Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PG Analyst Report

Caricato da

Pratiti ChatterjeeCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PG Analyst Report

Caricato da

Pratiti ChatterjeeCopyright:

Formati disponibili

Comment

Page 1

Equity Research

North America

United States of America

Procter & Gamble

Household & Personal Care

Reuters: PG.N Bloomberg: PG NYSE: PG

William Pecoriello

Strong 2Q; Right Moves

Ensure A Solid 05 Outlook

Javier Escalante

+1 (1)212 761 7965

Javier.Escalante@morganstanley.com

STOCK RATING

EQUAL-WEIGHT

Price (July 30, 2004)

$52.15

Price Target

$55

52-Week Range

$56.08-43.26

Stock ratings are relative to the analysts industry (or

industry teams) coverage universe.

GICS SECTOR

US Strategist Weight

S&P 500 Weight

WHATS CHANGED

2005 EPS estimate

2006 EPS estimate

August 02, 2004

Analysis of Sales/Earnings

+1 (1)914 225 4813

Bill.Pecoriello@morganstanley.com

CONSUMER STAPLES

12.4%

10.9%

$2.55 to $2.58

$2.80 to 2.85

PG beat our 2Q estimate by $0.01 and consensus by $0.02

2Q EPS of $0.50 was high quality driven by profits upsides across all divisions. Softer

op profit growth in Fabric & Home (4% vs. corporate average of +14%) reflects

P&Gs portfolio strategy, in our view. Organic sales of +8% was 100 basis points

ahead of mid-quarter guidance, which suggests that PG left F04 in a strong note.

P&G continues making the right portfolio moves

P&Gs F05 earnings seem to build on a more balanced top-line and margin math, as

expected. P&Gs reallocation of resources away from tissue through price increases

and the reinvestment of this upside into Wella is the right move. This investment in

Wella adds growth to P&Gs portfolio and likely extracts more value in the long-term.

We are raising 05 EPS to $2.58 or +11%-12% growth

Our 05 EPS excludes the impact of $0.02 gain from divesting Sunny D in F1Q05.

This revision accounts for greater comfort on: 1) the realization of price increases in

US tissue, 2) P&Gs flexibility to cover charges related to Wellas integration while

investing in its top-line, 3) the continuation of P&Gs emerging market momentum.

PG screens fair value after earnings changing

We are leaving our secular EPS growth unchanged at 10%, as 8% organic sales growth

in F4Q04 implies a 3 yr. run-rate of 4-5%, which is consistent with LT targets. We

estimate fair value at $53 today and leave our year-end PT at $55.

Industry View: In-Line

We find the HPC group fairly valued under a battery of valuation methodologies.

Morgan Stanley does and seeks to do business

with companies covered in its research reports.

As a result, investors should be aware that the

firm may have a conflict of interest that could

affect the objectivity of this report. Investors

should consider this report as only a single

factor in making their investment decision.

Customers of Morgan Stanley in the United

States can receive independent, third-party

research on the company or companies covered

in this report, at no cost to them, where such

research is available. Customers can access this

independent research at

www.morganstanley.com/equityresearch or can

call 800-624-2063 to request a copy of this

research.

FY ending Jun 30:

2003

2004

2005e

2006e

Modelware EPS ($)

Prior EPS Ests. ($)

First Call Consensus ($)

Revenue ($ m)

P/E

P/E Rel. to (local index) (%)

Price/Book

EV/EBITDA

Dividend Yield (%)

2.04

2.04

43,373

21.9

7.7

13.0

1.7

2.33

2.31

51,318

22.5

8.3

13.8

1.6

2.58

2.56

54,211

20.5

7.6

12.9

1.7

2.85

2.82

56,919

18.6

7.0

12.0

1.7

Market Cap ($ m)

Enterprise Value ($ m)

Debt/Cap (06/03)(%)

Return on Equity (06/03)(%)

Shares Outstanding (m)

144,803

35.8

41.1

2,776.7

Q'trly

2004e

EPS estmate

2005e

curr

prior

2006e

curr

prior

Q1

0.63

Q2

0.65

Q3

0.55

Q4

0.50

e = Morgan Stanley Research estimates; Please see explanation of Morgan Stanley ModelWare

initiative later in this report

Please see analyst certification and other important disclosures starting on page 10.

Page 2

Strong 2Q; Right Moves Ensure A Solid 05 Outlook

Company Description

Procter & Gamble (P&G) is a global consumer products company, with

leading worldwide market shares in the laundry detergent, hair care,

disposable diaper, and feminine protection segments

ModelWare is a proprietary framework for financial

analysis created by Morgan Stanley Research. This new

framework rests on the principles of comparability,

transparency and flexibility, and aims to provide

investors with better tools to assess the anticipated

performance of an enterprise.

Summary and Investment Conclusion

P&G posted another strong, top-line driven quarter

with earnings growth of 16%, exceeding our estimate by

$0.01. 2Q EPS of $0.50 was high quality driven by profits

upsides across all divisions. Softer op profit growth in

Fabric & Home (4% vs. corporate average of +14%) reflects

P&Gs portfolio strategy, in our view. Organic sales of

+8% was 100 basis points ahead of mid-quarter guidance,

which suggests that PG left F04 in a strong note. We also

note that P&G did not see the deceleration other CPG

companies and a few retailers experienced in July, which

implies that P&G still is ahead of the pack.

We believe that P&G continues making the right

strategic moves, as it is deepening its portfolio strategy

to extend this remarkable top-line momentum. As

expected, P&Gs F05 earnings growth builds on balancing

more the companys top-line with margin expansion,

reflecting both strategic moves and reporting mechanics

(e.g., the consolidation of Wella anniversaries in F1Q05).

P&Gs reallocation of resources away from slow-growth,

low-return businesses such as paper through price increases

and the reinvestment of that upside into Wella is the right

strategic move in two ways, in our view. First, Wella adds

growth to P&Gs portfolio. Second, by balancing

reinvestment and savings P&G will likely extract the most

long-term value out of this acquisition.

