Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Notification No.249 1985 CE

Caricato da

patelpratik1972Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Notification No.249 1985 CE

Caricato da

patelpratik1972Copyright:

Formati disponibili

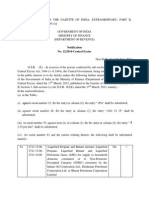

Notification No.

249/1985-CE Dated 20-12-1985

Supersession of the Notification No. 185/84-CE, dated 1/8/1984 - Exemption to aluminium.In exercise of the powers conferred by sub-rule (1) of rule 8 of the Central Excise Rules, 1944, and in

supersession of the notification of the Government of India in the Ministry of Finance (Department of

Revenue) No. 185/84-Central Excises, dated the 1st August, 1984, the Central Government hereby

exempts aluminium of the description specified in column (3) of the Table hereto annexed and falling

under the sub-items specified in the corresponding entry in column (2) of the said Table, of Item No. 27 of

the First Schedule to the Central Excises and Salt Act, 1944 (1 of 1944), from so much of the duty of

excise leviable thereon under the said Act at the rate specified in the said First Schedule as is in excess

of the amount calculated at the rate specified in the corresponding entry in column (4) thereof.

TABLE

S.

No.

(1)

1.

Sub-item

No.

(2)

(1)

Description of goods

2.

(2)

3.

(3)

4.

(3)

Wrought bars and rods (including

wire rods).

Wire rods produced by

manufacturers other than primary

producers.

5.

(3)

Angles, shapes and sections.

6.

(4)

Castings, not otherwise specified.

7.

8.

(5)

(6)

Aluminium wire.

Wrought plates, sheets, blanks

(including circles) and strips,

(3)

Unwrought aluminium in any form

including ingots, pigs, blocks, billets,

slabs, notched bars, wire bars, shots

and pellets.

Waste and scrap.

Rate of duty

(4)

Twelve per cent

ad valorem.

Fourteen per

cent ad valorem.

Seventeen per

cent ad valorem.

Rupees two

hundred and

fifty-eight and

paise fifty per

metric tonne.

Twenty-four per

cent ad valorem.

Twenty-four per

cent ad valorem.

Nil.

(a) circles having thickness of and

above 0.56 mm but not above 2 mm.

Twelve per cent

ad valorem.

(b) others.

Twenty-four per

cent ad valorem.

Twenty-four per

cent ad valorem.

Fourteen per

cent ad valorem.

Twenty-four per

cent ad valorem.

Twenty-four per

cent ad valorem.

9.

(7)

Aluminium foil.

10.

(8)

Aluminium powders and flakes.

11.

(9)

Pipes and tubes of aluminium.

12.

(10)

13.

(11)

Shells and blanks for pipes and

tubes; hollow sections and semihollow sections of aluminium.

Containers, plain, lacquered or

Twenty-four per

(1)

(2)

(3)

printed or lacquered and printed.

(4)

cent ad valorem.

Provided that nothing contained in this notification shall apply to aluminium to which the

notification of the Government of India in the Ministry of Finance (Department of Revenue) No.

248/85-Central Excises, dated the 20-12-1985 applies :

Provided further that the rates specified in column (4) against S. No. 8 of the Table annexed

above shall be reduced by Twelve per cent ad valorem in the case of strips if the same are

intended to be used for the manufacture of aluminium pipes which are exempt under S. No. 16 of

the Table annexed to the notification of the Government of India in the Ministry of Finance

(Department of Revenue) No. 183/84-Central Excises, dated the 1st August, 1984 and where

such use is elsewhere than in the factory of production of such strips, the procedure set out in

Chapter X of the Central Excise Rules, 1944 is followed :

Provided also that in respect of goods specified in S. No. 4 of the Table annexed above, the

exemption contained in this notification shall not apply if credit of duty paid on the ingots or

billets used in their manufacture has been taken under rule 56A of the said Rules.

Explanation. For the purposes of this notification, the expression primary producer means

any person licensed or registered under the Industries (Development and Regulation) Act, 1951

(65 of 1951), who produces aluminium from bauxite or alumina.

