Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Gap Waiver

Caricato da

kyle2fitzgeraldDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Gap Waiver

Caricato da

kyle2fitzgeraldCopyright:

Formati disponibili

Installment Sales Contract/Loan GAP Waiver Addendum Election Form

Please carefully review all of the terms and conditions of the GAP Waiver Addendum prior to signing.

Borrower

Account Number

Borrower Address

Seller/Lender Address

City

State

Vehicle Year

Seller/Lender

Make

ZIP

Model

Vehicle ID Number (VIN)

MSRP/NADA

Mileage

City

State

ZIP

GAP Waiver Date

Loan Officer

Loan Date

Amount Financed

Term in Months

APR

Monthly Payment

%

YES, You elect the GAP Waiver.

You understand that the purchase of the GAP Waiver Addendum is voluntary and is not required by the Seller/Lender to

obtain credit. You understand that this GAP Waiver Addendum is not an offer of insurance coverage. You understand that by

purchasing the GAP Waiver Addendum for your installment sales contract or loan that the Seller/Lender waives, in the event of a

Total Loss, Constructive Total Loss or Un-recovered Theft, its contractual right to hold you liable for the GAP Amount, subject to the

provisions and exclusions identified on this election form. You understand that this GAP Waiver addendum is not a substitute for

collision or property damage insurance. You understand that the Seller/Lender may retain all of the one-time fee, or pay a portion to a

third party as a service fee, or for indemnification.

The one-time cost is: $ _______________ (please see Cancellation/Refunds on reverse)

Signature:

Date:

Date:

Signature:

This Waiver does not include:

1. Any refundable additions to amount financed

5. Primary Insurance deductible in excess of $1,000*

2. Interest Accrued after the Date of Loss

6. Portion of installment sales contract/loan at loan inception

3. Delinquent Payments > 60 Days Past Due

date that exceeds 150% of MSRP (new cars) or 150% of

4. Late charges, fees, extensions and/or funds added

NADA average retail book value (used cars).

after installment sales contract/loan inception

*The Primary Insurance deductible is waived only to the extent it is part of the GAP Amount. Primary insurance carrier deductible

coverage is prohibited for installment sales contracts/loans originating in Arkansas or New York.

No, You do not elect the GAP Waiver.

In the event your vehicle is stolen or a total loss and your insurance company pays less than the unpaid net balance of your installment

sales contract/loan, you understand you will be fully responsible for any deficiency balance.

Signature:

Date:

Signature:

Date:

White Borrower Copy

GAP STD NR /Frost Rev (7/06)

Yellow- Administrator Copy

Pink Lender Copy

TERMS AND CONDITIONS OF THE GAP WAIVER ADDENDUM

This GAP Waiver Addendum is incorporated into and supplements the terms of the Installment Sales Contract/Loan. By electing this GAP Waiver

Addendum, the Debtor agrees to the terms below and on the reverse side, which are incorporated by reference into this Addendum.

DEFINITIONS

For the purposes of this Installment Sales Contract/Loan GAP Waiver Addendum, the following words are defined and their meanings will be as follows:

We, us, and our refer to the seller/lender; you and your means the borrower/debtor/buyer.

GAP Amount means the difference between the primary carriers physical damage insurance payment for a theft or total loss or, if uninsured, the

collaterals Actual Cash Value and the unpaid net balance of the installment sales contract/loan. If you are entitled to collect the same from others, including

but not limited to, primary and other insurance, or salvage sale, that portion of the payment will not be covered in the GAP settlement. GAP does not cover

deductions made by the primary insurance carrier for prior damage that has already been paid to you or due to prior salvaged title. Amount waived shall not

exceed $50,000 in total.

Total Loss or Constructive Total Loss means a loss where the cost to repair or replace the collateral would exceed the Actual Cash Value.

Un-recovered Theft means the covered collateral has been reported as stolen by you to both the police and primary insurance carrier, who have made

every effort, yet have failed to find and return the covered collateral.

Actual Cash Value means the amount determined by the primary insurance carrier at the time of loss. However, if there is no primary insurance at the

time of a loss, Actual Cash Value shall mean the retail value of the collateral using the National Automobile Dealers Association (NADA) Official Used Car

guide with appropriate adjustments for mileage or optional equipment.

Primary Insurance means in force insurance coverage, required by us, and carried by you to protect the covered collateral from collision and

comprehensive loss, naming us as Loss Payee or Lienholder. Additionally, primary insurance shall be any other coverage we may have protecting our

interest in the covered collateral, contingent upon the failure or absence or primary insurance coverage.

