Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Cash Flow Statement's Component Effect On Management Performance in Firms Enlisted in Tehran Stock Exchange

Caricato da

TI Journals PublishingTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Cash Flow Statement's Component Effect On Management Performance in Firms Enlisted in Tehran Stock Exchange

Caricato da

TI Journals PublishingCopyright:

Formati disponibili

Int. j. econ. manag. soc. sci., Vol(3), No (11), November, 2014. pp.

654-659

TI Journals

International Journal of Economy, Management and Social Sciences

www.tijournals.com

ISSN:

2306-7276

Copyright 2014. All rights reserved for TI Journals.

The cash flow statements component effect on Management

Performance in firms enlisted in Tehran Stock Exchange

Farzaneh Dalir Rezagholi Gheshlaghi *

Islamic Azad university; Centeral Tehran Branch; Islamic Azad university; Tehran; Iran.

Fahimeh Faal

Islamic Azad university; Centeral Tehran Branch; Islamic Azad university; Tehran; Iran.

*Corresponding author: farzane5894_dalir@yahoo.com

Keywords

Abstract

Operational activities

Investment return and interest paid to finance

Income tax

Investment activities

Financing activities

Return on assets

Important information is broadcast through cash flow statements which affect the judgments and

decisions of investors and also are effective in creating company profitability and assessing management

performance. Thus, in the present research we want to find an answer for the following question: Are cash

flows resulting from the cash flow statements component affective over return on assets which is among

criteria to assess management performance? The statistical society for the present research entail 138

firms enlisted in Tehran Stock Exchange that has been investigated during a time period of 5 years

between 2008 and 2012. Ti test the hypotheses we have used linear regression model and research

findings showed that there is a negative and meaningful relationship between cash flows resulting from

investment return and the interest paid to finance, and also between cash flows resulting from income tax

and cash flows resulting from investment activities and return on assets. Also there is no relationship

between cash flows resulting from operational activities, and financing activities and return on assets.

1.

Introduction

Economic and financial relationships among humans started from the start of his life and creation in all exchanges. These relations were existent

in its simple form in primitive societies. Gradually small communities were formed. Today nobody can deny the very sensitive and key role of

big and modern companies in economic structure of the countries. These companies consume a great deal of economic resources of the country

(such as capital, workforce, raw material, and managerial workforce), as the main bases of economy in countries. On the contrary regarding the

amount of production and sales, they have a very important role in development and economic enhancement. Therefore, it should be pointed out

that, several factors affect the management performance, performance of companies, controlling, and assessing them. One of the most important

factors is the effect of presenting some information prepared through financial reporting. Financial reporting is the foundation on which capital

appropriation flow has been founded. It is clear that an efficient flow of capital appropriation is necessary for economic health and the

enhancement of yield and encouraging the innovations. Also this can prepare an efficient and fluid market for bonds exchange and exchanging

credits. Financial reporting categorizes certain information about a company regarding the management's outlook and presents it meaningfully

for the users. And the investors, potential creditors and their consultants use it as a basis for decision making to appropriate capital. Cash flow

statement is considered as one of the main financial statements that have been considered as obligatory to be presented based on accounting

standards. This statement entails information about cash receipts and payments during the fiscal year which help the users in predicting future

cash flows. Based on what was said cash flow statement and output information of each of its parts can affect management efficiency rate and as

a result firm's performance [1].

2.

The theoretical framework of this research

Financial reporting is one of the information resources needed by those who tend to control, assess, and make decisions about activities in

business units. These individuals should integrate the information prepared through financial reporting with the related information from other

information resources about general and economic conditions for decision making, performance assessment and assessing the effective and

efficient management to carry out their tasks better [4]. Several factors affect management performance, firms' performance, assessment and

control of them. One of the most important factors is the effect of information prepared through financial reporting. Financial reporting

categorizes certain information of a company regarding management's outlook and presents it to the users meaningfully [9].

Cash flow statement, as one of the principal financial statements, is one of the most efficient reports to reflect the performance of a business unit

regarding cash and present information needed about creating and consuming cash to the users of financial statements. Cash is one of the

important resources in each economic unit and making a balance between accessible cash and cash needs is considered as the most important

factor in economic safety of each business unit. Based on different outlooks, different models have been proposed to present this financial

statement and each of the models have different comprehensibility and reliability regarding the amount of precision and transparency in

presenting information and different effects on users regarding decision making and performance assessment of business units [3].

Firms' performance is a criterion to measure the amount of achievement of organizational goals and includes financial and operational

performance. Effective factors on firms' performance can de divided into two groups. One group is categorized as relating to the structure,

mechanisms, and several factors present in the company and it affects performance directly such as management performance, internal controls,

corporate governance and . The other category is related to the type of performance of the company, using methods and tools in

announcements, the effect of presenting information resulted from financial statements, feedback of users of the information and [13].

Based on the above, one of the factors affecting firm's performance is management performance, which is one of the important management

tasks is to control Operating assets. If additional assets applied in the operation it will cause increasing operating costs. Return on asset by

controlling costs, net profit and sales volume causes managers to carefully plan the deployment of operational assets. In fact, the return on asset

is the basic scale used to evaluate the management performance [10].