We are raising our F05 projection to $2.58 from $2.56 or

+11.6% growth, as we exclude the $0.02 gain from

Sunny D. This revision increases our 05 earnings growth

forecast from +10% to +11-12% beyond the reflection of

the slightly greater 04 base and accounts for our greater

comfort on: 1) the realization of the price increases in paper

and pet food to recover commodity inflation; 2) P&Gs

flexibility to cover charges related to Wellas integration

while investing in preserving its top-line, 3) the

continuation of the emerging market momentum well into

F05.

Specifically, ModelWare will provide the investor with:

a broad set of consistently defined forecast measures

an extensive taxonomy of more than 3500 unique

metrics for comparison

the flexibility to combine data elements and

create user-defined metrics for customized analytics

the transparency to see components of every

calculation

the ability to make rapid, meaningful comparisons

across companies, industries or geographies

For more information on ModelWare, please see

"Introducing ModelWare: A Road Map for Investors," by

Trevor Harris and team, August 2, 2004.

According to our estimates, the market has been

disciplined when valuing PG shares. Based on 10-year

DCF/ EVA models, we estimate the fair value PG shares at

$53 today, which continues to point at a year-end price

target of $55. This valuation reflects our new 05 earnings

growth outlook of 11-12% while maintaining a long-term

growth rate of +10%. We estimate that F4Q04 organic

sales of +8% implies a 3-year run-rate of +4.3%, which is

consistent with P&Gs long-term growth targets. We

believe that PG is a core holding for investors seeking

exposure to consumer staples. We reiterate our Equalweight rating on the stock.

How does F4Q 04 change our view?

We leave F04 with increased comfort about P&Gs

portfolio strategy, as management is

Investing to preserve Wellas momentum and retaining

a larger portion of its go-to-market capability. These

moves seek to extract the most long-term value out of

this acquisition.

Procter & Gamble August 02, 2004

Please see analyst certification and other important disclosures starting on page 10.

Page 3

Taking commodity-related price increases in US tissue,

pet food and coffee. More encouraging, price increases

are gaining traction in tissue, the most promotional

category within staples.

EPS of $2.58 includes a $0.02 gain related to the

divestiture of Sunny Delight. P&G will book this gain in

1Q 05 and expects the subsequent dilution to offset fully the

gain.

Increasing exposure to emerging markets and boost the

underlying growth of its portfolio.

What we liked?

In addition to reflect a 04 earnings base that is $0.01

higher, we are increasing our F05 EPS estimate to $2.58

from $2.56 to account for

At least partial realization of price increases in US

tissue during the 2nd half of 2004, given the likely

adherence by competitors and acceptance by retailers

such as Wal-Mart.

Restructuring charges related to Wella seem easily

covered within P&Gs budget for on-going

restructuring.

Our F05 EPS estimate excludes the $0.02 gain from the

Sunny D divestiture and therefore we are raising 05

earning growth rate from 10% to 11.6% to account for the

above and favorable macros in emerging markets.

Procters top-line momentum is solid across developing

and mature markets, which bodes well for F05. We

estimate that P&G is growing in mature markets (W Europe,

North America and Japan) at +7%-8% despite a tough retail

environment and the maturity of P&Gs household

categories still half of the portfolio. This strong growth

suggests significant share gains across most categories.

Volume growth of +20% in developing markets reflects

both strong market and P&Gs exposure to the right

markets, such as China and Russia, and faster growth of

personal care categories with the improved macros, we

believe.

Price increases to recover commodity inflation appear to

be gaining traction. Starting in F1Q05, P&G applied price

increases in US tissue, Iams pet food and is seeking price

realization in coffee. These increases, if well accepted by

consumers and retailers and at least partly followed by

competitors, should free resources up to drive growth in

higher return categories such as beauty and health care.

What happened?

4Q EPS of $0.50 or +16% growth exceeded our forecast

by $0.01 and beat consensus by $0.02. Earnings quality

was very good, as operating profit of +14% was 6 points

ahead of forecasted +8-9%.

4Q organic sales of +8% implies a 3-year run-rate of

+4.3%, which is consistent with P&Gs long-term

growth targets. Reported sales of +19% included 3 points

of FX and 8 points from acquisitions, both roughly in-line

with forecast. Unit volume growth of +10% matched our

forecast, pricing of (1)% was also in-line, while the

company had a bit of better mix of (1)% vs. our forecast of

(2)%. The most salient difference to our forecast was the

performance of Baby and Family Care, as P&G did

significantly better (+8% vs. our +6%) owing to strong

trends in diapers and paper towels. Please refer to Exhibit 1

for an analysis of 4Q results.

05 guidance of $2.58 confirms consensus earnings

growth rate of +10.5-11.0%. New guidance simply

adjusts for $0.02 upside in 4Q and new 04 earnings base of

$2.33.

Reinvestment to support Wellas top-line as P&G

integrates these operations. P&G opted to retain more of

Wellas go-to-market capability and invest behind Wellas

top-line. We view this move as a net strategic positive and

consistent with the acquisition rationale of this business.

This move seeks to balance the realization of savings and

top-line synergies from Wella, given the growth issues P&G

encountered with Clairols hair color business whose

integration focused first on savings and less on the top-line.

In early F1Q 05, P&G announced the layoff of 1,500

employees, 80% of which are Wellas and the balance from

P&Gs. The way we understand the mechanics of reporting,

P&G will be matching the charges on the Wella portion

against a balance sheet reserve, effectively neutralizing its

P&L impact. P&G will be incurring in charges related to

the PG side (the other 20% being laid off) which seems

easily covered by P&Gs budget for on-going restructuring

of $150-200M.

Gains from the rollout of Herbal Essences in Europe

and Japan balance the weakness of Clairols color

portfolio in the US. P&G acquired Clairol because of the

hair color and not the shampoo business but the fact that

Procter & Gamble August 02, 2004

Please see analyst certification and other important disclosures starting on page 10.

Page 4

Herbal Essences has generated good traction in Europe and

Japan offsets some of the growth issues Clairols hair color

still has domestically, and therefore is a positive.

