Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FM Assignment1 Group9

Caricato da

Udhbhav AryanCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FM Assignment1 Group9

Caricato da

Udhbhav AryanCopyright:

Formati disponibili

FM Assignment 1 (Heritage Doll Co.

) Group 9

Sneha (PGP29342) | Anurag (PGP30302) | Chitra (PGP30307) | Nikhil (PGP30323)

The Heritage doll company is considering two projects:

Match My Doll Clothing(MMDC) : Is an opportunistic but entirely logical, follow-on

investment that builds on a prior success

Design Your Own Doll (DYOD) : Is ased o the o pa ys k owledge of its usto ers a d

their loyalty to the brand

Intuition suggests that the former may offer quicker success, but the latter a more durable

contribution to the franchise

NPV, IRR, Payback Period, PI analysis is carried out to understand the outcomes of the project.

Estimating the net present value

The main ingredients are

1. The initial investment

2. Expected future cash flows

3. A discount rate

4. A terminal value

1) Initial Investment

It has been available as a case fact.

2) Expected cash flows

EBIT(1-T)

Add depreciation

Less change in NWC

Less capital expenditure

= Free cash flow

In order to find the working capital, based on the assumptions provided in the case, each line item of

WC has been calculated from the ratios provided.

3) Discount Rate

Discount Rate for the projects has been provided in the case based on the risks involved (High Risk

@ 9%, Medium Risk @ 8.4%, and Low Risk @ 7.7%).

4) Terminal Value

Terminal Value is modelled as a perpetuity with a constant growth rate g = 3%

TV = FCFt+1/(r g)

Based on the calculated values, NPV, IRR, Payback Period & PI of MMDC is favourable.

FM Assignment 1 (Heritage Doll Co.) Group 9

Sneha (PGP29342) | Anurag (PGP30302) | Chitra (PGP30307) | Nikhil (PGP30323)

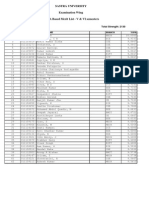

NPV Analysis for DYOD (Design you own Doll)

DYOD

Revenue

Revenue Growth

Production Costs

Fixed Production Expense (excl. depriciation)

Additional Development Costs (IT Personnel)

Variable production costs

Depriciation

Total Production Costs

Selling, General And Administrative Expense

Total Operating Expense

Operating Profit

Operating Profit/Sales

SG&A/Sales

Working Capital

Minimum Cash Balance as % of Sales

Day Sales Outstanding

Inventory Turnover (Production Cost/ Ending Inventory)

Days Payable Outstanding (Based on total operating expense)

Capital Expenditures

Growth in CAPEX

Net Working Capital Accounts

Cash

Accounts Receivable

Inventory

Accounts Payable

Net Working Capital

Change in Net Working Capital

Free Cash Flows

EBIT (1-t)

+ Depreciation

- Change in NWC

- Capital Expenditure

Free Cash Flow

Terminal Value 3%

Discount factor 9%

Present Value

NPV

NPV without terminal value

IRR analysis

Cash Flows

IRR

Payback Analysis

Cash Flows

Cumulative cash flow

Payback Period

5 year cumulative EBITDA

Profitability Index

NPV/Initial investment

2010

2011

$0

2012

$6,000

NA

2015

$21,435

6%

2016

$22,721

6%

2017

$24,084

6%

2018

$25,529

6%

2019

$27,061

6%

2020

$28,685

6%

1650

1683

0

1201

$1,201

($1,201)

0

435

0

0

435

0

$435

($435)

