Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Rich Vs King Paper With Abstract

Caricato da

JenniferTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Rich Vs King Paper With Abstract

Caricato da

JenniferCopyright:

Formati disponibili

Academy 2006 Best Paper Proceedings

Page 1 of 7

RICH VERSUS KING: THE ENTREPRENEURS DILEMMA

NOAM WASSERMAN

HARVARD BUSINESS SCHOOL

noam@hbs.edu

Rock Center 210, Cambridge, MA 02163

ABSTRACT

The two major motivations to start a new venture are the profit motive and the control

motive. This paper examines how entrepreneurs choices that increase their potential financial

gains (i.e., achieve the profit motive) should conflict with their ability to achieve the control

motive. In particular, it focuses on how attracting the external resources required to build value

can conflict with entrepreneurs abilities to keep control of their ventures at the CEO and board

levels. It explores whether this tension exists both at the level of the individual entrepreneurs

financial gains and at the level of the overall ventures value, and also whether entrepreneurs can

avoid the tradeoff by building more human capital before founding the venture and by retaining

more co-founders as the venture grows. It tests its hypotheses on a unique dataset of 457 private

technology ventures, and finds strong support for each of its core propositions. Implications

include the need for entrepreneurs to understand the small probability of achieving both the

profit and control motives, and to examine their core motivation and proactively plan their

strategic choices to achieve that motivation.

INTRODUCTION

Despite the importance of new ventures to economic development, such organizations

suffer from a significant liability of newness that results in a high rate of failure (Stinchcombe

1965; Aldrich and Fiol 1994). The factor that underlies this heightened failure rate is a lack of

resources (Stinchcombe 1965). Although an entrepreneur might already control some of the

resources necessary to pursue an opportunity, critical resources must almost always be acquired

from outside resource providers (Stevenson and Jarillo 1990). By acquiring these resources,

entrepreneurs can build more valuable companies than if they only used those resources they

already control.

The values of an organizations most powerful actors have a strong impact on the

organizations strategic choices, particularly regarding the attraction and allocation of resources

(Tagiuri 1965; Hambrick and Mason 1984:193). Consistent with upper echelons theory

(Hambrick and Mason 1984), this study suggests that entrepreneurs choices about resource

acquisition will have fundamental implications for their organizations and for the financial value

they can build. It focuses on the main two motivations, the profit motive and the control motive,

that lead entrepreneurs to start new ventures (Sapienza, Korsgaard and Forbes 2003), how those

motivations shape early choices about attracting human and financial resources, and how choices

that increase the ability to achieve the profit motive should conflict with the ability to achieve the

control motive (and vice versa). It uses a unique dataset comprised of data from 457 private

technology start-ups, to test hypotheses about tradeoffs between financial gains and control.

Academy 2006 Best Paper Proceedings

Page 2 of 7

THEORY AND HYPOTHESES

In new ventures, the entrepreneur is the critical actor shaping the firm (Hannan and

Freeman 1989; Eisenhardt and Schoonhoven 1990), and entrepreneurs early choices have a

powerful imprinting effect on the evolution of the organization (Boeker 1989; Bettis and

Prahalad 1995). New ventures are thus an excellent arena in which to study the impact of actors

strategic choices on them and their organizations. Entrepreneurs are attracted to take on the

challenge of building new organizations by the profit motive (e.g., Schumpeter 1942; Kirzner

1973) and by the drive to control decision making within the company they started (e.g.,

Sapienza, Korsgaard et al. 2003). However, Entrepreneurship is a process by which individuals

pursue opportunities without regard to the resources they currently control. (Stevenson and

Jarillo 1990:23) Because they are pursuing new opportunities, entrepreneurs usually lack key

resources needed to build their organizations (Starr and MacMillan 1990). Assembling the

necessary resources enables entrepreneurs both to increase their organizations rates of growth

and to reduce its risk of failure, potentially increasing dramatically the value of their companies.

