Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Month End/Quarterly/Year End Check Lists & Procedures

Caricato da

ZaidpzaidDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Month End/Quarterly/Year End Check Lists & Procedures

Caricato da

ZaidpzaidCopyright:

Formati disponibili

M O N T H

E N D / Q U A R T E R L Y / Y E A R

C H E C K

L I S T S

&

P R O C E D U R E S

ACCOUNTS RECEIVABLE ACCOUNTS PAYABLE

PAYROLL GENERAL LEDGER

PROCOM SOLUTIONS, INC.

OAKLAND CENTER

8980-A ROUTE 108

COLUMBIA, MD 21045

(800) 997-6777

E N D

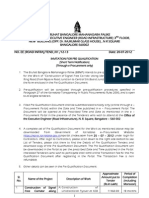

TABLE OF CONTENTS

SECTION

PAGE

Accounts Receivable Month End Check List

3-4

Accounts Receivable Year End Procedures

Physical Inventory Year End Procedures

Accounts Payable Month End Check List

7-9

Accounts Payable Year End Procedures

10

Payroll Month End Check List

11

Payroll Quarterly Check List

12

Payroll Year End Procedures

13

General Ledger Month End Check List

14

General Ledger Year End Procedures

15

ACCOUNTS RECEIVABLE MONTH END CHECK LIST

FOR THE MONTH OF: __________________________

[

Verify that all Sales have been posted for the month. Run an open orders report, review

the report for invoices that have not been posted.

Verify that all cash receipts have been posted for the month. Total the cash receipts

journal and cash sales journal to get the total cash received for the month. Compare the

total against the deposit totals.

Verify all adjustments to customer accounts have been posted for the month.

Verify all sales tax adjustments have been posted.

Verify all inventory receiving have been posted.

Verify all inventory adjustments have been posted.

* NOTE: Inventory adjustments require a journal entry in general ledger. We recommend

making the adjustments as part of your daily, or monthly process.

Verify all inventory transfers and vendor returns have been posted.

Apply unapplied credits to customer accounts.

Process finance charges and print invoices.

Display the Accounts Receivable balance, (run computed Accounts Receivable balance located

under Miscellaneous Programs #1) compare to your manual control sheet. If the totals do

not balance, make any necessary adjustments before continuing.

Print an Accounts Receivable trial balance in detail.

Review the trial balance for accuracy.

Make all necessary corrections to accounts before running statements.

Print statements.

Print Monthly Sales Analysis Reports:

[

[

[

[

[

[

[

[

]

]

]

]

]

]

]

]

(Make a backup before running statements)

Customer Sales Analysis Report

Customer Sales History Report

Sales Tax Analysis Report

Salesman Sales Analysis Report

Inventory Sales Analysis Report

Product Category Analysis Report

Inventory Valuation Report

General Ledger Distribution Report

MONTHEND/YR END/QRT END CHECK LIST

ACCOUNTS RECEIVABLE MONTH END CHECK LIST (CONTINUED)

OTHER REPORTS:

[

_____________________________________

_____________________________________

_____________________________________

_____________________________________

Use the sales tax analysis report to guide you in filing your sales tax information.

Clear Month to Date Totals. Note: Sales Analysis reports for the month being closed can

NOT be run again after clearing totals.

If you use salesmen commissions:

[

[

[

[

[

[

]

]

]

]

]

]

Sort the commission file.

Print the commission report.

Make adjustments if necessary.

Print commission statements.

Mark paid records.

Purge paid commission records (optional)

* Watch dates carefully when purging and always make a backup first.

If you use the work order system: (print as needed)

[

[

]

]

Print the technicians labor report.

Print the technicians hour report.

Transfer the General Ledger Distribution to the General Ledger.

* This is located under Inquiries and General Ledger Listings.

Go to General Ledger and run an edit list for the transactions transferred from Accounts

Receivable. Make any necessary corrections, and post.

After verifying that the transfer from Accounts Receivable to General Ledger was

successful, purge the General Ledger Distribution file for the period. (IN THE ACCOUNTS

RECEIVABLE MODULE) (This is optional, once purged you cannot re-run the General Ledger

Distribution report for that period again once purged).

Reconcile the General Ledger Accounts Receivable balance to the Accounts Receivable month

end balance.

Reconcile sales, cost of goods sold, inventory, and other General Ledger account totals.

*Note: these totals should balance to your monthly sales analysis report totals.

[

Inventory adjustments / cost adjustments made in accounts receivable are not

transferred to G/L. Make the appropriate adjustments in G/L.

* You should have two Month End tapes that you rotate every other month.

be done before the Month End is closed.

MONTHEND/YR END/QRT END CHECK LIST

The backup should

ACCOUNTS RECEIVABLE YEAR END PROCEDURES

A.

Run normal month ending procedures including:

Finance Charges, Reports, Statements, Month End Backup and Clear Monthly Totals.

B.

Select option for Year End Procedures:

Run Yearly Reports (optional); take your Year End Backup; Select Clear Year to Date

Totals.*

* Clearing Year to Date Totals, like clearing Monthly Totals, is clearing the cumulative

figures in the following files: Customer Master File, State Tax Files, Inventory Master

File, Product Category Files, Salesman's Master File, Sales Location Master Files.

The Yearly Reports are optional due to the fact that your Monthly Reports contain all

annual figures. Some additional reports that you might be interested in printing are:

Inventory Valuation (see physical), Customer Sales Analysis, Customer Name and Address

Listing, Customer Sales Analysis, Salesman's Sales Analysis Report, Inventory Sales

Analysis Sales Tax Analysis Report.

Running file purges is maintenance that should be followed yearly:

Suggested Purges: Customer and Inventory Product History (except on systems 80% full, or

higher), Promotions File By Date, Order Master File**, Customer Master File*, Inventory Master

File*.

