Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Superior Manufacturing

Caricato da

Cordel TwoKpsi TaildawgSnoop CookCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Superior Manufacturing

Caricato da

Cordel TwoKpsi TaildawgSnoop CookCopyright:

Formati disponibili

MEMORANDUM

TO: Herbert Waters, President, Superior Manufacturing Company

CC: Dr. DeWayne Searcy, University of Miami

FROM: Eric Antmann, Cordel Cook, Joshua Jordan, Sam Matthew, Fabiano Praca, Sathvika

Ramaji, and Raul Velarde, Hurricane Consulting Engineers

DATE: January 30th, 2015

SUBJECT: Cost Accounting System Analysis and Recommendations

Hurricane Consulting Engineers (the Analyst) has completed an analysis of the cost accounting

system utilized at Superior Manufacturing Company and submits the findings in this

Memorandum. Should you have any further questions please do let us know.

Introduction

The Superior Manufacturing Company manufactures three industrial products: 101, 102, and

103. Superior manufactures products based on a dedicated factory concept, meaning each

product is produced in a separate warehouse with a dedicated direct labor force with indirect

labor floating between factories. These factories also include raw material storage, receiving,

production-process facilities, finished-product inventory, and shipping. After several poor

management decisions primarily by the old president, the organization had suffered and caused a

net loss of $688,000 at the end of 2004. Since then Waters, has decided to review figures for the

first-half of 2005 to make better sense of what decisions to make.

Superior competes with a group of eight companies in the New England area, some of

which are larger and offer a greater range of products. Each company sells a similar product and

the largest company, Samra, releases its selling prices at the end of each year by which the

smaller companies must match to remain competitive. This can have a damaging effect for the

smaller companies because if prices were cut by Samra they would have to match prices and

subsequently reduce their profits. During 2004, Superiors share of industry sales was 12%, 8%,

and 10% for product 101, 102 and 103 respectively.

By utilizing a simple cost system Superior is able to efficiently track the cost of

production for each product and use to value inventories, prepare budges and analyze present and

future performance. Since each product is produced separately with its own group of dedicated

workers, accounting followed this method to easily track all direct and indirect costs (the two

January 23, 2015

Page 2 of 5

categories of Superiors cost allocation system. The following are important points of Superiors

cost system:

1. Unit costs were expressed in terms of 100 pounds of finished product cost. Per 100pound rent cost of each product =unit output/respective factory rent (based on cubic

space)

2. Total cost = Factory direct cost + allocated indirect costs (which includes interest on

loans)

3. Costs were assigned directly to each individual product factory.

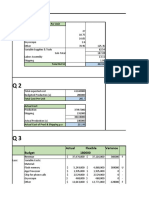

Drop or Keep Product 103?

By analyzing the years sales for 2004 and first half of 2005 for profit and loss it shows that

product 103 is operating at a loss of in both statements (2.2 million and 1 million respectively).

At a glance this could seem that 103 is draining resources and should be dropped from

production. But by simple cost analytics we can determine the true value of product 103. It

should be noted that there are more methods to analyze the cost data from Superiors accountants,

but we will only discuss the techniques described in class. By computing a contribution margin

of product 103 we can see value in the product. The following table shows the variable costs,

selling price and calculated contribution margin of product 103:

Variable Costs

Compensation

Insurance

Direct Labor

Power

Materials

Supplies

Repairs

0.46

6.97

0.31

4.91

0.36

0.10

13.11

Selling Price

with discount

Contribution

Margin

$

27.03

$

13.92

As the table shows, superior produces a product with a contribution margin of $13.92

which constitutes 51.5% of the total selling price. This indeed shows the product has potential to

make profit for the company. By producing more units, increasing sales the company could

January 23, 2015

Page 3 of 5

breakeven and begin to make a profitable product. If Superior dropped product 103 this would

bring as loss to all the non-variable and fixed costs, would cause a drop in sales, and would have

to renegotiate the factory rental agreement (a large portion of revenue expense) to offset this

decision. In addition, dropping product 103 would create a boom in excess capacity from which

a large portion of workers would have to be restructured or laid off in order to remain profitable

for product 101 and 102. If direct labor force were kept and the current market share remained

rigid then prices would have to drop dramatically to keep sales up, further reducing the

contribution margin. Overall we believe 103 should be continued into production and as sales

gradually increase in the long-term the product could bring valuable profit to the company.