655

The cash flow statements component effect on Management Performance in firms enlisted in Tehran Stock Exchange

International Journal of Economy, Management and Social Sciences Vol(3), No (11), November, 2014.

Therefore, management performance evaluation is very important. To assess the management performance, the owners use different tools and

scales. At any period of time, certain measures proposed and each beneficiary use these scales according to his vision to evaluate the

performance of managers. So the owners are always looking for the scales using them cause evaluate management performance and efficiency in

the best way [8].

According to the different models of cash flow statements and the effect of reporting type on management efficiency and effectiveness and also

the rate of return on assets is one of the measures scale for management performance specially investing centres, present research has been

carried out to investigate the effect of the cash flow statements component on the return on assets of firms enlisted in Tehran Stock Exchange.

3.

Review of related literature

The results of a research by Marti & Meysera (2006) entitled: "The effectiveness of cash flow statement and ratios related to it as an index for

assessing the weakness of a company" showed that the financial statement mentioned and its ratios were an appropriate index to show the health

and success of the company and managers and financial agents can rely on these ratios in showing the financial status of a company.

Reybern (2007) studied about cash resulting from operational activities accompanying cash flow statement and accruals accompanying stock

return. According to Reybern, regarding the fact that the primary and main interest of the users is the figures which show the performance of an

entity, the main focus of the research mentioned should be on operational cash flow, instead of sum of cash flow. Results of the research by

Reybern showed that there exists and accordance both between cash resulting from operational activities and return on equity and between

accruals and the return of this companionship.

Willson (2009) studied about the information content of the components of cash flow statements on information content of cash earning. This

research wanted to investigate whether the components of cash flow statements have had information content or not? Also do they affect cash

earnings? Willson found out in his research that there is coordination between the components of cash flow statements and cash earnings. The

result of his research showed that the related components do contain information load.

Mehrani, Mehrani (2003) studied the relationship between profitable ratios and stock return in Tehran Stock Exchange. This research was about

the relationship between stock return and profitability ratios including return of assets and return of equity. The research results showed that

some ratios such as ROA and ROE have a meaningful relationship with stock return and also some changes of some of the variables such as

equity and return of assets can not predict the changes in return of stock solely.

Sardarizadeh (2012) studied the relationship between net cash in each of the stages of cash flow statement and the ratio of price to earning per

each share. The goal of this research was to find out whether net cash resulting from operational activities, return of investment and interest paid

to finance, income tax of investment activities and financing activities can affect the ratio of price to earning per each share of the company or

not? The results showed that the effect of cash flows resulting from operational activities and investment activities on the earnings of each share

was negative and the effect of cash flow resulting from investment return and interest paid to finance on the variable mentioned was positive.

Also the effect of cash flows resulting from income tax and financing activities on the ratio of price to earnings per share has been meaningless.

4.

Research hypotheses

In the present research and based on the literature and theoretical foundations, the following hypotheses were devised.

Main hypothesis

The cash flow statements component effect management Performance.

Minor hypotheses

1- Cash flows resulting from operational activities affect return of assets.

2- Cash flow resulting from return of investments and interest paid to finance affects return of assets.

3- Cash flows resulting from income tax paid affect return of assets.

4- Cash flows resulting from investment activities affect return of assets.

5- Cash flows resulting from financing activities affect return of assets.

4.1 Population and statistical sample

In order to select our statistical sample, the following conditions were taken into consideration:

1- To observe the comparability, the fiscal year was decided to end at the end of Esfand (21st March).

2- During research period, the companies should not have had any type of activity stop and they should not have changed their fiscal

year.

3- All information needed about the companies should be accessible to carry out the research.

4- The companies selected should not be among banks and financial entities (investment companies, financial intermediaries, holding

companies, and leasing).

By considering the research limitations mentioned above, 138 companies were chosen for the time period between the years 2008 and 2012 and

formed our sample.

5.

Related models regarding hypotheses testing

In this research and regarding the effect of cash flow statement on return of equity and return of assets being tested, the dependent variable of the

research was return of equity and return of assets. To calculate these variables, we used multiple-regression models as follows:

Model1:

ROAi,t=1CFO i,t+2CFIR&SFi,t+3PTi,t+4CFIi,t+ 5CFFi,t+ 6 SIZEi,t+ 7LEVi,t

ROAi,t = return of assets of firm i in the year t

CFOi,t= operational cash flows of firm i in the year t

CFIR&SFi,t= cash flows of return of investments and interests paid to finance for firm i in the year t

PTi,t= paid tax of firm i in the year t

CFIi,t= cash flows of investment of firm i in the year t

CFFi,t= cash flows of finance of firm i in the year t

Farzaneh Dalir Rezagholi Gheshlaghi *, Fahimeh Faal

656

International Journal of Economy, Management and Social Sciences Vol(3), No (11), November, 2014.

Also in this research and based on the researches carried out in Iran, the following variables were considered as control variables:

Firm size: it can be obtained from the natural logarithm of sum of assets at the end of the period.