What concerns us

Top-line comps get tougher in the 2H 05. If growth

comps are considered, P&G guidance embeds acceleration

of sales growth relative to F1Q 05 guidance: 1Q organic

sales growth of +4-6% on top of 7% year ago and F05

organic sales of +5-6% lapping a full year comp of +8%.

This is a combination of conservatism (mainly the

acceptance of the price increases on paper, pet food and

coffee) and the timing of the 05 new product pipeline, we

believe.

to reinvest a significant portion of its increases on Iams to

counter Nestles higher ad spending and promotions.

Share-driven growth might ultimately trigger

competitive responses. P&G continues managing is

portfolio, as suggested by the aggressive pricing in

detergents. In this BU, P&G profits growth decelerated to

only +4% despite 9% volume growth. Since we do not

believe the macros in emerging markets could have lifted

the underlying growth of a mature category such as

detergents to 9%, P&G share gains are likely accelerating.

Changes in competitors strategies can make the going

tougher from here.

Risks to our Procter & Gamble outlook

The efficiency of the ad spending to support Wellas topline might come down a bit during the integration. The

fact that P&G is backing Wella with higher reinvestment is

without a doubt a strategic positive, as it ensures that

Wellas top-line does not weaken at a time that LOreal is

aggressively investing. It is possible however that this

spending might not have the bang it would, given the

execution difficulties the integration would conceivably

generate.

We are factoring the success of price increases in US

tissue, pet food and coffee but only partial increases are

possible. P&G is passing through higher commodity prices

in tissue and pet food, while it is seeking better price

realization in coffee as well. We are now including for the

first time in our forecast the successful increase in US tissue,

as up to now we have remained skeptical given Wal-Marts

agenda with White Cloud and Georgia-Pacifics with

Brawny. We expect the competitive dynamics in US paper

to remain fluid, as the promotional environment is

improving in tissue but appears to be worsening in diapers.

In pet food, Nestle is restaging Purina and P&G might need

1) Wella integration risk and fixing Clairol business are key

challenges; 2) Over exposure to mature markets like the US

and Western Europe in mature categories such as paper and

detergents could slow growth below projected 4.5%; 3)

Procters mid-tier pricing strategy could slow profit growth

below forecasted +7%; 4) The risk of new acquisitions and

Procters growth strategy in paper can further dilute its

ROIC; 5) Channel migration could reduce economic returns

in the longer run; 6) sustained global economic weakness

could hinder Procters growth.

Valuation of Procter & Gamble ($53) shares

Based on our estimates, we believe that PG largely reflects

the current risk-reward tradeoff and rate the shares EqualWeight. We estimate a current fair value of $50 through 10

year discounted cash flow and EVA models using a WACC

of 9.1% and a terminal growth of 3.0%, which implies a $55

12 month target price. We also triangulate PG valuation

against relative and ROIC spread valuations vs. staples and

HPC sectors.

Procter & Gamble August 02, 2004

Please see analyst certification and other important disclosures starting on page 10.

Page 5

Exhibit 1

PG Earnings Analysis

PROCTER & GAMBLE

$ millions except per share

Quarter ending 6/30

Income Statement (FY ending June)

YAGO

FCST

Revenue, by segment:

Fabric + Home Care

Baby + Family Care

Beauty- Proforma

Health Care

Snacks + Beverages

Corporate

Total Revenue

$3,265

2,508

3,075

1,391

779

(98)

$10,920

$3,507

2,618

4,471

1,577

860

(160)

$12,873

% change vs. prior

COGS

Gross Profit

Marketing, R&D, Admin + Other

EBIT

Operating margin

7.6%

5,600

5,320

3,470

1,850.0

16.9%

% change vs. prior

Tax

Tax Rate

Net Income Available to Common, by segment:

Fabric + Home Care

Baby + Family Care

Beauty Care

Health Care

Snacks + Beverages

Corporate

Core Net Income

Preferred Dividends

Core Net Income to Common (Basic)

% change vs. prior

Preferred Dividend Impact on ESOP

Core Net Income to Common (Diluted)

% change vs. prior

Core Earnings Per Share

Basic

Diluted

% change vs. prior

Avg. Shares - Basic

Avg. Shares - Diluted

YAGO

FCST

$3,487

2,731

4,412

1,636

855

(159)

$12,962

$222

223

1,337

245

76

(61)

$2,042

($20)

113

(59)

59

(5)

1

$89

18.7%

11.1%

0.8%

(879)

1,163

(874)

289

63

151

(2)

149

6,479

6,483

4,344

2,139

15.5%

16.5%

(148) bps

(44) bps

(136)

24

(166)

56

(175.0)

16.0

(39)

(8)

(9)

(40)

$751

271

679

158

83

(204)

$1,738

$821

284

779

186

95

(285)

$1,880

$782

350

792

222

115

(281)

$1,980

$31

79

113

64

32

(77)

$242

($39)

66

13

36

20

4

$100

11.3%

8.2%

13.9%

2.7%

5.8%

522

577

606

(84)

(29)

30.0%

30.7%

30.6%

(57) bps

9 bps

499.0

165.0

466.0

110.0

55.0

(79.0)

$1,216

31

$1,185

534.2

192.8

501.6

130.3

41.7

(97.7)

$1,303

31

$1,272

523.0

201.0

532.0

138.0

77.0

(97.0)

1,374.0

33

$1,341

24.0

36.0

66.0

28.0

22.0

(18.0)

$158

(2)

$156

(11.2)

8.2

30.4

7.7

35.3

0.7

$71

(2)

$69

12.3%

7.3%

13.2%

0.8%

5.8%

Change vs. prior

Interest Expense

Interest & other income, net

Pre-tax Income by segment:

Fabric + Home Care

Baby + Family Care

Beauty- Proforma

Health Care

Snacks + Beverages

Corporate

Pre-Tax Income

17.9%

6,542

6,332

4,342

1,990

B/(W)

ACTUAL

2

$1,214

2

$1,301

0

$1,374

2

$160

2

$73

12.3%

7.2%

13.2%

0.9%

6.0%

$0.46

$0.43

$0.50

$0.49

$0.52

$0.50

$0.06

$0.07

$0.02

$0.01

13.2%

14.0%

15.2%

2.1%

1.3%

(33)

(26)

16

128

2,589

2,799

2,540

2,645

2,556

2,773

Source: Company accounts, Morgan Stanley Research

Procter & Gamble August 02, 2004

Please see analyst certification and other important disclosures starting on page 10.

