Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Measuring and Managing Customer Relationships

Caricato da

GreyyyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Measuring and Managing Customer Relationships

Caricato da

GreyyyCopyright:

Formati disponibili

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

Chapter 6 Measuring and Managing Customer Relationships

Companies, in addition to costs of production, also incur marketing, selling,

distribution, and administrative (MSDA) expenses

Most of these expenses are independent of the volume and mix of products that

the company produces, so that they cannot be traced through causal

relationships to products

Many of these expenses are incurred through multiple distribution channels.

Customers and channels differ considerably in their use of MSDA resources.

Companies must understand the cost of selling through various channels to

diverse segments Extend ABC to trace MSDA expenses directly to customer

orders and to individual customers.

Metrics such as gross margins and product-line profitability can appear in the

financial perspective of the Balanced Scorecard (BSC), while the process

perspective can include metrics related to the costs of production and

purchasing processes.

if the only info that managers have about customers is financial performance,

then they may take actions that improve financial performance in ST but

damage LT customer relationships need both financial and nonfinancial

metrics to manage their performance with customers.

To balance the pressure to meet/exceed customer expectations, companies must

measure the cost to serve each customer and the profits earned

Ability to accurately calculate metrics (like % unprofitable customers) =

important for ABC in BSC

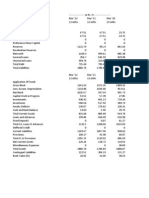

Example of Madison Dairy Measuring Customer Profitability

Madison Dairy has annual revenues of

3 million, and its MSDA expenses are

900k (30% of revenues). Madison has

2 important customers, Carver and

Delta, with about the same sales

revenue. Gene (divisions controller)

allocated MSDA expenses to

customers as a % of sales revenue, leading to the data on the right:

Gene believed that carver was more profitable customer than Delta, because

Carver ordered few products in large quantities, placed the orders predictable,

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

and required little sales/technical support. However, Delta placed many small

orders for special products, required expedited delivery, and used many

technical resources.

When Gene launched an ABC tudy of the companys MSDA costs, he developed

capacity cost rates for all resourcs in the support departments (ex: accounts

receivable department). He estimated time demands on various resources o

obtain/process orders, distribute orders, and serve customers.

Gene found that Carver was more profitable than calculated in his previous

report, which allocated MSDA costs as a fixed % of revenues.

Characteristics of High and Low Cost-to-Serve Customers

Companies can make money with high CTS customers/ lose money with low CTS

customers, but the info on MSDA costs incurred for each customer is vital for

effective mgmt. of customer relationship

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

Reporting and Displaying Customer Profitability

80-20 rule: 80% of land is owned by 20% of the population 80% of a regions

income/wealth was earned or held by the top 20% this applies to companies

products and customers too

when companies rank products and customers from highest volume to lowest,

they find that their top-selling 20% of products/customers generate 80% of total

sales

40-1 rule: lowest volume 40% of products/customers generates 1% of total

sales

The 80-20 law applies to sales revenues, but not profits.

Whale curve: graph of cumulative profits vs. customers, constructed from an

ABC customer profitability analysis customers are ranked on x-axis from most

to least profitable.

The most profitable 20% customers generate about 180% of total profits

(peak above sea level) the hump of a cumulative profitability curve

generally gits 150-250% of total profits by 20-40% of most profitable

customers

Middle 60% of customers is about break even

Least 20% profitable customers lose 80% of total profits some of the

largest customers fall on the far right-hand side of the curve because theyre

among the most unprofitable. This is because small customers dont do

enough business with the company to incur large losses. Only large

customers demand high discounts and make demands on technical, sales,

etc. resources.

Large customers are usually the most profitable or the most unprofitable,

rarely in middle.

High-profit customers, such as Carver, appear in the left section of the

profitability whale curve should be cherished and protected. Managers should

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

offer discounts, incentives, and special services to retain the loyalty of these

valuable customers

Customers like Delta appear on the right tail of whale curve, dragging

profitability down to sea level with low margins and high cost to serve

unpredictable order patterns, small order quantities for customized products,

nonstandard delivery requirements, & demands on technical/sales personnel.

The opportunity for a company to identify its unprofitable customers and the

transform them into profitable ones is perhaps the most powerful benefit that

managers can receive from an ABC system.

