Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Netflix What's Next?

Caricato da

Kristian VelascoCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Netflix What's Next?

Caricato da

Kristian VelascoCopyright:

Formati disponibili

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Group Case Study 1: Netflix: What Comes Next? A Group Case Analysis

Jennifer Glasscock, Rishona Grant, Sean Grove, and Kristina Velasco: Group 3

BUSI 690-07

April 12, 2015

Liberty University

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Executive Summary- Netflix, Incorporated.

Netflix is currently a leader in the home video rental market. Netflix desires to find the

best ways to attract and retain customers. Currently, at $7.99 a month for service, Netflix offers

an extremely low cost alternative to cable television, which can cost as much as $100 a month

for a basic package. Netflix not only has a low-cost strategy but a differentiation strategy as well.

The current cable market forces customers to pay for items they do not want, while Netflix offers

customers an abundance of shows and movies that a customer can watch at any time without

being forced to see what they do not want. Netflix is also an ideal choice for families who want

wholesome family viewing because they can choose to watch only shows and movies that they

approve of, without other various channels streaming content they do not want to watch or is not

appropriate for their beliefs. Netflix faces challenges related to incurring higher costs for

specialized licensing agreements, which enable the company to provide customers such a broad

range of movies and television shows. The movie industry also faces constant turmoil with

changes in technology and consumer preferences, which could mean that Netflix will have to

develop new movie formats or streaming technology in order to remain competitive. Netflix will

continue to seek the best talent and provide an innovative and creative HR philosophy in order to

retain such talent.

The following paper seeks to analyze the internal and external environment, as well as

the strategy of Netflix. The current missions and objectives will be shared and a new mission will

be provided. In an effort to thoroughly assess this company the following analysis will be

completed; SWOT analysis, BCG analysis, and competitor analysis. Also financial

documentation will be provided to support the new strategy of Netflix reallocating resources

from the declining DVD department to the increasingly popular streaming business.

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Current Mission Statement

Netflixs current mission statement is,Netflix is the worlds leading Internet television

network with over 57 million members in nearly 50 countries enjoying more than two billion

hours of TV shows and movies per month, including original series, documentaries and feature

films. Members can watch as much as they want, anytime, anywhere, on nearly any Internetconnected screen. Members can play, pause and resume watching, all without commercials or

commitments. (http://ir.Netflix.com/).the inline cite must match what you use at the beginning

of your reference

Netflix Existing Mission Components

The following nine components make up Netflixs mission and capabilities.

a. Customer: Netflix customers are any man, woman, or child who enjoys watching movies

or shows on demand

b. Products or services: Netflix provides digital entertainment through television shows and

movies

c. Markets: The firm currently competes in North America, Latin America, and certain areas

within Europe

d. Technology: The firm is current on technology, as it offers videos and television shows

through online digital streaming.

e. Concern for survival, growth, and profitability:

Netflix has many concerns regarding their ability to remain a strong and profitable

company. Among those are the following concerns, as listed in the 2013 Annual Report.

Objectives/Existing StrategiesNetflix must be able to attract and retain customers. They

must be able to compete effectively through price and desired customer selections. They

have licenses with studios which are costly to maintain, and if the content does not

3

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

resonate well with consumers, the company will lose money because the agreement with

the studios cannot be abandoned. Netflix must continue to build and maintain brand

recognition. They use Facebook and Twitter as a means of mass advertising, and have

reduced expenditures in other forms of marketing, such as television and print ads.

However, licensing for copyrights continues to increase, so where Netflix may save

money in one area such as marketing, the company still incurs higher expenses in

licensing. In addition to the high costs to obtain copyright licenses, if Netflix wants to

continue to expand offerings and have a larger role in the selection of programming, the

company will likely be asked to contribute funds to production costs. Another primary

concern is that Netflix must be able to run off of the bandwidth in all areas to be able to

sustain the level of connectivity that consumers desire. There is a limited amount of

bandwidth available, and it is critical to Netflixs ability to provide a quality

entertainment experience to consumers. If consumers become dissatisfied over the ability

of their internet provider to be able to properly handle their expectation regarding internet

streaming, consumers may decide to drop Netflix service. Furthermore, there is a rapid

decline in a desire to use the United States postal service. The USPS is making cuts in

many places. Consumers who formerly enjoyed using the video rental service provided

by Netflix may decide it is too slow for them, especially with several options available

through cable and other services like Netflix. Customer privacy concerns remain an issue,

especially in terms of payment data being secured, to avoid problems with hackers and

personal information theft. Another issue cited by Netflix is the ability to pay debt.

Netflix seeks to pay several millions of dollars in indebtness.