Page 6

Exhibit 2

Procter & Gamble Earnings Model

PROCTER & GAMBLE

2004

2005E

2006E

2007E

2008E

2009E

$13,868

10,718

17,122

6,991

3,482

(774)

$51,407

11%

25,076

26,331

$14,260

11,387

18,893

7,655

2,930

(805)

$54,320

$14,831

11,728

19,932

8,574

2,989

(829)

$57,224

$15,350

11,963

21,028

9,431

3,034

(854)

$59,951

$15,810

12,202

22,184

10,280

3,079

(880)

$62,676

$16,205

12,324

23,405

11,205

3,079

(906)

$65,312

$ millions except per share

1Q04

2Q04

3Q04

4Q04

2004

1Q05E

2Q05E

3Q05E

4Q05E

$3,393

$3,407

$3,581

$3,487

2,607

2,673

2,707

2,731

3,753

4,492

4,465

4,412

1,728

1,908

1,719

1,636

896

931

800

855

(182)

(190)

(243)

(159)

$12,195 $13,221 $13,029 $12,962

$13,868

10,718

17,122

6,991

3,482

(774)

$51,407

$3,580

2,796

4,766

1,866

789

(189)

$13,608

$3,560

2,840

4,717

2,032

806

(198)

$13,757

$3,581

2,863

4,733

1,908

649

(253)

$13,481

$3,539

2,888

4,677

1,849

687

(165)

$13,474

Income Statement (FY ending June)

Revenue, by segment:

Fabric + Home Care

Baby + Family Care

Beauty- Proforma

Health Care

Snacks + Beverages

Corporate

Total Revenue

% change vs. prior

COGS

Gross Profit

Gross margin -- core

Marketing, R&D, Admin + Other

EBIT

51.2%

16,504

9,827.0

Operating margin

51.2%

17,681

11,630

4.8 %

29,244

30,707

51.2%

18,270

12,437

4.5 %

30,573

32,103

51.2%

18,841

13,262

4%

31,532

33,780

51.7%

19,657

14,123

12.9%

5,879

6,316

51.8%

3,673

2,643

20.2%

6,324

6,897

52.2%

4,155

2,742

22.3%

6,394

6,635

50.9%

4,332

2,303

18.7%

6,479

6,483

50.0%

4,344

2,139

18.5%

25,076

26,331

51.2%

16,504

9,827

11.6%

6,532

7,076

52.0%

4,148

2,928

4.1%

6,535

7,223

52.5%

4,241

2,982

3.5%

6,606

6,875

51.0%

4,296

2,580

4.0%

6,804

6,670

49.5%

4,395

2,275

19.8%

20.3%

20.7%

21.2%

21.6%

21.7%

20.7%

17.7%

16.5%

19.1%

21.5%

21.7%

19.1%

16.9%

14%

(629)

152

9.5%

(887)

205

8.0%

(889)

167

6.9%

(908)

171

6.6%

(957)

175

6%

(925)

177

10 bps

(90) bps

(151) bps

(44) bps

(72) bps

(16) bps

93 bps

146 bps

38 bps

(141)

40

(149)

29

(164)

67

(175)

16

(629)

152

(222)

51

(222)

51

(222)

51

(222)

51

$3,287

1,623

3,662

1,448

557

(1,227)

$9,350

$3,388

1,847

4,157

1,618

479

(1,407)

$10,083

$3,589

1,799

4,505

1,866

481

(1,333)

$10,908

$3,738

1,859

4,879

2,118

491

(1,386)

$11,700

$3,874

1,927

5,281

2,371

499

(1,471)

$12,480

$3,995

1,977

5,712

2,640

530

(1,478)

$13,375

$832

472

913

406

162

(243)

$2,542

$843

444

1,047

500

188

(400)

$2,622

$830

357

910

320

92

(303)

$2,206

$782

350

792

222

115

(281)

$1,980

$3,287

1,623

3,662

1,448

557

(1,227)

$9,350

$895

531

1,049

429

149

(295)

$2,758

$890

511

1,132

549

175

(445)

$2,811

$859

429

1,041

382

68

(370)

$2,409

$743

375

935

259

87

(295)

$2,105

7%

11.1%

13.5%

13.5%

13.9%

781

804

678

606

% change vs. prior

13 %

Tax

2,869

Tax Rate

Core Net Income

Preferred Dividends

Core Net Income to Common (Basic)

Preferred Dividend Impact on ESOP

Core Net Income to Common (Diluted)

51.3%

17,079

10,764

5.3 %

27,914

29,311

19.1%

Change vs. prior

Interest Expense

Interest & other income, net

Pre-tax Income by segment:

