Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Prime Samia

Caricato da

Nurul MonsurCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Prime Samia

Caricato da

Nurul MonsurCopyright:

Formati disponibili

1

1.1 Background of the Study:

Bank is that financial institution which bridge between surplus group and deficit

group. This is the sector that can help in achieving economic growth of any

nation. Banking is one of the most competitive sectors in Bangladesh. Banking

industry has a huge growth during last decades. It is very difficult to capture a

large market share because of huge competition. Moreover it is totally service

based industry. So no one can deny the importance of customer service to gain

competitive advantage in banking industry and customer satisfaction is an

important dimension for performance measurement. As most of the banks offer

similar products and services, improving customer satisfaction has become the

crucial point to gain and increase market share.

The Prime Bank being the first privet sector bank is always one step ahead of

the other competitors in serving the customer and satisfying them. Its goal is to

meet customers expectation through offering better services.

1.2 Origin of the report:

This report is prepared as a compulsory part of BBA program of School of

Business, Sylhet International University, Sylhet. The main objective was to

translate theoretical knowledge into on the job situation. After completion of

academic courses of BBA program I was placed at Prime bank ltd., Subid Bazar

Branch, Svlhet as an intern.

This report covers the topic General Banking of Prime Bank Ltd., Snbid

Bazar Branch, Sylhet. During this internship period I learned how the host

organization works with the help of the internal supervisor. On the basis of

working experience for this period I have prepared this report and I have tried

my best to relate the theoretical knowledge with the practical work situation.

1.3 Scope of the Study:

The study is about Prime Bank Limited, it is a famous commercial bank and it

has 111 branches all over the Bangladesh. So the overall scope of the report

should be around all the branches of the bank. But my scope was limited

because I am appointed by the authority in Subid Bazar Branch of that

particular bank. So I had the opportunity to work at that branch only.

1.4 Objectives of the study:

Primary Objective

To fulfill the requirement of BBA program containing three months

internship and gain practical experience.

Secondary Objectives

1) To know about Prime Bank Limited and to observe and understand

the activities of customer service department.

2) To assess the quality and quantity of various service at Prime Bank

Limited.

3) To identify the customer perception towards the customer services of

Prime Bank Limited.

4) To identify problems in providing customer service.

5) To acquire the practical knowledge of the banking activities.

6) To know the mission, vision, objectives and strategies of the

organization.

7) To know the organizational major functions descriptions of its

business and detailed descriptions of various functional departments.

8) To explore the effectiveness of the products and services offered by

Bank Asia.

1.5 Methodology of the study:

To prepare the report on General Banking of Prime Bank Ltd., I have to

collect both primary and secondary data. The primary sources of my report areface to face conversation with the officers of Bank Asia, customers & expert

opinion. The secondary sources are-file record study, annual report of Prime

Bank Ltd. and other sample banks, journals, websites etc.

1.6 Limitations:

Time Limitation:

The duration of the internship was only three months. This time is not sufficient

to understand a broad sector like banking. So many aspects could not be

attached at this report only because of shortage of time.

Data Confidentiality:

The main barrier of preparing this report is data confidentiality. Data provided

by bank was not enough to cover the main aspects of this report. So I mainly

have to depend on observation of their internal banking process.

Information Validity:

Data was collected through observation and discussion of bank personnel.

Statistical analysis of the data has not been done. Thats why the findings are

not statistically validated.

Survey Limitation:

It was very difficult to questioning customers formally because of some

restrictions from bank. For this I mainly depend on informal conversation and

observation of customers.

2.1 Introduction:

The banking industry is highly competitive, with banks not only competing

among each other; but also with non-banks and other financial institutions.

Most bank product developments are easy to duplicate and when banks provide

nearly identical services, they can only distinguish themselves on the basis of

price and quality. Therefore, customer retention is potentially an effective tool

that banks can use to gain a strategic advantage and survive in todays everincreasing banking competitive environment.