1717

1751

1786

1822

1858

1895

1933

2250

310

4210

1240

$5,450

$550

0.092

0.207

7651

310

9644

2922

$12,566

$1,794

0.125

0.203

11427

310

13454

4044

$17,498

$2,724

0.135

0.2

12182

436

14369

4287

$18,656

$2,779

0.13

0.2

12983

462

15231

4544

$19,775

$2,946

0.13

0.2

13833

490

16145

4817

$20,962

$3,123

0.13

0.2

14736

520

17113

5106

$22,219

$3,310

0.13

0.2

15694

551

18140

5412

$23,553

$3,508

0.13

0.2

16712

584

19229

5737

$24,966

$3,719

0.13

0.2

NA

NA

NA

NA

$4,610

NA

NA

NA

NA

$0

3%

59.2X

12.2X

33.7X

$310

1000

1000

2011

-261

0

-1000

0

-1261

2012

180

973

346

474

1024

24

2012

330

310

-24

-310

306

3%

59.2X

12.3X

33.8X

$310

0%

2013

431

2328

786

1135

2410

1386

2013

1077

310

-1386

-310

-309

3%

59.2X

12.6X

33.9X

$2,192

608%

2014

607

3278

1065

1598

3352

942

2014

1634

310

-942

-2192

-1190

3%

59.2X

12.7X

33.9X

826%

-62%

2015

643

3475

1130

1694

3553

202

2015

1667

436

-202

-826

1076

3%

59.2X

12.7X

33.9X

$875

6%

2016

682

3683

1197

1796

3766

213

2016

1767

462

-213

-875

1141

3%

59.2X

12.7X

33.9X

$928

6%

2017

723

3904

1269

1904

3992

226

2017

1874

490

-226

-928

1210

3%

59.2X

12.7X

33.9X

$983

6%

2018

766

4139

1345

2018

4232

240

2018

1986

520

-240

-983

1283

3%

59.2X

12.7X

33.9X

$1,043

6%

2019

812

4387

1426

2139

4486

254

2019

2105

551

-254

-1043

1359

1

-5331

$7,058

($3,391)

0.9174

-1157

0.8417

258

0.7722

-239

0.7084

-843

0.6499

700

0.5963

681

0.547

662

0.5019

644

0.4604

626

3%

59.2X

12.7X

33.9X

$1,105

6%

2020

861

4650

1512

2267

4755

269

2020

2231

584

-269

-1105

1441

24737

0.4224

11058

2010

2011

0

-5331

17.90%

2010

-5331

-5331

-1261

306

-309

-1190

1076

1141

1210

1283

1359

26176

2011

-1261

-6592

2012

306

-6286

2013

-309

-6595

2014

-1190

-7784

2015

1076

-6708

2016

1141

-5566

2017

1210

-4357

2018

1283

-3074

2019

1359

-1715

2020

26178

24464

>10 years

2010

-721

-4610

-5331

2013

2014

$14,360 $20,222

139.30% 40.80%

8778

1.32

FM Assignment 1 (Heritage Doll Co.) Group 9

Sneha (PGP29342) | Anurag (PGP30302) | Chitra (PGP30307) | Nikhil (PGP30323)

NPV a alysis for MMDC (Match

MMDC

Revenue

Revenue Growth

Production Costs

Fixed Production Expense (excl depreciation)

Variable Production Costs

Depreciation

Total Production Costs

Selling, General & Administrative

Total Operating Expenses

2011

4,500

NA

2012

6,860

52.4%

2013

8,409

22.6%

2014

9,082

8.0%

2015

9,808

8.0%

2016

10,593

8.0%

2017

11,440

8.0%

2018

12,355

8.0%

2019

13,344

8.0%

2020

14,411

8.0%

575

2,035

152

2,762

1,155

3,917

575

3,404

152

4,131

1,735

5,866

587

4,291

152

5,029

2,102

7,132

598

4,669

152

5,419

2,270

7,690

610

5,078

164

5,853

2,452

8,305

622

5,521

178

6,321

2,648

8,969

635

6,000

192

6,827

2,860

9,687

648

6,519

207

7,373

3,089

10,462

660

7,079

224

7,963

3,336

11,299

674

7,685

242

8,600

3,603

12,203

($1,250)