Customers Costs in Service Companies

Service companies must focus on customer costs and profitability (more than

manufacturing companies do) because variation in demand for resources is

much more customer driven

Customer independent: manufacturing company producing standard products

can calculate production cost without regard to how their customers use them

only the costs of marketing, selling, order handling, delivery, and service of the

products may be customer specific

For service companies, customer behaviour determines quantity of demands for

resources

Measuring revenues and costs at customer level provides the company with

more relevant info than at the product level certain customers demand more

than others

Increasing Customer Profitability

Manufacturing and service companies can make breakeven/loss customers into

profitable ones:

1) Improve processes used to produce, sell, deliver, and service the customer

o

Examine internal operations to see where they can improve to lower costs

Ex: if most customers are migrating to smaller order sizes, strive to reduce

costs of setup and order handling so that customer preferences can be

accommodated without raising overall price

2) Deploy menu-based pricing to allow customer to select features/services to

receive/pay for

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

Activity based pricing establishes a base price for producing a standard

quantity for each standard product provide menu of options with

associated prices

Pricing surcharges can be imposed when designing special variants for

customers particular needs; discounts can be offered when customers

order patterns lowers cost of supplying it

Activity based pricing prices orders, not products

3) Enhance the customer relationship to improve margins and lower the cost to

serve

o

Managing customer relationships persuade them to use greater scope of

products/services

Establish minimum order sizes from unprofitable customers

Before taking action with a customer who has an unprofitable effect on one

product line, managers should understand all relationships it has with that

customer, and act on the basis of total relationship profitability, not just

based on profitability of a single product

Some customers may be unprofitable because it is the start of the

relationship with the company. The company may have incurred high costs to

acquire the customer, and the customers initial purchases may have been

insufficient to cover its acquisition and maintenance costs. No action is

required at this point. The company expects and hopes that the customers

purchases will increase and become profitable, including recovering any

losses incurred in the start-up years. Companies can afford to be more

tolerant of newly acquired unprofitable customers than they can of

unprofitable customers they have served for 10+ years.

4) Use more discipline in granting discounts and allowances

o

Pricing waterfall: chart that shows many revenue leaks from list price

cause by special allowances/discounts to build customer loyalty

Each small discount seems like small concession to get the order, encourage

sales, and receive prompt payment but can actually lead to huge revenue

leaks from original list price

Companies fail to see revenue leaks because they record allowances in

different systems and make revenue deductions at different times of the year

in different accounts

The volume discount may be refunded to the customer only once it

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

accumulates enough volume to qualify, and its not linked back to individual

transactions that qualified for volume discount

o

Good to offer discounts to the low cost-to-serve customers

See page 230 for an example of discounts that companies incur

Now, more common to calculate income for every quarter for every customer

Profitability depends on whether and how much the net product margins

recover customer-specific costs. Mapping customer profitability:

The y-axis = gross margins from all products sold to the customer net

revenues minus discounts/allowances minus all costs of production for that

customer in that period from ABC system; represents cost of actual

demands of resources to produce products for that customer

X-axis = sum of all MSDA costs to serve the customer and processing orders

Customers above the diagonal line are profitable. Below = unprofitable, as

gross margins do not cover all costs required to MSDA the customer.

Top right corner: can spend a lot on customers transportation, technical

support, and service because of high gross margins on products sold to this

customer

Top left: price insensitive; demand few discounts, low cost to serve

customers best type!

Bottom left: company can make money with highly discounter customer, as

long as cost of servicing that customer is low large purchasing volumes

may > low prices

Bottom right: problem because theyre large customer who demand big

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

discounts and lots of customized services and technical support right hand

edge of whale curve try to move these customer to breakeven point or

profitability through menu-based pricing, product mix rationalization,

elimination of discounts/allowances, and standardizing packaging/distribution

o

Worst case scenario fire a customer by encouraging it to buy from another

supplier

Salesperson Incentives

Instead of having to repair damages from unprofitable customers, it would be

better to avoid them in the first place these unwanted customer relationships

occur because salespeople have incentives to generate sales, not profit

because of commissions and minimum quotas

Companies base salespeoples rewards on revenues because its a simple

measure. Also, companies recently developed ability to trace MSDA costs they

used to only focus on revenue, not profit

Companies now use info from ERP (enterprise resource planning) and CRM

(customer relationship mgmt.) software systems, to base salesperson incentives

on order and customer profits & sales

Salespeople still accept breakeven/loss orders to penetrate a new account or

keep a loyal customer happy, but they accept this for future benefit,

understanding that it may not be a profitable order

Life-Cycle Profitability

By knowing the characteristics of profitable customers, companies can direct

their marketing efforts/resources to specific segments that are most likely to

yield profitable customers

Due to high acquisition costs and time required to establish a good relationship

(ex: multiple product offerings), even attractive new customers may initially be

unprofitable

To calculate total life-cycle profitability, companies must distinguish economics

