Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Q6

Caricato da

kheriaankitCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Q6

Caricato da

kheriaankitCopyright:

Formati disponibili

Module 4 - Assignment

9/25/14, 10:20 PM

Auritro Chatterjee

Home / MGMT-2600 / Module 4 / Module 4 - Assignment

Quiz navigation

Question

Not complete

Auritro Chatterjee

1

Finish attempt ...

Marked out of 1.00

Flag question

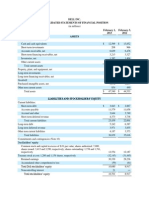

Compute and Interpret Z-score

Balance sheets and income statements for Lockheed Martin Corporation follow. Refer to

these nancial statements to answer the requirements.

Income Statement

Year Ended December 31

2005

2004

2003

(In millions)

Net sales

Products

$ 31,518 $ 30,202 $ 27,290

5,695

5,324

4,534

Service

Cost of sales

Products

Service

Unallocated coporate costs

Other income (expenses), net

Operating prot

Interest expense

Earnings before taxes

Income tax expense

Net earnings

37,213

35,526

31,824

28,800

5,073

803

27,879

4,765

914

25,306

4,099

443

34,676

33,558

29,848

2,537

449

1,968

121

1,976

43

2,986

370

2,089

425

2,019

487

2,616

791

1,664

398

1,532

479

$ 1,825 $ 1,266 $ 1,053

Balance Sheet

December 31 (In millions)

2005

2004

Assets

Cash and cash equivalents

Short-term investments

Receivables

Inventories

Deferred income taxes

Other current assets

Total current assets

Property, plant and equipment, net

Investments in equity securities

Goodwill

Purchased intangibles, net

Prepaid pension asset

Other assets

Total assets

Liabilities and stockholders' equity

Accounts payable

Customer advances and amounts in excess of costs incurred

Salaries, benets and payroll taxes

Current maturities of long-term debt

Other current liabilities

$ 2,244 $ 1,060

429

396

4,579

4,094

1,921

861

495

1,864

982

557

10,529

3,924

196

10,447

560

8,953

3,599

812

9,892

672

1,360

2,728

1,030

2,596

$ 29,744 $ 27,554

$ 1,998 $ 1,726

4,331

4,028

1,475

1,346

202

15

1,422

1,451

Total current liabilities

Long-term debt

9,428

4,784

8,566

5,104

Accrued pension liabilities

Other postretirement benet liabilities

Other liabilities

2,097

1,277

2,291

1,660

1,236

1,967

http://platform2.mybusinesscourse.com/mod/quiz/attempt.php?attempt=54555&page=5&scrollpos=0

Page 1 of 3

Module 4 - Assignment

9/25/14, 10:20 PM

Other liabilities

Stockholders' equity

Common stock, $1 par value per share

Additional paid-in capital

2,291

1,967

432

1,724

438

2,223

Retained earnings

Accumulated other comprehensive loss

7,278

(1,553)

(14)

7,915

(1,532)

(23)

9,867

9,021

Other

Total stockholders' equity

Total liabilities and stockholders' equity

$ 29,744 $ 27,554

Consolidated Statement of Cash Flows

Year Ended December 31 (In millions)

Operating Activities

2005

Net earnings

$

$

1,825 1,266

Adjustments to reconcile net earnings to net cash provided by operating

activities

Depreciation and amortization

Amortization of purchased intangibles

Deferred federal income taxes

Changes in operating assets and liabilities:

Receivables

Inventories

Accounts payable

Customer advances and amounts in excess of costs incurred

Other

Net cash provided by operating activities

Investing Activities

Expenditures for property, plant and equipment

Acquisition of business/investments in aliated companies

Proceeds from divestiture of businesses/Investments in aliated

companies

Purchase of short-term investments, net

Other

Net cash used for investing activities

Financing Activities

repayment of long-term debt

Issuances of long-term debt

Long-term debt repayment and issuance costs

Issuances of common stock

Repurchases of common stock

Common stock dividends

Net cash used for nancing activities

Net increase (decrease) in cash and cash equivalents

2004

2003

$

1,053

555

150

511

145

480

129

24

(58)

