Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

05 1MarginalCosting

Caricato da

vsrajeshvsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

05 1MarginalCosting

Caricato da

vsrajeshvsCopyright:

Formati disponibili

1

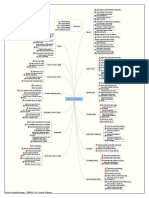

Marginal Costing

Marginal or Variable Costing

Marginalcostcanbedefinedasthecostofproducingonemoreadditionalunitofaproduct.

Marginalcostingisatechniqueofcostaccountingthatpaysspecialattentiontothebehaviorofcosts

withchangesinthevolumeofoutput.Mainfeaturesofmarginalcostingare

Allelementsofcostsareclassifiedintofixedandvariablecosts.

Variablecostsarechargedasthecostofproduction.

Profitiscalculatedbydeductingthefixedcostfromthecontribution,i.eexcessofsellingprice

overmarginalcostofsales.

Marginalcostequationcanbewrittenas

Profit=SalesTotalCost

Profit=SalesVariableCostFixedCost

Profit=ContributionFixedCost

ThedifferencebetweenSales&variablecosts(SalesVariableCosts)isknownascontribution.

Theaboveequationbringsthefactthatinordertoearnprofit,thecontributionmustbemorethanfixed

cost.Toavoidanyloss,contributionmustbeequaltofixedcost.

Contributioniscalledso,sinceitinitiallycontributestowardsrecoveryoffixedcostsandthereafter

towardsprofitofthebusiness.Thecontributionformsafundforfixedexpensesandprofit.

Thefollowingarethebasicdecisionmakingindicatorsinmarginalcosting.

BreakEvenPoint

ContributionMarginRatioorP/VorC/SRatio

MarginofSafety

IndifferencePointorCostBreakEvenPoint

ShutdownPoint

Importantdecisionmakingareasofmarginalcostingare

1. CVPAnalysis

2. BreakEvenAnalysis

3. MakeorBuyDecisions

4. ProductMixdecisions

5. ShutdownorContinueDecisions

6. Acceptanceofspecialorder

7. Submissionoftenders

8. Pricingdecisionsinspecialcircumstances

9. Retainorreplaceamachine

Majorlimitationsofmarginalcostingare

Itmaybeverydifficulttosegregatecostsintofixedandvariablecosts.

MarginalCostingtechniquecannotbesuitableforalltypeofindustries.Forexample,itis

difficulttoapplyinshipbuilding,contractindustriesetc.

Itassumesthatthefixedcostsarecontrollable,butinthelongrunallcostsarevariable.

Withthedevelopmentofadvancedtechnologyfixedexpensesareproportionallyincreased.

Therefore,theexclusionoffixedcostislesseffective.

MarginalCostingdoesnotprovideanystandardfortheevaluationofperformancewhichis

providedbystandardcostingandbudgetarycontrol.

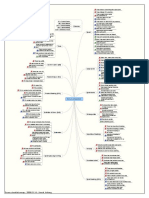

Cost Volume Profit Analysis

CVPanalysisisatechniquethatexaminesthechangesinprofitinresponsetochangesinsalesvolume,

costs&prices.CVPanalysisismainlyusedtoplanfuturelevelsofoperatingactivityandprovides

informationabout

Whichproductsorservicestoemphasize

Thevolumeofsalesneededtoachieveatargetedlevelofprofit

Theamountofrevenuerequiredtoavoidlosses

Whethertoincreasefixedcosts

Howmuchtobudgetfordiscretionaryexpenditures

Whetherfixedcostsexposetheorganizationtoanunacceptablelevelofrisk

MajorassumptionspertainingtoCVPanalysisare.

CostsSegregationCostscanbeseparatedintofixedandvariable.

ConstantsellingpriceSellingpricedoesnotchangewithvolumeorotherfactors.

ConstantfixedcostsFixedcostsdonotchangewithsales.

ConstantvariablecostsVariablecostperunitremainssame.

SynchronizedProduction&SalesNumberofunitsproducedandsoldwillbesamesothat

thereisnoopeningorclosingstockofgoods.

ConstantsalesmixThereisonlyoneproductandinthecaseofmanyproducts,productmix

willremainunchanged.

Nochangeinoperatingefficiency

NootherfactorsThevolumeofoutputorproductionistheonlyfactorthatinfluencesthecost.

Break Even Analysis

Theconceptofbreakevenanalysisisalogicalextensionofmarginalcosting.It,byclassifyingthetotal

costsintofixedandvariable,definesthemanufacturingcostandprofitfeatureofabusinessandshows

thetotalcostsatalllevelsofactivities.

Breakevenpointstatestheoutputlevelwhichevenlybreaksthecostandrevenue.Itshowsthepointat

whichthecostisequaltosalesorrevenuesothatthereisneitherprofitnorloss.

