Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Zakat Calculator 2009 Ver - 2014

Caricato da

a_mohid17Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Zakat Calculator 2009 Ver - 2014

Caricato da

a_mohid17Copyright:

Formati disponibili

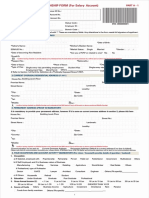

Zakat Calculation Spreadsheet

Zakat Calculator

1

1a

1b

1c

1d

Ver -2009

Printed on 01/19/2015

http://zakat.110mb.com/

(Use Only YELLOW cells to fill Values. Please read the Summary for details, before filling this)

Weight in

Estimated

Price/Gm

Grams

Value

ZAKAT ON GOLD (2.5%)

24 Carat Gold/Jewelry

.

22 Carat Gold/Jewelery

66.00

.

18 Carat Gold/Jewelry

.

Other Gold Valuables. (Pls insert the Current

Estimated Value)

ZAKAT ON PRECIOUS STONES (2.5%)

(Contentious subject. Refer Notes. Dont Calculate if you disagree or are uncomfortable.)

Calculate the nett Market Value of the Precious

stones like Diamonds, Rubies, Etc. and add them

to the Estimated Value Column

3

4

4a

4b

4c

4d

ZAKAT ON SILVER (2.5%)

Include Household Silver Utensils, Artefacts, and

Jewelery. For Utensils, usually the silver is 90%

pure so take 90% of the total weight

150.00

Actual Value

ZAKAT ON CASH IN HAND /BANK (2.5%)

Cash in Hand

Cash in Bank in Savings Accounts

Cash in Bank in Current Accounts

Cash held in Fixed Deposits

ZAKAT ON LOANS / INVESTMENTS/ FUNDS/

SHARES, ETC (2.5%)

5a Loans Receivable from Friends and Relatives

5b Investment in Govt Bonds

5c Provident Fund Contribution to date.

5

Actual Value

5d Insurance Premiums including bonus up to date

5e

Value of Shares (stocks) including Dividends.

Take their market value on the date of calculation

5f Government Security Deposits, ADRs, etc

5g Investment in Private Chits, Funds, etc

5f Other Sources of Wealth

6

Estimate Value

ZAKAT ON LANDED PROPERTY (2.5%)

6a Landed Property held as an Investment / Business (Estimate the

6b

7

7a

7b

7c

7d

7e

current Maket Value)

Zakat on Rentals Coming from Property (After Deducting for all

expenses)

(STOCK-IN-TRADE)

ZAKAT ON BUSINESS (2.5%) ---------Value of Saleable Stock

Value of Damaged / Dead Stock

Amount Receivable from Credit Sales

LESS: Amount Payable to Suppliers (Credit

taken from suppliers for stocking goods)

LESS: Bad Debts

ajameel@yahoo.com

Page 1 of 10

www.zakaat.freewebsites.com

Zakat Calculation Spreadsheet

Weight in

Grams

Printed on 01/19/2015

Estimated

Value

Price/Gm

TOTAL VALUE OF STOCK ( 7a+7b+7C-7d-7e)

ZAKAT ON SHARE IN PARTNERSHIP FIRMS

(2.5%)

8a Capital Balance as per Last balance Sheet

8b Loans Advanced by you to the Firm as of Date

8

8c LESS: Withdrawals made by you during the current Year.

Accumulated Profit from the date of Balance Sheet to this Date

8d (Estimate the Profit Value as it is difficult to get exact figures in

the middle of Accounting Year)

NETT TOTAL WORTH CALCULATED

ZAKAT ON AGRICULTURAL PRODUCE (10%,

7.5%, 5%)

9a Produce Dependent on Rain Water - @ 10% of product (crop) in

Value or Kind

9

Value of Produce

9b Produce totally dependent on Artificial Irrigation like Canal, Tank,

Borewell, etc. @ 5% of Produce (crop) in Value or in Kind

9c Produce dependent Partially on Rain Water and Partially on

Artificial Irrigation @ 7.5% of the produce Value or in Kind

10

ZAKAT ON ANIMALS & POULTRY & FISH

FARMING

Total Value

Animals/ Birds more than 6 months Old - @ 1

Animal or Bird PER 40 either in Kind or Value

thereof.

