Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Case 4, BF - Goodrich Worksheet

Caricato da

isgigles157Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Case 4, BF - Goodrich Worksheet

Caricato da

isgigles157Copyright:

Formati disponibili

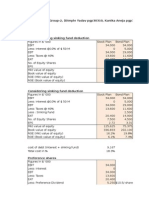

Exhibit I: B.F.

Goodrich-Rabobank Interest Rate Swap

($ in Millions)

Step 1: Determine Comparative Advantage:

Option A: BF Goodrich Fixed and Rabobank Floating

Option B: BF Goodrich Floating and Rabobank Fixed

BF Goodrich Fixed

12.50%

Rabobank Floating

L + 0.25%

Total Cost

L + 12.75%

*BF Goodrich should borrow floating and Rabobank should borrow fixed

BF Goodrich Floating

Rabobank Fixed (Semi-Annual)

Total Cost

L + 0.5%

10.7%

L + 11.2%

Total Savings to be Shared = L + 12.75% - L - 11.2%

Total Savings to be Shared =

1.55%

Step 2: Determine Annual Cost of $125K Fee (on Semi-Annual Yield Basis)

Fee Calculation:

Time 0

49.875

1

-5.500

2

-5.500

3

-5.500

4

-5.500

5

-5.500

6

-5.500

7

-5.500

8

-55.500

Cost (Annual Yield)

11.049%

Cost (Semi-Annual Yield)

10.759%

Less 10.7% Quoted Cost

-10.700%

Cost of Fee

0.059%

Step 3: Determine Benefit of Swap to Each Party

New Debt Issued:

Terms: BF Goodrich

Credit Rating:

BBB

Amount

$50

Maturity:

8 Yrs

Coupons:

Semi-annual

Coupon Rate:

Annual rate = 3 mo. Eurodollar LIBOR + 0.5%

Alt Cost of 8 Yr Fixed Rate Debt: 12-12.5%

L-x

<<< <<

Goodrich

(1+r/2)^2 = (1+x)

solve for r

Terms: Rabobank

Credit Rating:

AAA

Amount

$50

Maturity:

8 Yrs

Coupons:

Annual

Coupon Rate:

Fixed at 11%, semiannual equivalent YTM = 10.7%

Alt Cost of 8 Yr Float Rate Debt: L + 0.25% - L + 0.375%

<

L-x

<

<

Morgan

>>>>>>>>>>>

10.7+f+0.06

|

|

| L+0.5 to Bondholders

Rabobank

>>>>>>>>>>>>>>

10.70%

Outside Fixed Cost: 12.5%

|

|

| 10.7% Fixed to Bondholders

Outside Floating Cost: L +0.25%

Interest Rate Swap:

BF Goodrich:

Pay L+0.5% coupon payments semiannually on domestic debt

Pay Morgan $5.5M annually, $125K initial fee and an annual fee of "f"

Receive semiannual payments of L-x to cover its coupon payment obligations

Rabobank:

Pay 11% coupon payments annually on Eurobond debt (10.7% semiannual equivalent YTM)

Pay Morgan semiannual payments of L - x

Receive $5.5M annually to cover its coupon payment obligations

Cost to BF Goodrich:

CF to Bondholders:

CF to Morgan:

CF from Morgan:

Cost to Rabobank:

CF to Bondholders:

CF to Morgan:

CF from Morgan:

-(L + 0.5%)

-10.7% - f - 0.06%

+(L-x)

-10.7%

-(L-x)

+10.7%

CF to Morgan:

CF from BF:

CF from Rabo:

10.7% + f + 0.06% - (L-x)

(L-x) - 10.7%

Total Cost = -(L+0.5%) - 10.7% - f - 0.06% + (L-x)

Total Cost = -10.7% - (L - x) + 10.7%

Total to Morgan = 0.06% + f

If Fixed Cost = 12.5%:

Then: -(L+0.5%) - 10.7% - f - 0.06% + (L-x) < -12.5%

-L - 0.5% - 10.7% - f - 0.06% + L - x < -12.5%

-0.5% - 10.7% - f - 0.06% - x < -12.5%

-11.26% - f - x <-12.5%

11.26% + f + x < 12.5%

If Floating Rate = L + 0.25%:

Then: -10.7% - (L-x) + 10.7% < -(L + 0.25%)

-(L-x) < -(L+0.25%)

x > -0.25%

Annual fee for similar swaps = 8 - 37.5 bp

or 0.08-.375%.