*

Marking Customers & Inventory Records for deletion that have not been used, or hold no

quantity counts is recommended.

There are corresponding purge programs for these in

Purge

programs. (NOTE: Deleting customers and inventory items during your year where YTD

figures may be stored will throw off your yearly analysis reports. Only Delete if NO YTD

figures exist.

**

Now would be a good time to print an Order Edit List. The Order Edit List will print all

open Sales Orders, Quotes and Standing Orders. Have someone review these and cross off

any that may be deleted, or may need following up. Remember Sales Orders commit inventory

quantity counts. Quotes and standing orders do not commit inventory, so they may stay out

in the orders file indefinitely, but it is recommended that these should be reviewed every

quarter.

MONTHEND/YR END/QRT END CHECK LIST

PHYSICAL INVENTORY YEAR END PROCEDURES

There is normally a Year End process for most companies.

companies go about taking a correct inventory count.

There may be several ways that

Most begin with the following:

[

[

[

[

]

]

]

]

A few closed days for inventory counting, (or weekend).

All invoicing printed and updated for the year.

Inventory Valuation by any of the sorting methods.

Physical Inventory Worksheet again by any of the sorting methods, or Bin.

sheets may be used with, or without current quantity counts.

These

You may utilize one of the following methods of processing the information from your counters to

the computer:

1.

With Software Support's aid, (verbal, or written) you may clear the existing quantity

counts and key in all counts of all merchandise through Inventory Receipts & Postings.

This program will allow you to change cost and list price as well.

Your company may utilize the various work stations around for data entry. You may update

(Journalize) these as one large batch, or you may complete a Bin, Group, or Operator and

update each time. Either way, the inventory will be updated.

2.

Secondly you may utilize our Physical Inventory Postings Program. This program

offers not only entry of Quantity Counts (without clearing existing quantity

counts), but also offers variance analysis once the updating is performed. It is

suggested that you enter the transactions to physical inventory in several batches.

No matter which option you choose you should print a second final Inventory Valuation report for

your beginning records.

NOTE:

Running the maintenance programs from Miscellaneous Programs 2 may assist you in

establishing starting points for your counts, but, if you rely on negative quantity counts in

your system as a means of purchasing, or re-ordering, if you run the maintenance program

Reconcile On Hand Quantities, make sure you answer NO to clear negative quantities. If you

dont answer the question correctly, it will essentially take all negative quantity values and

make them 0 due to the fact that it is reconciling your actual receiving layers. Where there is

a negative count, there is NO layer any longer to reconcile against, therefore making it 0.

This process not only goes for Year End but throughout the year.

MONTHEND/YR END/QRT END CHECK LIST

ACCOUNTS PAYABLE MONTH END CHECK LIST

FOR THE MONTH OF: ________________________

[

Verify all invoices have been entered and updated for the month being closed.

Print an unverified payables edit list.

Verify that all invoices received have been updated.

Make an Accounts Payable actual entry in General Ledger for outstanding invoices.

Verify any necessary invoice adjustments have been updated for the month being closed.

Verify all standard entries have been updated for the month being closed.

Verify all manual and computer checks have been entered and updated for the month being

closed. Print the outstanding check report.

Verify all voided checks have been entered and updated for the month being closed.

Verify the Accounts Payable total is in balance. Compare the Accounts Payable control

sheet against the system total. (Run the computed Accounts Payable Total Program located

under Miscellaneous Programs #1). If the totals do not balance, make any necessary

adjustments before continuing.

Print the Accounts Payable General Ledger Distribution Report for the entire month. Note:

if adjustments to the distribution accounts are needed due to a distribution error, make

the correction in the General Ledger system under Posting and Daily Update, General

Journal Entries. Note: Even if this process is part of your daily processing, you may want

to print this report for the entire month.

Transfer the General Ledger data to the General Ledger for period being closed. Note:

Until you purge the distribution file, you may transfer the General Ledger data to the GL.

BEWARE: The General Ledger Distribution will only transfer once, unless you tell the

transfer that you do not want to skip previously transferred records.

If you are using Job Cost complete the following:

[

[

[

]

]

]

[

[

[

]

]

]

Print the job cost distribution report for the month being closed.

Transfer job cost data to the job cost system.

Verify the transaction was successfully transferred to the job cost system. (From the Job

Cost Menu print the estimates, adjustments, retainage and A/R transaction edit list.

Make any corrections necessary before updating.

Update the job cost estimate, adjustment file.

Purge the A/P job cost distribution file. Use the same dates chosen during the transfer

process.

MONTHEND/YR END/QRT END CHECK LIST

ACCOUNTS PAYABLE MONTH END CHECK LIST (CONTINUED)

Check Reconciliation

[

Enter cleared checks in check reconciliation file.

Print an edit list and verify that the check totals balance with the check total on the

bank statement.

Update the check reconciliation register.

Enter deposits, withdrawals and misc. charges.

Print a miscellaneous reconciliation edit list. Verify the total deposits balance with the

bank statement. Verify withdrawals, misc. charges and interest with the total on the bank

statements. Make any necessary adjustments.

Update the miscellaneous reconciliation register.

Verify the bank balance with your cash control sheet. Make any adjustments necessary.

Transfer the data to the G/L.

If you summary post to General Ledger:

A.

B.

All General Ledger accounts will be summarized by date.

The source reference in G/L is "AP" with the month and day of transfer.

If you post to General Ledger in detail:

A.

Only the Accounts Payable, cash and discount accounts will transfer in summary by date.

All other accounts will transfer in detail.

The source reference in G/L is "AP" with the month and day of the source register.