583

0.130

0.257

994

0.145

0.253

1,277

0.152

0.250

1,392

0.153

0.250

1,503

0.153

0.250

1,623

0.153

0.250

1,753

0.153

0.250

1,893

0.153

0.250

2,045

0.153

0.250

2,209

0.153

0.250

NA

NA

NA

0.0x

3.0%

59.2x

7.7x

30.8x

3.0%

59.2x

8.3x

30.9x

3.0%

59.2x

12.7x

31.0x

3.0%

59.2x

12.7x

31.0x

3.0%

59.2x

12.7x

31.0x

3.0%

59.2x

12.7x

31.0x

3.0%

59.2x

12.7x

31.0x

3.0%

59.2x

12.7x

31.0x

3.0%

59.2x

12.7x

31.0x

3.0%

59.2x

12.7x

31.0x

Capital Expenditures

growth in capex

1,470

952

-35.2%

152

-84.0%

152

0.0%

334

119.3%

361

8.0%

389

8.0%

421

8.0%

454

8.0%

491

8.0%

530

8.0%

Net Working Capital Accounts

Cash

Accounts Receivable

Inventory

Accounts Payable

Net Working Capital

WC

NPV Analysis MMDC

Free Cash Flows

EBIT (1-t)

+ Depreciation

- Change in NWC

- Capital Expenditure

Free Cash Flow

Terminal Value 3%

Initial Outlays

Net working capital

Net property, machinery

Discount factor 8.4%

Present Value

NPV

NPV without terminal value

IRR analysis

Cash Flows

IRR

Payback Analysis

Cash Flows

Cumulative cash flow

Payback Period

5 year cumulative EBITDA

Profitability Index

NPV/Initial investment

2010

2011

135

729

360

317

907

107

2012

206

1112

500

484

1334

428

2013

252

1363

396

593

1418

84

2014

272

1472

427

640

1531

113

2015

294

1590

461

692

1653

123

2016

318

1717

498

747

1786

133

2017

343

1855

538

807

1929

143

2018

371

2003

581

871

2084

154

2019

400

2163

627

941

2249

165

2020

432

2336

677

1016

2429

180

2011

350

152

-107

-952

-557

2012

596

152

-427

-152

169

2013

766

152

-84

-152

682

2014

835

152

-113

-334

541

2015

902

164

-122

-361

583

2016

974

178

-132

-389

630

2017

1052

192

-143

-421

680

2018

1136

207

-154

-454

735

2019

1227

224

-167

-491

793

2020

1325

242

-180

-530

857

16345

Operating Profit

operating Profit/sales

SGA/Sales

Working Capital Assumptions:

Minimum Cash Balance as % of Sales

Days Sales Outstanding

Inventory Turnover (prod. cost/ending inv.)

Days Payable Outstanding (based on tot. op. exp.)

2010

y Dolls clothing)

0

1,250

1,250

800

2010

-750

0

-750

-800

-1470

1

-3020

$7,150

($146)

2010

-3020

24.00%

2010

-3020

-3020

0.922509 0.851023 0.785077 0.724241 0.668119 0.616346 0.568585 0.524524 0.483879 0.446383

-514

144

535

392

390

388

387

386

384

7679

2011

-557

2012

169

2013

682

2014

541

2015

583

2016

630

2017

680

2018

735

2019

793

2020

17202

2011

-557

-3577

2012

169

-3408

2013

682

-2726

2014

541

-2185

2015

583

-1602

2016

630

-972

2017

680

-292

2018

735

443

7.4

2019

793

2020

17202

$6,522.00

2.37

years

Potrebbero piacerti anche

- The Smith Generator BlueprintsDocumento36 pagineThe Smith Generator BlueprintsZoran AleksicNessuna valutazione finora

- Investor PresDocumento24 pagineInvestor PresHungreo411Nessuna valutazione finora

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosDa EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNessuna valutazione finora

- Capital Budgeting and Investment Projects' SelectionDocumento81 pagineCapital Budgeting and Investment Projects' SelectionChiara Del PizzoNessuna valutazione finora

- Managerial EconomicsDocumento3 pagineManagerial EconomicsGuruKPONessuna valutazione finora

- GMH 2011 Depot - 14 - 154891Documento50 pagineGMH 2011 Depot - 14 - 154891LuxembourgAtaGlanceNessuna valutazione finora

- USDA Guide To CanningDocumento7 pagineUSDA Guide To CanningWindage and Elevation0% (1)

- PeopleSoft Security TablesDocumento8 paginePeopleSoft Security TablesChhavibhasinNessuna valutazione finora

- Financial Feasibility Study of Gypsum Board ProductionDocumento31 pagineFinancial Feasibility Study of Gypsum Board ProductionFiras AbsaNessuna valutazione finora