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

f. Philosophy: Netflix philosophy is that they should be able to provide customers with the

best home video experience, whenever and wherever they are, with a selection that rivals

that of the competition in order to become a household commodity.

g. Self-concept: Netflix prides itself on the ability to satisfy nearly everyones tastes for

entertainment, from popular childrens programming, to favorite hit television series from

different generations, to popular new movies. They spend considerable time studying

popular programming to see what customers will want, as well as invest large amounts of

money in paying for licensure agreements to be able to offer the movies and television

show series they provide.

h. Concern for public image: Netflix is consumer-friendly with their low price strategy and

provide a more customized service for customers than cable. Netflix also makes it

possible for parents to sensor what children view, as television shows and movies have to

be ordered, and there are parental controls available. Netflix is careful not to pirate

movies or series, and is careful to continually monitor end dates on licensing agreements

and copyright

i. Concern for employees: Netflix is committed to keeping the best talent they have, and

continually seek to gain more highly qualified professionals. The company does this

through a revolutionary human resources program. Netflix does not have a formal

vacation policy for most employees (there is an exception for call-center and warehouse

employees) (McCord, 2014). A few of the guiding principles of Netflix talent

management program include the following: hire, reward, and tolerate only fully formed

adults; tell the truth about performance; managers own the job of creating great teams;

leaders own the job of creating the company culture; good talent managers think like

business people and innovators first and like HR people last (McCord, 2014).

New Mission Statement

5

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Netflix exists as a household name in both the (C3) domestic (U.S.) and foreign markets

in the video-on-demand entertainment industry, due to our commitment to (C6) provide a vast

offering of (C2) popular television shows and movies when and where our customers want them,

providing a highly customizable experience. We offer digital streaming through cable and

mobile applications to a wide range of (C1) customers, young and old, who enjoy all genres of

television shows and movies through (C5) reliable and (C8) ethical licensing agreements and a

(C7) low price. Netflix strives to continue to provide a premier entertainment experience to our

customers through ensuring that we find the (C9) most talented employees and retain them with

an excellent benefits package and by fostering a highly independent and creative work

environment.

Business Model

As per Rothaermel (2013), the translation of strategy into action takes place in the firms

business model (p. 11). It would appear that customers would prefer the brick-and-mortar movie

rental places because of convenience, however, Netflix capitalized on their ability to fund

licensing agreements instead of operate brick-and-mortar stores. As a result Netflix can offer a

wider selection, at a low price. Netflix also exposed popular movie rental icon Blockbusters

system of charging late fees that were often of a higher price than the movie rental, which

angered customers (Cohan, 2013). Netflix used that to their advantage by offering a one set fee

for a month of movie rentals, with no late fees attached. The Netflix business model consists of

the following major components: key partners, key activities, value propositions, customer

relationship, channels, customer segments, cost structure, and revenue streams. (see Appendix

A).

Strengths, Weaknesses, Opportunities, and Threats of Netflix

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Evaluating the SWOT analysis of Netflix (see appendix B, C, and D) shows that the

company was able to capitalize on the weaknesses of the brick and mortar movie rental retailers

by providing consumers with a larger selection at lower price point.. When faced with the threat

of the cable television industry, Netflix gained an edge by paying millions of dollars into

copyright licensing agreements to have access to popular television shows and movies. Netflix

also realized consumers dissatisfaction with cable packages offered digital streaming through

game consoles and computer applications. These examples demonstrate how Netflix transformed

threats into opportunities. An example of how Netflix transformed a weakness into a strength is

the lack of a physical storefront and a large workforce of employees. Netflix utilizes the U.S.

Postal Service (USPS) for its movie deliveries. This helps keep costs low and keeps Netflix

from having to maintain a physical space. As a result, Netflix is able to pay for the licensing

agreements that make it highly successful. Netflix is not for the customer who wants every

television channel and the broadest cable television package available. Instead Netflix is for

budget-conscious, movie and T.V. show lovers who would rather customize their entertainment

programming experience rather than spend excessive amounts of money by paying for shows

that they do not want. Good...more detailed discussion of the SWOT component would be

useful. Detailed discussion of BCG goes here

Competitve Forces Analysis

A complete competive analysis involves the evaluation of Porters five forces. These five

forces include the threat of entry, the bargaining power of suppliers, the bargaining power of

buyers, the threat of substitutes, and the rivalry among existing competitors. In order to better

understand Netflixs positioning within the in video-on-demand industry (VOD) each of these

forces will be evaluated.

Threat of Entry

7

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

The threat of entry determines how easily it is for organization to enter into the VOD

industry. Entering into this market requires an extremely large amount of funds. Another issue

quality assurance. One of the concerns for customers is video quality. Advancing technology

makes this a small concern, since such technology is obtainable. Also the logistics required

within this industry prove that businesses with experience tend to be most successful. With these

factors in consideration the threat of entry is low.