For the entrepreneur, this introduces a fundamental tension, because the need to attract

outside resources can conflict with the major factors, both tangible and intangible, that motivate

people to become entrepreneurs. As detailed below, the entrepreneur will have to choose

between attracting the resources that will help build a valuable company, in the process giving up

a lot of equity and decision-making control, or else retain equity and control while not being able

to build as valuable a company. These tradeoffs should exist both at the entrepreneur level and

at the company level. (It is also suggested that one way that entrepreneurs can affect the tradeoff

is by accumulating appropriate human capital prior to founding the venture.)

For instance, the founder of Steria, an information-technology systems and services

company, faced such a tradeoff (Abetti 2005). In the end, the entrepreneurs desire to remain

independent and master of his own destiny led him to refuse to accept capital from outside

investors (relying instead on founder capital and bank loans), to maintain control of the

companys equity, to not grant stock to Sterias employees, and to remain chief executive officer.

As a result, the companys growth was slowed markedly (Abetti 2005). An alternate path for the

entrepreneur would have been to take capital from outside investors and to allocate equity to

others working for the company, thus potentially building a more valuable company. However,

doing so would have conflicted with what motivated him to start Steria.

Conflicting Motives, Founder Backgrounds, and Organizational Value

Both Adam Smith (1991 ed.) and Joseph Schumpeter (1942) emphasized that the

personal profit motive drives private enterprise. More specifically, entrepreneurs want to build

personal wealth by owning equity in a valuable venture (Schumpeter 1942; Kirzner 1973).

Supporting this, a recent study found that many founders of new high-technology ventures

believe that their chances of becoming wealthy are much greater if they were to start a venture

than if they were to pursue non-venture options (Amit, MacCrimmon, Zietsma and Oesch

2000:120). These opportunistic entrepreneurs are more motivated by financial gains than are

craftsman entrepreneurs, who are more motivated by the need for autonomy (Chell, Haworth

and Brearley 1991).

The more resources that a new venture can gain control of, and the quicker it can do so,

the better the ventures competitive position (Romanelli 1989:375). In particular, the major types

Academy 2006 Best Paper Proceedings

Page 3 of 7

of resources required by entrepreneurs are human resources and financial resources (Sapienza,

Korsgaard et al. 2003). However, gaining the resources to build valuable companies can also

come at a steep cost to the entrepreneur. In order to acquire control of critical resources,

organizations have to give up things that are of high value to their resource providers (Emerson

1962; Pfeffer and Salancik 1978). This is particularly true in new ventures, for the high rates of

growth of such ventures often require a very high percentage of resources not controlled initially

by the entrepreneur (Venkataraman 1997) and the most valuable resources are in limited supply

(Peteraf 1993:181). Entrepreneurs will have to give up a share of the ventures control and its

future rents in order to attract valuable co-founders, hires, and investors (Collis and Montgomery

1995; Coff 1999). High-quality co-founders and non-founding hires will demand more equity

than will lesser co-founders and hires. The same is true of investors who can add the most value,

compared to lower-value investors (Amit, Glosten and Muller 1990; Hsu 2004). If the

entrepreneur refuses to give up such control, he will fail to attract the best resource providers and

thus will build less value.

The central problem is that giving up control of the venture conflicts with the second core

motivation for entrepreneurs, the control motive. Not all entrepreneurs start ventures to get

wealthy (Amit, MacCrimmon et al. 2000:120). In fact, recent empirical studies have found that

entrepreneurs earn lower financial returns (Moskowitz and Vissing-Jorgensen 2002) and income

(Hamilton 2000) than would be expected. The major explanation offered by each study is that

this results from a willingness to forego economic benefits in order to gain the intangible benefits

of increased professional autonomy and personal control. In particular, entrepreneurs are

motivated by the chance to play a central role in driving and controlling the growth of the

company they founded (e.g., Carland, Hoy, Boulton and Carland 1984; Begley and Boyd 1987).

Because of this control motive, entrepreneurs want to maintain control of decision making within

the firm by retaining control of the CEO position (Wasserman 2003) or by retaining control of

the board of directors (Wasserman and Boeker 2005). Therefore, there is an inherent tension

between the profit motive and the control motive, for the resource-attraction choices that help

increase financial gains endanger the entrepreneurs control of the venture, and vice versa.