Zimmerman (1983) stated that bigger companies apply more conservatism since they have more political sensitivity (Theory of Political Cost).

In the present research, following what has been done in previous studies; we can use two variables as the criteria for firm size. Drashid & Zhang

(2003) used natural logarithm of total assets at the end of the period and Zimmerman (1983) used the logarithm of total sales income as the

representatives for firm size. But in this research we have used natural logarithm of total assets for firm size [2].

Financial leverage: this variable is gained by dividing total liability to total assets at the end of the period.

Accounting methods are related with financial leverage because one of the criteria noticed by the creditors (in Iranian banks) is the debt ratio of

companies. Thus, the higher debt ratio, there would be less tendency for the companies to use conservative methods. Therefore, it is expected

that firms' managers apply less conservatism in their financial statements in order to reduce the probability of lack of acceptance of loan

demands and to avoid incurring higher interest rates [5].

The following table shows the symbols and names of variables.

Table 1. Abbreviation and name of variables selected in the research

Variable name

Return of assets

Cash flows resulting from operational activities

Cash flows resulting from investment return and interest paid to finance

Cash flows resulting from paid income tax

Cash flows resulting from investment

Cash flows resulting from finance

Firm size

Leverage

6.

Symbol

ROA

CFO

CFIR*SF

PT

CFI

CFF

SIZE

LEV

Research findings

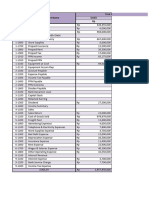

Table 2. Results of descriptive analysis

Variables

Observations

Mean

Std. Dev.

Skewness

Minimum

Maximum

ROA

690

0.096

0.122

-0.019

-0.340

0.491

CFO

690

0.110

0.121

0.374

-0.408

0.579

CFIR*SF

690

-0.066

0.061

-0.781

-0.346

0.368

PT

690

-0.015

0.018

-1.955

-0.139

0.000

CFI

690

-0.038

0.076

-0.759

-0.491

0.382

CFF

690

0.017

0.093

0.845

0.573

0.713

SIZE

690

13.327

1.774

-1.914

0.000

18.549

LEV

690

0.645

0.251

0.795

0.000

0.977

To study the normality of variables and residuals we used Kolomogorov-Smirnov's test. If the probability amount related to this test is more than

0.05, we can approve the normality of the distribution of variables with %95 assurance. On the contrary, the results of this test in table (3)

showed that all dependent variables of the research have had a normal distribution. As it can be seen, the amount of probability of each of the

variables is more than 0.05. Thus, we can test the data through a parametric test.

Table 3. Kolomogorov-Smirnov's test to measure data normality

ROA

1.379

0.089

Variables

Kolmogorov-Smirnov Z

Sig.

CFO

1.254

0.104

CFIR*SF

2.616

0.000

PT

5.197

0.000

CFI

4.054

0.000

CFF

2.828

0.000

SIZE

1.040

0.230

LEV

1.111

0.121

Pearson's correlation matrix is a test utilized to determine the amount of correlation between the data. For example, in table (4) in assurance level

of %99, there is a positive and meaningful relationship between return of assets and cash flows resulting from operational activities. This

relationship has resulted with a correlation coefficient of (0.420) through Pearson's correlation test and shows that there is a positive relationship

between return of assets and cash flows resulting from operational activities with an amount of %42.

Table 4. Correlation matrix

Variables

ROE

ROA

CFO

CFIR*SF

PT

CFI

CFF

SIZE

LEV

ROA

1

0.420

**

-0.393

**

-0.409

**

-0.207

0.007

**

0.104

**

-0.676

**

CFO

CFIR*SF

1

-0.480

**

-0.427

**

-0.396

**

-0.463

0.053

**

-0.250

1

0.468

-0.016

**

-0.105

-0.005

**

0.178

**

**

PT

1

0.100

-0.039

0.034

**

0.286

**

CFI

CFF

1

-0.319

-0.114

**

0.181

1

0.062

-0.022

**

**

SIZE

1

0.130

**

LEV

1

%99 * % 95 **

657

The cash flow statements component effect on Management Performance in firms enlisted in Tehran Stock Exchange

International Journal of Economy, Management and Social Sciences Vol(3), No (11), November, 2014.

7.

Results of testing hypotheses

Results of testing first hypothesis are as follows:

Table 5. Results of testing first hypothesis

ROA

(t-Statistic)

-0.653

5.598

-22.445

4.072

0.495

0.492

1.918

Prob. 0.000

Prob. 0.465

Prob. 0.000

Prob. 0.477

Prob.

