Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fairview UCare Choices Silver Silver Health Plan

Caricato da

mirzaakrambaigCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fairview UCare Choices Silver Silver Health Plan

Caricato da

mirzaakrambaigCopyright:

Formati disponibili

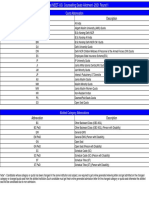

: Fairview UCare Choices Silver

Coverage Period: Beginning on or after 01/01/2014

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family | Plan Type: HMO

This is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan

document at www.ucare.org or by calling 1-877-903-0069.

Important

Questions

What is the overall

deductible?

Are there other

deductibles for

specific services?

Is there an outof

pocket limit on my

expenses?

What is not included

in

the outofpocket

limit?

Is there an overall

annual limit on what

the plan pays?

Does this plan use a

network of providers?

Do I need a referral

to see a specialist?

Answers

Why this Matters:

In-network: $1,900/Individual;

$3,800/Family. Non-network:

$3,800/Individual; $7,600/Family.

Deductible doesnt apply to in-network

preventive care. Copayments dont apply

to deductible.

No.

You must pay all the costs up to the deductible amount before this plan begins to

pay for covered services you use. Check your policy or plan document to see when

the deductible starts over (usually, but not always, January 1st). See the chart

starting on page 2 for how much you pay for covered services after you meet the

deductible.

Yes. $3,800 Individual/$7,600 Family for

in-network services. No out-of-pocket

limit for non-network services.

The out-of-pocket limit is the most you could pay during a coverage period

(usually one year) for your share of the cost of covered services. This limit helps

you plan for health care expenses.

Premiums, all non-network services, nonnetwork balance-billed charges, and

health care services this plan doesnt

cover.

No.

Even though you pay these expenses, they dont count toward the outofpocket

limit.

Yes. For a list of Fairview Health

Network providers, see www.ucare.org or

call toll-free 1-877-903-0069.

If you use an in-network doctor or other health care provider, this plan will pay

some or all of the costs of covered services. Be aware, your in-network doctor or

hospital may use an out-of-network provider for some services. Plans use the term

in-network, preferred, or participating for providers in their network. See the

chart starting on page 2 for how this plan pays different kinds of providers.

No.

You can see the specialist you choose without permission from this plan.

You dont have to meet deductibles for specific services, but see the chart starting

on page 2 for other costs for services this plan covers.

The chart starting on page 2 describes any limits on what the plan will pay for specific

covered services, such as office visits.

Are there services this Yes.

Some of the services this plan doesnt cover are listed on page 5. See your policy or

plan doesnt cover?

plan document for additional information about excluded services.

Questions: Call 1-877-903-0069 or visit us at www.ucare.org.

14-SBC-FCh-S-40015

If you arent clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary

1 of 8

at www.ucare.org or call 1-877-903-0069 to request a copy.

: Fairview UCare Choices Silver

Coverage Period: Beginning on or after 01/01/2014

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family | Plan Type: HMO

Copayments are fixed dollar amounts (for example, $15) you pay for covered health care, usually when you receive the service.

Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example, if

the plans allowed amount for an overnight hospital stay is $1,000, your coinsurance payment of 20% would be $200. This may change if

you havent met your deductible.

The amount the plan pays for covered services is based on the allowed amount. If an out-of-network provider charges more than the

allowed amount, you may have to pay the difference. For example, if an out-of-network hospital charges $1,500 for an overnight stay and

the allowed amount is $1,000, you may have to pay the $500 difference. (This is called balance billing.)

This plan may encourage you to use in-network providers by charging you lower deductibles, copayments and coinsurance amounts.

Your Cost If

You Use a

Services You May Need

Non-network

Provider

Primary care visit to treat an injury or $40 copay first 3 visits.

50% coinsurance

illness

Then 100% until

after non-network

deductible met. Then 20% deductible.

Specialist visit

coinsurance.

If you visit a health

Except $20 copay for all

care providers

Other practitioner office visit

convenience/retail or eoffice or clinic

visits.

Your Cost If You Use

an

In-network Provider

Common

Medical Event

Preventive

care/screening/immunization

Diagnostic test (x-ray, blood work)

If you have a test

Imaging (CT/PET scans, MRIs)

No charge

Not covered

20% coinsurance after

deductible.

50% coinsurance

after non-network

deductible.

