Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Think FundsIndia November 2014

Caricato da

marketingTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Think FundsIndia November 2014

Caricato da

marketingCopyright:

Formati disponibili

November 2014 Volume 07 11

Prashant Jain speaks

Prashant

Jain,

arguably

Indias

most famous fund

manager, manages

HDFC Equity and

HDFC Top 200, that together

have assets of over `30,000

crore. In May 2012, Mr. Jain

penned an essay titled, Its

tomorrow that matters, amid

much uncertainty and concerns,

global and local.

In Mr. Jains words, Pessimism

is all that one sees all around.

Even so, as a veteran of multiple

market cycles, he was able to

look at history and tell his

readers that the time to invest in

equities was at hand.

He wrote, The lower the

markets are, the bigger is the

opportunity. The Sensex is up

by 30 per cent since.

Today, Mr. Jain has spoken up

again in an interview. What does

he say? Simply put, he tells

readers to trust in equity

investing and stay invested.

History indicates that investors

will do well to heed the prescient

words of Mr. Prashant Jain. I

would urge all to read the

interview by clicking here.

Happy investing!

Srikanth Meenakshi

Co-Founder & COO

FundsIndia.com

Prefer Old to New

2014 has been a year in which mutual fund houses, barring a few, have moved

yet again to a familiar theme New Fund Offers (NFOs). This has happened

in 1992, 1994, 1999, 2005, 2007, and there we are again in familiar territory.

What is in it for investors?

Almost nothing. The universe of funds that existed at the end of 2013 was

more than adequate to take care of 99 per cent of the allocation and

investment needs of investors.

The residual 1 per cent will be essentially funds that chase riskier asset

classes, adopt riskier approaches, are complex, and / or are from new or old

fund houses that have an indifferent track record.

When it comes to international funds, they may look enticing given their

performance over the past five years in developed markets. All these

economies are in bad shape and equities from US and Europe, which make

up most of the MSCI World Index along with stocks from Japan, have

logged in compounded annual returns of 20 per cent over the past five

years. They are at the latter end of a long bullish phase that is unconnected

to reality. New funds are coming in from this space mostly.

This streak of international funds comes at a time when the value of the

Indian rupee (INR) is depreciating, or has been stable (as in the past few

months). INR appreciation can hurt you badly and it is never one-way

traffic.

The only area where genuinely decent funds have come up is corporate

bonds. Here too, please go only for those fund houses who hold a good

track record in debt funds, along with sizeable assets under management.

Prefer open-end funds any day to closed-end funds, except in the case of

Fixed Term Plans.

If you wish to own debt and a bit of equity, go for funds that focus

specifically on each class, rather than funds that seek to combine them.

In equity, there are at least about 125 funds with a track record of over 10

years, and a fairly sizeable number of funds have been around for 20 years;

ditto for the type of debt funds you need to own.

Please ask yourself and / or the sellers of these funds the question: why

new funds? You can be sure that rarely will there be a satisfactory answer.

S Vaidya Nathan

Editorial Consultant, FundsIndia.com

FundsIndia

Winner CNBC TV18 UTI Award 2013-14

National Online Advisory Services

www.fundsindia.com

Why equities are a must have in your portfolio

For all those who think equities are too risky to handle, or who think it cannot deliver enough,

heres why your portfolio cannot do without equities, if you have to beat inflation, build a decent

corpus for the long term and be tax efficient. I am going to take the approach of debunking

your notions about other asset classes when it comes to their risks and return.

Vidya Bala

Your Savings

EPF and PPF: For most salaried individuals, your Employees Provident Fund (EPF) would be your compulsory

saving. A few of you may also add the Public Provident Fund (PPF) as a part of your tax-saving investment and

believe these two should take care of your non-income earning future.

While these can be great saving habits, sadly, they will simply not suffice to build you a decent investment kitty in your

retirement years. For one, the interest rates on EPF have been on a steady decline over the past 20 years, hardly keeping

pace with inflation, especially in recent years.

For instance, the annual Consumer Price Inflation (industrial workers) was at an average of 9.5 per cent over the last

five years. That means, except in FY-11 when EPF rates were 9.5 per cent, for the rest of the years, you would actually

have earned real negative returns (that is, adjusted for inflation, your returns are negative)!

Your PPF rates too have been on a similar downtrend. The accompanying graphic shows how much ` 10,000 invested

every year in PPF would have delivered as compared to a similar investment in a tax-saving fund ICICI Pru Tax Plan.

The difference is stark, enough for you to realise how little you build with traditional options.