A bank is a financial institution and a financial intermediary that accepts

deposits and channels those deposits into lending activities, either directly or

through capital markets. A bank connects customers that have capital deficits to

customers with capital surpluses.

Banks act as payment agents by conducting checking or current accounts for

customers, paying checks drawn by customers on the bank, and collecting

checks deposited to customers current accounts. Banks also enable customer

payments via other payment methods such as Automated Clearing House

(ACH), Wire transfers or telegraphic transfer, and automated teller machine

(ATM).

Banks borrow money by accepting funds deposited on current accounts, by

accepting term deposits, and by issuing debt securities such as banknotes and

bonds. Banks lend money by making advances to customers on current

accounts, by making installment loans, and by investing in marketable debt

securities and other forms of money lending. Prime Bank Limited has resulted

in great success in all areas of operation with a view to improve the socioeconomic development of the country.

2.2 Historical Background of Prime Bank Limited:

Prime Bank started its journey in the year 1995 with the firm commitment of

excellent customer service with a difference. It was incorporated on 17th April

1995 with Tk. 1000 million of authorized capital and Tk. 100 million of paid up

capital by a group of successful entrepreneurs. It is not only a conventional

Bank. Its a modern, dynamic private commercial bank & plays a constructive

role in the economic development of the country. Prime bank is the first private

bank to introduce lease finance, Hire purchase & customer credit schemes along

with Islamic banking services in the banking sector in order to bring about

qualitative changes in the lives of people of Bangladesh. PBL through its steady

progress & continuous success has, by now, earned the reputation of being one

of the leading private sector Banks of the country. It has now established itself

as one of the leading and strongest of private sector Bangladeshi banks having

remarkable progress in all areas of operation despite challenging environment.

The sbank received ICAB Awards and SAFA merit Awards. The bank remains

fully committed to the delivery of higher shareholders value. The high

profitability track record underpins value that the shareholders derive from

investing in the shares of Prime Bank. In doing business, Prime Bank follows

the fundamental principles of Corporate Governance- Accountability,

Responsibility and Transparency. In discharging its responsibilities, Prime Bank

works as a socially responsible corporate entity. It has focused in the areas of

preservation of memory of Martyr, health care, education, games and sports,

talent development and contribution to charity.

2.3 Operation in Sylhet:

Prime Bank started its operation in Sylhet in the first quarter of 1996. To

provide the service to consumers of Sylhet; Prime Bank Ltd. extends its branch

in Laldidighirpar in Sylhet in January 10, 1996. This branch now acts as the

central branch in Svlhct zone. To consolidate its position in Sylhet the Islamic

banking branch in Amberkhana started its operation on December 17, 1997. The

opening of Amberkhana branch pronounced the managements vow to

strengthen islamic banking operation along with conventional banking for the

consumer of Sylhet. To better service of clients, Uposhohor branch of Sylhet,

came in to operation on December 4, 2005. To solidify the position and

considering the demands of consumers, Subidbazar branch started its operation

on October 25, 2007.

2.4 Vision:

To be the best Private Commercial Bank in Bangladesh in terms of efficiency,

capital adequacy, asset quality, sound management and profitability having

strong liquidity.

2.5 Mission:

To build prime bank ltd., into an efficient, market driven, customer focused

institution with good corporate governance structure. Continuous improvement

in our business policies, procedures and efficiency through integration of

technology at all levels.

2.6 Strategic Priority:

To have sustained growth, broaden and improve range of products and services

in all areas of banking activities with the aim to add increased values to

shareholders investment and offer highest possible benefits to customers.

2.7 Core Values:

For the customers: To be the best Private Commercial Bank in Bangladesh in

terms of efficiency, capital adequacy, asset quality, sound management and

profitability having strong liquidity.

For the employees: By promoting the well-being of the members of the staff.

For the shareholders: By ensuring fair return on their investment through

generating stable profit.