of their new customers from old customers recognize cross-sectional variation

of demands, and forecast the longitudinal variation of customers over time

Customer lifetime value (CLV):

o

assumes that you can estimate retention rate (r): probability of retaining a

customer

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

margin (Mt): total net revenues (after deducting discounts, promotions,

allowances) minus all costs to produce, market, distribute, and sell to the

customer in year t

ct = any additional costs-to-serve (and retain) customer in year t

customer lifetime value strategy: service companies invest money into new

customers because they want to become the lifetime provider for these

customers as they get good jobs and become successful company should

track each customer

1) initial acquisition cost

2) profits/losses earned each year

3) any additional costs incurred to retain the customer each year

4) the duration of the relationship

Some banks have analytic systems that allow them to estimate these

parameters based on the demographic characteristics of a potential/new

customer guide the banks promotion strategies and campaigns to attract

customers with the highest expected lifetime value.

RBC uses an analytic model of a customers future profitability based on age,

tenure with the bank, number of products/services already used at the bank, etc.

The bank assigns a personal account representative to its estimated high

lifetime value customers, ensures that their phone calls get picked up quickly,

and provides them with ready access to credit at attractive terms.

Measuring Customer Performance with Nonfinancial Metrics

ST metrics of customer cost and profitability may cause a company to take

actions that work well to improve customer profitability metrics, but risk LT

relationship with the customer so companies must supplement their financial

measurements with nonfinancial measures of customer relationship

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

Customer satisfaction: companies survey recent purchaser of companys

products/services

o

Writing customer surveys requires specialized expertise to get valid responses

from a high % of customers mail surveys, telephone interviews, and

personal interviews

Some customer satisfaction surveys become public info ranking companies

may rank companies in similar industries there are correlations between

rankings and future stock price

Customer loyalty: customers attitude toward a product/company doesnt

readily translate into desired behaviour of repeated/increased purchases. Loyal

customers are valuable because

1) Greater likelihood to repurchase lower costs of retaining them than to

acquire new people

2) Loyal customers persuade others to become new customers

3) Loyal customers are less likely to defect when competitors offer lower price

similar products

4) more willing to pay price premium to retain a known/trusted relationship with

supplier

5) willing to collaborate with supplier to improve performance and develop new

products

o

In competitive industries (many substitutes, low cost of switching), only

customers who give the company the highest satisfaction (5 out of 5) are

likely to repurchase the companys product somewhat satisfied people

may decent to competitor

Measure loyalty directly by actual repeat purchasing behaviour use %

growth of business with existing customers and account share, which

represents a companys % of a customers spending in its product/service

category (ex: what % of my closet is from Forever21)

Another measure = % customers from previous period who make at least one

purchase per year

Companies that can identify customers can readily measure customer

retention between periods

Companies that cannot identify individual customers to measure retention

often invest in loyalty programs that provide incentives to customers to

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

reveal themselves when they make purchases discounts for frequent

purchasers

Companies may view their customer satisfaction/loyalty along a five-stage

hierarchy

1) Satisfied customers: measure = how well their expectations are met per

transaction/LT relationship

2) Loyal customers: measure= customer devoting an increasing share of wallet

for repeat purchases

3) Committed customers: purchase frequently from supplier and tell others

about supplier

4) Apostle customers: committed customers who have credibility when they

recommend to others

5) Customer owners: take responsibility for continuing success of the

suppliers product or service

o

Companies want stages 3, 4, and 5 higher customer ,lifetime value

Net Promoter score (NPS): helps measure whether customers have moved

beyond stage 2 above

o

Some researchers find low correlations between customer satisfaction scores

and future revenue growth customers often remain with current supplier

because of inertia, high switching costs, or current lack of an alternative

supplier

Willingness to recommend: the variable most strongly correlated with

future growth/profit how likely is it that you would recommend this

company to a friend/colleague = best question

A score of 9 or 10 for question above means the customers are promoters

good!

A score of 7-8 means the customers are passively satisfied

A score of 1-6 means the customers are detractors: can harm reputation

and brand value

NPS: % customers who are promoters the % that are detractors

Median NPS across 400 companies in 28 industries on 130k survey responses

(1999-2002) = 16%

BU247 Lecture 11-12

Tues. June. 18. 2013

Thurs. June. 13.