GENERAL LIABILITIES - You need to deduct your direct Payables or

11 Liabilities which have not been deducted earlier - Usage of the loan should

have been on Zakatable Wealth only. HOME & CAR Loans are not to be

deducted

11a

Personal Loans/ Debts which are to be paid back

Income Tax / Wealth Tax Payable (which is due

11c

and already counted towards your wealth)

TOTAL LIABILITIES

TOTAL ZAKAT PAYABLE

IMPORTANT: PLEASE READ BELOW SUMMARY FOR INSTRUCTIONS & NOTES:

ajameel@yahoo.com

Page 2 of 10

www.zakaat.freewebsites.com

Zakat Calculation Spreadsheet

Weight in

Grams

Price/Gm

Printed on 01/19/2015

Estimated

Value

Dear Brothers & Sisters,

Alhamdulillah, the month of Ramadhan has been bestowed upon us by Allah. ZAKAT is one of the five fundamental

pillars of Islam, mandatory on all muslims who are of eligible wealth. Zakat is due from and payable by a person on his

wealth (and not his income), which has remained with him/her for one Islamic year.

It is difficult to calculate the completion of one year on each item of wealth, because purchase dates may vary. To

overcome this difficulty, a practical method is to fix a date (e.g. 1st of Ramadhan), compute your total wealth on that

date and calculate Zakat, thereon.

The attached spreadsheet is a humble attempt at making the calculation process simple and consolidated, for all

brothers and sisters who are fortunate to be worthy of paying Zakat. If there are any errors, its purely due to my

incomprehension and may be brought to my notice immdtly by email at ajameel@yahoo.com. This is also available

online at http://zakat.110mb.com/ . Please remember me in your supplications and may Allah give us all the rewards of

both worlds. Aameen.

A lot of brothers have asked me what Madhab do I belong and whether this covers Shias, Barelvis, Jaffris, Bohras and

other sects. All I can say here is that let us rise above all these covert little shells we have built around us. We are

Muslims first and if one is sincere, he will rise above all this secterianism, read the Quran himself and get the facts

firsthand. The practical life of our Prophet SAS is there to be followed and practiced. And pray to Allah that he show us

and keep us on the right path. Aaameen.

Yours Brother in Islam, Arif Jameel.

Details of Each Section to be used in conjunction with the Calculation Spreadsheet.

Zakat on Pure Gold and Gold Jewellery

Zakat should be calculated at 2.5% of the market value as on the date of valuation (In our case we consider 1st of

Ramadhan). Most Ulema favour the Market Value prevailing as on the date of Calculation and not the purchase price.

Zakat on Precious and Semi-Precious Stones

There is considerable contention on whether these are to be considered for valuation. In my humble opinion if they

have a value, then they calculate towards your wealth, and it is on the wealth that Zakat is mandatory. However please

consult with Ulema, before acting on this section. Most Ulema contend that a diamond is a piece of carbon and its value

varies, unlike that of gold or silver.

One may calculate the Saleable Value of Items-at-hand on the date of Zakat Calculation.

Zakat on Silver.

Zakat is to be paid on Silver in Pure form or Jewellery, Utensils, Decorative items and all household items including

crockery, cutlery made of silver at 2.5% of the prevailing market rates.

Zakat on Cash and Bank Balances

Zakat should be paid at 2.5% on all cash balance and bank balances in your savings, current or FD accounts. The

amount technically should be in the bank for one year. Usually it happens that the balance keeps on changing as per

personal requirements.

ajameel@yahoo.com

Page 3 of 10

www.zakaat.freewebsites.com

Zakat Calculation Spreadsheet

Weight in

Grams

Price/Gm

Printed on 01/19/2015

Estimated

Value

You may make your best judgement and the best way is to pay on remaining amount on the day of calculation

Zakat on Loans Given, Funds, etc

Zakat is payable by you on loans you have given to your friends and relatives. It should be treated as Cash in Hand.

You may deduct Loans Payable by you to arrive at the nett present value of your wealth. However, if you are in doubt,

on the return of your money, then you may not calculate it as your wealth. You can add it to your wealth, if and when

your receive your money.

Zakat on Landed Property

Zakat is not payable on personal residential House even if you have more than one and meant for residential purpose

only. Also Zakat is not applicable on the value of Property given on rent irrespective of how many. However Zakat is

payable on the rental income itself after deducting the maintenance and other expenses.

However if your intention of holding properties is to sell at a future date for a profit or as an investment, then Zakat is

payable on the Market Value of the property. Also, if your intention of holding properties changes in the current year,

i.e. from self use to business then you need to pay Zakat on that Property Value.

