Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Article 4

Caricato da

anmolsaini01Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Article 4

Caricato da

anmolsaini01Copyright:

Formati disponibili

2011

Omankhanlen Alex Ehimare

253

FOREIGN DIRECT INVESTMENT AND ITS EFFECT ON THE

NIGERIAN ECONOMY

Omankhanlen Alex Ehimare

Lecturer at the Department of Banking and Finance, Covenant University, Ota,

Ogun State, Nigeria.

Email: alexehimare@yahoo.com

Abstract

This research study deals with the effect of Foreign Direct Investment on the Nigerian economy over the period 1980-2009.It helped

examined empirically if the following growth determining variables in the economy-Balance on current account (Balance of payment),

Inflation and Exchange rate have any effect on Foreign Direct Investment. Also if Foreign Direct Investment have any effect on Gross

Domestic Product (GDP). Econometric models was developed to investigate the relationships between the aforementioned variables

and foreign direct investment. Based on the data analysis it was discovered that foreign direct investments have positive and significant

impact on current account balance in Balance of payment. While inflation was seen not to have significant impact on foreign direct

investment inflows. The exchange rate has positive effect on foreign direct investment. Therefore it is recommended that for Nigeria to

attract the desired level of FDI, it must introduce sound economic policies and make the country investor friendly. There must be political

stability, sound economic management and well developed infrastructure. Key words: Foreign direct investment, growth, human capital,

OLS, Nigeria, infrastructure, balance of payment, inflation, exchange rate.

Governments have been trying to lift the country out

of the economic doldrums without achieving success as

desired. Each of these governments has not focused much

attention on investment especially foreign direct investment

which will not only guarantee employment but will also

impact positively on economic growth and development.

FDI is needed to reduce the difference between the desired

gross domestic investment and domestic savings.

Jenkin and Thomas (2002) assert that FDI is expected

to contribute to economic growth not only by providing

foreign capital but also by crowding in additional

domestic investment. By promoting both forward and

backward linkages with the domestic economy, additional

employment is indirectly created and further economic

activity stimulated.

According to Adegbite and Ayadi (2010) FDI helps fill the

domestic revenue-generation gap in a developing economy,

given that most developing countries governments do

not seem to be able to generate sufficient revenue to meet

their expenditure needs. Other benefits are in the form

of externalities and the adoption of foreign technology.

Externalities here can be in the form of licencing, imitation,

employee training and the introduction of new processes

by the foreign firms (Alfaro,Chanda,Kalemli- Ozean and

Sayek 2006).

Foreign direct investment consists of external resources

including technology, managerial and marketing expertise

and capital. All these generate a considerable impact

on host nations productive capabilities. The success of

government policies of stimulating the productive base

of the economy depend largely on her ability to control

adequate amount of FDI comprising of managerial,

capital and technological resources to boast the existing

production capacity. Although the Nigerian government

has being trying to provide conducive investment climate

for foreign investment, the inflow of foreign investments

into the country have not been encouraging.

Given the Nigerian economy resource base, the countrys

foreign investment policy should move towards attracting

and encouraging more inflow of foreign capital. The need

for foreign direct investment (FDI) is born out of the under

developed nature of the countrys economy that essentially

hindered the pace of her economic development. Generally,

policy strategies of the Nigerian government towards

foreign investments are shaped by two principal objectives

of the desire for economic independence and the demand

for economic development.

An analysis of foreign flow into the country so far have

revealed that only a limited number of multinationals or

their subsidiaries have made Foreign Direct Investment

Ehimare O. A. - Foreign Direct Investment and its Effect on the Nigerian Economy

254

Business Intelligence Journal

in the country. Added to this problem of insufficient

inflow of FDI is the inability to retain the Foreign Direct

Investment which has already come into the country. Also

what effect have foreign direct investment have on such

variables as- Gross Domestic Product (GDP) and Balance

of Payment(BOP).Moreover, what effect does inflation and

exchange rate have on Foreign Direct Investment? Carkovic

and Levine (2002) in their study concluded that exogenous

component of FDI does not exert a robust positive influence

on economic growth.

According to Ayanwale (2007). The relationship

between FDI and economic growth in Nigeria is yet unclear,

and that recent evidence shows that the relationship may be

country and period specific. Therefore there is the need to

carry out more study on their relationship.

Developing countries economic difficulties do not

originate in their isolation from advance countries. The

most powerful obstacle to their development comes from

the way they are joined to the international system. Added

to this problem is the poor external image Nigeria have

and the concept of European Economic Community that

include Eastern Europe.

This translates to the fact that investment flows that

would normally come from western countries now go to

poor European Economic Communities which include

Eastern Europe.

Foreign direct investment (FDI) is a major component

of capital flow for developing countries, its contribution

towards economic growth is widely argued, but most

researchers concur that the benefits outweigh its cost on the

economy. (Musila and Sigue, 2006).

Mc Aleese (2004) states that FDI embodies a package

of potential growth enhancing attributes such as technology

and access to international market but the host country

must satisfy certain preconditions in order to absorb and

retain these benefits and not all emerging markets possess

such qualities. (Boransztain De Gregorio and Lee 1998, and

Collier and Dollar, 2001). This paper is divided into five

parts. Part one above is the introduction. Part two reviews

the relevant literature, part three discusses the methodology

employed in this study, and part four is data presentation

and analysis while part five discusses the findings and

recommendation.

