Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

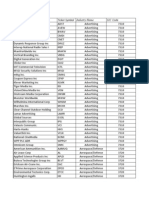

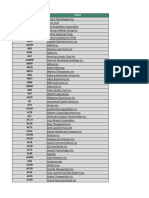

Investment Screener Results 9

Caricato da

Adeniyi AleseDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Investment Screener Results 9

Caricato da

Adeniyi AleseCopyright:

Formati disponibili

Symbol

A

AA

AAPL

ABBV

ABC

ABT

ACE

ACN

ADI

ADM

ADP

ADT

AEE

AEP

AES

AET

AFL

AGN

AIG

AIV

AIZ

ALL

ALTR

AMAT

AME

AMGN

AMP

AMT

ANTM

AON

APA

APC

APD

APH

ARG

AVB

AVGO

AVP

AVY

AXP

BA

BAC

BAX

BBT

BBY

BCR

BDX

BEN

BF.B

BHI

BK

BLK

BLL

BMY

BRCM

BWA

BXP

C

CA

CAG

CAH

CAT

CB

CBS

CCE

CCL

CF

CHK

CHRW

CI

CINF

CL

CLX

CMA

CMCSA

CME

CMI

CMS

CNP

CNX

COF

COG

COH

COL

COP

COST

CPB

CSC

CSCO

CSX

CTAS

CTL

CVS

CVX

D

DAL

DD

DE

DFS

DGX

DHI

DHR

DIS

DLPH

DNR

DO

DOV

DOW

DPS

DRI

DTE

DUK

DVN

ECL

ED

EFX

EIX

EL

EMC

EMN

EMR

EOG

EQR

EQT

ES

ESS

ESV

ETN

ETR

EXC

EXPD

EXPE

F

FAST

FCX

FDX

FE

FIS

FITB

FLIR

FLR

FLS

FMC

FOXA

FTR

GAS

GCI

GD

GE

GGP

GIS

GLW

GM

GMCR

GME

GPC

GPS

GRMN

GS

GT

GWW

HAL

HAR

HAS

HBAN

HCBK

HCN

HCP

HD

HES

HIG

HOG

HON

HOT

HP

HPQ

HRB

HRL

HRS

HST

HSY

HUM

IBM

ICE

IFF

INTC

INTU

IP

IPG

IR

IRM

ITW

IVZ

JCI

JNJ

JNPR

JOY

JPM

JWN

K

KEY

KIM

KLAC

KMB

KMI

KO

KR

KRFT

KSS

KSU

L

LEG

LEN

LLL

LLTC

LLY

LM

LMT

LNC

LOW

LRCX

LUK

LUV

LYB

M

MA

MAC

MAS

MAT

MCD

MCHP

MCK

MCO

MDLZ

MDT

MET

MHFI

MJN

MKC

MLM

MMC

MMM

MO

MON

MOS

MPC

MRK

MRO

MS

MSFT

MSI

MTB

MUR

MWV

NAVI

NBL

NBR

NDAQ

NE

NEE

NEM

NI

NKE

NLSN

NOC

NOV

NRG

NSC

NTAP

NTRS

NUE

NVDA

NWL

OKE

OMC

ORCL

OXY

PAYX

PBCT

PBI

PCAR

PCG

PCL

PCP

PDCO

PEG

PEP

PETM

PFE

PFG

PG

PGR

PH

PHM

PKI

PLD

PLL

PNC

PNR

PNW

POM

PPG

PPL

PRGO

PRU

PSA

PSX

PVH

PX

PXD

QCOM

QEP

R

RAI

RCL

RF

RHI

RIG

RL

ROK

ROP

ROST

RRC

RSG

RTN

SBUX

SCG

SCHW

SE

SEE

SHW

SIAL

SJM

SLB

SNA

SNDK

SNI

SO

SPG

SPLS

SRE

STI

STJ

STT

STX

SWK

SYK

SYMC

SYY

T

TAP

TE

TEG

TEL

TGT

TIF

TJX

TMK

TMO

TROW

TRV

TSCO

TSN

TSO

TSS

TWC

TWX

TXN

TXT

TYC

UHS

UNH

UNM

UNP

UPS

USB

UTX

V

VFC

VIAB

VLO

VMC

VNO

VTR

VZ

WBA

WDC

WEC

WFC

WFM

WHR

WIN

WM

WMB

WMT

WU

WY

WYN

WYNN

XEC

XEL

XL

XLNX

XOM

XRAY

XRX

XYL

YUM

ZION

ZMH

ZTS

Company

Agilent Technologies Inc

Alcoa Inc

Apple Inc

AbbVie Inc

AmerisourceBergen Corp

Abbott Laboratories

ACE Ltd

Accenture PLC

Analog Devices Inc

Archer Daniels Midland Co

Automatic Data Processing Inc

ADT Corp

Ameren Corp

American Electric Power Company Inc

AES Corp

Aetna Inc

Aflac Inc

Allergan Inc

American International Group Inc

Apartment Investment and Management Co

Assurant Inc

Allstate Corp

Altera Corp

Applied Materials Inc

Ametek Inc

Amgen Inc

Ameriprise Financial Inc

American Tower Corp

Anthem Inc

Aon PLC

Apache Corp

Anadarko Petroleum Corp

Air Products and Chemicals Inc

Amphenol Corp

Airgas Inc

AvalonBay Communities Inc

Avago Technologies Ltd

Avon Products Inc

Avery Dennison Corp

American Express Co

Boeing Co

Bank of America Corp

Baxter International Inc

BB&T Corp

Best Buy Co Inc

C R Bard Inc

Becton Dickinson and Co

Franklin Resources Inc

Brown-Forman Corp

Baker Hughes Inc

Bank of New York Mellon Corp

BlackRock Inc

Ball Corp

Bristol-Myers Squibb Co

Broadcom Corp

BorgWarner Inc

Boston Properties Inc

Citigroup Inc

CA Inc

ConAgra Foods Inc

Cardinal Health Inc

Caterpillar Inc

Chubb Corp

CBS Corp

Coca-Cola Enterprises Inc

Carnival Corp

CF Industries Holdings Inc

Chesapeake Energy Corp

C.H. Robinson Worldwide Inc

Cigna Corp

Cincinnati Financial Corp

Colgate-Palmolive Co

Clorox Co

Comerica Inc

Comcast Corp

CME Group Inc

Cummins Inc

CMS Energy Corp

CenterPoint Energy Inc

CONSOL Energy Inc

Capital One Financial Corp

Cabot Oil & Gas Corp

Coach Inc

Rockwell Collins Inc

ConocoPhillips

Costco Wholesale Corp

Campbell Soup Co

Computer Sciences Corp

Cisco Systems Inc

CSX Corp

Cintas Corp

Centurylink Inc

CVS Health Corp

Chevron Corp

Dominion Resources Inc

Delta Air Lines Inc

E I du Pont de Nemours and Co

Deere & Co

Discover Financial Services

Quest Diagnostics Inc

D.R. Horton Inc

Danaher Corp

Walt Disney Co

Delphi Automotive PLC

Denbury Resources Inc

Diamond Offshore Drilling Inc

Dover Corp

Dow Chemical Co

Dr Pepper Snapple Group Inc

Darden Restaurants Inc

DTE Energy Co

Duke Energy Corp

Devon Energy Corp

Ecolab Inc

Consolidated Edison Inc

Equifax Inc

Edison International

Estee Lauder Companies Inc

EMC Corp

Eastman Chemical Co

Emerson Electric Co

EOG Resources Inc

Equity Residential

EQT Corp

Eversource Energy

Essex Property Trust Inc

Ensco PLC

Eaton Corporation PLC

Entergy Corp

Exelon Corp

Expeditors International of Washington Inc

Expedia Inc

Ford Motor Co

Fastenal Co

Freeport-McMoRan Inc

FedEx Corp

FirstEnergy Corp

Fidelity National Information Services Inc

Fifth Third Bancorp

FLIR Systems Inc

Fluor Corp

Flowserve Corp

FMC Corp

Twenty-First Century Fox Inc

Frontier Communications Corp

AGL Resources Inc

Gannett Co Inc

General Dynamics Corp

General Electric Co

General Growth Properties Inc

General Mills Inc

Corning Inc

General Motors Co

Keurig Green Mountain Inc

GameStop Corp

Genuine Parts Co

Gap Inc

Garmin Ltd

Goldman Sachs Group Inc

Goodyear Tire & Rubber Co

W W Grainger Inc

Halliburton Co

Harman International Industries Inc

Hasbro Inc