Zakat on Business:

This is for Business Persons only. No matter what business you are into, you've got to pay Zakat on all STOCK-INTRADE. The stock must be valued at its Landed Cost Price. If you have any bills receivable (sales given on credit)

then you need to add the same towards calculations.

Deduct the Amounts due to your suppliers and deduct the loans on stock on the date of calculation. Dead Stock should

be calculated on scrap value or its saleable value. Damaged stock should also be valued at its scrap value.

Be honest in the calculations, as ZAKAT is an INSURANCE on your STOCK directly from ALLAH and who better an

insurer than Him.

There is no Zakat on Factory Buildings or any kind of machinery, but there is zakat on products produced in the factory

(i.e. finished goods value). Please refer to competent Ulema or a scholar who can shed more light on your specific

issues.

Zakat on Partnership Firms.

Zakat can be paid EITHER by the firm OR separately by the owners. If the firm is not paying, and the partner wants to

calculate his share, he should take the amount standing to his capital and loan account as per the last balance sheet.

Add his estimated share of profit till the date zakat is calculated.

This can only be estimated as it is difficult to calculate the exact profit or loss between an accounting year.

ajameel@yahoo.com

Page 4 of 10

www.zakaat.freewebsites.com

Zakat Calculation Spreadsheet

Weight in

Grams

Price/Gm

Printed on 01/19/2015

Estimated

Value

Zakat on Agricultural Product

Zakat is payable on all Agricultural produce including fruits, commercially grown flowers, vegetables and all types of

grains at the harvest time itself. The passing of One year does not apply for agrultural produce. If there are two or

more crops on the same land per year, then Zakat has to be paid as many times on the crop, irrespective of the time.

The Consensus formula for Zakat calculation on Agriculture is as follows:

On crops dependent purely on rain water it will be 10% of produce, On crops not irrigated through rain water but use

Canal Water, Tank Water, Borewell and Open wells, the Zakat is 5% of the produce. For Crops dependent partly on

Rain Water and partly on other water, the Zakat applicable would be 7.5% of produce.

Zakat on Animals

On all grazing animals like goats, sheep, camel, cows, broiler chickens, the consensus Zakat payable is one animal/bird

for every 40 animals owned. However you may wish to give cash in lieu of the animal/bird itself.

Please consult your local Scholar or Maulvi or Imaam who can guide you to the right direction, or refer to books of Fiqh

if you would like to have first hand confirmation of the situation.

Liabilities Deductions

If you have any pending tax payable to the govt, as of the date of Zakat Calculation, then the same may be deducted

before arriving at the net worth. If you have taken any loans from any person or institution, and if you have not already

deducted the same from any of the above sections, then you can deduct your Payables over here. Please be truthful,

as Zakat is a sure way of protecting ones wealth if Zakat has been paid on it regularly and fully.

LOANS taken only for Zakatable-Wealth should be deducted. Cars, Houses, etc are not Zakatable wealth. So any

loan/mortgate taken for these purposes are not to be deducted

FOOTNOTE: Please note that RIBA in any form is Haram and strictly prohibited. So please stay away from taking

Loans on Interests AND Collection of Interests from any body or institution or other forms of RIBA'.

For those who would like more details you may visit the FAQ section of zakat.110mb.com

COPYRIGHT NOTICE: You are free to distribute this Calculator, by email, by print or by posts over the Internet. My

intention in creating this was to make the task of Zakat as simple and easy as the act of Zakat itself. However if you

are making any modifications or changes please keep me informed.

ajameel@yahoo.com

Page 5 of 10

www.zakaat.freewebsites.com

Zakat Calculation Spreadsheet

Printed on 01/19/2015

com/

before filling this)

Zakat Payable

-

ate if you disagree or are uncomfortable.)

ajameel@yahoo.com

Page 6 of 10

www.zakaat.freewebsites.com

Zakat Calculation Spreadsheet

Printed on 01/19/2015

Zakat Payable

-

ajameel@yahoo.com

Page 7 of 10

www.zakaat.freewebsites.com

Zakat Calculation Spreadsheet

Printed on 01/19/2015

Zakat Payable

one of the five fundamental

and payable by a person on his

chase dates may vary. To

ute your total wealth on that

and consolidated, for all

ors, its purely due to my

.com. This is also available

Allah give us all the rewards of

s, Barelvis, Jaffris, Bohras and

ve built around us. We are

n himself and get the facts

d pray to Allah that he show us

t.

ur case we consider 1st of

on and not the purchase price.

n my humble opinion if they

is mandatory. However please

a piece of carbon and its value

household items including

rrent or FD accounts. The

ce keeps on changing as per

ajameel@yahoo.com

Page 8 of 10

www.zakaat.freewebsites.com

Zakat Calculation Spreadsheet

Printed on 01/19/2015

Zakat Payable

the day of calculation

be treated as Cash in Hand.