0.514

0.000

0.000

0.001

(Coefficient)

-0.026

0.013

-0.340

0.136

224.29

0.765

4.545

0.877

Variables

CFO

SIZE

LEV

C

R Squar

Adjusted R Square

Durbin-Watson

F

Godfrey

F-white

F-limer

Based on results of the test represented in table (5), the meaningfulness level of F-Limer statistic shows that pooled data method is preferred one

compared to panel data method. Also the meaningfulness level of F-White statistic represents that the regression has divergent variance. Thus,

after removing standard error and variance divergence, the adjusted regression is calculated as the table above. In the next stage and regarding

that F statistic has a meaningfulness level of below 5 percent, the regression has the description power. Also since the meaningfulness level of

cash flows resulting from operational activities in dependent variable of return of asset is more than 5 percent, it can be said that cash flows

resulting from operational activities do not have a meaningful effect on return of assets Also firm size and financial leverage have significant

effect on return of asset. Durbin-Watson statistic is between 1.5 and 2.5. Thus, we can conclude that there is not self-correlation problem

between the variables. Finally the amount of identification coefficient shows that changes in independent and control variables have resulted in

changes in dependent variables of return on assets amounting to %49.5, respectively.

Results of testing second hypothesis are as follows:

Table 6. Results of testing second hypothesis

Prob.

0.000

0.000

0.000

0.001

ROA

(t-Statistic)

-5.566

6.630

-23.116

3.298

0.568

0.566

1.981

Prob. 0.000

Prob. 0.982

Prob. 0.000

Prob. 0.345

(Coefficient)

-0.549

0.012

-0.316

0.091

301.54

0.018

30.556

1.119

Variables

CFIR_SF

SIZE

LEV

C

R Squar

Adjusted R Square

Durbin-Watson

F

Godfrey

F-white

F-limer

Based on results of the test represented in table (6), the meaningfulness level of F-Limer statistic shows that pooled data method is preferred one

compared to panel data method. Also the meaningfulness level of F-White statistic represents that the regression has divergent variance. Thus,

after removing standard error and variance divergence, the adjusted regression is calculated as the table above. In the next stage and regarding

that F statistic has a meaningfulness level of below 5 percent, the regression has the description power. Also since the meaningfulness level of

cash flows resulting from return of investments and interest paid to finance in dependent variable of return of assets is less than 5 percent, it can

be said that cash flows resulting from return of investments and interest paid to finance have a negative and meaningful effect on return on

assets. Also firm size and financial leverage have significant effect on return of asset. Durbin-Watson statistic is between 1.5 and 2.5. Thus, we

can conclude that there is not self-correlation problem between the variables. Finally the amount of identification coefficient shows that changes

in independent and control variables have resulted in changes in dependent variables of return on assets amounting %56.8, respectively.

Results of testing third hypothesis are as follows:

Table 7. Results of testing third hypothesis

ROA

(t-Statistic)

-8.734

6.236

-19.747

3.162

0.545

0.543

1.933

Prob. 0.000

Prob. 0.730

Prob. 0.000

Prob. 0.186

Prob.

0.000

0.000

0.000

0.001

(Coefficient)

-1.530

0.013

-0.307

0.092

274.37

0.313

3.950

1.549

Variables

PT

SIZE

LEV

C

R Squar

Adjusted R Square

Durbin-Watson

F

Godfrey

F-white

F-limer

Farzaneh Dalir Rezagholi Gheshlaghi *, Fahimeh Faal

658

International Journal of Economy, Management and Social Sciences Vol(3), No (11), November, 2014.

Based on results of the test represented in table (7), the meaningfulness level of F-Limer statistic shows that pooled data method is preferred one

compared to panel data method. Also the meaningfulness level of F-White statistic represents that the regression has divergent variance. Thus,

after removing standard error and variance divergence, the adjusted regression is calculated as the table above. In the next stage and regarding

that F statistic has a meaningfulness level of below 5 percent, the regression has the description power. Also since the meaningfulness level of

cash flows resulting from paid income tax in dependent variable of return on assets is less than 5 percent, it can be said that cash flows resulting

from paid income tax have a negative and meaningful effect on return on assets. Also firm size and financial leverage have significant effect on

return of asset. Durbin-Watson statistic is between 1.5 and 2.5. Thus, we can conclude that there is not self-correlation problem between the

variables. Finally the amount of identification coefficient shows that changes in independent and control variables have resulted in changes in

dependent variables of return on assets amounting %54.5, respectively.

Results of testing fourth hypothesis are as follows:

Table 8. Results of testing fourth hypothesis

Prob.

0.049

0.000

0.000

0.000

ROA

(t-Statistic)

-1.921

5.296

-21.923

4.094

0.498

0.496

1.905

Prob. 0.000

Prob. 0.429

Prob. 0.000

Prob. 0.485

(Coefficient)

-0.096

0.012

-0.334

0.136

227.042

0.847

4.175

0.863

Variables

CFI

SIZE

LEV

C

R Squar

Adjusted R Square

Durbin-Watson

F

Godfrey

F-white

F-limer

Based on results of the test represented in table (8), the meaningfulness level of F-Limer statistic shows that pooled data method is preferred one

compared to panel data method. Also the meaningfulness level of F-White statistic represents that the regression has divergent variance. Thus,

after removing standard error and variance divergence, the adjusted regression is calculated as the table above. In the next stage and regarding

that F statistic has a meaningfulness level of below 5 percent, the regression has the description power. Also since the meaningfulness level of

cash flows resulting from investment activities in dependent variable return on assets is less than 5 percent, it can be said that cash flows

resulting from investment activities have a negative and meaningful effect on return on assets. Also firm size and financial leverage have

significant effect on return of asset. Durbin-Watson statistic is between 1.5 and 2.5. Thus, we can conclude that there is not self-correlation

problem between the variables. Finally the amount of identification coefficient shows that changes in independent and control variables have

resulted in changes in dependent variables of return on assets amounting to %49.8, respectively.