Limitations & Exceptions

First 3 visits can be a combination of

primary care, specialty care, urgent care,

physical therapy, speech therapy,

occupational therapy, chiropractic,

mental health, or substance abuse office

visits. Authorization required for

physical, speech, and occupational

therapy.

No coverage non-network.

none

Questions: Call 1-877-903-0069 or visit us at www.ucare.org.

If you arent clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary

at www.ucare.org or call 1-877-903-0069 to request a copy.

2 of 8

: Fairview UCare Choices Silver

Coverage Period: Beginning on or after 01/01/2014

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family | Plan Type: HMO

Common

Medical Event

If you need drugs

to treat your illness

or condition

More information

about prescription

drug coverage is

available at

www.ucare.org

If you have

outpatient surgery

Services You May Need

Your Cost If You Use

an

In-network Provider

Your Cost If

You Use a

Non-network

Provider

Not covered

Formulary generic drugs

$10 copay per

prescription. $20 copay

for up to 90-day supply.

Not covered

Formulary brand drugs

40% coinsurance after

deductible.

Not covered

Generic: $10 copay; $20

copay for up to 90-day

supply. Brand: 40%

coinsurance after

deductible.

20% coinsurance after

deductible.

Not covered

Not covered

Non-formulary drugs

Formulary specialty drugs

Facility fee (e.g., ambulatory surgery

center)

Physician/surgeon fees

Emergency room services

If you need

immediate medical

attention

Emergency medical transportation

Urgent care

$250 first visit. Then

100% until deductible

met. Then 20%

coinsurance.

50% coinsurance

after non-network

deductible.

$250 first visit.

Then 100% until

in-network

deductible met.

Then 20%

coinsurance.

20% coinsurance after

20% coinsurance

deductible.

after in-network

deductible.

$40 copay first 3 visits.

50% coinsurance

Then 100% until

after non-network

deductible met. Then 20% deductible.

coinsurance.

Limitations & Exceptions

Must be on UCare formulary.

Up to 31-day supply per prescription. Up

to 90-day supply at in-network retail

pharmacy. No coverage non-network.

Authorization may be required.

Must be on UCare formulary. No

coverage non-network. Authorization

may be required.

Non-formulary drugs not covered.

Must be on UCare formulary. Cost

sharing then based on whether generic

or brand. No coverage non-network.

Authorization may be required.

none

Not covered outside U.S.

Not covered outside U.S.

First 3 visits can be a combination of

primary care, specialty care, urgent care,

outpatient therapy, chiropractic, mental

health, or substance abuse office visits.

Questions: Call 1-877-903-0069 or visit us at www.ucare.org.

If you arent clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary

at www.ucare.org or call 1-877-903-0069 to request a copy.

3 of 8

: Fairview UCare Choices Silver

Coverage Period: Beginning on or after 01/01/2014

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family | Plan Type: HMO

Common

Medical Event

If you have a

hospital stay

Services You May Need

Facility fee (e.g., hospital room)

20% coinsurance after

deductible.

Physician/surgeon fee

Mental/Behavioral health outpatient

services

If you have mental

health, behavioral

health, or

substance abuse

needs

Your Cost If You Use

an

In-network Provider

Mental/Behavioral health inpatient

services

Substance use disorder outpatient

services

Substance use disorder inpatient

services

Prenatal care

Postnatal care

If you are pregnant

Delivery and all inpatient services

Your Cost If

You Use a

Non-network

Provider

50% coinsurance

after non-network

deductible.

$40 copay for first 3 visits. 50% coinsurance

Then 100% until

after non-network

deductible met. Then 20% deductible.

coinsurance.

20% coinsurance after

deductible.

50% coinsurance

after non-network

deductible.

$40 copay for first 3 visits. 50% coinsurance

Then 100% until

after non-network

deductible met. Then 20% deductible.

coinsurance.

20% coinsurance after

deductible.

50% coinsurance

after non-network

deductible.

No charge

Not covered

$40 copay for first 3 visits. 50% coinsurance

Then 100% until

after non-network

deductible met. Then 20% deductible.

coinsurance.

20% coinsurance after

50% coinsurance

deductible.

after non-network

deductible.

Limitations & Exceptions

Authorization required.

First 3 visits can be a combination of

primary care, specialty care, urgent care,

outpatient therapy, chiropractic, mental

health, or substance abuse office visits.

Authorization required.

Authorization required.