If f = .375%

then, total fees to Morgan = .375% + 0.06% = 0.435%

If Fixed Cost = 12.5%

Then: f+x < 1.24%

If Float Cost = L + 0.25%

Then: x > -0.25%

If Float Cost = L + 0.375%

Then: x > -0.375%

If Fixed Cost = 12%

Then: f+x < 0.74%

Suppose:

f=

x=

0.38%

0.25%

Savings to BF Goodrich:

Savings to Rabobank:

Profit to Morgan:

Total Savings

0.61%

0.50%

0.43%

1.55%

Potrebbero piacerti anche

- Contracts Essay OutlineDocumento11 pagineContracts Essay Outlineisgigles157100% (14)

- Paginas Amarelas Case Week 8 ID 23025255Documento4 paginePaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- AltaRock MidYear Letter 2010Documento9 pagineAltaRock MidYear Letter 2010adib_motiwala100% (1)

- Business Law Cheat SheetDocumento9 pagineBusiness Law Cheat Sheetisgigles157100% (1)

- Pioneer PetroleumDocumento6 paginePioneer PetroleumKristine IbascoNessuna valutazione finora

- M&A Valuation Expanded BV SSDocumento4 pagineM&A Valuation Expanded BV SSvardhan73% (11)

- Calpine Corp. The Evolution From Project To Corporate FinanceDocumento4 pagineCalpine Corp. The Evolution From Project To Corporate FinanceDarshan Gosalia100% (1)

- Winfield Refuse ManagementDocumento13 pagineWinfield Refuse ManagementAnshul Sehgal100% (3)

- General Motors Transactional Translational ExposuresDocumento5 pagineGeneral Motors Transactional Translational ExposuresRaghavendra Somasundaram100% (3)

- Winfield ManagementDocumento5 pagineWinfield Managementmadhav1111Nessuna valutazione finora

- Loewen Group CaseDocumento2 pagineLoewen Group CaseSu_NeilNessuna valutazione finora

- Winfield CaseDocumento8 pagineWinfield CaseAbhinandan Singh67% (3)

- Petrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Documento1 paginaPetrolera Zuata, Petrozuata C.A. (HBS 9-299-012)Shrikant KrNessuna valutazione finora

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Documento3 pagineSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNessuna valutazione finora

- TCHE 303 - Tutorial 2Documento5 pagineTCHE 303 - Tutorial 2Phương Anh Trần100% (1)

- Rabocase 105019Documento6 pagineRabocase 105019CfhunSaatNessuna valutazione finora

- Buffet Bid For Media GeneralDocumento21 pagineBuffet Bid For Media Generalshivam chughNessuna valutazione finora

- Finance Simulation: M&A in Wine Country Valuation ExerciseDocumento7 pagineFinance Simulation: M&A in Wine Country Valuation ExerciseAdemola Adeola0% (2)

- Petrozuata Financial ModelDocumento3 paginePetrozuata Financial Modelsamdhathri33% (3)

- First American Bank - Case ReportDocumento2 pagineFirst American Bank - Case ReportFan Feng50% (2)

- Goodrich Rabobank 01Documento25 pagineGoodrich Rabobank 01asdadsNessuna valutazione finora

- Case StudyDocumento4 pagineCase StudylifeisyoungNessuna valutazione finora

- Jones Electrical DistributionDocumento5 pagineJones Electrical DistributionAsif AliNessuna valutazione finora