However, if you are in doubt,

t to your wealth, if and when

meant for residential purpose

ow many. However Zakat is

.

an investment, then Zakat is

changes in the current year,

ay Zakat on all STOCK-INable (sales given on credit)

calculation. Dead Stock should

d at its scrap value.

m ALLAH and who better an

oducts produced in the factory

more light on your specific

aying, and the partner wants to

as per the last balance sheet.

n accounting year.

ajameel@yahoo.com

Page 9 of 10

www.zakaat.freewebsites.com

Zakat Calculation Spreadsheet

Printed on 01/19/2015

Zakat Payable

vegetables and all types of

roduce. If there are two or

crop, irrespective of the time.

ed through rain water but use

Crops dependent partly on

Zakat payable is one animal/bird

d itself.

ection, or refer to books of Fiqh

n the same may be deducted

on, and if you have not already

over here. Please be truthful,

nd fully.

not Zakatable wealth. So any

ted

ase stay away from taking

s of RIBA'.

akat.110mb.com

posts over the Internet. My

Zakat itself. However if you

ajameel@yahoo.com

Page 10 of 10

www.zakaat.freewebsites.com

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Can I Parallel A DY1 and DY11 Transformer - Electric Power & Transmission & Distribution FAQ - Eng-TipsDocumento1 paginaCan I Parallel A DY1 and DY11 Transformer - Electric Power & Transmission & Distribution FAQ - Eng-Tipsa_mohid17Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- What Is Project ManagementDocumento58 pagineWhat Is Project Managementa_mohid17Nessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Personal Internet Banking FormDocumento1 paginaPersonal Internet Banking Forma_mohid17Nessuna valutazione finora

- MRDP503 Project Planning and ImplementationDocumento23 pagineMRDP503 Project Planning and Implementationa_mohid17Nessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- 70-GD-MFB-001 (Rev B) TS - System Description and Operation Philosophy For MSF PlantDocumento71 pagine70-GD-MFB-001 (Rev B) TS - System Description and Operation Philosophy For MSF Planta_mohid17Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- 01-Brb-Efs-100002-11-50 AC SafeDocumento66 pagine01-Brb-Efs-100002-11-50 AC Safea_mohid17Nessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Customer Manual March2011Documento29 pagineCustomer Manual March2011leen_badiger911Nessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- O365 Guide ForRollOut enDocumento43 pagineO365 Guide ForRollOut ena_mohid17Nessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- 01-Bra-Efs-100002-11-50 AC SafeDocumento68 pagine01-Bra-Efs-100002-11-50 AC Safea_mohid17Nessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- 80-GE-MFB-001 (Rev A0) P&ID - Process Flow DiagramDocumento1 pagina80-GE-MFB-001 (Rev A0) P&ID - Process Flow Diagrama_mohid17Nessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Zakah Overview: in The Name of Allah, The Most MercifulDocumento9 pagineZakah Overview: in The Name of Allah, The Most Mercifula_mohid17Nessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Zakat (Alms Tax) : Compiled By: Ms. Iffat KhalidDocumento27 pagineZakat (Alms Tax) : Compiled By: Ms. Iffat Khalida_mohid17Nessuna valutazione finora

- Some FAQs About Zakat and CharityDocumento7 pagineSome FAQs About Zakat and Charitya_mohid17Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Zakat Questions and Answers-2Documento1 paginaZakat Questions and Answers-2a_mohid17Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Case Study ManlogDocumento10 pagineCase Study ManlogmegassNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- New Companies Registered - Mehsana (2018-19)Documento2 pagineNew Companies Registered - Mehsana (2018-19)DishankNessuna valutazione finora

- 2017 Annual ReportDocumento160 pagine2017 Annual ReportRr.Annisa BudiutamiNessuna valutazione finora

