Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Wajid Saeed Final

Caricato da

SaadRasheedCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Wajid Saeed Final

Caricato da

SaadRasheedCopyright:

Formati disponibili

State Bank of Pakistan

STATE BANK OF PAKISTAN

(Head Office)

Page 1 of 72

201

4

State Bank Of Pakistan

201

4

INTERNSHIP REPORT ON

STATE BANK OF PAKISTAN

KARACHI

BY

Wajid Saeed

ROLL NO: 21272

BBA (Finance)

Page 2 of 72

State Bank Of Pakistan

201

4

DEPARTMENT OF MANAGEMENT SCIENCES

HAZARA UNIVERSITY MANSEHRA

SESSION 2010-2014

This Internship Report is submitted to the Department of Management Sciences

In Partial Fulfillment of the Requirements for the Degree of

Bachelor of Business Administration.

Page 3 of 72

State Bank Of Pakistan

201

4

Department of Management Sciences

Hazara University Mansehra

SESSION 2010-2014

APPROVAL SHEET

Internal Supervisor:

Name:

Mr. Haseeb Hassan

Signature:

Designation:

Lecturer

External Examiner:

Signature:

________________________

Chairman:

Signature:

Page 4 of 72

_________________________

State Bank Of Pakistan

201

4

DEDICATION

This Report is Dedicated to my loving Parents, Sisters, Teachers &

Friends who always supported, encouraged and helped me to complete

my education without any reluctant.

May they all live long?

Page 5 of 72

State Bank Of Pakistan

201

4

ACKNOWLEDGEMENT

Standing on a bank of river, a man cannot determine its depth unless and

until he sets foot in it. It has always been said that the best way to learn is

through experience.

First of all I would like to praise and thanks Almighty ALLAH, who gave me the

strength and will to complete this task that would not have been possible otherwise.

I am very grateful to the management of State Bank of Pakistan for offering the summer

internship program and providing me an opportunity to gain practical experience.

The completion of this report was a difficult task and it just became possible with the

cooperative & supportive staff of Risk management Department especially Mr. Mohsin

Rasheed (Director RMD), Mr. Qaimat Karim, Mr. Zohaib Pasha Khero and all the other

staff members of RMD. I am also very thankful to all my colleagues and friends whose

support & motivation help me in completing this report within the allocated time.

Page 6 of 72

State Bank Of Pakistan

201

4

PREFACE

This report encircles the basic framework of liquidity risk management in State Bank of

Pakistan and other financial institutions. This report is a result of my zealous efforts.

Though, I am professionally amateur but the continuous inspiration of my commendable

coordinator motivated me to make use of little talent that I had and come forth with this

report. I have, in this report concentrated on quality rather than blacking sheets with

worthless or irrelevant details.

All the crust matters have been discuss for the better understanding with the help of

data from authentic sources.

Data is acquired from the official website of SBP and from other websites. I am

amateur to make a practical analysis but I make our zealous efforts. This is only drawback

in our work. Yet I hope that whoever examines this project keep this factor in

concentration. I do hope in favorable anticipation that this project will be appreciated

keeping in view all the inherent discrepancies in its generation. (Thanks)

Page 7 of 72

State Bank Of Pakistan

Table of Contents

Page 8 of 72

201

4

State Bank Of Pakistan

201

4

Chapter No 1........................................................................................................................14

Introduction of the Internship Report...................................................................................14

1.2 Project Scope...................................................................................................... 14

1.3 Project Structure.................................................................................................. 14

1.4 Theme of the Study.............................................................................................. 15

Chapter No 2........................................................................................................................17

Introduction to the Banking System in Pakistan and Central Bank of Pakistan..................17

2.1 Banking..........................................................................................................................17

2.2 Banking System of Indo Pak before Partition.............................................................17

2.3 Banking in Pakistan.......................................................................................................19

2.4 BANKING SYSTEM IN PAKISTAN...........................................................................21

Introduction to State Bank of Pakistan................................................................................23

2.5 SBP Vision Statement........................................................................................... 23

2.6 SBP Mission Statement......................................................................................... 23

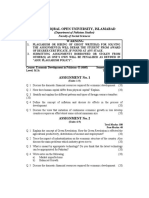

Figure 1 from SBP website.......................................................................................... 24

2.7 History of State Bank of Pakistan.............................................................................24

2.15 Risks in SBP and other Financial Institutions..............................................................32

2.15. Section A: Risk Management in SBP.........................................................................32

2.15.1 Risk.............................................................................................................. 32

2.15.2 Risks in State Bank of Pakistan............................................................................32

2.15.3 Risk Management Department............................................................................. 32

2.15.5 Key Functions of RMD...................................................................................... 33

2.15.6 Structure of RMD............................................................................................ 34

Figure 3 from Risk management department in SBP...........................................................34

2.15.7 Responsibilities of the RMD............................................................................... 34

2.15.8 Liquidity Risk:.........................................................................................................35

2.15.9 Risk Management............................................................................................ 35

Page 9 of 72

State Bank Of Pakistan

201

4

Figure 4 from Risk Management Department in SBP..........................................................36

2.15.10 Liquidity Risk Management.............................................................................. 36

2.15.11 Liquidity Risk management in a State Bank of Pakistan............................................37

Section B Risk Management in other Financial Institutions................................................41

2.15. B Liquidity Risk Management in Financial institutions................................................41

Requirements for Liquidity Risk Management..................................................................44

Chapter No 3 Financial Analysis of SBP.............................................................................45

Section A: Financial Analysis.............................................................................................45

3.1 Current Ratio...................................................................................................... 45

Interpretation........................................................................................................................45

3.2 Debt Ratio......................................................................................................................46

3.3 Interest Coverage Ratio..................................................................................................46

3.4 Operating Profit Margin.................................................................................................47

3.6 Return on Assets.............................................................................................................48

3.7.1Horizontal Analysis of Balance sheet of SBP..............................................................49

Balance sheet item...............................................................................................................49

State Bank Of Pakistan Issuing Department........................................................................49

Rupees in 000...................................................................................................................49

Horizontal analysis in % tage based on year 2011...............................................................49

Assets...................................................................................................................................49

2011......................................................................................................................................49

2012......................................................................................................................................49

2013......................................................................................................................................49

2012......................................................................................................................................49

2013......................................................................................................................................49

Page 10 of 72

State Bank Of Pakistan

201

4

Balance sheet item...............................................................................................................50

State Bank of Pakistan Banking Department.......................................................................50

Rupees in 000...................................................................................................................50

Horizontal analysis in % tage based on year 2011...............................................................50

Assets...................................................................................................................................50

2011......................................................................................................................................50

2012......................................................................................................................................50

2013......................................................................................................................................50

2012......................................................................................................................................50

2013......................................................................................................................................50

3.7.2 Vertical Analysis of Balance Sheet of Issuing Department of SBP............................53

Balance sheet item...............................................................................................................53

State Bank Of Pakistan Issuing Department........................................................................53

Rupees in 000...................................................................................................................53

Vertical analysis in % tage based on Total assets.................................................................53

2012......................................................................................................................................53

2013......................................................................................................................................53

2012......................................................................................................................................53

2013......................................................................................................................................53

Balance sheet item...............................................................................................................54

State Bank Of Pakistan Banking Department......................................................................54

Rupees in 000...................................................................................................................54

Vertical analysis in % tage based on Total assets.................................................................54

Assets...................................................................................................................................54

Page 11 of 72

State Bank Of Pakistan

201

4

2012......................................................................................................................................54

2013......................................................................................................................................54

2012......................................................................................................................................54

2013......................................................................................................................................54

Chapter 4 SWOT Analysis.......................................................................................... 57

SWOT analysis of state bank of Pakistan....57

4.2 Strengths.

..57

1. Premier Institution..

.57

2. Agent to

Government.