- Petrolera Zuata, Petrozuata CaseDocumento8 paginePetrolera Zuata, Petrozuata CaseAndy Vibgyor50% (2)

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocumento5 pagineCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNessuna valutazione finora

- CBRM Calpine Case - Group 4 SubmissionDocumento4 pagineCBRM Calpine Case - Group 4 SubmissionPranavNessuna valutazione finora

- AF 325 Pioneer PetroleumDocumento6 pagineAF 325 Pioneer PetroleumHiepXickNessuna valutazione finora

- Buffets Bid For Media GeneralDocumento23 pagineBuffets Bid For Media GeneralTerence TayNessuna valutazione finora

- Continental Carriers IncDocumento3 pagineContinental Carriers IncEnrique Garcia25% (4)

- Mehak Bluntly MediaDocumento18 pagineMehak Bluntly Mediahimanshu sagarNessuna valutazione finora

- Petrozuata CaseDocumento10 paginePetrozuata CaseBiranchi Prasad SahooNessuna valutazione finora

- Wildcat Capital InvestorsDocumento18 pagineWildcat Capital Investorsokta hutahaeanNessuna valutazione finora

- Winfield Refuse ManagementDocumento13 pagineWinfield Refuse Managementnishant JaiswalNessuna valutazione finora

- FPL Dividend Policy-1Documento6 pagineFPL Dividend Policy-1DavidOuahba100% (1)

- Foreign Exchange Hedging Strategies at General Motors: Case Study SolutionDocumento27 pagineForeign Exchange Hedging Strategies at General Motors: Case Study SolutionKrishna Kumar67% (3)

- Long QuestionsDocumento18 pagineLong Questionssaqlainra50% (2)

- LBS Tutorial 7 FinanceDocumento3 pagineLBS Tutorial 7 FinancegiovanniNessuna valutazione finora

- BUSI764 Cheat SheetDocumento6 pagineBUSI764 Cheat Sheetisgigles157Nessuna valutazione finora

- MLC Se01Documento29 pagineMLC Se01rjhav1025Nessuna valutazione finora

- Atlas Investment ManagementDocumento8 pagineAtlas Investment Managementanon_911384976100% (1)

- FRM CaseDocumento14 pagineFRM CaseKevval BorichaNessuna valutazione finora

- Continental CarriersDocumento10 pagineContinental Carriersnipun9143Nessuna valutazione finora

- Continental CarriersDocumento6 pagineContinental CarriersVishwas Nandan100% (1)

- Solution Interest Rate FuturesDocumento3 pagineSolution Interest Rate FuturesShankeyNessuna valutazione finora

- Continental CarriersDocumento4 pagineContinental CarriersNIkhil100% (2)

- Winfield PPT 27 FEB 13Documento13 pagineWinfield PPT 27 FEB 13prem_kumar83g100% (4)

- BF RaboBankDocumento8 pagineBF RaboBanknjwill100% (1)

- Winfieldpresentationfinal 130212133845 Phpapp02Documento26 pagineWinfieldpresentationfinal 130212133845 Phpapp02Sukanta JanaNessuna valutazione finora

- Chasecase PaperDocumento10 pagineChasecase PaperadtyshkhrNessuna valutazione finora

- LinearDocumento6 pagineLinearjackedup211Nessuna valutazione finora

- Monmouth CaseDocumento6 pagineMonmouth CaseMohammed Akhtab Ul HudaNessuna valutazione finora

- Massey Ferguson CaseDocumento6 pagineMassey Ferguson CaseMeraSultan100% (1)

- Industrial Grinders N VDocumento9 pagineIndustrial Grinders N Vapi-250891173100% (3)

- Petrozuata Case StudyDocumento20 paginePetrozuata Case StudyBasit Ali Chaudhry100% (1)

- Case Study - Linear Tech - Christopher Taylor - SampleDocumento9 pagineCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193Nessuna valutazione finora