Lower Price of Product 101? (as of January 1, 2006)

As we know, the sales for the first half of 2005 were still weak, Waters has deliberated on

the future scenario of pricing for product 101. As this is a competitive market, largely dictated by

Samras price setting, Superior has to be careful on where it places it price point. Waters made

two forecasts of the company sales of first semester 2006. The first one was to maintain the

original price of $24.5 while the second one was lowering the price to $22.5 as the competitors

planned to do. Maintaining the previous price Waters forecasted to reach 750, 000 units sales,

while reducing the price as Samra has planned to do, he forecasted 1,000,000 unit sales. The

following is a table producing a contribution margin of the product at both price points. It is

important to note that all prices have remained the same as the previous year with the exception

of materials and supplies which were predicted to drop by 5% below the 2005 standard.

$22.50

$24.50

January 23, 2015

Page 4 of 5

Variable Costs

Compensation

Insurance

Direct Labor

Power

Materials

Supplies

Repairs

$

0.39

$

6.06

$

0.11

$

3.41

$

0.24

$

0.08

$

10.29

$

0.39

$

6.06

0.11

$

3.41

$

0.24

$

0.08

$

10.29

Selling Price

Selling price

with discount

Contribution

Margin

Units Sold

Total Contribution

Margin

$

22.50

$

22.26

$

11.97

1,000,000

$

11,969,000

$

24.50

$

24.24

$

13.95

750,000

$10,460,55

0

By forecasting the sales figures with the predicted price points and unit sales, each

scenario Superior would be at a great loss, and would not be profitable. The contribution margin

calculation offers little insight to a solution to this problem, though favors the lower price largely

due to the increased units sold. Analyzing this solution from a strategic point of view, setting the

price to $23.00 with total sales at 975,000 will let us to reduce the losses, however this would

only be a short term solution due to the fact that maintaining this price higher than the one of

competitors in long term will likely lead to Superior lose market share.

Why did Superior improve profitability From Jan 1st to June

30th, 2005?

The 2005 statement was useful because it provided feedback on Waters decision to not make

changes at the end of 2004. The statements were increased in detail, showing cumulative costs

and variances of total company actual cots. Though the fundamental flaw of the 2005 statement

is that they did the determine actual product line reventues, costs and products. Instead unit

January 23, 2015

Page 5 of 5

prices were predicted and were not tailored to the current market. This way, Superior can not

accurately determine

Cost-System Appraisal

It is extremely important for Superior to have an effective cost system. This way the

company can actively monitor and predict its finances and give current feedback on whether

there management decisions are creating positive impact on the company. With a company such

as Superiors, the structure of the company offers little flexibility, as each factory at acts

independently from each other. This creates problems since each product factory has to be

assessed individually. By carefully tracking expenses Superior is able to make better judgments

on the progress of the company.

The strengths of this system are that is can be easily carried out at low cost, with good

punctuality, and covers the full costs of the company. By using the given data you can predict

accurate cost data and make good predictions. Though is does lack detail, and would benefit by

creating monthly cost analysis with further breakdown of costs.

Potrebbero piacerti anche

- Ome Case Study: Harman Foods, Inc. Section B: Group 02: Prudviraj - Priyanka - Joel - KarthikaDocumento4 pagineOme Case Study: Harman Foods, Inc. Section B: Group 02: Prudviraj - Priyanka - Joel - KarthikakarthikawarrierNessuna valutazione finora

- Case 34 - The Wm. Wrigley Jr. CompanyDocumento72 pagineCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Ma Case WriteupDocumento4 pagineMa Case WriteupMayank Vyas100% (1)

- Hallstead JewelersDocumento9 pagineHallstead Jewelerskaran_w350% (4)

- Salem CaseDocumento4 pagineSalem CaseChris Dunham100% (3)