Potrebbero piacerti anche

- Notification No.248 1985 CEDocumento1 paginaNotification No.248 1985 CEpatelpratik1972Nessuna valutazione finora

- Aluminum & Copper Semi-Finished Supplies World Summary: Market Values & Financials by CountryDa EverandAluminum & Copper Semi-Finished Supplies World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Notification No. 04/2015-Customs (ADD)Documento3 pagineNotification No. 04/2015-Customs (ADD)ashly_099Nessuna valutazione finora

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryDa EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Ix. Exemption To Certain Goods and IndustriesDocumento7 pagineIx. Exemption To Certain Goods and IndustriesManish GautamNessuna valutazione finora

- Cex0606 PDFDocumento19 pagineCex0606 PDFbravoswagatNessuna valutazione finora

- Notification No 8 2002Documento6 pagineNotification No 8 2002Dhananjay KulkarniNessuna valutazione finora

- LBT Rates NagpurDocumento15 pagineLBT Rates NagpurPankaj GoyenkaNessuna valutazione finora

- Vat Schedule TNDocumento40 pagineVat Schedule TNVenkatasubramanian KrishnamurthyNessuna valutazione finora

- Notification No. 9/2013-Customs (ADD)Documento3 pagineNotification No. 9/2013-Customs (ADD)stephin k jNessuna valutazione finora

- SCH 2 3Documento16 pagineSCH 2 3mahabalu123456789Nessuna valutazione finora

- Csadd 11 2013Documento3 pagineCsadd 11 2013stephin k jNessuna valutazione finora

- 10 2018 Notification Dated 02 Feb 2018Documento2 pagine10 2018 Notification Dated 02 Feb 2018vinodNessuna valutazione finora

- Sub: Technology Upgradation Fund Scheme (TUFS)Documento5 pagineSub: Technology Upgradation Fund Scheme (TUFS)palanisamyannurNessuna valutazione finora

- Government of India Ministry of Finance (Department of Revenue)Documento5 pagineGovernment of India Ministry of Finance (Department of Revenue)patelpratik1972Nessuna valutazione finora

- Government of India Ministry of Finance Department of RevenueDocumento3 pagineGovernment of India Ministry of Finance Department of Revenuepatelpratik1972Nessuna valutazione finora

- Central Excise & Customs: Salient Features of Budgetary ChangesDocumento5 pagineCentral Excise & Customs: Salient Features of Budgetary ChangesYunus ShaikhNessuna valutazione finora

- Sro 565-2006Documento44 pagineSro 565-2006Abdullah Jathol100% (1)

- SRO693 (I) 200629oct2013Documento42 pagineSRO693 (I) 200629oct2013Naveed AhmedNessuna valutazione finora

- Circular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedDocumento10 pagineCircular: Notification No.07/2020-Customs (N.T.), Made Effective From 4 February 2020 As AmendedNitesh RawatNessuna valutazione finora

- General Circular No 67 2011Documento3 pagineGeneral Circular No 67 2011mihiralNessuna valutazione finora

- Finance BillDocumento128 pagineFinance BillonepakistancomNessuna valutazione finora

- Anti Dumping Duty Notifications (Customs) No.35/2014 Dated 24th July, 2014Documento9 pagineAnti Dumping Duty Notifications (Customs) No.35/2014 Dated 24th July, 2014stephin k jNessuna valutazione finora

- Pratt & Whitney Canada: Illustrated Parts Catalog MANUAL PART NO. 3054928Documento32 paginePratt & Whitney Canada: Illustrated Parts Catalog MANUAL PART NO. 3054928betochalNessuna valutazione finora

- CADMIUM 23 3869 enDocumento4 pagineCADMIUM 23 3869 enThejaswiniNessuna valutazione finora

- Customs and Excise (Tariffs) (Amendment) - Eighth ScheduleDocumento18 pagineCustoms and Excise (Tariffs) (Amendment) - Eighth ScheduleSangwani NyirendaNessuna valutazione finora

- 1800 August 14Documento36 pagine1800 August 14RevmalcNessuna valutazione finora

- Series - 1800 Highway StandardsDocumento36 pagineSeries - 1800 Highway StandardsIonel MilasanNessuna valutazione finora

- Comprehensive Manual On 4ad RefundsDocumento50 pagineComprehensive Manual On 4ad RefundshaamaNessuna valutazione finora

- Second Schedule (Fifth Schedule)Documento95 pagineSecond Schedule (Fifth Schedule)Adnan KhanNessuna valutazione finora

- MEPC.2-Circ.17 (Tripartite 2011)Documento71 pagineMEPC.2-Circ.17 (Tripartite 2011)RayNessuna valutazione finora

- Section-XXI Chapter-98Documento10 pagineSection-XXI Chapter-98శ్రీనివాసకిరణ్కుమార్చతుర్వేదులNessuna valutazione finora