- Kellogg Consulting ClubDocumento12 pagineKellogg Consulting ClubCaroline KimNessuna valutazione finora

- Comfort Delgro - NomuraDocumento28 pagineComfort Delgro - NomuraTerence Seah Pei ChuanNessuna valutazione finora

- Learning Activity Sheet: 3 Quarter Week 1 Mathematics 2Documento8 pagineLearning Activity Sheet: 3 Quarter Week 1 Mathematics 2Dom MartinezNessuna valutazione finora

- Real Estate Broker ReviewerREBLEXDocumento124 pagineReal Estate Broker ReviewerREBLEXMar100% (4)

- Mckinsey & Co. Managing Knowledge and LearningDocumento15 pagineMckinsey & Co. Managing Knowledge and LearningVibhorSrivastava100% (1)

- MANAGEMENT ADVISORY SERVICES TOPICSDocumento19 pagineMANAGEMENT ADVISORY SERVICES TOPICSNovie Marie Balbin AnitNessuna valutazione finora

- LIST OF ENROLLED MEMBERS OF SAHIWAL CHAMBER OF COMMERCEDocumento126 pagineLIST OF ENROLLED MEMBERS OF SAHIWAL CHAMBER OF COMMERCEBASIT Ali KhanNessuna valutazione finora

- ISO 13485-2016 - DR - Pack - Control of Non Conforming ProductsDocumento4 pagineISO 13485-2016 - DR - Pack - Control of Non Conforming ProductskmasanNessuna valutazione finora

- 5 - 6. Valo BisDocumento31 pagine5 - 6. Valo BisRaimond DuflotNessuna valutazione finora

- PR - 27 March 2013 - Proforma Financial Information - Icade-Silic - 31 December 2012Documento10 paginePR - 27 March 2013 - Proforma Financial Information - Icade-Silic - 31 December 2012IcadeNessuna valutazione finora

- Key Investment Highlights: Revenue (In $million) Adjusted Net Income (In $million) EBITDA (In $million)Documento3 pagineKey Investment Highlights: Revenue (In $million) Adjusted Net Income (In $million) EBITDA (In $million)Rambotan17Nessuna valutazione finora

- Investment Banking (A) Group AssignmentDocumento29 pagineInvestment Banking (A) Group AssignmentHarsh SudNessuna valutazione finora

- A Report On MindTreeDocumento19 pagineA Report On MindTreeBhaskar Chatterjee100% (1)

- Seminar 3 Capital Budgeting: Synopsis of The Company and The Doll IndustryDocumento6 pagineSeminar 3 Capital Budgeting: Synopsis of The Company and The Doll IndustryHina SaharNessuna valutazione finora

- ACC GRP 2Documento15 pagineACC GRP 2Rumbidzai KambaNessuna valutazione finora

- BSDE ReportDocumento22 pagineBSDE ReportBambang SugihartoNessuna valutazione finora

- ZECO Audited Results For FY Ended 31 Dec 13Documento1 paginaZECO Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNessuna valutazione finora

- Starhill Global REIT Ending 1Q14 On High NoteDocumento6 pagineStarhill Global REIT Ending 1Q14 On High NoteventriaNessuna valutazione finora

- Strategic Management - Professional Competence: Multi Subject Assessment StageDocumento16 pagineStrategic Management - Professional Competence: Multi Subject Assessment StageRamzan AliNessuna valutazione finora

- How Do We Measure An Economy's Performance?: Topic - 1Documento18 pagineHow Do We Measure An Economy's Performance?: Topic - 1Jibananda SamalNessuna valutazione finora

- Group D Presentation on Market Gap VS Market ShareDocumento17 pagineGroup D Presentation on Market Gap VS Market Sharewalid hosnyNessuna valutazione finora

- 2.edited FM Capital BudgetingDocumento72 pagine2.edited FM Capital BudgetingbelovedbijithNessuna valutazione finora

- Chapter 5Documento56 pagineChapter 5yedinkachaw shferawNessuna valutazione finora

- 2843 - XPGDM - Ea - Ii - PPT - 1Documento18 pagine2843 - XPGDM - Ea - Ii - PPT - 1Jibananda SamalNessuna valutazione finora

