Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Taxation in Chile

Caricato da

Javier Pérez MarchantCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Taxation in Chile

Caricato da

Javier Pérez MarchantCopyright:

Formati disponibili

INTERNATIONAL EXECUTIVE SERVICES

Thinking

Beyond Borders

Chile

kpmg.com

Chile

Introduction

As a general rule, any person domiciled or resident in Chile is

subject to income taxes on a worldwide basis. Individuals who

are neither resident nor domiciled in Chile pay taxes only on their

Chilean-sourced income.

Contact

Antonieta Rodriguez

KPMG in Chile

Director

T: +56 2 7981435

E: antonietarodriguez@kpmg.com

Catalina Droguett

KPMG in Chile

Senior

T: +56 2 7981415

E: cdroguett@kpmg.com

Cristin Posa

KPMG in Chile

Senior

T: +56 2 7981415

E: cristianposa@kpmg.com

Key messages

Foreigners with residence or domicile in Chile only pay taxes on their Chilean-sourced income for the first three years of

domicile after which taxes are levied on worldwide income.

THINKING BEYOND BORDERS: MANAGEMENT OF EXTENDED BUSINESS TRAVELERS

2012 KPMG International Cooperative (KPMG International), a Swiss entity. Member firms of the KPMG network of

independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

Income tax for individuals

As a general rule, any person domiciled or resident in Chile

is subject to income taxes on a worldwide basis. Individuals

who are neither resident nor domiciled in Chile pay taxes only

on their Chilean-sourced income.

Foreigners with residence or domicile in Chile will pay taxes

only on their Chilean-sourced income for the first three

years after their arrival in Chile. After this period has elapsed,

foreigners will be subject to income taxes on their worldwide

income. Chilean legislation establishes that this period might

be extended in certain circumstances, but in practice, this

extension is unusual.

Further, according to Chilean income tax law, Chilean-sourced

income is defined as the income derived from activities

performed or goods located in Chile. Thus, compensation

received for employment activities carried out within the

country should be considered as Chilean-sourced income,

and therefore be subject to taxes in Chile, regardless of the

nationality or residence status of the individual, and the place

of payment.

For tax purposes, resident status is acquired once an

individual has been in Chile for more than six consecutive

months in one calendar year, or six months consecutive

or not within two consecutive fiscal years. According to

Article 49 of the Chilean Civil Code the accounting of a fact

(time spent in Chile) must be analyzed within a certain

period, it will be accomplished if it is met by midnight of

the day before.

Chilean income tax law does not provide for a domicile

definition, but according to Article 59 of the Chilean Civil

Code, domicile requires residency in a property and the

intention to remain there. In accordance, Chilean IRS has

understood that an individual may acquire tax domicile in

Chile, for example, when he/she has moved to Chile with

their family, the person has purchased or rented a house in

Chile; their children attend a school in Chile; and the person

came to the country under a Chilean employment contract.

Accordingly, a person will acquire Chilean domicile once the

aforementioned requirements (residency and intention to

remain in it) are met.

On the other hand, if domicile is not acquired as the person

enters the country, the residency test should be analyzed to

determine the tax treatment in Chile.

Applicable taxation

Business travelers that are considered nonresident and

not domiciled in Chile for tax purposes will be subject to

nonresidents income tax (Additional Tax), which is levied at a

flat rate of 15 percent on the gross employment income, if the

activities can be qualified as technical or engineering work or

professional services that an individual renders through a report,

advice or plan development, rendered in Chile or abroad.

After seven months in Chile, the individual will be taxable

according to resident Chilean income taxes, and subject to

Second Category Tax (employment income tax), which has

progressive rates ranging from 0 to 40 percent on the net

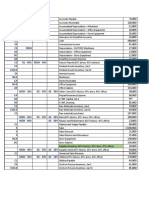

salary. Current tax rates are shown in the chart below and

amounts are listed in Chilean pesos (CLP). Please note that

the exact figures are updated on a monthly basis.

