Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

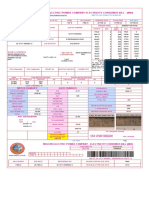

Form 16 TDS certificate for FY 2014-15

Caricato da

RamyaMeenakshiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Form 16 TDS certificate for FY 2014-15

Caricato da

RamyaMeenakshiCopyright:

Formati disponibili

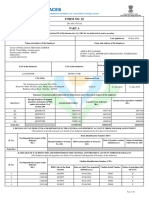

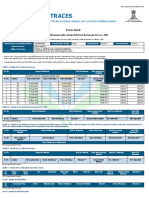

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. AEPTMDH

Last updated on

Name and address of the Employer

29-May-2014

Name and address of the Employee

BMW INDIA PRIVATE LIMITED

7TH FLOOR, BUILDING NO. 8, TOWER-B, PHASE-II,, DLF CYBER

CITY,

GURGAON - 122002

Haryana

+(91)124-124566622

Vaishali.Ahuja@bmw.co.in

BALAN SATHEESHKUMAR

D NO 17, SIVAMALAI PILLAI VEEDU, NANTHAVANA THERU,

TIRUCHENGODE, NAMAKKAL - 637211 Tamilnadu

PAN of the Deductor

TAN of the Deductor

AABCB7140C

RTKB03796C

PAN of the Employee

Employee Reference No.

provided by the Employer

(If available)

CEYPS9970M

CIT (TDS)

Assessment Year

The Commissioner of Income Tax (TDS)

C.R. Building, Sector 17 . E, Himalaya Marg Chandigarh - 160017

2014-15

Period with the Employer

From

To

01-Apr-2013

31-Mar-2014

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Q1

GYOXXQVB

69249.00

1620.00

1620.00

Q2

GPZXCTIA

63103.00

797.00

797.00

Q3

QASUGJQB

59588.00

415.00

415.00

Q4

QQPHDCNC

3.00

0.00

0.00

191943.00

2832.00

2832.00

Total (Rs.)

Amount of tax deposited / remitted

(Rs.)

Amount of tax deducted

(Rs.)

Amount paid/credited

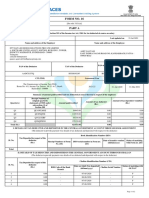

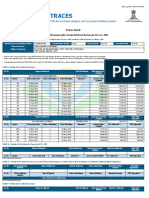

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher Status of matching

(dd/mm/yyyy)

with Form no. 24G

Total (Rs.)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

340.00

0510308

30-04-2013

02510

1120.00

0510308

31-05-2013

00868

160.00

0510308

28-06-2013

00546

504.00

0510308

05-08-2013

02612

Page 1 of 2

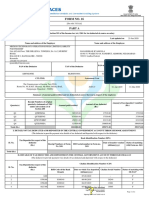

Certificate Number: AEPTMDH

Sl. No.

TAN of Employer: RTKB03796C

Tax Deposited in respect of the

deductee

(Rs.)

PAN of Employee: CEYPS9970M

Assessment Year: 2014-15

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

141.00

0004329

25-09-2013

16013

152.00

0510308

03-10-2013

01196

151.00

0510308

30-10-2013

00880

228.00

0510308

29-11-2013

00750

36.00

0510308

31-12-2013

00435

10

0.00

31-01-2014

11

0.00

27-02-2014

12

0.00

31-03-2014

Total (Rs.)

2832.00

Verification

I, SUBASH CHANDER, son / daughter of GANAPATHY working in the capacity of SENIOR GENERAL MANAGER HUMAN RESOURCES (designation) do hereby

certify that a sum of Rs. 2832.00 [Rs. Two Thousand Eight Hundred and Thirty Two Only (in words)] has been deducted and a sum of Rs. 2832.00 [Rs. Two Thousand

Eight Hundred and Thirty Two Only] has been deposited to the credit of the Central Government. I further certify that the information given above is true, complete

and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place

GURGAON

Date

31-May-2014

Designation: SENIOR GENERAL MANAGER HUMAN RESOURCES

(Signature of person responsible for deduction of Tax)

Full Name: SUBASH CHANDER

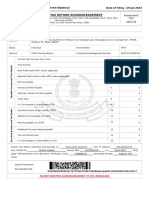

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend

Description

Definition

Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Digitally signed by SUBASH CHANDER

Date: 2014.05.31 15:28:25 +05:30

Location: Gurgaon

Page 2 of 2

Potrebbero piacerti anche

- Foreign Exchange Market: Introduction ToDocumento20 pagineForeign Exchange Market: Introduction ToTraders AdvisoryNessuna valutazione finora

- CASH APP HACK Get A Chance To Win 750$ Cash App MoneyDocumento6 pagineCASH APP HACK Get A Chance To Win 750$ Cash App Moneyالرجل الخفي مر من هناNessuna valutazione finora