Breakevenanalysishelpsinmakingmanyofthedaytodaydecisions.Themainusesare

PreparationofflexiblebudgetsHelpstoprojectprofitsandtherebypreparebudgets

ProductsdecisionsHelpsinthefixationofsellingprices&effectivevariationstherein,

decidingaboutprofitableproductsandproductmix.

ProductiondecisionsToselectmostefficientmethodofproductionoutofavailable

alternatives.

Capitaldecisions

Dumping

BEP(%ofcapacity)=BES/EstimatedSales

P/V Ratio

P/Vratioisusedtomeasuretherelationshipofcontribution&therelativeprofitabilityofdifferent

productsordepartments.

=Contributionperunit/Priceperunit

=TotalContribution/TotalSales

Managementisinterestedtoknowwhichproductismoreprofitable.Organizationwantstorewardthe

department,whichisworkingefficientlyandpullupthatone,thatisnotworkingtothelevelexpected.

HigherthePVRatio,morewillbetheprofit.Thus,aimofmanagementisatincreasingthePVRatio,

identifyingwheretheactionisneeded.PVRatioindicatesavailabilityofmarginonsalesmade.So,

firmthatenjoyshigherPVRatiostandstogain,whendemandfortheproductisgrowing

PVratiocanbecomputedbyanotherrelationshipandthisischangeincontributionorprofitdividedby

changeinsales.

P/VRatio=ChangeinProfit/ChangeinSales

Margin of Safety

Marginofsafetyisthedifferencebetweentheactualsalesandthesalesatthebreakevenpoint.The

marginofsafetycanbeexpressedinabsolutesalesorinpercentage.

Marginofsafetyisthatsaleswhichgivesusprofitaftermeetingfixedcosts.

MarginofSafety=SalesBreakEvenPointSales

MarginofSafety=Profit/CMR

Profit=MOS*CMR

Marginofsafetyratio=MOS/ActualSales

Themarginofsafetyindicatesthestrengthofabusiness.Alargemarginofsafetyisasignof

soundnessofthebusinesssinceevenwithasubstantialreductioninsales,profitshallbeearnedbythe

business.Ifthemarginofsafetyissmall,reductioninsaleseventoasmalllevelmayaffecttheprofit

positionveryadverselyandlargereductionofsalesvaluemayevenresultinloss.

Marginofsafetycanbeimprovedby

Increasingthesellingprice

Reducingthevariablecost

SelectingaproductmixoflargerP/Vratio

Reducingfixedcosts

Increasingtheoutput.

Cash Break Even Point

Cashbreakevenpointcanbedefinedasthatpointofsalesvolume,wherecashrevenueisequaltothe

cashcosts.

CashFixedCost/CashContributionperUnit

CashFixedCost=FixedCostDepreciationincludedinthefixedcost.

Cashcontributionperunit=priceAVCdepreciationincludedinAVC

Break Even Chart

ABEchartisgraphicalrepresentationofmarginalcosting.Itisconsideredtobeoneofthemostuseful

graphicalpresentationofaccountingdata.BEchartshowstherelationshipbetweencost,sales&profit.

Angleofincidenceistheangleformedbetweensaleslineandtotalcostline.Thisangleisanindicator

ofprofitearningcapacityoverthebreakevenpoint.Theobjectiveofmanagementshouldbetohavea

largeanglewhichwillindicateanearningofhighmarginprofitoncefixedoverheadsarecovered.On

theotherhandasmallanglemeanthatevenifprofitsaremade,theyarebeingmadeatalowrate.

DegreeofOperatingLeverageThedegreeofoperatingleverageistheextenttowhichthecost

functionismadeupoffixedcosts.Organizationswithhighoperatingleverageincurmoreriskofloss

whensalesdecline.Conversely,whenoperatingleverageishighanincreaseinsales(oncefixedcosts

arecovered)contributesquicklytoprofit.

DegreeofLeverage=ContributionMargin/Profit

CompositeBreakevenPoint=CashFixedCost/CompositePVR

CompositePVR=TotalContribution/TotalSales

Questions

DiscussthemanagerialusesofMarginalcosting(10)

Problem(10)

Problem(10)

Problem(10)

Problem(10)

Problem(10)

BreakEvenPoint(3)

AngleofIncidence(3)

WhataretheassumptionsofCVPanalysis(3)

P/VRatio(3)

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Finance DictionaryDocumento155 pagineFinance DictionaryAmeet Kumar100% (5)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Scrum Checklist All PDFDocumento1 paginaScrum Checklist All PDFvsrajeshvsNessuna valutazione finora

- Intraday: Trading With TheDocumento4 pagineIntraday: Trading With Thepetefader100% (2)