.57

3. Reserve

Custodian

.57.

4. Employee Benefit.............................................................................................................58

5. Broad Network.................................................................................................................58

6. Strictly follows Rules & Regulations...............................................................................59

7. Professional Competence.................................................................................................59

8. Healthy Environment......................................................................................................59

9. Learning Resource Center................................................................................................59

10. Online Network..............................................................................................................59

11. Transparency and accountability.......................................................................................60

4.3 Weaknesses.....................................................................................................................60

1. Lack of Marketing Efforts................................................................................................60

2. Political Pressure..............................................................................................................60

Page 12 of 72

State Bank Of Pakistan

201

4

3. Favoritism and Nepotism.................................................................................................60

4. Uneven Work Distribution...............................................................................................60

4.4 Opportunities..................................................................................................................61

1.

Electronic Banking......................................................................................................61

2.

Micro Financing..........................................................................................................61

4.5 Threats............................................................................................................................61

1.

Political Pressure by Elected Government..................................................................61

2.

Data theft.....................................................................................................................61

3.

Customer Complaints..................................................................................................62

Chapter No

5

63

5.1 Recommendations and Conclusion................................................................................63

5.1.1 Recommendations.......................................................................................................63

5.2 Regulatory Guidelines for Banks...................................................................................64

5.3 Conclusion.....................................................................................................................64

Page 13 of 72

State Bank Of Pakistan

201

4

Chapter No 1

Introduction of the Internship Report

1.1 Introduction

SBP offered internship curriculum twice every year consisting summer internship and winter

internship for the students of B.B.A (Hons), M.B.A and economics of comparative departments

in different universities all over Pakistan. In 1st two weeks orientation sessions are conducted

for interns at Learning Resource Center (LRC) of SBP for introduction of the central bank of

Pakistan presented by diverse directors about their departments that how they are functioning

and what are their jobs and responsibilities. After this the interns are allocated to different

departments in the bank. I was detailed in Risk management Department where I have to work

on multiple types of risks and as well as Liquidity Risk management in central bank and other

institutions of the country.

1.2 Project Scope

This project intricate two interrelated issues, namely financial stability of the whole

financial system and the Liquidity risk management function in the Central Bank of Pakistan.

The project main objective is to provide a visible understanding of the specificities of the Central

Bank of Pakistan activities in the supply of liquidity to the financial sectors in the economy.

Page 14 of 72

State Bank Of Pakistan

201

4

1.3 Project Structure:

The structure of my report consists of two parts. First, the function of the Central Bank

of Pakistan as liquidity providers and lenders of last resort to all commercial banks in search to

defend financial stability of the economy. Holding and investment of Foreign exchange reserves

in such a way that will be favorable for upcoming recessions and inauspicious events later in the

coming years. This role will in turn explain why the Central Bank of Pakistan has expanded their

balance sheets during the crisis.

Second, to intricate on Liquidity risk management in the Central Bank of Pakistan ,

explaining how this differs from risk management practices in other public or private financial

institutions in the country and also about the risk management framework and how this

contributes to the policy goals and objectives , among other things, by ensuring the institutions

financial protection.

1.4 Theme of the Study

Management and Liquidity risk in any organization is a tough challenge as well as an

opportunity for financial institutions as they broaden their playing field. Beyond the goal of

regulatory compliance, banks are working to establish liquidity risk and management. Risk

management and specially the Liquidity risk management underscores the actuality that the

survival of an organization depends heavily on its capabilities to predict and get ready for the

change rather than just waiting for the change and react to it.

The objective of Liquidity risk management is not to prohibit or prevent or avoid risk taking

activity, but to make sure that the risks are knowingly taken with full knowledge, purpose and

clear understanding so that it can be evaluated , measured and mitigated. It also prevents an

institution from suffering undesirable or un foreseen loss that causing an institution to suffer or

materially damage its competitive position. Functions of Liquidity risk management actually be

bank specific dictated by the size and quality of balance sheet, complexity of functions,

Page 15 of 72

State Bank Of Pakistan

201

4

technical/ professional manpower and the status of Management Information System existed in

that bank.

By better monitoring the liquidity of their products, counterparties and the market as a

whole, bank can be able to successfully focus their attention on the most liquidity-efficient

actions and make decisions in accordance with their level of liquidity risk appetite. The Basel III

principled helps all the banks to improve their risk management framework to deliver successful

liquidity risk management and build up their competitive performance.

The 2nd Chapter of this report comprises of Introduction of the banking system in

Pakistan and Introduction to the central bank of Pakistan as well as Risk management

Department located at the 9th floor of the state bank where I worked on different types of risks

mainly Liquidity risk management in the Central bank and other financial Institutions of the

economy that how to handle these risks and mitigate them.

3rd Chapter of my report is on financial analysis consisting multiple types of ratios and

also including horizontal and vertical analysis of statements of position of Issuing and banking

Departments as well as profit and loss accounts of the central bank of Pakistan.

4th Chapter consists of SWOT analysis of the bank to put into practice their strategies

well as much as necessary and to convert their weaknesses to strengths to prevail over the

deficiencies and to take benefit from new opportunities in the market and become attentive of all

the threats in the financial systems and the economy.

5th Chapter comprises on recommendations and conclusion I concluded after assessing

and evaluating different types of ratios and also providing some of the regulatory guidelines and

suggestions to the central bank as well as other financial institutions in the financial systems and

the economy.

Page 16 of 72

State Bank Of Pakistan

201

4

Chapter No 2

Introduction to the Banking System in Pakistan and Central Bank

of Pakistan

Introduction

This Chapter of the report comprises of Introduction of the banking system in Pakistan and

Introduction to the central bank of Pakistan as well as Risk management Department of the state

bank where I worked on different types of risks specifically Liquidity risk management in the

Central Bank and other financial Institutions of the financial system that how to deal with these

risks and diminish them.

2.1 Banking

The 1962 ordinance of banking companies define banking as:

Banking means accommodating or accepting of multiple types of deposits of money for the

function of lending or investing from individuals, households and repayable on demand or else

and withdrawal by cheques, drafts, order, or else.

