Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Capital Letter February 2014

Caricato da

marketingTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Capital Letter February 2014

Caricato da

marketingCopyright:

Formati disponibili

Volume 7, Issue 02

07Feb2014

A New Look and a New Product

Srikanth Meenakshi

Inside this issue:

Greetings from FundsIndia!

Hope is a beautiful

thing Srikanth

Meenakshi

Around the middle of last month, we launched the new look portfolio pages for FundsIndia

account holders. I hope you had a chance to login and take a look.

2

Should you choose

the dividend option

or the growth option? - Vidya Bala

The new design came about after consultation with different sets of people customers, advisors, and a

great web design team. Our goal was to give the most useful information about an investors portfolio in

one single place in the most accessible manner while keeping it pleasing to the eye and easy to use. After numerous trials, changes, and fixes, we think we have the arguable best portfolio page among all

mutual fund platforms in the country.

Equity Recommendations

- B. Krishna Kumar

The Rajan regime

makes fixedincome unpredictable Dhirendra

Kumar

The new portfolio page presents, at a glance, the performance of the portfolio, the current scheme details (including Value Research ratings), the asset allocation profile, as well as the long-term and shortterm capital gains in each of the holdings. This is presented in an easy-to-use tabbed format. For an

investor with multiple portfolios, each portfolio is now accessible as a separate tab as well so that they

can focus on a particular set of holdings at a time if they wish. No data, no functionality that was previously present has been removed in the new look.

The feedback about the new look has thus far been uniformly positive. On Twitter, Facebook, email,

chat, and phone calls, investors have praised the new design as refreshing and very useful. There have

been some helpful comments as well. We thank you all for your encouragement and inputs.

The portfolio page recast is only a start for the redesign of the account user interface. Over the next

weeks, please look forward to a redesign of the workflows for transactional pages as well.

Also, last month saw the launch of a unique new product in FundsIndia. We launched Reliance My Gold Plan (RMGP) in FundsIndia. Our

customers have always wanted the ability to buy physical gold, and with RMGP, we have made it possible.

RMGP is about the best way to buy in physical gold in installments. It is superior to the schemes offered by jewelers in terms of pricing (it

employs cost averaging All subscriptions made will be split into 20 daily purchases, thus reducing market timing risk). At redemption

time, gold can be obtained from any of the many empanelled jewelers.

For a limited time, FundsIndia will also be offering free gold worth 6% of your first installment when you enroll in this plan. So, please do

take advantage of the opportunity.

Happy Investing!

Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing.

Volume 7, Issue 02

Page 2

Should you choose the dividend option or the growth option?

Vidya Bala, Posted on March 15, 2013, FundsIndia Blog

Your investment time frame, cash flow needs and tax bracket will decide whether you

should go for dividend or growth options

Should I go for growth option or take out the dividends in my fund? is a question frequently asked by many of you, when venturing into

mutual fund investments. Before we move on to discussing what suits you best, let us get down to some brass tacks.

The difference

The growth option simply implies that the profits you make stay reinvested. In other words, the profits, along with your capital, are invested in stocks/debt to earn you more money.

Dividend payout implies that a part of such profits (an amount that the fund decides to give out) is stripped from your NAV and given to

you. That means, a part of the funds profits are given in cash. Hence, your NAV falls to the extent of dividends. This is wh y the NAV of

growth and dividend option are not the same.

In dividend reinvestment option too, profits are stripped. But instead of giving them as cash, they are allotted to you as units at the prevailing NAV. Hence, indirectly, by adding more units, you simply stay invested in the fund. Conceptually, the dividend reinvestment option is

the same as growth option for all equity funds.

Which one to choose?

Two key factors will determine what is appropriate option is for you:

1. Cash requirement and time frame

2. Tax efficiency

Most people base their decisions on tax efficiency. While it is a key deciding criteria, let us also look at how other factors too, will play a role

in choosing between dividend and growth.

Equity funds

Lets take on the easy one first. Equity funds are meant for the long term. Your reason for choosing an equity fund must be to build wealth

towards some goal which is perhaps at least few years away.

That simply means you should stay invested in the fund and not take the cash out (unless you will invest the dividends back diligently) to

help compounding work for you. Since, long-term capital gains are free of tax, the solution here is simple: As a general principle, go for

growth or dividend reinvestment in equity funds.