12%

1000000

11%

800000

10%

600000

Apr-14

Apr-13

Apr-12

Apr-11

Apr-10

Apr-09

Apr-08

Apr-07

Apr-06

Apr-05

Apr-04

Apr-03

` 3, 12,325

Apr-02

FY-14

FY-13

FY-12

FY-11

FY-09

FY-10

FY-08

FY-07

FY-06

FY-05

FY-04

FY-03

FY-02

FY-00

FY-01

FY-99

0

FY-98

7%

FY-97

200000

FY-96

` 10,37,367

PPF Balance

400000

8%

Apr-00

8.75%

Tax-saving fund market value

Apr-99

9%

FY-95

PPF vs Tax-saving funds

1200000

Apr-01

EPF interest rate on a downtrend

13%

Actual rates of PPF are taken for calculation. ICICI Pru Tax Plan is the tax-saving equity fund considered. It was launched in August

1999. Past returns are not indicative of future performance. PPF is a 15-year investment product but earns interest up to its 16th year.

Hence, investment comparison has been done on a similar basis.

Deposits: When it comes to other voluntary savings that you make, bank deposits are likely to be on the top of your

list. Not only are deposits tax inefficient, they are also likely to give you real negative returns that is not give you

anything over inflation.

Given below is a graph that shows the three scenarios of Fixed Deposit (FD) returns with an interest rate of 8, 9

and 10 per cent per annum. We have assumed a tax slab of 30 per cent and inflation of 8 per cent. You will see that

the FD does not beat inflation even with a rate as high as 10 per cent.

A popular observation about the markets is that the markets have run up nearly 40 per cent in the

last one year. A more pertinent observation is that the markets are up only around 30 per cent from

the pre Lehman levels over the last 6 years...

Prashant Jain, Chief Investment Officer, HDFC Mutual Fund

www.fundsindia.com

Real negative return

FD Rate

Post-tax return

Post inflation real return

10.0%

9.0%

8.0%

5.5%

-2.5%

6.2%

-1.8%

6.9%

-1.1%

Inflation of 8 per cent and an income tax rate of 30 per cent plus

cess has been considered.

Your Investments

Property: Multi-baggers in real estate are not uncommon

to hear. You may have probably heard of people saying

that their property value has doubled or tripled.

But very likely the person who sold it would not have told

you over what period the money doubled. So what,

equities hardly make that, you might think. They probably

delivered just 15 percent compounded annual returns in

five years.

Did you convert that into money terms? It means your

money actually more than doubled in five years! So often

times, the notion of returns in real estate is partly

overdone.

Also, remember, your confidence in real estate stems from

not knowing information as compared to an overload of

information with equities.

Just in case you wish to know the short-term returns of

real estate, go to the National Housing Bank (NHB)

website and see the property price index called Residex.

If you take the average returns from property in the top

15 cities over the past three years (ending March 2014), its

a mere 5.3 per cent annually! Surprised? An investment in

any top quartile equity fund over the same period (which

was among the worst period for equities) would have

delivered 12 per cent annually!

Youre better off not knowing too much information on

your property price isnt it? Try it with equities too!

Gold: Agreed almost the whole of last decade was a

period of extraordinary returns for gold, with the yellow

metal delivering as much as 15.8 per cent annually (MCX

prices). But then, do remember, almost seven out of those

10 years were periods of global turmoil and slow recovery,

which is when gold is perceived as a safe haven and more

takers flock to it, thus pushing up price.

Still, take a look at how gold prices stacked up against the

return of equity funds.

Remember, gold too goes through cycles and if the last

one years indications are anything, it may be going

through low patches.

18.8%

20.0%

15.9%

15.5%

15.0%

16.5%

13.2%

12.4%

10.0%

5.0%

0.0%

10-year annualised returns

15-year annualised returns

Price of gold (rupee terms) Avg. returns of equity funds* CNX 500

Your Wealth Creator

Equities: Ok, I am not going to again draw a chart

showing you the returns made by equities in the long run.

You would have seen it everywhere, but they may have

seldom convinced you.

EPF/ Deposits Real

PPF

Estate

Liquidity

No Partly

No

Invest in tranches Yes

Yes

No

Transparency

Yes

Yes

No

Tax efficiency

Yes

No

No

Superior returns No

No

Yes

Gold

Equities

Partly

Partly

No

No

Partly

Yes

Yes

Yes

Yes

Yes

Unless you have hit a jackpot, which asset class can

provide you with liquidity, convenience of investing small

sums, transparency, tax efficiency and of course, superior

returns as equities? And if risks become marginal by

holding over the long term (we have discussed this in our

earlier publications), then are short-term pains that hard

to bear? No pain, no gain!

Vidya Bala

Head - Mutual Fund Research, FundsIndia.com

www.fundsindia.com

Active or passive?

We have a few of our investors asking I read that index

funds are low cost. Should I prefer them over actively

managed funds?

It is first important for you to get two things straight: the

distinction between active and passive funds, especially in

the Indian context, and what has been the historical

performance between these two categories of funds.

Active Management: A dedicated fund manager

manages an active fund. Such a fund manager selects

sectors and stocks within the boundaries of the funds

mandate, based on quantitative and qualitative research,

as well as his/her own judgment.

The fund manager, in such cases, generally seeks to

outperform a particular market index. He constantly

receives inputs and ideas from a dedicated research team,

and from external research support as well.