There are two major levels on which the entrepreneur can keep or give up control of

decision making: controlling whether the entrepreneur remains CEO (Hellman 1998; Wasserman

2003) and whether outsiders or insiders control the board of directors (Sahlman 1990; Lerner

1995). First, investors who want to grow a more valuable company will often push to bring in a

new CEO to replace the entrepreneur. However, such actions run counter to the wishes of an

entrepreneur whose primary motivation is being able to control the development of the

organization he or she has founded. Entrepreneurs who do not want to give up the CEO position

will be less attractive to investors who want to be able to change CEOs as the company grows,

thus hurting the entrepreneurs abilities to gain resources from outsiders.

Hypothesis 1: If the entrepreneur still holds the CEO position, the value of the

entrepreneurs equity stake will be lower.

The second level where entrepreneurs want to control decision making within their firms

is within the board of directors. The board of directors controls most major decisions within

modern companies (Mace 1971), and maintaining control of more than half of the board can give

entrepreneurs powerful influence over those decisions. Within new ventures, for most corporate

decisions, board control is critical (Lerner 1995; Kaplan and Stromberg 2004). Such decisions

Academy 2006 Best Paper Proceedings

Page 4 of 7

can have fundamental implications for the founders of the company, making it very important to

entrepreneurs that they retain control of the board as long as possible (Wasserman and Boeker

2005). However, given the money and other resources they contribute to the company, investors

also want to control key decisions as much as possible. Entrepreneurs who resist giving such

investors control at the board level may thus harm their own ability to attract the resources of

such outsiders, reducing their ability to grow the value of their companies.

Hypothesis 2: If the entrepreneur still controls the board of directors, the value of

the entrepreneurs equity stake will be lower.

The hypotheses above focused on how the need to attract resources should increase the

chances that the entrepreneur will have to give up control of the venture. However, past work on

strategic choices (e.g., Hitt and Tyler 1991) has found significant impacts of an executives prior

work experience and functional experience on organizational outcomes, with specific

applications to entrepreneurial contexts. This prior experience should have an important impact

on the entrepreneurs ability to build the venture, in ways that may help the entrepreneur achieve

his or her motivations beyond what would be expected from the tradeoff described above. Most

centrally, entrepreneurs having general management (GM) experience influences the strategies

adopted by new firms (Boeker 1988) and the thresholds with which entrepreneurs evaluate firm

performance and whether to exit (Gimeno, Folta, Cooper and Woo 1997). Furthermore, in

contrast to managers with narrower functional backgrounds, managers who have GM experience

consistently lead their business units to higher levels of performance (Govindarajan 1989).

Therefore, we would expect founders who have GM experience to have built greater value than

founders who do not have GM experience.

Hypothesis 3: Entrepreneurs who had general management experience before

founding the venture will have more valuable equity stakes in their venture.

The first three hypotheses capture the tradeoff between the founders retaining control of

the venture and the value of the founders personal equity stake. However, does the founders

choice to retain control affect the value of the overall venture? Especially during the early stages

of venture growth (Wasserman 2006), when founders are more likely to act like organizational

stewards (Davis, Schoorman and Donaldson 1997), the key consideration for entrepreneurs

may be how their choices will affect the overall value of the venture itself. For instance,

entrepreneurs may be more willing to give up control if it means that the venture will benefit,

even at the expense of the entrepreneurs financial gain. If so, we should see a negative

relationship between the control retained by the entrepreneur and the value of the venture itself.

Hypothesis 4: If the entrepreneur has been replaced as CEO or if outsiders control

the board of directors, the companys valuation will be higher.

CONCEPTUAL INTEGRATION: THE RICH VS. KING TRADEOFF

We can integrate these factors into a matrix that summarizes the Rich vs. King tradeoff.

On the horizontal axis is the value of the entrepreneurs financial stake. The vertical axis shows

Academy 2006 Best Paper Proceedings

Page 5 of 7

the degree to which the entrepreneur has kept control at the CEO and board levels, varying from

keeping little control (being a minor player) to keeping a lot of control (major player).