Bargaining Power of Suppliers

The bargaining power of suppliers is high. There are a limited number of suppliers that

Netflix may purchase movies from. This is due to the fact that Netlfix must purchase movies

from various studios they were created at. An example of this is Netflix contract expiration with

Viacom, in which it lost popular shows from Nickelodeon and Nick Jr. such as SpongeBob

SquarePants (Chozick, 2013). Since these studios are the sole creator of the movies that Netflix

wish to purchase they are able to set prices as they see fit in order to maximize their profits. One

way that Netflix has tried to lessen the power of suppliers is by creating several television serios

on their own (Cohan, 2013).

Bargaining Power of Buyers

Buyer power refers to the ability of buyers to place pressure on producers within an

industry (Rothaermel, 2013). The bargaining power of buyers is moderate. Although no one

individual buyer can influence the industry, loyalty and reputation within this industry is

important for success. Customers that are more sensitive to price have several options to choose

from. Even more so since movie watching is not a necessity, elminiating cost is not an option and

switching prices is very minimal.

Threat of Substitutes

The threat of substitutes occurs when another product and/or service is able to replace

what Netflix offers. This could be due to comparable costs, value, and availability. Netflix faces

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

several alternatives which include store retails, online retailers, on-demand, pay-per-view,a nd

movie theaters.

Rivalry Among Existing Competitiors

There are many different firms within the industry and that there are a variety of

alternatives that consumers can watch movies from. Advancing technology has increased the

competition that Netflix faces from competitors. Cable service providers, Blockbuster, Amazon,

Hulu, Redbox and even illegal downloading from internet sites are all rivals that Netflix are up

against. Also, the reality is that there isnt much differientation between all of these competitors.

The BCG Matrix misplaced

The BCG Matrix shown in Appendix E shoe four distinctive sections: the star, the cash

cow, the question mark, and the dog. On the right side we see the star and cash cow; outlets that

bring the most profit to Neflix. Netflix's streaming service is clearly the cash cow. Available on

devices such as internet connected TVs, Blu-ray disc players, game consoles, computers,

smartphones, and tablets, these are Netflix's streaming services that are accessible to 30 million

members globally.

Competitive Profile Matrix and Analysis

The Competitive Profile Matrix developed measures Netflix against two of its

competitors, Amazon Prime and Redbox. This Competitve Profile Matrix uses 12 factors to

measure against; partnerships, product offerings, customer service, store locations, rental time,

advertising, , customer loyalty, market share, product quality, ease of use, and competitive

pricing. (see Appendix F). This analysis reveals that among the three companies Netflix leads in

areas of product offerings, market share, product quality, and global expansion. On the other

hand Amazon Prime excels in customer service, rental time, enabled devices, , and customer

loyalty. Redbox ranked highest in pricing, financial position, and ease of use. Although for the

purposes of the Competitive Profile Matrix these companies may appear to have low ranks each

of them hold a strong competitive positioning.

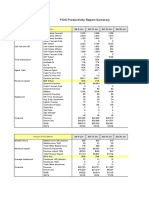

Competitors Ratio Analyis

9

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

The ratios of Amazon Prime, Redbox, and Netflix provide some insight into how these

businesses stand against one another. (see Apendix G). In terms of current and quick ratio Netflix

appears to be stronger than both Amazon Prime and Redbox, which means Netflix can pay back

debt more quickly. The Return on Equity (ROE) is highest at Redbox and lowest at Amazon. The

net profit margin ratio complete shows that Redbox brings in more profit after expenses than

Netflix and Amazon Prime. Between all the companies Amazon Prime had the highest total asset

turnover, with Redbox coming in second indicating that how well use their assets to create

revenue.

Current and Historical Financial Statements Analysis

Netflixs gross profit has progressively increased in the last three years, whereas the net

income has increased tremendously over this period by an overall percentage of 83%. (see

Appendix H). This has resulted from the record 13.0 million new members in 2014, compared to

the 11.1 million that were inquired in 2013 domestically. Also, the introduction of two additional

higher priced membership plans has played a role in increased revenues.

Another substantial increase has been in their operating income from $50K in 2012 to a

little over $400k in 2014. This is partially offset by the increase in cost of revenues due to the

increase in licensing expenses for current as well as new streaming content provided to its

customers. paragraphs need to be 3 7 sentences

The interest expense has had a significant increase, 72% in 2013, and 45% in 2014 which

results from the increased long-term debt obligations and the amortization of debt issuance costs

as seen on the Cash Flow statement (see Appendix I). In the cash flow statement, the amount of

operating expenses has increased since 2012, and is a trend that if foreseen to continue. As stated

above, the more content Netflix acquires, the more expenses they incur due to licensing costs

10

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

associated with the rights to stream content to their viewers. Operating expenses overall has gone

from $4K in 2012, to $-250K in 2014.