These entail a cost. Hence, the fund manager seeks to

generate excess returns over the benchmark to make up

for the costs involved.

Active fund managers take dynamic calls whether to

increase or decrease cash, or curtail falls and participate

optimally in markets by specific strategies, or exit or enter

certain stocks or sectors based on their potential and

valuations. Of course, the down side is that all calls do

not work.

Passive Management: Passive funds, such as index

funds invest their assets in the same stocks and in the

same proportion as the index they seek to track. In

developed markets where long-term annual returns are at

much lower levels, passively managed funds are more

popular compared with actively managed funds.

Passive funds, as they do not need day-to-day active calls,

have lower costs, a relatively low portfolio turnover, and

less or zero cash holding. In Indian markets, the universe

of under-researched stocks outside the indices provide

ample scope to outperform.

Active Funds Outperform: Our analysis of diversified

large-cap as well as mid-and small-cap funds with a 10 and

15-year track record reveals that a majority of active

funds, in the Indian context, outperformed their

respective indices over the past 10 years and 15 years. Midcap funds, especially, outperformed their indices by a

good margin of 4-5 percentage points.

Yes, while the expenses incurred is higher in an actively

managed fund, the margin of outperformance more than

makes up for the costs involved, that is, if you had chosen

from the 78 per cent of outperforming funds!

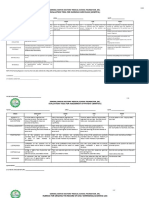

Active Funds Performance

/ Market Cap

Performance No. of funds that

over past

outperformed their

10 Years

benchmarks

No. of funds that

underperformed

their benchmarks

Outperformance

Percentage

Performance No. of funds

over past

outperformed their

15 Years

benchmarks

No. of funds that

underperformed

their benchmarks

Outperformance

Percentage

Large-Cap

Funds

36

Mid - &

Small-Cap Funds

10

10

78 per cent

100 per cent

65 per cent

100 per cent

17

Analysis is as of October 22, 2014. Outperformance percentage

relates the number of outperforming funds to total number of funds

in each category in the analysis.

Strategy: So what approach should you choose? There

are two ways to looking at this. One, if you simply want

to move with the markets and do not want to leave the

decision of your portfolio calls to a fund manager, then

index funds are your best bet. At least, it is better than not

having any equity in your portfolio.

But if you are a long-term investor, then a combination of

both would help you build a superior portfolio. You could

then consider investing 15-25 per cent of your portfolio

in index funds to ensure that at least a part of your

portfolio is not worse than the market index. Allow active

funds to generate additional returns with a chunk of your

investments there. The caveat: do your research in

choosing the right funds or seek help from your advisor.

N. Sathyamoorthy

Analyst, Mutual Fund Research, FundsIndia.com

www.fundsindia.com

Market Place

FundsIndia Blog

Handling loan application rejection

Have you ever applied for an auto loan, a home loan or a

personal loan? What if the loan application got rejected?

What to do next? Rejection of any kind is one of the

greatest fears that lie within us. But there is also a way to

address this. Put on your thinking cap to understand the

few ways on what to do next when your loan application

gets rejected.

Know and understand: Check with the credit institution

to know the reason for the rejection read it and

understand the reason. As per the Reserve Bank of India,

A bank cannot reject your loan application without

furnishing valid reason(s) for the same. Does the reason

for rejection talk about a low credit score? Does it point

to poor payment history? Are the reasons reflecting in

your credit history? Its time to check your credit report to

know the reasons behind the rejection.

Re-check your credit score: A low credit score is one of

the reasons for which the credit institution may have

rejected the loan application. It is advisable to check your

credit score with one of the credit bureaus in the country

to know how credit healthy you are.

Do an error check: A credit report contains your

demographic details, credit account details and payment

history. Do a check to see if there are errors on your credit

report related to your personal details or account details

and get them rectified.

Seek help: Do you need help to understand your credit

report? Do you find it difficult to read your credit report?

Credit counselors guide you in understanding and

reviewing your credit report.

Rejections are always a learning experience. Stop worrying

and instead, be a little more alert, a little more prudent, a

little more assertive, and a little more proactive because

who knows? A window of opportunity may open soon

for you!

Satish Mehta is the Founder and Director of www.credexpert.in

a credit and debt counselling company. Read more such thoughtful

articles at Market Place FundsIndia, the official blog of

FundsIndia.com at http://www.fundsindia.com/blog.

Invest With A Plan

Five, not one market in equity

Just as `market is not equal to just equity, there is no one

single market in equity. When you hear of equity, please

do not understand it as a homogeneous market where you

could draw conclusions that would be relevant across the

board all the time. Even if a few factors are common

across the market, the nature of their impact on the prices

of stocks differs. To make the right investment allocation

in equity, it is important to understand the different

markets in Indian equity as an asset class.

Large-cap stocks: These are major names that we are

familiar with, as they are a part of the Nifty Index. In

general, if you list all the stocks on the National Stock

Exchange in the descending order of market

capitalization, stocks that account for about 70 per cent of

the overall market capitalization would constitute this

category. You could approximately reckon the top 100

hundred stocks by market cap as large-cap stocks. Even

here, the second 50 would have a different risk-return

profile as compared to the top 50.

