Tiong Bio V BirDocumento3 pagineTan Tiong Bio V BirKylie Kaur Manalon DadoNessuna valutazione finora

- Deduction - Losses - CharitableDocumento12 pagineDeduction - Losses - CharitableVictor LimNessuna valutazione finora

- CA Foundation Accounts RTP Nov22Documento29 pagineCA Foundation Accounts RTP Nov22adityatiwari122006Nessuna valutazione finora

- Federal Income Tax Outline 2021 AH FINALDocumento71 pagineFederal Income Tax Outline 2021 AH FINALAndrea Healy100% (1)

- Chapter 5 Accounting For Merchandising OperationsDocumento15 pagineChapter 5 Accounting For Merchandising OperationsSantun Pi TOen100% (2)

- IFRS 15 QuestionsDocumento6 pagineIFRS 15 QuestionsSahilPatelNessuna valutazione finora

- Tan Tiong Bio vs. CIR, G.R. No. L-15778, April 23, 1962Documento12 pagineTan Tiong Bio vs. CIR, G.R. No. L-15778, April 23, 1962KidMonkey2299Nessuna valutazione finora

- Banking Products & Services IIDocumento39 pagineBanking Products & Services IIAinnur HaziqahNessuna valutazione finora

- MCQ Accounting StandardDocumento13 pagineMCQ Accounting StandardNgân GiangNessuna valutazione finora

- Sale ContractDocumento4 pagineSale ContractNhung NguyễnNessuna valutazione finora

- PadDocumento6 paginePadAfser Sid RubelNessuna valutazione finora

- MT - Assignment 01 StudentsDocumento2 pagineMT - Assignment 01 Studentspatburner1108Nessuna valutazione finora

- Journalizing The Transactions in A Merchandising Business: Quarter 2 - Week 4Documento26 pagineJournalizing The Transactions in A Merchandising Business: Quarter 2 - Week 4Marchyrella Uoiea Olin Jovenir100% (4)

- At 31 May 20X7 RobertaDocumento6 pagineAt 31 May 20X7 RobertaTrung Anh NguyenNessuna valutazione finora

- 01 - Accounting For Trades and Other ReceivablesDocumento5 pagine01 - Accounting For Trades and Other ReceivablesCatherine CaleroNessuna valutazione finora

- Hire PurchaseDocumento3 pagineHire PurchaseQuestionscastle FriendNessuna valutazione finora

- Consignment Account Doc 2Documento13 pagineConsignment Account Doc 2subhankar fcNessuna valutazione finora

- Forum ACC WM - Sesi 3 (REV)Documento9 pagineForum ACC WM - Sesi 3 (REV)Windy Martaputri100% (2)

- 6.1 Business Regulations Case Studies With Solutions 2022Documento8 pagine6.1 Business Regulations Case Studies With Solutions 2022sicarda61Nessuna valutazione finora

- BCOM FA Unit-2Documento44 pagineBCOM FA Unit-2Kavitha aradhyaNessuna valutazione finora

- KẾ TOÁN QUỐC TẾ NÂNG CAO - ÔNDocumento7 pagineKẾ TOÁN QUỐC TẾ NÂNG CAO - ÔNcamnhu622003Nessuna valutazione finora

- Contract For International Sale of Goods: Seller Cataclysm Equipment LTDDocumento6 pagineContract For International Sale of Goods: Seller Cataclysm Equipment LTDK59 Ngo Thi Tra LyNessuna valutazione finora

- 2022 FinalsDocumento49 pagine2022 FinalsJane GaliciaNessuna valutazione finora

- Tan Tiong Bio Vs CIRDocumento2 pagineTan Tiong Bio Vs CIRDan Locsin50% (2)

- Ch20 Questions and Problems AnswersDocumento7 pagineCh20 Questions and Problems AnswersFung PingNessuna valutazione finora

- PUP Review Handout 3 OfficialDocumento2 paginePUP Review Handout 3 OfficialDonalyn CalipusNessuna valutazione finora

- Foundations in Financial ManagementDocumento17 pagineFoundations in Financial ManagementchintengoNessuna valutazione finora

- Problems: Problem 1-1Documento4 pagineProblems: Problem 1-1Gwen Cornet Pugal Alimo-ot0% (1)

- ADocumento7 pagineAAyad Abdelkarim NasirNessuna valutazione finora

- PPE and Inventory-For DiscussionDocumento8 paginePPE and Inventory-For DiscussionAndrea Gail GatpandanNessuna valutazione finora

- Chapter 4 Bad DebtsDocumento5 pagineChapter 4 Bad DebtsDeveender Kaur JudgeNessuna valutazione finora