Value of Stake

Substantially lower

than potential value

Control Kept

- CEO position

- Board control

Minor player

FlopText

Major player

King

Close to potential

value

Rich

Rich & Regal

For many founders, the ideal entrepreneurial outcome would be one where the

entrepreneur both grows a valuable company and remains a big player in it (Rich & Regal in

the matrix). However, within a particular type of business, most entrepreneurs will face a

tradeoff between building value and keeping decision-making control i.e., between being

Rich (a minor player with a valuable stake) and being King (a major player holding a much

less valuable stake). At the same time, entrepreneurs who have a general management

background should have a higher likelihood of becoming Rich & Regal.

DATA, METHODS, AND RESULTS

The data used in this study was collected in annual surveys of private American firms. To

reduce the chance that the results are sensitive to the year in which the data were collected, this

study uses data from the 2000, 2001, and 2002 surveys, while controlling for the year of

collection. The full dataset includes 457 private technology companies.

The first dependent variable, the current value of the entrepreneurs equity holdings, is

computed by multiplying the companys pre-money valuation times the entrepreneurs

percentage of equity held (e.g., Lerner 1994; Kaplan and Stromberg 2004), logarithmically

transformed. (Auxiliary models were run using the logarithm of the amount of capital raised,

with similar results.) To test Hypothesis 4 regarding the value of the company, the logarithm of

the companys pre-money valuation was used as the dependent variable. The core independent

variables included three dummy variables: whether the entrepreneur still held the CEO position

(Hypothesis 1), whether founders still controlled the board of directors (Hypothesis 2), and

whether the entrepreneur had a general management background from prior work experience

(Hypothesis 3). To test Hypothesis 4, the organization-level models used as dependent variables

the companys valuation and its total capital raised. The control variables included human capital

controls, company controls, and segment and year dummies.

In summary, all four hypotheses are supported. Most centrally, entrepreneurs who give

up the CEO position (p<.01) and board control (p<.005) hold more valuable equity stakes. At

the same time, when the entrepreneur has a general-management background (p<.05), the

entrepreneurs stake is more valuable. The results also hold for the core organization-level

model: company valuation is greater if the entrepreneur has given up the CEO position (p<.01)

and if the entrepreneur has given up control of the board (p<.005). Thus, there appears to be a

strong tradeoff between value created and control retained, but that entrepreneurs who have prior

general management backgrounds may be able to build more value than strictly implied by the

Rich vs. King tradeoff.

Academy 2006 Best Paper Proceedings

Page 6 of 7

DISCUSSION

This study has examined the conflict between entrepreneurs two major motivations, the

profit motive and the control motive. People are motivated to become entrepreneurs by potential

economic benefits and by the ability to control and shape the companies they start.

Entrepreneurs who want to build valuable companies must attract the outside resources that can

help them do so, by attracting co-founders, non-founding executives, and investors. However, to

attract these outside resources, entrepreneurs have to give up something that may have motivated

them to begin with: control of decision making. This requires them to choose between attracting

resources that can help grow their companies and keeping those core benefits that are their main

motivations for becoming entrepreneurs.

Hypotheses about this tradeoff were tested on a unique dataset of 457 private ventures in

the technology industry. The results show that the more decision-making control kept (at both

the CEO and board levels), the lower the value of the entrepreneurs equity stake. Thus,

entrepreneurs are more likely to grow a more valuable venture if they are willing to give up

control, or they can keep control, not attract the best resources (people, capital) to the venture,

and be more likely to end up with less-valuable stakes. These results were found in both older

and younger start-ups. At the organization level, this study also found that entrepreneurs

choices about retaining control also affect the valuation of the overall venture.

For entrepreneurs with simple motivations for instance, entrepreneurs driven primarily

by the profit motive and very little by the control motive, or vice versa the set of choices they

face should be more straightforward than if they are driven by both motives.1 However,

entrepreneurs driven by both major motives face a more complex series of choices (Sapienza,

Korsgaard et al. 2003). These are the entrepreneurs who face tougher dilemmas in their

strategic choices. Ideally, it would make sense for these entrepreneurs to try to achieve the

entrepreneurial ideal of being both Rich & Regal. However, much as moves to claim value

harm a persons ability to create value (Lax and Sebenius 1986), attempts by entrepreneurs to

achieve one goal should harm their ability to achieve the other goal. This is why, despite

prominent Rich & Regal entrepreneurs like Michael Dell and Bill Gates, most entrepreneurs are

not like these exception cases and instead have to sacrifice one goal or risk achieving neither.