The description is either the vendor name, OR vendor number and invoice number. This

option

is set in the Accounts Payable system information file.

B.

C.

Verify the General Ledger transactions have successfully transferred to the General

Ledger.

(Under Posting and Daily Update in the General Ledger system print the General Ledger Edit

List.)

Make any necessary adjustments prior to updating.

Update the General Journal in General Ledger.

Purge A/P General Ledger Distribution File. Use the same starting and ending dates chosen

during the transfer to General Ledger. (This is optional, once purged you will be unable

to re-run).

MONTHEND/YR END/QRT END CHECK LIST

ACCOUNTS PAYABLE MONTH END CHECK LIST (CONTINUED)

Print Accounts Payable Reports:

[

Accounts Payable Aged Trial Balance in Detail.

Vendor Status Report (optional)

Print monthly check report. (print the outstanding check report for the month being

closed.)

Other Reports:

_____________________________________________

_____________________________________________

_____________________________________________

_____________________________________________

File all reports as part of your permanent records.

Transfer to history all A/P open entries for vendors with no balance.

MONTHEND/YR END/QRT END CHECK LIST

ACCOUNTS PAYABLE YEAR END PROCEDURES

A.

Normal Month End Procedures Run

B.

Process Year End Procedures

Suggested Reports for Year End

Aging Report

Vendor Analysis

Vendor Name and Address

C.

Printing, if any, 1099's.

D.

Clearing Year to Date Totals.

E.

Deleting any vendors you do not wish to have.

F.

File purging vendor history. General Ledger Transaction History (if not already done at

month end).

(NOTE: Vendor transaction history will not purge unless the status of your check

has been reconciled meaning you performed the check reconciliation process.)

We

have been finding more and more customers not following through with this process

and it promotes problems later down the road. If you are one of these customers,

please contact support for guidance.)

MONTHEND/YR END/QRT END CHECK LIST

10

PAYROLL MONTH END CHECK LIST

FOR THE MONTH OF: __________________________

[

Verify that all paychecks have been posted.

Print the following monthly total reports:

[

[

[

[

[

[

[

]

]

]

]

]

]

]

Department monthly totals.

Job classification monthly totals.

Deductions monthly totals.

Employee monthly totals.

Monthly federal tax report.

Monthly state tax report.

Monthly state unemployment report.

Verify the totals and make any adjustments necessary.

Reprint the reports if adjustments are made.

Print 941 form.

Print the General Ledger Distribution Report.

Transfer the G/L distribution to the General Ledger.

Reconcile paychecks by using the payroll check reconciliation function listed under misc.

programs.

If you do not automatically accrue vacation hours you can manually post employee accrued

vacation hours, listed under misc. programs.

Clear month to date totals.

Print other necessary reports needed:

] __________________________________________________

] __________________________________________________

] __________________________________________________

Note: You are responsible for any changes in State, Federal, FUTA, SUTA, and FICA taxes.

Please call software support for assistance in updating changes.

MONTHEND/YR END/QRT END CHECK LIST

11

PAYROLL QUARTERLY CHECK LIST

FOR THE QUARTER ENDING:_________________________

[

Verify that the month end procedures have been completed.

Verify that all paychecks have been posted.

Print the following quarterly total reports:

[

[

[

[

[

[

[

]

]

]

]

]

]

]

Department quarterly totals.

Job classification quarterly totals.

Deductions quarterly totals.

Employee quarterly totals.

Quarterly federal tax report.

Quarterly state tax report.

Quarterly state unemployment report.

Verify the totals and make any adjustments necessary.

Reprint the reports if adjustments are made.

Print Quarterly 941 form.

Clear Quarter to date totals.

MONTHEND/YR END/QRT END CHECK LIST

12

PAYROLL YEAR END PROCEDURES

A.

Process your last Payroll for the year.

B.

Go to Year End Procedures

Print Monthly and Quarterly Reports

Make Payroll Data Backup only (hold on to this)

Print W2's - MD customers tables 3,4,5 for State Code may be applicable.

VA and other customers State Table 3 may be the only applicable table.

Clear Year to Date Totals - this clears monthly and quarterly as well.

Print (optional) Employee Paycheck History Report.

Purge Employee Paycheck History 12/31/??.

Check all tax table information in File Maintenance to ensure that all corrections and,

or alterations for State and Federal tax have been made. (NOTE: If you save your employee

paycheck attendance from Payroll to Payroll and the tax tables have changed, or you have altered

employee's pay rates you will need to re-calculate employee paychecks the next time that you

process Payroll so the saved attendance may pick up the changes). It is strongly recommended

that you process Year End and W2's at your Year End Close, but if you are not able to process

W2's right away and need a little time, Software Support can assist you in taking a backup of

your Payroll, (prior to performing Year End Clear) so that you may use it when you are ready.

NOTE: Year End does not have to be done the day of your last Payroll - as long as you have done

Year End of Payroll before your first new year Payroll. Please give yourself plenty of time and

do not save until the last minute.

Transfer G/L transactions to G/L as normal.

REFER TO PAYROLL MANUAL FOR A DETAILED DISCUSSION REGARDING YEAR END (CHAPTER 11).

MONTHEND/YR END/QRT END CHECK LIST

13

GENERAL LEDGER MONTH END CHECK LIST

FOR THE MONTH OF: _______________________

[

Verify that Accounts Payable, Accounts Receivable, Payroll and Job Cost Month End

Procedures have been completed.

Verify that all General Ledger Distributions have been transferred to the General Ledger

from Accounts Payable, Accounts Receivable, Payroll and Job Cost.

Verify that all standard entries have been updated for the month being closed.

Verify that all journals and reversing entries have been entered and updated for the month

being closed.

Print a General Ledger trial balance in detail.