This study will evaluate the flow of FDI in Nigeria and

its Effect on the Nigerian Economy. The period 1980-2009

will be investigated in the study. Only FDI, Government

Expenditure and Gross Capital formation will be used

as the explanatory variables. While GDP and balance on

July

current account of Balance of payment will be used as the

dependent variables.

Literature Review

The Changing international economic and political

environment has led to a renewed interest in the benefits

foreign direct investment (FDI) can offer to developing

countries in achieving economic growth. The growing

interest in foreign direct investment (FDI), stand from

the perceived opportunities derivable from utilizing this

form of foreign capital injection into the economy, to

augment domestic savings and further promote economic

development in most developing economies (Aremu 2005).

FDI is believed to be stable and easier to service than

bank credit. FDI are usually on long term economic

activities in which repatriation of profit only occur when

the project earn profit. As stated by Dunning and Rugman

(1985) Foreign Direct Investment (FDI) contributes to

the host countrys gross capital formation, higher growth,

industrial productivity and competitiveness and other spinoff benefits such as transfer of technology, managerial

expertise, improvement in the quality of human resources

and increased investment.

According to Riedel (1987) as cited by Tsai (1994) while

the potential importance of FDI in less developed countries

(LDCs) development process is getting appreciated, two

fundamental issues concerning FDI remains unresolved. In

the first place what are the determinants of FDI? Specifically

from LDCs point of view are there factors in the control of

the host country that can be manipulated to attract FDI?

Or as some researchers claim that by and large LDCs

play a relatively passive role in determining the direction

and volume of FDI. This is the question about the demand

side determinants (or host country factors) of FDI which

are widely discussed in the literature.

There are also the supply side determinants or firm

specific factors of FDI (Ragazzi 1973). The supply

side factors are beyond the control of LDCs. A body of

theoretical and empirical literature has investigated the

importance of FDI on economic growth and development

in less developed countries. For example see (Dauda 2007)

(Akinlo 2004) (Deepak, Mody and Murshid 2001) (Aremu

2005) e.t.c.

Modern growth theory rest on the view that economic

growth is the result of capital accumulation which leads to

investment. Given the overriding importance of an enabling

environment for investment to thrive, it is important to

Business Intelligence Journal - July, 2011 Vol.4 No.2

2011

Omankhanlen Alex Ehimare

examine necessary conditions that facilitate FDI inflow.

These are classified into economic, political, social and

legal factors. The economic factors include infrastructural

facilities, favourable fiscal, monetary, trade and exchange

rate policies. The degree of openness of the domestic

economy, tariff policy, credit provision by a countrys

banking system, indigenization policy, the economys

growth potentials, market size and macroeconomic stability.

Other factors like higher profit from investment, low

labour and production cost, political stability, enduring

investment climate, functional infrastructure facilities and

favourable regulatory environment also help to attract and

retain FDI in the host country. (Ekpo 1997).

According to the International Monetary Fund (1985)

foreign Direct Investment is an investment made to acquire

a lasting interest in a foreign enterprise with the purpose

of having effective voice in management. While Dunning

(1993) describe it as an investment made by an investor

based in a country to acquire assets in another country

with the intention to manage the assets. Mwillima (2003)

describe foreign direct investment as investment made so

as to acquire a lasting management interest (for instance

10% of voting stocks) and at least 10% of equity shares in

an enterprise operating in another country other than that of

the investors country.

Foreign Direct investment can also be describe as an

investment made by an investor or enterprises in another

enterprises or equivalent in voting power or other means

of control in another country with the aim to manage the

investment and maximize profit. This investment involves

not only the transfer of fund but also the transfer of physical

capital, technique of production, managerial and marketing

expertise, product advertising and business practice with

the aim to make profit.

In recent years due to the rapid growth and changes in

global investment patterns, the definition of Foreign Direct

investment have been broadened to include the acquisition

of a lasting management interest in a company or enterprise

outside the investors home country.

Generally, the theory that explains the nexus between

FDI and growth in terms of output and productivity is

significantly positive. However, empirical literature

yields varying results. Some research studies find positive

outcome from outward FDI for the investing country (Van,

Poffelsberghe, De La Potterie & Lichtenberg, 2001), but

suggest a potential negative impact from inward FDI on

the host country. This results from a possible decrease in

indigenous innovative capacity or crowding out of domestic

firms. Other studies report more findings that are positive.

255

For example, Nadiri (1993) finds positive and significant

effects from US sourced FDI on productivity growth of

manufacturing industries in France, Germany, Japan and

United Kingdom. Borensztein, Gregorio and Lee (1998)

also find a positive influence of FDI flows from industrial

countries on developing countries growth. However, they

also report a minimum threshold level of human capital for

the productivity enhancing impact of FDI, emphasizing the

role of absorptive capacity.

In the neo-classical production function approach, output

is generated by using capital and labour in the production

process. With this framework in mind, FDI can exert an

influence on each argument on the production function.

