Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

TNCs Notes

Caricato da

Mansi Mayra KhannaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

TNCs Notes

Caricato da

Mansi Mayra KhannaCopyright:

Formati disponibili

Nature of TNCs

According to John H Dunnings nature of TNCs are

1. Appears as confederation of loosely knit foreign affiliates

2. Designed primarily to serve the parent company on natural

resources of local markets with manufactured products and

services

3. Described as provider of capital, management and technology

to outlaying affiliates

4. Presume themselves and GLOBAL and not national markets

5. Executives are trained in world wide operations and not just

domestic and international division

6. Management I recruited from many countries; components

and supplies are purchased where they can be obtained at

least cost & investments are made where anticipated returns

are the greatest.

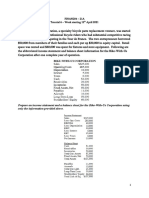

Organizational Structure of TNCs

Product Organizing Structure- Activities are divided on the basis of

products, product line and service and are grouped into department

All important functions such are marketing, production, finance and

human resources are contained within each department.

Geographical Organization Structure- Functions are grouped into

departments based on the activities performed in the geographical

areas

Each geographical units include all functions required to produce

and market the products in a particular geographical areas

This structure is used by chain stores, power companies, restaurant

chains, dairy products, banking companies etc.

Decentralized Business Unit Structure- Grouping activities based on

product lines has been a trend among diversified companies. In a

diversified firm, the basic operational building blocks are its

business units, each business is operated as a stand long profit

center.

Strategic Business Unit Structure- business can be effectively

controlled, if the related businesses are grouped into strategic units

and the efficient and senior effective is delegated the authority and

responsibility for its executive.

It is grouping of business subsidiaries based on some important

strategic elements common to each.

Matrix Organization Structure- Some firms possess a dual chain of

command.

Both functional and project managers exercise authority over

organizational activities Therefore personnel in matrix have 2

supervisors.

This is appropriate when:

1. Management attention must be focused on two or more key

issues such as technical issues, consumer needs, financial

efficiency etc.

2. Large amounts of diverse information needs to be processed

3. Problem solving in complex in complex like environment

uncertainty, interdependence among organizational units,

complex products or technology.

4. Economies of scale require the sharing of human resource

expertise to achieve high performance.

Investment Pattern of TNCs

Investments have been made by TNCs in developing countries with

the following motive

1. To exploit the natural resources of the host countries

2. To reduce the production in costs by making use of the cheap

labour and with less transportation costs

3. To enjoy benefits of tax havens

4. To circumvent tariff walls

5. Gain dominance in the foreign markets

6. To adjust to the government regulation in the host country

7. To mitigate the impact the impact of home country

regulations, like anti-trust regulations, regulations against

industries causing ecological problems.

Growth of TNCs

According to PETER DRUCKER period of rapid growth was the

50s and 60s.

Jumped from 7000 in 1970 to 40000 in 1995

Despite growing number power is isolated at the top(300

largest account for of worlds productive assets)

UN describes these as the productive core of globalizing world

economy

Manufacture and sell most of worlds industrial capacity, of

control eg. Automobiles, airplanes, communications etc

Factors Contributing to the Growth of TNCs

i. Financial Superiority- Enjoy F S over National Companies, they

area) Huge financial resources at disposal

b) Easy access to external capital markets

c) Easily mobilize different types of high quality resources

d) Have access to international banks and financial

institutions

e) Can use funds more efficiently, economically and

effectively

ii.

Technical Superiority- Rich in advanced technology developed

through continuous research and development. Rich resources

enable them to invest on R&D and develop advanced

technology

iii.

Product innovation- by virtue of their widespread in many

countries collects information regarding customers, taste and

preferences. Further with strong R&D departments can invent

new products and develop existing products

iv.

