Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Morning Market Snapshot

Caricato da

api-274468947Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Morning Market Snapshot

Caricato da

api-274468947Copyright:

Formati disponibili

Morning Market Snapshot

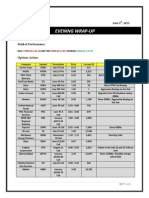

January 7th, 2015

Market Action

Futures

DJIA

S&P 500

NASDAQ

Change

Index

17,382 (+92)

Nikkei

2,006.25 (+11.75) Hang Seng

4,124 (+21.75)

Change

Forex

16,885 (+2)

EUR/USD

23,681.26 (+195.85)

USD/JPY

Change

Commodity

1.1827 (-0.0063) Crude Oil

119.10 (+0.71)

FTSE

6,421.27 (+54.76)

GBP/USD 1.5132 (-0.0019)

DAX

9,567.93 (+98.27)

USD/CAD 1.1834 (-0.0002)

Change

48.25 (+0.32)

Gold

1,213.40 (-6)

Silver

16.42 (-0.22)

Economic Calendar

Time (ET)

Currency

Economic Data

8:15AM

USD

ADP Employment Report

8:30AM

USD

Gallup U.S. Job Creation Index

8:30AM

USD

International Trade

10:30AM

USD

EIA Petroleum Status Report

2:00PM

USD

FOMC Minutes

Market News

-

Investment firm 3G Capital Partners is looking at new acquisition targets after investors

pledged about $5 billion to form a new takeover fund. Executives at the investment firm

are discussing the possibility of buying a food or beverage company such as Campbell

Soup (CPB) or PepsiCo (PEP).

Be advised that the Bank of England Rate Decision will be taking place tomorrow,

January 8th, at 7:00AM ET.

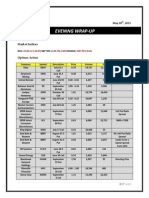

Analyst Action

Goldman Sachs upgrades American Express (AXP) from Neutral to Buy ($102)

Barclays downgrades Linn Energy (LINE) from Overweight to Equalweight

Credit Suisse downgrades Automatic Data Processing (ADP) from Outperform to Neutral

Evercore ISI downgrades Aon Corp. (AON) from Buy to Hold ($93 $99)

KeyBanc downgrades Joy Global (JOY) from Buy to Hold ($65)

Keybanc downgrades Terex (TEX) from Buy to Hold ($45)

Piper Jaffray kept its Overweight rating and raised its price target on VCA Antech (WOOF) to $57

Piper Jaffray kept its Overweight rating and raised its price target on J.C. Penney (JCP) to $12

Barclays initiates an Underweight rating on Hologic (HOLX) with a price target of $24

Open Interest Changes

From 1/6 Options Action:

McDonalds (MCD) February 95 Call OI jumps from 10,140 to 47,813

Ultrashort Euro (EUO) May 26 Call OI jumps from 40 to 7,953

Credit Suisse (CS) March 25 Call OI jumps from 663 to 13,601

Deutsche Bank (DB) February 30 Call OI jumps from 45 to 5,156

Scientific Games (SGMS) April 15 Call OI jumps from 5,785 to 12,742

JP Morgan (JPM) February 60 Call OI jumps from 4,778 to 67,743

Apple (AAPL) March 110/130 Call Spread OI jumps from 13,088 and 21,599 to 21,275 and 34,209

respectively

Royal Caribbean Cruises (RCL) June 82.5 Call OI jumps from 30 to 12,018

Currency Shares British Pound (FXB) March 145 Put OI jumps from 3 to 8,078

Insider Action

From 1/6 Form 4 Filings:

Buying: Alico Inc (ALCO) and Spectrum Brands Holdings (SPB)

Selling: Ashland Inc. (ASH), Best Buy (BBY), Build A Bear Workshop (BBW), Clorox (CLX), Masonite

International (DOOR), Las Vegas Sands (LVS), Six Flags Entertainment (SIX), Unitedhealth Group (UNH),

and Xoma Corp. (XOMA)