- Jackson AutomotiveDocumento3 pagineJackson AutomotiveErika Theng25% (4)

- Destin Brass Case Study SolutionDocumento5 pagineDestin Brass Case Study SolutionAmruta Turmé100% (2)

- Stuart DawDocumento2 pagineStuart DawMike ChhabraNessuna valutazione finora

- WalthamMotors CaseAnalysisDocumento9 pagineWalthamMotors CaseAnalysisabeeju100% (5)

- Alberta Gauge Company CaseDocumento2 pagineAlberta Gauge Company Casenidhu291Nessuna valutazione finora

- Jackson Automotive Systems ExcelDocumento5 pagineJackson Automotive Systems Excelonyechi2004Nessuna valutazione finora

- Prestige Data ServicesDocumento2 paginePrestige Data ServicesSubrata Dass100% (4)

- Superior Manufacturing Company MpettesDocumento8 pagineSuperior Manufacturing Company Mpettesapi-250891173100% (5)

- Accounts Case StudyDocumento9 pagineAccounts Case Studydhiraj agarwalNessuna valutazione finora

- Hilton Manufacturing Company 1201326783827489 2Documento6 pagineHilton Manufacturing Company 1201326783827489 2julijulijulioNessuna valutazione finora

- Hilton Manufacturing Company 1201326783827489 2Documento6 pagineHilton Manufacturing Company 1201326783827489 2Bilal Asim0% (1)

- Managerial Accounting - Hallstead Jewelers CaseDocumento2 pagineManagerial Accounting - Hallstead Jewelers Casesxzhou23100% (1)

- Kanthal Activity-Based CostingDocumento13 pagineKanthal Activity-Based CostingRaymon AquinoNessuna valutazione finora

- Wlatham SolutionDocumento3 pagineWlatham Solutionadi_santhi100% (7)

- Bill French - AccountantDocumento6 pagineBill French - AccountantRahul BakshiNessuna valutazione finora

- Kanthal Case Study SolutionsINTRODUCTIONKanthal Is Comp Termpaper Essay Studies Test 1071194975Documento5 pagineKanthal Case Study SolutionsINTRODUCTIONKanthal Is Comp Termpaper Essay Studies Test 1071194975rahuldesai1189Nessuna valutazione finora

- Case Study - Destin Brass Products CoDocumento6 pagineCase Study - Destin Brass Products CoMISRET 2018 IEI JSCNessuna valutazione finora

- BBO2020Documento41 pagineBBO2020qiuNessuna valutazione finora

- Selligram Case Answer KeyDocumento3 pagineSelligram Case Answer Keysharkss521Nessuna valutazione finora

- Hilton Case1Documento2 pagineHilton Case1Ana Fernanda Gonzales CaveroNessuna valutazione finora

- Superior Manufacturing CaseDocumento4 pagineSuperior Manufacturing Casenand bhushan100% (1)

- Case-Bill FrenchDocumento3 pagineCase-Bill FrenchthearpanNessuna valutazione finora

- SUBJECT: Analyses and Recommendations For The Different Cost AccountingDocumento4 pagineSUBJECT: Analyses and Recommendations For The Different Cost AccountinglddNessuna valutazione finora

- Bill FrenchDocumento6 pagineBill FrenchRohit AcharyaNessuna valutazione finora

- Destin BrassDocumento5 pagineDestin Brassdamanfromiran100% (1)

- Bill French Case - FINALDocumento6 pagineBill French Case - FINALdamanfromiran0% (1)

- Glaxo ItaliaDocumento11 pagineGlaxo ItaliaLizeth RamirezNessuna valutazione finora

- Halstead JewlersDocumento8 pagineHalstead JewlersZeeshan Ali100% (1)

- Miles High Cycles Katherine Roland and John ConnorsDocumento4 pagineMiles High Cycles Katherine Roland and John ConnorsvivekNessuna valutazione finora

- Merrimack Tractors and MowersDocumento10 pagineMerrimack Tractors and MowersAtul Bhatia0% (1)

- Destin Brass FinalDocumento10 pagineDestin Brass FinalKim Garver100% (2)