For the community: By assuming the role as a socially responsible corporate

entity in a tangible manner through close adherence to national policies and

objectives.

2.8 Objectives of the Bank:

To build up strong pillar of capital, To promote trade, commerce and industry,

To discover strategies for achieving systematic growth, To improve and broaden

the range of product and services, To develop human resource by increasing

employment opportunities, To enhance asset of shareholders, To offer standard

financial services to the people, To keep business morality, To develop welfare

oriented banking service, To offer highest possible benefit to customers.

2.9 Hierarchy of Prime Bank Ltd:

Top Level Management

Chairman

Board of Director

Executive Committee

Managing Director

Additional Managing Director

Executive Level Management

Deputy Managing Director

Senior Executive Vice President

Executive Vice President

Senior Vice President

Vice President

Senior Assistant Vice President

Assistant Vice President

Mid Level Management

Junior Level Management

2.10 Branch Overview:

First Assistant Vice President

Senior Executive Officer

Executive Officer

Principal Officer

Senior Officer

Management Trainee Officer

Officer

Junior Officer

Trainee Assistant

Prime Bank Limited always tries to give proper services to their customers. For

this they open several branches on convenient places for their customers. Prime

Bank Limited, Subidbazar Branch is number 55th among 111 branches. As the

branch situated at residential area generally they have more general customer

either than commercial customers. But there are also some commercial

customers. Some related information regarding this branch is given below.

Branch Serial Number:

55

Branch code:

160

Date of Opening:

25 October, 2007

Head of Branch:

Md. Ahsanul Mubin

Operation Manager:

Md. Muhiduzzarnan

Total Employee:

12

Functioning Departments:

General Banking, Credit department, Foreign

Exchange

Address:

Subid Bazar Branch,Corner View (1st floor,

west side) , Plot # 488(SA), 2155(RS),

Sylhet-3100.

3.1 General banking in Prime Bank Ltd:

The Prime Bank limited Subidbazar Branch has divided its whole General

banking process in to the following sections;

Account Opening Section

Cash Department

Loan Section

Foreign Remittance Section

3.2 Products and Services of Prime Bank Ltd:

Prime Bank Limited offers various kinds of deposit products and loan schemes.

The bank also has highly qualified professional staff members who have the

capability to manage and meet all the requirements of the bank. Every account

is assigned to an account manager who personally takes care of it and is

available for discussion and inquiries, whether one writes, telephones or calls.

3.2.1 Deposit Scheme:

Fixed Deposit Scheme

Contributory Saving Scheme

Monthly Benefit Deposit Scheme

Education Savings Scheme

Double benefit Deposit Scheme

Lakhpoti Deposit Scheme

Savings Deposit Account

Current Deposit Account

My First Account

STD Account

NRTA (Non Resident Taka Account)

NFCD (Non Resident Foreign Currency Deposit Account)

NITA (Non Resident Investors Taka Account)

3.2.2 loan Schemes:

10

General loan schemes:

Consumer credit scheme

lease Finance

Small and Medium Enterprises Credit Scheme

Financing Scheme for Contractors

Prime Bank Master/ Visa card Credit Card

House Building Apartment Loan Scheme

Advance Against Share

3.3 Customer Services in Account Opening Section:

At Prime Bank Ltd. Subidbazar branch, Sylhet, customer services mainly

provided at Account Opening Section. It serves both of the customers who

comes frequently and the customers who comes at once for banking.

3.3.1 Account information:

In the customer service desk, various information regarding current account,

savings account, fixed deposit, deposit scheme, benefit of deposits, Interest rate

etc. are provided. The key jobs are listening customers problems and solve it.

3.3.2 Account opening:

To open any type of account in Prime Bank Ltd, there are some requirements

which must have to be filled. During my job on this desk I have observe the

process of account opening and the documents which are necessary for this. I

was also engaged to provide various types customer service in this section.