Earnings Central

Earnings After the Close today (1/7):

Ticker

Company

WDFC

WD-40 Company

Earnings Before the Open tomorrow (1/8):

Ticker

Company

APOL

Apollo Education Group

FDO

Family Dollar

STZ

Constellation Brands

Potrebbero piacerti anche

- Paul Thomson Search Fund Manifesto 2011 09Documento25 paginePaul Thomson Search Fund Manifesto 2011 09mitiwanaNessuna valutazione finora

- Banking Awareness Capsule by Affairscloud NewwwDocumento59 pagineBanking Awareness Capsule by Affairscloud Newwwnagasai93% (42)

- Chap 009Documento19 pagineChap 009van tinh khucNessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento3 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento3 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Special Report by Epic Reseach 26 August 2013Documento7 pagineSpecial Report by Epic Reseach 26 August 2013EpicresearchNessuna valutazione finora

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocumento4 pagineEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947Nessuna valutazione finora

- Evening Wrap-Up: June 9, 2015Documento5 pagineEvening Wrap-Up: June 9, 2015api-274468947Nessuna valutazione finora

- Danske Daily: Key NewsDocumento5 pagineDanske Daily: Key NewsMacdonald 'Tuneweaver' EzekweNessuna valutazione finora

- Daily Report 20140912Documento3 pagineDaily Report 20140912Joseph DavidsonNessuna valutazione finora

- Hammerstone Midday Look 9-24-2014Documento4 pagineHammerstone Midday Look 9-24-2014TheHammerstoneReportNessuna valutazione finora

- Morning Market Briefing: June 17, 2015Documento4 pagineMorning Market Briefing: June 17, 2015api-274468947Nessuna valutazione finora

- Special Report by Epic Reseach 27 August 2013Documento7 pagineSpecial Report by Epic Reseach 27 August 2013EpicresearchNessuna valutazione finora

- Daily Report 20140910Documento3 pagineDaily Report 20140910Joseph DavidsonNessuna valutazione finora

- Market Outlook Market Outlook: Dealer's DiaryDocumento12 pagineMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Daily Report 20140916Documento3 pagineDaily Report 20140916Joseph DavidsonNessuna valutazione finora

- Market Outlook Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Daily Report 20141009Documento3 pagineDaily Report 20141009Joseph DavidsonNessuna valutazione finora

- Daily Report 20141010Documento3 pagineDaily Report 20141010Joseph DavidsonNessuna valutazione finora

- Important Meetings Today: Morning ReportDocumento3 pagineImportant Meetings Today: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Market Outlook Market Outlook: Dealer's DiaryDocumento11 pagineMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Aus Tin 20106163Documento158 pagineAus Tin 20106163david_smith_med1946Nessuna valutazione finora

- Special Report 12 - Sep-2013 by Epic ResearchDocumento7 pagineSpecial Report 12 - Sep-2013 by Epic ResearchNidhi JainNessuna valutazione finora

- Emini SP500 Daily Apr 01 2014Documento1 paginaEmini SP500 Daily Apr 01 2014Mrugender LalNessuna valutazione finora

- Upward Climb in ASPI Amidst Crossings Adding 54% To TurnoverDocumento6 pagineUpward Climb in ASPI Amidst Crossings Adding 54% To TurnoverRandora LkNessuna valutazione finora

- Daily Report 20141031Documento3 pagineDaily Report 20141031Joseph DavidsonNessuna valutazione finora

- Currency Daily Report August 17Documento4 pagineCurrency Daily Report August 17Angel BrokingNessuna valutazione finora

- Conomic EWS: Yesterday's EventsDocumento7 pagineConomic EWS: Yesterday's Eventsapi-145402281Nessuna valutazione finora

- Daily Report 20141024Documento3 pagineDaily Report 20141024Joseph DavidsonNessuna valutazione finora

- Danske Daily: Key NewsDocumento5 pagineDanske Daily: Key NewsMacdonald 'Tuneweaver' EzekweNessuna valutazione finora