467

(390)

(39)

239

(87)

519

288

(258)

(94)

330

296

534

(228)

568

(285)

(13)

3,194 2,924

1,809

(865)

(564)

(769)

(91)

(687)

(821)

935

279

234

(33)

28

(156)

29

(240)

53

(499)

(708) (1,461)

(133) (1,089) (2,202)

--- 1,000

(12) (163) (175)

406

164

44

(1,310) (673) (482)

(462)

(405)

(261)

(1,511) (2,166) (2,076)

1,184

50 (1,728)

Cash and cash equivalents at beginning of year

1,060 1,010

2,738

Cash and cash equivalents at end of year

$

$

2,244 1,060

$

1,010

As of December 31, there were the approximate shares outstanding:

2005 - 434,264,432

2004 - 440,445,630

As of December 31, the company's stock closed at the following values:

2005 - $63.63

2004 - $55.55

(a) Compute and compare the Altman Z-scores for both years. (Do not round until your nal

answer; then round your answers to two decimal places.)

2005 z-score = 0

2004 z-score = 0

http://platform2.mybusinesscourse.com/mod/quiz/attempt.php?attempt=54555&page=5&scrollpos=0

Page 2 of 3

Module 4 - Assignment

9/25/14, 10:20 PM

Which of the following explain the trend in the Z-scores from 2004 to 2005? (Select all that

apply.)

The market value of Lockheed's equity improved somewhat over the year.

Lockheed decreased its liquidity due to an increase in retained earnings.

Lockheed improved its short-term liquidity by increasing cash.

Lcokheed improved its long-term liquidity by decreasing total liabilities.

(b) Which of the following statements best describes the company's Altman Z-scores?

The Altman Z-scores have increased from 2004 to 2005 which indicates the company's

bankruptcy risk has decreased.

Both the Altman Z-scores are above 3.00 which indicate the company has a very low

probability of bankruptcy.

Both the Altman Z-scores are below 1.80 which indicate the company has a very high

probability of bankruptcy.

The Altman Z-scores have decreased from 2004 to 2005 which indicates the company's

bankruptcy risk has increased.

Check

Next

http://platform2.mybusinesscourse.com/mod/quiz/attempt.php?attempt=54555&page=5&scrollpos=0

Page 3 of 3

Potrebbero piacerti anche

- The Millionaire Fastlane: Crack The Code To Wealth and Live Rich For A Lifetime! - MJ DeMarcoDocumento6 pagineThe Millionaire Fastlane: Crack The Code To Wealth and Live Rich For A Lifetime! - MJ DeMarcowureleli17% (6)

- Consolidated Financial StatementsDocumento66 pagineConsolidated Financial StatementsJorge LazaroNessuna valutazione finora

- Aswath Damodaran Tesla ValuationDocumento60 pagineAswath Damodaran Tesla ValuationHarshVardhan Sachdev100% (1)

- Teuer Furniture A Case Solution PPT (Group-04)Documento13 pagineTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- Financial Analysis ToolDocumento50 pagineFinancial Analysis ToolContessa PetriniNessuna valutazione finora

- Remaking The North America Food SystemDocumento385 pagineRemaking The North America Food SystemSnuse04100% (1)

- Airthread WorksheetDocumento21 pagineAirthread Worksheetabhikothari3085% (13)

- Ceres Gardening Company Submission TemplateDocumento7 pagineCeres Gardening Company Submission TemplateKiran SinghNessuna valutazione finora

- I Vey School of Businss-Cariboo Industrial LTDDocumento13 pagineI Vey School of Businss-Cariboo Industrial LTDshirlynesNessuna valutazione finora

- Chief Financial Officer Job DescriptionDocumento8 pagineChief Financial Officer Job Descriptionfinancemanagement702Nessuna valutazione finora