Second Category Tax (CLP) August 2012

Taxable base

Tax rate

Discount

CLP534,195.00

0%

CLP534,195.01

CLP1,187,100.00

5%

CLP26,709.75

CLP1,187,100.01

CLP1,978,500.00

10%

CLP86,064.75

CLP1,978,500.01

CLP2,769,900.00

15%

CLP184,989.75

CLP2,769,900.01

CLP3,561,300.00

25%

CLP461,979.75

CLP3,561,300.01

CLP4,748,400.00

32%

CLP711,270.75

CLP4,748,400.01

CLP5,935,500.00

37%

CLP948,690.75

CLP5,935,500.01

and more

40%

CLP1,126,755.75

From

To

CLP0

THINKING BEYOND BORDERS: MANAGEMENT OF EXTENDED BUSINESS TRAVELERS

2012 KPMG International Cooperative (KPMG International), a Swiss entity. Member firms of the KPMG network of

independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

For these purposes, accommodation, cost-of living

allowance, and most other fringe benefits are generally also

considered as taxable income for employment tax purposes.

However, in the computation of the net salary, the foreign

individual can deduct social security contributions paid in

Chile or abroad, and all non-taxable items.

It should be mentioned that social security

contributions paid abroad are deductible in Chile with

a cap of 60 Development Units (hereinafter UF) equivalent

to CLP1.353.569 at August 2012.

Social security mandatory

in Chile

Foreign individuals exempt from contributing to the

Chilean social security system

Legislation (Law No. 18.156) in Chile allows foreign

individuals and the companies that bring them to Chile, to

be exempt from making social security contributions in Chile

and to keep their affiliation to a foreign social security system,

when certain requisites are met.

In order to be exempt from contributing to the Chilean social

security system under Law 18.156, it is necessary to meet

the following requirements:

The foreign individuals must be affiliated to a foreign

social security system which provides benefits at least

equal to those minimum benefits provided by the Chilean

social security system, which covers for illness, disability,

retirement and death.

The foreign individual must declare their intention to keep

their affiliation to the foreign social security system for the

duration of their Chilean employment contract.

The foreign individual must have a technical or professional

degree, and this fact must be backed up with the

corresponding documentation.

The documentation required to support such an exemption,

according to instructions issued by the Pension Fund

Administration Commission, is a certificate from the

corresponding social security institution duly legalized,

officially translated, and registered with a Chilean Notary,

where it states clearly the obligations of that institution to

grant insurance for the four contingences (illness, disability,

retirement and death).

Finally, it is important to bear in mind that if the individual

does not fulfill the requisites to be exempt, and does not

contribute to the Chilean social security system, a penalty

of 5 Annual Tax Units (approximately CLP2,374,200) can be

imposed, which can be doubled if the individual commits

more than one infraction in a period of two years.

Please note that this exemption does not apply to the

payments made towards insurance related to labor accidents

and professional illness, nor to the contributions to be made

to the unemployment insurance.

Foreign social security contributions paid abroad receive

a similar treatment as those paid towards the Chilean

social security contributions, and therefore, they may be

deducted from the gross salary in Chile with a cap of 60

UF (approximately CLP1,353,569) for the calculation of the

individuals Chilean resident employment tax.

Foreign individuals who should contribute to the Chilean

social security system

In the case that the individual does not meet the requisites

of Law 18.156, they will have to contribute to the Chilean

social security system. As a general rule, employees

working in Chile are subject to the payment of social security

contributions, which are deducted from their gross salary

with certain caps. These contributions must be withheld by

the employer and are paid as follows:

10 percent to the pension fund administrator

7 percent to the health institution

These figures are calculated over the gross salary with a cap

of 67.4 UF per month (approximately CLP1,520,509). This

cap is adjusted annually, with consideration placed on the

variation of the real wage rate, determined by the National

Institute of Statistics.

In certain circumstances, a foreign individual who decides to

leave the country may seek reimbursement of funds provided

to the pension fund administrator, except the commission,

which must be analyzed on a case-by-case basis.

It should also be noted that private pension funds (AFP)

may request the respective new or different backgrounds

(i.e. any kind of information that the Private Pension Fund

Administrator may require, such as contributions of social

security abroad) in order to comply with Law No. 18,156,

authorizing the waiver or refund of the funds provided.

Finally, it is important to consider that the return of the

compulsory contributions and agreed deposits is subject to

the Second Category Tax (under Article 42 No.1 and Article 43

No. 1 of the Income Tax Law), and the return of the Voluntary

Pension Funds Savings Account B is subject to taxation under

Article 42 of the Income Tax Law, meaning that the AFP must

withhold the corresponding withholding income taxes.