- Dhanshui PlantDocumento7 pagineDhanshui PlantAkanksha Nikita Khalkho100% (1)

- Group 2 - Danshui Plant Case Study - SolutionDocumento6 pagineGroup 2 - Danshui Plant Case Study - SolutionArindam MandalNessuna valutazione finora

- Hilton Case1Documento2 pagineHilton Case1Ken KandellNessuna valutazione finora

- Jones Electrical DistributionDocumento4 pagineJones Electrical Distributioncagc333Nessuna valutazione finora

- Fuel SalesDocumento11 pagineFuel SalesFabiola SE100% (1)

- Bill French - Write Up1Documento10 pagineBill French - Write Up1Nina EllyanaNessuna valutazione finora

- Prestige Telephone Company - Question 1Documento1 paginaPrestige Telephone Company - Question 1Kim Alexis MirasolNessuna valutazione finora

- Berkshire Toy CompanyDocumento25 pagineBerkshire Toy CompanyrodriguezlavNessuna valutazione finora

- Group 5 PresentationDocumento73 pagineGroup 5 PresentationSourabh Arora100% (4)

- Exhibits of Blaine Kitchenware, Inc - CaseDocumento6 pagineExhibits of Blaine Kitchenware, Inc - CaseSadam Lashari100% (3)

- Destin Brass Products Co Case WorksheetDocumento2 pagineDestin Brass Products Co Case WorksheetManishNessuna valutazione finora

- Industrial Grinders NVDocumento6 pagineIndustrial Grinders NVCarrie Stevens100% (1)

- Danshui Plant 2Documento13 pagineDanshui Plant 2Bernard EugineNessuna valutazione finora

- Industrial Grinders N VDocumento9 pagineIndustrial Grinders N Vapi-250891173100% (3)

- Running Head: HALLSTEAD JEWELERS 1Documento12 pagineRunning Head: HALLSTEAD JEWELERS 1KathGu100% (1)

- Des Tin BrassDocumento7 pagineDes Tin Brassfundu123100% (9)

- Bridgeton HWDocumento3 pagineBridgeton HWravNessuna valutazione finora

- Group 4 Project 3 (Rev 1)Documento10 pagineGroup 4 Project 3 (Rev 1)Ashley Winters100% (1)

- Elwy Melina-Sarah MHCDocumento7 pagineElwy Melina-Sarah MHCpalak32Nessuna valutazione finora

- Destin Brass AnalysisDocumento2 pagineDestin Brass AnalysisGlenn HengNessuna valutazione finora

- Bill French Google Docs Group 5Documento7 pagineBill French Google Docs Group 5Jay Florence DalucanogNessuna valutazione finora

- f5 2012 Jun Q PDFDocumento7 paginef5 2012 Jun Q PDFcatcat1122Nessuna valutazione finora

- UntitledDocumento4 pagineUntitledWiLliamLoquiroWencesLaoNessuna valutazione finora

- c5 PDFDocumento28 paginec5 PDFDhanny MiharjaNessuna valutazione finora

- Cost & Managerial Accounting II EssentialsDa EverandCost & Managerial Accounting II EssentialsValutazione: 4 su 5 stelle4/5 (1)

- 120 Câu Tìm Từ Đồng Nghĩa-Trái Nghĩa-Dap AnDocumento9 pagine120 Câu Tìm Từ Đồng Nghĩa-Trái Nghĩa-Dap AnAlex TranNessuna valutazione finora

- The Function and Importance of TransitionsDocumento4 pagineThe Function and Importance of TransitionsMarc Jalen ReladorNessuna valutazione finora

- Travelstart Ticket (ZA10477979) PDFDocumento2 pagineTravelstart Ticket (ZA10477979) PDFMatthew PretoriusNessuna valutazione finora

- Facultybooklet2011-2012final - 006 (Unlocked by WWW - Freemypdf.com)Documento199 pagineFacultybooklet2011-2012final - 006 (Unlocked by WWW - Freemypdf.com)kalam19892209Nessuna valutazione finora