- JPM CDO Research 12-Feb-2008Documento20 pagineJPM CDO Research 12-Feb-2008Gunes KulaligilNessuna valutazione finora

- Entropia Universe GuideDocumento164 pagineEntropia Universe GuidePeter Paul Baldwin Panahon100% (1)

- Pob Scheme of Work Form 4 - September To December 2021Documento8 paginePob Scheme of Work Form 4 - September To December 2021pratibha jaggan martinNessuna valutazione finora

- Form 16Documento2 pagineForm 16robin0903Nessuna valutazione finora

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocumento2 pagineForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9Nessuna valutazione finora

- Form 16-2017-18Documento4 pagineForm 16-2017-18Yaswitha SadhuNessuna valutazione finora

- QUA05242 Form16Documento5 pagineQUA05242 Form16saurabhNessuna valutazione finora

- Form 16 Salary CertificateDocumento9 pagineForm 16 Salary CertificateHarish KumarNessuna valutazione finora

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocumento1 paginaIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurupaappaapNessuna valutazione finora

- Kaushik Sarkar Form 16 DynProDocumento5 pagineKaushik Sarkar Form 16 DynProKaushik SarkarNessuna valutazione finora

- Credit Administration, MeasurementDocumento11 pagineCredit Administration, Measurementmentor_muhaxheriNessuna valutazione finora

- FORM 16 DETAILSDocumento2 pagineFORM 16 DETAILSKushal MalhotraNessuna valutazione finora

- Form No. 16: Part ADocumento7 pagineForm No. 16: Part AFuture ArtistNessuna valutazione finora

- Risk and ReturnDocumento19 pagineRisk and ReturnLeny MichaelNessuna valutazione finora

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocumento1 paginaIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDipak Ranjan RathNessuna valutazione finora

- Accounting and Finance For BankersDocumento89 pagineAccounting and Finance For BankersHewadsafi54% (13)

- Accounting and Finance For BankersDocumento89 pagineAccounting and Finance For BankersHewadsafi54% (13)

- Form 16 FY 18-19 PART - ADocumento2 pagineForm 16 FY 18-19 PART - Asai venkataNessuna valutazione finora

- PDF 691846850250723Documento1 paginaPDF 691846850250723Anish MishraNessuna valutazione finora

- Payment Slip Dec 2022Documento1 paginaPayment Slip Dec 2022alik17548Nessuna valutazione finora

- Itr 20-21Documento1 paginaItr 20-21Rohit kandpalNessuna valutazione finora

- Indian Income Tax Return Acknowledgement SummaryDocumento1 paginaIndian Income Tax Return Acknowledgement SummaryPradeep NegiNessuna valutazione finora

- Salary details and tax deductionsDocumento3 pagineSalary details and tax deductionsBALANessuna valutazione finora

- YourForm16 2022Documento8 pagineYourForm16 2022BHARATH MPNessuna valutazione finora

- Form No. 16: Part ADocumento6 pagineForm No. 16: Part Asamir royNessuna valutazione finora

- Itr 23-24Documento1 paginaItr 23-24addy01.0001Nessuna valutazione finora

- Form 16 Part B 2016-17Documento4 pagineForm 16 Part B 2016-17atulsharmaNessuna valutazione finora

- Form 16 651746Documento4 pagineForm 16 651746Arslan1112Nessuna valutazione finora

- CHAPTER 6 Caselette - Audit of InvestmentsDocumento30 pagineCHAPTER 6 Caselette - Audit of InvestmentsCharlene Mina0% (1)

- Deve 60398Documento7 pagineDeve 60398Devesh Pratap ChandNessuna valutazione finora

- Punjab Education Authority Salary StatementDocumento1 paginaPunjab Education Authority Salary StatementMuhammad Ahmad JavedNessuna valutazione finora

- Pre-Colonial AfricaDocumento75 paginePre-Colonial AfricaSean JoshuaNessuna valutazione finora

- Itr 2018-19 PDFDocumento1 paginaItr 2018-19 PDFMalik MuzafferNessuna valutazione finora

- Anil 21-22Documento2 pagineAnil 21-22chrisj 99Nessuna valutazione finora

- b5047 Form16 Fy1819 PDFDocumento9 pagineb5047 Form16 Fy1819 PDFBhumika JoshiNessuna valutazione finora

- Form 16 TDS CertificateDocumento9 pagineForm 16 TDS CertificateAmit GautamNessuna valutazione finora

- Ahxxxxxxxq q4 2022-23Documento2 pagineAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNessuna valutazione finora

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocumento1 paginaIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNessuna valutazione finora