FDI increases capital, and may qualitatively improve the

factor labour and by transferring new technologies, it also

has the potential to raise total factor productivity. Therefore,

in addition to the direct, capital augmenting effect, FDI

also have additional indirect and thus permanent effects

on output growth rate. Further, by raising the number of

varieties for intermediate goods or capital equipments, FDI

can also increase productivity (Borensztein, Gregorio &

Lee, 1998).

Therefore, though FDI could produce a significant effect

on output growth through speeding up capital formation

process, the effect tends to diminish in the long run because

of the principle of diminishing return.

As opposed to the limited contribution that the neoclassical theory accredits to FDI, the endogenous growth

literature points out that FDI can not only contribute to

economic growth through capital formation and technology

transfers (Blomstrom, Lipsey & Zejan, 1996) but also do

so through the augmentation of the level of knowledge via

labour training and skill acquisition (De Mello, 1997).

Research Methodology Model

Specification

This study is based on the assumption that the inflow

of FDI affects economic growth in Nigeria (GDP) and

Nigerias Balance of Payment (BOP). And again, that

inflation and exchange rate in turn affect the inflow of

Foreign Direct Investment (FDI). In other-words, GDP and

BOP are dependent on FDI, hence the model:

GDP = f (FDI)

Ehimare O. A. - Foreign Direct Investment and its Effect on the Nigerian Economy

(1)

256

Business Intelligence Journal

(2)

BCA = f (FDI)

(3)

FDI = f (INFL., EXR.)

Where:

GDP = Gross Domestic Product

BCA = Current Account Balance

FDI = inflow of Foreign Direct Investment

INFL. = Inflation rate

EXR. = Exchange rate

Considering the fact that the GDP and BOP of an

economy are not determined by FDI alone, the inclusion

of two more growth determining variables is made so as to

get a more realistic model: Hence, equation (1) is extended

thus:

(4)

GDP = f (FDI, GOV, GCF)

(5)

BCA = f (FDI, GOV, GCF)

(6)

FDI = f (INFL, EXR.)

Where:

0 =

0 =

I =

2 =

3 =

I =

2 =

e =

the intercept for equations (1) and (2)

the intercept for equation (3)

the parameter estimate of FDI.

the parameter estimate of GOV.

the parameter estimate of GCF.

the parameter estimate of INFL.

the parameter estimate of EXR.

the random variable or error term.

Annual time-series data on the variables under study

covering thirty year period 1980-2009 are used in this study

for estimation of functions. Foreign Direct Investment

inflow (FDI), Government Expenditure (GE) and Gross

fixed Capital Formation (GCF) are the relevant explanatory

variables. Equally, the Gross Domestic Product and Balance

on Current Account are the dependent variables. The Gross

Domestic Product is the quantitative variable that measures

economic performance of a country and the Balance on

Current Account measures BOP.

Presentation of Results

The regression analysis and tests of hypotheses are

conducted at 5% significance level. After running the

relevant regressions, the following results were obtained

and are presented below:

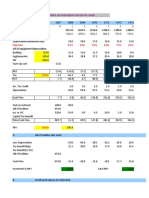

Estimated Results

Where:

Model 1

GOV = Government expenditure

GCF = Gross fixed capital formation

Equations (4) and (5) show that GDP and BCA are

dependent on FDI, GOV and GCF.

The statistical forms of the models are thus:

GDP = o + I FDI + 2 GOV + 3 GCF + e

(7)

GDP = o + I FDI + 2 GOV + 3 GCF + e

GDP= 1.6709 + 4.0912FDI + 6.2835GOV. + 1.5457GFC

S.E.= (1.9847) (2.6086)

t

BCA = o + I FDI - 2 GOV + 3 GCF + e

0.842

1.568

R2 = 0.989607

(0.61381)

10.237

(0.50454)

3.063

F-Statistic= 825.24

D.W.= 2.74

Model 2

(8)

BCA = o + I FDI - 2 GOV + 3 GCF + e

(9)

FDI = o - I INFL. - 2 EXR. + e

July

BCA= -1.3500 + 7.0662FDI + -0.49248GOV. + 0.42403GFC

S.E.= (1.1447) (21.5046) (0.35404) (0.29101)

t

-1.179

4.696

-1.391

R2 = 0.919443 F-Statistic

Business Intelligence Journal - July, 2011 Vol.4 No.2

1.457

= 98.917 D.W.= 1.72

Omankhanlen Alex Ehimare

2011

Model 3

FDI = o - I INFL. - 2 EXR. + e

FDI= -14108. + -310.46 INFL. + 3731.5 EXR.

S.E.= (58549)

t

-0.241

R2 = 0.666903

(1678.9)

-0.185

(538.18)

6.934

F-Statistic= 27.029

D.W.= 0.453

Model 1

257

Furthermore, the result obtained from the regression

shows that Gross Fixed Capital Formation has a positive

impact on GDP. This is indicated in its positive coefficient

of 1.5457. This coefficient is revealed to be statistically

significant by the standard error and t-values. Thus, from

this it implies that Gross fixed Capital Formation is elastic

to GDP. The coefficient of Gross fixed Capital Formation

being positive conforms to the economic a priori expectation

of a positive impact of GCF on the growth of the economy

vis--vis GDP.