- Continental CarrierDocumento10 pagineContinental CarrierYetunde James100% (1)

- Petroleraa ZuataDocumento9 paginePetroleraa ZuataArka MitraNessuna valutazione finora

- Worksheet in GM HedgingDocumento3 pagineWorksheet in GM HedgingPaola ValleNessuna valutazione finora

- Marriott Solutions WACC LodgingDocumento3 pagineMarriott Solutions WACC LodgingPabloCaicedoArellanoNessuna valutazione finora

- The Loewen Group IncDocumento7 pagineThe Loewen Group IncKamal NagvaniNessuna valutazione finora

- Continental CarriersDocumento2 pagineContinental Carrierschch917100% (1)

- Cost of Capital LectureDocumento36 pagineCost of Capital LectureMartn Carldazo Drogba100% (1)

- Cheniere Energy Valuation ModelDocumento11 pagineCheniere Energy Valuation Modelngarritson1520100% (1)

- Risk Free: Special Dividend Effect On Beta: Chrysler, The Automotive Manufacturer, Had ADocumento18 pagineRisk Free: Special Dividend Effect On Beta: Chrysler, The Automotive Manufacturer, Had AAshutosh TulsyanNessuna valutazione finora

- Cost of CapitalDocumento31 pagineCost of CapitalMariam JahanzebNessuna valutazione finora

- Chapter 3 Lecture Hand-Outs - Problem SolvingDocumento5 pagineChapter 3 Lecture Hand-Outs - Problem SolvingLuzz LandichoNessuna valutazione finora

- The Cost of Capital: Taufikur@ugm - Ac.idDocumento31 pagineThe Cost of Capital: Taufikur@ugm - Ac.idNeneng WulandariNessuna valutazione finora

- The Rockville 2014 CAFR PaperDocumento9 pagineThe Rockville 2014 CAFR Paperisgigles157Nessuna valutazione finora

- CFR Sample QuestionsDocumento10 pagineCFR Sample Questionsisgigles157Nessuna valutazione finora

- Assignment #1 Bank ManagementDocumento3 pagineAssignment #1 Bank Managementisgigles157Nessuna valutazione finora

- Ch16 Marketing Strategies For Growth MarketsDocumento10 pagineCh16 Marketing Strategies For Growth Marketsisgigles157Nessuna valutazione finora

- Consideration - Business LawDocumento2 pagineConsideration - Business Lawisgigles157Nessuna valutazione finora

- Isabel V CapitalismDocumento1 paginaIsabel V Capitalismisgigles157Nessuna valutazione finora

- Take g-10m/s - 2 Give Answers To 2 Significant Figures. Formulas and Calculations Required For All AnswersDocumento10 pagineTake g-10m/s - 2 Give Answers To 2 Significant Figures. Formulas and Calculations Required For All Answersisgigles157Nessuna valutazione finora

- Business Law PowerpointsDocumento123 pagineBusiness Law Powerpointsisgigles157Nessuna valutazione finora

- Useful Links For InformationDocumento1 paginaUseful Links For Informationisgigles157Nessuna valutazione finora

- Problem 1 - Operations ManagementDocumento1 paginaProblem 1 - Operations Managementisgigles157Nessuna valutazione finora

- Lecture 6, Unwinding SwapsDocumento4 pagineLecture 6, Unwinding Swapsisgigles157Nessuna valutazione finora

- Finance Problem SetDocumento9 pagineFinance Problem Setisgigles157Nessuna valutazione finora

- Strategic and Transformational IT Emerging Tech PaperDocumento12 pagineStrategic and Transformational IT Emerging Tech Paperisgigles157Nessuna valutazione finora

- The Scientific Method: Observation, Theory, and More ObservationDocumento5 pagineThe Scientific Method: Observation, Theory, and More Observationisgigles157Nessuna valutazione finora

- MircoeconomicsDocumento2 pagineMircoeconomicsisgigles157Nessuna valutazione finora