- Form No. 16: Part ADocumento10 pagineForm No. 16: Part ARAJASHEKAR KYAROLLANessuna valutazione finora

- Selling Skills - Role PlaysDocumento10 pagineSelling Skills - Role PlaysPIYUSH RAGHUWANSHINessuna valutazione finora

- PDF 816776770290723Documento1 paginaPDF 816776770290723Sunita SinghNessuna valutazione finora

- IT@Intel: Developing An Enterprise Cloud Computing StrategyDocumento16 pagineIT@Intel: Developing An Enterprise Cloud Computing StrategyRamyaMeenakshiNessuna valutazione finora

- BLO Unit 1-1Documento24 pagineBLO Unit 1-1Mohammad MAAZNessuna valutazione finora

- Indian Income Tax Return Acknowledgement for Rs. 240,551Documento1 paginaIndian Income Tax Return Acknowledgement for Rs. 240,551maxNessuna valutazione finora

- Financial Institutions Management - Chap011Documento21 pagineFinancial Institutions Management - Chap011sk625218Nessuna valutazione finora

- PDFReportsDocumento6 paginePDFReportsDeeptimayee SahooNessuna valutazione finora

- A 40029127 Part-ADocumento2 pagineA 40029127 Part-Adeepak_cool4556Nessuna valutazione finora

- 14374752Documento2 pagine14374752Anshul MehtaNessuna valutazione finora

- PrintTax14 PDFDocumento2 paginePrintTax14 PDFarnieanuNessuna valutazione finora

- TDS certificate details for employeeDocumento2 pagineTDS certificate details for employeeravibhartia1978Nessuna valutazione finora

- Sungf9tIqDhAO64RjsPj Form16 PartADocumento2 pagineSungf9tIqDhAO64RjsPj Form16 PartARAJIV RANJAN PRIYADARSHINessuna valutazione finora

- Form 16Documento4 pagineForm 16Aruna Kadge JhaNessuna valutazione finora

- 1 1000 Form16Documento5 pagine1 1000 Form16Rakshit SharmaNessuna valutazione finora

- Indian Income Tax Return AcknowledgementDocumento1 paginaIndian Income Tax Return AcknowledgementSagar Kumar GuptaNessuna valutazione finora

- Form 16 ADocumento5 pagineForm 16 Anisha_khanNessuna valutazione finora

- Apfpm0726b 2019-20 (1527)Documento2 pagineApfpm0726b 2019-20 (1527)Basant Kumar MishraNessuna valutazione finora

- Form16 Till 14 Dec 2019Documento11 pagineForm16 Till 14 Dec 2019Aviral SankhyadharNessuna valutazione finora

- FORM 16 TDS CERTIFICATEDocumento8 pagineFORM 16 TDS CERTIFICATESaleemNessuna valutazione finora

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocumento2 pagineAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNessuna valutazione finora

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Documento3 pagineForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Lavanya MittaNessuna valutazione finora

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Documento2 pagineComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalNessuna valutazione finora

- FORM 16 TAX DEDUCTION CERTIFICATEDocumento2 pagineFORM 16 TAX DEDUCTION CERTIFICATEpiyushkumar patelNessuna valutazione finora

- Annual Tax Statement Form 26ASDocumento4 pagineAnnual Tax Statement Form 26ASMadhukar GuptaNessuna valutazione finora

- Pay Slip March 2017Documento4 paginePay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Documento4 pagineForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kapil KaroliyaNessuna valutazione finora

- Itr-V FKTPM7864L 2023-24 756976760270723Documento1 paginaItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNessuna valutazione finora

- 2019 10 01 16 36 43 414 - 1569928003414 - XXXPK7141X - Acknowledgement PDFDocumento1 pagina2019 10 01 16 36 43 414 - 1569928003414 - XXXPK7141X - Acknowledgement PDFAtul TiwariNessuna valutazione finora

- Acppk4010m 2018Documento4 pagineAcppk4010m 2018Rohit GuptaNessuna valutazione finora

- Form 16: Wipro LimitedDocumento5 pagineForm 16: Wipro LimitedRishabh PareekNessuna valutazione finora

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeDocumento2 pagineEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmNessuna valutazione finora

- Cfupm8774e 2016-17Documento2 pagineCfupm8774e 2016-17Sukanta ParidaNessuna valutazione finora

- Ahspy8053e 2014-15Documento2 pagineAhspy8053e 2014-15kzx08110Nessuna valutazione finora

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesDa EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNessuna valutazione finora

- No Place for Us? Finding Home in a Crowded CityDocumento9 pagineNo Place for Us? Finding Home in a Crowded Citysudhirvatsa100% (1)

- What If It Finishes... ?: A Bus JourneyDocumento10 pagineWhat If It Finishes... ?: A Bus JourneysudhirvatsaNessuna valutazione finora