But there are exceptions: One, in case of theme funds or sector funds that you hold tactically, it makes sense to either opt for dividend

payouts or book profits as the fortunes of themes can take a turn after one good cycle. Two, in case of ELSS, avoid dividend reinvestment

as every reinvested unit will be subject to a three-year lock in. Prefer growth, Three, if you are generally risk averse and prefer to take your

money out to invest in some debt option, then you should consider payouts or set triggers to book profits.

(Continued on page 3 . . . )

Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing.

Volume 7, Issue 02

Page 3

Debt funds

This category gets a bit tricky because the dividend suffers dividend distribution tax (DDT). DDT is nothing but the tax on the dividend

paid out in debt and debt-oriented funds and gold funds. DDT is not applicable for equity funds.

Let us suppose a fund declares Rs 10 as dividend. A DDT of 28.33% ( 25% plus surcharge of 10% plus cess of 3% from June 1) is Rs 2.833.

Now while you will get Rs 10 in your hands, Rs 2.833 will be further reduced from your NAV (your NAV after dividend will be predividend NAV minus dividend minus DDT).

Now, to know the tax implication Let us split your universe into two based on your cash needs:

1. You need some cash flows from your debt fund: In this case, you can choose the dividend payout or the systematic withdrawal

plan (SWP) under growth option. Look at the table below. The SWP is a clear winner for those in the 10% and 20% tax brackets. But please

ensure that you do not end up paying exit load. Opt for SWP post the exit load period if you wish to avoid the load.

Those in the 30% tax bracket, can go for dividend payout, if

you intend to hold the fund for less than a year.

But you do not gain much by doing so, as DDT will increase

to 25% for all debt funds (earlier only for liquid funds) effective June 1.

But if you can park your money for more than a year and have no immediate cash flow requirements, opt for growth right when you invest

and do a SWP from the beginning of the second year.

Remember, switching between options will also unnecessarily entail capital gains tax if you have profits. Hence, get your inv estment time

frame right when you start your investment.

2. You dont need cash flows from your debt fund: In this case, you have 2 options to go for growth or dividend reinvestment.

Look at the table below. Growth option scores in most cases, except when you are in the 30% tax bracket and redeem in less than a year.

When you are in the 30% tax bracket and hold for less than

a year (will be the case with most of your liquid or ultra

short-term funds) you will suffer DDT of 28.33% (including

surcharge and cess effective June 1) on the dividend reinvested.

This will be slightly lower than the income tax slab of 30.9%

(including cess).

Consider your fresh investments through the above routes. But if you make your switches now, do take into account the exit load(will vary

for each fund) and the capital gains, if any, you may suffer on the fund now, especially if your holding period is less than a year and you do

not have a long time frame for the investment from here on.

This article was first published on the FundsIndia Blog on March 15th 2013.

Vidya Bala is the Head of Mutual Fund Research at FundsIndia. She writes for our monthly newsletter on topics including mutual fund,

personal finance and equity markets. Vidya Bala can be reached at vidyabala@fundsindia.com

Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing.

Volume 7, Issue 02

Page 4

The Month Ahead - Equity Recommendations

B. Krishna Kumar

The year 2014 did not start on a particularly positive note for the stock markets. The frontline indices NSE Nifty and BSE Sensex recorded losses in January. The foreign institutional investors have not been that aggressive in buying Indian equities which was the primary

reason for the weakness.

The Reserve Bank of Indias decision to hike interest rate in its January 28 meeting affected sentiment. The US Federal Reserves decision

to taper its quantitative easing program did not help the cause either. The Indian Rupee too showed signs of volatility and semblance of

weakness was visible in the last week of January.

On the positive side, there were signs of inflation cooling off with the consumer and the wholesale price index showing some improvement

in December. We remain cautious on the Nifty and the only positive aspect is that the key support at 5,960 is still intact.

We would however await a breakout past 6,360 before concluding that the worst is over for the Nifty. The corporate earnings season is

underway and the scorecard thus far is not too disappointing. The banking sectors provisioning for bad loans has gone up, which is a

cause of concern.

As highlight earlier, investors may adopt a SIP kind of approach to investment. Buying index ETFs on weakness would not be such a bad

idea. Once 6,360 is taken out, we expect the Nifty to rally to our target of 6,650-6,700.

This month, we cover the outlook for a couple of mid cap stocks - Crompton Greaves and Deepak Fertilisers. We are positive on both these

stocks and expect 10-12% appreciation from a short-term perspective. Investors may accumulate these stocks at the current levels as well

as on declines.