- Anexa NR 3 msn1819Documento37 pagineAnexa NR 3 msn1819Creatine AngliaNessuna valutazione finora

- Scheduled Industries (Submission of Production Returns) Rules, 1979Documento3 pagineScheduled Industries (Submission of Production Returns) Rules, 1979Latest Laws TeamNessuna valutazione finora

- Duty Drawback Feb 2020Documento192 pagineDuty Drawback Feb 2020AkashAgarwalNessuna valutazione finora

- Central Excise Tariff Act 1985Documento13 pagineCentral Excise Tariff Act 1985Luvjoy ChokerNessuna valutazione finora

- Non-Levy/Short Levy of Additional DutyDocumento5 pagineNon-Levy/Short Levy of Additional Dutybiko137Nessuna valutazione finora

- TN Vat RatesDocumento57 pagineTN Vat RatesdeepadeepadeepaNessuna valutazione finora

- Scheduled Industries (Submission of Production Returns) Rules, 1979Documento3 pagineScheduled Industries (Submission of Production Returns) Rules, 1979Latest Laws TeamNessuna valutazione finora

- Unloading of Petrol Into Storage at Petrol StationsDocumento41 pagineUnloading of Petrol Into Storage at Petrol StationsPeter100% (1)

- A Missoula County Air Quality Permit Will Be Required For Locations Within Missoula County. A List of The Permitted Equipment Is Contained in Section I.A of The PermitDocumento20 pagineA Missoula County Air Quality Permit Will Be Required For Locations Within Missoula County. A List of The Permitted Equipment Is Contained in Section I.A of The Permitmacross086Nessuna valutazione finora

- Central Excise: Chapter 1 To 12Documento17 pagineCentral Excise: Chapter 1 To 12Jitendra Suraaj TripathiNessuna valutazione finora

- DBK Rate 2018 PDFDocumento176 pagineDBK Rate 2018 PDFmahen aryaNessuna valutazione finora

- 9 Instruction 11Documento4 pagine9 Instruction 11TRI City GujaratNessuna valutazione finora

- MODU Part 4 eDocumento168 pagineMODU Part 4 efrmarzoNessuna valutazione finora

- Notification No. 8 /2013-Customs (ADD)Documento3 pagineNotification No. 8 /2013-Customs (ADD)stephin k jNessuna valutazione finora

- HighLights ST FEDocumento34 pagineHighLights ST FEShakir MuhammadNessuna valutazione finora

- Escc Construction Spec For Dev 08Documento122 pagineEscc Construction Spec For Dev 08p_mincher5209Nessuna valutazione finora

- Table of Content: International Trade LawDocumento8 pagineTable of Content: International Trade LawPRAWARTIKA SINGHNessuna valutazione finora

- Customs: Chapter 1 and 2Documento10 pagineCustoms: Chapter 1 and 2tskang7Nessuna valutazione finora

- TheFinanace (Supplementary) Act2022Documento24 pagineTheFinanace (Supplementary) Act2022Syed Adnan raza ShahNessuna valutazione finora

- csnt77-2023 - Applicable 30-Oct-23Documento159 paginecsnt77-2023 - Applicable 30-Oct-23Sumit ChhuganiNessuna valutazione finora

- Petroleum Act 1998Documento122 paginePetroleum Act 1998PrasathNessuna valutazione finora

- 2009 BIR-RMC ContentsDocumento56 pagine2009 BIR-RMC ContentsMary Grace Caguioa AgasNessuna valutazione finora

- Harmonized System CodeDocumento175 pagineHarmonized System CodeHas SaphanaraNessuna valutazione finora

- Jordan Investment Law EngDocumento40 pagineJordan Investment Law EngHatem MomaniNessuna valutazione finora

- Central Excise Tariff Notification No.12/2014 Dated 11th July, 2014Documento6 pagineCentral Excise Tariff Notification No.12/2014 Dated 11th July, 2014stephin k jNessuna valutazione finora

- Cost Audit Applicability PDFDocumento22 pagineCost Audit Applicability PDFAmit NuwalNessuna valutazione finora

- CFR 29 1910.110Documento99 pagineCFR 29 1910.110ELVERT ARTURO ARRIETA ESTRELLANessuna valutazione finora

- Reiki Symbols PDFDocumento8 pagineReiki Symbols PDFpatelpratik1972Nessuna valutazione finora