Model 2

From the regressions result, the R-squared (R) value of

0.989607 shows that at 98.96% the explanatory variables

explain changes in the dependent variable. This means that

at 98.96% the independent variables explain changes on

the Gross Domestic Product (GDP). This simply means

that the explanatory variables explain the behaviour of the

dependent variable at 98.96%. The calculated F-statistics

of 825.24 which is greater than the value in the F-table

(2.9751) implies that all the variables coefficients in the

regression result are all statistically significant to GDP.

The Durbin-Watson (DW) as shown in the regression

analysis is 2.74 which shows that there is the presence of

autocorrelation.

The above model tested the effect of three different

variables namely Foreign Direct Investment (FDI),

Government Expenditure (GOV) and Gross fixed Capital

Formation (GCF) on Gross Domestic Product (GDP). In

order to obtain the regression result, the OLS technique

with the help of the PC Give software was used.

The result obtained from the regression shows that there

is positive impact of Foreign Direct Investment (FDI) on

Gross Domestic Product (GDP) with a coefficient of 4.0912.

However, this coefficient is not statistically significant as

revealed by its corresponding standard error and t-values.

Hence, FDI is inelastic to GDP. This positivity in the

coefficient of Foreign Direct Investment is in conformity

to the economic a priori expectation of a positive impact of

Foreign Direct Investment on the economic growth of the

economy (GDP).

Also, the regression result shows that the Government

Expenditure has a positive impact on GDP with a

coefficient of 6.2835. The standard error and t-values

showed that this parameter is statistically significant. Thus,

the Government Expenditure is elastic to Gross Domestic

product. This positivity of the coefficient of GOV conforms

to the economic a priori expectation of a positive impact of

Government Expenditure on GDP.

From the regressions result of model 2, the R-squared

(R) value of 0.919443 shows that at 91.94% the explanatory

variables explain changes in the dependent variable. This

means that at 91.94% the independent variables explain

changes on Current Account Balance (BCA). This simply

means that the explanatory variables explain the behaviour

of the dependent variable at 91.94%. The calculated

F-statistics of 98.917 which is greater than the value in the

F-table (2.9751) implies that all the variables coefficients

in the regression result are all statistically significant to

GDP.

The Durbin-Watson (DW) as shown in the regression

analysis is 1.72 which shows that there is the presence of

autocorrelation.

The above model tested the effect of three different

variables namely Foreign Direct Investment (FDI),

Government Expenditure (GOV) and Gross fixed Capital

Formation (GCF) on Current account Balance (BCA). In

order to obtain the regression result, the OLS technique

with the help of the PC Give software was used.

The result obtained from the regression shows that

there is positive and significant impact of Foreign Direct

Investment (FDI) on Current Account Balance (BCA)

with a coefficient of 7.0662. This coefficient is statistically

significant as revealed by its corresponding standard

error and t-values. Hence, FDI is elastic to BCA. This

positivity in the coefficient of Foreign Direct Investment

is in conformity to the economic a priori expectation of a

positive impact of Foreign Direct Investment on Current

Account Balance of the nation.

Also, the regression result shows that the Government

Expenditure has a negative impact on BCA with a

coefficient of -0.49248. The standard error and t-values

showed that this parameter is not statistically significant.

Thus, the Government Expenditure is inelastic to Current

Account Balance. This negativity of the coefficient of GOV

Ehimare O. A. - Foreign Direct Investment and its Effect on the Nigerian Economy

258

Business Intelligence Journal

conforms to the economic a priori expectation of a negative

impact of Government Expenditure on BCA.

Furthermore, the result obtained from the regression

shows that Gross Fixed Capital Formation has a positive

impact on BCA. This is indicated in its positive coefficient

of 0.42403. However, this coefficient is revealed not to be

statistically significant by the standard error and t-values.

Thus, from this it implies that Gross fixed Capital Formation

is inelastic to BCA. The coefficient of Gross fixed Capital

Formation being positive conforms to the economic a priori

expectation of a positive impact of GCF on Balance of

Payment vis--vis BCA.

Model 3

From the regressions result of model 3, the R-squared

(R) value of 0.666903 shows that at 66.69% the explanatory

variables explain changes in the dependent variable. This

means that at 66.69% the independent variables explain

changes on Foreign Direct Investment (FDI). This simply

means that the explanatory variables explain the behaviour

of the dependent variable at 66.69%. The calculated

F-statistics of 27.029 which is greater than the value in the

F-table (3.3541) implies that all the variables coefficients

in the regression result are all statistically significant to FDI.

The Durbin-Watson (DW) as shown in the regression

analysis is 0.453 which shows that there is the presence of

autocorrelation.

The above model tested the effect of two different

variables namely inflation rate (INFL.) and Foreign

Exchange Rate (EXR.) on Foreign Direct Investment (FDI).

In order to obtain the regression result, the OLS technique

with the help of the PC Give software was used.

The result obtained from the regression shows that there

is negative and non-significant impact of inflation on Foreign

Direct Investment (FDI) with a coefficient of -310.46.

Hence, inflation is inelastic to FDI. This negativity in the

coefficient of inflation is in conformity to the economic a

priori expectation of a negative impact of inflation on FDI.

Again, the regression result shows that foreign exchange

has a positive effect on FDI with a coefficient of 3731.5.