Print a General Ledger working trial balance. (optional)

Review the trial balance for accuracy.

Reconcile the General Ledger balances for:

[

[

[

[

[

[

]

]

]

]

]

]

Accounts Receivable (compare to A/R month end trial balance)

Accounts Payable (compare to A/P month end trial balance)

Verify cash account(s) balance(s)

Inventory totals with inventory valuation report

Payroll tax accounts

Payroll salary accounts

Other account balances to reconcile:

[

________________________________________

________________________________________

________________________________________

_________________________________________

Make any necessary adjustments.

If adjustments were made, reprint a final General Ledger trial balance

as part of your permanent month end records.

Print other Month End Reports

[

Balance Sheet [

_______________________________

Income Statement

_______________________________

Cash Flow Report

_______________________________

MONTHEND/YR END/QRT END CHECK LIST

14

GENERAL LEDGER YEAR END PROCEDURES

FOR THE YEAR ENDING:

This section presents instructions for executing the year-end processing procedure.

procedure accomplishes several tasks simultaneously:

This

Creates a closing entry transaction for each income statement account

Creates a profit (loss) transaction to a specified balance sheet

Prints the closing entry transaction register

Prints the closing trial balance

Updates the last year balance file with current year balances

Prints the opening balance register

Clears the year-to-date file of prior year's transactions

Clears opening trial balance transactions for the year-to-date file

Because the year-end closing procedure clears the transactions file, it is recommended that

permanent backup copies of the files be made before executing this procedure. Other procedures

recommended for execution at year-end include:

Printing of all desired financial reports.

Copying your data files onto a backup tape, or keep a copy a copy of your data on your

hard drive (Call support for assistance).

Update budgets from last year's figures (Section 11.5).

All these procedures should be considered for execution before running the year-end program

which

clears the files. Reports and Listings that must be printed for the current year before the

files are cleared include:

General Ledger Account Master File List

Standard Entries Master List

General Ledger Trial Balance

Income Statement and Schedules

Balance Sheet and Schedules

Cash Flow Report - Changes in Components

Income Statement Trend Report

Comparative Income Statement Trend

Balance Sheet Trend Report

Cash Flow Trend - Changes in Components Trend

Chart of Accounts Extract

System Information File List

Period Ending Dates List

Employee Ledger

941A forms

W2 forms

1099 and Miscellaneous List

Many of these reports and listings can be included as part of your routine year-end processing.

It is up to you to determine what documentation you need at the close of each fiscal year.

Remember that all reports for the current year must be printed before running the Year-end

program.

New year transactions may be posted before the year end procedures are run.

If you want to

produce a new year's financial statement before clearing the previous year's figures, enter a

new fiscal year start date. This prevents the previous year's transactions from being included

in the YTD figures. Period end dated must also be changed in the System Information File. To

run the year end procedures for the previous year, period end dates must be changed back to

their

previous condition.

MONTHEND/YR END/QRT END CHECK LIST

15

7.1

YEAR END PROCESSING

This section presents instructions for executing the year-end processing procedure.

procedure accomplishes several tasks simultaneously:

This

Creates a closing entry transaction for each income statement account

Creates a profit (loss) transaction to a specified balance sheet

Prints the closing entry transaction register

Prints the closing trial balance

Updates the last year balance file with current year balances

Prints the opening balance register

Clears the year-to-date file of prior year's transactions

Creates opening trial balance transactions for the year-to-date file

Because the year-end closing procedure clears the transactions file, it is recommended that

permanent backup copies of the files be made before executing this procedure. Please consult the

introduction (Section 7.0) for additional recommended year-end processing.

It is recommended that you record your responses to the prompts as you progress through this

procedure. If, for any reason, year-end processing is interrupted, a record of your responses

will facilitate retracing your steps to initiate a restart.

Follow these STEPS to execute the year-end close procedure:

STEP 1:

From the MAIN MENU select <5> for YEAR END PROCESSING, and press <ENTER>.

STEP 2:

The program prompts: "ENTER AUTHORIZATION CODE". Enter the authorization code and

press <ENTER>.

The authorization code is a security code which limits access to

the

system.

STEP 3:

The program displays the following message, and prompts:

THIS PROCEDURE WILL DO THE FOLLOWING:

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

CREATE A CLOSING ENTRY TRANSACTION FOR EACH P&L ACCOUNT

CREATE A PROFIT (LOSS) TRANSACTION FOR THE BALANCE SHEET

PRINT THE CLOSING ENTRY TRANSACTION REGISTER

PRINT THE CLOSING TRIAL BALANCE

UPDATE THE LAST YEAR BALANCE FILE

PRINT THE OPENING BALANCE REGISTER

CLEAR THE YEAR TO DATE FILE OF PRIOR YEAR TRANSACTIONS

CREATE OTB TRANSACTIONS FOR THE YEAR TO DATE FILE

ARE YOU SURE YOU WANT TO CONTINUE?

STEP 4:

Enter <N>(NO), and press <ENTER> if you do not wish to continue. The program

returns to the Monitor. Type <GL>, and press <ENTER> to display the Main Menu.

Enter <Y>(YES), and press <ENTER>, if you wish to continue.

STEP 5:

When <Y>(YES) is entered in STEP 4, and the <ENTER> key is pressed, the program

displays the current year ending date, and the period ending dates set up in the

System Information File (Section 3.6).

The program prompts: "ARE THE YEAR ENDING DATE AND CLOSING YEAR DATES CORRECT?".

Type <Y>(YES), and press <ENTER> if these dates are correct.

Type <N>(NO), and press <ENTER> if any of these dates are not correct.

displays the following message, and returns to the Monitor.