Huntington Bancshares Inc

Hudson City Bancorp Inc

Health Care REIT Inc

HCP Inc

Home Depot Inc

Hess Corp

Hartford Financial Services Group Inc

Harley-Davidson Inc

Honeywell International Inc

Starwood Hotels & Resorts Worldwide Inc

Helmerich & Payne Inc

Hewlett-Packard Co

H & R Block Inc

Hormel Foods Corp

Harris Corp

Host Hotels & Resorts Inc

Hershey Co

Humana Inc

International Business Machines Corp

Intercontinental Exchange Inc

International Flavors & Fragrances Inc

Intel Corp

Intuit Inc

International Paper Co

Interpublic Group of Companies Inc

Ingersoll-Rand PLC

Iron Mountain Inc

Illinois Tool Works Inc

Invesco Ltd

Johnson Controls Inc

Johnson & Johnson

Juniper Networks Inc

Joy Global Inc

JPMorgan Chase and Co

Nordstrom Inc

Kellogg Co

KeyCorp

Kimco Realty Corp

KLA-Tencor Corp

Kimberly-Clark Corp

Kinder Morgan Inc

The Coca-Cola Co

Kroger Co

Kraft Foods Group Inc

Kohl's Corp

Kansas City Southern

Loews Corp

Leggett & Platt Inc

Lennar Corp

L-3 Communications Holdings Inc

Linear Technology Corp

Eli Lilly and Co

Legg Mason Inc

Lockheed Martin Corp

Lincoln National Corp

Lowe's Companies Inc

Lam Research Corp

Leucadia National Corp

Southwest Airlines Co

LyondellBasell Industries NV

Macy's Inc

MasterCard Inc

Macerich Co

Masco Corp

Mattel Inc

McDonald's Corp

Microchip Technology Inc

McKesson Corp

Moody's Corp

Mondelez International Inc

Medtronic PLC

Metlife Inc

McGraw Hill Financial Inc

Mead Johnson Nutrition Co

McCormick & Company Inc

Martin Marietta Materials Inc

Marsh & McLennan Companies Inc

3M Co

Altria Group Inc

Monsanto Co

Mosaic Co

Marathon Petroleum Corp

Merck & Co Inc

Marathon Oil Corp

Morgan Stanley

Microsoft Corp

Motorola Solutions Inc

M&T Bank Corp

Murphy Oil Corp

MeadWestvaco Corp

Navient Corp

Noble Energy Inc

Nabors Industries Ltd

NASDAQ OMX Group Inc

Noble Corporation PLC

NextEra Energy Inc

Newmont Mining Corp

NiSource Inc

Nike Inc

Nielsen NV

NORTHROP GRUMMAN CORP

National Oilwell Varco Inc

NRG Energy Inc

Norfolk Southern Corp

NetApp Inc

Northern Trust Corp

Nucor Corp

NVIDIA Corp

Newell Rubbermaid Inc

ONEOK Inc

Omnicom Group Inc

Oracle Corp

Occidental Petroleum Corp

Paychex Inc

People's United Financial Inc

Pitney Bowes Inc

PACCAR Inc

PG&E Corp

Plum Creek Timber Company Inc

Precision Castparts Corp

Patterson Companies Inc

Public Service Enterprise Group Inc

PepsiCo Inc

PetSmart Inc

Pfizer Inc

Principal Financial Group Inc

Procter & Gamble Co

Progressive Corp

Parker Hannifin Corp

PulteGroup Inc

PerkinElmer Inc

Prologis Inc

Pall Corp

PNC Financial Services Group Inc

Pentair plc

Pinnacle West Capital Corp

Pepco Holdings Inc

PPG Industries Inc

PPL Corp

Perrigo Company PLC

Prudential Financial Inc

Public Storage

Phillips 66

PVH Corp

Praxair Inc

Pioneer Natural Resources Co

Qualcomm Inc

QEP Resources Inc

Ryder System Inc

Reynolds American Inc

Royal Caribbean Cruises Ltd

Regions Financial Corp

Robert Half International Inc

Transocean Ltd

Ralph Lauren Corp

Rockwell Automation Inc

Roper Industries Inc

Ross Stores Inc

Range Resources Corp

Republic Services Inc

Raytheon Co

Starbucks Corp

SCANA Corp

Charles Schwab Corp

Spectra Energy Corp

Sealed Air Corp

Sherwin-Williams Co

Sigma-Aldrich Corp

J M Smucker Co

Schlumberger NV

Snap-On Inc

SanDisk Corp

Scripps Networks Interactive Inc

Southern Co

Simon Property Group Inc

Staples Inc

Sempra Energy

SunTrust Banks Inc

St. Jude Medical Inc

State Street Corp

Seagate Technology PLC

Stanley Black & Decker Inc

Stryker Corp

Symantec Corp

Sysco Corp

AT&T Inc

Molson Coors Brewing Co

TECO Energy Inc

Integrys Energy Group Inc

TE Connectivity Ltd

Target Corp

Tiffany & Co

TJX Companies Inc

Torchmark Corp

Thermo Fisher Scientific Inc

T. Rowe Price Group Inc

Travelers Companies Inc

Tractor Supply Co

Tyson Foods Inc

Tesoro Corp

Total System Services Inc

Time Warner Cable Inc

Time Warner Inc

Texas Instruments Inc

Textron Inc

Tyco International PLC

Universal Health Services Inc

UnitedHealth Group Inc

Unum Group

Union Pacific Corp

United Parcel Service Inc

U.S. Bancorp

United Technologies Corp

Visa Inc

VF Corp

Viacom Inc

Valero Energy Corp

Vulcan Materials Co

Vornado Realty Trust

Ventas Inc

Verizon Communications Inc

Walgreens Boots Alliance Inc

Western Digital Corp

Wisconsin Energy Corp

Wells Fargo & Co

Whole Foods Market Inc

Whirlpool Corp

Windstream Holdings Inc

Waste Management Inc

Williams Companies Inc

Wal-Mart Stores Inc

Western Union Co

Weyerhaeuser Co

Wyndham Worldwide Corp

Wynn Resorts Ltd

Cimarex Energy Co

Xcel Energy Inc

XL Group PLC

Xilinx Inc

Exxon Mobil Corp

DENTSPLY International Inc

Xerox Corp

Xylem Inc

Yum! Brands Inc

Zions Bancorporation

Zimmer Holdings Inc

Zoetis Inc

S&P 500

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

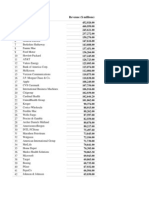

Price

$42.70

$14.95

$129.09

$60.46

$103.10

$47.22

$114.37

$91.18

$59.78

$47.85

$90.18

$39.08

$42.19

$56.15

$12.65

$100.50

$62.57

$235.80

$55.65

$37.94

$61.69

$70.98

$37.54

$25.63

$53.75

$159.63

$134.90

$99.40

$146.93

$100.24

$65.79

$82.02

$158.13

$57.22

$118.90

$169.66

$129.02

$8.86

$53.93

$82.03

$153.80

$16.01

$69.96

$38.40

$38.63

$168.30

$148.04

$54.40

$91.88

$62.55

$39.65

$376.42

$72.66

$62.30

$46.19

$63.01

$138.76

$53.49

$32.84

$35.10

$89.52

$83.00

$101.46

$61.75

$46.40

$45.19

$311.37

$16.60

$73.60

$122.48

$53.03

$71.01

$109.92