The tradeoff examined here mirrors examinations in the strategy literature (e.g., Coff

1999) of the relationship between rent generation and rent appropriation, and in the overall

resource dependency literature on top managements ability to attract critical resources from the

external environment (Pfeffer and Salancik 1978). Further research can help us understand how

entrepreneurs may be able to reduce the drastic liabilities of newness that come from a lack of

resources, further increasing the impact of entrepreneurs on capitalist economies.

To the extent that entrepreneurs are motivated by other motivations beyond the two examined here, and to the

extent that their corresponding strategic choices are unrelated or even conflicting with the Rich versus King tradeoff,

the existence of such other motivations should make this studys empirical conclusions more conservative.

Academy 2006 Best Paper Proceedings

Page 7 of 7

The Rich-versus-King Tradeoff

Share of company valuation ($M)

$10

$9

$8

$7

Older company (n=219)

Younger company (n=230)

$6

$5

$4

$3

$2

Kept CEO

Gave up both

Position only

CEO and

Board Control

Kept Board Kept CEO and

Control only Board Control

REFERENCES AVAILABLE FROM THE AUTHOR

Potrebbero piacerti anche

- Comercial Manager - #1 Buyer Persona Whaticket 2023Documento14 pagineComercial Manager - #1 Buyer Persona Whaticket 2023Mario HurtadoNessuna valutazione finora

- Redbus TicketDocumento4 pagineRedbus TicketNiharika RangasamudramNessuna valutazione finora

- Global Baby Cereals Market, 2009-2015Documento3 pagineGlobal Baby Cereals Market, 2009-2015Axis Research MindNessuna valutazione finora

- Willy Wonka: Vermont Tire & ServiceDocumento35 pagineWilly Wonka: Vermont Tire & ServiceCoolerAdsNessuna valutazione finora

- Zenefits Press ReleaseDocumento2 pagineZenefits Press ReleaseTom Gara100% (1)

- APP - MET - Enhanced Medical Benefit Plan-3 (NEXtCARE) - July 2021Documento8 pagineAPP - MET - Enhanced Medical Benefit Plan-3 (NEXtCARE) - July 2021FebilaNessuna valutazione finora

- Solaris Root Password RecoveryDocumento3 pagineSolaris Root Password RecoveryMirza Jubayar TopuNessuna valutazione finora

- 16 17 ChapterDocumento22 pagine16 17 Chapterpiku25894Nessuna valutazione finora

- BS Sample Paper 1 UnsolvedDocumento9 pagineBS Sample Paper 1 UnsolvedSeema ShrivastavaNessuna valutazione finora

- EfW Sept 16 2022 TemplateDocumento2 pagineEfW Sept 16 2022 TemplateMuhammad NasirNessuna valutazione finora

- Suitability-Declaration-Jobsplus-v2Documento1 paginaSuitability-Declaration-Jobsplus-v2work permitofficeNessuna valutazione finora

- Vinayak Resume 2022Documento5 pagineVinayak Resume 2022Maitry VasaNessuna valutazione finora

- Raspberry Pi Based Security System PDFDocumento56 pagineRaspberry Pi Based Security System PDFMohd KhanNessuna valutazione finora

- .PDF 2Documento12 pagine.PDF 2aarghjNessuna valutazione finora

- Aptean Industrial Manufacturing ERP Whitepaper 4 Pillars of A Future Ready Manufacturing Business enDocumento14 pagineAptean Industrial Manufacturing ERP Whitepaper 4 Pillars of A Future Ready Manufacturing Business enmadhurimaNessuna valutazione finora

- CertificateDocumento3 pagineCertificatesidhesh randhaveNessuna valutazione finora

- HUDCOShelterOctober 2020Documento117 pagineHUDCOShelterOctober 2020tarekyousryNessuna valutazione finora

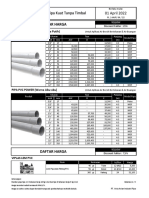

- PL Power Yellow - 01 Apr 22Documento9 paginePL Power Yellow - 01 Apr 22Dunia FantasiNessuna valutazione finora