Unemployment insurance and occupational accidents

According to Law No. 19.728 on unemployment insurance,

employers and employees will be obliged to make

contributions for unemployment insurance, even when

qualifying for the exemption under the Act discussed

above (18.156).

THINKING BEYOND BORDERS: MANAGEMENT OF EXTENDED BUSINESS TRAVELERS

2012 KPMG International Cooperative (KPMG International), a Swiss entity. Member firms of the KPMG network of

independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

The aforementioned unemployment insurance is calculated

as follows:

0.6 percent of taxable wages of the employee, paid by

the employee (with a cap of 101.1 UF, approximately

CLP2,280,763 as of August of the current year)

2.4 percent of taxable wages (with a cap of 101.1 UF) which

is a cost for the employer

contribution of the State, whose amount is determined

according to the rules established by law.

The funds corresponding to the contributions of employees

and employers should be paid to the management company

within the first 10 days of the following month in which

wages are paid.

When the contract is over, and to the extent that certain

requirements are met, the individual may be entitled

to withdraw contributions made to the unemployment

insurance.

Compliance obligations

Should the individual receive all or a portion of their

remuneration from a foreign country, the individual must

report and pay the corresponding taxes by completing Form

50 of Monthly Declaration and Simultaneous Payment, within

the first 15 days of the following month after the month

of payment, in the case of Second Category Tax, or within

the first 12 days in the case of Additional Tax (income tax

applicable to nonresidents or those domiciled in Chile).

If the individual receives compensation paid from a Chilean

employing entity, the employer will be responsible for

withholding, declaring and remitting the Chilean income tax

to the Chilean treasury.

Other issues

Below is a list of the countries with whom Chile has

conducted double taxation treaties.

It should be mentioned that a foreign individual who uses this

insurance while outside of the country will be charged in the

same way as a Chilean resident.

Finally, the employer must pay certain amounts for insurance

of occupational accidents and occupational diseases, which

corresponds to 0.95 percent calculated on the monthly

salary of the individual with a cap of 67.4 UF per month

(approximately CLP1,520,509). Additionally, the employer

must contribute 1.49 percent for insurance and disability to

the workers AFP, which is also calculated upon the same cap

of 67.4 UF.

Double Taxation Treaties with Chile: List of Countries

Argentina (only valid until

Ecuador

Paraguay

Belgium

Spain

Peru

Brazil

France

Poland

Canada

Ireland

Russia

Colombia

Malaysia

United Kingdom

Korea

Mexico

Sweden

Croatia

Norway

Thailand

Denmark

New Zealand

Switzerland

31 December 2012)

THINKING BEYOND BORDERS: MANAGEMENT OF EXTENDED BUSINESS TRAVELERS

2012 KPMG International Cooperative (KPMG International), a Swiss entity. Member firms of the KPMG network of

independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved.

kpmg.com/socialmedia

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual

or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is

accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information

without appropriate professional advice after a thorough examination of the particular situation.

2012 KPMG International Cooperative (KPMG International), a Swiss entity. Member firms of the KPMG network of independent

firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to

obligate or bind KPMG International or any other member firm vis--vis third parties, nor does KPMG International have any such

authority to obligate or bind any member firm. All rights reserved.

The KPMG name, logo and cutting through complexity are registered trademarks or trademarks of KPMG International.

Designed by Evalueserve.

Publication name: Thinking Beyond Borders Chile

Publication number: 121073

Publication date: November 2012

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- (Midterm-Second Week) Maam CJ Chris Ramtom: Technical English 1 (Investigative Report Writing and Presentation) Cdi 5Documento7 pagine(Midterm-Second Week) Maam CJ Chris Ramtom: Technical English 1 (Investigative Report Writing and Presentation) Cdi 5Givehart Mira BanlasanNessuna valutazione finora

- Transmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocumento2 pagineTransmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueLayne Kendee100% (2)

- v62 Form Honda CivicDocumento2 paginev62 Form Honda Civicdawudaaa9Nessuna valutazione finora

- Order in The Matter of M/s.Peers Allied Corporation LTDDocumento28 pagineOrder in The Matter of M/s.Peers Allied Corporation LTDShyam SunderNessuna valutazione finora