$46.14

$59.87

$97.12

$143.43

$34.35

$20.69

$31.48

$79.15

$29.15

$43.56

$90.72

$64.40

$147.94

$46.75

$71.00

$30.19

$34.67

$84.51

$37.63

$104.19

$105.90

$70.32

$45.39

$78.49

$91.03

$60.26

$70.90

$27.14

$87.47

$105.89

$80.14

$8.30

$30.66

$72.41

$49.35

$79.20

$64.38

$80.44

$77.06

$60.86

$115.96

$61.82

$94.84

$63.72

$83.40

$28.88

$75.41

$58.33

$89.06

$77.58

$80.67

$50.25

$225.16

$23.77

$71.00

$77.67

$32.83

$48.25

$92.18

$16.57

$41.50

$21.13

$176.80

$34.29

$68.24

$19.51

$32.82

$58.48

$62.10

$64.59

$35.16

$7.95

$47.86

$35.84

$139.80

$26.11

$29.23

$53.50

$24.63

$37.61

$130.87

$38.67

$96.94

$41.41

$50.45

$191.79

$27.20

$239.20

$42.99

$142.39

$63.15

$10.96

$9.91

$77.38

$42.18

$116.12

$74.11

$41.26

$65.07

$104.58

$82.86

$65.71

$34.92

$34.19

$58.51

$78.77

$21.43

$102.66

$162.00

$160.48

$239.32

$122.77

$34.06

$98.68

$56.98

$22.50

$67.78

$37.49

$99.56

$40.46

$51.90

$103.22

$24.01

$43.66

$61.77

$80.68

$64.29

$14.02

$26.31

$65.70

$110.41

$40.83

$43.20

$70.94

$63.80

$74.26

$117.03

$40.59

$45.82

$50.04

$131.26

$49.55

$71.12

$58.08

$203.02

$58.77

$75.09

$84.48

$23.70

$44.22

$86.10

$63.90

$92.02

$84.63

$26.53

$26.56

$100.00

$52.41

$228.22

$96.77

$36.89

$78.83

$51.82

$103.49

$104.64

$75.40

$143.35

$57.24

$170.50

$56.50

$121.30

$53.53

$101.78

$58.58

$27.67

$36.24

$43.88

$68.89

$122.77

$49.11

$52.94

$19.51

$46.41

$12.54

$50.92

$15.94

$101.54

$25.89

$42.34

$98.75

$44.95

$167.10

$55.79

$23.39

$110.25

$38.58

$70.51

$47.13

$22.60

$39.65

$44.07

$80.52

$44.03

$77.74

$50.40

$15.19

$23.11

$64.91

$53.40

$43.44

$217.37

$50.38

$40.94

$99.00

$82.94

$34.77

$52.46

$85.41

$27.09

$123.77

$22.43

$47.15

$42.70

$103.49

$92.95

$66.21

$62.86

$27.10

$237.70

$33.40

$157.55

$82.15

$197.55

$77.00

$106.74

$130.28

$154.75

$72.66

$21.70

$94.73

$75.88

$79.01

$9.70

$62.79

$16.48

$138.06

$117.73

$168.55

$105.99

$49.43

$41.42

$110.45

$94.23

$55.56

$30.17

$35.19

$47.51

$290.89

$138.07

$114.96

$84.62

$148.29

$80.25

$72.44

$44.87

$190.04

$17.02

$107.13

$41.27

$68.36

$75.57

$61.56

$98.92

$96.01

$25.26

$38.97

$34.64

$75.91

$19.13

$73.49

$72.95

$77.68

$90.60

$69.47

$53.99

$131.35

$83.39

$107.90

$89.31

$42.17

$90.76

$38.73

$155.51

$82.77

$59.94

$44.44

$43.26

$114.49

$114.40

$33.86

$120.75

$101.93

$44.88

$123.19

$278.29

$77.24

$70.75

$58.67

$84.50

$110.98

$74.68

$49.47

$83.62

$108.78

$50.11

$55.55

$56.22

$215.00

$7.86

$54.85

$49.03

$83.96

$20.04

$35.20

$94.11

$142.43

$109.85

$34.41

$36.54

$42.11

$88.04

$53.42

$13.58

$36.17

$81.80

$27.11

$121.39

$47.31

Dividend Yield

0.95%

0.81%

1.46%

3.37%

1.13%

2.03%

2.28%

2.27%

2.73%

2.34%

2.21%

2.14%

3.87%

3.68%

3.08%

1.00%

2.51%

0.09%

0.90%

2.97%

1.76%

1.70%

1.95%

1.60%

0.68%

2.00%

1.74%

1.53%

1.71%

1.00%

1.52%

1.28%

1.97%

0.89%

1.88%

2.97%

1.10%

2.82%

2.61%

1.27%

2.06%

1.27%

3.01%

2.52%

1.99%

0.52%

1.64%

1.11%

1.37%

1.09%

1.74%

2.35%

0.73%

2.43%

1.24%

0.85%

1.89%

0.08%

3.08%

2.86%

1.56%

3.38%

2.27%

1.02%

2.42%

2.27%

1.96%

2.10%

2.05%

0.03%

3.49%

2.15%

2.72%

1.75%

1.68%

2.08%

2.19%

3.30%

4.76%

0.78%

1.52%

0.28%

3.10%

1.35%

4.48%

0.97%

2.68%

1.30%

2.85%

1.87%

1.02%

5.71%

1.35%

4.01%

3.59%

0.81%

2.41%

2.65%

1.57%

2.17%

0.92%

0.62%

1.10%

1.27%

2.98%

1.64%

2.22%

3.41%

2.44%

3.44%

3.36%

4.05%

1.56%

1.14%

4.12%

1.24%

2.60%

1.16%

1.59%

2.15%

3.25%

0.75%

2.60%

0.15%

3.23%

2.59%

2.45%

3.10%

4.18%

3.66%

1.33%

0.78%

3.67%

2.70%

5.78%

0.45%

4.12%

1.54%

2.69%

1.36%

1.45%

1.16%

0.95%

0.86%

5.26%

4.15%

2.26%

1.79%

3.54%

2.34%

3.05%

1.97%

3.22%

0.90%

3.57%

2.56%

2.21%

3.87%

1.26%

0.90%

1.82%

1.68%

0.96%

2.95%

2.19%

1.64%

4.28%

5.34%

2.06%

1.33%

1.76%

1.95%

2.01%

1.87%

4.10%

1.84%

2.34%

1.71%

2.42%

3.81%

2.06%

0.68%

2.72%

1.10%

1.54%

2.89%

1.02%

2.84%

2.15%

1.73%

5.17%

1.96%

2.48%

2.05%

2.73%

1.67%

1.81%

2.61%

1.84%

3.04%

1.87%

3.65%

3.08%

3.21%

4.39%

3.05%

1.04%

3.43%

2.44%

1.14%

0.61%

2.75%

0.32%

2.01%

2.49%

2.85%

1.12%

3.00%

1.39%

1.24%

0.87%

1.05%

0.56%

3.26%

1.96%

0.71%

3.11%

1.37%

5.78%

3.44%

2.79%

0.42%

1.40%

1.62%

1.57%

2.75%

1.28%

1.58%

2.12%

1.12%

1.97%

2.43%

3.70%

1.63%

1.88%

1.90%

3.07%

3.02%

1.12%

2.83%

2.00%

2.31%

2.75%

1.88%

2.99%

1.52%

1.87%

1.20%

9.01%

2.98%

0.38%

2.42%

1.15%

2.21%

1.69%

3.39%

2.42%

2.16%

1.71%

1.89%

3.17%

1.54%

1.93%

5.47%

2.51%

1.10%

3.70%

3.05%

4.36%

3.24%

1.37%

3.39%

4.05%

0.06%

1.60%

3.71%

2.65%

0.94%

3.26%

2.81%

3.02%

2.57%

2.05%

1.42%

0.60%

3.37%

1.21%

2.09%

1.93%

3.71%

3.98%

1.14%

4.37%

0.32%

2.87%

2.84%

2.55%

0.14%

2.24%

0.05%

2.32%

0.37%

1.57%

3.54%

1.57%

2.08%

1.29%

18.60%

1.46%

2.22%

0.60%

0.89%

0.32%

2.74%

2.22%

1.37%

3.83%

0.82%

4.17%

1.10%

0.94%

0.67%

2.22%

2.38%

1.44%

1.50%

1.27%

4.59%

2.94%

2.86%

2.59%

1.95%

1.74%

1.61%

3.53%

2.12%

1.46%

2.38%

3.08%

5.44%

2.16%

4.58%

3.64%

1.61%

2.71%

1.72%

1.02%

0.95%

0.46%

2.52%

2.05%

0.73%

0.97%

1.85%

1.05%

1.95%

1.71%

2.31%

0.18%

1.71%

0.35%

1.32%

1.97%

1.83%

2.87%

2.20%

2.10%

0.71%

1.67%

1.89%

2.59%

0.48%

2.29%

3.11%

4.45%

1.62%

1.87%

3.32%

2.56%

0.92%

1.42%

12.67%

2.83%

4.73%

2.34%

3.18%