2.2 Banking System of Indo Pak before Partition

Ever since, money became the standard of exchange in different societies, banks existed

in multiple forms, and though in previous years their principle was primarily to lend money to

the public and the kings. In the words of R.C. Dutt: Loans and usury were well understood in

those days and Rishis bewail their state of indebtedness with the ease of primitive times

The Vedic Epic cleared about lending and taking of credit and also mentioned about contracts

of debts at dicing. Later on, Manu in his Sammurti cleared those transactions by mentioning,

a rational man should deposit his money with an individual of good family, of good behavior,

well-known with the laws rules and regulations having many relatives prosperous and

Page 17 of 72

State Bank Of Pakistan

201

4

respectable. Manu has also prescribed the rules to govern the policies of loans and rates of

interest.

In 5th century common peoples were familiar to use hundies as a credit instrument. The

land income was collected generally in different kinds, while the services were salaried mostly in

cash. Consequently, bankers assistance in these matters and other financial matters of State was

very much obligatory and having of great significance. The bankers enjoyed better standings, and

the people deposited their ornaments, stuff, Embroidery and cash holdings with them for safe

supervision. Different types of loans were lend to the people against delicate and other securities

such as ornaments, goods and immovable properties like land buildings and the banker and

customer had very cordial associations.

The Muslim rules and regulations also provided considerable support to the farmers by

giving them soft interest-free loans and grants in cash. They also permitted them to pay the land

proceeds in cash or other kind. This helps the farmers fairly enough and this agricultural finance

resulted in quantitative food production, which had a great surplus after utilization at home.

Therefore, it was being exported beside pure gold in different foreign countries.

Other developments like manufacturing development were also not ignored at all. Smallscale units as well as industries were functioning effectively and efficiently under the backing.

Loans were also lend for growing the production through the parentage and motivation of the

King and the State. These industries thus created enough for home consumption and left other

considerable quantities for exports to overseas countries against pure gold. Yard goods, dyeing,

ceramic objects, china-ware, indigo, opium, metal work, paper, leather and sugar and surgical

instruments at that time were being exported to foreign countries like China, East Indian nations

and Pacific Islands to acquire pure gold thus the port towns in India and East Bengal become the

centers of the earth trade where numerous overseas buyers used to come for purchasing different

types of Indian possessions.

Muslim historians of the 12th century also operate as agents to the administration to collect

revenues. They also charged money to administration. Such a wealthy society did need wellPage 18 of 72

State Bank Of Pakistan

201

4

regulated financial institutions with ideal management having professional knowledge

concerning banking and monetary system. Muhammad Tughlaq was the foremost who

introduced coupon exchange in India. He issued metal coins as well as paper currency from the

Royal Mints in his period.

After this ShershahSuri and then Mughal emperors additionally advance this structure.

Akbar also makes efforts in the country to prepare and issue money. Royal treasuries were also

recognized at that time that performs for the entire country under a well conceived arrangement

so that they could function as the offices of Central Bank of the time and due to improvements

and affluence of Indian society of that time, the Royal mints and Treasuries did perform as

agencies for moving of money as well as for custody of valuables.

2.3 Banking in Pakistan

At the time of separation the areas now which represent Pakistan, were producing

different food grains and agricultural raw objects for the complete living beings of the

subcontinent. There were industries and doesn't matter what raw material was produced was

being exported from Pakistan. However, commercial Banking conveniences were provided

reasonably well here.

Before 14th August 1947 the complete banking system was in the control of non-Muslims.

When Hindus capitalists become convinced of division of sub-continent, they transferred their

resources to India in secure custodies. Pakistan was affirmed as an independent state after which

most of the Non-Muslims initiate immigration from Pakistan to India. The large scale movement

of Non-Muslims from Pakistan to India caused the cutback in banking deposits. So scheduled

bank branches were condensed from 619 to 213 and the numbers of non-scheduled bank

branches was condensed from 411 to 106. The independent sate of Pakistan had no central bank

of its own at time of separation.

Without possessions it was very difficult for a new state like Pakistan to run its

individual banking system instantly and effortlessly. Therefore, in agreement with the provision

of Indian independence Act of 1947, an Expert Committee was allotted to study the vital issue.

Page 19 of 72

State Bank Of Pakistan

201

4

The Committee accomplished that time observance in view the troubles facing after partition that

the Reserve bank of India should prolong to function in Pakistan until 30th September 1948, so

that problems of maturity of different liabilities and demand liability, coinage, currencies,

exchange etc. are settled between India and Pakistan. It is important to enlist the important

events in the history of banking in Pakistan.

The first imperative event before partition was establishment of Habib Bank Limited, on 25th

of August, 1941 at Bombay. This was the foremost bank in Indian sub-continent, which was

operated by Muslims. Habib bank Limited transferred its Registered (Cranium) Head Office to

Karachi located on I.H Chandigarh road on August 07, 1947 which played an enormous role in

the next forty year of financial progress in the country.

The 2nd important occasion in the history of Banking in Pakistan is the establishment of

Australasia Bank Limited, at Lahore on 3rd December 1942. Its name was altered to Allied Bank

of Pakistan Limited, on 1st July 1974. After nationalization of the Banking Industry on 1st

January, 1974 three other banks were amalgamated in to it.

The other important date is 9th July 1947; when the Muslim Commercial Bank Limited was

registered and integrated at Calcutta. Its registered Head Office was transferred to Dacca on 17

August 1948. Consequently its registered Head Office moved to Karachi on 23rd August 1956.

The most important day was 01 July 1948, when the State Bank of Pakistan was

inaugurated at Karachi as the central Bank of the Islamic Republic of Pakistan. Central bank

addressed itself with the vital task of creating a national banking arrangement as well as

functioning as regulatory and supervisory authority for banks from the time when it came into

being. In order to accomplish this target it provided every assistance and inspiration to Habib

Bank to expand its network of branches, and also suggested to Government the establishment of

a new bank which could serve as an representative of State Bank. As a result, The National Bank

of Pakistan came into existence on 09 November 1949 and by 1952 it became muscular enough

to take over the agency function from the Imperial Bank of India. This was the first Commercial

Bank in the public sector of Pakistan. At the closing stages of June 1999, the number of

Page 20 of 72

State Bank Of Pakistan

201

4

scheduled Banks in Pakistan was 52 with 7,950 branches. Out of these there are 25 Pakistani

bank with 7,779 branches and 27 foreign banks with 171 branches.

On 1st January 1947 the government of Pakistan decided to nationalized the Pakistani

scheduled banks and promulgated the bank (Nationalization) Act, 1974, with the following main

objectives:

To flat the progress of the government to use the capital for the raid economic

augmentation of the country and the more urgent social welfare projects.

To allocate equality bank credit to diverse classes, Sectors and regions.

To synchronize the banking procedure in a variety of areas of practicable joint activity

without eliminating vigorous competition among the banks.

The Act additionally mentioned for the setting up of the Pakistan Banking Council all

Nationalized commercial Banks, consisting of the following members.