- Intacc FinalsDocumento81 pagineIntacc FinalsargoNessuna valutazione finora

- Meter Reading Billing Cash Collections and Credit Management For Electricity Supplies in NigeriaDocumento10 pagineMeter Reading Billing Cash Collections and Credit Management For Electricity Supplies in Nigeriajoseph KogiNessuna valutazione finora

- Acctg For Special Transaction - Second Lesson PDFDocumento6 pagineAcctg For Special Transaction - Second Lesson PDFDebbie Grace Latiban LinazaNessuna valutazione finora

- Examples Self IFRS 9 PDFDocumento9 pagineExamples Self IFRS 9 PDFErslanNessuna valutazione finora

- Nguyễn Đăng Hồng Phúc - 20CNATMCLC03 Purchase And Sale ContractDocumento3 pagineNguyễn Đăng Hồng Phúc - 20CNATMCLC03 Purchase And Sale ContractPhúc NguyễnNessuna valutazione finora

- Ias 37 Provisions, Contingent Liabilities & Contingent AssetsDocumento12 pagineIas 37 Provisions, Contingent Liabilities & Contingent AssetsTawanda Tatenda HerbertNessuna valutazione finora

- Accounting For BanksDocumento4 pagineAccounting For BanksBrenda audrey SonfackNessuna valutazione finora

- MCQ Negotiable Instruments LawDocumento10 pagineMCQ Negotiable Instruments LawJustine Jay Casas Lope75% (4)

- Selection Process of SuppliersDocumento1 paginaSelection Process of SuppliersJustine Jay Casas LopeNessuna valutazione finora

- Case DigestsDocumento4 pagineCase DigestsJustine Jay Casas LopeNessuna valutazione finora

- Cir V. Solidbank Corporation: FactsDocumento3 pagineCir V. Solidbank Corporation: FactsJustine Jay Casas LopeNessuna valutazione finora

- Summary of MeasurementDocumento21 pagineSummary of MeasurementJustine Jay Casas LopeNessuna valutazione finora

- Zamora VDocumento9 pagineZamora VJustine Jay Casas LopeNessuna valutazione finora

- Case Digest PDFDocumento4 pagineCase Digest PDFJustine Jay Casas LopeNessuna valutazione finora

- Sales Training TemplateDocumento7 pagineSales Training TemplatewNessuna valutazione finora

- Strategic Plan On Al Abbas Cement LTDDocumento34 pagineStrategic Plan On Al Abbas Cement LTDRizwan Ahmed91% (11)

- Marketing Management (Chapter 14)Documento23 pagineMarketing Management (Chapter 14)Hamidul Islam100% (1)

- Bhogadi Road Near Birihundi Yesh Valley View LAYOUT - MysoreDocumento3 pagineBhogadi Road Near Birihundi Yesh Valley View LAYOUT - MysoreRanjan Patali JanardhanaNessuna valutazione finora

- Macon Beacon Calls Out Democrat Marshand Crisler For Playing The Race CardDocumento2 pagineMacon Beacon Calls Out Democrat Marshand Crisler For Playing The Race CardMajority In Mississippi blogNessuna valutazione finora

- Reyes vs. Lim, G.R. No. 134241, 11aug2003Documento2 pagineReyes vs. Lim, G.R. No. 134241, 11aug2003Evangelyn EgusquizaNessuna valutazione finora

- MamalateoDocumento12 pagineMamalateoKim Orven M. SolonNessuna valutazione finora

- Spin SellingDocumento45 pagineSpin SellingKammie100% (15)

- Ruby Introduction English FinalDocumento3 pagineRuby Introduction English Finalrazanym100% (1)

- CH 8Documento7 pagineCH 8sunanda88Nessuna valutazione finora

- Advertising CrosswordDocumento2 pagineAdvertising CrosswordDiego OrcajadaNessuna valutazione finora

- LinkedIn Templates by Brynne Tillman 1Documento10 pagineLinkedIn Templates by Brynne Tillman 1Kannan Srinivasan100% (1)

- GAP HistoryDocumento16 pagineGAP HistoryFrankie LamNessuna valutazione finora

- MBA711 - Answers To Book - Chapter 3Documento17 pagineMBA711 - Answers To Book - Chapter 3noisomeNessuna valutazione finora

- 21 Tips For Upselling Guest Rooms in Hotel Front OfficeDocumento2 pagine21 Tips For Upselling Guest Rooms in Hotel Front Officetesfaneh mengistuNessuna valutazione finora

- Production FlowchartDocumento58 pagineProduction FlowchartMukes RajakNessuna valutazione finora

- Agricultural Licensure Examination ReviewerDocumento31 pagineAgricultural Licensure Examination ReviewerRuebenson Acabal100% (13)