Mid-cap stocks: The second hundred stocks could be

considered as mid-cap stocks. These stocks carry a higher

level of risk and return. Liquidity levels are also not as

good as in the large-cap category. Risks are higher as are

returns, but you need to know when to back off, if you are

to make money in this category. Returns tend to be

compressed in very short periods. It gets progressively

even more risky from here.

Small-cap stocks: The third hundred stocks could be

considered as small-cap stocks. You need to dig really hard

to find quality and returns.

Micro-cap stocks: The fourth hundred stocks could be

considered as micro-cap stocks. This is the space for

lottery.

Penny Stocks: A very large proportion of the rest of the

listed stocks would be in this category. Forget about them.

We will examine what this graded equity market means

for performance next month.

If you look carefully, almost all old money secrets can be traced to a single source: a longer-term

outlook.

Bill Bonner

www.fundsindia.com

Nifty

Technical View

Tata Motors DVR

After a minor downward correction, the Nifty has been in

a recovery mode in the past few weeks. Its long-term

outlook is bullish. There is a strong case for the index to

cross the 10,000 mark in 12-15 months. From a shortterm perspective, there is a strong resistance at the 8,1008,150 mark.

Once it breaches 8,150, the Nifty could rally to the target

zone of 8,350-8,400. Any downward correction to the

7,750-7,800 support would be a buying opportunity for

long-term investors. Investors may use any weakness to

buy fundamentally sound stocks from the banking,

automobile, auto ancillary and infrastructure sectors.

After a sharp rally, Tata Motors DVR corrected since

September 12. The decline was arrested at the crucial

support zone on October 17, and the subsequent price

action suggests that the next leg of the upward trend is

underway. Buy at current levels and on weakness for an

initial target at ` 392, and a secondary target of ` 425.

Have a stop loss at ` 289.

Transport Corporation of India

The Transport Corporation of India stock is on a strong

upward trend and the recent pull back offers an

opportunity to buy the stock. As long as the stock trades

above the stop loss level of ` 185, there is a possibility of

a rally to the target zone of ` 265-270. A move beyond `

270 could trigger a rally to the second target of ` 285.

B Krishna Kumar, Head Equity Research, FundsIndia.com

This column is targeted at investors who are registered customers with FundsIndia for trading and investing in equity as well as prospective

investors who wish to open an equity account with FundsIndia. B Krishna Kumar hosts a weekly webinar that discusses the market outlook

for the following week. You can follow him on Livestream. If you wish to receive reminders for his webinars, go to

https://www4.gotomeeting.com/register/131985103

Disclaimer for Think FundsIndia: Mutual Fund Investments are subject to market risks. Please read the offer documents available at the website of each mutual fund carefully

before investing. Past performance does not indicate or guarantee future performance. There is risk of capital loss and uncertainty of dividend distribution. Think FundsIndia,

a monthly publication of Wealth India Financial Services, is for information purposes only. Think FundsIndia is not and should not be construed as a prospectus, scheme

information document or offer document Information in this document has been obtained from sources that are credible and reliable.

Publisher: Wealth India Financial Services

Editor: Srikanth Meenakshi

www.fundsindia.com

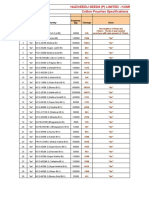

Equity Performance Snapshot

Index

1 Year

CNX Nifty

S&P BSE Sensex

CNX Mid Cap

CNX Small Cap

CNX 100

CNX 500

CNX Bank

CNX Energy

CNX FMCG

CNX Infrastructure

CNX IT

MSCI Emerging Markets

MSCI World

30.7

30.0

57.0

66.9

32.5

37.9

49.0

19.6

9.9

35.7

25.9

-2.8

5.1

5 Years

11.6

11.5

12.1

10.5

11.9

11.3

14.7

1.9

21.9

-0.7

17.1

16.1

20.4

10 Years

16.4

17.0

17.4

17.0

16.5

15.9

21.1

10.9

23.4

11.0

15.3

12.1

9.9

Returns (in per cent as of October 30, 2014) for less than one year is on an

absolute basis and for more than one year on a compounded annual basis.

Q&A

Q - Do funds maintain separate portfolios for the

dividend option and the growth option, or is it just

accounting jugglery? I always thought the dividend

option requires a different approach for stock selection,

as against the growth option.

A - Separate Net Asset Values (NAVs) are maintained

for growth and dividend options as they have to be

declared separately. There may not necessarily be

separate portfolios. There is usually a single fund, and

the stocks or bonds that it invests in do not vary

between the two options. A dividend option does not

mean that a fund will only look to invest in stocks that

pay regular dividend. The dividend and growth options

are merely ways to distribute/plough back your profits.