The cash flow from investing activities has recovered with an 83% increase in 2014

compared to 2013, providing Netflix with less of a loss in that area. In 2013, the net cash

provided by financing obligations saw an astonishing increase from a little over $5K in 2012, to

almost $500K in 2013. This flowed in 2014 with a slightly higher increase of 13.74%.

As seen on the balance sheet (see Appendix J) the overall total assets continue to increase

of about an average of 30% each year, whereas a significant increase has been the total

stockholders equity by 79% from 2013 to 2014. This is mainly due to the increase in paid-in

capital with a 157.76% increase from 2013 to 2014.

Current and Historical Ratio Analysis

The following section will analysis the financial rations of the past and present. (See

Appendix K). Each ratio will be evaluate and its releveancy will be explained.

Current Ratio

The current ratio in 2012 was 1.3 and has increase every year to 1.5 in 2014. The current

ratio is a measure of a companys ability to pay back its short term debts. The higher the ratio is

over 1 the more liquid the company is and shows a greater ability to pay its debts over the next

12 months. However, Netflix needs to increase its liquidity to improve it position if seeking

capital on a short-term basis.

Quick Ratio

The quick ratio is similar to the current ratio with the exception that inventory is excluded

and measures of a companys ability to pay its debts immediately. The quick ratio for Netflix was

1.3 in 2012, 1.4 in 2013, and 1.5 in 2014 respectively. This shows that Netflix has the ability to

11

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

convert its current assets into cash to pay off short term debt immediately if needed, but this

needs to improve.

LTD to Equity/ Debt-to-equity (D/E) ratio

Essentially, the D/E ratio is the measure of a companys current book value. In 2012,

Netflix had a D/E ratio of 1.4 which means that Netflix had 1 dollar and 40 cents of debt to every

1 dollar of equity. This was reduced in 2013 to 1 dollar of debt to every dollar of equity. This

trend continued in 2014, where Netflix only had 80 cents of debt to every 1 dollar of equity. This

signifies that Netflix is not very leveraged and has reduced the amount of debt it is incurring to

grow.

Total Asset turnover ratio

The total asset turnover measures a companys ability to generate sales using its assets.

The higher the ratio, the more efficiently a company is using its assets. Netflix had .9 total asset

turnover ratio in 2012, followed by .8 in 2013 and 2014, respectively. This ratio fluctuates

greatly between industries but it does imply that Netflix may need to adjust the way it uses it

assets to create sales.

Gross Profit Margin ratio

The gross margin ratio examines the amount of money a company gains for every dollar

that it earns. Companies with a higher gross profit margin tend to be more profitable than

companies with lower margins. However, this is highly contingent on other factors. Netflix had a

.3 gross profit margin for 2012, 2013, and 2014, respectively. This means that for every dollar in

revenue that Netflix earned, it only took in 30 cents of it. This indicates that its cost of revenue is

too high and it would be beneficial for the company to find ways to cut cost.

Net Profit Margin Ratio

12

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Net profit margin ratio tells what percentage a company actually earns after all expenses

are paid out. Netflix did not earn enough net income in any of the 3 years analyzed to register a

ratio .1 or above. This indicates that over the period of 2012-2014, Netflix was not very

profitable.

Return on Equity Ratio

The return on equity ratio analyzes how much profit was made from its investors money.

Netflix was able to generate about 10% in returns for its stockholders in 2013 and 2014. In 2012,

the percentage was less than 10% and did not return a ratio value.

Alternative Strategies

Netflix has the opportunity to source for the infrastructure and technology to provide

VOD services to its customers. Moreover, it is even better for the company since it can first

review its competitors VOD structure and develop better and stronger VOD services that are not

prone to limitations facing its competitors (Kriete, 2013). Netflixs online infrastructure mainly

used for online customers could also be used to provide VOD online. This would see the

decrease in problems such as damaged or lost DVDs.

With the continuous growth in technology, the world keeps changing erratically and

exponentially. Bearing that in mind, Netflix should adapt strategies that will see it remain

relevant even with the continuous changes in technology being witnessed daily. One of the

recommendations that Netflix should adapt is the second screen engagement. Second screen in

the entertainment industry basically means the emergence of tablets and smart phones. These

electronic devices are now commonly serving as extensions of consumers primary watching

mechanisms. Research indicates that more than 80% of smart phone and tablet owners report use

their devices while watching TV (Kriete, 2013) . For example one may be watching a movie

13

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

while at the same time gathering information about it in Wikipedia. Having shown interest in this

technology, Netflix should fully embrace it since it would go a long way in increasing their client

base. Moreover, this technology if fully adapted will greatly impact Netflix growth since their

apps among the largest in the sector.