Investors may buy Crompton Greaves at or below Rs.108, with a stop loss at Rs.98 and target

of Rs.119. A breakout past Rs.119 would be a

sign of strength and the stock could then rally to

the next target of Rs.126. The positive view in

Cromtpon would be under threat if the stock

slides below Rs.98 as this would open up further

downside.

Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing.

Volume 7, Issue 02

Page 5

The chart pattern in Deepak Fertiliser is almost similar to that of Crompton. After a persistent downtrend, the price action shows some

buying interest at the lower levels. We expect the stock to reach our target of Rs.124-126 range soon.

Investors may buy the stock at or below Rs.107 with a stop loss at Rs.98 and target of Rs.125 to begin with. A move past Rs.125 would lend

momentum to the uptrend and we would then expect the stock to rally to Rs.131.

Mr. B. Krishna Kumar also hosts a weekly webinar that discusses the market outlook for the following week. You can follow him on Livestream to receive reminders for his webinars: http://

new.livestream.com/accounts/4749821

Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing.

Volume 7, Issue 02

Page 6

The Rajan regime makes fixed-income unpredictable

By Dhirendra Kumar | Feb 5th 2014

Between a strong-willed RBI governor and a fraught external environment, fixed income fund investors should get used to a new level

of unpredictability

Last week, RBI Governor Rajan sprang a surprise when he raised interest rates. Talking heads everywhere were convinced that he

would keep rates static, with hardly anyone allowing an outside possibility that he would raise rates. In fact the fringe suggesting a rate

cut was actually larger than the one suggesting a rate hike. As it happened, Rajan came out all guns blazing on inflation. However, he

went a step further. He completely reframed the conventional growth (low rate) vs inflation fighting (high rates) debate by emphasising that low inflation was a pre-condition for growth to come back.

The point he made--which I felt wasn't adequately appreciated--that it is impossible to lower rates in the face of high inflation, not the

least because it's unfair to savers. First, inflation must be brought into control, then rates will fall, and then growth will follow. It's not

possible for these three steps to occur out of this sequence. Between the new-found focus on consumer inflation on one hand, and the

worry about savers getting a fair rate on the other, the concerns of the common man (I won't use the now politically loaded 'AA'

phrase) is central to this RBI in a way that it has never been before.

But anyhow, he impact on inflation, growth etc will work out as they will. At the end of the day, the government has to do a lot and

we'll see how and what happens if and when we get a real government. However, there's another aspect to the RBI's new modus operandi, and that's something that affects investors directly. Events of the last few months have shown investors in fixed income mutual

funds will have to get used to a new kind of environment, one where surprises are not only possible but even likely.

For a long time--in fact, since the time in the early 2000s when fixed income fund investing came off age in India, it has been a fairly

dull and predictable activity. There have been some surprises--like in 2008, obviously--but by and large fixed income investing has

been a placid activity. The central bank's rate changes--which are the immediate drivers behind returns--have been almost always predictable. Almost always, the consensus of the talking head economists has been correct. The central bank has done what the conventional wisdom of the day has been. There may have been some mild surprises on the magnitude of the action, but hardly ever on the

direction.

Those days are gone. Firstly, since the middle of the last year, when Ben Bernanke first set off the tapering bomb, fixed-income investors have had an unwelcome amount of excitement and thrills. While the whole tapering affair is an external shock that will play out in

some unpredictable way, the subsequent months have seen investors trying to contend with the Raghuram Rajan way of thinking and

working. So far, the motivation and the instincts of the new RBI have been hard for the bond markets to fathom. This is unlikely to

change in the near future.

While bond traders will look after themselves as best they can, fixed-income mutual fund investors need to take a close look at how

well they have been sticking to the basic rules of how they should act and invest. It's very much back to the basics time. And back to the

basics means aligning your investment horizon with the maturity of the fund that you choose. In the new uncertain environment, investing for a few days or weeks in funds which are holding bonds with years of residual maturity can be disastrous. In fact, as the

events of last July showed, even liquid funds--which are the safest--can make losses for a day or two. This is an unprecedented phenomena for Indian investors.

Like equity and other types of investing, a new element of risk has entered fixed income investing. It may be small compared to equity

but within the context, it is just as significant--and it's not going to go away.