- Seven: Interest Rates and Bond ValuationDocumento42 pagineSeven: Interest Rates and Bond ValuationPrasanna IyerNessuna valutazione finora

- General Mathematics Reviewer s1 q2Documento5 pagineGeneral Mathematics Reviewer s1 q2lancono86Nessuna valutazione finora

- Finance Decisions: Unit IvDocumento70 pagineFinance Decisions: Unit IvFara HameedNessuna valutazione finora

- Machine Learning in Fixed Income Markets, Forecasting and Portfolio ManagementDocumento204 pagineMachine Learning in Fixed Income Markets, Forecasting and Portfolio Managementvothikimanh1007Nessuna valutazione finora

- Thinkdesktop User ManualDocumento54 pagineThinkdesktop User ManualLloyd Buffett BlankfeinNessuna valutazione finora

- Chapter 16: Fixed Income Portfolio ManagementDocumento20 pagineChapter 16: Fixed Income Portfolio ManagementSilviu TrebuianNessuna valutazione finora

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocumento17 pagineBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing Riskomar hashmiNessuna valutazione finora

- Chapter 2 Bond ManagementDocumento6 pagineChapter 2 Bond ManagementPanashe MachekepfuNessuna valutazione finora

- TBchap 010Documento90 pagineTBchap 010DemianNessuna valutazione finora

- NISM V-A QuestionnaireDocumento245 pagineNISM V-A QuestionnaireAMOGH SHERLA100% (3)

- P4AFM SQB As - d09 PDFDocumento108 pagineP4AFM SQB As - d09 PDFTaariq Abdul-MajeedNessuna valutazione finora

- Financial Management (Fin 501) Homework Ii Name: ID#Documento8 pagineFinancial Management (Fin 501) Homework Ii Name: ID#baroun2019Nessuna valutazione finora

- S P Capital IQ Excel Plug-In Template GuideDocumento35 pagineS P Capital IQ Excel Plug-In Template Guiderudy gullitNessuna valutazione finora

- Good Datastream CodesDocumento79 pagineGood Datastream CodesDimitris AnastasiouNessuna valutazione finora

- Reuters ProVestor Plus Company ReportDocumento20 pagineReuters ProVestor Plus Company ReportDunes BasherNessuna valutazione finora

- Flinder Valves and Controls Inc. - WorksheetsDocumento22 pagineFlinder Valves and Controls Inc. - WorksheetsBach Cao50% (4)

- Mid Test SolutionDocumento5 pagineMid Test SolutionHương Phạm MaiNessuna valutazione finora

- Chapter 10 - Risk and Term Structure of Interest RatesDocumento28 pagineChapter 10 - Risk and Term Structure of Interest RatesSilva, Phoebe Chates Bridget B.Nessuna valutazione finora

- F528 First Group Assignment 2020 NewDocumento7 pagineF528 First Group Assignment 2020 NewJulio Andre Pizarro GiraoNessuna valutazione finora

- Cash Management ReportDocumento118 pagineCash Management Reportkamdica85% (20)

- Chapter 5: Introduction To Risk, Return and The Historical RecordDocumento5 pagineChapter 5: Introduction To Risk, Return and The Historical RecordJohn FrandoligNessuna valutazione finora

- 1 1 Investment Management Interview QuestionsDocumento3 pagine1 1 Investment Management Interview Questionsdeepu9989Nessuna valutazione finora

- FINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Documento20 pagineFINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Nicole BabatundeNessuna valutazione finora

- Problem Set 3Documento2 pagineProblem Set 3david AbotsitseNessuna valutazione finora

- Full Download Book Fundamentals of Corporate Finance 5Th Global Edition PDFDocumento41 pagineFull Download Book Fundamentals of Corporate Finance 5Th Global Edition PDFshirley.sur179100% (23)

- Valuasi Saham MppaDocumento29 pagineValuasi Saham MppaGaos FakhryNessuna valutazione finora