First 3 visits can be a combination of

primary care, specialty care, urgent care,

outpatient therapy, chiropractic, mental

health, or substance abuse office visits.

Authorization required.

Authorization required.

No coverage non-network.

First 3 visits can be a combination of

primary care, specialty care, urgent care,

outpatient therapy, chiropractic, mental

health, or substance abuse office visits.

Authorization required.

Questions: Call 1-877-903-0069 or visit us at www.ucare.org.

If you arent clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary

at www.ucare.org or call 1-877-903-0069 to request a copy.

4 of 8

: Fairview UCare Choices Silver

Coverage Period: Beginning on or after 01/01/2014

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family | Plan Type: HMO

Common

Medical Event

If you need help

recovering or have

other special

health needs

Your Cost If You Use

an

In-network Provider

Services You May Need

Home health care

Rehabilitation services

Habilitation services

Skilled nursing care

Durable medical equipment

Your Cost If

You Use a

Non-network

Provider

20% coinsurance after

deductible.

50% coinsurance

after non-network

deductible.

No charge

Not covered

Limitations & Exceptions

Authorization required. Limit of 120

home health care visits per calendar year.

Skilled nursing facility services limited to

120 days per admission. Limit of 30 days

of home hospice services per calendar

year, no authorization required.

Hospice service

Eye exam

If your child needs

dental or eye care

20% coinsurance after

deductible.

20% coinsurance after

deductible.

Glasses

Dental check-up

Limit of 1 routine eye exam per calendar

year. No coverage non-network.

Limit of 1 per calendar year. No

coverage non-network.

Limit of 2 per calendar year. No

coverage non-network.

Not covered

Not covered

Excluded Services & Other Covered Services:

Services Your Plan Does NOT Cover (This isnt a complete list. Check your policy or plan document for other excluded services.)

Acupuncture

Bariatric Surgery

Cosmetic Surgery

Dental Care (Adult)

Hearing aids-unless under age 18 and

requirements are met

Infertility treatment

Intensive behavioral therapy for treatment

of autism spectrum disorders

Long-term care

Non-emergency care when traveling

outside U.S.

Non-formulary drugs unless an exception

is obtained

Private-duty nursing-except up to 120

hours is covered to train hospital staff for

a ventilator-dependent patient

Routine eye care (Adult)

Routine foot care

Weight loss programs

Questions: Call 1-877-903-0069 or visit us at www.ucare.org.

If you arent clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary

at www.ucare.org or call 1-877-903-0069 to request a copy.

5 of 8

: Fairview UCare Choices Silver

Coverage Period: Beginning on or after 01/01/2014

Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual or Family | Plan Type: HMO

Other Covered Services (This isnt a complete list. Check your policy or plan document for other covered services and your costs for these

services.)

Chiropractic care

Your Rights to Continue Coverage:

Federal and State laws may provide protections that allow you to keep this health insurance coverage as long as you pay your premium. There are

exceptions, however, such as if: You commit fraud The insurer stops offering services in the State You move outside the coverage area.

For more information on your rights to continue coverage, contact the insurer at 612-676-6609 or toll-free 1-877-903-0069. You may also contact your

state insurance department at 651-296-2488 or toll-free 1-800-657-3602.

Your Grievance and Appeals Rights:

If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. For

questions about your rights, this notice, or assistance, you can contact: Minnesota Department of Commerce at 651-296-2488 or toll-free 1-800-657-3602.

Does this Coverage Provide Minimum Essential Coverage?

The Affordable Care Act requires most people to have health care coverage that qualifies as minimum essential coverage. This plan or policy does

provide minimum essential coverage.

Does this Coverage Meet the Minimum Value Standard?

The Affordable Care Act establishes a minimum value standard of benefits of a health plan. The minimum value standard is 60% (actuarial value). This

health coverage does meet the minimum value standard for the benefits it provides.

Language Access Services:

Spanish (Espaol): Para obtener asistencia en Espaol, llame al 1-877-903-0069

Hmong (Hmoob): Yog koj yuav kev pab hais lus hmoob, hu rau 1-877-903-0069

Somali: Caawimaad luuqada af Soomaaliga ah wac: 1-877-903-0069

Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-877-903-0069

To see examples of how this plan might cover costs for a sample medical situation, see the next page.

Questions: Call 1-877-903-0069 or visit us at www.ucare.org.