- ChapterDocumento11 pagineChapterRamyaMeenakshiNessuna valutazione finora

- A Seed Shares a Farmer's StoryDocumento8 pagineA Seed Shares a Farmer's StoryRamyaMeenakshiNessuna valutazione finora

- Blow Hot, Blow ColdDocumento8 pagineBlow Hot, Blow ColdAshim ChakrabartyNessuna valutazione finora

- A Seed Shares a Farmer's StoryDocumento8 pagineA Seed Shares a Farmer's StoryRamyaMeenakshiNessuna valutazione finora

- JAIIB CorrectionsDocumento4 pagineJAIIB CorrectionsNive AdmiresNessuna valutazione finora

- Jaiib Updated Syllabus NewwwDocumento10 pagineJaiib Updated Syllabus NewwwMahesh NakhateNessuna valutazione finora

- General MSME Frequently Asked Questions: Manufacturing SectorDocumento33 pagineGeneral MSME Frequently Asked Questions: Manufacturing SectorRamyaMeenakshiNessuna valutazione finora

- JAIIB CorrectionsDocumento4 pagineJAIIB CorrectionsNive AdmiresNessuna valutazione finora

- Trial Leave PlanDocumento7 pagineTrial Leave PlanRamyaMeenakshiNessuna valutazione finora

- 1Documento2 pagine1RamyaMeenakshiNessuna valutazione finora

- Trial Leave PlanDocumento7 pagineTrial Leave PlanRamyaMeenakshiNessuna valutazione finora

- How To Create Your Own Private Cloud?: Let's ImplementDocumento8 pagineHow To Create Your Own Private Cloud?: Let's ImplementRamyaMeenakshiNessuna valutazione finora

- Eyeos-Installation ManualDocumento6 pagineEyeos-Installation ManualprovaNessuna valutazione finora

- Unit - IiiDocumento45 pagineUnit - IiiAnonymous DQGLUZxHNessuna valutazione finora

- MEPCO ONLINE BILL KamiDocumento1 paginaMEPCO ONLINE BILL KamiMisali SchoolNessuna valutazione finora

- Depreciation and Error Analysis A Depreciation Schedule For Semi PDFDocumento1 paginaDepreciation and Error Analysis A Depreciation Schedule For Semi PDFAnbu jaromiaNessuna valutazione finora

- Chap 012Documento77 pagineChap 012sucusucu3Nessuna valutazione finora

- 3B Binani GlassfibreDocumento2 pagine3B Binani GlassfibreData CentrumNessuna valutazione finora

- Periodic Method-Joseph MerchandiseDocumento8 paginePeriodic Method-Joseph MerchandiseRACHEL DAMALERIONessuna valutazione finora

- Tata AIA Life Insurance Fortune Pro Unit Linked PlanDocumento13 pagineTata AIA Life Insurance Fortune Pro Unit Linked PlanabhilashrkNessuna valutazione finora

- Pay Slip For August 2023: Entero Healthcare Solutions LimitedDocumento1 paginaPay Slip For August 2023: Entero Healthcare Solutions Limitedkadamaniket7894Nessuna valutazione finora

- Global IME BankDocumento29 pagineGlobal IME BankSujan Bajracharya100% (2)

- Open Cloze ...... /15pts: Academic English Use of English Sample Test 60 MinDocumento5 pagineOpen Cloze ...... /15pts: Academic English Use of English Sample Test 60 MinKamillaJuhászNessuna valutazione finora

- Multinational Inventory ManagementDocumento2 pagineMultinational Inventory ManagementPiyush Chaturvedi75% (4)

- International Portfolio Investment Q & ADocumento7 pagineInternational Portfolio Investment Q & AaasisranjanNessuna valutazione finora

- Bank Service PricingDocumento12 pagineBank Service PricingworkulemaNessuna valutazione finora

- Jekale CM Consultancy: Financial Management FOR Construction ProjectsDocumento43 pagineJekale CM Consultancy: Financial Management FOR Construction ProjectskidusNessuna valutazione finora

- BBA LIBOR Strengthening PaperDocumento15 pagineBBA LIBOR Strengthening PaperJaphyNessuna valutazione finora

- Finance for Managers: Financial Markets GuideDocumento5 pagineFinance for Managers: Financial Markets GuidehonathapyarNessuna valutazione finora

- BSBFIA301 Maintain Financial RecordsDocumento7 pagineBSBFIA301 Maintain Financial RecordsMonique BugeNessuna valutazione finora

- Moniepoint Document 2023-07-28T05 05.xlaDocumento42 pagineMoniepoint Document 2023-07-28T05 05.xlacurtispengeleroyNessuna valutazione finora