Unpaid Net Balance means the amount owed by you to clear the outstanding installment sales contract/loan account upon the date of loss. This amount

may not include any unearned finance charges or interest; installment sales contract/loan charges; late charges; deferred payment; any delinquent payments;

any uncollected service charges; refundable prepaid taxes and fees; or any other proceeds you may duly recover by canceling insurance coverages; service

contracts; warranties, disposition fees, termination fees, penalty fees, or other items built into or added to the initial installment sales contract/loan balance.

Delinquent Payments means any payment, as described in the installment sales contract/loan instrument, which remains unpaid for a period of more than

sixty (60) days after the due date stated in the installment sales contract/loan instrument.

Multiple Collateral If two or more pieces of covered collateral are secured under the installment sales contract/loan agreement, we will not pay more than

a proportionate share of the total unpaid net balance that each piece of covered collateral represents to the total loan.

INSTALLMENT SALES CONTRACT/LOAN GAP WAIVER ADDENDUM

In consideration for the payment of the cost shown on the reverse side of this form, we will waive the GAP Amount due to a total loss, constructive total loss

or an unrecovered theft to the collateral shown on the reverse side of this form. The deductible is waived only to the extent it is part of the GAP Amount.

Our maximum waiver shall be the GAP Amount including, if the collateral is protected by primary insurance, up to $1,000 for the primary insurance

deductible. If the collateral is not protected by primary insurance, we will waive only the GAP Amount obtained by subtracting the Actual Cash Value of the

covered collateral from the unpaid net balance and you will remain responsible for the Actual Cash Value of the collateral. We will not waive the portion of

the unpaid net balance attributable to the original installment sales contract/loan amount exceeding 150% of the Manufacturers Suggested Retail Price

(MSRP) on new cars, or 150% of NADA average retail book value on used cars, including all refundable items such as service contracts, warranties,

insurance, or other such items.

CANCELLATION/REFUNDS

This GAP Waiver Addendum may be canceled for a full refund within sixty (60) days of the Origination Date for any reason. However, in the event of a

Total Loss, Constructive Total Loss or Unrecovered Theft of the covered Vehicle, the GAP Waiver Addendum fee will be deemed as fully earned and

therefore, no refund will be due. This Installment Sales Contract/Loan GAP Waiver Addendum is fully earned and non-refundable after sixty (60)

days from the Origination Date, unless otherwise required by applicable state regulations.

ELIGIBILITY REQUIREMENTS, CONDITIONS AND EXCLUSIONS

There are Eligibility requirements, Conditions and Exclusions that could prevent you from receiving benefits under the GAP Waiver Addendum. Please

review the (6) six Exclusions listed on the reverse side of the Addendum. This GAP Waiver does not apply when the total loss or theft is: (1) to a vehicle

that is part of a fleet that is intended for use as a public or livery conveyance, or any vehicle with commercial use; (2) due to war, whether or not declared,

invasion, civil war, insurrection, rebellion or revolution; (3) due to wear and tear, freezing, mechanical or electrical breakdown of failure; (4) resulting from

forgery; (5) resulting directly or indirectly from any fraudulent act by the borrower; (6) is to a vehicle with a salvage title; (7) arising from a defect in

title which existed at the time the instrument was written or became effective; (8) caused intentionally by the borrower; (9) due to conversion,

embezzlement or secretion by any person in lawful possession of the covered collateral; (10) due to legal confiscation by a public official; (11) to other than

the standard or optional equipment available from the manufacturer of the covered collateral; (12) sustained outside of the United States of America, its

territories or possessions, Canada and the Republic of Mexico; (13) due to losses occurring prior to the GAP Waiver effective date.

NOTICE OF LOSS

You must notify us within 90 days of receiving final settlement from the primary or third party insurance carrier and provide the following: (a) copy of the

insurance settlement, (b) verification of the insurance deductible, (c) copy of police report in the case of an unrecovered theft.

IMPORTANT NOTICE

You are solely responsible for the payment of any and all Taxes you may owe due to

the discharge of your debt under this Addendum. You may wish to consult with a tax professional.

You are reminded that this GAP Waiver is not an insurance policy.

All provisions within this Waiver are subject to state specific regulations.