- Bali Major 2023 - Media Handbook 1Documento25 pagineBali Major 2023 - Media Handbook 1mikeionaNessuna valutazione finora

- Spectrophotometer Importer3Documento5 pagineSpectrophotometer Importer3Maurice AbdullahiNessuna valutazione finora

- Mahaavir Exotique Phase I Brochure PDFDocumento9 pagineMahaavir Exotique Phase I Brochure PDFShailendraNessuna valutazione finora

- IDFC FIRST Savings Account Form V5Documento4 pagineIDFC FIRST Savings Account Form V5xyzNessuna valutazione finora

- Digested Journal#6Documento4 pagineDigested Journal#6Jay Raymond DelfinNessuna valutazione finora

- PowerSchool SIS Start of Year GuideDocumento30 paginePowerSchool SIS Start of Year GuideSandi HodgsonNessuna valutazione finora

- Balmer Lawria - Assistant Manager - SRD 2023Documento6 pagineBalmer Lawria - Assistant Manager - SRD 2023Sandeep kumar TanwarNessuna valutazione finora

- Brochure - Fortis WallsDocumento20 pagineBrochure - Fortis WallsMANessuna valutazione finora

- Excel2019 Pag3 4Documento2 pagineExcel2019 Pag3 4GuidoNessuna valutazione finora

- Qatar Law 16 of 2002Documento11 pagineQatar Law 16 of 2002Jai RamosNessuna valutazione finora

- DePaul Slides Nov.2022Documento77 pagineDePaul Slides Nov.2022Euro LinkNessuna valutazione finora

- School of Medicine Interview Information 2023 v1Documento4 pagineSchool of Medicine Interview Information 2023 v1dovidNessuna valutazione finora

- Wakounig - Organizing A New Telco - Detecon Whitepaper - NeuDocumento19 pagineWakounig - Organizing A New Telco - Detecon Whitepaper - NeuM. AlimNessuna valutazione finora

- SterliteDocumento1 paginaSterliteRamesh KumarNessuna valutazione finora

- Update ResumeDocumento2 pagineUpdate ResumeHey MamasNessuna valutazione finora

- Target Course Day-22 Percentage 12.10.20Documento68 pagineTarget Course Day-22 Percentage 12.10.20Pranjal BajpaiNessuna valutazione finora

- Panduan Ringkas Ahli Master ServerDocumento16 paginePanduan Ringkas Ahli Master ServerElderick Almer MaxmillianNessuna valutazione finora

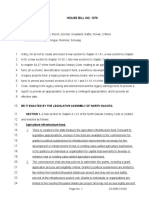

- HB 1379Documento12 pagineHB 1379Jeremy TurleyNessuna valutazione finora

- Amazon PresentationDocumento17 pagineAmazon PresentationAndleeb RazzaqNessuna valutazione finora

- 519 Study Guide MidtermDocumento22 pagine519 Study Guide MidtermAGreenNessuna valutazione finora

- Q2 2022 Supply Chain Tech Report PreviewDocumento9 pagineQ2 2022 Supply Chain Tech Report PreviewAkbaraly KevinNessuna valutazione finora

- Adaptive Automation Design of Authority For Syste 2003 IFAC Proceedings VolDocumento10 pagineAdaptive Automation Design of Authority For Syste 2003 IFAC Proceedings VolNGUYEN MANHNessuna valutazione finora

- Pharmacology and Pathology Question Paper ADocumento4 paginePharmacology and Pathology Question Paper ASahil YadavNessuna valutazione finora

- Final Exp of DISHA 13-07-2022Documento48 pagineFinal Exp of DISHA 13-07-2022Radha bhagatNessuna valutazione finora

- Script of FMDocumento3 pagineScript of FMDhanu PrihatmaNessuna valutazione finora

- RECRUITMENT OF JUNIOR ASSOCIATES (CUSTOMER SUPPORT & SALES) Advertisement No. CRPD - CR - 2022-23 - 15Documento5 pagineRECRUITMENT OF JUNIOR ASSOCIATES (CUSTOMER SUPPORT & SALES) Advertisement No. CRPD - CR - 2022-23 - 15Mrinmayee BamNessuna valutazione finora