3.3.3 Basic requirements for opening a Bank Account:

11

Two Copies photograph with attested by introducer.

Valid ID (NID/Passport/Driving License copy/Chairmans Certificate/

Councilors Certificates).

Nominees Photograph one copy, attested by the Account holder.

Prove of Income Source (Job ID/ Job Certificate/ Trade License of business).

Introducer, which is Account holder of the same bank, in same branch or any

other branch.

Initial Deposit as Savings Account open with minimum Taka 2,000/- (Two

Thousand Taka only) and SND Account opens with minimum Taka 25000/(Twenty Five Thousand Taka only).

3.3.4 Procedure of Account opening:

To open a bank account in the Prime Bank Ltd. the following steps need to be

maintained:

Collect an Account Opening Form from the Bank.

Fill-up all the requirements of the Form.

Nominee is must be specified.

Photograph is most important for any account.

The account holder signature in front of the authorized officer.

Any valid photo ID or photocopy of the Passport.

Deposit slip for initial deposit for the account.

3.3.5 Account Closing:

For two reasons, one account can be closed. One is by banker and other is by

the customer.

By Banker: If any customer doesnt maintain any transaction within six years

and the A/C balance becomes lower than the minimum balance, banker has the

right to close an A/C.

12

By Customer: If the customer wants to close the A/C, he has to write an

application to the manager urging him to close his A/C.

Closing Process:

Closing process for current and savings account:

# After receiving customers application the officer verifies the balance of the

A/C.

# Then he calculates the interest and other charges accumulated on the

A/C.

# If it bears a credit balance, the officer writes advice voucher. He gives

necessary accounting entries post to the customer.

# The balance is returned to the customer.

# Finally the A/C is closed.

3.3.6 Cheque book Issues:

The bank issues cheque book to their clients with great care and customers

dont face any problem to withdraw the money from any of the branches of

Prime Bank Ltd. in Bangladesh because the Bank offers Online banking facility

to the customers. Prime Bank also provides ATM service to their customers for

cash withdrawal at any time from specific ATM Booth. Some rules and

regulations that are strongly followed by banks prove that they are on their right

track to keep clients privacy and confidentiality.

3.3.7 Apply for Debit Card:

With a Prime Bank Master Debit Card, customer can go for shopping, dining,

paying utility bills or withdraw cash without visiting any branches. If the

customers have current or savings account in the Bank, then they are able to

apply for Debit Card. To apply for a debit card, customer have to collect

prescribed form from the bank and have to fill-up the requirement of the form

and shall have to submit to respective bank. On successfully filled-up the form,

the debit card is provided to the customer within next 14 working days.

13

3.3.8 Account Balance Inquiry:

Customers of Prime Bank Ltd. are entitled to inquiry for their account balance

by their respective account number directly from the account opening section of

the bank, or over the phone. Bank also provides bank statement of the

customers previous transactions.

3.3.9 Fill out a Withdraw Slip / Cheque:

If any customer become unable to fill out the withdraw Slip, then the staff of

Prime Bank Ltd. helps them to fill out the withdraw slip or the bank cheque, or

the deposit slip.

3.3.10 Order New Cheque Book:

On the requirement of a new cheque book of any customer, the Prime Bank Ltd.

issues a new cheque book within 3 working days. As such, the customer has to

fill- up a Cheque requisition slip and submit to the respective Customer Service

Desk. Prime bank provides two types of cheque book, i.e.

(i) 10 Page Cheque Book for the savings account, and

(ii) 50 page Cheque Book for the current account.

3.3.11 Issuance of Solvency Certificate:

The Prime Bank Ltd. issues Bank Solvency Certificate to the account holder on

their requirement.

3.3.12 Mail:

Prime Bank accept cheque deposits, cheque requisition, accounts opening form

via mail and use mail to communicate to their customers, e.g. by sending out

statements.