White Borrower Copy

GAP STD NR /Frost Rev (7/06)

Yellow- Administrator Copy

Pink Lender Copy

Potrebbero piacerti anche

- Car InsuranceDocumento34 pagineCar InsurancesuithinkNessuna valutazione finora

- CoverPlus $100 ExcessDocumento12 pagineCoverPlus $100 ExcessPerhan LauNessuna valutazione finora

- Infinite Rentcar Web EnglishDocumento3 pagineInfinite Rentcar Web EnglishGeosNessuna valutazione finora

- CSC Private Car Eng Ver 1.1 10.04.19 06.01.2020Documento8 pagineCSC Private Car Eng Ver 1.1 10.04.19 06.01.2020Haikal MashkovNessuna valutazione finora

- Is Your Insurance Company Listening To You?Documento10 pagineIs Your Insurance Company Listening To You?beingviswaNessuna valutazione finora

- Digit Private Car Stand Alone Damage Add-On Cover - WordingsDocumento21 pagineDigit Private Car Stand Alone Damage Add-On Cover - Wordingsashokdas test5Nessuna valutazione finora

- Car Hire Policy DocumentDocumento19 pagineCar Hire Policy DocumentGabor SzucsNessuna valutazione finora

- Auto365 Comprehensive Premier - PDS - Kur - ENG - 1022Documento4 pagineAuto365 Comprehensive Premier - PDS - Kur - ENG - 1022Kanggatharan MunusamyNessuna valutazione finora

- AD116 - Policybook - 0110Documento60 pagineAD116 - Policybook - 0110johndkellyNessuna valutazione finora

- Nrma Business PolicyDocumento104 pagineNrma Business PolicyAnon BoletusNessuna valutazione finora

- Private Car Stand Alone Own Damage Add - On CoverDocumento19 paginePrivate Car Stand Alone Own Damage Add - On CoverParul SinghNessuna valutazione finora

- Private Car Stand Alone Own Damage Add - On CoverDocumento18 paginePrivate Car Stand Alone Own Damage Add - On CoverRaj PurusothamanNessuna valutazione finora

- Opcf 43Documento1 paginaOpcf 43MarketplaceNessuna valutazione finora

- 2023 - 07 - Terms of Business v5.9 Live Date 04.09.2023Documento9 pagine2023 - 07 - Terms of Business v5.9 Live Date 04.09.2023Talib HussainNessuna valutazione finora

- CSC Motorcycle Eng Ver 1.1 10.04.19 06.01.2020Documento8 pagineCSC Motorcycle Eng Ver 1.1 10.04.19 06.01.2020Haikal MashkovNessuna valutazione finora

- Motor Insurance HandbookDocumento10 pagineMotor Insurance HandbookdaramanishNessuna valutazione finora

- Credit Guarantee Policy DocumentDocumento10 pagineCredit Guarantee Policy Documentchaka2002Nessuna valutazione finora

- Amex Terms and ConditionsDocumento5 pagineAmex Terms and ConditionsJohn StephensNessuna valutazione finora

- Terms of BusinessDocumento9 pagineTerms of Businessksenos.ukNessuna valutazione finora

- Magallanes Broker AgreementDocumento15 pagineMagallanes Broker AgreementKyle LampetNessuna valutazione finora

- Hertz VIR20150630Documento2 pagineHertz VIR20150630Sal SNessuna valutazione finora

- Vehicle Lease AgreementDocumento6 pagineVehicle Lease AgreementDebasis PatraNessuna valutazione finora

- Digit Commercial Vehicle Package Policy (Miscellaneous and Special Types of Vehicle) Add On CoversDocumento15 pagineDigit Commercial Vehicle Package Policy (Miscellaneous and Special Types of Vehicle) Add On CoversWPP 3204Nessuna valutazione finora

- Comprehensive Car Insurance PolicyDocumento27 pagineComprehensive Car Insurance Policym8562Nessuna valutazione finora

- Takaful MyMotor Motor PDS ENGDocumento4 pagineTakaful MyMotor Motor PDS ENGNamirahMujahidahSyahidahNessuna valutazione finora

- Digit Private Private Car PolicyDocumento15 pagineDigit Private Private Car PolicyHabib HussainNessuna valutazione finora

- Covernote of Krishendu RoyDocumento1 paginaCovernote of Krishendu Royanon_3913650Nessuna valutazione finora

- Digit Private Car PolicyDocumento15 pagineDigit Private Car PolicyLegal NoticeNessuna valutazione finora

- Zurich Motor Disclosure SheetDocumento6 pagineZurich Motor Disclosure SheetSyazwan SuhaimiNessuna valutazione finora

- Car PEDG 25022021Documento3 pagineCar PEDG 25022021Tsheltrim DorjiNessuna valutazione finora