3.30%

1.84%

4.21%

0.58%

3.63%

1.77%

2.74%

3.12%

0.55%

2.05%

1.58%

2.02%

0.60%

0.73%

0.72%

P/E Ratio <span class='wsod-txt9'>(TTM)</span>

15.30

16.43

17.40

18.21

23.92

20.71

11.67

19.57

23.63

15.29

29.96

18.61

17.51

16.32

9.73

15.04

10.16

35.51

11.99

18.33

10.30

13.10

24.70

23.30

22.12

18.37

15.58

49.45

16.64

17.56

11.15

19.96

26.40

25.43

24.47

23.43

22.71

11.81

17.29

14.67

17.82

28.09

13.72

13.43

16.58

20.01

23.06

14.55

29.54

14.82

16.25

19.45

18.73

33.68

20.17

19.33

26.33

14.15

13.30

16.18

22.16

13.03

13.25

20.11

16.22

23.17

17.29

11.53

24.13

16.48

19.86

24.24

23.64

14.69

20.43

28.65

15.69

19.41

15.33

33.49

10.43

31.01

17.29

19.47

12.13

30.69

18.63

15.85

15.56

17.96

27.35

14.42

23.10

10.44

20.50

13.55

19.62

11.48

11.54

17.29

17.62

23.64

23.27

15.71

7.98

9.38

15.54

15.92

21.64

32.68

17.45

16.97

12.40

27.74

15.97

24.44

13.97

27.62

18.63

10.68

15.03

17.99

24.55

23.73

18.96

26.49

3.69

15.17

13.32

13.74

25.13

25.97

14.41

24.85

10.78

22.30

13.39

22.01

11.41

22.03

13.00

16.47

16.03

19.42

41.84

18.06

13.03

17.85

15.73

21.98

19.81

16.10

12.41

33.99

11.79

21.03

14.95

16.27

11.24

9.65

19.51

10.69

26.03

19.86

14.23

30.97

18.74

13.88

24.87

17.73

11.76

16.81

18.95

27.35

10.12

9.31

19.76

24.90

15.60

14.29

25.67

21.66

9.82

25.35

24.17

14.62

34.62

18.74

22.96

20.29

29.52

21.27

16.06

15.68

17.29

24.75

13.23

11.68

21.69

16.79

12.98

18.93

20.66

18.62

35.82

21.07

21.76

19.88

17.43

24.28

16.17

25.89

17.81

16.23

23.82

25.49

18.74

17.81

9.73

28.12

18.13

44.72

21.89

9.74

14.36

29.31

23.51

26.01

17.71

18.69

21.66

21.29

22.99

20.96

19.61

9.03

26.40

28.05

22.37

41.79

20.30

22.76

21.98

24.41

20.05

11.51

16.74

14.26

14.85

17.07

29.07

16.22

14.44

28.62

10.06

19.75

11.20

17.62

5.42

19.27

23.75

24.62

29.30

18.50

18.71

8.44

111.38

17.25

16.92

20.74

20.67

18.99

19.73

27.37

18.77

15.95

13.31

28.31

17.66

12.16

16.99

15.30

36.81

16.82

22.69

14.83

21.38

19.20

15.39

11.87

19.96

13.09

16.14

18.09

19.09

22.83

28.05

12.73

17.33

17.56

21.34

24.40

13.63

25.13

8.92

24.66

11.61

15.31

20.75

32.37

14.86

15.61

16.95

22.12

23.31

12.44

27.91

3.33

16.96

18.57

26.25

23.98

35.06

21.13

16.27

34.02

14.66

31.10

21.72

25.54

32.68

31.60

20.46

15.19

20.74

15.77

18.29

15.97

21.33

17.02

22.65

12.78

17.18

14.82

12.00

17.63

20.30

14.60

21.53

13.80

18.38

18.75

23.71

18.47

22.07

21.78

21.91

13.42

18.90

18.61

10.21

33.58

14.10

13.10

20.94

20.57

20.24

23.88

18.59

21.21

19.81

20.07

9.54

20.96

21.41

14.62

17.73

30.65

25.00

12.86

8.90

89.89

22.74

16.67

14.77

24.81

13.35

19.13

13.55

35.14

18.89

60.46

22.12

60.53

16.46

12.60

27.94

20.82

18.79

19.01

16.95

9.90

17.62

11.58

21.37

12.13

18.36

26.56

15.85

20.06

30.13

Price to Book (MRQ)

2.69

1.23

6.79

55.30

11.69

2.89

1.28

9.16

3.95

1.57

6.52

2.17

1.49

1.63

1.23

2.62

1.54

9.11

0.73

4.66

0.84

1.45

3.46

3.97

4.08

4.71

2.68

9.71

1.64

4.31

0.88

1.86

4.48

6.03

4.78

2.48

10.06

12.61

4.61

4.06

12.47

0.75

4.65

1.27

3.36

6.98

5.62

2.77

9.67

1.44

1.18

2.36

8.03

6.90

3.06

3.88

2.76

0.80

2.64

2.76

4.76

2.99

1.47

4.59

7.84

1.10

3.39

0.73

10.27

2.97

1.32

46.73

91.78

1.12

2.91

1.56

3.24

2.56

1.96

1.36

0.98

5.62

4.93

6.49

1.52

5.18

9.15

2.62

2.73

3.09

4.63

1.43

3.15

1.28

3.51

4.31

5.41

3.60

2.55

2.37

1.93

2.62

3.77

7.88

0.57

0.94

3.24

3.01

6.71

3.94

1.71

1.33

0.95

4.71

1.44

5.12

1.89

8.25

2.50

3.00

4.00

2.76

2.64

1.92

1.60

2.37

0.68

2.13

1.40

1.17

4.98

6.19

2.57

6.42

0.98

3.42

1.16

2.89

1.12

2.87

2.83

4.36

5.50

3.71

2.18

1.49

2.32

3.92

1.92

3.47

4.69

1.63

1.68

6.15

1.99

4.47

5.88

2.83

1.14

1.94

4.97

2.24

5.41

5.42

1.50

1.10

2.03

1.76

16.42

0.93

0.95

4.79

4.60

9.68

1.45

2.40

6.02

4.27

4.60

2.20

14.93

2.58

13.24

2.18

6.53

2.90

9.10

4.59

4.37

2.98

9.04

5.70

1.91

2.99

4.14

2.11

1.51

1.09

6.29

8.01

1.18

2.21

2.97

41.16

2.52

6.19

6.79

8.61

2.50

3.18

0.62

5.46

1.95

2.08

8.80

5.15

1.46

18.86

0.97

7.33

2.72

0.85

4.43

5.17

4.05

15.54

2.21

8.38

3.05

7.57

4.89

5.10

470.53

2.22

4.06

0.94

52.13

36.21

5.35

2.22

4.34

8.25

37.10

8.04

1.85

2.70

3.27

1.00

1.07

4.04

5.91

1.46

1.07

2.60

1.87

1.63

0.62

1.47

0.55

2.20

0.99

2.16

8.01

3.29

4.67

1.16

0.68

2.75

3.38

1.97

1.86

2.88

5.80

2.29

6.02

4.13

1.72

10.32

1.01

60.55

3.40

1.59

4.57

3.25

3.56

1.70

8.38

7.87

2.94

1.51

3.36

2.30

2.77

1.73

2.61

1.41

5.99

1.10

2.65

1.54

1.58

6.20

1.63

2.42

0.88

6.58

1.93

2.01

6.32

2.68

3.11

0.96

2.76

8.91

2.12

0.83

8.71

0.43

3.04

6.11

3.55

9.70

2.41

1.90

3.50

13.42

1.67

3.60

2.27

8.63

28.02

5.25

2.37

2.86

3.87

2.71

4.37

2.08

10.00

1.81

2.18

0.99

4.61

1.64

7.10

2.38

4.23

3.01

4.33

2.07

1.58

1.74

1.78

3.31

3.53

4.24

11.22

1.90

2.56

4.01

1.44

9.39

2.29

1.64

4.24

5.44

2.84

6.09

2.87

4.10

2.99

3.38

1.00

5.07

14.58

2.04

3.45

7.74

5.92

7.82

1.44

2.66

3.35

2.82

15.01

3.89

2.89

2.56

1.74

5.33

2.89

21.08

4.27

1.82

3.15

8.05

3.49

9.23

108.86

2.13

1.70

0.82

4.08

2.06

3.26

1.45

3.09

22.31

0.86

3.15

24.59

Price to Sales (TTM)