Fabric + Home Care

Baby + Family Care

Beauty- Proforma

Health Care

Snacks + Beverages

Corporate

Pre-Tax Income

5.7 %

26,476

27,843

30.7%

$6,481

131

$6,350

0

$6,481

% change vs. prior

Core Earnings Per Share

Basic

Diluted

% change vs. prior

Avg. Shares - Basic

Avg. Shares - Diluted

7.8 %

3,075

30.5%

$7,007

124

$6,883

8

$6,999

8.2 %

3,327

30.5%

$7,581

124

$7,457

8

$7,573

7.3 %

3,569

30.5%

$8,132

124

$8,008

8

$8,124

6.7 %

3,806

30.5%

$8,673

124

$8,549

8

$8,665

4,079

30.5%

$9,296

124

$9,172

8

$9,288

30.7%

$1,761

33

$1,728

0

$1,761

30.7%

$1,818

32

$1,786

0

$1,818

30.7%

$1,528

33

$1,495

0

$1,528

30.6%

$1,374

33

$1,341

0

$1,374

12.9%

2,869

30.7%

$6,481

131

$6,350

0

$6,481

8.5%

7.2%

9.2%

6.3%

841

857

735

642

30.5%

1,916

31

$1,885

2

$1,914

30.5%

1,954

31

$1,923

2

$1,952

30.5%

1,674

31

$1,643

2

$1,672

30.5%

1,463

31

$1,432

2

$1,461

13 %

8%

8%

7%

7%

7%

11.8%

14.4%

14.3%

13.2%

13.4%

8.7%

7.4%

9.5%

6.3%

$2.46

$2.33

$2.75

$2.58

$3.06

$2.85

$3.38

$3.14

$3.74

$3.46

$4.17

$3.84

$0.67

$0.63

$0.69

$0.65

$0.58

$0.55

$0.52

$0.50

$2.46

$2.33

$0.75

$0.70

$0.77

$0.72

$0.66

$0.62

$0.58

$0.54

14.2%

2,581

2,790

10.7%

2,504

2,722

10.5%

2,439

2,656

10.2%

2,368

2,585

10.2%

2,288

2,506

11.0%

2,202

2,419

12.5%

2,593

2,798

14.0%

2,591

2,801

14.6%

2,583

2,790

16.3%

2,556

2,773

14.2%

2,581

2,790

Source: Company accounts, Morgan Stanley Research

Procter & Gamble August 02, 2004

Please see analyst certification and other important disclosures starting on page 10.

11.1%

2,531

2,748

10.8%

2,512

2,730

12.7%

2,495

2,713

8.0%

2,479

2,697

Page 7

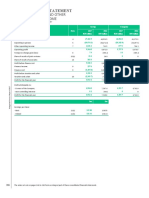

Exhibit 3

Procter & Gamble Cash Flow Statement

PROCTER & GAMBLE

$ millions except per share

2004

2005E

2006E

2007E

2008E

2009E

Cash Flow Statement

Net Income from Continuing Operations

Adjustments:

Provision for Restructuring

Depreciation & Amortization

Other Non-cash Items

Changes in Working Capital

Other Non-current Assets & Liabilities

Net Cash from Operating Activities

$6,481

$7,007

$7,581

$8,132

$8,673

$9,296

1,733

1,803

1,885

1,990

2,116

2,261

434

714

$9,362

296

(637)

$8,470

132

216

$9,814

186

208

$10,515

59

206

$11,054

119

197

$11,873

Capital Expenditures

Asset sales or retirements (PP&E)

Sale/(Acquisition) of Businesses

Change in Marketable securities

Net Cash from Investing Activities

(2,024)

230

(7,476)

(121)

(9,391)

(2,173)

(2,289)

(2,398)

(2,507)

(2,612)

0

(2,173)

0

(2,289)

0

(2,398)

0

(2,507)

0

(2,612)

Purchase of Treasury Stock

Proceeds from Stock Options

Additions to Long-term Debt

Repayment of Long-Term Debt

Increase (Decrease) in ST Debt

Dividends Paid to Shareholders

Net Cash from Financing Activities

(4,070)

555

1,963

(1,188)

4,911

(2,539)

($368)

(4,000)

0

0

1,569

(4,400)

0

0

(5)

(5,500)

0

0

576

(6,875)

0

0

1,606

(8,250)

0

0

2,331

(2,816)

($5,247)

(2,929)

($7,333)

(3,038)

($7,962)

(3,138)

($8,407)

(3,227)

($9,145)

(46)

(443)

5,912

5,469

0

1,049

5,469

6,518

0

192

6,518

6,710

0

156

6,710

6,866

0

140

6,866

7,006

0

116

7,006

7,122

Exchange Rate Effect

Increase (Decrease) in Cash + Equivalents

Cash + Equivalents at Beginning of Period

Cash + Equivalents at End of Period

Source: Company accounts, Morgan Stanley Research

Procter & Gamble August 02, 2004

Please see analyst certification and other important disclosures starting on page 10.

Page 8

Exhibit 4

Procter & Gamble Balance Sheet

PROCTER & GAMBLE

$ millions except per share

2004

2005E

2006E

2007E

2008E

2009E

$5,892

4,062

4,400

2,761

17,115

14,108

23,900

1,925

$57,048

$6,941

3,358

4,715

2,118

17,133

14,665

23,712

1,925

$57,435

$7,133

3,459

4,741

2,226

17,560

15,257

23,524

1,925

$58,266

$7,289

3,542

4,887

2,182

17,900

15,853

23,336

1,925

$59,015

$7,429

3,617

5,026

2,281

18,353

16,433

23,148

1,925

$59,859

$7,545

3,680

5,097

2,377

18,699

16,972

22,960

1,925

$60,556

$11,306

2,554

13,860

20,841

5,069

$39,770

$11,126

1,999

13,125

20,841

1,569

1,562

2,869

$39,966

$11,313

2,179

13,492

22,410

(5)

1,625

3,023

$40,545

$11,525

2,337

13,863

22,405

576

1,689

3,167

$41,700

$11,742

2,493

14,235

22,982

1,606

1,751

3,311

$43,883

$11,912

2,672

14,584

24,587

2,331

1,808

3,450

$46,761

17,278

$57,048

17,469

$57,435

17,721

$58,266

17,315

$59,015

15,976

$59,859

13,795

$60,556

Balance Sheet

Assets:

Total Cash + Equivalents

Net Accounts Receivable

Inventories

Other Current Assets, incl. Def. Taxes

Total Current Assets

Property, Plant + Equipment

Net Goodwill and Intangibles

Other Assets

Total Assets

Liabilities + Shareholders' Equity:

Accounts Payable and Accrued Liabilities

Income Taxes

Total Current Liabilities

Old Total Debt

New Debt/(Debt Paydown)

Deferred Income Taxes

Other Long-Term Liabilities

Total Liabilities

Shareholders' Equity:

Total Shareholders' Equity

Total Liabilities + Shareholders' Equity

Source: Company accounts, Morgan Stanley Research

Procter & Gamble August 02, 2004

Please see analyst certification and other important disclosures starting on page 10.