Results of testing fifth hypothesis are as follows:

Table 9. Results of testing fifth hypothesis

ROA

(t-Statistic)

-0.653

5.598

-22.445

4.072

0.495

0.492

1.918

Prob. 0.000

Prob. 0.465

Prob. 0.000

Prob. 0.477

Prob.

0.514

0.000

0.000

0.000

(Coefficient)

-0.026

0.013

-0.340

0.136

224.292

0.765

4.545

0.877

Variables

CFF

SIZE

LEV

C

R Squar

Adjusted R Square

Durbin-Watson

F

Godfrey

F-white

F-limer

Based on results of the test represented in table (9), the meaningfulness level of F-Limer statistic shows that pooled data method is preferred one

compared to panel data method. Also the meaningfulness level of F-White statistic represents that the regression has divergent variance. Thus,

after removing standard error and variance divergence, the adjusted regression is calculated as the table above. In the next stage and regarding

that F statistic has a meaningfulness level of below 5 percent, the regression has the description power. Also since the meaningfulness level of

cash flows resulting from financing activities in dependent variable of return on assets is less than 5 percent, it can be said that cash flows

resulting from financing activities do not have a meaningful effect on return on assets. Also firm size and financial leverage have significant

effect on return of asset. Durbin-Watson statistic is between 1.5 and 2.5. Thus, we can conclude that there is not self-correlation problem

between the variables. Finally the amount of identification coefficient shows that changes in independent and control variables have resulted in

changes in dependent variables of return on assets amounting to %49.5, respectively.

8.

Conclusion

The goal of doing the present research was to study the effect of components of cash flow statement on management Performance in firms

enlisted in Tehran Stock Exchange. Research findings showed that effect of cash flows resulting from operational activities on return on assets is

meaningless. Maybe we can say that current assets of the company were inefficient and lack enough ability to achieve return. Cash flows

resulting from return on investment and interest paid to finance affect return on assets negatively. The reason is that in Iran, most companies

finance through borrowing and these borrowings are carried out either through stockholders or getting loans from the banks. Therefore, the

659

The cash flow statements component effect on Management Performance in firms enlisted in Tehran Stock Exchange

International Journal of Economy, Management and Social Sciences Vol(3), No (11), November, 2014.

interest and earning paid for the stock will be more than interest and earnings received. Since interest cost and earning payment have reverse

relationships with earnings, their increase will result in earnings reduction. On the other hand, due to the greater amount of output flow of cash

compared to its input, liquidity will reduce and this will limit activities such as investment and earnings' achievement. Cash flows resulting from

paid income tax affect return on assets negatively. This is due to the fact that tax is the transfer of a portion of the income of a business unit to

the government or giving a part of the earnings of economic activities by the companies which is got by the government because it is the

government that has prepared the facilities to achieve income and earnings. Therefore, the more tax being paid means that a greater portion of

earning has been appropriated to the government and this will reduce earning and the ratios of return on assets. Besides that, the more increases

in these cashes, the more will be drawn out of the company and cash resources needed for investment and achieving more return will be limited.

Cash flows resulting from investment activities affect both return on assets negatively. The reason of the result achieved can be explained in two

ways. One is that the investments carried out in firms under investigations have not been efficient appropriately or cash flows resulting from

sales and conferring more investments that cash flows resulting from the purchase of investments through which the cashes resulted were not

consumed for reinvestment. And they have been consumed in other cases except investment, such as the repayment of liabilities. Another

explanation is that most investments carried out by the companies under investigations were of long-term types which were in their primary

stages and their recovery by the companies will be done during the years after this research period is over.

Cash flows resulting from financing activities did not have any progressive or regressive effects on return on assets because financing affects

earnings in two ways. One is through interest cost and stock earnings related to t whose effect will be reflected through part 2 of cash flow

statement, namely, return of investments and earnings paid to finance. And the other one is that when the supplied resources are spent for

investment its effect will affect cash flow statements of earnings through part 4. Thus, we can say that financing through other parts will reflect

their own effect, and as a whole net cash flows resulting from financing affect only cash flows and not the earnings. Therefore, it does not have

any effect on return on assets.

Suggestions resulting from research findings

1-

2-

3-

Investors: regarding the results of this research it can be suggested that the investors should pay more attention to cash flows statements

when they make decisions for investment. Not only it should be investigated to recognize cash flow of the company, but all components of

it and the reasons resulting in increasing and decreasing their cash flows to be investigated completely and its effect on earnings and also

the operations of oneself to invest was measured.

Managers: regarding the fact that the goal of managers is to deserve the trust of owners. Thus, they should consider this issue that one of

the most important tools for deserving this trust is reports that transfers through financial statements. Therefore, financial statements such as

cash flows statement are highly important and the management should try to observe transparency and increasing information content ,

should present it in a way that users not only are helped in assessing cash flows, but also in performance assessment.