- Bus247 Case 1Documento10 pagineBus247 Case 1Yuvraj Singh GrewalNessuna valutazione finora

- CMT Ar 2009Documento180 pagineCMT Ar 2009Sassy TanNessuna valutazione finora

- 2021 - Bpe 35403 Business Valuation 20192020 - Wo PWDocumento4 pagine2021 - Bpe 35403 Business Valuation 20192020 - Wo PWShaza NaNessuna valutazione finora

- National Income Accounting Reference - Chapter 5Documento13 pagineNational Income Accounting Reference - Chapter 5hannah_clariceNessuna valutazione finora

- Enterp7a Financial MGMTDocumento17 pagineEnterp7a Financial MGMTVanessa Tattao IsagaNessuna valutazione finora

- Examples of Key Financial Performance MeasuresDocumento12 pagineExamples of Key Financial Performance MeasuresabdelmutalabNessuna valutazione finora

- Lecture 8Documento37 pagineLecture 8Tesfaye ejetaNessuna valutazione finora

- Midsem Exams Fin Accting WeekendDocumento4 pagineMidsem Exams Fin Accting WeekendMichael LastNessuna valutazione finora

- BBA 311-Financial Management set 1Documento10 pagineBBA 311-Financial Management set 1Innocent BwalyaNessuna valutazione finora

- Din Textile MillsDocumento41 pagineDin Textile MillsZainab Abizer MerchantNessuna valutazione finora

- FPP.1x Real Sector SlidesDocumento25 pagineFPP.1x Real Sector SlidesYuliño Clever Anastacio ClementeNessuna valutazione finora

- CMT Ar 2008Documento176 pagineCMT Ar 2008Sassy TanNessuna valutazione finora

- Financial Statement Analysis: An Analysis of Key Financial MetricsDocumento17 pagineFinancial Statement Analysis: An Analysis of Key Financial MetricsJanNessuna valutazione finora

- NIA - Sector AccountingDocumento20 pagineNIA - Sector Accountingroasted friesNessuna valutazione finora

- Financial Accounting Analysis for Godfrey Phillips India LimitedDocumento8 pagineFinancial Accounting Analysis for Godfrey Phillips India LimitedSOURAV ACHARJEENessuna valutazione finora

- Makerere University Business School Jinja CampusDocumento54 pagineMakerere University Business School Jinja CampusIanNessuna valutazione finora

- November 2007 Examinations: © The Chartered Institute of Management Accountants 2007Documento36 pagineNovember 2007 Examinations: © The Chartered Institute of Management Accountants 2007magnetbox8Nessuna valutazione finora

- 34 FFFDocumento23 pagine34 FFFDaddyNessuna valutazione finora

- COLOPLASTDocumento32 pagineCOLOPLASTAryan MittalNessuna valutazione finora

- Life - Cycle - Costing F5 NotesDocumento6 pagineLife - Cycle - Costing F5 NotesSiddiqua KashifNessuna valutazione finora

- Index: PPLTVF PPLF PPTSF PPCHFDocumento52 pagineIndex: PPLTVF PPLF PPTSF PPCHFTunirNessuna valutazione finora

- KFin Technologies - Flash Note - 12 Dec 23Documento6 pagineKFin Technologies - Flash Note - 12 Dec 23palakNessuna valutazione finora

- Measuring GDP - 2Documento17 pagineMeasuring GDP - 2AbdullahRafiqNessuna valutazione finora

- With Exponential Smoothing As An Example of Technique For Forecasting Revenue of TCSDocumento17 pagineWith Exponential Smoothing As An Example of Technique For Forecasting Revenue of TCSVedanti JainNessuna valutazione finora

- Profit and Loss Account For The Year Ended 31 March, 2012Documento6 pagineProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliNessuna valutazione finora

- Stanley Furniture Announces Fourth Quarterand Total Year 3013 Operating ResultsDocumento7 pagineStanley Furniture Announces Fourth Quarterand Total Year 3013 Operating Resultsjcf129erNessuna valutazione finora