- Sales.07.Nietes V CADocumento3 pagineSales.07.Nietes V CAQuina IgnacioNessuna valutazione finora

- A Comparative Analysis of Kohl's Corporation and J.C. Penney CorporationDocumento18 pagineA Comparative Analysis of Kohl's Corporation and J.C. Penney Corporation2plump2cNessuna valutazione finora

- Excise Invoice Number GenerationDocumento35 pagineExcise Invoice Number GenerationNaveen Shankar MauwalaNessuna valutazione finora

- Offline Marketing SimplifiedDocumento54 pagineOffline Marketing SimplifiedRita AsimNessuna valutazione finora

- Sales Process Max NewDocumento67 pagineSales Process Max NewumeshrathoreNessuna valutazione finora

- BUS 306 Exam 2 - Fall 2012 (B) - SolutionDocumento14 pagineBUS 306 Exam 2 - Fall 2012 (B) - SolutionNguyễn Thu PhươngNessuna valutazione finora

- Candle BusinessDocumento15 pagineCandle BusinessBHAWANI SINGH TANWAR100% (2)

- INFOSYS Knowledge Transition PDFDocumento0 pagineINFOSYS Knowledge Transition PDFHemanta Kumar DashNessuna valutazione finora

- DivyaDocumento11 pagineDivyaRavi Kanth M NNessuna valutazione finora

- Organizational Study On ABTECDocumento15 pagineOrganizational Study On ABTECjaijailalNessuna valutazione finora

- Truearth Healthy Foods: Market Research For A New Product IntroductionDocumento19 pagineTruearth Healthy Foods: Market Research For A New Product IntroductionAnoop Biswas100% (1)

- SCM ExerciseDocumento4 pagineSCM Exercisemnbvqwerty0% (1)

- Prediction For Best Credit Card Best BrandDocumento17 paginePrediction For Best Credit Card Best Brandapi-355102227Nessuna valutazione finora

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryDa EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryValutazione: 4 su 5 stelle4/5 (26)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureDa EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureValutazione: 4.5 su 5 stelle4.5/5 (100)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeDa EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeValutazione: 4.5 su 5 stelle4.5/5 (90)

- The Master Key System: 28 Parts, Questions and AnswersDa EverandThe Master Key System: 28 Parts, Questions and AnswersValutazione: 5 su 5 stelle5/5 (62)

- Having It All: Achieving Your Life's Goals and DreamsDa EverandHaving It All: Achieving Your Life's Goals and DreamsValutazione: 4.5 su 5 stelle4.5/5 (65)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsDa EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsValutazione: 5 su 5 stelle5/5 (48)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurDa Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurValutazione: 4.5 su 5 stelle4.5/5 (3)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelDa EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelValutazione: 5 su 5 stelle5/5 (51)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthDa EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthValutazione: 4.5 su 5 stelle4.5/5 (1027)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizDa EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizValutazione: 4.5 su 5 stelle4.5/5 (112)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveDa EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNessuna valutazione finora

- Every Tool's a Hammer: Life Is What You Make ItDa EverandEvery Tool's a Hammer: Life Is What You Make ItValutazione: 4.5 su 5 stelle4.5/5 (249)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedDa EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedValutazione: 4.5 su 5 stelle4.5/5 (38)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderDa EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderValutazione: 4.5 su 5 stelle4.5/5 (60)

- Your Next Five Moves: Master the Art of Business StrategyDa EverandYour Next Five Moves: Master the Art of Business StrategyValutazione: 5 su 5 stelle5/5 (802)

- Entrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveDa EverandEntrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveValutazione: 4.5 su 5 stelle4.5/5 (89)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldDa Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldValutazione: 5 su 5 stelle5/5 (20)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleDa EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleValutazione: 4.5 su 5 stelle4.5/5 (48)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeDa EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeValutazione: 4.5 su 5 stelle4.5/5 (58)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyDa EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyValutazione: 5 su 5 stelle5/5 (22)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessDa EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessValutazione: 4.5 su 5 stelle4.5/5 (407)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessDa EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessValutazione: 4.5 su 5 stelle4.5/5 (25)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeDa EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeValutazione: 5 su 5 stelle5/5 (25)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andDa EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andValutazione: 4.5 su 5 stelle4.5/5 (709)

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberDa EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberValutazione: 5 su 5 stelle5/5 (39)

- Transformed: Moving to the Product Operating ModelDa EverandTransformed: Moving to the Product Operating ModelValutazione: 4 su 5 stelle4/5 (1)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyDa EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyValutazione: 4.5 su 5 stelle4.5/5 (300)

- Summary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoDa EverandSummary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoValutazione: 4 su 5 stelle4/5 (1)