The government of Pakistan from different economic actions, business plans and patterns in

the earlier two decades has realized that the national economy which was subjugated by public

sector and production, trade and finance were over regulated. This resulted not only in chronic

budget deficit, leaving not much for social and physical infrastructure.

The government of Pakistan introduced concise economic reforms designed at liberalization

and deregulation of trade, commerce, industry, banking and finance, dropping the role of public

sector to increase social sector actions. In order to deregulate the financial sector, various

governing laws were amended in 1990.

Banks (Nationalized Second Amendment) Ordinance, 1991 was also promulgated the way

for privatization of banking in Pakistan. Muslim Commercial Bank, Allied Bank of Pakistan and

First Women Bank were disinvested. It is expected that this new policy and practice of

disinvestments and privation of banking and financial sector would assist in bringing an

innovative period of financial development.

2.4 BANKING SYSTEM IN PAKISTAN

Page 21 of 72

State Bank Of Pakistan

201

4

The banking arrangement of a country by the banking institutions is recognized through

the association between the central bank and the other banks working in the economy of the

country. It embodies the principles and practices relating to the banking transactions prevalent in

the country.

In Pakistan there is a central banking system monitored by the central bank, the State bank of

Pakistan. The central bank (SBP) directs and monitors the actions of all other banks running in

the economy. It guides commercial banks through the monetary dealings, which are

cooperatively favorable for the economic development of the country.

At the time of separation, there were 631 offices of the scheduled banks. West Pakistan

contained 487 and East Pakistan (Bangladesh) having 144 such offices. There were only two

Pakistani banks namely Habib Bank and Australasia Bank transformed to Allied bank with their

head offices in Pakistan.

The Central Bank of the state (SBP) was inaugurated in July 1948. It suggested to the

government to establish a new bank as an representative of the Central Bank as well as forefront

of its credit policy. The government accepted the suggestion f SBP and National Bank of

Pakistan came into existence on 15th September 1949. This bank also helped Habib Bank to

enlarge its organization all over the country. From here onwards quick development took place in

the banking system of the country. Currency notes having the value of Rs.5, Rs.10, and 100 were

issued by the State Bank for the first time in October 1948 and by August 1949 all currency notes

issued by the Reserve Bank of India worth Rs.12, 000 million were withdrawn and replaced with

Pakistani currency.

Under the banks Nationalization Act of 1974 the commercial banks were nationalized in

January 1974. The public banks included Habib Bank, Allied Bank, Muslim Commercial Bank

and National bank besides these Nationalized Commercial banks (NCBs) and other commercial

banks in the private sector, there are certain foreign bar operating in Pakistan like Citibank,

standard chartered and Grind lays Bank etc. The foreign banks are under the administrative

control of State Bank being the central Bank of the country.

Page 22 of 72

State Bank Of Pakistan

201

4

The national Government also setup the Pakistan Banking Council (PBC) on 21st March 1974

underneath the banks nationalized Act of 1974. It reports directly to the Ministry of Finance and

provides support and guidance to the State Bank. Its responsibilities include.

Evaluate performance of (NCBs) according to criteria laid down by the PBC and socio

economic objective lay down by the Central Bank of Pakistan.

Policy recommendations to the administration of the state.

Policy procedures to the nationalized commercial banks of the country.

Appointment of superior staff and guidance within the (NCBs).

Magnificent approval to (NCBs) to write off loans beyond Rs.25, 000, 00.

Supervise performance of (NCBs) counting overseas branches and

Yearly Inspections of (NCBs).

Vital steps were also taken to put into practice a more adequate and flat form of banking and

financial system in harmony with the injunctions of fundamental principles of Islamic Banking

System. The major acceptable modes of National Islamic Banking finances are:

Musharikaha

Mudaribaha

Salam and Istisna.

Introduction to State Bank of Pakistan

STATE BANK OF PAKISTAN

2.5 SBP Vision Statement

Page 23 of 72

State Bank Of Pakistan

201

4

Renovate State Bank of Pakistan into modern and self-motivated State Bank of Pakistan, highly

specialized and well-organized, fully prepared to play an evocative role, on sustainable basis, in

the economic and social enlargement of Pakistan.

2.6 SBP Mission Statement

Endorse monetary and financial stability and foster a sound and self-motivated financial

system, so as to accomplish continuous reasonable economic growth and prosperity in Pakistan.

Figure 1 from SBP website

2.7 History of State Bank of Pakistan

Reserve Bank of India was the central bank Before 14 August 1947, for both India and

Pakistan. On 30 December 1948 Reserve Bank of India reserves were dispersed among Pakistan

and India -30 percent (750 M gold) for Pakistan and 70 percent for India. In July 1, 1948

Page 24 of 72

State Bank Of Pakistan

201

4

Muhammad Ali Jinnah inaugurate the State Bank of Pakistan under the SBP order 1948, with the

responsibility to control the other banks, issuing of currency notes and maintenance of reserves

for securing monetary stability in Pakistan and commonly to operate the currency and credit

system of the country.

State bank's duties were widened when the State Bank of Pakistan Act 1956 was

introduced. Which help the state bank to regulate the monetary and credit system of Pakistan and

to improve its growth in the best national interest with the purpose of securing monetary stability

and fuller utilization of the Pakistan productive possessions? In 1974 SBP was fully nationalize

beneath Government of Pakistan in the period of Zulfikar Bhutto but In February 1994, the State

Bank has given full sovereignty and On January 21, 1997, sovereignty of SBP was further

strengthened when the Government of Pakistan issued three Amendments in Ordinances

(approved by the Parliament in May 1997). Which includes the State Bank of Pakistan Act 1956,

Banking Companies Ordinance, 1962 and Banks Nationalization Act, 1974? By these changes,

SBP was given complete and special authority to control the banking sector, for the conduct of an

independent monetary policy and to set perimeter on government borrowings from the SBP.

2.8 Functions of State Bank of Pakistan

2.8.1 Primary Functions of state bank of Pakistan

1. Monetary Policy Management

Control the monetary and credit circumstances to achieve inflation target, while keeping in view

the financial growth scenarios intact.

Instruments

Discount Rate or Interest rate.

Operations of Open Market

Page 25 of 72

State Bank Of Pakistan

201

4

Legislative Liquidity Requirements (CRR, SLR)

2.

Regulation & Supervision of Banking System

Ensuring the financial stability of Banks and financial Institutions

On-site and off-site monitoring

CAMELS and IRAF

Split Prudential Regulations for Corporate Consumer, SMEs, Microfinance, Agriculture

and Islamic Banking Sectors.

3.

Sole Authority to issue Currency Notes

Page 26 of 72

State Bank Of Pakistan

201

4

4. Lender of Last Resort

The Central Bank lends Short Term Loans to scheduled banks in times of their need

against securities.