Syndicated from Value Research Online. Read the article online here: http://www.valueresearchonline.com/story/h2_storyview.asp?

str=24567

Wealth India Financial Services Pvt. Ltd.,

H.M. Centre, Second Floor,

29, Nungambakkam High Road,

Nungambakkam,

Chennai - 600 034

Phone: (0) 7667 166 166

Email: contact@fundsindia.com

Disclaimer: Mutual Fund Investments are subject to market risks. Please read all scheme related documents carefully before investing.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Secured Transaction - Cornell ArticleDocumento89 pagineSecured Transaction - Cornell ArticleFitBody IndiaNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Raj MehtaNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

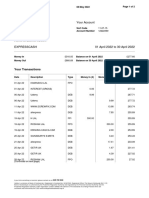

- 2022 April StatementDocumento2 pagine2022 April StatementAvishekNessuna valutazione finora

- Chapter 11 The Efficient Market HypothesisDocumento33 pagineChapter 11 The Efficient Market HypothesisAhmad Aziz P PNessuna valutazione finora

- Case Study II: Sleeping Beauty Bonds: Name Imitation Affiliated Instructor Course DateDocumento6 pagineCase Study II: Sleeping Beauty Bonds: Name Imitation Affiliated Instructor Course DateCollins GathimbaNessuna valutazione finora

- BBLS - Risk Management - v.0.1 PDFDocumento27 pagineBBLS - Risk Management - v.0.1 PDFNitishNessuna valutazione finora

- Lecture 6 and 7 Project Finance Model 1Documento61 pagineLecture 6 and 7 Project Finance Model 1w_fibNessuna valutazione finora

- Accounting For PartnershipsDocumento3 pagineAccounting For PartnershipsRixa Doreen Antoja50% (2)

- McKinsey ReportDocumento58 pagineMcKinsey ReportSetiady MaruliNessuna valutazione finora

- Think FundsIndia October 2014Documento8 pagineThink FundsIndia October 2014marketingNessuna valutazione finora

- Think FundsIndia January 2015Documento9 pagineThink FundsIndia January 2015marketingNessuna valutazione finora

- Think FundsIndia September 2014Documento8 pagineThink FundsIndia September 2014marketingNessuna valutazione finora

- Think FundsIndia November 2014Documento8 pagineThink FundsIndia November 2014marketingNessuna valutazione finora

- Think FundsIndia July 2014Documento10 pagineThink FundsIndia July 2014marketingNessuna valutazione finora

- Capital Letter November 2013Documento6 pagineCapital Letter November 2013marketingNessuna valutazione finora

- Capital Letter March 2014Documento8 pagineCapital Letter March 2014marketingNessuna valutazione finora

- Think FundsIndia June 2014Documento9 pagineThink FundsIndia June 2014marketingNessuna valutazione finora

- Capital Letter September 2013Documento8 pagineCapital Letter September 2013marketingNessuna valutazione finora

- Think FundsIndia August 2014Documento8 pagineThink FundsIndia August 2014marketingNessuna valutazione finora

- Capital Letter December 2013Documento6 pagineCapital Letter December 2013marketingNessuna valutazione finora

- Capital Letter JanuaryDocumento6 pagineCapital Letter JanuarymarketingNessuna valutazione finora

- Capital Letter September 2013Documento8 pagineCapital Letter September 2013marketingNessuna valutazione finora

- Capital Letter May 2013Documento7 pagineCapital Letter May 2013marketingNessuna valutazione finora

- Capital Letter July 2013Documento7 pagineCapital Letter July 2013marketingNessuna valutazione finora

- Capital Letter March 2013Documento7 pagineCapital Letter March 2013marketingNessuna valutazione finora

- Capital Letter May 2012Documento5 pagineCapital Letter May 2012marketingNessuna valutazione finora

- Capital Letter August 2013Documento7 pagineCapital Letter August 2013marketingNessuna valutazione finora

- Capital Letter November 2012Documento8 pagineCapital Letter November 2012marketingNessuna valutazione finora

- Capital Letter January 2013Documento6 pagineCapital Letter January 2013marketingNessuna valutazione finora

- Capital Letter February 2013Documento7 pagineCapital Letter February 2013marketingNessuna valutazione finora

- Monthly newsletter from FundsIndia discusses tough times in equity marketsDocumento6 pagineMonthly newsletter from FundsIndia discusses tough times in equity marketsmohamedayazuddinNessuna valutazione finora