Quite a few companies have negative NPSs, and since 2002, the average

NPS has dropped < 10%

Power of NPS is that for customers to make recommendations, company

must do 2 things:

1) Product/service must offer superior value for the money and they feel

good about the relationship thy have with the company

2) Customers are confident that the company will treat their friends well if

theres a problem

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Internationalisation of The Dune Group - Written ReportDocumento24 pagineInternationalisation of The Dune Group - Written Reportgemmahagan92100% (1)

- Cash Flow ProjectionDocumento8 pagineCash Flow ProjectionSuhailNessuna valutazione finora

- GBusiSBG11 PDFDocumento168 pagineGBusiSBG11 PDFkemime100% (2)

- 2 Ethics and Investment Professionalism PDFDocumento28 pagine2 Ethics and Investment Professionalism PDFSenthil Kumar KNessuna valutazione finora

- Davangere distillery industry profileDocumento53 pagineDavangere distillery industry profilePrachi Rungta AnvekarNessuna valutazione finora

- Sample Strategy MapsDocumento10 pagineSample Strategy MapsAimon ItthiNessuna valutazione finora

- How Bureaucracy Kills Your OrganisationDocumento8 pagineHow Bureaucracy Kills Your Organisationvikrambakshi67Nessuna valutazione finora

- RSM1222 Quiz #2 Questions and SolutionsDocumento9 pagineRSM1222 Quiz #2 Questions and SolutionsgckodaliNessuna valutazione finora

- Tefr & DPR - PM - Module - IIIDocumento21 pagineTefr & DPR - PM - Module - IIIAtish NairNessuna valutazione finora

- Project Proposal On Fast Food CoyDocumento6 pagineProject Proposal On Fast Food CoyOloye ElayelaNessuna valutazione finora

- SAP Product Costing 101 - Product Costing OverviewDocumento40 pagineSAP Product Costing 101 - Product Costing Overviewsanty406380% (5)

- Green Productivity PDFDocumento341 pagineGreen Productivity PDFSiddharth PalNessuna valutazione finora

- TVS Balance SheetDocumento6 pagineTVS Balance SheetNihal LamgeNessuna valutazione finora

- 6.dia Represn in Biz StatisticsDocumento6 pagine6.dia Represn in Biz StatisticsBoobalan RNessuna valutazione finora

- Profit and Loss AccountDocumento32 pagineProfit and Loss AccountBayezid Hossain100% (1)

- Nature and Scope of AccountingDocumento10 pagineNature and Scope of AccountingRohan Kumar100% (4)

- Strategic Choice and EvaluationDocumento4 pagineStrategic Choice and EvaluationJean PierreNessuna valutazione finora

- Anthony Battaglia Financial Disclosure Report For Battaglia, AnthonyDocumento7 pagineAnthony Battaglia Financial Disclosure Report For Battaglia, AnthonyJudicial Watch, Inc.Nessuna valutazione finora

- Results & Discussion: Table - 1 Gross Profit Ratio Year Gross Profit Net Sales 100 RatioDocumento9 pagineResults & Discussion: Table - 1 Gross Profit Ratio Year Gross Profit Net Sales 100 RatioeswariNessuna valutazione finora

- MCOM - Ac - Paper - IDocumento542 pagineMCOM - Ac - Paper - IKaran BindraNessuna valutazione finora

- Sales DepartmentDocumento8 pagineSales DepartmentKat Miranda100% (1)

- Profit & Loss Aptitude QuestionsDocumento3 pagineProfit & Loss Aptitude QuestionsVasundharaKrishNessuna valutazione finora

- Finance Assignment Ratio - Financial ManagementDocumento9 pagineFinance Assignment Ratio - Financial ManagementKelly Brook100% (3)

- Kara Wet Wipes SWOT Analysis and StrategiesDocumento51 pagineKara Wet Wipes SWOT Analysis and StrategiesHarsh GuptaNessuna valutazione finora

- Multiple Choice CH 4Documento5 pagineMultiple Choice CH 4gotax100% (2)

- TP Assignment 007Documento48 pagineTP Assignment 007Wasik Abdullah MomitNessuna valutazione finora

- 30 Years of Infosys: PDF Processed With Cutepdf Evaluation EditionDocumento214 pagine30 Years of Infosys: PDF Processed With Cutepdf Evaluation EditionMalik NasirNessuna valutazione finora

- Valuation of VariationDocumento53 pagineValuation of VariationIsurupriya KulasingheNessuna valutazione finora

- ESTIMATING AND COSTING Chapter 1Documento3 pagineESTIMATING AND COSTING Chapter 1kaze100% (1)