The idea of dividend is to periodically strip the profits

and give it back to you in the form of cash (dividend

payout), or additional units (dividend reinvestment). In

the case of growth option, the gain is retained and

reinvested into your portfolio.

Wisdom

What does not kill you

Investing, when it looks the easiest, is at its hardest.

Only a small number of investors maintain the

fortitude and confidence to pursue long-term

investment success, even at the price of short-term

underperformance. Short-term underperformance

doesn't trouble them.

Most investors feel the hefty weight of short-term

performance expectations, forcing them to take up

marginal or highly speculative investments.

The payoff from a risk-averse, long-term orientation is

just that - long term. It is measurable only over the

span of many years, over one or more market cycles.

An investors willingness to invest amidst failing

markets is the best way to build positions at great

prices; but this strategy can cause short-term

underperformance.

Buying as prices are falling can look stupid until sellers

are exhausted; and buyers who held back cannot

effectively deploy capital, except at much higher prices.

The resolve in holding cash balances - sometimes very

large ones - in the absence of a compelling

opportunity is another potential performance drag. But

in a world in which being anti-fragile is good, what

doesn't kill you can make you stronger.

Patience and discipline can make investors look

foolishly out of touch until time makes them look

prudent and even prescient.

Seth Klarman is the founder of the Baupost Group.

Must Read: Keep in mind that even terribly hostile market environments do not resolve into uninterrupted

declines, writes John Hussman in On the Tendency of Large Market Losses to Occur in Succession. Read his

insightful comments at www.hussmanfunds.com

www.fundsindia.com

FundsIndia Select Funds

Equity Moderate Risk: Preferred picks in this category are:

Axis Equity

BNP Paribas Equity

HDFC Top 200

ICICI Pru Focused

Kotak Select Focus

UTI Equity

Birla SunLife Top 100

Franklin Bluechip

ICICI Pru Dynamic

ICICI Pru Top 100

Mirae Asset Allocation

UTI Opportunities

What is FundsIndia Select Funds: This is a listing of

mutual funds that we think are most investment worthy

for a regular investor. We review this list on a quarterly

basis. Do note, however, that past performance is not a

guarantee of future results. Please consider your specific

investment requirements before designing a portfolio that

suits your needs.

Please click here for a complete listing of our preferred

funds.

Investment Quiz

1 Who is the Chief Economic Advisor to the Prime

Minister of India?

2 Who is the author of Fooled by Randomness?

3 Which was the first-gold related fund to be launched in

India?

4 What is the usual benchmark for Balanced Funds (in

India)?

5 Name the person in the image. She is

the Head of one of the largest banks

in India.

Answers for October 2014 Quiz: 1 National Securities Clearing

Corporation 2 Shriram Mutual Fund and CRB Mutual Fund 3

85% 4 Barry Ritholtz 5 Prashant Jain, HDFC Mutual Fund

There were no winners for the October 2014 Quiz.

@fundsindia.com in October

App Upgrade FundsIndias mobile app for Android users

has been upgraded to enable new investments and

additional investments. Investors will be able to make

payments towards these investments from their internetbanking accounts.

Recommended Book

Quick Tax Saver We have introduced a Quick Tax Saver

feature. This will help investors invest in the best tax saving

funds that have been hand-picked by our experts in a jiffy.

New Gold Plan Satyug Mera Gold Plan is now available on

the FundsIndia platform. Investors will now be able to

systematically accumulate 24 Karat gold through this plan.

To start buying gold with SMGP, please click here.

To invest, call 0 7667 166 166

About us: FundsIndia.com is India's leading online investment platform. It offers a wide range of investment options such

as mutual funds, equities, corporate deposits, bonds, the National Pension System, loans, insurance and 24 Karat gold, to name

a few, in one convenient online location. FundsIndia also offers a host of value-added services such as Systematic Investment

Plans (SIPs), Alert SIPs, Flexi SIPs, trigger-based investing, and more, that further enrich your investment experience.

Recovery in economic growth is expected to be led by a revival in the capex/investment cycle by FY 16-17. Hence,

recovery in earnings of cyclical sectors could be back-ended. Valuations of cyclical stocks might look expensive

from the next 12-month perspective. Sanjay Dongre, Senior Fund Manager, UTI Mutual in Marketplace,

FundsIndia Blog.

www.fundsindia.com

Potrebbero piacerti anche

- Capital Letter December 2011Documento5 pagineCapital Letter December 2011marketingNessuna valutazione finora

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Da EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Nessuna valutazione finora

- Perspective of MF in IndiaDocumento5 paginePerspective of MF in Indiaranbirk82Nessuna valutazione finora

- Think FundsIndia July 2014Documento10 pagineThink FundsIndia July 2014marketingNessuna valutazione finora

- Capital Letter September 2013Documento8 pagineCapital Letter September 2013marketingNessuna valutazione finora

- TipsDocumento2 pagineTips9824534642Nessuna valutazione finora

- Nvesting Verview: o o o o o oDocumento26 pagineNvesting Verview: o o o o o oranjanmodiNessuna valutazione finora