The program

"PLEASE CORRECT YOUR PERIOD ENDING DATES WITH THE SYSTEM INFORMATION MAINTENANCE

PROGRAM

02217 PROGRAM ABORTED

:"

MONTHEND/YR END/QRT END CHECK LIST

16

STEP 6:

When <Y>(YES) is entered in STEP 5, and the <ENTER> key is pressed, the program

prompts:

"YEAR ENDING DATE: 12/31/94

PLEASE ENTER:

NEW YEAR OPENING DATE"

Enter the date you wish to specify as the new year opening date, and press <ENTER>.

Remember to follow the MMDDYY format when entering dates. Do not enter any

separating punctuation when entering dates. The program formats the date upon

entry.

STEP 7:

When the new year opening date is entered, and the <ENTER> key is pressed, the

program prompts:

"CLOSING ACCOUNT #:".

Enter the closing account number, and

press <ENTER>.

Enter six numeric characters.

Do not enter any formatting

punctuation.

The closing account number is the balance sheet account that the net profit (loss)

amount is to be posted to. Any valid posting account number is acceptable.

STEP 8:

When the closing account number has been entered, and the <ENTER> key is pressed,

the program prompts: "IS EVERYTHING OK?".

Enter <N>(NO), and press <ENTER> if you wish to re-enter this information.

program returns to the prompt for entry of the new year opening date.

The

Enter <Y>(YES), and press <ENTER> if you wish to continue.

STEP 9:

When <Y>(YES) is entered in STEP 8, and the <ENTER> key is pressed, the print

function is activated.

The program prints the closing Income Statement.

While printing, the program

displays this message:

"CLOSING INCOME STATEMENT ACCOUNTS...PLEASE DO NOT

INTERRUPT". When printing is complete, the program prompts:

** GENERAL LEDGER TRIAL BALANCE **

(R) REGULAR REPORT..(M) MEMO REPORT...:

STEP 10:

These prompts determine the nature of the next report: The General Ledger Trial

Balance.

Enter <R>, and press <ENTER> if you wish to base the General Ledger Trial Balance

Report on General Ledger regular accounts.

Enter <M>, and press <ENTER> if you wish to base the General Ledger Trial Balance

Report on memo (units) accounts.

STEP 11:

When selection is made, the program prompts:

"IS THIS A RESTART?".

Enter <N>(NO), and press <ENTER> if this is a new General Ledger Trial Balance

Report, and you do not wish to initiate printing with a particular account number.

Enter <Y>(YES), and press <ENTER> if printing of the General Ledger Trial Balance

has previously been interrupted, and you wish to restart is at a particular

account. The program prompts: "ENTER LAST ACCOUNT NUMBER PRINTED:".

Enter the number identifying the last successfully completed account in the

statement, and press <ENTER>. The printout will begin with the next sequential

account.

When the account number is entered, and the <ENTER> key is pressed, the program

prompts: "O.K.?".

Enter <N>(NO), and press <ENTER> if you wish to re-enter the last account number

printed.

Enter <Y>(YES), and press <ENTER> to continue.

MONTHEND/YR END/QRT END CHECK LIST

17

STEP 12:

When selection has been made, the program prompts:

** GENERAL LEDGER TRIAL BALANCE **

(1) REPORTING PERIOD START DATE....................:

(2) REPORTING PERIOD END DATE......................:

(3) PROFIT CENTER TO BE REPORTED OR ALL............:

ENTER PROFIT CENTER (1-99) OR "ALL"

(4) DO YOU WANT ACCOUNT DETAIL?....................:

(5) DO YOU WANT TO SUPPRESS ZERO BALANCES?.........:

Enter the information called for, line for line. Press <ENTER> after each entry to advance

the cursor to the next line. Follow the guidelines below when making your entries:

The Screen Displays:

You Respond / Enter:

(1) REPORTING PERIOD START

DATE

Enter MMDDYY.

Enter the date you wish to serve as the report period start date,

and press <ENTER>.

The current year start date should be used as specified in the

System Information File (Section 6.6).

Remember to follow the MMDDYY format when entering dates. Do not

enter any separating punctuation. The program formats

the date upon entry.

(2) REPORTING PERIOD END

DATE

Enter MMDDYY.

Enter the date you wish to serve as the report period end date,

and press <ENTER>.

The current year end date should be used as specified in the

System Information File (Section 6.6).

Remember to follow the MMDDYY format when entering dates. Do not

enter any separating punctuation. The program formats the date

upon entry.

(3) PROFIT CENTER TO BE

REPORTED OR ALL ENTER

PROFIT CENTER (1-99) OR

"ALL"

(4) DO YOU WANT ACCOUNT

DETAIL?

Type <ALL>.

Type <ALL>, and press <ENTER> to include all profit centers in the

year-end trial balance report.

(5) DO YOU WANT TO SUPPRESS

ZERO

BALANCES?

STEP 13:

Type <Y> or <N>.

Type <Y>(YES), and press <ENTER> if you wish to include detail in

the year-end trial balance report.

Type <N>(NO), and press <ENTER> if you wish the report to include

only account balances.

Type <Y> or <N>.

Type <Y>(YES), and press <ENTER> if you wish to exclude accounts

with zero balances from the report.

Type <N>(NO), and press <ENTER> if you wish to include accounts

with zero balances in the report.

When these entries are complete, the program prompts: "IS EVERYTHING OK?'.

Type <N>(NO), and press <ENTER> if you wish to change any information just entered.

The "SELECT:" prompt appears. Type the line number of the information you wish to

change, and press <ENTER>. Then type the new information, and press <ENTER>. Type

<M>, and press <ENTER> to return to the Main Menu. Type <E>, and press <ENTER> to

exit to the Monitor.

Type <Y>(YES), and press <ENTER> if you wish to continue.