- Allianz General Insurance Company (Malaysia) BerhadDocumento6 pagineAllianz General Insurance Company (Malaysia) BerhadSiti Nurazlin FariddunNessuna valutazione finora

- ZGTMB Z-Driver PDS - ENGDocumento3 pagineZGTMB Z-Driver PDS - ENGAzizul YahayaNessuna valutazione finora

- ZGIMB Motor Insurance PDS ENG HODocumento6 pagineZGIMB Motor Insurance PDS ENG HONurul IzzatiNessuna valutazione finora

- Our Terms and ConditionsDocumento23 pagineOur Terms and ConditionsU1162498Nessuna valutazione finora

- MyECP Terms and ConditionsDocumento1 paginaMyECP Terms and Conditionsgoyneser1Nessuna valutazione finora

- Product Disclosure Sheet: Pacific & Orient Insurance Co. BerhadDocumento4 pagineProduct Disclosure Sheet: Pacific & Orient Insurance Co. BerhadHamzah AzizanNessuna valutazione finora

- Terms of BusinessDocumento5 pagineTerms of BusinessmoNessuna valutazione finora

- Digit Private Car Policy: 6,381 Words That Can Be Summed Up in Two "You're Covered."Documento15 pagineDigit Private Car Policy: 6,381 Words That Can Be Summed Up in Two "You're Covered."Madhu ShyoranNessuna valutazione finora

- Digit Private Car Policy: 6,381 Words That Can Be Summed Up in Two "You're Covered."Documento15 pagineDigit Private Car Policy: 6,381 Words That Can Be Summed Up in Two "You're Covered."Madhu ShyoranNessuna valutazione finora

- Commercial 147 Policy File RefDocumento12 pagineCommercial 147 Policy File RefBaciu DanielNessuna valutazione finora

- Budget Terms and ConditionsDocumento32 pagineBudget Terms and Conditionsgringhidu gehtdichnichtsangoogleNessuna valutazione finora

- Sompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetDocumento6 pagineSompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetMuhammad Shamaran AbdullahNessuna valutazione finora

- Policy PLATINUM EUDocumento19 paginePolicy PLATINUM EUmeNessuna valutazione finora

- Policy DocumentDocumento9 paginePolicy DocumentDiana DuțuNessuna valutazione finora

- Extended Warranty Terms & Conditions For Cardholders in The United Arab Emirates Table of BenefitsDocumento7 pagineExtended Warranty Terms & Conditions For Cardholders in The United Arab Emirates Table of BenefitsjohnNessuna valutazione finora

- Digit Private Car (Bundled) - Add-OnsDocumento21 pagineDigit Private Car (Bundled) - Add-OnsVrishti PrajapatiNessuna valutazione finora

- Digit Private Car (Bundled) - Add-OnsDocumento20 pagineDigit Private Car (Bundled) - Add-OnsRAVJEET SINGH LUTHRANessuna valutazione finora

- Amex Extended WarrantyDocumento23 pagineAmex Extended Warrantyganbare112Nessuna valutazione finora

- Extended Cover Insurance Policy Terms and Conditions: UnrestrictedDocumento12 pagineExtended Cover Insurance Policy Terms and Conditions: UnrestrictedElijahNessuna valutazione finora

- Car Insurance Policy BookletDocumento28 pagineCar Insurance Policy BookletvenunainiNessuna valutazione finora

- AIG Autoplus Private MotorDocumento2 pagineAIG Autoplus Private Motorcutiemocha1Nessuna valutazione finora

- Motor Private Car ENGDocumento4 pagineMotor Private Car ENGascap77Nessuna valutazione finora

- Best Car Insurance PlansDocumento2 pagineBest Car Insurance PlansVishal HalpatiNessuna valutazione finora

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocumento3 pagineIffco-Tokio General Insurance Co - LTD: Servicing OfficeAnonymous pKsr5vNessuna valutazione finora

- Extended Manufacturer Warranty Insurance: Proposal & Policy ScheduleDocumento21 pagineExtended Manufacturer Warranty Insurance: Proposal & Policy ScheduleFaizan FarasatNessuna valutazione finora

- Autosure EssentialDocumento5 pagineAutosure EssentialiSi_NZNessuna valutazione finora

- Policy DocumentDocumento8 paginePolicy DocumentGabriel GabrielNessuna valutazione finora

- Takaful First PartyDocumento3 pagineTakaful First Partyahrafza91Nessuna valutazione finora

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyDa EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNessuna valutazione finora

- Viva Questions For Even SemestersDocumento22 pagineViva Questions For Even SemestersSiddhanta DuttaNessuna valutazione finora