The committee for devising accounting standards: it can be suggested to FASB that due to the highly importance of cash flow statements in

statements of the model or methods which lead to the presentation of financial statements with more reliability and transparency and also

higher information content. They should have deeper effects on decision making by he users. They studied those models and use alternative

models utilized.

References

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

Ahmadi, Mostafa (2012). Superior presentation of cash flow statement regarding the outlook of creditors and financial managers", MA Dissertation in

Accounting, Central Tehran University.

Cano-Rodrguez, M. (2010). "Big auditors, private firms and accounting conservatism: Spanish evidence". European Accounting Review.19(1). 131159.

Dastgir, Mohsen; Khodabandeh, Ramin. The relationship between information content of main components of cash flow statements, return of stocks.

FSSB (1978) ''objectives of Financial reporting by business enterprises ''statement of Financial Accounting Concepts No 1 par lr.

Hassas-e-Yeghaneh, Yahya; Shahryari, Alireza (2010). Studying the relationship between ownership concentration and conservatism in Tehran Stock

Exchange. Journal of Financial Management Researches, year 2, No. 2.

.Marti;and Meysera Cash Flow Statements and the related ratios efficacy measure for the assessment of corporate failure;Financial Studies (2006).

Mehrani, Sasan; Mehrani, Kaveh (2013). The relationship between profitability and stock return in Tehran Stock Exchange. Quarterly Journal of

Accounting and auditing Studies.

Nmazi, Mohammad (2009). Studying the Q Tobin ratio and comparison with other measures of performance, managers in firms enlisted in Tehran Stock

Exchange , Journal of Accounting Developments

Pourbagheri, Hossein (2009). Studying the ability of cash flows resulting from operational activities in predicting future cash flows, Quarterly Journal of

Accounting Studies.

Rezaee, Farzin (2013). Comparison the factors affecting the rate of return on assets with a focus on business strategies, Journal of Management

Accounting, No. 17.

Reybern; Cash flow from operating activities, cash and accruals, stock returnsJournal Of Accountancy (2007).

Sardarizadeh, Mahtaab (2012). Studying the relationship between net cash in each of the categories of cash flow statements and the ratio of price to

earnings per share in firms enlisted in Tehran Stock Exchange. MA Dissertation in Accounting, Central Tehran University.

Tilekani, Shooleh (2007). The assessment of performance in corporations in Malasysia www.taavon.ir

Wilson;G Peter The Capital Structure Using the Evaluation Criteria;Accountants Magazine (2009).

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Numerical Optimization of Biogas Absorber Geometry For Highest Methane Purity of The Egyptian BiogasDocumento5 pagineNumerical Optimization of Biogas Absorber Geometry For Highest Methane Purity of The Egyptian BiogasTI Journals PublishingNessuna valutazione finora

- Language Free Character Recognition Using Character Sketch and Center of Gravity ShiftingDocumento5 pagineLanguage Free Character Recognition Using Character Sketch and Center of Gravity ShiftingTI Journals PublishingNessuna valutazione finora

- Does Book-to-Market Ratio Matter in Profitability of Momentum Investment Strategy in Tehran Stock Exchange?Documento5 pagineDoes Book-to-Market Ratio Matter in Profitability of Momentum Investment Strategy in Tehran Stock Exchange?TI Journals PublishingNessuna valutazione finora

- The Ideal Type of University in Knowledge Society and Compilating Its Indicators in Comparison To The Traditional UniversityDocumento5 pagineThe Ideal Type of University in Knowledge Society and Compilating Its Indicators in Comparison To The Traditional UniversityTI Journals PublishingNessuna valutazione finora

- The Right To Clean and Safe Drinking Water: The Case of Bottled WaterDocumento6 pagineThe Right To Clean and Safe Drinking Water: The Case of Bottled WaterTI Journals PublishingNessuna valutazione finora

- Investigating A Benchmark Cloud Media Resource Allocation and OptimizationDocumento5 pagineInvestigating A Benchmark Cloud Media Resource Allocation and OptimizationTI Journals PublishingNessuna valutazione finora

- The Simulation of Conditional Least Squares Estimators and Weighted Conditional Least Squares Estimators For The Offspring Mean in A Subcritical Branching Process With ImmigrationDocumento7 pagineThe Simulation of Conditional Least Squares Estimators and Weighted Conditional Least Squares Estimators For The Offspring Mean in A Subcritical Branching Process With ImmigrationTI Journals PublishingNessuna valutazione finora

- The Impact of El Nino and La Nina On The United Arab Emirates (UAE) RainfallDocumento6 pagineThe Impact of El Nino and La Nina On The United Arab Emirates (UAE) RainfallTI Journals PublishingNessuna valutazione finora

- Factors Affecting Medication Compliance Behavior Among Hypertension Patients Based On Theory of Planned BehaviorDocumento5 pagineFactors Affecting Medication Compliance Behavior Among Hypertension Patients Based On Theory of Planned BehaviorTI Journals PublishingNessuna valutazione finora