Page 9

Modelware is a proprietary framework for financial analysis created by Morgan Stanley Research. This new framework rests

on the principles of comparability, transparency, and flexibility, and aims to provide investors with better tools to view the

anticipated performance of an enterprise. The result of an 18-month global effort, Modelware harmonizes the underlying data

and calculations in Morgan Stanley models with a broad set of consistently defined financial metrics. Our analysts have

populated the database with over 2.5 million data points, based on an extensive taxonomy of more than 3,500 unique metrics

and more than 400 Morgan Stanley calculations. The Modelware framework will also have the flexibility to allow analysts and

investors to add or change data elements, even quickly customize their own analytical approach.

What makes the Modelware architecture distinctive lies in the separation of data from calculations. Its transparency will permit

users to see every component of every calculation, to choose elements or recombine them as they wish without laborious

adjustments or recalculations. When choices must be made in defining standard or industry-specific measures, Modelware

defaults to economic logic, rather than favoring one accounting rule over another. This discipline facilitates comparability

across sectors and regions. Underlying the Modelware data is a new set of systems that check the internal consistency of

forecast data in each of our analysts models.

Modelware EPS illustrates the approach taken. It represents Modelware net income divided by average fully diluted shares

outstanding. Modelware net income sums net operating profit after tax (NOPAT), net financial income or expense (NFE), and

other income or expense. Modelware adjusts reported net income to improve comparability across companies, sectors, and

regions. These adjustments include the following: We exclude goodwill amortization and items deemed by analysts to be

one-time events; we capitalize operating leases where their use is significant (e.g., in transportation and retail); we convert

inventory to FIFO accounting when LIFO costing is used; and we include unrealized gains and losses on available-for-sale

securities in earnings (financial services companies only). For more information on these adjustments and others, as well as

additional background, please see Introducing Modelware: A Road Map for Investors, by Trevor Harris and team, August 2,

2004.

Procter & Gamble August 02, 2004

Please see analyst certification and other important disclosures starting on page 10.

Page 10

Analyst Certification

The following analysts hereby certify that their views about the companies and their securities discussed in this report are

accurately expressed and that they have not received and will not receive direct or indirect compensation in exchange for

expressing specific recommendations or views in this report: William Pecoriello.

Important US Regulatory Disclosures on Subject Companies

The information and opinions in this report were prepared by Morgan Stanley & Co. Incorporated and its affiliates (collectively,

"Morgan Stanley").

As of June 30, 2004, Morgan Stanley beneficially owned 1% or more of a class of common equity securities of the following

companies covered in this report: Avon Products and Kimberly-Clark.

Within the last 12 months, Morgan Stanley managed or co-managed a public offering of securities of Procter & Gamble and

Gillette.

Within the last 12 months, Morgan Stanley has received compensation for investment banking services from Procter & Gamble,

Colgate-Palmolive, Gillette and Kimberly-Clark.

In the next 3 months, Morgan Stanley expects to receive or intends to seek compensation for investment banking services from

Procter & Gamble, Avon Products, Colgate-Palmolive, Gillette and Kimberly-Clark.

Within the last 12 months, Morgan Stanley has received compensation for products and services other than investment banking

services from Avon Products, Colgate-Palmolive, Gillette and Kimberly-Clark.

Within the last 12 months, Morgan Stanley has either provided or currently is providing investment banking services to the

following companies covered in this report Procter & Gamble, Avon Products, Colgate-Palmolive, Gillette and Kimberly-Clark.

Within the last 12 months, Morgan Stanley has either provided or currently is providing non-investment banking, securities

related services to and/or in the past has entered into an agreement to provide services or currently has a client related

relationship with the following companies covered in this report Procter & Gamble, Avon Products, Colgate-Palmolive, Gillette

and Kimberly-Clark.

The research analysts, strategists, or research associates principally responsible for the preparation of this research report have

received compensation based upon various factors, including quality of research, investor client feedback, stock picking,

competitive factors, firm revenues and overall investment banking revenues.

Procter & Gamble August 02, 2004

Page 11

Stock Ratings

Different securities firms use a variety of rating terms as well as different rating systems to describe their recommendations. For example,

Morgan Stanley uses a relative rating system including terms such as Overweight, Equal-weight or Underweight (see definitions below). A

rating system using terms such as buy, hold and sell is not equivalent to our rating system. Investors should carefully read the definitions of

all ratings used in each research report. In addition, since the research report contains more complete information concerning the analysts

views, investors should carefully read the entire research report and not infer its contents from the rating alone. In any case, ratings (or

research) should not be used or relied upon as investment advice. An investors decision to buy or sell a stock should depend on individual

circumstances (such as the investors existing holdings) and other considerations.

Global Stock Ratings Distribution

(as of July 31, 2004)

Coverage Universe

Stock Rating Category

Count

% of

Total

Investment Banking Clients (IBC)

Count

% of

Total IBC

% of Rating

Category

Overweight/Buy

638

36%

271

41%

42%

Equal-weight/Hold

800

45%

297

45%

37%

Underweight/Sell

349

20%

94

14%

27%

Total

1,787

662

Data include common stock and ADRs currently assigned ratings. For disclosure purposes (in accordance with NASD and NYSE requirements), we note that

Overweight, our most positive stock rating, most closely corresponds to a buy recommendation; Equal-weight and Underweight most closely correspond to neutral and

sell recommendations, respectively. However, Overweight, Equal-weight, and Underweight are not the equivalent of buy, neutral, and sell but represent recommended

relative weightings (see definitions below). An investor's decision to buy or sell a stock should depend on individual circumstances (such as the investor's existing

holdings) and other considerations. Investment Banking Clients are companies from whom Morgan Stanley or an affiliate received investment banking compensation in

the last 12 months.

Analyst Stock Ratings

Overweight (O). The stocks total return is expected to exceed the average total return of the analysts industry (or industry

teams) coverage universe, on a risk-adjusted basis, over the next 12-18 months.

Equal-weight (E). The stocks total return is expected to be in line with the average total return of the analysts industry (or

industry teams) coverage universe, on a risk-adjusted basis, over the next 12-18 months.