- The Consulting Industry and Its Transformations in WordDocumento23 pagineThe Consulting Industry and Its Transformations in Wordlei ann magnayeNessuna valutazione finora

- Daftar Harga Toko Jeremy LengkapDocumento2 pagineDaftar Harga Toko Jeremy LengkapSiswadi PaluNessuna valutazione finora

- Wits Appraisalnof Jaw Disharmony by JOHNSONDocumento20 pagineWits Appraisalnof Jaw Disharmony by JOHNSONDrKamran MominNessuna valutazione finora

- Amine Processing Unit DEADocumento9 pagineAmine Processing Unit DEAFlorin Daniel AnghelNessuna valutazione finora

- Final Matatag Epp Tle CG 2023 Grades 4 10Documento184 pagineFinal Matatag Epp Tle CG 2023 Grades 4 10DIVINE GRACE CABAHUGNessuna valutazione finora

- GSM Radio ConceptsDocumento3 pagineGSM Radio ConceptsMD SahidNessuna valutazione finora

- Huawei - ESM48100 - User ManualDocumento44 pagineHuawei - ESM48100 - User ManualNguyen Minh ThanhNessuna valutazione finora

- Geography NotesDocumento2 pagineGeography NotesMinethegroundNessuna valutazione finora

- Corregidor Title DefenseDocumento16 pagineCorregidor Title DefenseJaydee ColadillaNessuna valutazione finora

- Technical and Business WritingDocumento3 pagineTechnical and Business WritingMuhammad FaisalNessuna valutazione finora

- Sco 8th Class Paper - B Jee-Main Wtm-15 Key&Solutions Exam DT 17-12-2022Documento4 pagineSco 8th Class Paper - B Jee-Main Wtm-15 Key&Solutions Exam DT 17-12-2022Udaya PrathimaNessuna valutazione finora

- Ch04Exp PDFDocumento17 pagineCh04Exp PDFConstantin PopescuNessuna valutazione finora

- DS SX1280-1-2 V3.0Documento143 pagineDS SX1280-1-2 V3.0bkzzNessuna valutazione finora

- Brachiocephalic Artery: AnteriorDocumento37 pagineBrachiocephalic Artery: AnteriorFarah FarahNessuna valutazione finora

- Appendix 3 COT RPMS For T I III SY 2020 2021 in The Time of COVID 19Documento12 pagineAppendix 3 COT RPMS For T I III SY 2020 2021 in The Time of COVID 19Marjun PachecoNessuna valutazione finora

- DU Series MCCB CatalogueDocumento8 pagineDU Series MCCB Cataloguerobinknit2009Nessuna valutazione finora

- 1000 KilosDocumento20 pagine1000 KilosAbdullah hayreddinNessuna valutazione finora

- 24 Inch MonitorDocumento10 pagine24 Inch MonitorMihir SaveNessuna valutazione finora

- Eureka Math Grade 2 Module 3 Parent Tip Sheet 1Documento2 pagineEureka Math Grade 2 Module 3 Parent Tip Sheet 1api-324573119Nessuna valutazione finora

- PBPO008E FrontmatterDocumento13 paginePBPO008E FrontmatterParameswararao Billa67% (3)

- Internal Gear Pump: Replaces: 03.08 Material No. R901216585 Type PGH.-3XDocumento36 pagineInternal Gear Pump: Replaces: 03.08 Material No. R901216585 Type PGH.-3XbiabamanbemanNessuna valutazione finora

- Corporate Valuation WhartonDocumento6 pagineCorporate Valuation Whartonebrahimnejad64Nessuna valutazione finora

- Bofa Turkish Banks-Back On The RadarDocumento15 pagineBofa Turkish Banks-Back On The RadarexperhtmNessuna valutazione finora

- 762id - Development of Cluster-7 Marginal Field Paper To PetrotechDocumento2 pagine762id - Development of Cluster-7 Marginal Field Paper To PetrotechSATRIONessuna valutazione finora

- Advanced Statistical Approaches To Quality: INSE 6220 - Week 4Documento44 pagineAdvanced Statistical Approaches To Quality: INSE 6220 - Week 4picalaNessuna valutazione finora