MONTHEND/YR END/QRT END CHECK LIST

18

STEP 14:

When <Y>(YES) is typed in STEP 13, and the <ENTER> key is pressed, the print

function is activated.

While printing, the screen displays the message:

"GENERAL LEDGER TRIAL BALANCE

PRINTING".

Type the <CMD> key, and then the <E> key if you wish to stop the listing.

When printing of the trial balance report is complete, the program automatically

prints the opening trial balance report, which is identified as the "POST CLOSING

TRIAL BALANCE" in the printout.

STEP 15:

When printing of the opening trial balance is complete, the program returns to the

Miscellaneous Functions Menu.

Type <M>, and press <ENTER> to return to the Main Menu.

Type <E>, and press

<ENTER> to exit to the Monitor.

MONTHEND/YR END/QRT END CHECK LIST

19

Potrebbero piacerti anche

- Better Handwriting For AdultsDocumento48 pagineBetter Handwriting For Adultsnala_finance84% (19)

- Better Handwriting For AdultsDocumento48 pagineBetter Handwriting For Adultsnala_finance84% (19)

- Accounting ProcessDocumento5 pagineAccounting ProcessValNessuna valutazione finora

- Review of The Accounting ProcessDocumento18 pagineReview of The Accounting ProcessRoyceNessuna valutazione finora

- CH 4 Work Sheet2Documento54 pagineCH 4 Work Sheet2Yasin Arafat ShuvoNessuna valutazione finora

- General Ledger: General Ledger 1. What Are The Key Functions Provided by GL?Documento9 pagineGeneral Ledger: General Ledger 1. What Are The Key Functions Provided by GL?1sacNessuna valutazione finora

- Demystifying Google HacksDocumento11 pagineDemystifying Google HacksIvy LoveNessuna valutazione finora

- Demystifying Google HacksDocumento11 pagineDemystifying Google HacksIvy LoveNessuna valutazione finora

- Production & Operations Mangement Master Slide.Documento358 pagineProduction & Operations Mangement Master Slide.SakshiAgarwalNessuna valutazione finora

- Fico PDFDocumento148 pagineFico PDFAniruddha ChakrabortyNessuna valutazione finora

- Isys6300 - Business Process Fundamental: Week 8 - The General Ledger and Financial ReportingcycleDocumento37 pagineIsys6300 - Business Process Fundamental: Week 8 - The General Ledger and Financial ReportingcycleEdwar ArmandesNessuna valutazione finora

- VOLUNTARY RETIREMENT SCHEME FinalDocumento70 pagineVOLUNTARY RETIREMENT SCHEME FinalDishangi50% (4)

- Sap B1 - FinancialsDocumento7 pagineSap B1 - FinancialsRhon Ryan TamondongNessuna valutazione finora

- Developing Financial ProjectionsDocumento14 pagineDeveloping Financial ProjectionsIngrid AtaydeNessuna valutazione finora

- Flow Chart - Trial Balance - WikiAccountingDocumento6 pagineFlow Chart - Trial Balance - WikiAccountingmatthew mafaraNessuna valutazione finora

- Ee Roadinfra Tend 01Documento3 pagineEe Roadinfra Tend 01Prasanna VswamyNessuna valutazione finora

- Overview of General Ledger TasksDocumento8 pagineOverview of General Ledger TasksamrNessuna valutazione finora

- Sap Fico GlossaryDocumento12 pagineSap Fico Glossaryjohnsonkkuriakose100% (1)

- Corporate Governance, Business Ethics, Risk Management and Internal ControlDocumento91 pagineCorporate Governance, Business Ethics, Risk Management and Internal ControlJoshua Comeros100% (3)

- Payables Reconciliation: Support NotesDocumento8 paginePayables Reconciliation: Support NotesJohnson JosephNessuna valutazione finora

- Triune Technologies: General Ledger (GL)Documento26 pagineTriune Technologies: General Ledger (GL)Saq IbNessuna valutazione finora

- Flow Chart - Accounting CycleDocumento11 pagineFlow Chart - Accounting Cyclematthew mafaraNessuna valutazione finora

- Alexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002Documento45 pagineAlexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002andresabelr100% (1)

- SBL Revision Notes PDFDocumento175 pagineSBL Revision Notes PDFAliRazaSattar100% (3)

- Systemic Pathology Study NotesDocumento33 pagineSystemic Pathology Study NotesLaura BourqueNessuna valutazione finora

- Management Consulting Firms - Finding The Right Growth StrategyDocumento140 pagineManagement Consulting Firms - Finding The Right Growth Strategyer_manikaur2221Nessuna valutazione finora

- AP CloseDocumento9 pagineAP CloseStephan OttenhoffNessuna valutazione finora

- WorksheetsDocumento23 pagineWorksheetsoxygeniaxxNessuna valutazione finora

- Year End Closing GLDocumento11 pagineYear End Closing GLErshad RajaNessuna valutazione finora

- Oracle r12 GL Interview QuetionsDocumento24 pagineOracle r12 GL Interview Quetionslaxman_naraNessuna valutazione finora

- Period-End Process in Receivables r12Documento9 paginePeriod-End Process in Receivables r12devender143Nessuna valutazione finora

- Bookeeping EntrepDocumento71 pagineBookeeping EntrepJanelle Ghia RamosNessuna valutazione finora

- General Ledger: Instructor: MANISH CHAUHANDocumento53 pagineGeneral Ledger: Instructor: MANISH CHAUHANRanbeer CoolNessuna valutazione finora

- WSDocumento4 pagineWSmattokleisenNessuna valutazione finora

- Chapter 7 - Finance CycleDocumento15 pagineChapter 7 - Finance Cyclecarmel andreNessuna valutazione finora