Market Superiority- enjoy M S over domestic companies such

asa) Enjoy quick transportation and warehousing facilities

b) Adopt more effective advertising and sales promotion

techniques

c) Availability of more reliable and up to date information

relating to market expansion in different countries

Advantages of TNCs

They help both home and host country

IN HOST COUNTRY

1. Level of industrial and economic development increases due

to growth in ancillary and service of the host country

2. Help increase the investment level and thereby income and

employment

3. Transfer technology, esp in the developing countries

4. Get latest sophisticated management techniques from

managerial practices of TNCs

5. Domestic industry can make use of R&D outcomes of TNCs

6. Enables to increase exports and decrease import requirement

7. Can break protectionism, create competition among domestic

companies and thus enhance their competitiveness

IN HOME COUNTRY

1. Industry activity gets activated

2. Contributes for favorable balance of payments in long run

3. Create opportunities for marketing the products produced in

the home country throughout the world

4. Increase GNP of home country

5. Create employment oppurtunities in home country

Disadvantages of TNCs

IN HOST COUNTRY

1. They imperil political sovereignty of nations

2. Through power flexibility, they can evade or undermine

national economic autonomy and control

3. May destroy competition and acquire monopoly power

4. May adopt ethnocentric approach in staffing and thereby

cause unemployment

5. Large sum of money flows to the foreign countries in terms of

payments towards profits, dividends and royalty

6. Only invest in those sectors which earn high rate of profit,

exploit material

IN HOME COUNTRY

1. May neglect the home countries industrial and economic

development so as to invest in more profitable countries

2. Transfer capital causing unfavorable balance of payment

3. May not create employment in home country as it may follow

geocentric or polycentric approach

4. May bring culture of foreign country which may be detrimental

to the interest of the home country

ROLE OF TNCs in INDIA

At the end of 1990 there were 469 foreign companies in India.

In addition many f=Indian companies with foreign equity

participation

Later with economic liberalization in 1991, the Govt encouraged the

pvt sector and invited foreign firms to invest in India.

Now there are a number of fortune 500 MNCs in India

TNcs are specifically covered under Foreign Exchange Management

act.

India expects NCs to increase their exports and earn foreign

exchange for India

GOVT has allowed TNCs to invest in India through joint ventures or

technical collaborations with the Indian Companies

TnCs are widely criticized in india for not investing in environmental

pollution controlling equipment as they normally do in home

countries.

Potrebbero piacerti anche

- Role of SpeakerDocumento7 pagineRole of SpeakerMansi Mayra KhannaNessuna valutazione finora

- Property Types, Rights and Concepts ExplainedDocumento11 pagineProperty Types, Rights and Concepts ExplainedMansi Mayra Khanna100% (1)

- 11 - Dr. S.K. Gupta - Artical On Int'l Envt'l - Law - Corrected - OnDocumento20 pagine11 - Dr. S.K. Gupta - Artical On Int'l Envt'l - Law - Corrected - OnAnkit TiwariNessuna valutazione finora

- Allaudn Khilji - NOTESDocumento14 pagineAllaudn Khilji - NOTESMansi Mayra Khanna0% (1)

- Amendment of Fundamental Rights ProjectDocumento25 pagineAmendment of Fundamental Rights ProjectMansi Mayra KhannaNessuna valutazione finora

- TNCs NotesDocumento4 pagineTNCs NotesMansi Mayra KhannaNessuna valutazione finora

- Development of Civil LawDocumento21 pagineDevelopment of Civil LawMansi Mayra Khanna100% (1)

- Ijtihaad ProjectDocumento31 pagineIjtihaad ProjectMansi Mayra Khanna100% (1)

- RAPEDocumento36 pagineRAPEMansi Mayra KhannaNessuna valutazione finora

- Imprisonment in Default of FineDocumento17 pagineImprisonment in Default of FineMansi Mayra KhannaNessuna valutazione finora

- Rule of LawDocumento28 pagineRule of LawMansi Mayra KhannaNessuna valutazione finora

- The Sociological Jurisprudence of Roscoe Pound Part IDocumento27 pagineThe Sociological Jurisprudence of Roscoe Pound Part IMansi Mayra KhannaNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5782)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Case Study On Beximco Pharma Ltd.Documento32 pagineCase Study On Beximco Pharma Ltd.Abdullah Al FahadNessuna valutazione finora

- Kossan AR 2019 PDFDocumento163 pagineKossan AR 2019 PDFWH TNessuna valutazione finora

- Economics: Paul Krugman - Robin WellsDocumento23 pagineEconomics: Paul Krugman - Robin WellshenryNessuna valutazione finora

- Business Plan On Comfort Airlines: TopicDocumento11 pagineBusiness Plan On Comfort Airlines: TopicJubayer Uddin Shamim 1511989647Nessuna valutazione finora

- Week 1 Slides (IAS 8, 1, 34, IFRS 13, FinReport Slides)Documento13 pagineWeek 1 Slides (IAS 8, 1, 34, IFRS 13, FinReport Slides)JanaNessuna valutazione finora