Underweight (U). The stocks total return is expected to be below the average total return of the analysts industry (or industry

teams) coverage universe, on a risk-adjusted basis, over the next 12-18 months.

More volatile (V). We estimate that this stock has more than a 25% chance of a price move (up or down) of more than 25% in

a month, based on a quantitative assessment of historical data, or in the analysts view, it is likely to become materially more

volatile over the next 1-12 months compared with the past three years. Stocks with less than one year of trading history are

automatically rated as more volatile (unless otherwise noted). We note that securities that we do not currently consider "more

volatile" can still perform in that manner.

Unless otherwise specified, the time frame for price targets included in this report is 12 to 18 months. Ratings prior to March

18, 2002: SB=Strong Buy; OP=Outperform; N=Neutral; UP=Underperform. For definitions, please go to

www.morganstanley.com/companycharts.

Analyst Industry Views

Attractive (A). The analyst expects the performance of his or her industry coverage universe over the next 12-18 months to be

attractive vs. the relevant broad market benchmark named on the cover of this report.

In-Line (I). The analyst expects the performance of his or her industry coverage universe over the next 12-18 months to be in

line with the relevant broad market benchmark named on the cover of this report.

Cautious (C). The analyst views the performance of his or her industry coverage universe over the next 12-18 months with

caution vs. the relevant broad market benchmark named on the cover of this report.

Stock price charts and rating histories for companies discussed in this report are also available at

www.morganstanley.com/companycharts. You may also request this information by writing to Morgan Stanley at 1585

Broadway, 14th Floor (Attention: Research Disclosures), New York, NY, 10036 USA.

Procter & Gamble August 02, 2004

Page 12

Stock Price, Price Target and Rating History (See Rating Definitions)

Procter & Gamble August 02, 2004

Page 13

Procter & Gamble August 02, 2004

Page 14

Procter & Gamble August 02, 2004

Page 15

Other Important Disclosures

This research report has been published in accordance with our conflict management policy, which is available at

www.morganstanley.com/institutional/research/conflictpolicies.

For a discussion, if applicable, of the valuation methods used to determine the price targets included in this summary and the

risks related to achieving these targets, please refer to the latest relevant published research on these stocks. Research is

available through your sales representative or on Client Link at www.morganstanley.com and other electronic systems.

This report does not provide individually tailored investment advice. It has been prepared without regard to the individual

financial circumstances and objectives of persons who receive it. The securities discussed in this report may not be suitable for

all investors. Morgan Stanley recommends that investors independently evaluate particular investments and strategies, and

encourages investors to seek the advice of a financial adviser. The appropriateness of a particular investment or strategy will

depend on an investors individual circumstances and objectives.

This report is not an offer to buy or sell any security or to participate in any trading strategy. In addition to any holdings

disclosed in the section entitled "Important US Regulatory Disclosures on Subject Companies", Morgan Stanley and/or its

employees not involved in the preparation of this report may have investments in securities or derivatives of securities of

companies mentioned in this report, and may trade them in ways different from those discussed in this report. Derivatives may

be issued by Morgan Stanley or associated persons.

Morgan Stanley & Co. Incorporated and its affiliate companies do business that relates to companies covered in its research

reports, including market making and specialized trading, risk arbitrage and other proprietary trading, fund management,

investment services and investment banking. Morgan Stanley sells to and buys from customers the equity securities of

companies covered in its research reports on a principal basis.

Morgan Stanley makes every effort to use reliable, comprehensive information, but we make no representation that it is

accurate or complete. We have no obligation to tell you when opinions or information in this report change apart from when

we intend to discontinue research coverage of a subject company.

With the exception of information regarding Morgan Stanley, reports prepared by Morgan Stanley research personnel are based

on public information. Facts and views presented in this report have not been reviewed by, and may not reflect information

known to, professionals in other Morgan Stanley business areas, including investment banking personnel.

Morgan Stanley research personnel conduct site visits from time to time but are prohibited from accepting payment or

reimbursement by the company of travel expenses for such visits.

The value of and income from your investments may vary because of changes in interest rates or foreign exchange rates,

securities prices or market indexes, operational or financial conditions of companies or other factors. There may be time

limitations on the exercise of options or other rights in your securities transactions. Past performance is not necessarily a guide

to future performance. Estimates of future performance are based on assumptions that may not be realized.

This publication is disseminated in Japan by Morgan Stanley Japan Limited; in Hong Kong by Morgan Stanley Dean Witter

Asia Limited; in Singapore by Morgan Stanley Dean Witter Asia (Singapore) Pte., regulated by the Monetary Authority of

Singapore, which accepts responsibility for its contents; in Australia by Morgan Stanley Dean Witter Australia Limited A.B.N.

67 003 734 576, holder of Australian financial services licence No. 233742, which accepts responsibility for its contents; in

Canada by Morgan Stanley Canada Limited, which has approved of, and has agreed to take responsibility for, the contents of

this publication in Canada; in Spain by Morgan Stanley, S.V., S.A., a Morgan Stanley group company, which is supervised by

the Spanish Securities Markets Commission (CNMV) and states that this document has been written and distributed in

accordance with the rules of conduct applicable to financial research as established under Spanish regulations; in the United

States by Morgan Stanley & Co. Incorporated and Morgan Stanley DW Inc., which accept responsibility for its contents; and in

the United Kingdom, this publication is approved by Morgan Stanley & Co. International Limited, solely for the purposes of

section 21 of the Financial Services and Markets Act 2000 and is distributed in the European Union by Morgan Stanley & Co.

International Limited, except as provided above. Private U.K. investors should obtain the advice of their Morgan Stanley & Co.

International Limited representative about the investments concerned. In Australia, this report, and any access to it, is intended

only for wholesale clients within the meaning of the Australian Corporations Act.

The trademarks and service marks contained herein are the property of their respective owners. Third-party data providers make

no warranties or representations of any kind relating to the accuracy, completeness, or timeliness of the data they provide and

shall not have liability for any damages of any kind relating to such data. The Global Industry Classification Standard

("GICS") was developed by and is the exclusive property of MSCI and S&P.