- Module 1 Intro To Financial Management 1Documento22 pagineModule 1 Intro To Financial Management 1Jenalyn OrtegaNessuna valutazione finora

- Month End Closing ProceduresDocumento4 pagineMonth End Closing Proceduresctgshabbir3604Nessuna valutazione finora

- Cfas 3Documento10 pagineCfas 3Bea charmillecapiliNessuna valutazione finora

- Accounting CycleDocumento4 pagineAccounting Cycleadeebaa480Nessuna valutazione finora

- Module 3 CFAS PDFDocumento7 pagineModule 3 CFAS PDFErmelyn GayoNessuna valutazione finora

- Worksheet PreparationDocumento3 pagineWorksheet PreparationJon PangilinanNessuna valutazione finora

- Completing The Accounting Cycle For A Merchandising BusinessDocumento11 pagineCompleting The Accounting Cycle For A Merchandising BusinessRhea BernabeNessuna valutazione finora

- What Is An Extended TrialDocumento19 pagineWhat Is An Extended TrialocalmaviliNessuna valutazione finora

- SAP T-Codes and ResiduesDocumento18 pagineSAP T-Codes and ResiduesPushpanka PatraNessuna valutazione finora

- Assign 1 Audit AssuranceDocumento5 pagineAssign 1 Audit AssuranceAyesha HamidNessuna valutazione finora

- Hoor Oil Industry Multan Format For Weekly ReportDocumento5 pagineHoor Oil Industry Multan Format For Weekly ReportAlizaNessuna valutazione finora

- R2R Unit 1Documento16 pagineR2R Unit 1Bhavika ChughNessuna valutazione finora

- Fabm1 ReviewerDocumento16 pagineFabm1 ReviewerNjay SanchezNessuna valutazione finora

- EFS User - Manual - AccountingforFS V01 130722 1657 2Documento52 pagineEFS User - Manual - AccountingforFS V01 130722 1657 2CARMEN STEFANIA BUIACUNessuna valutazione finora

- Journals, Transactions and Manufacturing Company Accounting CycleDocumento3 pagineJournals, Transactions and Manufacturing Company Accounting CycleRio MartinNessuna valutazione finora

- ReportsDocumento4 pagineReportscarlaNessuna valutazione finora

- Describe Merchandising Operations and Inventory SystemsDocumento4 pagineDescribe Merchandising Operations and Inventory SystemsSadia RahmanNessuna valutazione finora

- Accounting CycleDocumento4 pagineAccounting CycleAmitNessuna valutazione finora

- Act08 - Lfca133e022 - Lique GiinoDocumento4 pagineAct08 - Lfca133e022 - Lique GiinoGino LiqueNessuna valutazione finora

- ADJUSTMENTS Adjusting Entries-2Documento11 pagineADJUSTMENTS Adjusting Entries-2Moses IrunguNessuna valutazione finora

- CH 4Documento59 pagineCH 4ad_jebbNessuna valutazione finora

- Adjustments: Steps For Recording Adjusting EntriesDocumento2 pagineAdjustments: Steps For Recording Adjusting EntriesYahnsea AlfaroNessuna valutazione finora

- Sage One Accounting Getting Started Guide 1Documento82 pagineSage One Accounting Getting Started Guide 1romeoNessuna valutazione finora

- The Eight Steps of The Accounting CycleDocumento9 pagineThe Eight Steps of The Accounting CycleDana GoanNessuna valutazione finora

- 644231822518e63b09005ae5 - The Month-End Close Checklist For The Account TeamDocumento8 pagine644231822518e63b09005ae5 - The Month-End Close Checklist For The Account Teamparvez ansariNessuna valutazione finora

- Acc201 Su2Documento5 pagineAcc201 Su2Gwyneth LimNessuna valutazione finora

- J FabmDocumento192 pagineJ FabmJillian Anika CuerdoNessuna valutazione finora

- Intergration With Sales Order ManagementDocumento6 pagineIntergration With Sales Order ManagementYudita Dwi Nur'AininNessuna valutazione finora

- Month End Closing and Year End ClosingDocumento11 pagineMonth End Closing and Year End ClosingT VandanaNessuna valutazione finora

- FSA Level 1Documento31 pagineFSA Level 1Rahul MaheshwariNessuna valutazione finora

- Accounts (1) FinalDocumento28 pagineAccounts (1) FinalManan MullickNessuna valutazione finora

- Adjusted Trial Balance & Adjusting Journal EntriesDocumento1 paginaAdjusted Trial Balance & Adjusting Journal EntriesSophee SophiaNessuna valutazione finora

- Chapter 8Documento50 pagineChapter 8Caleb GetubigNessuna valutazione finora

- Tools to Beat Budget - A Proven Program for Club PerformanceDa EverandTools to Beat Budget - A Proven Program for Club PerformanceNessuna valutazione finora

- Summary of Tycho Press's Accounting for Small Business OwnersDa EverandSummary of Tycho Press's Accounting for Small Business OwnersNessuna valutazione finora

- Company Balance SheetDocumento12 pagineCompany Balance SheetAlok KumarNessuna valutazione finora

- Master ReportDocumento51 pagineMaster ReportZaidpzaidNessuna valutazione finora

- Apeejay Pre School SaketDocumento7 pagineApeejay Pre School SaketZaidpzaidNessuna valutazione finora

- AdfgklkDocumento3 pagineAdfgklkZaidpzaidNessuna valutazione finora

- Company Balance SheetDocumento12 pagineCompany Balance SheetAlok KumarNessuna valutazione finora

- HHJDocumento1 paginaHHJZaidpzaidNessuna valutazione finora

- Objective: Rocky Kumar H. No. - 953, VPO Karala, Delhi - 110081 9899566660Documento2 pagineObjective: Rocky Kumar H. No. - 953, VPO Karala, Delhi - 110081 9899566660ZaidpzaidNessuna valutazione finora