14

3.3.13 SMS Banking:

Prime Bank Limited provides SMS Banking services for ensuring customers

instant access to their account information at any time. Any mobile phone user

having an account with Prime Bank Limited can get this service through the

mobile phone.

3.3.14 Internet Banking:

Customer can now do banking from anywhere at anytime with internet banking

without spending hours in traffic or waiting in a queue. Customer can easily

access their account through internet to check account balance, statement, loan

schedule etc.

3.4 Cash Department:

All financial transactions of the bank are conducted through the cash

department of the Bank. Under this section, transactions are made in cash. At

PBL subidbazar branch four cash officer provide customer service in cash

counter. Every kind of deposit and withdrawal are processed in the cash

department. During withdrawal they cross cheque to identify the person and the

signature of the account holder. The following services provided in cash

counter i.e Cash receive

Cash payment

Buy and sell prize bond

Receives utility bills i.e Gas bill, tuition fees etc.

Manage the liquidity level for banks daily transaction.

3.5 Foreign Remittance Service:

Remittance is the transfer of fund from one place to another or from one person

to another. Remittance service provided by banks to customer as well noncustomer. Since it is not a free service, it is also a source of income o the bank.

15

PBL Subidbazar branch deals with local and foreign remittance.

Instrument of remittance service are as follows Demand Draft (DD) issue and collection

Pay Order (P0) issue and collection

Pay Slip

Outward Bills Collection (OBC)

Inward Foreign Remittance

Outward Foreign Remittance

3.6 Online branch banking:

The bank has set up a Wide Area Network (WAN) across the country to provide

online branch banking facilities to its valued clients. Under these scheme clients

of any branch is being able to do banking transaction at other branches of the

hank.

Under this system a client is able to do the following kinds of transaction:

a) Cash withdrawal from his/her account at any branch of the bank.

b) Cash deposit at his/her account at any branch of the bank irrespective of

location.

c) Cash deposit at others account at any branch of the bank irrespective of the

location.

d) Transfer of money from his/her account with any branch of the bank.

3.7 Automated Teller Machines (ATM):

Prime Bank ltd. also provides automated teller machine facilities. Privileges of

automated teller machine are Cash Withdrawal: Customer can withdraw cash from any ATM booth of

Prime Bank Ltd. and Dutch -Bangla Bank Ltd. at free of cost.

16

Balance Enquiry: Customer can check the balance from any ARM booth of

PBL and Dutch Bangla Bank.

Mini Statement: Mini Statement facility can be easily obtained from any booth

of Prime Bank Limited at free of cost.

17

4. SWOT analysis:

SWOT analysis is the detailed study of an organizations exposure and potential

in perspective of its strength, weakness, opportunity and threat. This facilitates

the organization to make their existing line of performance and also foresee the

future to improve their performance in comparison to their competitors. As

though this tool, an organization can also study its current position, it can also

be considered as an important tool for making changes in the strategic

management of the organization.

4.1 Strength:

(a) Good Customer Relationship:

PBL provides quality services to the clients compared to its other contemporary

competitors. The bank has a very good relationship with its customers. The

bank believes in maintaining personal relationship with the customer.

(b) Experienced Senior Management:

The senior management of PBL is responsible for promoting the highest level

of business ethics and integrity. Their aim is to create and foster a culture

throughout the bank that emphasizes and demonstrate the importance of

maintaining high business ethics and close relationship with customers.

(c) Islamic Banking Activities:

Beside the conventional banking activities Islamic banking activities of Prime

Bank ltd. provides a great edge to the bank then the other bank. So the

consumer of different mentalities can be satisfied getting two ways of banking

service in a single bank.

(f) Cooperative Banking environment:

In the Prime Bank, there always exist cooperative banking environment for the

clients and employees that also influenced its customers and the success of the

bank.

18

(g) Social responsibility through CSR activities:

Prime Bank Limited supports the concept of triple bottom line approaching in

Social responsibility through CSR: Good economic performance, Good Social

practice, Good environmental practice to that end.