The standard error and t-values showed that this parameter

is statistically significant. Thus, the foreign exchange rate is

elastic to FDI. This negativity of the coefficient of foreign

exchange rate does not conform to the economic a priori

expectation of a negative impact of foreign exchange rate

on FDI.

July

Discussion of Findings

The OLS regression analysis is carried out to determine

the impact of FDI, Government expenditure and Gross

fixed Capital Formation on GDP (proxy for economic

performance) and Balance of Payment through Balance

on Current Account (BCA), . Hence, GDP and BCA were

regressed on FDI, GOV and GCF. Though the impact of

FDI is of primary concern here, the other two economic

variables were included to serve as control variables to

check the overstating of the estimated coefficient of FDI.

In model 3, the effects of two macroeconomic indicators,

inflation and exchange rates were also examined. Hence,

FDI was regressed on inflation and foreign exchange rates.

The results of the findings show that FDI has positive

effect, though not statistically significant on GDP. In other

words, the inflow of FDI into the Nigerian economy for the

stipulated period this research was carried out (1980-2009),

showed that FDI was not a major contributor to economic

growth of the nation. However, the findings show that FDI

has positive and significant impact on BOP through current

account balance during the same period of analysis.

The effect of inflation and foreign exchange rates on

FDI, brought under scrutiny, also showed that whereas

inflation rate did not have major effect on the inflow of

FDI into the Nigerian economy, foreign exchange rate had

great effect on the inflow of FDI into the Nigerian economy

within the same period (1980-2009).

From the foregoing discussion, it should be pointed

out that although the government have made reasonable

efforts in attracting FDI, certain economic and political

circumstances prevalent in the country have hindered its

inflow and its overall performance.

The primary objective of this study was to determine the

impacts and significance of FDI on the Nigerian economy

and the nations Balance of Payment (BOP). This was

achieved through the use of the OLS regression analysis of

data on the GDP, BCA, FDI, Government Expenditure and

Gross fixed Capital Formation sourced from the Central

Bank of Nigeria Statistical Bulletin.

The study also gave an opportunity for the examination

of the effects of inflation rate and exchange rate on FDI. The

impact of Government expenditure on economic growth

was also examined. Therefore the following findings were

revealed:

First, it was discovered that, FDI have not contributed

significantly to the economic growth of Nigeria in the

period under consideration.

Business Intelligence Journal - July, 2011 Vol.4 No.2

2011

Omankhanlen Alex Ehimare

Also, inflation was found not to have any major effect on

the inflow of FDI into the country. But exchange rate was

found to have major effect on FDI inflow into the country.

In addition FDI contributed to Balance of payment

position through Current account balance. While Gross

fixed capital formation is inelastic to Balance on current

account.

In conclusion after the OLS regression analysis had been

carried out and with the study about the various factors

affecting FDI within the country, it is seen that:

1. There is no empirical strong evidence to support the

notion that Foreign Direct Investment has been pivotal

to economic growth in Nigeria; which could have

justify the effort of successive governments in the

country at using FDI as a tool for economic growth.

2. Governments direct involvement in the provision of

goods and services by establishing and controlling

corporations, for example, has contributed little

to economic growth in Nigeria. This justifies the

privatization policy of the various administrations in

our government to allow for the possible takeover by

investors (both foreign and domestic) of the government

corporations.

3. Though FDI has contributed significantly to Balance

of Payment (BOP) through the nations current account

balance. This is thus an effective measure of correcting

balance of payment disequilibrium in our economy.

Recommendations

The most significant factors that make Nigeria a good

host for FDI are her abundance in natural resources and

large population, indicating a large market.

The outcome of this study shows that though FDI was

not found to have significantly contributed to the nations

economic growth, if well harnessed it can contribute to

economic growth in Nigeria. To increase the inflow of FDI

and its performance, the following recommendations from

this study are enunciated:

i. Balasubramanyam et al (1996) showed that most

economies benefit best from FDI when they are open to

foreign trade. Hence, the Nigerian government should

reduce the bureaucratic bottlenecks in foreign trade

especially the one constituted by the customs and port

authorities.

ii. Broensztein et al (1998) proved that there is a

high positive relationship between FDI and the level of

educational standard in the host economy. Based on this,

259

the countrys education should be in favour of science and

technology which would provide the economy with the

required skills that FDI require.

iii. Competitiveness should be encouraged, and as a

result, the existing and yet-to-exist export processing and

free trade zones should be equipped with state-of-the-art

infrastructures and technologies.

iv. The infrastructures in the country need to be

enhanced to meet the needs/requirements of foreign

investors. For example, electricity should be provided at an

uninterrupted level to reduce the extra cost that investors

incur in the procurement of power generating sets coupled

with their maintenance. Also, good network roads and

adequate water supply should be provided so as to cut the

cost of investors doing business.

v. Appropriate measures should be placed to check

economic and financial crimes.

vi. The nations monetary authorities should develop

and implement measures that will ensure that both inflation

and foreign exchange rates are sustained at levels that will

ensure increasing level of inflow of FDI.

vii. The government and the private sector stakeholders

of our economy should consider harnessing inflow of

FDI as a measure of improving the nations BOP through

current account balance, thereby ensuring the countrys

international competitiveness.

viii. Policy consistency should be emphasized.