- Capital Letter April 2012Documento5 pagineCapital Letter April 2012marketingNessuna valutazione finora

- Capital Letter December 2012Documento6 pagineCapital Letter December 2012marketingNessuna valutazione finora

- Capital Letter October 2012Documento7 pagineCapital Letter October 2012marketingNessuna valutazione finora

- Capital Letter August 2012Documento6 pagineCapital Letter August 2012marketingNessuna valutazione finora

- Capital Letter September 2012Documento7 pagineCapital Letter September 2012marketingNessuna valutazione finora

- Capital Letter March 2012Documento6 pagineCapital Letter March 2012marketingNessuna valutazione finora

- Capital Letter February 2012Documento6 pagineCapital Letter February 2012marketingNessuna valutazione finora

- Chapter 22 ArensDocumento12 pagineChapter 22 Arensrahmatika yaniNessuna valutazione finora

- Research Activity 2:: Generation, Opportunity Evaluation, Planning, Company Formation/launch and GrowthDocumento4 pagineResearch Activity 2:: Generation, Opportunity Evaluation, Planning, Company Formation/launch and GrowthmalouNessuna valutazione finora

- Transactions-In-The-Real-Estate-Sector 2020 - PWC ReportDocumento56 pagineTransactions-In-The-Real-Estate-Sector 2020 - PWC ReportNimisha GandechaNessuna valutazione finora

- School of Advanced Studies: Principles and Processes For Enterprise DevelopmentDocumento70 pagineSchool of Advanced Studies: Principles and Processes For Enterprise DevelopmentRaymond Wagas GamboaNessuna valutazione finora

- SSRN Id923557 PDFDocumento11 pagineSSRN Id923557 PDFMuhammad Ali HaiderNessuna valutazione finora

- Salary Loan/Advance - Application Form: Personal InformationDocumento2 pagineSalary Loan/Advance - Application Form: Personal InformationJohn Ray Velasco100% (1)

- DCB RTGSDocumento2 pagineDCB RTGSBharat VardhanNessuna valutazione finora

- Final Project Report On Working Capital Management in Bhilai Steel PlantDocumento59 pagineFinal Project Report On Working Capital Management in Bhilai Steel Plantaisha pannaNessuna valutazione finora

- Advanced ExcelDocumento6 pagineAdvanced ExcelKeith Parker100% (4)

- Fintech Assignment 2-ReportDocumento6 pagineFintech Assignment 2-ReportAnku Rani0% (1)

- 86Fb Football Trading: Everything You Need To Know About Your IncomeDocumento5 pagine86Fb Football Trading: Everything You Need To Know About Your IncomeMavixkeyz Onice IzoduwaNessuna valutazione finora

- International Economics: Exchange Rate DeterminationDocumento41 pagineInternational Economics: Exchange Rate DeterminationKhai Quang PhamNessuna valutazione finora

- Engineering Economics: Ronel E. Romero, RCE, MCEDocumento19 pagineEngineering Economics: Ronel E. Romero, RCE, MCEkate asiaticoNessuna valutazione finora

- AS-AD ModelDocumento5 pagineAS-AD ModelSunil VuppalaNessuna valutazione finora

- ACE Nifty Futures Trading System - Performance Report (01.04.2007 To 31.03.2013)Documento3 pagineACE Nifty Futures Trading System - Performance Report (01.04.2007 To 31.03.2013)Prasad SwaminathanNessuna valutazione finora

- Cost of CapitalDocumento93 pagineCost of CapitalMubeenNessuna valutazione finora

- Banking Law Topics and CasesDocumento5 pagineBanking Law Topics and CasesNeRi Arcega NicomedesNessuna valutazione finora

- Olympic Industries LimitedDocumento18 pagineOlympic Industries LimitedRakib HasanNessuna valutazione finora

- Development Bank of The Philippines V CA 1998Documento2 pagineDevelopment Bank of The Philippines V CA 1998Thea P PorrasNessuna valutazione finora

- Weekly Equity Report 17 Feb 2014Documento8 pagineWeekly Equity Report 17 Feb 2014EpicresearchNessuna valutazione finora

- Examination: Subject SA3 General Insurance Specialist ApplicationsDocumento3 pagineExamination: Subject SA3 General Insurance Specialist Applicationsdickson phiriNessuna valutazione finora