2.27

0.76

3.76

4.83

0.18

3.35

1.92

1.77

6.19

0.37

3.68

1.94

1.69

1.63

0.53

0.61

1.22

9.78

1.23

5.95

0.41

0.84

5.85

3.41

3.29

6.04

2.03

9.60

0.54

2.33

1.79

2.25

3.24

3.32

1.69

13.30

6.37

0.44

0.78

2.44

1.19

1.77

2.25

2.76

0.32

3.76

3.37

4.01

4.89

1.11

2.79

5.61

1.16

6.52

3.28

1.72

8.86

1.79

3.35

0.90

0.31

0.91

1.75

2.18

1.32

1.69

3.14

0.53

0.80

0.92

1.76

3.73

2.58

3.14

2.24

10.51

1.36

1.32

0.96

1.95

1.91

5.54

2.67

2.34

1.43

0.57

1.76

0.80

3.21

2.71

2.20

1.19

0.84

0.94

3.30

0.93

1.97

0.89

3.00

1.38

1.16

3.10

3.61

1.37

1.20

1.49

1.48

0.98

2.50

1.13

1.16

2.28

1.27

2.44

1.40

4.65

1.55

2.88

2.40

1.18

1.63

2.71

10.77

4.96

2.06

14.78

1.16

1.49

1.12

1.03

1.42

2.03

0.45

3.29

1.02

1.07

0.96

3.02

2.47

3.02

0.40

1.72

2.13

2.29

1.67

1.04

1.35

1.50

1.76

10.12

1.83

3.16

0.39

4.51

0.44

0.97

1.07

3.37

2.42

0.40

1.62

1.11

1.67

1.86

3.00

4.10

7.64

8.58

1.84

1.53

0.95

2.47

2.03

2.39

1.82

0.58

3.10

1.63

1.65

3.03

3.05

0.50

1.70

6.57

3.22

2.89

5.96

0.92

1.23

1.38

2.52

2.61

3.37

0.79

3.89

2.11

1.11

2.45

1.14

1.57

2.79

10.48

3.70

1.93

5.36

4.11

0.34

2.06

0.79

5.01

1.05

1.63

1.32

0.92

8.25

4.03

2.34

1.41

1.13

1.30

2.77

0.76

1.61

0.90

0.77

11.16

12.93

1.09

1.49

3.55

5.03

0.31

6.05

1.81

4.43

0.83

5.51

4.79

2.28

3.32

2.39

3.40

4.54

3.76

2.16

0.29

3.95

1.56

1.87

3.85

2.31

3.45

1.59

1.57

1.39

3.29

0.53

2.46

0.96

2.65

1.77

2.07

2.87

2.65

1.38

1.02

0.50

2.92

1.93

3.65

0.71

2.62

1.86

0.75

1.30

4.98

2.66

6.99

3.39

1.22

1.23

1.49

5.18

3.07

1.20

1.90

2.20

1.19

4.42

1.46

2.82

0.82

1.33

1.42

2.38

12.36

3.87

3.00

1.68

1.99

1.40

2.11

1.93

5.32

0.75

15.54

0.26

1.07

3.09

4.52

4.44

1.11

0.76

4.76

2.15

2.41

1.81

0.65

1.59

2.41

4.77

2.00

3.08

1.66

1.49

4.15

1.60

6.53

4.00

1.29

2.51

5.92

2.13

2.23

2.63

2.58

3.73

2.18

11.74

0.48

2.39

2.47

3.48

2.92

1.42

1.36

3.76

2.61

0.48

1.36

2.10

1.61

0.90

2.11

0.67

2.78

1.65

1.75

3.11

5.46

1.28

2.13

0.40

0.28

2.94

1.91

2.45

4.85

0.89

1.76

1.40

0.84

0.81

4.44

1.58

3.75

1.72

16.32

2.72

2.06

0.23

3.76

7.79

8.03

1.62

1.17

1.66

2.26

3.26

1.38

0.85

0.81

1.80

4.80

0.56

1.86

2.42

2.15

2.66

3.95

1.49

1.34

4.53

0.90

2.57

0.73

1.68

2.67

2.33

4.40

4.96

Price to Cash Flow (TTM)

10.25

7.31

15.95

15.64

20.50

14.08

10.82

16.16

20.76

10.30

22.32

4.90

7.31

7.33

4.11

11.58

10.08

31.32

7.03

16.13

7.57

10.49

20.85

18.49

17.94

13.82

12.99

21.59

11.73

12.40

1.99

6.25

15.31

19.95

13.34

20.86

17.33

7.35

9.83

12.10

13.29

15.61

10.28

10.39

9.32

15.14

15.37

13.00

27.71

7.39

10.73

17.07

11.93

22.85

12.63

13.35

19.81

10.64

8.51

9.66

17.08

7.01

11.13

16.03

10.91

8.48

11.73

2.71

21.23

12.40

17.66

20.52

18.30

11.51

9.82

23.87

12.32

8.10

5.48

9.20

6.85

11.71

11.28

14.56

5.14

21.00

13.17

6.37

12.60

11.21

19.03

3.63

17.39

5.56

11.52

8.28

13.37

7.30

10.18

11.24

16.51

17.19

18.37

11.12

3.01

4.32

11.15

8.49

17.28

15.62

7.09

8.67

4.67

16.20

8.19

16.71

6.12

19.65

11.59

7.38

10.20

7.27

20.00

10.20

10.85

27.64

2.45

11.71

4.38

4.75

21.85

12.73

5.29

21.70

3.74

11.15

5.47

12.56

8.38

17.10

9.55

13.46

12.73

16.37

6.01

8.36

8.99

14.62

10.08

23.66

13.68

9.33

4.46

23.85

8.53

17.24

10.24

14.20

8.51

4.86

15.30

6.57

22.01

12.93

8.81

17.48

17.45

13.91

19.23

4.98

5.01

12.37

15.31

19.42

5.89

5.68

16.22

21.04

11.27

11.14

20.49

15.34

7.50

19.51

19.66

8.13

26.18

8.91

14.74

14.44

12.55

16.24

14.73

11.19

13.76

7.11

9.21

8.71

13.31

12.14

12.25

17.28

16.01

13.89

25.65

17.10

11.45

16.16

8.56

16.33

8.06

13.11

14.68

12.04

21.55

18.13

14.30

13.73

9.93

17.18

14.30

23.97

12.85

7.63

8.30

22.63

25.88

17.93

11.82

14.03

14.96

19.85

20.22

15.26

16.69

8.68

23.28

24.84

17.79

22.42

15.91

17.04

21.09

18.51

10.56

7.41

9.88

4.50

12.21

13.16

21.35

12.62

3.35

12.89

9.47

6.36

2.66

13.42

2.82

8.47

7.28

11.54

26.08

11.17

14.32

6.61

4.40

11.54

11.60

13.24

10.30

18.02

15.07

14.23

14.43

12.67

7.51

22.84

17.37

7.93

10.10

6.20

22.02

19.19

19.84

7.33

15.29

13.14

10.92

8.31

15.00

12.81

13.28

16.25

13.28

16.43

22.76

9.74

12.57

7.43

7.85

17.73

7.18

19.19

7.63

21.58

8.88

9.74

12.56

12.54

13.69

3.04

3.63

20.81

11.51

8.02

24.01

2.04

11.85

15.99

19.88

19.09

9.62

8.74

14.04

25.48

8.03

23.95

12.44

14.94

26.22

25.07

14.11

9.57

17.19

9.97

7.52

8.93

22.19

9.13

11.28

8.70

13.37

10.83

7.64

11.43

16.60

10.03

14.31

5.72

11.45

7.85

11.06

13.58

10.23

17.80

16.87

7.29

11.71

16.53

4.26

25.01

12.64

7.83

12.15

7.91

5.58

15.93

11.17

14.93

23.65

15.47

8.55

15.13

14.62

12.68

13.61

24.24

16.47

4.31

5.84

27.52

23.50

19.52

6.87

17.85

7.98

11.06

11.27

21.24

11.42

3.18

9.83

20.24

10.61

9.32

14.84

14.38

13.29

7.31

8.03

7.80

15.99

7.48

15.28

5.73

13.05

16.73

10.39

14.51

23.86

Return on Equity (TTM)