- Economic Impacts of Fertilizers Subsidy Removal in Canola Production in IranDocumento5 pagineEconomic Impacts of Fertilizers Subsidy Removal in Canola Production in IranTI Journals PublishingNessuna valutazione finora

- Empirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachDocumento12 pagineEmpirical Analysis of The Relationship Between Economic Growth and Energy Consumption in Nigeria: A Multivariate Cointegration ApproachTI Journals PublishingNessuna valutazione finora

- A Review of The Effects of Syrian Refugees Crisis On LebanonDocumento11 pagineA Review of The Effects of Syrian Refugees Crisis On LebanonTI Journals Publishing100% (1)

- The Impact of Economic Growth and Trade On The Environment: The Canadian CaseDocumento11 pagineThe Impact of Economic Growth and Trade On The Environment: The Canadian CaseTI Journals PublishingNessuna valutazione finora

- Assessment of Some Factors Affecting The Mechanical Properties of Potato TubersDocumento6 pagineAssessment of Some Factors Affecting The Mechanical Properties of Potato TubersTI Journals PublishingNessuna valutazione finora

- Evaluation of Efficiency of A Setup Designed For Analysis of Radon Using Electronic Radon DetectorDocumento7 pagineEvaluation of Efficiency of A Setup Designed For Analysis of Radon Using Electronic Radon DetectorTI Journals PublishingNessuna valutazione finora

- Novel Microwave Assisted Synthesis of Anionic Methyl Ester Sulfonate Based On Renewable SourceDocumento5 pagineNovel Microwave Assisted Synthesis of Anionic Methyl Ester Sulfonate Based On Renewable SourceTI Journals PublishingNessuna valutazione finora

- Dynamic Hysteresis Band Fixed Frequency Current ControlDocumento4 pagineDynamic Hysteresis Band Fixed Frequency Current ControlTI Journals PublishingNessuna valutazione finora

- Unstable Economy: Reflections On The Effects and Consequences in The Event of Deflation (The Case of Italy)Documento12 pagineUnstable Economy: Reflections On The Effects and Consequences in The Event of Deflation (The Case of Italy)TI Journals PublishingNessuna valutazione finora

- Flexural Properties of Finely Granulated Plastic Waste As A Partial Replacement of Fine Aggregate in ConcreteDocumento4 pagineFlexural Properties of Finely Granulated Plastic Waste As A Partial Replacement of Fine Aggregate in ConcreteTI Journals PublishingNessuna valutazione finora

- Simulation of Control System in Environment of Mushroom Growing Rooms Using Fuzzy Logic ControlDocumento5 pagineSimulation of Control System in Environment of Mushroom Growing Rooms Using Fuzzy Logic ControlTI Journals PublishingNessuna valutazione finora

- Documentation of Rice Production Process in Semi-Traditional and Semi-Mechanized Systems in Dargaz, IranDocumento5 pagineDocumentation of Rice Production Process in Semi-Traditional and Semi-Mechanized Systems in Dargaz, IranTI Journals PublishingNessuna valutazione finora

- Allelopathic Effects of Aqueous Extracts of Bermuda Grass (Cynodon Dactylon L.) On Germination Characteristics and Seedling Growth of Corn (Zea Maize L.)Documento3 pagineAllelopathic Effects of Aqueous Extracts of Bermuda Grass (Cynodon Dactylon L.) On Germination Characteristics and Seedling Growth of Corn (Zea Maize L.)TI Journals PublishingNessuna valutazione finora

- Emerging Stock Markets and Global Economic System: The Nigeria ExperienceDocumento3 pagineEmerging Stock Markets and Global Economic System: The Nigeria ExperienceTI Journals PublishingNessuna valutazione finora

- Effects of Priming Treatments On Germination and Seedling Growth of Anise (Pimpinella Anisum L.)Documento5 pagineEffects of Priming Treatments On Germination and Seedling Growth of Anise (Pimpinella Anisum L.)TI Journals PublishingNessuna valutazione finora

- Prediction of Output Energy Based On Different Energy Inputs On Broiler Production Using Application of Adaptive Neural-Fuzzy Inference SystemDocumento8 paginePrediction of Output Energy Based On Different Energy Inputs On Broiler Production Using Application of Adaptive Neural-Fuzzy Inference SystemTI Journals PublishingNessuna valutazione finora

- Relationship Between Couples Communication Patterns and Marital SatisfactionDocumento4 pagineRelationship Between Couples Communication Patterns and Marital SatisfactionTI Journals PublishingNessuna valutazione finora

- How Does Cooperative Principle (CP) Shape The News? Observance of Gricean Maxims in News Production ProcessDocumento6 pagineHow Does Cooperative Principle (CP) Shape The News? Observance of Gricean Maxims in News Production ProcessTI Journals Publishing100% (1)

- The Investigation of Vegetation Cover Changes Around of Hoze-Soltan Lake Using Remote SensingDocumento3 pagineThe Investigation of Vegetation Cover Changes Around of Hoze-Soltan Lake Using Remote SensingTI Journals PublishingNessuna valutazione finora