- Management Glossary - PDF Version 1Documento75 pagineManagement Glossary - PDF Version 1Fàrhàt HossainNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Raúl Bajo Buenestado: PresentDocumento2 pagineRaúl Bajo Buenestado: PresentraulbajobNessuna valutazione finora

- Automobile Industry Part 2Documento4 pagineAutomobile Industry Part 2stephen mwendwaNessuna valutazione finora

- 1111 - 920 - CBDR Paper For OWG 112113Documento4 pagine1111 - 920 - CBDR Paper For OWG 112113Aaron WuNessuna valutazione finora

- Global Optical CaseletDocumento1 paginaGlobal Optical Caseletchandan tiwariNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- GSC Qaiser Brothers Fianl ProjectDocumento11 pagineGSC Qaiser Brothers Fianl ProjectImtiaz NawazNessuna valutazione finora

- Yuqipeng-Cv Updated 11-10-2020Documento3 pagineYuqipeng-Cv Updated 11-10-2020api-506780939Nessuna valutazione finora

- Project On Punjab National BankDocumento86 pagineProject On Punjab National BankPrakash Singh100% (1)

- Demand-Pull Inflation & Cost-Push InflationDocumento4 pagineDemand-Pull Inflation & Cost-Push InflationAlec Hope BuenaventuraNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Questionnaire - First Security Islami Bank LimitedDocumento3 pagineQuestionnaire - First Security Islami Bank LimitedBishu BiswasNessuna valutazione finora

- Salary SlipDocumento1 paginaSalary SlipMunib ParachaNessuna valutazione finora

- Toyota Global Strategy and Specific Strategy in ChinaDocumento7 pagineToyota Global Strategy and Specific Strategy in ChinaYK ZhouNessuna valutazione finora

- Chapter 11: Financial Risk Management: International Accounting, 7/eDocumento31 pagineChapter 11: Financial Risk Management: International Accounting, 7/eSara AlsNessuna valutazione finora

- Salary Account Opening FormDocumento12 pagineSalary Account Opening FormVijay DhanarajNessuna valutazione finora

- The Fraud of Bank LoansDocumento62 pagineThe Fraud of Bank Loansncwazzy100% (25)

- Holland & Knight, 2020) : Advertising-And-Marketing-CampaignsDocumento1 paginaHolland & Knight, 2020) : Advertising-And-Marketing-CampaignsAriannejoy ValerosNessuna valutazione finora

- BUS 591 WK 6 Template - 092417Documento43 pagineBUS 591 WK 6 Template - 092417kapil sharma100% (2)

- Country Presentation - Sri LankaDocumento28 pagineCountry Presentation - Sri LankaADBI EventsNessuna valutazione finora

- Finance Director Operations Management in Portland OR Resume Kathleen MartinDocumento3 pagineFinance Director Operations Management in Portland OR Resume Kathleen MartinKathleenMartinNessuna valutazione finora

- Business PlanDocumento18 pagineBusiness PlanAngelo Francis100% (2)

- PDF Chapter 3 Test Bankk Creativity and Innovation - CompressDocumento10 paginePDF Chapter 3 Test Bankk Creativity and Innovation - CompressZNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Adrian, T. & Brunnermeier, M. (2008) CoVaRDocumento53 pagineAdrian, T. & Brunnermeier, M. (2008) CoVaRMateo ReinosoNessuna valutazione finora

- Group A PDFDocumento32 pagineGroup A PDFJoy KhetanNessuna valutazione finora

- 59 - Paper8Section AFinancialManagementModule 2Documento290 pagine59 - Paper8Section AFinancialManagementModule 23043 - M ManoharNessuna valutazione finora

- Income Tax June 2023-Dec 2020Documento116 pagineIncome Tax June 2023-Dec 2020binuNessuna valutazione finora

- Session 3. 4e - Chapter 5Documento12 pagineSession 3. 4e - Chapter 5toan_leeNessuna valutazione finora

- Disha: (Constitute of Symbiosis International University)Documento1 paginaDisha: (Constitute of Symbiosis International University)dishaNessuna valutazione finora

- Midwest-The Lost Book of Herbal Remedies, Unlock the Secrets of Natural Medicine at HomeDa EverandMidwest-The Lost Book of Herbal Remedies, Unlock the Secrets of Natural Medicine at HomeNessuna valutazione finora

- Eat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less TimeDa EverandEat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less TimeValutazione: 4.5 su 5 stelle4.5/5 (3231)