- WalmartcaseDocumento30 pagineWalmartcaseBarret RobisonNessuna valutazione finora

- Survival BagDocumento5 pagineSurvival BagShokhsanam IkramovaNessuna valutazione finora

- Motor Catalogue 2018Documento48 pagineMotor Catalogue 2018Pandu BirumakovelaNessuna valutazione finora

- 3 ComDocumento465 pagine3 ComWagner VictoriaNessuna valutazione finora

- PS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital CompanyDocumento1 paginaPS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital CompanyJhansi RokatiNessuna valutazione finora

- SAP Fundamentals: An SAP Crash Course For Students New To SAPDocumento34 pagineSAP Fundamentals: An SAP Crash Course For Students New To SAPBhagath Krishnan BNessuna valutazione finora

- British Gases Business EthicsDocumento16 pagineBritish Gases Business EthicsLewis MutembeiNessuna valutazione finora

- MULESOFT Top 7 Digital Transformation Trends Shaping 2023Documento26 pagineMULESOFT Top 7 Digital Transformation Trends Shaping 2023Melissa Perú ViagemNessuna valutazione finora

- Financial Literacy ClassVIIDocumento67 pagineFinancial Literacy ClassVIIsohamkabiraj12Nessuna valutazione finora

- Cmat GK 500 PDFDocumento133 pagineCmat GK 500 PDFamareshgautam100% (1)

- ABM BF PPT2 Organizational Chart and The Roles of The VP Finance 1Documento36 pagineABM BF PPT2 Organizational Chart and The Roles of The VP Finance 1Jm JuanillasNessuna valutazione finora

- Group6 - Bourbon finalLLLLLLLLLLDocumento34 pagineGroup6 - Bourbon finalLLLLLLLLLLPriyanjaliDasNessuna valutazione finora

- Volvo Eicher JointventureDocumento11 pagineVolvo Eicher JointventureBhavini64Nessuna valutazione finora

- JobDescription - Discipline Lead - Piping - HVAC - MechanicalDocumento3 pagineJobDescription - Discipline Lead - Piping - HVAC - MechanicalIlija KoricaNessuna valutazione finora

- Financial ManagementDocumento27 pagineFinancial ManagementMohamed KotbNessuna valutazione finora

- 2 Mitchell Article (1) - 3 LecturaDocumento16 pagine2 Mitchell Article (1) - 3 LecturaVanessa AljureNessuna valutazione finora

- Linking Business Management With E-Ship GrowthDocumento14 pagineLinking Business Management With E-Ship GrowthJenniferNessuna valutazione finora

- Rich vs. KingDocumento11 pagineRich vs. KingJenniferNessuna valutazione finora

- Working Groups Vs TeamsDocumento1 paginaWorking Groups Vs TeamsJenniferNessuna valutazione finora

- Working Groups Vs TeamsDocumento1 paginaWorking Groups Vs TeamsJenniferNessuna valutazione finora

- Frank Knight On Risk, Uncertainty and The FirmDocumento14 pagineFrank Knight On Risk, Uncertainty and The FirmJenniferNessuna valutazione finora

- Why Are Entrepreneurs More Risk Loving PDFDocumento27 pagineWhy Are Entrepreneurs More Risk Loving PDFMauroNessuna valutazione finora

- Prospect Theory & Entrepreneurship QuizDocumento5 pagineProspect Theory & Entrepreneurship QuizJenniferNessuna valutazione finora

- Faulkner Sound and FuryDocumento3 pagineFaulkner Sound and FuryRahul Kumar100% (1)

- Succession Under Muslim Law 2Documento12 pagineSuccession Under Muslim Law 2Z_JahangeerNessuna valutazione finora

- EARNINGDocumento5 pagineEARNINGDEST100% (2)

- Buried BodiesDocumento2 pagineBuried BodiesNeil Ian S. OchoaNessuna valutazione finora

- RESUME, Sharad PaudyalDocumento2 pagineRESUME, Sharad PaudyalSharad PaudyalNessuna valutazione finora

- PIOT Remotely GlobalDocumento12 paginePIOT Remotely Globaletioppe50% (2)