- KPITTECH 03082020160338 KPITInvestorUpdateSEuploadDocumento28 pagineKPITTECH 03082020160338 KPITInvestorUpdateSEuploadSreenivasulu Reddy SanamNessuna valutazione finora

- Bumi Serpong DamaiDocumento21 pagineBumi Serpong DamaiBambang SugihartoNessuna valutazione finora

- Keppel Corp upgraded to Buy on increased confidence in executionDocumento5 pagineKeppel Corp upgraded to Buy on increased confidence in executiontansillyNessuna valutazione finora

- Bos 42922 CP 6Documento32 pagineBos 42922 CP 6Roshani parmarNessuna valutazione finora

- Nucleus HDFCDocumento15 pagineNucleus HDFCDavuluri OmprakashNessuna valutazione finora

- Discounted Cash Flow ValuationDocumento45 pagineDiscounted Cash Flow Valuationnotes 1Nessuna valutazione finora

- PI Industries DolatCap 141111Documento6 paginePI Industries DolatCap 141111equityanalystinvestorNessuna valutazione finora

- Unit 2-7Documento125 pagineUnit 2-7saron100% (1)

- National Income Accounting - Contd Eep-IDocumento25 pagineNational Income Accounting - Contd Eep-IanonymousNessuna valutazione finora

- Project, Program and Portfolio SelectionDocumento40 pagineProject, Program and Portfolio Selectionsaif ur rehman shahid hussain (aviator)Nessuna valutazione finora

- IRRI AR 2013 Audited Financial StatementsDocumento62 pagineIRRI AR 2013 Audited Financial StatementsIRRI_resourcesNessuna valutazione finora

- Assignment 2 CarZumaDocumento4 pagineAssignment 2 CarZumaUdhbhav AryanNessuna valutazione finora

- Chapter 14 Exam Questions - 8th EdDocumento11 pagineChapter 14 Exam Questions - 8th EdUdhbhav Aryan100% (1)

- Cadbury V 1.0Documento6 pagineCadbury V 1.0Udhbhav AryanNessuna valutazione finora

- Strategy and Society: The Link Between Competitive Advantage and Corporate Social ResponsibilityDocumento23 pagineStrategy and Society: The Link Between Competitive Advantage and Corporate Social ResponsibilityUdhbhav AryanNessuna valutazione finora

- Avantgarde Case StudyDocumento7 pagineAvantgarde Case StudyUdhbhav AryanNessuna valutazione finora

- Strauss & Corbin'a Approach Example VGDocumento7 pagineStrauss & Corbin'a Approach Example VGUdhbhav AryanNessuna valutazione finora

- Chapter 15 Exam Questions - 8th EdDocumento8 pagineChapter 15 Exam Questions - 8th EdUdhbhav AryanNessuna valutazione finora

- UNIDO Guide To Suppler DevelopmentDocumento44 pagineUNIDO Guide To Suppler DevelopmentUdhbhav AryanNessuna valutazione finora

- MPX ManualDocumento230 pagineMPX ManualUdhbhav AryanNessuna valutazione finora

- The PeopleSoft ContestDocumento9 pagineThe PeopleSoft ContestUdhbhav AryanNessuna valutazione finora

- ONMITELDocumento5 pagineONMITELUdhbhav AryanNessuna valutazione finora

- SBI: Organizational Design and Technology: Project ProposalDocumento4 pagineSBI: Organizational Design and Technology: Project ProposalUdhbhav AryanNessuna valutazione finora

- Tribes and Mentoring ArticleDocumento20 pagineTribes and Mentoring ArticleUdhbhav AryanNessuna valutazione finora

- Tribes and Mentoring ArticleDocumento20 pagineTribes and Mentoring ArticleUdhbhav AryanNessuna valutazione finora

- Attention Outgone StudentsDocumento1 paginaAttention Outgone StudentsUdhbhav AryanNessuna valutazione finora

- Huella Online Travel Group-7Documento10 pagineHuella Online Travel Group-7Udhbhav AryanNessuna valutazione finora

- Organic Agriculture and Food IndustryDocumento8 pagineOrganic Agriculture and Food IndustryUdhbhav AryanNessuna valutazione finora