If you arent clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary

at www.ucare.org or call 1-877-903-0069 to request a copy.

6 of 8

: Fairview UCare Choices Silver

Coverage Period: Beginning on or after 01/01/2014

Coverage for: Individual or Family | Plan Type: HMO

Coverage Examples

About these Coverage

Examples:

These examples show how this plan might cover

medical care in given situations. Use these

examples to see, in general, how much financial

protection a sample patient might get if they are

covered under different plans.

This is

not a cost

estimator.

Dont use these examples to

estimate your actual costs

under this plan. The actual

care you receive will be

different from these

examples, and the cost of

that care will also be

different.

See the next page for

important information about

these examples.

Having a baby

Managing type 2 diabetes

(normal delivery)

(routine maintenance of

a well-controlled condition)

Amount owed to providers: $7,540

Plan pays $4,950

Patient pays $2,590

Amount owed to providers: $5,400

Plan pays $2,890

Patient pays $2,510

Sample care costs:

Hospital charges (mother)

Routine obstetric care

Hospital charges (baby)

Anesthesia

Laboratory tests

Prescriptions

Radiology

Vaccines, other preventive

Total

$2,700

$2,100

$900

$900

$500

$200

$200

$40

$7,540

Sample care costs:

Prescriptions

Medical Equipment and Supplies

Office Visits and Procedures

Education

Laboratory tests

Vaccines, other preventive

Total

$2,900

$1,300

$700

$300

$100

$100

$5,400

Patient pays:

Deductibles

Copays

Coinsurance

Limits or exclusions

Total

$1,900

$20

$520

$150

$2,590

Patient pays:

Deductibles

Copays

Coinsurance

Limits or exclusions

Total

$1,900

$520

$10

$80

$2,510

Questions: Call 1-877-903-0069 or visit us at www.ucare.org.

If you arent clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary

at www.ucare.org or call 1-877-903-0069 to request a copy.

7 of 8

: Fairview UCare Choices Silver

Coverage Examples

Coverage Period: Beginning on or after 01/01/2014

Coverage for: Individual or Family | Plan Type: HMO

Questions and answers about the Coverage Examples:

What are some of the

assumptions behind the

Coverage Examples?

Costs dont include premiums.

Sample care costs are based on national

averages supplied by the U.S.

Department of Health and Human

Services, and arent specific to a

particular geographic area or health plan.

The patients condition was not an

excluded or preexisting condition.

All services and treatments started and

ended in the same coverage period.

There are no other medical expenses for

any member covered under this plan.

Out-of-pocket expenses are based only

on treating the condition in the example.

The patient received all care from innetwork providers. If the patient had

received care from out-of-network

providers, costs would have been higher.

What does a Coverage Example

show?

Can I use Coverage Examples

to compare plans?

For each treatment situation, the Coverage

Example helps you see how deductibles,

copayments, and coinsurance can add up. It

also helps you see what expenses might be left

up to you to pay because the service or

treatment isnt covered or payment is limited.

Yes. When you look at the Summary of

Does the Coverage Example

predict my own care needs?

No. Treatments shown are just examples.

The care you would receive for this

condition could be different based on your

doctors advice, your age, how serious your

condition is, and many other factors.

Does the Coverage Example

predict my future expenses?

No. Coverage Examples are not cost

Benefits and Coverage for other plans,

youll find the same Coverage Examples.

When you compare plans, check the

Patient Pays box in each example. The

smaller that number, the more coverage

the plan provides.

Are there other costs I should

consider when comparing

plans?

Yes. An important cost is the premium

you pay. Generally, the lower your

premium, the more youll pay in out-ofpocket costs, such as copayments,

deductibles, and coinsurance. You

should also consider contributions to

accounts such as health savings accounts

(HSAs), flexible spending arrangements

(FSAs) or health reimbursement accounts

(HRAs) that help you pay out-of-pocket

expenses.

estimators. You cant use the examples to

estimate costs for an actual condition. They

are for comparative purposes only. Your

own costs will be different depending on

the care you receive, the prices your

providers charge, and the reimbursement

your health plan allows.

Questions: Call 1-877-903-0069 or visit us at www.ucare.org.

If you arent clear about any of the underlined terms used in this form, see the Glossary. You can view the Glossary

at www.ucare.org or call 1-877-903-0069 to request a copy.