- Daily Report: 11 OCTOBER. 2013Documento7 pagineDaily Report: 11 OCTOBER. 2013api-212478941Nessuna valutazione finora

- Daily Report: 4th SEPT. 2013Documento7 pagineDaily Report: 4th SEPT. 2013api-212478941Nessuna valutazione finora

- Daily Report: 29 OCTOBER. 2013Documento7 pagineDaily Report: 29 OCTOBER. 2013api-212478941Nessuna valutazione finora

- US Trading Note August 09 2016Documento3 pagineUS Trading Note August 09 2016robertoklNessuna valutazione finora

- Daily market update and analysisDocumento3 pagineDaily market update and analysisAyush JainNessuna valutazione finora

- Daily Report 20140911Documento3 pagineDaily Report 20140911Joseph DavidsonNessuna valutazione finora

- MOSt Market Roundup SummaryDocumento7 pagineMOSt Market Roundup SummaryBhupendra_Rawa_1185Nessuna valutazione finora

- Daily Report: 07 NOVEMBER. 2013Documento7 pagineDaily Report: 07 NOVEMBER. 2013api-212478941Nessuna valutazione finora

- Weekly Report 21 To 25 JanuaryDocumento2 pagineWeekly Report 21 To 25 JanuaryFEPFinanceClubNessuna valutazione finora

- Special Report 19-09-2013 by Epic ResearchDocumento7 pagineSpecial Report 19-09-2013 by Epic ResearchNidhi JainNessuna valutazione finora

- Daily Report 20141017Documento3 pagineDaily Report 20141017Joseph DavidsonNessuna valutazione finora

- Currency Daily Report October 23Documento4 pagineCurrency Daily Report October 23Angel BrokingNessuna valutazione finora

- Daily Report 20141013Documento3 pagineDaily Report 20141013Joseph DavidsonNessuna valutazione finora

- Daily Report 20140915Documento3 pagineDaily Report 20140915Joseph DavidsonNessuna valutazione finora

- Daily Report 20141029Documento3 pagineDaily Report 20141029Joseph DavidsonNessuna valutazione finora

- Market Outlook Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Evening Wrap-Up: June 12, 2015Documento4 pagineEvening Wrap-Up: June 12, 2015api-274468947Nessuna valutazione finora

- Ireland Returns To The Debt Markets: Morning ReportDocumento3 pagineIreland Returns To The Debt Markets: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Central Banks Centre of Attention: Morning ReportDocumento3 pagineCentral Banks Centre of Attention: Morning Reportnaudaslietas_lvNessuna valutazione finora

- Index Dipped Amidst Profit Taking : Tuesday, April 30, 2013Documento7 pagineIndex Dipped Amidst Profit Taking : Tuesday, April 30, 2013Randora LkNessuna valutazione finora

- Daily Trade Journal - 08.07.2013Documento6 pagineDaily Trade Journal - 08.07.2013Randora LkNessuna valutazione finora

- Market Outlook Market Outlook: Dealer's DiaryDocumento13 pagineMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- June-14-Dj Asia Daily Forex OutlookDocumento3 pagineJune-14-Dj Asia Daily Forex OutlookMiir ViirNessuna valutazione finora

- Bluechips Stepped Center Stage Amidst Rallying of IndicesDocumento6 pagineBluechips Stepped Center Stage Amidst Rallying of IndicesRandora LkNessuna valutazione finora

- Currency Daily Report, July 11 2013Documento4 pagineCurrency Daily Report, July 11 2013Angel BrokingNessuna valutazione finora

- The Power of Japanese Candlestick Charts: Advanced Filtering Techniques for Trading Stocks, Futures, and ForexDa EverandThe Power of Japanese Candlestick Charts: Advanced Filtering Techniques for Trading Stocks, Futures, and ForexValutazione: 4.5 su 5 stelle4.5/5 (2)

- Morning Market Briefing: July 29, 2015Documento4 pagineMorning Market Briefing: July 29, 2015api-274468947Nessuna valutazione finora