- A STUDY ON THE ADMINISTRATION DEPARTMENT OF VADAMALAYAN HOSPITAL (Recovered) NewDocumento41 pagineA STUDY ON THE ADMINISTRATION DEPARTMENT OF VADAMALAYAN HOSPITAL (Recovered) NewP.DEVIPRIYANessuna valutazione finora

- Kohler Co. (A)Documento18 pagineKohler Co. (A)Juan Manuel GonzalezNessuna valutazione finora

- Managerial Economics and Business Environment 1Documento42 pagineManagerial Economics and Business Environment 1dpartha2000479750% (2)

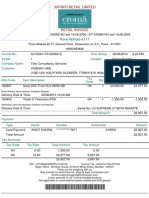

- TV Bill FormatDocumento2 pagineTV Bill Formatkheriaankit100% (3)

- Mindtree ValuationDocumento74 pagineMindtree ValuationAmit RanderNessuna valutazione finora

- Ar 2005 Financial Statements p55 eDocumento3 pagineAr 2005 Financial Statements p55 esalehin1969Nessuna valutazione finora

- Selected Financial Summary (U.S. GAAP) : For The YearDocumento82 pagineSelected Financial Summary (U.S. GAAP) : For The YearshanzarapunzleNessuna valutazione finora

- Puma Energy Results Report q4 2016Documento8 paginePuma Energy Results Report q4 2016KA-11 Єфіменко ІванNessuna valutazione finora

- FMT Tafi Federal LATESTDocumento62 pagineFMT Tafi Federal LATESTsyamputra razaliNessuna valutazione finora

- Macys 2011 10kDocumento39 pagineMacys 2011 10kapb5223Nessuna valutazione finora

- Standalone Accounts 2008Documento87 pagineStandalone Accounts 2008Noore NayabNessuna valutazione finora

- Cisco - Balance Sheeet Vertical AnalysisDocumento8 pagineCisco - Balance Sheeet Vertical AnalysisSameh Ahmed Hassan0% (1)

- 2006 To 2008 Blance SheetDocumento4 pagine2006 To 2008 Blance SheetSidra IrshadNessuna valutazione finora

- Financial+Statements-Ceres+Gardening+Company 1Documento5 pagineFinancial+Statements-Ceres+Gardening+Company 1AG InteriorNessuna valutazione finora

- Income Statement: Assets Non-Current AssetsDocumento213 pagineIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNessuna valutazione finora

- Dell IncDocumento6 pagineDell IncMohit ChaturvediNessuna valutazione finora

- Copia de Analytical Information 30 Sep 2010Documento12 pagineCopia de Analytical Information 30 Sep 2010Ivan Aguilar CabreraNessuna valutazione finora

- MCB - Standlaone Accounts 2007Documento83 pagineMCB - Standlaone Accounts 2007usmankhan9Nessuna valutazione finora

- Samsung Electronics Co., LTD.: Non-Consolidated Statements of Cash Flows For The Years Ended December 31, 2009 and 2008Documento3 pagineSamsung Electronics Co., LTD.: Non-Consolidated Statements of Cash Flows For The Years Ended December 31, 2009 and 2008Nitin SharmaNessuna valutazione finora

- Consolidated Balance Sheet Consolidated Balance SheetDocumento12 pagineConsolidated Balance Sheet Consolidated Balance SheetAbu Ammar AsrafNessuna valutazione finora

- Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) NotesDocumento3 pagineNotes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) NotesSameh Ahmed HassanNessuna valutazione finora

- MSSL Results Quarter Ended 31st December 2011Documento4 pagineMSSL Results Quarter Ended 31st December 2011kpatil.kp3750Nessuna valutazione finora

- Financial ModelDocumento38 pagineFinancial ModelufareezNessuna valutazione finora

- Fianancial StatementsDocumento84 pagineFianancial StatementsMuhammad SaeedNessuna valutazione finora

- Nigeria German Chemicals Final Results 2012Documento4 pagineNigeria German Chemicals Final Results 2012vatimetro2012Nessuna valutazione finora