8 of 8

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Open School: IHI Open School Online Courses: Course Summary SheetsDocumento56 pagineOpen School: IHI Open School Online Courses: Course Summary SheetsCrystalycNessuna valutazione finora

- Rubric For Drug StudyDocumento2 pagineRubric For Drug StudyMart Juaresa Yambao100% (2)

- Presentation NeuramisDocumento18 paginePresentation Neuramisalmahyra apotekNessuna valutazione finora

- June 2015 Paper 1-15-16 NCSEDocumento2 pagineJune 2015 Paper 1-15-16 NCSERiah TiffanyNessuna valutazione finora

- Community Health Nursing ExamDocumento24 pagineCommunity Health Nursing ExamClarisse SampangNessuna valutazione finora

- Wound Healing - Alternatives in Management PDFDocumento68 pagineWound Healing - Alternatives in Management PDFHealer MobeiusNessuna valutazione finora

- jpsr09021729 PDFDocumento6 paginejpsr09021729 PDFirsyad tsaniNessuna valutazione finora

- Begs 183Documento4 pagineBegs 183viploveNessuna valutazione finora

- Evaluation of The Modified Naranjo CriteriaDocumento7 pagineEvaluation of The Modified Naranjo CriteriaShiv Thakare FanNessuna valutazione finora

- Academic Sessions: Date Topic Speaker Designation DepartmentDocumento6 pagineAcademic Sessions: Date Topic Speaker Designation Departmentgoutham valapalaNessuna valutazione finora

- Managing Treatment For The Orthodontic Patient With Periodontal ProblemsDocumento18 pagineManaging Treatment For The Orthodontic Patient With Periodontal Problemsapi-26468957Nessuna valutazione finora

- Home BirthDocumento3 pagineHome BirthMutiara Ummu SumayyahNessuna valutazione finora

- 1224 Visual Acuity FromDocumento1 pagina1224 Visual Acuity FromMartin UrrizaNessuna valutazione finora

- Bahawalpur SentDocumento6 pagineBahawalpur SentAtta Ul MohsinNessuna valutazione finora

- Elsevier Future of Healthcare Report Edited2021Documento68 pagineElsevier Future of Healthcare Report Edited2021Pipit SyafiatriNessuna valutazione finora

- Pharma RLE OverviewDocumento10 paginePharma RLE OverviewNathaniel PulidoNessuna valutazione finora

- HerbalismDocumento18 pagineHerbalismmieNessuna valutazione finora

- Healthcare 4.0: Trends, Challenges and Research DirectionsDocumento16 pagineHealthcare 4.0: Trends, Challenges and Research DirectionsPranit padhi100% (1)

- Chittoor DEIC NotificationDocumento8 pagineChittoor DEIC NotificationnagarjunaNessuna valutazione finora

- Blue Book Chapters 1 5Documento134 pagineBlue Book Chapters 1 5エルミタ ジョイ ファティマNessuna valutazione finora

- M. KOOYMAN The Therapeutic Community and The Medical Model PDFDocumento12 pagineM. KOOYMAN The Therapeutic Community and The Medical Model PDFLagusNessuna valutazione finora

- Provisional Result For Round-1 UG 2021Documento723 pagineProvisional Result For Round-1 UG 2021Aditya Banerjee100% (1)

- Country Paper IndiaDocumento63 pagineCountry Paper IndiaShashank16Nessuna valutazione finora

- NuCM 103 RLE Promoting Physiological HealthDocumento2 pagineNuCM 103 RLE Promoting Physiological HealthJohn Allan PasanaNessuna valutazione finora

- Pott Disease PDFDocumento5 paginePott Disease PDFAndri wijayaNessuna valutazione finora

- Acupuncture For Chronic PainDocumento9 pagineAcupuncture For Chronic PainmichNessuna valutazione finora

- Fundamentals of Nursing Letter AnswersDocumento1 paginaFundamentals of Nursing Letter AnswersEpaphras Joel MilitarNessuna valutazione finora

- Fundamentals of Nursing Test IDocumento18 pagineFundamentals of Nursing Test IclobregasNessuna valutazione finora

- Assessing Healthcare Service Quality: A Comparative Study of Patient Treatment TypesDocumento16 pagineAssessing Healthcare Service Quality: A Comparative Study of Patient Treatment TypeshariiNessuna valutazione finora

- Kimberly Cremerius: ObjectiveDocumento3 pagineKimberly Cremerius: Objectiveapi-252001755Nessuna valutazione finora