5. Payment System

Monitoring and controlling the payment and settlement system

Real-time on line settlement systems and

Facilitating electronic banking products, services and information technology

infrastructure

2.8.2 Secondary Functions of State bank of Pakistan

1. Public Debt Management

Subscribing government securities at the time of their issue

Sale/purchase of short term securities

Responsibility of sale/purchase of prize bonds

2. Management of Foreign Exchange

Page 27 of 72

State Bank Of Pakistan

201

4

Exchange Rate is identified according to market conditions with limited involvement by

the SBP

Managing Foreign Exchange reserves.

3. Advisor to Government

Suggest the state concerning monetary and economic issues

Monetary and Fiscal Coordination Board

Information and reports on the State of the financial system

Maintaining good associations with International monetary Institutions

4. Bankers Bank

Commercial banks keep their deposits as legislative reserves

The Central Bank endow with concessional remittance facilities

Facilitating cheque clearance facility through NIFT

5. Banker to Government

Allow the deposits of cash and drafts

Undertakes gathering of cheques

The Central Bank can advance loans to government on certain stipulations and

conditions.

2.8.3 Developmental Functions of SBP

Page 28 of 72

State Bank Of Pakistan

Expansion of financial framework

Providing credit to priority sectors / specialized monetary institutions

Growth in different sectors including:

Farming sector

Islamic Banking System

Micro Finance

Small & Medium Enterprises (SMEs)

Accommodation and Infrastructure

2.9 Powers, Functions & Operations in SBP are governed by:

State Bank of Pakistan Order 1948

State Bank of Pakistan Act 1956

Nationalization Act 1974

Autonomy of State Bank of Pakistan in 1997

Banking Companies Ordinance 1962

Page 29 of 72

201

4

State Bank Of Pakistan

2.10 Organogram of SBP

Figure 2 from the Official website of SBP

Page 30 of 72

201

4

State Bank Of Pakistan

2. 11 Organizational Structure of SBP

Governor State Bank of Pakistan.

Deputy Governor Banking Department SBP

Deputy Governor Operations Department SBP

Deputy Governor Islamic Banking department and Special Initiatives

2.12 ORGANIZATION AND STRUCTURE

SBP is a sovereign organization having three entities including

State Bank of Pakistan (The Head Office) Karachi

SBP Banking Services Corporation(BSC) Karachi

National Institute of Banking & Finance(NIBAF) Islamabad

2.13 SBP Core Values

1. Courage

Page 31 of 72

201

4

State Bank Of Pakistan

201

4

To construct and own decisions, give and accept suggestions openly without favor or

fear

2. Commitment to Excellence

Doing the best under the specified circumstances and looking beyond the observable.

3. Problem solving approach

To have optimistic approach to issues, with commitment to total resolution. Be part of

the solution, not the problem

2.14 Departments in State Bank of Pakistan

Agricultural Credit & Microfinance Department.

Banking Inspection (On-Site) Department.

Banking Policy & Regulations Department (BPRD).

Banking Surveillance Department.

Consumer Protection Department (CPD).

DFIs & Exchange Companies Inspection (On-Site) Department.

Domestic Market & Monetary Management Department.

Exchange Policy Department (EPD).

Economic Policy Review Department.

External Relations Department.

Finance Department..

Human Resource Department (HRD).

Information Systems & Technology Department.

Infrastructure, Housing & SMEs Finance Department.

Internal Audit & Compliance Department.

International Markets & Investments Department.

Islamic Banking Department.

Museum & Art Gallery Department.

Office of the Corporate Secretary.

Off-site Supervision & Enforcement Department.

Payment Systems Department.

Page 32 of 72

State Bank Of Pakistan

201

4

Research Department.

Statistics and Data Warehouse Department.

Treasury Operations (Back Office) Department and

Risk Management department.

After 1st two weeks of Internship all the interns are detailed to different departments to work

within the surroundings of SBP with extremely experienced employs of SBP to make the most of

their majors in practical. I was detailed in Risk management department where I have assigned

the project of liquidity risk management in central bank as well as other financial institutions of

the economy

2.15 Risks in SBP and other Financial Institutions

2.15. Section A: Risk Management in SBP

2.15.1 Risk:

The possibility of happening of unfavorable occurrence is called Risk or chance of encountering

destruction or failure, hazard, or a chance of injury or loss is called Risk.

Banks for International Settlement (BIS) define risk as- Risk is the danger that an

incident or action will negatively affect an organizations ability to accomplish its

objectives/goals and lucratively carry out its strategies.

2.15.2 Risks in State Bank of Pakistan:

Strategic Risk, Regulatory Risk, Technological Risk, sovereign Risk, Innovative Risk,

Political Risk, Liquidity Risk, Foreign Exchange Risk, Credit Risk, operational risk, Cultural

Risk, Market Risk etc. As all risks have its own magnitude but we will focus our attention on

Liquidity Risk and managing it.

Page 33 of 72

State Bank Of Pakistan

201

4

2.15.3 Risk Management Department

In extension of the Banks restructuring plan, in August 2007 Risk Management Cell was

transformed to Risk Management & Compliance Department headed by the Chief Risk Officer.

In 2009 it yet again became a unite but in 2014, observance in view the most up-to-date

development in banking sector and bringing the clearness and accuracy in operation of the SBP,

the board of directors decided again to renovate this Risk Management & Compliance unite into

full fledge department named Risk Management Department

2.15.4 Mission Statement

Exists to diminish financial loss, include risk culture, and creates principles of risk

management in the entity.

2.15.5 Key Functions of RMD

Key functions of Risk Management Department are:

Build up and execute Bank wide Risk Management approach.

Page 34 of 72

State Bank Of Pakistan

201

4

Recommend the Governor on the different risk related issues.

Build up and continue risk exposure measurement and compliance framework and

provide suitable level of risk reporting.

Suggest risk appetite to the senior management.

Compel the risk committees to generate risk inventory and gaps and engage in

organization wide risk issues on a sensible basis.

Create oversight mechanism for determining risks in the Banks subsidiaries and

associated entities.

Publicity of different risks i.e. Financial Risks, Operational Risk, Strategic, Policy,

and Other Risks.

Page 35 of 72

State Bank Of Pakistan

2.15.6 Structure of RMD

Page 36 of 72

201

4

State Bank Of Pakistan

201

4

Figure 3 from Risk management department in SBP

2.15.7 Responsibilities of the RMD

The farm duties of the risk management department are as under:

Ensuring each internal/external risk of the State Bank of Pakistan and to discover,

assess, report and monitor and assisting the risk with the aim of controlling and

mitigating those risks;

Suggesting the board of directors on the risk management policy and process and any

deviations from the risk management policy;

Exposure on any significant risk event to the board of directors in an appropriate

manner; executing the risk management system approved by the board of directors;

Recording the risk records and risk register;

Preparing reports to the board of directors as per their requirements.

Communicating the risk management policy, process and roles and farm duties relating

to bank.