Pro-forma Financial Statement Analysis

The proposed strategy is to move Netflix completely out the struggling DVD mail

subscription segment and focus on the streaming content segment. Evaluating this strategy

against the current strategy shows that there would be 17 percent more cash available in 2015, 24

percent more in 2016, and 26 percent more in 2017. (see Appendix L). This is accomplished by

the cash accumulated from the sales of DVD equipment and properties, and the proceeds from

sale of the DVD content library. This extra cash flow enables Netflix to become more liquid and

creates greater revenue than the current strategy.

Evaluating the proposed strategy against the current strategy of Netflix over the next 3

years (2015-2017) the income statement of both strategies are both profitable. However, the

proposed strategy would cut down the cost of revenue by 3.5 percent in the first year (2015), 6.5

percent in the second year (2016), and 9.7 percent in the last year (2017), while increasing

revenue by 1.8, 3.3, and 4.4 percent in 2015, 2016, and 2017 respectively. (see Appendix M).

This is increase and revenue and decrease in cost would yield 11 percent greater gross profit in

year one (2015), 20 percent greater in year two (2016), and 26 percent in the final year (2017).

Furthermore, there would be a reduction of 8 percent in 2015 in sales, general and admin with

the implementation of the proposed strategy. In the years 2016 and 2017, sales, general and

admin would be 15 and 22 percent lower than the current proposed strategy. These factors add up

14

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

to a 50 percent increase in net income in the first year (2015), 74 percent in the second year

(2016), and 86 percent increase in the last year (2017) over the current strategy.

Overall, this translates to higher shareholder equity on the balance sheet, which would be

24.6 percent higher in 2015, 44.8 percent higher in 2016, and 71 percent higher in 2017. (see

Appendix N). Although the proposed strategy would reduce total assets by 15.2 percent in 2015,

14.4 percent in 2016, and 9.2 percent in 2017, it would produce greater return on those assets

and increase the overall value of Netflix.

Pro-forma Ratios (Proposed Strategy vs. Current Strategy) Analysis

When the current strategy of Netflix is compared to the proposed strategy, the most

critical financial ratios favor the new proposed strategy. This is especially true when evaluating

the current and quick ratios over 2015-2017. (see Appendix O ).The current strategy would yield

a 1.5 current and quick ratio over that time span. Whereas, the proposed strategy would produce

a .3 increase over the current strategies 1.5, which totals a current and quick ratio of 1.8 in 2015.

This grows another.3 to 2.1 in 2016 and another .3 in 2017 to bring the current and quick ratio to

2.4 by the end of 2017. Also, the debt to equity ratio is .1 lower with the proposed strategy in

2015 and .2 lower in 2016 and 2017 than the current strategy employed. Furthermore, gross

profit margin is .1 higher for each year with the proposed strategy. Due to the rounding of

millions, it is unclear of the additional benefit provided by the proposed strategy over the current

strategy when evaluating net profit margin, return on assets, and return on equity.

Recommended Strategy Excellent

The proposed strategy of increasing revenue for Netflix is to reallocate resources from

the DVD department to the streaming business where the resources are needed. The DVD

business is slowly becoming obsolete.

15

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Formula: (see Appendix Q)

Where C0 = 314, 674 (Total Cash flows for 2013 from Operating, Investing and Financing

Activities (314,000,000)

Ct = Future expected cash flows to 2017 (2,000,000,000)

T = Time period of four years from 2013 to 2016 (4 Years)

R = Interest rate of 15%

NPV = 2,000,000,000 - 314,674

(1 + 0.15)4

= $ 828,832,000

After adopting the recommended strategies, Netflix net present value would total to

$828,832,000

Analysis

It is worth noting that after implementation of the strategy, income is expected to rise by

roughly 15% each year to 2016.

EPS = Total Earnings After Tax

Number of Ordinary Shares

EPS (2013) = 48,421,000

26,173,514

EPS (2014) = 55,684,150

26,173,514

EPS (2015) = 64,036,775

26,173,514

EPS (2016) = 73,642,288

16

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

26,173,514

EPS 2013 = 1.85

EPS 2014 = 2.13

EPS 2015 = 2.45

EPS 2016 = 2.81

The earnings per share would increase gradually from 1.85 in 2013 to 2.81 in 2016. The

specific recommended strategy for Netflix is to capitalize on its streaming business and exit the

DVD market strategically to help the customers in that department transit seamlessly from it to

the streaming department (Noren, 2013) following the suggested timetable (see Appendix P ).