18.09%

7.59%

37.36%

131.89%

50.69%

15.26%

11.13%

50.57%

16.43%

10.25%

23.51%

11.89%

8.65%

10.05%

12.45%

16.40%

16.11%

28.57%

6.24%

24.93%

8.36%

11.78%

14.04%

17.66%

17.86%

27.24%

17.90%

20.18%

10.40%

23.07%

6.96%

9.64%

16.98%

24.32%

18.69%

7.67%

47.90%

42.22%

22.48%

29.05%

48.62%

3.29%

32.88%

10.26%

18.77%

35.73%

24.30%

19.66%

33.14%

10.09%

7.71%

12.22%

41.39%

20.20%

16.15%

19.71%

6.30%

5.89%

19.46%

16.52%

21.72%

20.83%

11.34%

21.38%

40.36%

6.20%

18.95%

7.43%

44.33%

18.38%

6.91%

152.75%

372.74%

7.96%

14.56%

5.32%

20.85%

13.18%

13.01%

4.17%

10.06%

17.06%

28.68%

33.55%

12.17%

17.45%

50.11%

17.53%

17.72%

17.57%

16.82%

9.18%

13.81%

12.41%

17.14%

25.21%

23.87%

29.55%

22.91%

14.34%

11.22%

11.18%

16.54%

45.34%

6.87%

9.99%

20.62%

18.08%

31.51%

12.28%

10.00%

7.84%

7.74%

17.09%

9.07%

20.34%

14.27%

30.91%

13.40%

27.86%

26.60%

15.94%

5.96%

8.79%

8.56%

2.96%

13.53%

13.39%

10.61%

8.90%

19.75%

23.65%

17.72%

26.41%

8.26%

15.23%

8.59%

13.39%

10.67%

13.06%

19.66%

27.07%

31.70%

19.27%

4.80%

8.23%

20.01%

20.69%

11.98%

5.25%

25.43%

11.20%

15.83%

18.38%

17.42%

20.66%

41.07%

17.39%

11.65%

33.44%

25.28%

22.75%

20.84%

27.20%

11.27%

3.29%

4.92%

8.11%

58.30%

5.41%

8.40%

26.56%

23.83%

22.12%

14.75%

25.50%

39.55%

17.64%

29.87%

8.46%

55.98%

11.85%

108.41%

8.43%

26.48%

20.29%

28.62%

18.95%

19.22%

14.53%

27.01%

23.89%

11.83%

18.99%

22.73%

7.46%

11.88%

10.40%

32.54%

40.24%

9.40%

9.17%

18.57%

58.22%

4.32%

27.66%

32.24%

37.16%

14.80%

13.68%

3.83%

18.41%

12.85%

12.11%

37.66%

17.22%

7.86%

86.02%

10.55%

24.57%

16.39%

2.00%

19.33%

45.14%

28.10%

55.97%

2.67%

34.47%

16.98%

35.85%

24.59%

24.73%

227.52%

9.76%

20.57%

9.49%

86.37%

157.88%

22.80%

7.17%

19.91%

30.44%

128.61%

23.79%

9.27%

22.71%

20.93%

6.69%

7.61%

23.85%

16.55%

9.93%

7.26%

8.76%

18.80%

9.01%

5.61%

8.19%

8.81%

12.30%

4.17%

8.96%

26.81%

16.65%

19.97%

13.11%

1.20%

16.46%

20.38%

10.28%

9.23%

15.89%

27.79%

9.22%

29.27%

26.67%

10.98%

36.20%

5.52%

192.32%

19.45%

10.65%

12.06%

15.93%

15.17%

11.69%

32.20%

38.18%

19.22%

12.82%

18.53%

18.16%

18.20%

10.03%

13.69%

4.40%

23.67%

9.88%

13.90%

8.87%

9.86%

22.85%

12.05%

9.44%

10.49%

22.09%

17.19%

12.93%

27.18%

9.43%

21.48%

6.32%

15.52%

37.75%

8.65%

7.12%

31.70%

11.47%

18.15%

32.91%

14.16%

42.56%

7.65%

8.93%

18.82%

39.32%

10.98%

12.77%

10.37%

29.57%

63.69%

17.09%

11.16%

18.25%

18.76%

16.98%

28.34%

13.30%

25.14%

10.45%

9.83%

8.23%

27.67%

11.15%

56.98%

12.96%

20.55%

20.49%

20.15%

14.40%

9.06%

9.30%

7.59%

18.57%

14.26%

18.83%

51.79%

11.93%

13.64%

22.88%

14.41%

29.71%

14.20%

15.15%

20.86%

28.16%

13.64%

26.19%

15.11%

18.46%

16.05%

17.22%

10.12%

24.16%

89.29%

15.04%

18.53%

20.63%

23.66%

60.19%

16.73%

3.03%

6.73%

5.41%

87.71%

15.54%

21.97%

13.65%

14.15%

15.09%

16.71%

17.76%

19.40%

3.79%

19.86%

73.83%

11.83%

40.50%

257.16%

11.64%

10.20%

8.75%

24.49%

17.59%

14.61%

11.23%

16.47%

63.49%

6.41%

16.17%

61.86%

Return on Assets (TTM)