4.2 Weakness:

(a) Offers only few services among the wide service range:

Though Prime Bank Ltd. has a wide range of services but they offer only a few

of them in Sylhet. In Sylhet, they offer some specific types of services.

(b) Lack in concentrating on marketing activities:

Prime bank does not promote their customer services on a regular basis. They

seem to be not concern about promoting themselves and their services at all.

Where other competitors use billboard to promote their single services, PBL

only use some 5 or 6 feet banners to promote the inauguration of new branch.

(c) Technological Backup is not satisfactory:

One of the major weaknesses of Prime bank Ltd. is the lack of proper

technological backup. Technological backup is not up to date for PBL which

often slower the pace of work. Recently, PBL entered into agreement with

Dutch-Bangla Bank Limited (DBBL) to facilitate the clients of PBI by

providing ATM facilities through ATM (Automated Teller Machine) Booth of

DBBL. This also is the lacking in technological facilities of PBL.

(d) Unavailability of ATM Booth:

There is shortage of ATM booth of Prime Bank in the Sylhet zone. The Prime

Bank provides only 4 ATM booths in Sylhet City, where sufficient balance of

money also become shortage. Beside ATM service charges of Prime Bank is so

high that is why customers are being dissatisfied with it.

19

4.3 Opportunities:

(a) Branch Expansion:

Prime bank is growing quickly all over the country. Besides expanding in the

urban areas, PBL has prospects to open more branches in sub-urban areas,

which will eventually enhance the governments efforts at reviving the rural

economy as well as reaching more people by better service.

(b) Training Facility:

Prime Bank Training Institute (PBTI) is supporting the bank by offering in

house training courses, workshops and seminars. As the bank has its own

training institute to enhance the capability of human resources, PBL can use this

opportunity to train their employees in specific areas and create specialized and

expert people for the bank.

(c) Banking Software:

Providing quality service is one of the major goal of Prime Bank ltd.

TEMENOUS T24 is functionally a rich thin client scalable modular system

which increase operational efficiency and is enabling the bank to gain

competitive edge and opportunity. The Prime Bank, Subidbazar branch is

enjoying the installment of this software from the very beginning.

(d) Banks Goodwill:

Prime Bank Ltd. has its own corporate goodwill that factors influenced the

success of this branch.

4.4 Threat:

(a) Level of competition:

Competition is always a major threat for any organization. In recent years, the

number of private bank is increasing. These banks always pose a threat for

others by coming up with new product line, innovative technology, quality

services, etc. thus the level of competition rises and create threat for Prime

Bank.

20

(b) Online facilities provided by the competitive bank:

As the technology is getting advanced, most of the banks, especially private

banks are installing more sophisticated Online Banking Systems to survive in

the industry. With time, the advancement of technology is posing a threat for the

bank.

(c) Lack of motivation:

The low compensation package of the employees from mid level to lower level

position threats the employee motivation. As a result, well qualified employees

leave the organization and its effects the organization as a whole.

(d) Threat of new entrance:

Recently government has approved few new banks to start their business

activities. As the customers demand for new attractive products and services

with new features are growing rapidly and new banks can expect to earn

attractive profits, as such the new entrance are classified to be a threat for Prime

Bank Limited.

21

5.1 Recommendations:

On the basis of my studies and observation, from my point of view, the

following recommendations can be judged and applied to promote the product

& service of Prime Bank Ltd.

1. Provide Prompt Customer Service:

Branch has to deal with lots of customers of the bank that is what it needs to

focus more on efficient service and more staffs are required for the Customer

Service Desk.

2. Introduce New Service:

According to their huge number of customer, product variety, number of

products and its availability should be increased and offered to the customers.

3. Promotional Activities:

The Prime Bank should amplify their effective promotional activity. As such it

should pursue more advertisement campaign in order to build a strong image

among people. To attract new customers they could use print and electronic

media.