- Comparison of Addicted and Non-Addicted University Students in Loneliness and Mental HealthDocumento3 pagineComparison of Addicted and Non-Addicted University Students in Loneliness and Mental HealthTI Journals PublishingNessuna valutazione finora

- The Changes of College Students Value Orientation For Womens Social AdvancementDocumento5 pagineThe Changes of College Students Value Orientation For Womens Social AdvancementTI Journals PublishingNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- AFM Capital Structure Cp5Documento61 pagineAFM Capital Structure Cp5drmsellan7Nessuna valutazione finora

- 2nd Quarter - 1st ENTREPRENEUR SummativeDocumento3 pagine2nd Quarter - 1st ENTREPRENEUR SummativeCyrill Gabunilas Fausto100% (1)

- Annual Statistical Report of Egyptian Insurance Market 2010 - 2011Documento50 pagineAnnual Statistical Report of Egyptian Insurance Market 2010 - 2011Mohammed RagabNessuna valutazione finora

- Pre-Joining Documents: InstructionsDocumento6 paginePre-Joining Documents: InstructionsHeyder HeyderovNessuna valutazione finora

- SampleDocumento8 pagineSampleTahir SirtajNessuna valutazione finora

- Jam Jelly Murabba Manufacturing ProjectDocumento2 pagineJam Jelly Murabba Manufacturing ProjectcasagarteliNessuna valutazione finora

- 1dgp5a3-2018!05!15 Chakana Investors PresentationDocumento34 pagine1dgp5a3-2018!05!15 Chakana Investors PresentationYuri Vladimir Ordonez LamaNessuna valutazione finora

- ICAEW - Accounting 2020 - Chap 2Documento56 pagineICAEW - Accounting 2020 - Chap 2TRIEN DINH TIENNessuna valutazione finora

- Factors Influencing Transfer Pricing Compliance An Indonesian Perspective PDFDocumento301 pagineFactors Influencing Transfer Pricing Compliance An Indonesian Perspective PDFAlfharis AriyantoNessuna valutazione finora

- Impact of Recession On Hotel IndustryDocumento22 pagineImpact of Recession On Hotel Industryarchanadandekar100% (1)

- Indofood CBP Sukses Makmur - Bilingual - 31 - Mar - 21Documento129 pagineIndofood CBP Sukses Makmur - Bilingual - 31 - Mar - 21NicoleNessuna valutazione finora

- 2022 Cost of Living Report (Portland Business Alliance)Documento4 pagine2022 Cost of Living Report (Portland Business Alliance)KGW NewsNessuna valutazione finora

- Antique National SchoolDocumento3 pagineAntique National SchoolFaith Emmanuelle Antang DavaoNessuna valutazione finora

- Reconcilliation Part1Documento25 pagineReconcilliation Part1019. Disha Das fybafNessuna valutazione finora

- Additional District Inspector of Schools (Se) Asansol Sub Division. Pay Slip Government of West BengalDocumento1 paginaAdditional District Inspector of Schools (Se) Asansol Sub Division. Pay Slip Government of West BengalABHIJIT HAZRANessuna valutazione finora

- 183531Documento11 pagine183531artemis42Nessuna valutazione finora

- Siklus Akuntansi Pada PT Adi JayaDocumento11 pagineSiklus Akuntansi Pada PT Adi Jayafitrianura04Nessuna valutazione finora

- Non-Profit Organizations: Learning ObjectivesDocumento12 pagineNon-Profit Organizations: Learning Objectivesbobo kaNessuna valutazione finora

- Worksheet and Closing EntriesDocumento3 pagineWorksheet and Closing EntriesL LiteNessuna valutazione finora

- Howard Marks Fourth Quarter 2009 MemoDocumento12 pagineHoward Marks Fourth Quarter 2009 MemoDealBook100% (3)

- MB 0045Documento337 pagineMB 0045rakeshrakesh1Nessuna valutazione finora

- Co Op Business Plan Template PDFDocumento15 pagineCo Op Business Plan Template PDFIngle Satish100% (1)

- Retail MathDocumento50 pagineRetail MathMauro PérezNessuna valutazione finora

- Pa Bab 13 DividendsDocumento3 paginePa Bab 13 DividendsRahmi RestuNessuna valutazione finora

- I CPADocumento2 pagineI CPAHydeeNessuna valutazione finora

- Financial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFDocumento5 pagineFinancial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFani2sysNessuna valutazione finora

- 94 - AFAR Preweek LectureDocumento18 pagine94 - AFAR Preweek LectureBarbado ArleneNessuna valutazione finora

- 08 NPC Vs CabanatuanDocumento2 pagine08 NPC Vs CabanatuanJanno SangalangNessuna valutazione finora

- Slip PDFDocumento1 paginaSlip PDFPratikDuttaNessuna valutazione finora

- 327-329 Plaridel Surety & Insurance v. CIR Collector v. Goodrich International Rubber Co.Documento2 pagine327-329 Plaridel Surety & Insurance v. CIR Collector v. Goodrich International Rubber Co.Eloise Coleen Sulla PerezNessuna valutazione finora