Providing guidance, support and prop up different department in the area of risk

management to overcome their department risks to mitigate problems

Preparing the essential information available to the internal audit gathering to facilitate

independent assessment of the risk management Process/system; and

Supporting the board of directors in promoting a culture of risk awareness, determining

and managing at each and every stage within departments of the SBP.

2.15.8 Liquidity Risk:

Page 37 of 72

State Bank Of Pakistan

201

4

A liquid market is a market where participant can rapidly execute large volume

transactions with a small impact on prices (BIS)

The risk that a sudden surge in liability withdrawals may leave a Financial

Institution in a position of having to liquidate assets in a very short period of time

and at low prices.

Liquidity risk is the risk to a banks earnings and capital arising from its inability

to timely meet obligations when they come due without incurring unacceptable

losses.

2.15.9 Risk Management:

Risk Management is a designed technique of dealing with the possible loss or damage. It

is an ongoing procedure of risk assessment through various methods and tools which

continuously

Evaluate what could go wrong

Find out which risks are vital to deal with and

Execute strategies to treat with those risks

Page 38 of 72

State Bank Of Pakistan

201

4

Figure 4 from Risk Management Department in SBP

2.15.10 Liquidity Risk Management

Liquidity risk management is a vital banking function and an integral part of the asset and

liability management process. The primary role of banks is the maturity transformation of shortterm deposits (liabilities) into long-term loans (assets) and makes banks inherently susceptible to

liquidity risk. The renovation process creates asset and liability maturity mismatches on a banks

balance sheet that must be aggressively managed with available liquidity. This entire procedure

is known as liquidity risk management. The availability of liquidity either internally or externally

is dominant in the management of these maturity mismatches. The successful management of

liquidity allows a bank to fund increases in its assets (loans and investments) and to meet

obligations as they come due (withdrawal of deposits). A collapse in liquidity risk management

results in a bank becoming not capable to meet its obligations. This circumstances if played out

could easily cause a bank to be unsuccessful. A bank can continue to meet its uncertain cash flow

obligations and stay in good physical shape by managing liquidity risk carefully.

2.15.11 Liquidity Risk management in a State Bank of Pakistan

The Central Bank of Pakistan has preferences and constraints that differ from those of

private banks. The objectives of State Bank of Pakistan are defined in their statutes, i.e. the

protection of financial stability of whole financial system in Pakistan as their primary mandate. It

is necessary For State Bank of Pakistan to create such policies which become flourishing in long

run otherwise whole financial system will be decomposed.

SBP have no liquidity risk in home market as it has the authority and right to print and

issue currency notes in Pakistan. But as for as liquidity risk in global prospective concern , State

Page 39 of 72

State Bank Of Pakistan

201

4

bank of Pakistan has liquidity risk adjacent to its investments and receivables or assets. It needs

to remain credible by making sure that at least two conditions are met.

First, State Bank of Pakistan adequately capitalized and runs in such a way that it

remains financially independent. Financial independence helps to keep external parties from

unduly interfering in the conduct of monetary policy.

Second, the long-term satiability of a State Bank of Pakistan needs to be ensured or very

essential, so that the banks reaction to specific economic circumstances is not influenced by

considerations of the short-term financial impact of such policies on its profit and loss accounts

along with its global trading account.

In normal market operations or in lending operations, the Liquidity risk control structure

applied in bank to plan according to four basic principles: protection, consistency, simplicity

and transparency. Protection is considering the main objective of the risk control framework,

while consistency, simplicity and transparency are needed for the framework to work in an

efficient, accountable and conventional manner.

Risks taken in State Bank of Pakistan actions are examine in a holistic manner, bearing in

mind the interaction of different portfolios that it had made in Foreign exchange and operations.

For that reason, a state-of-the-art comprehensive risk monitoring and reporting framework is

done within Risk Management Department, for capable of providing decision-making bodies

with appropriate liquidity risk management input. As a vital element of the risk management

purpose at a State Bank of Pakistan, the uppermost governance principles are practiced, both in

terms of the reporting lines and organizing the risk management meaning within department.

In boom period or in ordinary times, State Banks has to retain its balance sheet in

contraction way in terms of risk-taking capacity. And in recession or in critical time SBP has to

expand balance sheet and taking more risks in situations where other market participants are

deleveraging and dropping their risks. The main determinants of the risk profile, especially on

the asset side of a State Banks balance sheet by considering the applicable risk mitigation

Page 40 of 72

State Bank Of Pakistan

201

4

measures are done as well. The extent to which State Bank of Pakistan hold Foreign exchange

risk in their balance sheets differs considerably from the typically much lower Foreign exchange

exposures of private organizations.

Limit/Exposure Type

Amount ( US $ Million)

Total Counterparty Current Limit

4770

In-House counterparty MM Exposure

3272

In-House FX Credit Exposure

59

Nostro Account Balance

491

Overnight EUR Placement with NBP

Federal Reserve NY & DBB RA

0

3026

Position

Fixed Income in Chinese Bonds

1053

Total In-house Exposure

7901

SBP Net Exposure

8650

State Bank of Pakistan has exposure to exchange rate (or FX) risk. SBP has $ 8.65

Billion in-house reserves and details are as follows;

In the same way the credit exposure of out-source reserves of SBP is as under with the splendid

total of $1.95 billion

Credit Exposure SBP (US $ Millions) on June 2014

Region

Total

Asia Pacific

164.61

Europe

482.56

North America

Page 41 of 72

1,272.28

State Bank Of Pakistan

201

4

Supranational

28.25

Grand total

1,947.69

On June 2014 Regions and Rating Bonds details of SBP Foreign Exchange Reserves;

Regions

LT Ratings

Asia Pacific

27.21

AAA

56.81

North America

38.93

AA

15.68

Western Europe

27.9

27.51

Middle East

5.96

BBB

The foreign currency positions regularly listed in the management reports which point out

that SBP has implemented a system for evaluating, monitoring and controlling its liquidity

positions of FX in all foreign locations which are supportive to covers significant foreign

currency positions.

These foreign exchange reserves display the soundness of any country. These foreign

exchange reserves are so important for import base countries like Pakistan which have almost

trade deficit from its sovereignty. Similarly the holding and investment of existing reserves are

major concern for State Bank of Pakistan in term of return as well as its liquidity. The SBP also

use foreign reserves for intervention purposes, State Bank of Pakistan use to intervene in the

markets by selling foreign currency if a sudden appreciation of those currencies impairs price

stability or financial stability directly or indirectly. In a sense, the need to intervene represents a

contingent policy liability on SBP, and by taking such an FX risk, are effectively hedging or

matching such contingent liability.

Gold price movements are also considerably important in State Bank of Pakistan than in

private banks. State bank of Pakistan has holdings of gold, amount to just about

246,096,839,000, according to annual report of 2013. The holdings are on this scale not only for

historical reasons, but also for risk management reasons, as gold is use to safe from upcoming

Page 42 of 72

State Bank Of Pakistan

201

4

adverse times. In times of financial suffering or recession time, gold indeed helps State Bank of

Pakistan to maintain a frozen financial position.