4. Provide Banking Material faster:

The time duration from application to delivery of ATM/Master card of the

Prime Bank to its customer should be shorten.

5. Promote additional ATM Booth:

The Number of ATM booth has to be increased for the Sylhet zone.

6. Fully online banking facilities:

Prime Bank Limited is an online bank, but still they could not provide all the

facilities of online banking. Customers have to collect their cheque books, ATM

cards, etc, from the branch where they open account. These cause problems in

many times, and inconvenient for customers. So they must take steps to be a

fully online bank that means to provide all kinds of online facilities to

customers.

22

7. Foreign Remittance Service:

The foreign remittance exchange service should be provided in every branch of

Prime bank.

8. SMS Banking & Phone Banking:

The SMS banking and Phone banking service should be provided to customer

of Prime bank swiftly.

9. Internet Banking facilities:

The internet banking facilities for the customers of Prime Bank should be

uncomplicated as providing worldwide internet banking facility so that the

customer can exercise it even from outside the country.

10. Internal Network System:

The internal network service of Prime Bank should be more strong and

effective so that it does not get down during the working hour and the day to

day services can be served to the customers effectively.

11. Willingness to serve:

The Management of bank should improve the willingness among their staff to

serve their customer for better customer satisfaction.

12. Islamic banking activities:

In Sylhet, the Prime Bank Limited provides the Islamic banking service only

through Amborkhana branch. But in my point view, it should promote the

Islamic banking service through every branch in Sylhet as there are lots of

customer demands.

14. Motivation:

Lack of motivation is a strong threat for the Prime Bank Limited. As such the

HRM department of the Prime Bank should take effective measures to promote

and motivate their employees.

23

5.2 Conclusion:

The customers today are more conscious and apply their precious judgment in

selecting their service providers. Thus The Prime Bank finds a fundamental

change in the way the customers think and act in choosing their products and

services. The customer wants to know the value, ethical standard, tangibles etc

demonstrated by the banks. They are also careful and sensitive about the way

the banks treat the employees as well as the community in which the bank

operates their businesses. As such, it is imperative on the part of the bank to

strike the balance between profitability and service sensitiveness. To the end,

Prime Bank Limited is integrating their responsibility into service and its

operation.

During the three months internship program in Prime Bank Ltd. Subidbazar

branch, almost all the desks have been observed. As such, it has been observed

that the branch provides all the conventional banking services as well as some

specialized Financing activities to the economy. Customers Services of any

bank is a crucial department in reality. A banks performance is largely depends

on this department. The Prime Bank Ltd. Subidbazar branch provides all the

services related to the variety of products of the bank to its customers. Thus the

Prime Bank Ltd. Subidbazar branch is playing an important role in the banking

systems and service in Sylhet.

24

Bibliography:

1. Annual Report of the Prime Bank Ltd. (2011-2012)

2. Prime Magazine, 2nd & 3rd Issue. Published by Prime Bank Limited.

4. Booklet, brochures of various products of Prime Bank Limited.

5. Previous Internship report on Prime Bank Limited.

6. Book Reference:

i) Business Research Methods by William G. Zikmund, Barry J. Babin, Jon C.

Carr & Mitch Griffin, Eight Edition.

ii) Principles of Marketing by Philip Kotler, Fourteen Edition.

iii) Crafting & Executing Strategy by Arther A. Thompson, A.J. Strikiand III,

John E. Gamble, Sixteenth Edition.