- Timothy Leary - Space Migration SMIILE PDFDocumento53 pagineTimothy Leary - Space Migration SMIILE PDFRichard Woolite100% (1)

- Master of Education (Instructional Technology)Documento2 pagineMaster of Education (Instructional Technology)Abel Jason PatrickNessuna valutazione finora

- George Barna and Frank Viola Interviewed On Pagan ChristianityDocumento9 pagineGeorge Barna and Frank Viola Interviewed On Pagan ChristianityFrank ViolaNessuna valutazione finora

- MetaphysicsDocumento148 pagineMetaphysicsMonizaBorges100% (3)

- Quantitative Research Questions & HypothesisDocumento10 pagineQuantitative Research Questions & HypothesisAbdul WahabNessuna valutazione finora

- Neonaticide and NursingDocumento6 pagineNeonaticide and Nursingapi-471591880Nessuna valutazione finora

- Evolution of The KabbalahDocumento58 pagineEvolution of The KabbalahJudith Robbins100% (1)

- Sociological Theory: Three Sociological Perspectives: Structural FunctionalismDocumento8 pagineSociological Theory: Three Sociological Perspectives: Structural FunctionalismAbdulbasit TanoliNessuna valutazione finora

- PHILO - FallaciesDocumento17 paginePHILO - FallaciesERICA EYUNICE VERGARANessuna valutazione finora

- Essay Writing FCE Part 1 - Sample Task # 5 - Technological DevelopmentsDocumento3 pagineEssay Writing FCE Part 1 - Sample Task # 5 - Technological DevelopmentsMaria Victoria Ferrer Quiroga100% (1)

- Significance of Rosary in SikhismDocumento9 pagineSignificance of Rosary in SikhismhansrabNessuna valutazione finora

- Critique of "Ali Mirza The Heretic:Refutation of Allegations of Heretic Ali Mirza On Saiyiduna Uthman RD:and His Governors RD:.Documento11 pagineCritique of "Ali Mirza The Heretic:Refutation of Allegations of Heretic Ali Mirza On Saiyiduna Uthman RD:and His Governors RD:.AHLUSSUNNAHVSALIMIRZANessuna valutazione finora

- G. W. F. Hegel - H. S. Harris - Walter Cerf - The Difference Between Fichte's and Schelling's System of Philosophy-SUNY Press (1977)Documento242 pagineG. W. F. Hegel - H. S. Harris - Walter Cerf - The Difference Between Fichte's and Schelling's System of Philosophy-SUNY Press (1977)sixobjectsNessuna valutazione finora

- Jean Molino: Semiologic TripartitionDocumento6 pagineJean Molino: Semiologic TripartitionRomina S. RomayNessuna valutazione finora

- The Life Cycle of A Butterfly Lesson PlanDocumento2 pagineThe Life Cycle of A Butterfly Lesson Planst950411Nessuna valutazione finora

- Chapter 1-Law and Legal ReasoningDocumento9 pagineChapter 1-Law and Legal Reasoningdimitra triantosNessuna valutazione finora

- NGOTips - Fostering Effective NGO GovernanceDocumento5 pagineNGOTips - Fostering Effective NGO GovernanceKakak YukaNessuna valutazione finora

- Leadership Theories and Styles: A Literature Review: January 2016Documento8 pagineLeadership Theories and Styles: A Literature Review: January 2016Essa BagusNessuna valutazione finora

- 1881 Lecture by William George LemonDocumento12 pagine1881 Lecture by William George LemonTim LemonNessuna valutazione finora

- Hart Fuller DebateDocumento10 pagineHart Fuller DebatePulkit GeraNessuna valutazione finora

- Edmund Dulac, W B Yeats and The MagiDocumento23 pagineEdmund Dulac, W B Yeats and The MagiRaphael888Nessuna valutazione finora

- Types of Tests Used in Special EducationDocumento5 pagineTypes of Tests Used in Special EducationCbrc CebuNessuna valutazione finora

- Communicative Language TeachingDocumento71 pagineCommunicative Language TeachingLuqman Hakim100% (1)

- Writing An Academic EssayDocumento9 pagineWriting An Academic EssayKerryNessuna valutazione finora