- Essential Guide To Stock InvestingDocumento20 pagineEssential Guide To Stock InvestingvinaysatijaNessuna valutazione finora

- How To Build WealthDocumento12 pagineHow To Build WealthAshishNessuna valutazione finora

- Fidelity's: Top TipsDocumento24 pagineFidelity's: Top Tipsmandar LawandeNessuna valutazione finora

- Investment Lessons BookletDocumento20 pagineInvestment Lessons BookletShakti ShivanandNessuna valutazione finora

- Mfi 0516Documento48 pagineMfi 0516StephNessuna valutazione finora

- Ultimate Guide To SIP in Pakistan Ebook FinalDocumento39 pagineUltimate Guide To SIP in Pakistan Ebook FinalbisaxNessuna valutazione finora

- Think FundsIndia October 2018Documento10 pagineThink FundsIndia October 2018dahigaonkarNessuna valutazione finora

- Capital Letter November 2013Documento6 pagineCapital Letter November 2013marketingNessuna valutazione finora

- Sensex Will Gain Over 30% in Three Years: Sunil Singhania, Reliance Mutual FundDocumento5 pagineSensex Will Gain Over 30% in Three Years: Sunil Singhania, Reliance Mutual FundGurdeep Singh ChhabraNessuna valutazione finora

- SimpleDocumento3 pagineSimplehrammrpNessuna valutazione finora

- Equity Can Be A Risky Asset Class Even When You Don't Invest in The Stock Market. Here's How - ET-June-30-2022Documento3 pagineEquity Can Be A Risky Asset Class Even When You Don't Invest in The Stock Market. Here's How - ET-June-30-2022Grimoire HeartsNessuna valutazione finora

- Sofia Times October 2017Documento27 pagineSofia Times October 2017dhanrajkamatNessuna valutazione finora

- Ppfas MF Factsheet May 2021Documento13 paginePpfas MF Factsheet May 2021basabNessuna valutazione finora

- Ppfas MF Factsheet May 2021Documento13 paginePpfas MF Factsheet May 2021RajagopalNessuna valutazione finora

- Reasons 4 InvestingDocumento11 pagineReasons 4 InvestingChikwason Sarcozy MwanzaNessuna valutazione finora

- Think FundsIndia August 2014Documento8 pagineThink FundsIndia August 2014marketingNessuna valutazione finora

- DSPBRIM-Mutual Fund Basics and SIP Presentation NewDocumento45 pagineDSPBRIM-Mutual Fund Basics and SIP Presentation NewavinashmunnuNessuna valutazione finora

- February 2011Documento3 pagineFebruary 2011gradnvNessuna valutazione finora

- How Much Should You InvestDocumento3 pagineHow Much Should You InvestKurian PunnooseNessuna valutazione finora

- S&P 500 IndexDocumento3 pagineS&P 500 IndexAnn AbrahamNessuna valutazione finora

- June 2019 Investor LetterDocumento7 pagineJune 2019 Investor LetterMohit AgarwalNessuna valutazione finora

- Systematic Investment Plan - A Better Way To Build Wealth Over The Long TermDocumento5 pagineSystematic Investment Plan - A Better Way To Build Wealth Over The Long Termginig69Nessuna valutazione finora

- Stock Markets: Has History Taught You Anything?: VolatilityDocumento11 pagineStock Markets: Has History Taught You Anything?: Volatilityprashant kumarNessuna valutazione finora

- July 2019 NewsletterDocumento6 pagineJuly 2019 NewsletterRaghav BehaniNessuna valutazione finora

- Personal Financial PlanningDocumento25 paginePersonal Financial Planninghari gallaNessuna valutazione finora

- How To Build WealthDocumento12 pagineHow To Build WealthsushilNessuna valutazione finora

- Why Equity Investment Is Must in Your Financial PlanDocumento3 pagineWhy Equity Investment Is Must in Your Financial Planmanish2519Nessuna valutazione finora

- Zerodha Technical AnalysisDocumento104 pagineZerodha Technical Analysisicecrack100% (1)

- Letter One Must ReadDocumento2 pagineLetter One Must ReadSecure PlusNessuna valutazione finora

- Empower July 2011Documento74 pagineEmpower July 2011Priyanka AroraNessuna valutazione finora

- 2 - 16th April 2008 (160408)Documento5 pagine2 - 16th April 2008 (160408)Chaanakya_cuimNessuna valutazione finora

- The Fidelity SIP Guide: We're Here To HelpDocumento12 pagineThe Fidelity SIP Guide: We're Here To HelpkrishchellaNessuna valutazione finora

- Are You InvestingDocumento10 pagineAre You InvestingShailesh BansalNessuna valutazione finora

- IPRU InsightsDocumento13 pagineIPRU InsightssandeepNessuna valutazione finora

- A Contrarian ChecklistDocumento7 pagineA Contrarian ChecklistvinamraNessuna valutazione finora