- ExportDocumento8 pagineExportZaidpzaidNessuna valutazione finora

- AgreementDocumento1 paginaAgreementZaidpzaidNessuna valutazione finora

- LalaDocumento2 pagineLalaZaidpzaidNessuna valutazione finora

- Birthday PartyDocumento1 paginaBirthday PartyZaidpzaidNessuna valutazione finora

- Kunal: Curriculum VitaeDocumento2 pagineKunal: Curriculum VitaeZaidpzaidNessuna valutazione finora

- Hudhud CycloneDocumento1 paginaHudhud CycloneZaidpzaidNessuna valutazione finora

- Resume SRVDocumento3 pagineResume SRVZaidpzaidNessuna valutazione finora

- Rochana Sarkar NSRDocumento1 paginaRochana Sarkar NSRBhargav GamitNessuna valutazione finora

- Shilpi SangalDocumento5 pagineShilpi SangalZaidpzaidNessuna valutazione finora

- Personal Profile: Biju CDocumento2 paginePersonal Profile: Biju CZaidpzaidNessuna valutazione finora

- Hudhud CycloneDocumento1 paginaHudhud CycloneZaidpzaidNessuna valutazione finora

- CL31 - Considering The Effects of Accounting Standards - IPADocumento18 pagineCL31 - Considering The Effects of Accounting Standards - IPAZaidpzaidNessuna valutazione finora

- Interview QuestionsDocumento6 pagineInterview QuestionsZaidpzaidNessuna valutazione finora

- Kathuria RajatDocumento40 pagineKathuria RajatZaidpzaidNessuna valutazione finora

- Circulation:Finance Staff: Accounts Payable/CreditorsDocumento4 pagineCirculation:Finance Staff: Accounts Payable/CreditorsZaidpzaidNessuna valutazione finora

- Circulation:Finance Staff: Accounts Payable/CreditorsDocumento4 pagineCirculation:Finance Staff: Accounts Payable/CreditorsZaidpzaidNessuna valutazione finora

- Circulation:Finance Staff: Accounts Payable/CreditorsDocumento4 pagineCirculation:Finance Staff: Accounts Payable/CreditorsZaidpzaidNessuna valutazione finora

- Impact of Training On Employee Performance The Case of (NKB)Documento11 pagineImpact of Training On Employee Performance The Case of (NKB)mahbobullah rahmaniNessuna valutazione finora

- 1 - MB Group Assignment I 21727Documento2 pagine1 - MB Group Assignment I 21727RoNessuna valutazione finora

- Shell Digital Marketing StrategiesDocumento69 pagineShell Digital Marketing StrategiesFiorella AvalosNessuna valutazione finora

- Edited by Foxit Reader Copyright (C) by Foxit Software Company, 2005-2007 ForDocumento1 paginaEdited by Foxit Reader Copyright (C) by Foxit Software Company, 2005-2007 ForChristopher RoyNessuna valutazione finora

- CFAS IAS 1 ReviewerDocumento8 pagineCFAS IAS 1 ReviewerAviona BermejoNessuna valutazione finora

- Business Plan Jan 05Documento18 pagineBusiness Plan Jan 05Carolyn TaylorNessuna valutazione finora

- Raman MittalDocumento2 pagineRaman MittalSuresh BabuNessuna valutazione finora

- PDFDocumento2 paginePDFRodrigo Uribe BravoNessuna valutazione finora

- Midterm ManaccDocumento13 pagineMidterm ManaccTheodora YenneferNessuna valutazione finora

- Manajemen Biaya Strategik PDFDocumento9 pagineManajemen Biaya Strategik PDFVeneranda AtriaNessuna valutazione finora

- Assessment of The Perception of Farming Households On Off Farm Activities As A Livelihood Coping Strategy in Wudil Lga of Kano State, NigeriaDocumento7 pagineAssessment of The Perception of Farming Households On Off Farm Activities As A Livelihood Coping Strategy in Wudil Lga of Kano State, NigeriaEditor IJTSRDNessuna valutazione finora

- Tarea 2 Capítulo 2Documento14 pagineTarea 2 Capítulo 2Eber VelázquezNessuna valutazione finora

- Bangladesh Income Tax RatesDocumento5 pagineBangladesh Income Tax RatesaadonNessuna valutazione finora

- Homework Solution 7Documento64 pagineHomework Solution 7Shalini VeluNessuna valutazione finora

- 3-Charge GSTDocumento19 pagine3-Charge GSTamit jangraNessuna valutazione finora

- Assessment Test Week 6 (ECO 2) - Google FormsDocumento3 pagineAssessment Test Week 6 (ECO 2) - Google FormsNeil Jasper CorozaNessuna valutazione finora

- The 6 Killerapps-NotesDocumento6 pagineThe 6 Killerapps-NotesKashifOfflineNessuna valutazione finora

- Job Letter For Opening Bank AccountDocumento4 pagineJob Letter For Opening Bank Accountseoerljbf100% (2)

- Enginuity Kronos SpecsDocumento33 pagineEnginuity Kronos SpecsmandapatiNessuna valutazione finora

- Chapter 8 Profit Maximization &cmptitive SupplyDocumento92 pagineChapter 8 Profit Maximization &cmptitive Supplysridhar7892Nessuna valutazione finora

- CH 07Documento11 pagineCH 07Bhabuk AryalNessuna valutazione finora

- De La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsDocumento27 pagineDe La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsAmber QuiñonesNessuna valutazione finora

- The Other Face of Managerial AccountingDocumento20 pagineThe Other Face of Managerial AccountingModar AlzaiemNessuna valutazione finora