- Central Excise Notf - No.34-99 CEDocumento1 paginaCentral Excise Notf - No.34-99 CEpatelpratik1972Nessuna valutazione finora

- Reiki Master Handbook-Full InglesDocumento44 pagineReiki Master Handbook-Full Inglesanon-523638100% (13)

- Karmic Reiki Practitioners ManualDocumento10 pagineKarmic Reiki Practitioners ManualCrina Mihaela Danea100% (1)

- GST - Concept & Status: For Departmental Officers OnlyDocumento7 pagineGST - Concept & Status: For Departmental Officers Onlypatelpratik1972Nessuna valutazione finora

- Reiki Symbols and MeaningsDocumento31 pagineReiki Symbols and Meaningspatelpratik1972100% (3)

- Notification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The CentralDocumento5 pagineNotification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The Centralpatelpratik1972Nessuna valutazione finora

- Government of India Ministry of Finance Department of RevenueDocumento3 pagineGovernment of India Ministry of Finance Department of Revenuepatelpratik1972Nessuna valutazione finora

- Notification No.103 93 C.EDocumento1 paginaNotification No.103 93 C.Epatelpratik1972Nessuna valutazione finora

- Notification No. 145 89 C.EDocumento11 pagineNotification No. 145 89 C.Epatelpratik1972Nessuna valutazione finora

- Notification No.251 1985 CEDocumento1 paginaNotification No.251 1985 CEpatelpratik1972Nessuna valutazione finora

- NEFTE Compass November 25, 2009 IssueDocumento12 pagineNEFTE Compass November 25, 2009 IssueCommittee for Russian Economic FreedomNessuna valutazione finora

- Albuquerque Journal Homestyle 01/06/2017Documento15 pagineAlbuquerque Journal Homestyle 01/06/2017Albuquerque JournalNessuna valutazione finora

- Research About The Effects of Graft and Corruption in The Philippines (AngeDocumento28 pagineResearch About The Effects of Graft and Corruption in The Philippines (AngeNicole Basinio100% (1)

- Michael Guichon Sohn Conference PresentationDocumento49 pagineMichael Guichon Sohn Conference PresentationValueWalkNessuna valutazione finora

- Pip CalculatorDocumento5 paginePip CalculatorcalvinlcqNessuna valutazione finora

- Diaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)Documento3 pagineDiaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)EvangerylNessuna valutazione finora

- BCG, IE & Grand MatrxDocumento2 pagineBCG, IE & Grand MatrxlionalleeNessuna valutazione finora

- Chartbook For Level 3.13170409Documento65 pagineChartbook For Level 3.13170409calibertraderNessuna valutazione finora

- ENPSForm Amandeep KaurDocumento5 pagineENPSForm Amandeep KaurManmohan SinghNessuna valutazione finora

- Wicktator Trade MaterialDocumento11 pagineWicktator Trade MaterialrontechtipsNessuna valutazione finora

- Reporte Dibella Group Alineada A #Iso26000Documento32 pagineReporte Dibella Group Alineada A #Iso26000ALBERTO GUAJARDO MENESESNessuna valutazione finora

- 09dinvestmentinequitysecuritiescostequitymethodpdfpdf PDF FreeDocumento14 pagine09dinvestmentinequitysecuritiescostequitymethodpdfpdf PDF FreeLouierose Joy CopreNessuna valutazione finora

- Financial Management Lec-2Documento21 pagineFinancial Management Lec-2Gojart KamberiNessuna valutazione finora

- Narasimham Committee: By: Pranav Dagar 2019PBA9202 MBAC401Documento12 pagineNarasimham Committee: By: Pranav Dagar 2019PBA9202 MBAC401Diksha VashishthNessuna valutazione finora

- Himalayan Bank LTD Nepal Introduction (Essay)Documento2 pagineHimalayan Bank LTD Nepal Introduction (Essay)Chiran KandelNessuna valutazione finora

- Latihan Soal - 231121-CBTDocumento6 pagineLatihan Soal - 231121-CBTsitepu1223Nessuna valutazione finora

- Nepal Chartered Accountants Act, 1997 and Regulation, 2061, NepaliDocumento164 pagineNepal Chartered Accountants Act, 1997 and Regulation, 2061, NepaliSujan PahariNessuna valutazione finora

- PWC: A Calculated Breach of TrustDocumento33 paginePWC: A Calculated Breach of TrustAFRNessuna valutazione finora