- Think Fundsindia August UpdatedDocumento6 pagineThink Fundsindia August UpdatedAkshay PandeyNessuna valutazione finora

- Hyderabad Lecture Notes April 2010 Raghu IyerDocumento76 pagineHyderabad Lecture Notes April 2010 Raghu Iyeraradhana avinashNessuna valutazione finora

- How To Build A Mutual Fund Portfolio: The Debt-Equity RatioDocumento10 pagineHow To Build A Mutual Fund Portfolio: The Debt-Equity Ratioparry5000Nessuna valutazione finora

- Financial Planning - Mutual FundDocumento20 pagineFinancial Planning - Mutual FundTRIVIKRAM JOSHINessuna valutazione finora

- 8 - 16th December 2007 (161207)Documento4 pagine8 - 16th December 2007 (161207)Chaanakya_cuimNessuna valutazione finora

- Shikhar Sharma Theswedishinvestor Iag1-HmmDocumento5 pagineShikhar Sharma Theswedishinvestor Iag1-HmmresourcesficNessuna valutazione finora

- How An SIP Works: Mutual Funds Post Office BankDocumento9 pagineHow An SIP Works: Mutual Funds Post Office BankAbhishek BansalNessuna valutazione finora

- 10 Big, Safe, Income DoublersDocumento12 pagine10 Big, Safe, Income Doublerskuky6549369Nessuna valutazione finora

- Nippon Large Cap Fund 3.0Documento3 pagineNippon Large Cap Fund 3.0Ritam chaturvediNessuna valutazione finora

- Top 10 Investment Options: Public Provident Fund Real EstateDocumento3 pagineTop 10 Investment Options: Public Provident Fund Real EstateleninbapujiNessuna valutazione finora

- How To Identify Winning Mutual Funds (Safal Niveshak)Documento20 pagineHow To Identify Winning Mutual Funds (Safal Niveshak)Vishal Safal Niveshak KhandelwalNessuna valutazione finora

- Your Today Will Define Your TomorrowDocumento3 pagineYour Today Will Define Your TomorrowpremalbthakkarNessuna valutazione finora

- Capital Letter May 2011Documento6 pagineCapital Letter May 2011marketingNessuna valutazione finora

- Saurabh MukherjeaDocumento8 pagineSaurabh MukherjeaGurjeevNessuna valutazione finora

- Fourth Quarter 2018 Letter To LRI ClientsDocumento15 pagineFourth Quarter 2018 Letter To LRI ClientsDbbbssNessuna valutazione finora

- What Is Systematic Investment Plan or SIP?: Investment Avenue Mutual FundDocumento7 pagineWhat Is Systematic Investment Plan or SIP?: Investment Avenue Mutual FundCheruv SoniyaNessuna valutazione finora

- Empower June 2012Documento68 pagineEmpower June 2012pravin963Nessuna valutazione finora

- Think FundsIndia August 2014Documento8 pagineThink FundsIndia August 2014marketingNessuna valutazione finora

- Capital Letter November 2013Documento6 pagineCapital Letter November 2013marketingNessuna valutazione finora

- Capital Letter December 2012Documento6 pagineCapital Letter December 2012marketingNessuna valutazione finora

- Capital Letter May 2011Documento6 pagineCapital Letter May 2011marketingNessuna valutazione finora

- Capital Letter September 2011Documento6 pagineCapital Letter September 2011marketingNessuna valutazione finora

- Capital Letter July 2011Documento5 pagineCapital Letter July 2011marketingNessuna valutazione finora

- Capital Letter August 2011Documento5 pagineCapital Letter August 2011marketingNessuna valutazione finora

- Project Report Devki Nandan Sharma AmulDocumento79 pagineProject Report Devki Nandan Sharma AmulAvaneesh KaushikNessuna valutazione finora

- College PrepDocumento2 pagineCollege Prepapi-322377992Nessuna valutazione finora

- Guidebook On Mutual Funds KredentMoney 201911 PDFDocumento80 pagineGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNessuna valutazione finora

- Signal&Systems - Lab Manual - 2021-1Documento121 pagineSignal&Systems - Lab Manual - 2021-1telecom_numl8233Nessuna valutazione finora

- The Bipolar Affective Disorder Dimension Scale (BADDS) - A Dimensional Scale For Rating Lifetime Psychopathology in Bipolar Spectrum DisordersDocumento11 pagineThe Bipolar Affective Disorder Dimension Scale (BADDS) - A Dimensional Scale For Rating Lifetime Psychopathology in Bipolar Spectrum DisordersDM YazdaniNessuna valutazione finora

- Kindergarten Report Card SampleDocumento3 pagineKindergarten Report Card Sampleapi-294165063Nessuna valutazione finora

- Listening Fill in The Gaps and ExercisesDocumento4 pagineListening Fill in The Gaps and ExercisesAdriano CamargoNessuna valutazione finora

- Not Just Another Winter Festival: Rabbi Reuven BrandDocumento4 pagineNot Just Another Winter Festival: Rabbi Reuven Brandoutdash2Nessuna valutazione finora