References

Adegbite E.O and F.S. Ayadi (2010) The Role of FDI

in Economic Development: A Study of Nigeria.

World Journal of Entrepreneurship, Management

and Sustainable Development.Vol.6 No 1/2[Internet]

Available from www.worldsustainable.org

Akinlo, A.E. 2004. Foreign direct investment and

growth in Nigeria: An empirical investigation.

Journal of Policy Modeling, 26: 62739

Alfaro, L., Chanda, A., Kalemli-Ozcan, S. & Sayek,

S. (2006). How Does Foreign Direct Investment

Promote Economic Growth? Exploring the Effects

of Financial Markets on Linkages. NBER Working

Paper no. 12522, National Bureau of Economic

Research, Cambridge, MA.

Aremu, J.A. 2005. Foreign direct investment and

performance. Paper delivered at a workshop on

Foreign Investment Policy and Practice organized

by the Nigerian Institute of Advanced Legal Studies,

Lagos on 24 March

Ehimare O. A. - Foreign Direct Investment and its Effect on the Nigerian Economy

260

Business Intelligence Journal

Ayanwale A.B. (2007) FDI and Economic Growth:

Evidence from Nigeria. Africa Economic Research

Consortium Paper 165 Nairobi

Balasubramanyan, V., N. M.A. Salisu and D. Sapsford.

(1996). Foreign Direct Investment and Growth

in EP and IS Countries, Economic Journal, 106:

92105

Borensztein, E., J. De Gregoria and J. Lee. 1998. How

does foreign investment affect economic growth?

Journal of International Economics, 45(1): 11535.

Carkovic, M and Levine, R. (2002) Does Foreign

Direct Investment Accelerate Economic Growth

University of Minnesota Working Paper,

Minneapolis.

Collier, P. and Dollar, D. (2001) Development

effectiveness: What have we learnt? Development

Research Group, the World Bank[internet].

Availablefromhttp://www.oecd.org.

Dauda, R. O.S. (2007) The Impact of FDI on Nigerias

Economic Growth: Trade Policy Matters. Journal

of Business and Policy Research Vol. 3, No.2, Nov

Dec

Deepak M., Mody A. and Murshid A.P. (2001)

Private Capital Flows and Growth, Finance and

Development. Vol. 38, June ,No.2.

De Mello L.R. (1997) Foreign Direct InvestmentLed Growth: Evidence from Time Series and Panel

Data, Oxford Economic Papers, 51: 133- 151.

Dunning J. (1993) Multinational Enterprises and the

Global Economy. England:Workingham Addison

Wesley Publishing.

Ekpo, A.H. 1995. Foreign direct investment in

Nigeria: Evidence from time series data. CBN

Economic and Financial Review, 35(1): 5978

July

IMF (1985) Foreign Private Investment in

Developing Countries, International Monetary

Fund, Washington .D.C.

Jenkins, C. and Thomas, L. (2002) Foreign direct

investment in Southern Africa:determinants,

characteristics and implications for economic

growth andpoverty alleviation, University of

Oxford [internet.] Available from http://www.csae.

ox.ac.uk/reports/pdfs/rep2002-02.pdf

McAleese, D. (2004) Economics for business:

competition, macro-stability and globalisation. 3rd

ed. Edinburgh Gate: Pearson Education Limited

Musila, J.W. and Sigu, S.P. (2006) Accelerating

foreign direct investment flow to Africa: from policy

statements to successful strategies. Managerial

Finance, 32(7), 577-593.

Nadiri, M.I., 1993. Innovations and Technological

Spillovers, Working Papers 93-31, C.V. Starr

Center for Applied Economics, New York

University.

Nwillima N. (2008) Characteristics, Extent and

Impact of Foreign Direct Investment on African

Local Economic Development. Social Science

Research Network Electronic Paper Collection.

http://ssrn.com Ragazzi, G. (1973) Theories of the

Determinants of Direct Foreign Investment, IMF

staff papers,20

Tsai, P.L. (1991) Determinants of Foreign Direct

Investment in Taiwan: An Alternative Approach

with Time Series Data World Development.

Van Pottelsberghe De La Potterie, B. and F. Lichtenberg

(2001), Does Foreign Direct Investment Transfer

Technology Across Borders? The Review of

Economics and Statistics Vol. 3 (3), 490-497.

Business Intelligence Journal - July, 2011 Vol.4 No.2

Omankhanlen Alex Ehimare

2011

261

Appendix I

REGRESSION RESULT

PcGive 8.00, copy for meuller session started at 13:39:56 on 24th October 2010

Data loaded from: alexpr~1.wks

EQ( 1) Modelling GDP by OLS - The present sample is: 1 to 30

Variable

Constant

Coefficient

Std.Error

t-value

t-prob

PartR2

1.6709e+005

1.9847e+005

0.842

0.4075

0.0265

FDI

4.0912

2.6086

1.568

0.1289

0.0864

GOV._EXP.

6.2835

0.61381

10.237

0.0000

0.8012

GFC

1.5457

0.50454

3.063

0.0050

0.2652

R2 = 0.989607 F(3, 26) = 825.24 [0.0000] s = 820013 DW = 2.74

RSS = 1.748293983e+013 for 4 variables and 30 observations

EQ( 2) Modelling BCA by OLS - The present sample is: 1 to 30

Variable

Coefficient

Std.Error

t-value

t-prob

PartR2

-1.3500e+005

1.1447e+005

-1.179

0.2489

0.0508

7.0662

1.5046

4.696

0.0001

0.4590

GOV._EXP.