9.47%

3.05%

19.28%

18.91%

4.56%

8.39%

3.42%

17.78%

10.96%

4.91%

4.06%

3.58%

2.69%

2.89%

2.36%

4.54%

2.25%

17.66%

1.26%

4.95%

1.43%

2.16%

8.17%

10.63%

9.36%

9.68%

1.14%

3.97%

4.08%

5.68%

3.82%

3.51%

7.20%

10.81%

6.23%

4.31%

17.90%

5.54%

6.59%

3.82%

6.75%

0.34%

10.91%

1.18%

5.67%

13.04%

9.10%

14.34%

16.14%

6.51%

0.75%

1.45%

7.20%

9.20%

11.62%

10.16%

2.31%

0.64%

9.62%

4.72%

5.30%

4.70%

3.61%

6.89%

7.63%

3.81%

7.93%

2.72%

14.80%

3.59%

2.39%

19.52%

14.03%

0.87%

4.84%

1.88%

10.84%

2.66%

2.60%

1.85%

1.48%

7.25%

19.28%

8.89%

5.54%

6.46%

9.80%

6.00%

9.67%

5.96%

8.27%

2.94%

7.18%

7.32%

3.84%

5.39%

7.63%

4.73%

3.03%

6.14%

5.58%

7.35%

9.42%

13.89%

3.00%

5.51%

8.87%

5.86%

8.74%

3.98%

3.06%

2.74%

3.93%

6.52%

2.75%

10.16%

3.06%

15.11%

7.15%

8.15%

11.24%

8.07%

2.77%

4.56%

2.96%

1.54%

8.20%

6.45%

2.38%

2.55%

12.92%

5.17%

2.22%

21.53%

3.28%

7.09%

2.10%

6.23%

1.13%

8.99%

8.77%

10.69%

10.36%

7.28%

1.07%

2.16%

6.46%

7.67%

2.57%

1.53%

7.22%

7.31%

3.48%

13.47%

9.31%

8.67%

15.72%

12.80%

0.97%

4.55%

16.17%

11.07%

9.57%

9.50%

1.04%

0.42%

2.40%

4.35%

14.97%

3.18%

0.63%

8.58%

9.54%

6.49%

10.67%

6.91%

12.70%

11.96%

11.06%

5.11%

16.18%

5.01%

13.60%

1.60%

12.16%

12.80%

15.73%

4.39%

3.42%

5.37%

3.74%

9.84%

5.34%

6.89%

12.87%

4.74%

5.97%

0.86%

7.99%

8.81%

1.05%

3.05%

9.97%

12.29%

1.66%

9.69%

5.63%

8.33%

6.02%

6.89%

1.20%

7.22%

5.24%

5.07%

27.25%

8.44%

5.14%

9.92%

0.65%

8.01%

10.20%

0.40%

6.85%

17.66%

7.41%

24.85%

1.11%

5.04%

7.89%

14.59%

12.21%

4.75%

19.24%

4.25%

9.50%

0.74%

17.28%

19.99%

9.97%

3.97%

8.91%

15.07%

14.81%

11.38%

5.55%

8.36%

10.05%

3.68%

0.62%

12.73%

5.00%

1.16%

3.49%

3.27%

0.56%

4.17%

2.70%

3.92%

4.96%

3.23%

2.18%

2.29%

16.20%

6.06%

7.40%

8.28%

0.35%

6.05%

8.02%

0.77%

4.78%

9.74%

8.87%

2.35%

5.23%

13.41%

6.83%

10.00%

0.74%

6.07%

6.54%

2.87%

3.95%

9.57%

7.73%

4.10%

9.15%

16.92%

8.49%

0.61%

8.81%

4.85%

8.97%

5.55%

7.04%

2.58%

10.87%

1.26%

6.58%

2.87%

2.79%

7.90%

3.37%

5.82%

0.57%

11.71%

7.56%

5.03%

9.07%

5.16%

17.23%

2.46%

3.10%

11.90%

3.76%

0.96%

19.22%

5.90%

11.71%

14.24%

7.77%

20.91%

2.89%

3.51%

7.93%

19.35%

3.38%

0.91%

3.22%

4.75%

14.26%

13.08%

6.22%

10.79%

9.98%

11.11%

13.33%

3.90%

5.05%

5.64%

3.06%

0.96%

11.19%

0.82%

17.85%

5.40%

10.57%

9.11%

7.39%

4.52%

5.12%

2.83%

2.20%

8.46%

5.12%

11.05%

20.23%

2.71%

6.37%

21.24%

3.50%

17.86%

6.19%

6.18%

9.33%

4.40%

5.56%

15.18%

4.52%

7.75%

6.66%

6.57%

1.47%

9.94%

12.24%

1.50%

6.92%

14.88%

13.21%

10.14%

7.42%

1.56%

1.95%

2.32%

5.96%

8.11%

12.71%

4.03%

1.43%

10.08%

5.38%

0.68%

5.22%

1.42%

8.03%

8.62%

5.20%

5.88%

8.48%

6.06%

2.89%

2.15%

13.38%

9.20%

7.36%

4.71%

7.44%

16.01%

0.69%

10.87%

12.13%

EPS <span class='wsod-txt9'>(TTM)</span>

2.79

0.91

7.42

3.32

4.31

2.28

9.80

3.63

2.53

3.13

3.01

2.10

2.41

3.44

1.30

6.68

6.16

6.64

4.64

1.98

5.99

5.42

1.52

1.10

2.43

8.69

8.66

2.01

8.83

5.71

5.90

4.11

5.99

2.26

4.86

5.19

5.68

0.75

3.12

5.59

8.63

0.57

5.10

2.86

1.09

8.41

6.42

3.74

2.29

4.22

2.44

19.35

3.88

1.85

2.29

3.26

2.82

3.78

2.47

1.55

4.04

6.37

7.66

3.07

2.86

1.95

18.01

1.44

3.05

7.43

2.67

2.93

4.65

3.14

2.93

3.39

9.14

1.77

1.35

0.94

7.59

0.94

2.52

4.66

5.31

3.77

2.51

4.48

1.94

1.93

2.40

2.61

4.51

10.14

3.43

3.35

4.00

7.93

5.22

4.10

1.54

3.70

4.55

5.10

1.04

3.27

4.66

3.10

3.66

1.15

4.61

4.54

4.91

4.18

3.87

3.88

4.56

3.02

1.55

7.06

3.88

4.95

1.72

3.40

2.65

2.79

6.44

4.68

5.83

2.39

1.92

3.55

1.15

1.67

1.96

6.70

2.56

3.10

1.71

1.49

4.50

3.77

4.03

1.81

0.19

2.65

2.75

7.83

1.66

0.39

2.08

1.53

3.03

3.85

1.38

4.61

2.77

3.10

17.07

2.82

12.26

4.02

5.47

3.18

0.77

0.32

1.68

1.95

4.67

4.18

3.51

3.87

5.52

3.03

6.49

3.75

2.51

2.35

5.05

0.83

4.00

7.48

16.35

9.44

5.08

2.33

2.85

3.04

0.98

3.34

1.27

4.68

2.52

3.31

5.97

0.97

2.81

5.29

3.72

3.83

1.08

0.60

3.18

5.93

1.14

2.05

2.48

3.21

4.26

4.82

2.51

1.77

2.46

8.09

2.08

2.79

3.10

11.40

6.04

2.67

4.66

0.53

2.02

8.84

4.45

3.14

0.75

1.02

1.50

5.35

2.42

10.72

4.21

1.76

4.02

5.74

3.92

3.73

2.75

3.43

2.82

7.49

2.57

1.82

2.67

8.84

3.50

1.94

2.44

2.57

2.37

7.57

3.40

1.85

1.94

2.35

0.79

2.89

2.94

5.27

1.09

1.72

2.61

2.43

8.93

6.61

0.21

6.39

2.28

3.40

2.28

1.19

2.01

1.61

4.29

2.12

5.84

1.34

0.86

1.90

3.82

3.49

1.18

12.92

2.22

2.76

4.63

3.04

2.26

4.42

4.28

2.07

7.67

1.24

2.47

1.18

3.69

7.30

3.82

3.58

1.27

9.74

2.45

6.27

9.21

5.25

6.63

5.54

6.28

4.78

4.89

1.39

5.59

3.43

3.39

0.78

2.25

4.95

8.14

6.34

6.42

4.42

1.41

1.96

6.79

2.77

3.79

0.97

1.62

1.86

8.90

4.37

5.62

5.57

7.15

5.09

3.96

2.81

4.90

0.67

4.73

3.23

3.98

5.10

5.13

5.61

4.73

1.73

1.81

2.51

4.13

1.02

3.10

3.95

3.52

2.69

3.17

4.02

6.95

4.48

10.57

2.66

2.99

6.93

1.85

7.56

4.09

2.51

2.39

2.04

5.78

5.70

3.55

5.76

4.76

3.07

6.95

9.08

3.09

5.50

6.59

0.94

1.83

1.60

3.35

2.46

8.15

2.62

4.10

1.60

11.38

0.13

2.48

0.81

5.10

1.59

1.26

4.52

7.58

5.78

2.03

3.69

2.39

7.60

2.50

1.12

1.97

3.08

1.71

6.05

1.57

Performance data represents past performance and does not guarantee future results. Be aware that your investments are subject to risks.

The value of your investment may fluctuate and may be worth more or less than its original value when redeemed.

Securities are offered by Capital One Investing, LLC, a registered broker-dealer and Member FINRA/SIPC. Advisory services are provided by Capital One Advisors, LLC, an SEC registered investment advisor. Insurance products are offered through Capital One Agency LLC. All are subsidiaries of Capital One Financial Corporation.

ShareBuilder and Capital One ShareBuilder are marketing names for Capital One Investing, LLC. ShareBuilder 401k and ShareBuilder Advisors are the marketing names for Capital One Advisors, LLC.

Capital One Investing, LLC is a subsidiary of Capital One Financial Corporation.

(c) 2015 Capital One. Capital One and ShareBuilder are federally registered service marks. All third-party trademarks are the property of their respective owners.

Securities and services are: Not FDIC insured * Not bank guaranteed * May lose value * Not a deposit * Not Insured by any Federal Government Agency

Potrebbero piacerti anche

- Company Coverage Overview - As of December 16, 2011: Consumer Energy Financials MediaDocumento1 paginaCompany Coverage Overview - As of December 16, 2011: Consumer Energy Financials Mediaaditya81Nessuna valutazione finora

- sp500 Components 2022 07 16Documento9 paginesp500 Components 2022 07 16Carlos TresemeNessuna valutazione finora

- IndnameDocumento302 pagineIndnamesurya277Nessuna valutazione finora

- CRSP US Total MarketDocumento170 pagineCRSP US Total MarketsefiplanNessuna valutazione finora

- Investment Screener Results 114Documento491 pagineInvestment Screener Results 114Adeniyi AleseNessuna valutazione finora

- Fortune 500 Companies 2014Documento60 pagineFortune 500 Companies 2014bahveshNessuna valutazione finora

- 2 ND 100Documento1 pagina2 ND 100Parth V. PurohitNessuna valutazione finora

- Regional Stocks For May 22Documento1 paginaRegional Stocks For May 22Melissa SchupmannNessuna valutazione finora

- The Bespoke 50 Stock Company SectorDocumento4 pagineThe Bespoke 50 Stock Company SectorbabbabeuNessuna valutazione finora

- OBBDocumento168 pagineOBBaptureinc100% (3)

- Regional Stocks For June 5Documento1 paginaRegional Stocks For June 5Melissa SchupmannNessuna valutazione finora

- SuratDocumento92 pagineSuratpraveenNessuna valutazione finora

- Companies Who Uses SAPDocumento2 pagineCompanies Who Uses SAPkhnaveedNessuna valutazione finora

- Dallas Top CompaniesDocumento275 pagineDallas Top CompaniesCharles Binu67% (3)

- 20th Century FoxDocumento22 pagine20th Century FoxenochlsNessuna valutazione finora

- Fortune 500 Spreadsheet List 2015Documento120 pagineFortune 500 Spreadsheet List 2015David BowmanNessuna valutazione finora

- List of US Companies Who Outsource To IndiaDocumento17 pagineList of US Companies Who Outsource To Indiapraveenbagde80% (5)

- After College Requested Company Eng DetailDocumento91 pagineAfter College Requested Company Eng DetailAlexia BonatsosNessuna valutazione finora

- BetterInvesting Weekly Stock Screen 5-6-13Documento1 paginaBetterInvesting Weekly Stock Screen 5-6-13BetterInvestingNessuna valutazione finora

- Weekly Options List - Equities: (Note - Hot List Highlighted) Symbol Company Symbol CompanyDocumento1 paginaWeekly Options List - Equities: (Note - Hot List Highlighted) Symbol Company Symbol CompanyMohamedKeynanNessuna valutazione finora

- List of Companies: (Corrected)Documento27 pagineList of Companies: (Corrected)Anandh LNessuna valutazione finora

- Companies of The Russell 3000 IndexDocumento864 pagineCompanies of The Russell 3000 IndexShubha TandonNessuna valutazione finora

- Goldman Sachs (Disney123) Pepsi-Cola Kroger Walmart: Cintel GAPDocumento3 pagineGoldman Sachs (Disney123) Pepsi-Cola Kroger Walmart: Cintel GAPaskucherNessuna valutazione finora

- Ne SkidajDocumento186 pagineNe SkidajMaja BumbarNessuna valutazione finora

- SPUSA 500 USDUF P US L ConstituentsDocumento17 pagineSPUSA 500 USDUF P US L ConstituentsjunyigmxNessuna valutazione finora

- Chwmeg MembersDocumento4 pagineChwmeg MembersJudea EstradaNessuna valutazione finora

- Wilshire 5000Documento640 pagineWilshire 5000Agustín SeréNessuna valutazione finora

- GICS 2012 Sector IndustryDocumento544 pagineGICS 2012 Sector IndustrycapnpaulNessuna valutazione finora

- Russell 2000 Value Membership ListDocumento18 pagineRussell 2000 Value Membership ListSatyabrota DasNessuna valutazione finora

- List of Companies of The United States by StateDocumento93 pagineList of Companies of The United States by StateRaghu PonugotiNessuna valutazione finora

- Quick Ticker Symbol List: Stock Market SimulationDocumento4 pagineQuick Ticker Symbol List: Stock Market SimulationbadblindNessuna valutazione finora