- Unit - 4.4 Hawtrey's Theory.Documento3 pagineUnit - 4.4 Hawtrey's Theory.Mahima guptaNessuna valutazione finora

- Rural Entrepreneurship: Scope & ChallengesDocumento26 pagineRural Entrepreneurship: Scope & ChallengesSandeep KumarNessuna valutazione finora

- CFAB - Accounting - QB - Chapter 9Documento13 pagineCFAB - Accounting - QB - Chapter 9Nga Đào Thị Hằng100% (1)

- Trust CFDocumento1 paginaTrust CFShaira May Dela CruzNessuna valutazione finora

- 14 PDFDocumento6 pagine14 PDFsrinu02062Nessuna valutazione finora

- Ratan Tata-Term PaperDocumento29 pagineRatan Tata-Term PaperFahim Shahriar SwapnilNessuna valutazione finora

- 14 Cession or AssignmentDocumento8 pagine14 Cession or AssignmentJong PerrarenNessuna valutazione finora

- Cumulative FD - Non-Cumulative Fixed DepositDocumento10 pagineCumulative FD - Non-Cumulative Fixed Depositconfirm@Nessuna valutazione finora

- Real Estate Markets: UBS Alpine Property Focus 2019Documento13 pagineReal Estate Markets: UBS Alpine Property Focus 2019Manonsih VictoryaNessuna valutazione finora

- Contract DocumentDocumento44 pagineContract DocumentEngineeri TadiyosNessuna valutazione finora

- Q. On Cost SheetDocumento5 pagineQ. On Cost SheetPradeepKumarNessuna valutazione finora

- Acca Fa Test 1 - CHP 1,3,4,5 SolnDocumento11 pagineAcca Fa Test 1 - CHP 1,3,4,5 SolnAkash RadhakrishnanNessuna valutazione finora

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyDa EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyValutazione: 5 su 5 stelle5/5 (2)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersDa EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersValutazione: 5 su 5 stelle5/5 (4)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersDa EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersValutazione: 5 su 5 stelle5/5 (2)

- The Absolute Beginner's Guide to Cross-ExaminationDa EverandThe Absolute Beginner's Guide to Cross-ExaminationNessuna valutazione finora

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsDa EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsValutazione: 3 su 5 stelle3/5 (2)

- Legal Writing in Plain English: A Text with ExercisesDa EverandLegal Writing in Plain English: A Text with ExercisesValutazione: 3 su 5 stelle3/5 (2)

- Federal Income Tax: a QuickStudy Digital Law ReferenceDa EverandFederal Income Tax: a QuickStudy Digital Law ReferenceNessuna valutazione finora

- Admissibility of Expert Witness TestimonyDa EverandAdmissibility of Expert Witness TestimonyValutazione: 5 su 5 stelle5/5 (1)

- Torts: QuickStudy Laminated Reference GuideDa EverandTorts: QuickStudy Laminated Reference GuideValutazione: 5 su 5 stelle5/5 (1)

- Legal Writing: QuickStudy Laminated Reference GuideDa EverandLegal Writing: QuickStudy Laminated Reference GuideNessuna valutazione finora

- Commentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769Da EverandCommentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769Valutazione: 4 su 5 stelle4/5 (6)

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersDa EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersNessuna valutazione finora

- Employment Law: a Quickstudy Digital Law ReferenceDa EverandEmployment Law: a Quickstudy Digital Law ReferenceValutazione: 1 su 5 stelle1/5 (1)

- How to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!Da EverandHow to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!Valutazione: 5 su 5 stelle5/5 (1)

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionDa EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionValutazione: 5 su 5 stelle5/5 (1)

- Legal Research: a QuickStudy Laminated Law ReferenceDa EverandLegal Research: a QuickStudy Laminated Law ReferenceNessuna valutazione finora

- Legal Guide for Starting & Running a Small BusinessDa EverandLegal Guide for Starting & Running a Small BusinessValutazione: 4.5 su 5 stelle4.5/5 (9)

- Flora and Vegetation of Bali Indonesia: An Illustrated Field GuideDa EverandFlora and Vegetation of Bali Indonesia: An Illustrated Field GuideValutazione: 5 su 5 stelle5/5 (2)

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolDa EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolNessuna valutazione finora

- Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayDa EverandSolve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayValutazione: 4 su 5 stelle4/5 (8)

- Legal Writing in Plain English, Third Edition: A Text with ExercisesDa EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesNessuna valutazione finora