- Cisco Systems, Inc. Confidential 12/4/20131:12 PMDocumento1 paginaCisco Systems, Inc. Confidential 12/4/20131:12 PMSameh Ahmed HassanNessuna valutazione finora

- ICI Pakistan Limited: Balance SheetDocumento28 pagineICI Pakistan Limited: Balance SheetArsalan KhanNessuna valutazione finora

- Electrona Financial StatementsDocumento18 pagineElectrona Financial StatementsAnonymous HVLVK4Nessuna valutazione finora

- Puma Energy Results Report q3 2016 v3Documento8 paginePuma Energy Results Report q3 2016 v3KA-11 Єфіменко ІванNessuna valutazione finora

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Documento18 pagineTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauNessuna valutazione finora

- HYUNDAI Motors Balance SheetDocumento4 pagineHYUNDAI Motors Balance Sheetsarmistha guduliNessuna valutazione finora

- 17-Horizontal & Vertical AnalysisDocumento2 pagine17-Horizontal & Vertical AnalysisRebecca HarrisonNessuna valutazione finora

- Fin AnalysisDocumento16 pagineFin AnalysisMakuna NatsvlishviliNessuna valutazione finora

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Documento14 pagineSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeNessuna valutazione finora

- Result Y15 Doc2Documento15 pagineResult Y15 Doc2ashokdb2kNessuna valutazione finora

- Financial Statements Year Ended Dec 2010Documento24 pagineFinancial Statements Year Ended Dec 2010Eric FongNessuna valutazione finora

- Hls Fy2010 Fy Results 20110222Documento14 pagineHls Fy2010 Fy Results 20110222Chin Siong GohNessuna valutazione finora

- PEL 2009 FinancialsDocumento7 paginePEL 2009 FinancialssaqibaliraoNessuna valutazione finora

- SMC Financial StatementDocumento4 pagineSMC Financial StatementHoneylette Labang YballeNessuna valutazione finora

- Wipro Financial StatementsDocumento37 pagineWipro Financial StatementssumitpankajNessuna valutazione finora

- 17 Financial HighlightsDocumento2 pagine17 Financial HighlightsTahir HussainNessuna valutazione finora

- Zimplow FY 2012Documento2 pagineZimplow FY 2012Kristi DuranNessuna valutazione finora

- GulahmedDocumento8 pagineGulahmedOmer KhanNessuna valutazione finora

- D.G Khan Cement Company Limited Income StatementDocumento25 pagineD.G Khan Cement Company Limited Income StatementadnanjeeNessuna valutazione finora

- Annual Report OfRPG Life ScienceDocumento8 pagineAnnual Report OfRPG Life ScienceRajesh KumarNessuna valutazione finora

- Question For Case Study DXY and KfimaDocumento8 pagineQuestion For Case Study DXY and KfimaKogi JeyaNessuna valutazione finora

- MeharVerma IMT CeresDocumento8 pagineMeharVerma IMT CeresMehar VermaNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonDocumento9 pagineNet Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonvenkeeeeeNessuna valutazione finora

- Bharti Airtel: Concerns Due To Currency VolatilityDocumento7 pagineBharti Airtel: Concerns Due To Currency VolatilityAngel BrokingNessuna valutazione finora

- Name Annapoorneshwari .S. UDocumento4 pagineName Annapoorneshwari .S. Uannapoorneshwari suNessuna valutazione finora

- Fin 254 Group Project ExcelDocumento12 pagineFin 254 Group Project Excelapi-422062723Nessuna valutazione finora

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryDa EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Industrial Machinery World Summary: Market Values & Financials by CountryDa EverandIndustrial Machinery World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryDa EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Brake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryDa EverandBrake, Front End & Wheel Alignment Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryDa EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Session 1-2Documento34 pagineSession 1-2kheriaankitNessuna valutazione finora

- Reduced Rate Countries 2013Documento1 paginaReduced Rate Countries 2013kheriaankitNessuna valutazione finora