This would ensure that the company retains a large proportion of its clients. The strategy is the

best for the company because it mitigate against the primary weakness of the company which is

loss of revenue from the DVD department due to sharply declining membership. The above

strategy will cost the company around three million dollars in marketing, upgrading present

infrastructure and investing in more infrastructure and technologies. The strategy is supposed to

yield the company about 15% growth in earnings for the next four years upon where the earnings

will plateau necessitating the adoption of a different strategy depending on the market situation

at that time. In other words, Netflix is worth more than it costsit makes a net contribution to

value.

Proposed New Model a bit more is needed to articulate value

As far as the Netflixs current strategy is concerned, the following two main points can be

considered as a new proposed strategy that can better assist in improving the firms ability to

reach its target market. The overall proposal has the focus in delivering a faster, on-demand, and

more convenient viewing experience. However, in this proposal, the structure in how the

technical core can structure a system to implement is the main objective.

17

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

1. The key is to meet the standards and exceed customer expectations, an extremely wellorganized facility distribution and provisions are necessary in order to deliver a consistent

and high-quality service to Netflix members.

2. As far as the subscription-based structure is concerned; a tooling situation is needed for

demonstrating and accumulating facility fundamentals (clear service descriptions, for

instance) as well as an operational means of handling the structural development.

18

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Appendicies

Appendix A very nice

19

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Appendix B good; just need verbiage a bit more in writeup

Appendix C

ExternalFactorEvaluationMatrix(EFE)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10

.

Opportunities

Strongtalentpool

Digitalageoftechnology

Videoondemandcapability

Reliablelicensingagreements

LowThreattoEntry

FreeAdvertisingavailable

CustomerServicerealtimereviews

Highcustomerdesire

Competitiveprices

Requirementtopartnerwithproductioncompanies

20

Weigh

t

0.05

0.05

0.05

0.05

0.05

0.05

0.05

0.05

0.05

0.05

Ratin

g

4

4

4

4

4

4

4

4

4

4

Weighted

Score

0.20

0.20

0.20

0.20

0.20

0.20

0.20

0.20

0.20

0.20

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Weigh

t

0.05

0.05

0.05

Ratin

g

4

2

2

Weighted

Score

0.20

0.10

0.10

1.

2.

3.

4.

Threats

Marketregulation

Issueswithtechnologyorbandwidth

Risingcostoftechnologyandinternetpricing

Abilitytosecurelicensingagreements

0.05

0.20

5.

6.

Declineinmailordersales

0.05

0.10

Innovationoffastertechnology

0.05

0.20

7.

8.

9.

10

.

Inabilitytosecurenewandskilledtalent

Copyrightlitigation

IssueswiththeUSPS

0.05

0.05

0.05

4

4

2

0.20

0.20

0.10

Issuesinpaymentprocessing

0.05

0.10

TOTALS

1.00

3.50

Appendix D You indicate that all element are equally important. Is this realistic?

1.

2.

3.

4.

5.

6.

7.

8.

9.

10

.

InternalFactorEvaluationMatrix(IFE)

Strengths

Strongbrandname

Excellentworkenvironment

Competitivepricing

Strongrelationshipswithproductioncompanies

Diverseproductselection

Expansionintoforeignmarkets

Providecustomizedcustomerexperience

Useoffreeadvertisingmedia

Abilitytooffervideoondemandthroughapps

Strongfinancialposition

Weigh

t

0.05

0.05

0.05

0.05

0.05

0.05

0.05

0.05

0.05

Ratin

g

4

4

4

4

4

4

4

4

4

0.05

0.20

Weigh

t

0.05

0.05

0.05

0.05

0.05

0.05

0.05

0.05

Ratin

g

2

1

1

1

2

1

1

1

Weighted

Score

0.10

0.05

0.05

0.05

0.10

0.05

0.05

0.05

Weighted

Score

0.20

0.20

0.20

0.20

0.20

0.20

0.20

0.20

0.20

Appendix D (continued)

1.

2.

3.

4.

5.

6.

7.

8.

Weaknesses

Longtermandfixednatureofcontentcommitments

Relianceuponstudiosandproductioncompanies

RelianceuponUSPS

RelianceuponserviceproviderstoofferNetflix

Abilitytoprotectintellectualproperty

Highriskoflawsuitsforpropertyrights

Abilitytoadapttochange

Vulnerabletopiracy

21

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

9.

10

.