Another prominent difference of State Bank of Pakistan exposures compared with those of

private institutions is to be originating in their investment portfolios. State Bank of Pakistan is

typically managed with a very high degree of prudence. Investment is made in only AAA, AA, A

rating countries and companies. From the above matrix it can be seen that SBP has not only

invested in well rating companies but also in well reputed countries as well. Almost 57%

investment is made in AAA companies and By this way risks are kept to least levels that ensure

the financial buffers of the institution remain free to meet policy needs accordingly, while at the

same time attempting to achieve sufficient income to cover inflationary effect or operating

expenses along with to ensure long-term profitability. The regular fixed-income portfolios of the

SBP, as an example, are managed against internally derived benchmark portfolios which serve as

a key for performance and risk measurement. The management of these real portfolios beside

with those of benchmarks is constrained by a number of characteristic risk control measures,

such as relative value-at-risk limits and caps imposed on credit and liquidity risk exposures.

Section B Risk Management in other Financial Institutions

2.15. B Liquidity Risk Management in Financial institutions

A banks liquidity risk management standards are set down undoubtedly and

communicated to key decision makers in the bank. Unlike other risks that intimidate the very

solvency of a Financial Institution, liquidity risk is a normal aspect of the daily management of a

Financial Institution.

Depository Institutions complimentary handle liquidity so they are able to pay out cash as

deposit holders request withdrawals of their funds.

Only in extreme cases liquidity risk creates problems develop into solvency risk problems.

2.15 C Levels of Liquidity risk in Financial Institutions.

Page 43 of 72

State Bank Of Pakistan

201

4

Depository Institutions having soaring exposure

Life Insurance Companies having moderate Exposure

Mutual funds, hedge funds, pension funds, and property or Casualty

insurance companies: having low exposure typically low, which does not

mean zero:

September 2006, Amaranth Advisors, a hedge fund forced to shut down

Causes of liquidity risk

Seriously Reliance on demand deposits

Core deposits of FIs

Depository Institutions need the capacity to forecast the distribution of net

deposit drains.

Seasonality effects in net withdrawal patterns from banks.

Early 2000s difficulty with low rates in financial sector: Financial

Institution doings suitable investment opportunities for the large inflows

Methods use by FIs for managing its Liquidity Risk.

Liquidity Risk in Liability side

1. Purchased Liquidity Management 2. Stored Liquidity Management

Liquidity Risk in Assets side

1. Purchased Liquidity Management 2. Stored Liquidity Management

Traditionally, FI managers have seriously relied on stored liquidity management as most

important method for liquidity management. But today, many financial Institutions particularly

the largest banks with entrance to the money market and other non deposit markets for funds are

relying on purchased liquidity (or liability) management i.e. borrowing from interbank market or

using discount window to deal with the risk of cash shortfalls.

Bank Deposits generally have a much shorter contractual maturity than loans and

liquidity management needs to provide a cushion to cover anticipated deposit withdrawals from

banks. Liquidity is the ability to efficiently hold deposit of banks as also reduction in liabilities

and to fund the loan growth and possible funding of the banks off-balance sheet claims. These

Page 44 of 72

State Bank Of Pakistan

201

4

cash flows are placed in different time buckets based on expectations on the basis of behavior of

assets, liabilities and off-balance sheet items. Liquidity risk consists of Funding Risk, Time Risk

& Call Risk.

Funding Risk: It is the need to restore net out flows due to unexpected withdrawal

/nonrenewal of deposit from banks.

Time risk: It is the need to pay off for non receipt of expected inflows of funds from banks,

i.e. performing assets turning into nonperforming assets.

Call risk: Call risk will happen on account of crystallization of contingent liabilities and

inability to undertake profitable business opportunities when desired.

From 1st January 2014, SBP has made regulations for all banks operating in Pakistan to

adopt Basel III. In financial crisis the inability of banks to roll over their short-term financing,

Basel III introduces two new ratios: the Liquidity Coverage Ratio (LCR) and the Net Stable

Funding Ratio (NSFR), with the objective of to improve the banks short-term (LCR) and longterm (NSFR) balance sheet resilience.

The Liquidity Coverage Ratio (LCR)

Stock of high-quality liquid assets

Total net cash outflows over the next 30 calendar days

Characteristics of high-quality liquid assets

(a) Fundamental characteristics

Low credit and market risk:

Ease and sureness of valuation:

Low correspondence with risky assets:

Listed on a developed and predictable exchange market:

(b) Market-related characteristics

Page 45 of 72

> 100%

State Bank Of Pakistan

201

4

Energetic and sizable market:

Occurrence of committed market makers:

Low market concentration:

Flight to quality:

The Net Stable Funding Ratio (NSFR)

Available amount of stable funding > or = 100%

Required amount of stable funding

By adopting these new ratios, banks are able to achieve the following goals:

Promote short-term resilience of banks liquidity risk profile.

Enhance the banking sectors ability to suck up shocks arising from financial and

economic stress.

Provide a sustainable maturity arrangement for assets and liabilities.

Encourage banks to fund their actions with additional stable sources of funding.

Requirements for Liquidity Risk Management

The risk management process should make up the following broad lowest requirements.

The risk must be managed within a definite Liquidity risk management plan (decisionmaking)

A clear liquidity risk management and funding approach must be approved at an

executive and non-executive board altitude

Operating restrictions to liquidity risk exposures must be set and adhered to.

Procedures for liquidity planning under substitute scenarios must be agreed, Including

crisis situations

Page 46 of 72

State Bank Of Pakistan

201

4

Some common failures have been recognized in banks liquidity risk management

processes, which have contributed to severe sustainability issues.

A weak liquidity risk management structure that did not account for the risks posed by

products and business lines

Business incentives that were uneven with the risk tolerance level of the bank

Misjudging unforeseen contingent obligations and the liquidity that would be necessary

for the bank to meet these obligations

The belief that prolonged liquidity disruptions as practiced during the financial market

crisis, were improbable

Stress tests that abortive to account for possible market wide global strain or the severity

and duration of disruptions.

Chapter No 3 Financial Analysis of SBP

Introduction

This Chapter of my report is on financial analysis consisting multiple type of ratios as

well as horizontal and vertical analysis of statements of position of Issuing and banking

Departments of SBP as well as profit and loss accounts of SBP.

Section A: Financial Analysis

Page 47 of 72

State Bank Of Pakistan

201

4

3.1 Current Ratio

Current ratio = (Current Assets / Current Liabilities)*100

Rupees in 000

Years

2012

2013

Current Assets

212566111

470360068

Current Liabilities

81176181

71152175

Current Ratio

2:61

2:98

Interpretation

This ratio is one of the most significant ratios that evaluate the solvency of an organization

and the aptitude of that fastidious organization to pay the short term obligations. As shown in the

table above in 2012 the bank has 2:61 ratio which means that if it has two rupees it has to pay 61

paisa as liability that is extremely good ratio in banking sector. If we look at the 2013 the ratio

has increased to 2:98 means for every two rupees it has to pay 98 paisa liability because of the

liabilities that have increased due to IMF loan and other conditional foreign loans.