- Market Outlook: Week of June 22, 2015Documento6 pagineMarket Outlook: Week of June 22, 2015api-274468947Nessuna valutazione finora

- Evening Wrap-Up: June 12, 2015Documento4 pagineEvening Wrap-Up: June 12, 2015api-274468947Nessuna valutazione finora

- Market Outlook: Week of June 8, 2015Documento5 pagineMarket Outlook: Week of June 8, 2015api-274468947Nessuna valutazione finora

- Morning Market Briefing: June 17, 2015Documento4 pagineMorning Market Briefing: June 17, 2015api-274468947Nessuna valutazione finora

- Evening Wrap-Up: June 5, 2015Documento5 pagineEvening Wrap-Up: June 5, 2015api-274468947Nessuna valutazione finora

- UntitledDocumento5 pagineUntitledapi-274468947Nessuna valutazione finora

- UntitledDocumento3 pagineUntitledapi-274468947Nessuna valutazione finora

- Evening Wrap-Up: June 16, 2015Documento5 pagineEvening Wrap-Up: June 16, 2015api-274468947Nessuna valutazione finora

- UntitledDocumento6 pagineUntitledapi-274468947Nessuna valutazione finora

- UntitledDocumento4 pagineUntitledapi-274468947Nessuna valutazione finora

- Evening Wrap-Up: June 9, 2015Documento5 pagineEvening Wrap-Up: June 9, 2015api-274468947Nessuna valutazione finora

- UntitledDocumento5 pagineUntitledapi-274468947Nessuna valutazione finora

- Leap Report: Options Research June 2, 2015Documento3 pagineLeap Report: Options Research June 2, 2015api-274468947Nessuna valutazione finora

- Evening Wrap-UpDocumento4 pagineEvening Wrap-Upapi-274468947Nessuna valutazione finora

- UntitledDocumento3 pagineUntitledapi-274468947Nessuna valutazione finora

- Educational & Training Services: Under The Radar Research May 25, 2015Documento4 pagineEducational & Training Services: Under The Radar Research May 25, 2015api-274468947Nessuna valutazione finora

- Market Outlook: Week of June 1, 2015Documento5 pagineMarket Outlook: Week of June 1, 2015api-274468947Nessuna valutazione finora

- Market Outlook: Week of May 25, 2015Documento5 pagineMarket Outlook: Week of May 25, 2015api-274468947Nessuna valutazione finora

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocumento4 pagineEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocumento4 pagineEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947Nessuna valutazione finora

- Evening Wrap-Up: Djia: S&P 500: NasdaqDocumento4 pagineEvening Wrap-Up: Djia: S&P 500: Nasdaqapi-274468947Nessuna valutazione finora

- Morning Market SnapshotDocumento2 pagineMorning Market Snapshotapi-274468947Nessuna valutazione finora

- Market Outlook: Week of May 18, 2015Documento5 pagineMarket Outlook: Week of May 18, 2015api-274468947Nessuna valutazione finora

- PPE Accounting Guide for Asset Acquisition, Depreciation and DisposalDocumento18 paginePPE Accounting Guide for Asset Acquisition, Depreciation and DisposalJustz LimNessuna valutazione finora

- Financial Analysis of HDFC BankDocumento48 pagineFinancial Analysis of HDFC BankAbhay JainNessuna valutazione finora

- Commerce Is The Branch of Production That Deals WiDocumento6 pagineCommerce Is The Branch of Production That Deals WiAli SalehNessuna valutazione finora

- Vocabulary in Context. MoneyDocumento12 pagineVocabulary in Context. MoneyShaxnoza JienbaevaNessuna valutazione finora

- Importance of Time Value of Money in Financial ManagementDocumento16 pagineImportance of Time Value of Money in Financial Managementtanmayjoshi969315Nessuna valutazione finora

- Struktur Organisasi Bank MegaDocumento1 paginaStruktur Organisasi Bank MegaDilla AjaNessuna valutazione finora