Vulnerabletocyberattacks

0.05

0.05

Risktoshareholderopinionofdebt

0.05

0.10

TOTALS

1.00

2.65

Appendix E Need to use the one in our template link

Appendix F

Competitive Profile Matrix

Factors

Partnerships (Networks)

Product Offerings

Customer Service

Global Expansion

Rental Time

Enabled Devices

Financial Position

Weight

0.12

0.12

0.05

0.08

0.03

0.08

0.07

Netflix

4

4

2

4

3

3

3

22

Amazon Prime

3

3

4

3

4

4

2

RedBox

2

2

3

1

1

1

4

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Customer Loyalty

Market Share

Product Quality

Ease of use

Price Competitiveness

3

4

4

3

3

0.08

0.10

0.09

0.08

0.10

4

2

3

2

2

2

3

2

4

4

Ranking 1-4 (4= major strength, 3= minor strength, 2= major weakness, 1= minor weakness

Appendix G:

Amazon Prime

Netflix

RedBox

2013

2014

2012

2013

2014

2012

2013

2014

2012

1.1

1.1

1.1

1.3

1.4

1.5

1.0

1.1

1.1

0.8

0.7

0.8

1.3

-0.7

-0.4

1.0

1.1

1.1

0.4

0.3

0.8

0.5

0.4

0.5

0.6

1.3

10.0

10.1

10.0

10.7

1.9

1.9

1.6

0.9

0.8

0.8

1.4

1.2

1.5

0.2

0.3

0.3

0.3

0.3

0.3

0.3

0.3

0.3

0.0

0.0

0.0

0.0

0.0

0.0

0.1

0.1

0.0

ROA

0.0

0.0

0.0

0.0

0.0

0.0

0.1

0.1

0.1

ROE

0.0

0.0

0.0

0.0

0.1

0.1

0.3

0.3

1.1

Current

Ratio

Quick

Ratio

LTD to

Equity

Inventory

Turnover

Total

Asset

Turnover

Gross

Profit

Margin

Net Profit

Margin

Appendix H

23

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Appendix I

24

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Appendix J

25

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Appendix K

26

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Current and Historical Ratio Analysis

2012

2013

2014

Current Ratio

1.3

1.4

1.5

Quick Ratio

1.3

-0.7

-0.4

Long Term Debt to Equity

1.4

1.0

0.8

Inventory Turnover

0.0

0.0

0.0

Total Asset Turnover

0.9

0.8

0.8

Gross Profit Margin

0.9

0.8

0.8

Net Profit Margin

0.0

0.0

0.0

Return on Total Assets

0.0

0.0

0.0

Return on Equity

0.0

0.1

0.1

Appendix L

27

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Appendix M very well done

28

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Appendix N

29

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Appendix O

30

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

Pro forma Ratio Chart

Proposed Strategy

Current Strategy

2015

2016

2017

Current Ratio

1.8

2.1

2.4

1.5

1.5

1.5

Quick Ratio

1.8

2.1

2.4

1.5

1.5

1.5

Long Term Debt to

Equity

0.4

0.3

0.3

0.5

0.5

0.5

Inventory Turnover

0.0

0.0

0.0

0.0

0.0

0.0

Total Asset Turnover

0.9

0.9

0.8

.8

0.7

0.7

Gross Profit Margin

0.4

0.4

0.5

0.3

0.4

0.4

Net Profit Margin

0.1

0.1

0.1

0.1

0.1

0.1

Return on Total Assets

0.1

0.1

0.1

0.0

0.0

0.1

Return on Equity

0.2

0.2

0.2

0.2

0.2

0.2

Appendix P

31

2015

2016

2017

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

NPV Analysis

2015

2016

2017

Outflow

$10,450

$0

$100

Inflow

$94,308

$1,03,904

$1,25,947

Cash Flow

$83,858

$1,03,904

$1,25,847

10%

$1

$1

$1

NPV

$76,227

$85,825

$94,511

PVF @

Appendix Q

32

Running head: CASE ANALYSIS 1-NETFLIX GROUP 3

References

Amazon.com, Inc. (2015). About Amazon Prime. Retrieved on April 9, 2015. Retrieved from:

http://www.amazon.com/gp/help/customer/display.html?nodeId=200444160

Chozick, A. (2013, June 4). In Viacom Deal, Amazon Scoops Up Childrens Shows.

NY Times. Retrieved from: http://www.nytimes.com/2013/06/05/business/media/viacomstrikes-deal-with-amazon-to-stream-childrens-shows.html?_r=0

Cohan, P. (2013, April 23). How Netflix Reinvented Themselves. Forbes. Retrieved from:

http://www.forbes.com/sites/petercohan/2013/04/23/how-Netflix-reinvented-itself/

Kriete, L. (2013). NETFLIX Strategic Plan .NETFLIX .Retrieved from:

https://lpelin.expressions.syr.edu/trf483/files/2013/05/final_strategic_report.pdf