- MR Revision QuesDocumento25 pagineMR Revision QueskheriaankitNessuna valutazione finora

- Spring Specialisations List Updated 10062021Documento19 pagineSpring Specialisations List Updated 10062021ashokNessuna valutazione finora

- Helios Power Solutions: Presented byDocumento28 pagineHelios Power Solutions: Presented bylalith vamsiNessuna valutazione finora

- Yusoph Hassan F. Macarambon BSPE 4C DEC 6, 2016 Engineering Economy & Accounting AssignmentDocumento4 pagineYusoph Hassan F. Macarambon BSPE 4C DEC 6, 2016 Engineering Economy & Accounting AssignmentHassan MacarambonNessuna valutazione finora

- Retail Management Unit 1Documento33 pagineRetail Management Unit 1Richa Garg100% (1)

- 爭議帳款聲明書Documento2 pagine爭議帳款聲明書雞腿Nessuna valutazione finora

- Firm Behaviour: Microeconomics (Exercises)Documento9 pagineFirm Behaviour: Microeconomics (Exercises)Камилла МолдалиеваNessuna valutazione finora

- Calculation For Shovel and Trucks Cost Using Cater Pillar MethodDocumento3 pagineCalculation For Shovel and Trucks Cost Using Cater Pillar MethodTaonga SimariNessuna valutazione finora

- Becg m-4Documento25 pagineBecg m-4CH ANIL VARMANessuna valutazione finora

- Pso Summer Internship ReportDocumento19 paginePso Summer Internship ReportMaria Masood100% (3)

- Standard & Poors Outlook On GreeceDocumento10 pagineStandard & Poors Outlook On GreeceEuronews Digital PlatformsNessuna valutazione finora

- Final Report11Documento28 pagineFinal Report11suvekchhya76% (17)

- VWV2023 - Sale Brochure (EP1) FADocumento6 pagineVWV2023 - Sale Brochure (EP1) FAsarahNessuna valutazione finora

- Klabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Documento66 pagineKlabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Klabin_RINessuna valutazione finora

- Week 6 Financial Accoutning Homework HWDocumento7 pagineWeek 6 Financial Accoutning Homework HWDoyouknow MENessuna valutazione finora

- Tiyasha Guha CG Law343 17.09Documento2 pagineTiyasha Guha CG Law343 17.09raj vardhan agarwalNessuna valutazione finora

- Addis Ababa University College of Development StudiesDocumento126 pagineAddis Ababa University College of Development StudieskindhunNessuna valutazione finora

- CPChem (Ras Laffan Petrochem) T&Cs Qatar v2 (301023)Documento2 pagineCPChem (Ras Laffan Petrochem) T&Cs Qatar v2 (301023)mahisoftsol1Nessuna valutazione finora

- Mawb LR 749-30816310Documento1 paginaMawb LR 749-30816310Hemant PrakashNessuna valutazione finora

- Adverbial ClauseDocumento3 pagineAdverbial ClausefaizzzzzNessuna valutazione finora

- Audit of The Capital Acquisition and Repayment CycleDocumento7 pagineAudit of The Capital Acquisition and Repayment Cyclerezkifadila2Nessuna valutazione finora

- EXEC 870-3 e - Reader - 2016Documento246 pagineEXEC 870-3 e - Reader - 2016Alexandr DyadenkoNessuna valutazione finora

- Eclectica Agriculture Fund Feb 2015Documento2 pagineEclectica Agriculture Fund Feb 2015CanadianValueNessuna valutazione finora

- The Impact of Food Quality On Customer Satisfaction and Behavioural Intentions: A Study On Madurai RestaurantDocumento5 pagineThe Impact of Food Quality On Customer Satisfaction and Behavioural Intentions: A Study On Madurai RestaurantJohn Francis SegarraNessuna valutazione finora

- G11 Organization Management Q1 L4Documento4 pagineG11 Organization Management Q1 L4Cherry CieloNessuna valutazione finora