-0.49248

0.35404

-1.391

0.1760

0.0693

GFC

0.42403

0.29101

1.457

0.1571

0.0755

Constant

FDI

R2 = 0.919443 F(3, 26) = 98.917 [0.0000] s = 472972 DW = 1.72

RSS = 5.816258697e+012 for 4 variables and 30 observations

EQ( 3) Modelling FDI by OLS - The present sample is: 1 to 30

Variable

Coefficient

Std.Error

t-value

t-prob

PartR2

Constant

-14108.

58549.

-0.241

0.8114

0.0021

INFL.

-310.46

1678.9

-0.185

0.8547

0.0013

EXR

3731.5

538.18

6.934

0.0000

0.6404

R2 = 0.666903 F(2, 27) = 27.029 [0.0000] s = 155120 DW = 0.453

RSS = 6.496770871e+011 for 3 variables and 30 observations

Ehimare O. A. - Foreign Direct Investment and its Effect on the Nigerian Economy

Potrebbero piacerti anche

- Gross Profit Ad Expenses Depreciation (Dedicated Inv) Jell-O Equipment DepreciationDocumento11 pagineGross Profit Ad Expenses Depreciation (Dedicated Inv) Jell-O Equipment Depreciationanmolsaini01Nessuna valutazione finora

- Exhibit 4 (B) : Volatility of Foreign Exchange Ratesa (1/86-9/95)Documento5 pagineExhibit 4 (B) : Volatility of Foreign Exchange Ratesa (1/86-9/95)anmolsaini01Nessuna valutazione finora

- March Prelims Special Current Affairs Binder-IiiDocumento60 pagineMarch Prelims Special Current Affairs Binder-IiiPradeep EthanNessuna valutazione finora

- 28marchindia Year Book 2018 - Volume II Binder PDFDocumento128 pagine28marchindia Year Book 2018 - Volume II Binder PDFBijay Kumar SwainNessuna valutazione finora

- Marriott Cost of CapitalDocumento3 pagineMarriott Cost of Capitalanmolsaini01Nessuna valutazione finora

- Case Solution Titanium DioxideDocumento4 pagineCase Solution Titanium Dioxideanmolsaini01Nessuna valutazione finora

- Prelims Special: Current AffairsDocumento52 paginePrelims Special: Current Affairsanmolsaini01Nessuna valutazione finora

- Technical Analysis: Online Training Program OnDocumento4 pagineTechnical Analysis: Online Training Program Onanmolsaini01Nessuna valutazione finora

- Book Building ProcessDocumento17 pagineBook Building Processmukesha.kr100% (9)

- Agricultural Development Role of State - AgriComp - 09Documento6 pagineAgricultural Development Role of State - AgriComp - 09anmolsaini01Nessuna valutazione finora

- Grammer RuleDocumento104 pagineGrammer Rulegourav rakshitNessuna valutazione finora

- Agri Morris V AidDocumento19 pagineAgri Morris V Aidanmolsaini01Nessuna valutazione finora

- IBFS NotesDocumento14 pagineIBFS Notesanmolsaini01Nessuna valutazione finora

- Gears and NomenclatureDocumento27 pagineGears and NomenclatureJJNessuna valutazione finora

- One Liners Geography Final PDFDocumento10 pagineOne Liners Geography Final PDFanmolsaini01Nessuna valutazione finora

- CSP GS Paper1 PDFDocumento40 pagineCSP GS Paper1 PDFSumit MishraNessuna valutazione finora

- SBI PO MAINS Data Analysis Interpretation Memory Based 1Documento4 pagineSBI PO MAINS Data Analysis Interpretation Memory Based 1Binay TripathyNessuna valutazione finora

- Memory Based Sbi (English) PDFDocumento13 pagineMemory Based Sbi (English) PDFdragonbourneNessuna valutazione finora

- Risk Analysis in InvestmentDocumento39 pagineRisk Analysis in Investmentanmolsaini01Nessuna valutazione finora

- Compression Ignition Engine CombustionDocumento81 pagineCompression Ignition Engine CombustionHarish Reddy Singamala100% (1)

- G8 (Forum) - Wikipedia, The Free EncyclopediaDocumento25 pagineG8 (Forum) - Wikipedia, The Free Encyclopediaanmolsaini01Nessuna valutazione finora

- Financial Terms A-ZDocumento6 pagineFinancial Terms A-ZHarish NagamaniNessuna valutazione finora

- Banking Quiz PDFDocumento37 pagineBanking Quiz PDFmonamiNessuna valutazione finora

- Uid and Financial InclusionDocumento15 pagineUid and Financial Inclusionanmolsaini01Nessuna valutazione finora

- 00chapter 3 Hhkukuh Nugigjlk NKNKLNG VTTVHJ HJTFTDocumento136 pagine00chapter 3 Hhkukuh Nugigjlk NKNKLNG VTTVHJ HJTFTanmolsaini01Nessuna valutazione finora