3.2 Debt Ratio

Debt Ratio = (Total Liabilities / Total Assets)*100

Rupees in 000

Years

Total Liabilities

Total Assets

2012

803915612

1126761585

71:34%

2013

979089234

1377964974

71:05%

Page 48 of 72

Debt Ratio

State Bank Of Pakistan

201

4

Interpretation

The debt ratio assesses the percentage of assets financed by the money borrowed or rented.

The enlarged value in this ratio tells about the higher amount of other peoples money being

used to engender (increase) the revenue. The bank has approximately same ratio in

both the years that shows its assets are financed up to 71% by the borrowed money

that is a bad symptom because it reduces the confidence level of investors and this

particular ratio is satisfactory up to 50% only. This ratio tells about the bank took

loans from outsiders to run its affairs.

3.3 Interest Coverage Ratio

Times interest earning ratio = (Operating income / interest expense)

Rupees in 000

Year

Operating Income

Interest expense

Interest Coverage ratio

2013

165235507

3748759

44.07

This ratio evaluates about an organization aptitude to meet its

c o n t r a c t u a l i n t e r e s t p a y m e n t s . The upper value indicates that the organization having

higher ability to make its contractual interest payments. The central bank has a definite figure

that shows it can easily meet its interest obligations in 2013. On the other hand the bank also has

a good current ratio that illustrate that it is able to meet its contractual obligations.

3.4 Operating Profit Margin

Page 49 of 72

State Bank Of Pakistan

201

4

Operating Profit margin = operating Profit / Revenue (Interest)

Rupees in 000

Years

Operating Profit

Revenue

Operating Profit Margin

2013

165235507

180054065

91.76%

Interpretation

This ratio shows the proportion of each rupee remain as profit after the presumption of

expenses and all the other costs apart from finance cost and taxes. The 91.76% shows that

bank is earning almost 92 paisa and 8 paisa is going under the head of expenses. The

higher ratio tells that the organization earnings are better.

3.5 Net profit margin Ratio

Net profit margin Ratio = (Net profit / Revenue) *100

Rupees in 000

Years

2012

2013

Net profit

164793359

204212004

Revenue

180054065

222428693

Net profit margin

91.52%

91.81%

Interpretation

The net profit margin shows the proportion of each rupee remain as profit after the presumption

of costs and all expenses counting finance cost and taxes. Higher net profit margin is

Page 50 of 72

State Bank Of Pakistan

201

4

preferable. The State bank net profit margin has increased in 2013 as compared to

2012 that shows the higher amount of return in the year 2013.

3.6 Return on Assets

Return on assets = (Net Profit / Total assets)*100

Rupees in 000

Years

Net Profit

Total assets

Return on assets

2012

164793359

1126761585

14.62%

2013

204212004

1377964974

14.81%

Interpretation

This ratio evaluates the efficacy of management that how it utilizes the accessible assets to

generate profits. Higher the ratio better is the position of the firm. In case of State

Bank of Pakistan it is also increased from 14.62 % to 14.81% in the year of 2013 which shows

the good display of bank performance and utilizing banks assets in a superior and proper way.

3.7.1Horizontal Analysis of Balance sheet of SBP

State Bank Of Pakistan Issuing Department

Balance sheet item

Rupees in 000

Horizontal analysis in %

tage based on year 2011

Assets

Gold reserves held by

the bank

Foreign Currency

Page 51 of 72

2011

2012

2013

2012

2013

81277106

1309705

157545

61.14

93.84

68546858

52

4391047

51

378121392

-35.94

-44.48

State Bank Of Pakistan

reserves

Special drawing Rights

7

12383051

assets receivable from

69

1163221

5

of IMF

Notes and coins

India notes representing

201

4

Investment

-6.06

-48.96

638249

683678

727665

7.12

14.01

3012270

2718036

249623

-9.77

-17.13

-6.82

-11.69

321.08

520.61

the reserve Bank of

India

Total notes

631815

3650519

10883031

1

3401714

322390

4582597

1

675410375

65

Commercial paper held

in Bangladesh (former

east Pakistan)

Asset held with the

78500

78500

78500

0.00

0.00

1740325

2591897

302174

48.93

73.63

17.08

36.97

17.08

36.97

reserve bank of India

Total assets

89342839

1046039412

3

122371761

Liability bank note

9

89342839

1046039412

2

122371761

issue

Balance sheet item

Horizontal analysis in %

State Bank of Pakistan Banking Department

Page 52 of 72

tage based on year 2011

State Bank Of Pakistan

201

4

Rupees in 000

Assets

Local currency

2011

2012

2013

135646

181913

196449

34.11

44.82

430086636

21.12

164.16

952112

339594

-98.32

-40.24

418534

3137123

61

611752

649.55

1361.6

22019148

2014773

2

470360068

-8.50

5

113.61

5

10881

13

13286

22.10

38.30

-100.00

reserves

Foreign Currency

16281511

reserves

Earmarked foreign

7

56822188

1972006165

currency balances

Special drawing

Rights of IMF

Reserve tranche

15048

2012

2013

with the IMF under

quota arrangement

Securities

33715973

purchased under

100.00

agreement to resale

Current account

of govt of Punjab

Current account

409158

1390879

3

518564

37306680

6357398

495348215

of govt of Baluchistan

Current account

of govt of AJK

Investment

6

Page 53 of 72

60

712773

4820407

65

188.54

47.87

70.14

32.78

State Bank Of Pakistan

201

4

Loan advances

28809146

2428804

331853796

and bill of exchange

Balance due from

0

4677500

10

5033592

541613

govt of India and

-15.69

15.19

7.61

15.79

Bangladesh (former

east Pakistan)

Property and

19019433

1852228

180737

-2.68

-4.97

equipments

Intangible assets

163769

4

120923

33

116393

-26.16

-28.93

Other assets

15433411

1760545

863007

14.07

-44.08

Total assets

95919112

0

1135820480

7

137796497

18.41

73.66

114.09

-50.19

44.73

-53.15

-89.07

Liabilities

Bill payable

Current account

of Govt

Current account

571942

14219755

8

with SBP banking

1224446

7082334

8

2369636

Services corporation

827785

666218

68

370252

2

a subsidiary

Securities sold

under agreement to

61816757

6758751

repurchase

Deposits of banks

100.00

and other financial

30516857

4245493

273739781

39.12

61.12

institution

Other deposits

6

10413599

82

1456010

167779189

39.82

61.12

and accounts

Page 54 of 72

26

State Bank Of Pakistan

201

4

Payable to IMF

85063742

9126368

490030

7.29

92.58

Other liabilities

72229063

6

6027983

41

430168

-16.54

-40.44

77118363

7

8005004

15

974691

3.80

26.39

4

11484789

76

1218399

00

420468

6.09

-63.39

0.00