- Companies Who Use SAP PDFDocumento2 pagineCompanies Who Use SAP PDFLavanyaNessuna valutazione finora

- Copia de GAS Module - 4 Years of Financial DataDocumento53 pagineCopia de GAS Module - 4 Years of Financial Dataadrian5pgNessuna valutazione finora

- CSA Invited Universe 2021Documento793 pagineCSA Invited Universe 2021MiyakhanNessuna valutazione finora

- 1601 Rank WosymDocumento136 pagine1601 Rank WosymHaimei WangNessuna valutazione finora

- POWER-GEN International Exhibitor List UsDocumento18 paginePOWER-GEN International Exhibitor List UsChander Shekhar SharmaNessuna valutazione finora

- Russell 2000 Membership List 2013Documento23 pagineRussell 2000 Membership List 2013KevinSunNessuna valutazione finora

- Divestment List Latest PDFDocumento32 pagineDivestment List Latest PDFYongky ANessuna valutazione finora

- Fortune 100 Companies ListDocumento46 pagineFortune 100 Companies Listsayeedkhan007Nessuna valutazione finora

- BetterInvesting Weekly Stock Screen 6-10-13Documento1 paginaBetterInvesting Weekly Stock Screen 6-10-13BetterInvestingNessuna valutazione finora

- Ebay Dropshipping Vero ListDocumento20 pagineEbay Dropshipping Vero ListLasith GunasekaraNessuna valutazione finora

- Wilshire 5000 StocksDocumento140 pagineWilshire 5000 StocksKai YangNessuna valutazione finora

- Top 200 BrandsDocumento1.050 pagineTop 200 Brandsps3257933% (3)

- SAP Client ListDocumento33 pagineSAP Client ListAsad Zaheer100% (1)

- EmployersDocumento822 pagineEmployersuhlsys0% (1)

- CD TalDocumento188 pagineCD Talmst04012002Nessuna valutazione finora

- List VERODocumento16 pagineList VEROfahrizalNessuna valutazione finora

- Logos Logos LogosDocumento51 pagineLogos Logos LogosBadrinath ShenoyNessuna valutazione finora

- Fortune500 CIO DatabaseDocumento120 pagineFortune500 CIO Databasegomzy_45650% (2)

- Florida Publicly Traded CompaniesDocumento13 pagineFlorida Publicly Traded Companiescsims22Nessuna valutazione finora

- Full Forms List - JavatpointDocumento27 pagineFull Forms List - JavatpointPratikNessuna valutazione finora

- DT Reports Symbol Guide: Through Aug. 5, 2015: Index EtfsDocumento6 pagineDT Reports Symbol Guide: Through Aug. 5, 2015: Index Etfschr_maxmannNessuna valutazione finora

- Empresas Que Cotizan en La BolsaDocumento174 pagineEmpresas Que Cotizan en La Bolsasandra_maciasNessuna valutazione finora

- Nasdaq Tickers inDocumento69 pagineNasdaq Tickers inErnie DaysNessuna valutazione finora

- Companies That Hire Ex-Offenders and FelonsDocumento6 pagineCompanies That Hire Ex-Offenders and FelonsBaileyNessuna valutazione finora

- Administrative Assistant's and Secretary's HandbookDa EverandAdministrative Assistant's and Secretary's HandbookValutazione: 4 su 5 stelle4/5 (5)

- Handbook of International Electrical Safety PracticesDa EverandHandbook of International Electrical Safety PracticesNessuna valutazione finora

- Competition Engine Building: Advanced Engine Design and Assembly TechniquesDa EverandCompetition Engine Building: Advanced Engine Design and Assembly TechniquesValutazione: 4.5 su 5 stelle4.5/5 (7)

- Quantum Computing Solutions: Solving Real-World Problems Using Quantum Computing and AlgorithmsDa EverandQuantum Computing Solutions: Solving Real-World Problems Using Quantum Computing and AlgorithmsNessuna valutazione finora

- Donny's Unauthorized Technical Guide to Harley Davidson 1936 to Present: Volume Ii: Performancing the Twin CamDa EverandDonny's Unauthorized Technical Guide to Harley Davidson 1936 to Present: Volume Ii: Performancing the Twin CamNessuna valutazione finora

- Lean Six Sigma Transformation: A Strategy For Achieving and Sustaining ExcellenceDocumento4 pagineLean Six Sigma Transformation: A Strategy For Achieving and Sustaining ExcellenceAdeniyi AleseNessuna valutazione finora

- 327PVsensitivity ExcelDocumento2 pagine327PVsensitivity ExcelAdeniyi AleseNessuna valutazione finora

- How To Perform A Nonprofit SWOT AnalysisDocumento14 pagineHow To Perform A Nonprofit SWOT AnalysisAdeniyi AleseNessuna valutazione finora

- Sensitivity Analysis: Enter Base, Minimum, and Maximum Values in Input CellsDocumento5 pagineSensitivity Analysis: Enter Base, Minimum, and Maximum Values in Input CellsAdeniyi AleseNessuna valutazione finora

- How 2018 Reframed The Democrats' Biggest Choice For 2020 - CNNPDocumento7 pagineHow 2018 Reframed The Democrats' Biggest Choice For 2020 - CNNPAdeniyi AleseNessuna valutazione finora

- Transforming OrganizationsDocumento11 pagineTransforming OrganizationsAdeniyi AleseNessuna valutazione finora

- Compress Ible FlowsDocumento47 pagineCompress Ible FlowsAdeniyi AleseNessuna valutazione finora

- BRM CH 20Documento20 pagineBRM CH 20Adeniyi AleseNessuna valutazione finora

- Farming Snails For The TableDocumento3 pagineFarming Snails For The TableAdeniyi AleseNessuna valutazione finora

- 2016 Spelling Bee Word ListDocumento10 pagine2016 Spelling Bee Word ListAdeniyi AleseNessuna valutazione finora

- BRM CH 09Documento12 pagineBRM CH 09Adeniyi AleseNessuna valutazione finora

- BRM CH 20Documento20 pagineBRM CH 20Adeniyi AleseNessuna valutazione finora

- BRM CH 21Documento31 pagineBRM CH 21Adeniyi AleseNessuna valutazione finora

- You Are The ConsultantsDocumento2 pagineYou Are The ConsultantsAdeniyi Alese0% (3)

- Research Prospectus Plan DirectionsDocumento2 pagineResearch Prospectus Plan DirectionsAdeniyi AleseNessuna valutazione finora

- Actdu Workshop 2015: Supported by The Commonwealth Department of Education and The Australian Debating FederationDocumento38 pagineActdu Workshop 2015: Supported by The Commonwealth Department of Education and The Australian Debating FederationAdeniyi AleseNessuna valutazione finora

- Research Prospectus GuidelineDocumento5 pagineResearch Prospectus GuidelineAdeniyi AleseNessuna valutazione finora

- Answer To Question-1: Agricultural ApplicationsDocumento7 pagineAnswer To Question-1: Agricultural ApplicationsSoham ChaudhuriNessuna valutazione finora

- Dr. Mike Israetel Training Volume Landmarks Hypertrophy RoutineDocumento26 pagineDr. Mike Israetel Training Volume Landmarks Hypertrophy RoutineJose Fernando PereiraNessuna valutazione finora

- Exam Materials ScienceDocumento10 pagineExam Materials ScienceChimzoe CatalanNessuna valutazione finora

- Test Intensiv Engleza 5Documento30 pagineTest Intensiv Engleza 5Simona Singiorzan90% (30)

- Problem Set Solution QT I I 17 DecDocumento22 pagineProblem Set Solution QT I I 17 DecPradnya Nikam bj21158Nessuna valutazione finora

- Defeat Cancer NaturallyDocumento94 pagineDefeat Cancer NaturallyRknuviprasys Low100% (3)

- The Beginningof The Church.R.E.brownDocumento4 pagineThe Beginningof The Church.R.E.brownnoquierodarinforNessuna valutazione finora

- Sea Shanty PrintDocumento3 pagineSea Shanty PrintDiego DracvsNessuna valutazione finora

- Naplan Year 9 PracticeDocumento23 pagineNaplan Year 9 PracticetonynuganNessuna valutazione finora

- SWOT Analysis Textile IndustryDocumento23 pagineSWOT Analysis Textile Industrydumitrescu viorelNessuna valutazione finora

- Ebp Cedera Kepala - The Effect of Giving Oxygenation With Simple Oxygen Mask andDocumento6 pagineEbp Cedera Kepala - The Effect of Giving Oxygenation With Simple Oxygen Mask andNindy kusuma wardaniNessuna valutazione finora

- Heavy Earth Moving MachinaryDocumento34 pagineHeavy Earth Moving MachinaryMAZHAR ALAMNessuna valutazione finora