- Surefire Hellfighter Power Cord QuestionDocumento3 pagineSurefire Hellfighter Power Cord QuestionPedro VianaNessuna valutazione finora

- Where Is The Love?-The Black Eyed Peas: NBA National KKK Ku Klux KlanDocumento3 pagineWhere Is The Love?-The Black Eyed Peas: NBA National KKK Ku Klux KlanLayane ÉricaNessuna valutazione finora

- Analysis of The Tata Consultancy ServiceDocumento20 pagineAnalysis of The Tata Consultancy ServiceamalremeshNessuna valutazione finora

- Sportex 2017Documento108 pagineSportex 2017AleksaE77100% (1)

- List of Notified Bodies Under Directive - 93-42 EEC Medical DevicesDocumento332 pagineList of Notified Bodies Under Directive - 93-42 EEC Medical DevicesJamal MohamedNessuna valutazione finora

- PEDIA OPD RubricsDocumento11 paginePEDIA OPD RubricsKylle AlimosaNessuna valutazione finora

- Corrugated Board Bonding Defect VisualizDocumento33 pagineCorrugated Board Bonding Defect VisualizVijaykumarNessuna valutazione finora

- Bon JourDocumento15 pagineBon JourNikolinaJamicic0% (1)

- HitchjikersGuide v1Documento126 pagineHitchjikersGuide v1ArushiNessuna valutazione finora

- Sultan Omar Ali Saifuddin IIIDocumento14 pagineSultan Omar Ali Saifuddin IIISekolah Menengah Rimba100% (3)

- Mythologia: PrologueDocumento14 pagineMythologia: ProloguecentrifugalstoriesNessuna valutazione finora

- ReportDocumento8 pagineReportTrust Asia Cargo in OfficeNessuna valutazione finora

- Cotton Pouches SpecificationsDocumento2 pagineCotton Pouches SpecificationspunnareddytNessuna valutazione finora

- The Rescue Agreement 1968 (Udara Angkasa)Documento12 pagineThe Rescue Agreement 1968 (Udara Angkasa)Rika Masirilla Septiari SoedarmoNessuna valutazione finora

- Sugar Industries of PakistanDocumento19 pagineSugar Industries of Pakistanhelperforeu50% (2)

- SPE-199498-MS Reuse of Produced Water in The Oil and Gas IndustryDocumento10 pagineSPE-199498-MS Reuse of Produced Water in The Oil and Gas Industry叶芊Nessuna valutazione finora

- 2011 06 13-DI-PER8-Acoustic Insulation Catalogue-Rev 01Documento12 pagine2011 06 13-DI-PER8-Acoustic Insulation Catalogue-Rev 01Tien PhamNessuna valutazione finora

- 2nd Quarter Exam All Source g12Documento314 pagine2nd Quarter Exam All Source g12Bobo Ka100% (1)

- CO-PO MappingDocumento6 pagineCO-PO MappingArun Kumar100% (1)

- Air Microbiology 2018 - IswDocumento26 pagineAir Microbiology 2018 - IswOktalia Suci AnggraeniNessuna valutazione finora

- Latvian Adjectives+Documento6 pagineLatvian Adjectives+sherin PeckalNessuna valutazione finora

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsDa EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNessuna valutazione finora

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Da EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Valutazione: 5 su 5 stelle5/5 (89)

- How To Budget And Manage Your Money In 7 Simple StepsDa EverandHow To Budget And Manage Your Money In 7 Simple StepsValutazione: 5 su 5 stelle5/5 (4)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassDa EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNessuna valutazione finora

- The Best Team Wins: The New Science of High PerformanceDa EverandThe Best Team Wins: The New Science of High PerformanceValutazione: 4.5 su 5 stelle4.5/5 (31)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessDa EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessValutazione: 4.5 su 5 stelle4.5/5 (4)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationDa EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationValutazione: 4.5 su 5 stelle4.5/5 (18)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantDa EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantValutazione: 4 su 5 stelle4/5 (104)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsDa EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsValutazione: 4 su 5 stelle4/5 (4)

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationDa EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationValutazione: 4.5 su 5 stelle4.5/5 (5)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonDa EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonValutazione: 5 su 5 stelle5/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDa EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNessuna valutazione finora

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Da EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Valutazione: 3.5 su 5 stelle3.5/5 (9)

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouDa EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouValutazione: 4 su 5 stelle4/5 (2)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherDa EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherValutazione: 5 su 5 stelle5/5 (14)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitDa EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNessuna valutazione finora

- Money Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasDa EverandMoney Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasValutazione: 3 su 5 stelle3/5 (1)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyDa EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyValutazione: 5 su 5 stelle5/5 (1)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitDa EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitValutazione: 4.5 su 5 stelle4.5/5 (9)

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomDa EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomValutazione: 4.5 su 5 stelle4.5/5 (2)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesDa EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesValutazione: 4.5 su 5 stelle4.5/5 (30)