- Bilant in EngDocumento13 pagineBilant in EngDaniela BulardaNessuna valutazione finora

- Buehler Stoch Prop DividendsDocumento21 pagineBuehler Stoch Prop DividendserererehgjdsassdfNessuna valutazione finora

- Security Analysis and Port Folio Management: Question Bank (5years) 2 MarksDocumento7 pagineSecurity Analysis and Port Folio Management: Question Bank (5years) 2 MarksVignesh Narayanan100% (1)

- EDCH ServiceSheet EID Exchange E.1.0.1Documento1 paginaEDCH ServiceSheet EID Exchange E.1.0.1Baris AsNessuna valutazione finora

- Jamaican Citizenship by NaturalizationDocumento2 pagineJamaican Citizenship by Naturalizationtricia0910Nessuna valutazione finora

- Statutory Maternity Pay (SMP) : If You Are An EmployerDocumento4 pagineStatutory Maternity Pay (SMP) : If You Are An EmployerMahwish Ghafoor ChaudhryNessuna valutazione finora

- Income Tax RatesDocumento1 paginaIncome Tax RatesAcharla NarasimhaNessuna valutazione finora

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocumento1 paginaACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNessuna valutazione finora

- Hype Cycle For Supply Chain Management, 2009Documento65 pagineHype Cycle For Supply Chain Management, 2009ramapvkNessuna valutazione finora

- Repo Vs Reverse RepoDocumento9 pagineRepo Vs Reverse RepoRajesh GuptaNessuna valutazione finora

- Account Statement PDF 1620001413032 12 April 2019Documento57 pagineAccount Statement PDF 1620001413032 12 April 2019elisgretyNessuna valutazione finora

- Case Digest Cir Vs PNBDocumento2 pagineCase Digest Cir Vs PNBElyza Jane De Castro100% (2)

- InvocieDocumento1 paginaInvociepankajsabooNessuna valutazione finora

- August 19, 2016Documento16 pagineAugust 19, 2016Anonymous KMKk9Msn5Nessuna valutazione finora

- THE 10th INTERNATIONAL CONFERENCE ON ISLAMIC ECONOMICS AND FINANCE (ICIEF) Institutional Aspects of Economic, Monetary and Financial ReformsDocumento21 pagineTHE 10th INTERNATIONAL CONFERENCE ON ISLAMIC ECONOMICS AND FINANCE (ICIEF) Institutional Aspects of Economic, Monetary and Financial ReformsKhairunnisa MusariNessuna valutazione finora

- Pdic 2Documento6 paginePdic 2jeams vidalNessuna valutazione finora

- Business Plan Template-ECI11Documento21 pagineBusiness Plan Template-ECI11Mawada MawadaNessuna valutazione finora

- Directives by Sam Thomas Davies PDFDocumento53 pagineDirectives by Sam Thomas Davies PDFAlDobkoNessuna valutazione finora

- Bank Alfalah Clearance DepartmentDocumento7 pagineBank Alfalah Clearance Departmenthassan_shazaib100% (1)

- Bir RMC No 81-2012-Tax Treatment On Interest From Financial InstrumentDocumento4 pagineBir RMC No 81-2012-Tax Treatment On Interest From Financial InstrumentDuko Alcala EnjambreNessuna valutazione finora

- Accounting For Business Combination PART 1Documento30 pagineAccounting For Business Combination PART 1Niki DimaanoNessuna valutazione finora

- Marat Terterov-Doing Business With Russia (Global Market Briefings) (2004)Documento417 pagineMarat Terterov-Doing Business With Russia (Global Market Briefings) (2004)addaaaNessuna valutazione finora

- Training On Mutual Funds For AMFI Certification: Uma ShashikantDocumento162 pagineTraining On Mutual Funds For AMFI Certification: Uma ShashikantDEVAANSH LALWANINessuna valutazione finora

- Azur Metro ProjectDocumento9 pagineAzur Metro ProjectAmit BhatiaNessuna valutazione finora

- Cotton Greaves FinalDocumento34 pagineCotton Greaves FinalGautam KumarNessuna valutazione finora

- 06 Standards of Professional ... Ecommendations, and ActioDocumento15 pagine06 Standards of Professional ... Ecommendations, and ActioIves LeeNessuna valutazione finora