- GR No. 7593, March 27, 1913: Supreme Court of The PhilippinesDocumento6 pagineGR No. 7593, March 27, 1913: Supreme Court of The PhilippinesM A J esty FalconNessuna valutazione finora

- Indian Overseas Bank PO 2009 Solved Question PaperDocumento8 pagineIndian Overseas Bank PO 2009 Solved Question Paperkapeed_supNessuna valutazione finora

- Current Affairs-2018: Current Affairs 786 By: Sharjeel Wassan & Dr. Muhammad SabeehDocumento17 pagineCurrent Affairs-2018: Current Affairs 786 By: Sharjeel Wassan & Dr. Muhammad SabeehTahir RehmanNessuna valutazione finora

- Monthly Statement: Name Address Account Number Statement PeriodDocumento18 pagineMonthly Statement: Name Address Account Number Statement PeriodAlexander Weir-WitmerNessuna valutazione finora

- Karwa Letter 5Documento19 pagineKarwa Letter 5Samyak DahaleNessuna valutazione finora

- Money - Buying, Selling, PayingDocumento1 paginaMoney - Buying, Selling, Payingsave1407Nessuna valutazione finora

- Department of Labor: 96 22717Documento11 pagineDepartment of Labor: 96 22717USA_DepartmentOfLaborNessuna valutazione finora

- The Prons and Cons of Internet and World Wide WebDocumento6 pagineThe Prons and Cons of Internet and World Wide WebMohamad Razali RamdzanNessuna valutazione finora

- Sanction Letter CustDocumento1 paginaSanction Letter CustSanjay SolankiNessuna valutazione finora

- Forward Contracts Prohibitions On PDFDocumento23 pagineForward Contracts Prohibitions On PDFIqbal PramaditaNessuna valutazione finora

- ABU ROAD SHOE MARKET SANJAY PLACE ACCOUNTANTS LISTDocumento209 pagineABU ROAD SHOE MARKET SANJAY PLACE ACCOUNTANTS LISTDev SharmaNessuna valutazione finora

- FACULTY OF BUSINESS AND MANAGEMENT BACHELOR OF BUSINESS ADMINISTRATION (HONS.) ISLAMIC BANKING ADVANCE FIQH MUAMALAT (ISB548) GROUP PROJECT SHARI’AH CONTRACT AND ISSUESDocumento29 pagineFACULTY OF BUSINESS AND MANAGEMENT BACHELOR OF BUSINESS ADMINISTRATION (HONS.) ISLAMIC BANKING ADVANCE FIQH MUAMALAT (ISB548) GROUP PROJECT SHARI’AH CONTRACT AND ISSUESNurin HannaniNessuna valutazione finora

- New Arrival Books at BIIT LibraryDocumento52 pagineNew Arrival Books at BIIT Libraryanon_528496618Nessuna valutazione finora

- ERM Case Studies of an FMCG Company and a Multinational BankDocumento22 pagineERM Case Studies of an FMCG Company and a Multinational BankgordukhanNessuna valutazione finora

- ExxxxxxDocumento2 pagineExxxxxxGuiness DeguzmanNessuna valutazione finora

- Bank Credit Instruments-Fm122Documento27 pagineBank Credit Instruments-Fm122Jade Solante Cervantes100% (1)

- The Tools of Monetary PolicyDocumento53 pagineThe Tools of Monetary Policyrichard kapimpaNessuna valutazione finora

- Ap Macroeconomics NotesDocumento40 pagineAp Macroeconomics NotesBrandon Piyevsky100% (1)

- The Bank of Punjab Internship ReportDocumento76 pagineThe Bank of Punjab Internship Reportbbaahmad89100% (4)

- Banking Sector Overview: Definitions, Regulation, FunctionsDocumento39 pagineBanking Sector Overview: Definitions, Regulation, FunctionsDieu NguyenNessuna valutazione finora

- Banking Law B.com - Docx LatestDocumento38 pagineBanking Law B.com - Docx LatestViraja GuruNessuna valutazione finora