- DLL English 7-10, Week 1 Q1Documento8 pagineDLL English 7-10, Week 1 Q1Nemfa TumacderNessuna valutazione finora

- Macroeconomics Measurement: Part 2: Measurement of National IncomeDocumento13 pagineMacroeconomics Measurement: Part 2: Measurement of National IncomeManish NepaliNessuna valutazione finora

- PESTEL AnalysisDocumento2 paginePESTEL AnalysisSayantan NandyNessuna valutazione finora

- AM2020-AFP1010 Installation Programming OperatingDocumento268 pagineAM2020-AFP1010 Installation Programming OperatingBaron RicthenNessuna valutazione finora

- Body Wash Base Guide Recipe PDFDocumento2 pagineBody Wash Base Guide Recipe PDFTanmay PatelNessuna valutazione finora

- Bhakra Nangal Project1Documento3 pagineBhakra Nangal Project1Sonam Pahuja100% (1)

- Syllabus Financial AccountingDocumento3 pagineSyllabus Financial AccountingHusain ADNessuna valutazione finora

- Safety Data Sheet: Section 1. IdentificationDocumento10 pagineSafety Data Sheet: Section 1. IdentificationAnonymous Wj1DqbENessuna valutazione finora

- Public Economics - All Lecture Note PDFDocumento884 paginePublic Economics - All Lecture Note PDFAllister HodgeNessuna valutazione finora

- Amazing RaceDocumento2 pagineAmazing Racegena sanchez BernardinoNessuna valutazione finora

- Slides 5 - Disposal and AppraisalDocumento77 pagineSlides 5 - Disposal and AppraisalRave OcampoNessuna valutazione finora

- EL119 Module 2Documento4 pagineEL119 Module 2Kristine CastleNessuna valutazione finora

- Modeling and Simulation of The Temperature Profile Along Offshore Pipeline of An Oil and Gas Flow: Effect of Insulation MaterialsDocumento8 pagineModeling and Simulation of The Temperature Profile Along Offshore Pipeline of An Oil and Gas Flow: Effect of Insulation MaterialsInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Site AnalysisDocumento4 pagineSite AnalysisS O NALNessuna valutazione finora

- Design Report of STOL Transport AircraftDocumento64 pagineDesign Report of STOL Transport Aircrafthassan wastiNessuna valutazione finora

- Police Log September 24, 2016Documento14 paginePolice Log September 24, 2016MansfieldMAPoliceNessuna valutazione finora

- Product Management Software Director in Austin TX Resume Chad ThreetDocumento2 pagineProduct Management Software Director in Austin TX Resume Chad ThreetChad ThreetNessuna valutazione finora

- PRIMARY Vs Secondary Vs TertiaryDocumento1 paginaPRIMARY Vs Secondary Vs TertiaryIshi Pearl Tupaz100% (1)

- 2.fundamentals of MappingDocumento5 pagine2.fundamentals of MappingB S Praveen BspNessuna valutazione finora

- Grade 8 Mock 1Documento11 pagineGrade 8 Mock 1yutika GhuwalewalaNessuna valutazione finora

- Kalsi P S - Organic Reactions and Their Mechanisms 5eDocumento26 pagineKalsi P S - Organic Reactions and Their Mechanisms 5eeasy BooksNessuna valutazione finora

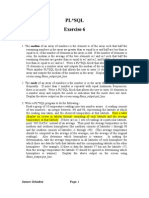

- PL SQL Exercise6Documento2 paginePL SQL Exercise6Nishant AndhaleNessuna valutazione finora

- DNA Structure and Replication: Chapter Nine Khalid HussainDocumento49 pagineDNA Structure and Replication: Chapter Nine Khalid HussainKhalid HussainNessuna valutazione finora

- Oil RussiaDocumento8 pagineOil RussiaAyush AhujaNessuna valutazione finora

- Research Topics For Economics Thesis in PakistanDocumento7 pagineResearch Topics For Economics Thesis in PakistanStacy Vasquez100% (2)

- Sears Canada: Electric DryerDocumento10 pagineSears Canada: Electric Dryerquarz11100% (1)

- Pressuremeter TestDocumento33 paginePressuremeter TestHo100% (1)

- Everyday Life - B1 - ShoppingDocumento7 pagineEveryday Life - B1 - ShoppingAmi BarnesNessuna valutazione finora

- Recruitment of Officers in Grade B' (General) - DR - By-2019Documento2 pagineRecruitment of Officers in Grade B' (General) - DR - By-2019Shalom NaikNessuna valutazione finora