- ActionverbsDocumento2 pagineActionverbsapi-241737054Nessuna valutazione finora

- Grammar Googly 1Documento6 pagineGrammar Googly 1Udhbhav AryanNessuna valutazione finora

- Downloads News 2010 Aug Dean List 2 V & VI SEMESTERDocumento1 paginaDownloads News 2010 Aug Dean List 2 V & VI SEMESTERUdhbhav AryanNessuna valutazione finora

- WECDocumento4 pagineWECUdhbhav AryanNessuna valutazione finora

- Chapter 14Documento26 pagineChapter 14owaishazaraNessuna valutazione finora

- Problem StatementDocumento2 pagineProblem StatementUdhbhav AryanNessuna valutazione finora

- Chandan KumarDocumento2 pagineChandan KumarUdhbhav AryanNessuna valutazione finora

- Downloads News 2010 Aug Dean List 2 V & VI SEMESTERDocumento1 paginaDownloads News 2010 Aug Dean List 2 V & VI SEMESTERUdhbhav AryanNessuna valutazione finora

- Histogarm EqDocumento2 pagineHistogarm EqUdhbhav AryanNessuna valutazione finora

- Chan Mri Ud Appo: TotalDocumento8 pagineChan Mri Ud Appo: TotalUdhbhav AryanNessuna valutazione finora

- Typical T Intersection On Rural Local Road With Left Turn LanesDocumento1 paginaTypical T Intersection On Rural Local Road With Left Turn Lanesahmed.almakawyNessuna valutazione finora

- Technical Manual - C&C08 Digital Switching System Chapter 2 OverviewDocumento19 pagineTechnical Manual - C&C08 Digital Switching System Chapter 2 OverviewSamuel100% (2)

- Philippine Population 2009Documento6 paginePhilippine Population 2009mahyoolNessuna valutazione finora

- Seminar Course Report ON Food SafetyDocumento25 pagineSeminar Course Report ON Food SafetyYanNessuna valutazione finora

- Technical Specification of Heat Pumps ElectroluxDocumento9 pagineTechnical Specification of Heat Pumps ElectroluxAnonymous LDJnXeNessuna valutazione finora

- Flowmon Ads Enterprise Userguide enDocumento82 pagineFlowmon Ads Enterprise Userguide ennagasatoNessuna valutazione finora

- GS16 Gas Valve: With On-Board DriverDocumento4 pagineGS16 Gas Valve: With On-Board DriverProcurement PardisanNessuna valutazione finora

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocumento2 pagineBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledCesar ValeraNessuna valutazione finora

- Ielts Practice Tests: ListeningDocumento19 pagineIelts Practice Tests: ListeningKadek Santiari DewiNessuna valutazione finora

- United States Bankruptcy Court Southern District of New YorkDocumento21 pagineUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNessuna valutazione finora

- Maharashtra Auto Permit Winner ListDocumento148 pagineMaharashtra Auto Permit Winner ListSadik Shaikh50% (2)

- JM Guide To ATE Flier (c2020)Documento2 pagineJM Guide To ATE Flier (c2020)Maged HegabNessuna valutazione finora

- 4 Factor DoeDocumento5 pagine4 Factor Doeapi-516384896Nessuna valutazione finora

- Sinclair User 1 Apr 1982Documento68 pagineSinclair User 1 Apr 1982JasonWhite99Nessuna valutazione finora

- 202112fuji ViDocumento2 pagine202112fuji ViAnh CaoNessuna valutazione finora

- Training Customer CareDocumento6 pagineTraining Customer Careyahya sabilNessuna valutazione finora

- LSMW With Rfbibl00Documento14 pagineLSMW With Rfbibl00abbasx0% (1)

- White Box Testing Techniques: Ratna SanyalDocumento23 pagineWhite Box Testing Techniques: Ratna SanyalYogesh MundhraNessuna valutazione finora

- 02 Slide Pengenalan Dasar MapinfoDocumento24 pagine02 Slide Pengenalan Dasar MapinfoRizky 'manda' AmaliaNessuna valutazione finora

- Letter From Attorneys General To 3MDocumento5 pagineLetter From Attorneys General To 3MHonolulu Star-AdvertiserNessuna valutazione finora