- Interview Checklist QJQQB UIQ UIWBJ WB W 8Q3YGUI 7 EE G U QVYQ9GUQGU G7QGY 9Q BFBWEDocumento1 paginaInterview Checklist QJQQB UIQ UIWBJ WB W 8Q3YGUI 7 EE G U QVYQ9GUQGU G7QGY 9Q BFBWEanmolsaini01Nessuna valutazione finora

- Bod CeoDocumento43 pagineBod Ceoanmolsaini01Nessuna valutazione finora

- Strategy Adopted For Financial InclusionDocumento7 pagineStrategy Adopted For Financial Inclusionanmolsaini01Nessuna valutazione finora

- Used Cars - Cam Huifenfkehfuoehnjlewnvoihepfn Euwfioenfq Efvuiqenf QefbqefiofnpusDocumento2 pagineUsed Cars - Cam Huifenfkehfuoehnjlewnvoihepfn Euwfioenfq Efvuiqenf Qefbqefiofnpusanmolsaini01Nessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Salvage Law Act No. 2616: Sanilyn V. Ramirez Llb3Documento9 pagineThe Salvage Law Act No. 2616: Sanilyn V. Ramirez Llb3Syannil VieNessuna valutazione finora

- Prof SB Salter 6815 Quiz 2: Q - Total Fixed Costs ProfitDocumento10 pagineProf SB Salter 6815 Quiz 2: Q - Total Fixed Costs Profitmae KuanNessuna valutazione finora

- Johnson Turnaround Case StudyDocumento16 pagineJohnson Turnaround Case StudySofiah Zahrah100% (6)

- Final ExaminationDocumento16 pagineFinal ExaminationLorry Fe A. SargentoNessuna valutazione finora

- ABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsDocumento11 pagineABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsArchimedes Arvie Garcia0% (1)

- September 2010 Philippine Supreme Court Decisions On TaxDocumento2 pagineSeptember 2010 Philippine Supreme Court Decisions On TaxNgan TuyNessuna valutazione finora

- OTB Notice 2020 08 20 19 15 50 186683Documento3 pagineOTB Notice 2020 08 20 19 15 50 18668369j8mpp2sc0% (1)

- Coffee Shop Bplan PDFDocumento24 pagineCoffee Shop Bplan PDFHenry SoehardimanNessuna valutazione finora

- Tenancy Agreement (Kamal Carwash)Documento3 pagineTenancy Agreement (Kamal Carwash)Syed Isamil75% (8)

- Chapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentDocumento9 pagineChapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentMan Tran Y NhiNessuna valutazione finora

- IrectDocumento16 pagineIrectBhargav MosaliNessuna valutazione finora

- Acknowledgment For Request For New PAN Application (881030119090704)Documento1 paginaAcknowledgment For Request For New PAN Application (881030119090704)Mahesh YadaNessuna valutazione finora

- Cir Vs BurroughsDocumento2 pagineCir Vs BurroughsLove Lee Hallarsis FabiconNessuna valutazione finora

- SolutionsDocumento11 pagineSolutionsRaghuveer ChandraNessuna valutazione finora

- Olmstead Corporation S Capital Structure Is As Follows The Following Additional InformationDocumento1 paginaOlmstead Corporation S Capital Structure Is As Follows The Following Additional InformationHassan JanNessuna valutazione finora

- Company Valuation P&G 2023Documento16 pagineCompany Valuation P&G 2023santiagocorredor602Nessuna valutazione finora

- Great Zimbabwe University Faculty of CommerceDocumento5 pagineGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNessuna valutazione finora

- SohoDocumento4 pagineSohoTiara Ayu PratamaNessuna valutazione finora

- Dividends - and - Share - Repurchases - Basics - SlidesDocumento19 pagineDividends - and - Share - Repurchases - Basics - Slideszaheer9287Nessuna valutazione finora

- Progress Edition 2013Documento47 pagineProgress Edition 2013wdt_rpominvilleNessuna valutazione finora

- Pricing DecisionsDocumento3 paginePricing DecisionsMarcuz AizenNessuna valutazione finora

- Actbas 1 - Lesson 7 Journalizing, Posting and TBDocumento11 pagineActbas 1 - Lesson 7 Journalizing, Posting and TBJustineGomezChan100% (1)

- 6.06 A.b.03 CIR V Kudos Metal Corp - G.R. No. 178087Documento14 pagine6.06 A.b.03 CIR V Kudos Metal Corp - G.R. No. 178087Julia BalanagNessuna valutazione finora

- Business CombinationDocumento10 pagineBusiness CombinationCloudKielGuiang0% (1)

- BMGT 28 Taxation Problem SetDocumento8 pagineBMGT 28 Taxation Problem SetPatriciaNessuna valutazione finora

- Tax Situs 1Documento4 pagineTax Situs 1imoymito100% (1)

- Covered Call Strategies P1 PDFDocumento10 pagineCovered Call Strategies P1 PDFThành Tâm DươngNessuna valutazione finora

- Basics - Financial Accounting, TheDocumento401 pagineBasics - Financial Accounting, Theramon studiesNessuna valutazione finora

- Finance Act 2013Documento12 pagineFinance Act 2013Tapia MelvinNessuna valutazione finora

- MergerDocumento41 pagineMergerarulselvi_a9100% (1)