- Al Meezan Investment Management LTD: Ground Floor, Block 'B', Finance & Trade Centre, Shahrah-e-Faisal, KarachiDocumento2 pagineAl Meezan Investment Management LTD: Ground Floor, Block 'B', Finance & Trade Centre, Shahrah-e-Faisal, KarachiAli RazaNessuna valutazione finora

- Fauji Fertilizer Bin Qasim Ltd. - Valuation Report: Industry OverviewDocumento7 pagineFauji Fertilizer Bin Qasim Ltd. - Valuation Report: Industry OverviewValeed ChNessuna valutazione finora

- Company AnalysisDocumento9 pagineCompany AnalysisNaveen KumarNessuna valutazione finora

- Financial StatementsDocumento27 pagineFinancial StatementsIrish Castillo100% (1)

- PT Suzuki Finance Indonesia Rating SummaryDocumento2 paginePT Suzuki Finance Indonesia Rating SummaryfirmanNessuna valutazione finora

- Hershey's Lecturer BookDocumento19 pagineHershey's Lecturer BookAbdel CowoNessuna valutazione finora

- Project Report of SIEMENS AurangabadDocumento58 pagineProject Report of SIEMENS AurangabadShahnawaz Aadil50% (2)

- Cash To Accrual Basis, Single Entry and Error CorrectionDocumento7 pagineCash To Accrual Basis, Single Entry and Error CorrectionHasmin Saripada AmpatuaNessuna valutazione finora

- Business Feasibility Study Outline Updated PDFDocumento9 pagineBusiness Feasibility Study Outline Updated PDFPea Del Monte AñanaNessuna valutazione finora

- Fin 004 Prelim 2Documento49 pagineFin 004 Prelim 2Joana Marie Lapuz MaramonteNessuna valutazione finora

- Transfer PricingDocumento25 pagineTransfer PricingAmanVashistNessuna valutazione finora

- Analysis of Bfsi Industry in India: Prepared by Devansh VermaDocumento4 pagineAnalysis of Bfsi Industry in India: Prepared by Devansh VermaDevansh VermaNessuna valutazione finora

- What Are Equity Securities?Documento2 pagineWhat Are Equity Securities?Tin PangilinanNessuna valutazione finora

- FINAN204-21A - Tutorial 6 Week 7Documento10 pagineFINAN204-21A - Tutorial 6 Week 7Danae YangNessuna valutazione finora

- Chapter 4 - Exchange Rate DeterminationDocumento9 pagineChapter 4 - Exchange Rate Determinationhy_saingheng_760260980% (10)

- Anatan Cristine Joy BSCM 1aDocumento6 pagineAnatan Cristine Joy BSCM 1aJAN CLARISSE GEOCADINNessuna valutazione finora

- Chapte R: Dividend TheoryDocumento19 pagineChapte R: Dividend TheoryArunim MehrotraNessuna valutazione finora

- 02 06 2014 The Future of Electricity Prices in California Final Draft 1Documento38 pagine02 06 2014 The Future of Electricity Prices in California Final Draft 1RohitSinghNessuna valutazione finora

- Understanding Business Finance ConceptsDocumento3 pagineUnderstanding Business Finance ConceptsAira ConzonNessuna valutazione finora

- Philippines As An Emerging Market: Mentor - Dr. Shalini TiwariDocumento10 paginePhilippines As An Emerging Market: Mentor - Dr. Shalini TiwariRahul ChauhanNessuna valutazione finora

- Strategic Management Complete Project On McDonaldDocumento88 pagineStrategic Management Complete Project On McDonaldTanzi Jutt0% (3)

- 02 Per. Invest 26-30Documento5 pagine02 Per. Invest 26-30Ritu SahaniNessuna valutazione finora

- Steps in The Accounting Cycle of A Service Business (Posting and Preparing Trial Balance)Documento15 pagineSteps in The Accounting Cycle of A Service Business (Posting and Preparing Trial Balance)Zybel RosalesNessuna valutazione finora

- Howard Ross and Bernard Ross, As Trustees For Lena Rosenbaum v. Robert A. Bernhard, 403 F.2d 909, 2d Cir. (1969)Documento9 pagineHoward Ross and Bernard Ross, As Trustees For Lena Rosenbaum v. Robert A. Bernhard, 403 F.2d 909, 2d Cir. (1969)Scribd Government DocsNessuna valutazione finora

- Case Compare-The-Meerkat + SWOTDocumento28 pagineCase Compare-The-Meerkat + SWOTKenan AgacdikenNessuna valutazione finora