7. Web Reference:

i) www.primebank.com.bd.

ii) www.banking.com

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

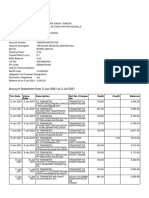

- Account Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento8 pagineAccount Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanatan ThakurNessuna valutazione finora

- 2nd Mate OOW For Ratings STC UKDocumento5 pagine2nd Mate OOW For Ratings STC UKFabian MascarenhasNessuna valutazione finora

- OidhvohsDocumento10 pagineOidhvohsDeepak ShastriNessuna valutazione finora

- Bank Reconciliation StatementDocumento40 pagineBank Reconciliation StatementPrashant100% (1)

- 2017 Transpay Service GuideDocumento7 pagine2017 Transpay Service GuideBuddy KertunNessuna valutazione finora

- Visa Fee For AustraliaDocumento11 pagineVisa Fee For AustraliaShaifur RahmanNessuna valutazione finora

- Eft 101Documento12 pagineEft 101Khushbu KothariNessuna valutazione finora

- RBA APU PPT - OJK 16 April 2018 PDFDocumento46 pagineRBA APU PPT - OJK 16 April 2018 PDFBunnyNessuna valutazione finora

- Power of AttorneyDocumento5 paginePower of AttorneyAshokNessuna valutazione finora

- Blue Chip Stocks TipsDocumento16 pagineBlue Chip Stocks TipsPinal MehtaNessuna valutazione finora

- RaresDocumento2 pagineRaresLohanel RaresNessuna valutazione finora

- Current Issues in Istisna & Tijarah (Final)Documento12 pagineCurrent Issues in Istisna & Tijarah (Final)Hasan Irfan Siddiqui100% (1)

- Merger and Acquisition in Bank Sector in IndiaDocumento63 pagineMerger and Acquisition in Bank Sector in IndiaOmkar Chavan0% (1)

- 2551QDocumento3 pagine2551QJerry Bantilan JrNessuna valutazione finora

- Kfs Current AccountsDocumento10 pagineKfs Current Accountsritika sainiNessuna valutazione finora

- Account Activity Generated Through HBL MobileDocumento2 pagineAccount Activity Generated Through HBL MobileAðnan YasinNessuna valutazione finora

- 2.3 Audit AssuranceDocumento27 pagine2.3 Audit AssurancemohedNessuna valutazione finora

- AICPA - Develops Standards For Audits ofDocumento3 pagineAICPA - Develops Standards For Audits ofAngela PaduaNessuna valutazione finora

- Report On HBLDocumento81 pagineReport On HBLSafdar KhanNessuna valutazione finora

- Ross4ppt ch19Documento36 pagineRoss4ppt ch19씨나젬Nessuna valutazione finora

- Aml Kyc NotesDocumento12 pagineAml Kyc Notesabhi_33Nessuna valutazione finora

- Competitive Analysis of Stock Brokers ReligareDocumento92 pagineCompetitive Analysis of Stock Brokers ReligareJaved KhanNessuna valutazione finora

- FIN036 AssignmentDocumento25 pagineFIN036 AssignmentSandeep BholahNessuna valutazione finora

- Apni Shakhsiyat Ki Tameer Kaise Ki JaeDocumento99 pagineApni Shakhsiyat Ki Tameer Kaise Ki JaeMansoorNessuna valutazione finora

- Legendary Chef Makes A Triumphant Return: Pierre KoffmannDocumento36 pagineLegendary Chef Makes A Triumphant Return: Pierre KoffmannCity A.M.Nessuna valutazione finora

- Bank Audit Work PaperDocumento47 pagineBank Audit Work PaperKaushal JhaNessuna valutazione finora

- BANK ACT 1864 (Original) Common-Law RemedyDocumento4 pagineBANK ACT 1864 (Original) Common-Law Remedyin1or100% (1)

- Profile of CompleteBankData in The Pittsburgh Business TimesDocumento1 paginaProfile of CompleteBankData in The Pittsburgh Business TimesNate TobikNessuna valutazione finora

- App Aud - Prelim Exam (Key)Documento16 pagineApp Aud - Prelim Exam (Key)Shaina Kaye De GuzmanNessuna valutazione finora

- TciDocumento53 pagineTciarunzmr007Nessuna valutazione finora