McCord, P. (2014). How Netflix reinvented HR. Harvard Business Review [Online]. Retrieved

from https://hbr.org/2014/01/how-Netflix-reinvented-hr

Noren, E. (2013). Analysis of the Netflix Business Model .Digital Business Models. Retrieved

from: http://www.digitalbusinessmodelguru.com/2013/01/analysis-of-Netflix-businessmodel.html

Netflix, Incorporated. 2013 and 2014 Annual Reports. Retrieved from

http://ir.Netflix.com/annuals.cfm

33

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Public Entertainer - TaxDocumento2 paginePublic Entertainer - TaxChong Sin LingNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- IMC Belch and Belch Chapter 1Documento20 pagineIMC Belch and Belch Chapter 1Sarah TaufiqueNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Redseer Consulting Report On Vernacular LanguagesDocumento36 pagineRedseer Consulting Report On Vernacular LanguagesMalavika SivagurunathanNessuna valutazione finora

- Dial v. Procter & Gamble - Purclean Trademark Complaint PDFDocumento38 pagineDial v. Procter & Gamble - Purclean Trademark Complaint PDFMark JaffeNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Mass Media in Pakistan by Raja KamranDocumento22 pagineMass Media in Pakistan by Raja Kamranwaqasaliwasti100% (12)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Cambridge International Advanced Subsidiary and Advanced LevelDocumento4 pagineCambridge International Advanced Subsidiary and Advanced LevelAsad Aasim AliNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- DEA Production Assistance AgreementsDocumento184 pagineDEA Production Assistance AgreementsSpyCultureNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Satellite TelevisionDocumento2 pagineSatellite TelevisionDorin LunguNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Iptv Content DeliveryDocumento29 pagineIptv Content DeliveryangelpyNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Service Quality and Customer Satisfaction in The Pay TV Industry: A Case Study of Multichoice Zambia LimitedDocumento6 pagineService Quality and Customer Satisfaction in The Pay TV Industry: A Case Study of Multichoice Zambia LimitedNowshin FarhinNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- FTTH Business Guide 2012 V3.0 English PDFDocumento83 pagineFTTH Business Guide 2012 V3.0 English PDFAmr AwadElkairm Abdalla100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Inform-Entertain-Attract or Die!Documento3 pagineInform-Entertain-Attract or Die!neondawnNessuna valutazione finora

- Rules Arboretum English 2019 1 PDFDocumento4 pagineRules Arboretum English 2019 1 PDFalfNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Bootleg Film Festival Toronto Program 2012Documento32 pagineBootleg Film Festival Toronto Program 2012bootlegfilmfestivalNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Executive ProducerDocumento3 pagineExecutive Producerapi-289624692Nessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Rajput, Nitish - The Broken Pillars of Democracy (2022, Invincible Publishers) - Libgen - LiDocumento97 pagineRajput, Nitish - The Broken Pillars of Democracy (2022, Invincible Publishers) - Libgen - Libodev563290% (1)

- Introduction of Jio 4G (Data Grid)Documento2 pagineIntroduction of Jio 4G (Data Grid)Vipul GargNessuna valutazione finora

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocumento1 paginaNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNessuna valutazione finora

- Hypothesis ProblemsDocumento5 pagineHypothesis ProblemsshukpriNessuna valutazione finora

- PPM Top-Line Radio StatisticsDocumento1 paginaPPM Top-Line Radio StatisticsThe Vancouver SunNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- 6 Present and Future of Marketing Communication in Border RegionsDocumento16 pagine6 Present and Future of Marketing Communication in Border RegionsPtthoai PtthoaiNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Marketing Mix and 4 PS: Understanding How To Position Your Market OfferingDocumento8 pagineThe Marketing Mix and 4 PS: Understanding How To Position Your Market OfferingSabhaya ChiragNessuna valutazione finora

- Telvista Productivity Report - FIOS RollupDocumento28 pagineTelvista Productivity Report - FIOS RollupwabecerraoNessuna valutazione finora

- Service Marketing Unit - 4: Service Delivery and PromotionDocumento9 pagineService Marketing Unit - 4: Service Delivery and PromotionrajeeevaNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Netflix PresentationDocumento29 pagineNetflix PresentationQaziAbubakarNessuna valutazione finora

- The Office S03E01 Gay Witch HuntDocumento26 pagineThe Office S03E01 Gay Witch HuntCaesario TanumihardjaNessuna valutazione finora

- Englis EssayDocumento7 pagineEnglis Essayapi-305189614Nessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Research TopicsDocumento50 pagineResearch TopicsDIKITSONessuna valutazione finora

- History of BRTVDocumento3 pagineHistory of BRTVAbdulmalik Grema100% (2)

- Building A Yagi Antenna For UHF - J-Tech Engineering, LTDDocumento15 pagineBuilding A Yagi Antenna For UHF - J-Tech Engineering, LTDRobert GalargaNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)