This report or any portion hereof may not be reprinted, sold or redistributed without the written consent of Morgan Stanley.

Procter & Gamble August 02, 2004

Page 16

Morgan Stanley research is disseminated and available primarily electronically, and, in some cases, in printed form.

Additional information on recommended securities is available on request.

Procter & Gamble August 02, 2004

The Americas

Europe

Japan

Asia/Pacific

1585 Broadway

New York, NY 10036-8293

United States

Tel: +1 (1)212 761 4000

25 Cabot Square, Canary Wharf

London E14 4QA

United Kingdom

Tel: +44 (0)20 7425 8000

20-3, Ebisu 4-chome

Shibuya-ku,

Tokyo 150-6008, Japan

Tel: +81 (0)3 5424 5000

Three Exchange Square

Central

Hong Kong

Tel: +852 2848 5200

INDUSTRY COVERAGE: HOUSEHOLD & PERSONAL CARE

Company

Avon Products

Colgate-Palmolive

Gillette

2004 Morgan Stanley

Ticker

AVP.N

CL.N

G.N

Rating

as of

O

07/06/04

O

10/31/03

U

09/11/03

Price

at 08/02/04

$43.23

$53.34

$39.12

Rating

Price

Company

Ticker

as of

at 08/02/04

Kimberly-Clark

KMB.N

U

01/06/04

$64.98

Procter & Gamble

PG.N

E

09/11/03

$53.34

Stock ratings are subject to change. Please see latest research for each company.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Clarkson Lumber Co (Calculations) For StudentsDocumento18 pagineClarkson Lumber Co (Calculations) For StudentsShahid Iqbal100% (5)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- FIN254 Assignment# 1Documento6 pagineFIN254 Assignment# 1Zahidul IslamNessuna valutazione finora

- Alvaro CV CBS Resume FormatDocumento1 paginaAlvaro CV CBS Resume FormatAlvaroDeCampsNessuna valutazione finora

- Report Banking RiabkovDocumento6 pagineReport Banking RiabkovKostia RiabkovNessuna valutazione finora

- Sulzer Annual Results Presentation 2012Documento29 pagineSulzer Annual Results Presentation 2012Diana PoltlNessuna valutazione finora

- Dividend - Wikipedia, The Free EncyclopediaDocumento6 pagineDividend - Wikipedia, The Free Encyclopediaapi-3763198Nessuna valutazione finora

- Delta Djakarta Annual Report 2013 Dlta Laporan Tahunan Company Profile Indonesia Investments PDFDocumento128 pagineDelta Djakarta Annual Report 2013 Dlta Laporan Tahunan Company Profile Indonesia Investments PDFsaniNessuna valutazione finora

- Sources and Uses of Working CapitalDocumento4 pagineSources and Uses of Working CapitalChaitanya DachepallyNessuna valutazione finora

- (JP Morgan) Just What You Need To Know About Variance SwapsDocumento30 pagine(JP Morgan) Just What You Need To Know About Variance Swapsmarco_aita100% (1)

- 2 Just For FEET Case Analysis REWRITEDocumento7 pagine2 Just For FEET Case Analysis REWRITEJuris Renier MendozaNessuna valutazione finora

- Sbi MF Common Equity Form Arn EuinDocumento2 pagineSbi MF Common Equity Form Arn EuinARVINDNessuna valutazione finora

- Equity Compensation in Early Stage CompaniesDocumento32 pagineEquity Compensation in Early Stage CompaniesFrank Demmler67% (3)

- Ias 20Documento2 pagineIas 20Mamun AbdullahNessuna valutazione finora

- Order in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Documento10 pagineOrder in The Matter of Sarang Viniyog Ltd. (Formerly Known As Pincon Spirit LTD.)Shyam SunderNessuna valutazione finora

- BRM PresentationDocumento12 pagineBRM PresentationAbhijeet SinghNessuna valutazione finora

- CH 02 SMDocumento105 pagineCH 02 SMapi-234680678100% (1)

- Consumer Durable ResearchDocumento9 pagineConsumer Durable ResearchjyotianshuNessuna valutazione finora

- Financial Analysis For PepsicoDocumento5 pagineFinancial Analysis For PepsicoZaina Alkendi100% (1)

- Chris Lewis The Day Trader's GuiDocumento299 pagineChris Lewis The Day Trader's Guinanda kumarNessuna valutazione finora

- IntroductionDocumento58 pagineIntroductionSumit AgarwalNessuna valutazione finora

- FM Course Outline & Materials-Thappar UnivDocumento74 pagineFM Course Outline & Materials-Thappar Univharsimranjitsidhu661Nessuna valutazione finora

- Analysis of Select FMCG Companies' Stock Performance With MarketDocumento7 pagineAnalysis of Select FMCG Companies' Stock Performance With MarketHenston DantyNessuna valutazione finora

- Stock Market Game (SMG)Documento15 pagineStock Market Game (SMG)MarcusLamarWalkerNessuna valutazione finora

- CHAPTER 1 - Introduction To InvestmentDocumento41 pagineCHAPTER 1 - Introduction To InvestmentSuct WadiNessuna valutazione finora

- Financial Institutions Management: MSC in Finance and BankingDocumento2 pagineFinancial Institutions Management: MSC in Finance and BankingouamarNessuna valutazione finora

- Project On FII's in IndiaDocumento47 pagineProject On FII's in IndiaNeha Thadani0% (2)

- Safari - 12 Aug 2019 at 1:00 PM PDFDocumento1 paginaSafari - 12 Aug 2019 at 1:00 PM PDFPauline BiancaNessuna valutazione finora

- مانيول شابتر 3Documento38 pagineمانيول شابتر 3Abood AlissaNessuna valutazione finora

- Of Profit or Loss and Other Comprehensive Income: Consolidated StatementDocumento11 pagineOf Profit or Loss and Other Comprehensive Income: Consolidated Statementaslanalan0101Nessuna valutazione finora

- Ap 1-4 IsDocumento1 paginaAp 1-4 Isapi-334420312Nessuna valutazione finora