- Case Analysis Sweet Beginnings CoDocumento5 pagineCase Analysis Sweet Beginnings CoChristian Torres31% (13)

- Facilitation Process Reference CardDocumento1 paginaFacilitation Process Reference CardvsrajeshvsNessuna valutazione finora

- The Tech Debt PlaybookDocumento10 pagineThe Tech Debt PlaybookvsrajeshvsNessuna valutazione finora

- Cynefin Nov17Documento2 pagineCynefin Nov17vsrajeshvsNessuna valutazione finora

- Form of Convertible SecurityDocumento4 pagineForm of Convertible SecurityYoichiro TakuNessuna valutazione finora

- Scrum Checklist Prio1 PDFDocumento1 paginaScrum Checklist Prio1 PDFvsrajeshvsNessuna valutazione finora

- 2018 Kanban Guide For Scrum TeamsDocumento8 pagine2018 Kanban Guide For Scrum TeamsvsrajeshvsNessuna valutazione finora

- The 8 Stances of A Scrum Master Whitepaper v2Documento36 pagineThe 8 Stances of A Scrum Master Whitepaper v2Valmir Maia Meneses JuniorNessuna valutazione finora

- Scrum ChecklistDocumento2 pagineScrum ChecklistcmihaiNessuna valutazione finora

- Fa Mod1 Ont 0910Documento511 pagineFa Mod1 Ont 0910subash1111@gmail.comNessuna valutazione finora

- Postera4 Optimized PDFDocumento2 paginePostera4 Optimized PDFvsrajeshvsNessuna valutazione finora

- Ias 32Documento24 pagineIas 32fadfadiNessuna valutazione finora

- Vitug Vs CaDocumento2 pagineVitug Vs CaRocky CadizNessuna valutazione finora

- Scrum Checklist All PDFDocumento1 paginaScrum Checklist All PDFvsrajeshvs0% (1)

- Business Plan of Mineral Water PlantDocumento27 pagineBusiness Plan of Mineral Water PlantHaytham FugahaNessuna valutazione finora

- Kanbanworkbook SampleDocumento23 pagineKanbanworkbook Samplevsrajeshvs100% (2)

- SAFe Implementation RoadmapDocumento5 pagineSAFe Implementation Roadmapvsrajeshvs50% (4)

- Brainstorm Checklist 2018Documento1 paginaBrainstorm Checklist 2018vsrajeshvsNessuna valutazione finora

- How To Select Individuals For Agile Teams VFinalDocumento13 pagineHow To Select Individuals For Agile Teams VFinalvsrajeshvs100% (1)

- Agile Fluency Project Ebook RTW 1Documento37 pagineAgile Fluency Project Ebook RTW 1vsrajeshvs100% (1)

- Kanban ExampleDocumento2 pagineKanban Examplemehul3685Nessuna valutazione finora

- Scrum Community - Scrum AllianceDocumento3 pagineScrum Community - Scrum AlliancevsrajeshvsNessuna valutazione finora

- Agile Version Control With Multiple Teams CheatsheetDocumento1 paginaAgile Version Control With Multiple Teams CheatsheetbmintegNessuna valutazione finora

- Lean Study Tour 2009Documento6 pagineLean Study Tour 2009vsrajeshvsNessuna valutazione finora

- 01 ValuationDocumento7 pagine01 ValuationvsrajeshvsNessuna valutazione finora

- Agile Version Control With Multiple Teams CheatsheetDocumento1 paginaAgile Version Control With Multiple Teams CheatsheetbmintegNessuna valutazione finora

- Scrum in Large Companies Public Edition v1.1 PDFDocumento4 pagineScrum in Large Companies Public Edition v1.1 PDFvsrajeshvs100% (1)

- TheHandbookofAgileKeywords v1Documento35 pagineTheHandbookofAgileKeywords v1vsrajeshvsNessuna valutazione finora

- Chap10 Global BrandingDocumento29 pagineChap10 Global BrandingvsrajeshvsNessuna valutazione finora

- BC NotesDocumento5 pagineBC NotesvsrajeshvsNessuna valutazione finora

- 02 ContractLaw 2Documento12 pagine02 ContractLaw 2vsrajeshvsNessuna valutazione finora

- Verbal CommunicationDocumento1 paginaVerbal CommunicationvsrajeshvsNessuna valutazione finora

- 01 IntroductionDocumento5 pagine01 IntroductionvsrajeshvsNessuna valutazione finora

- AidaDocumento97 pagineAidaSanaNessuna valutazione finora

- 02 ContractLaw 1Documento10 pagine02 ContractLaw 1vsrajeshvsNessuna valutazione finora

- FMA Sues Akin GumpDocumento67 pagineFMA Sues Akin GumpDomainNameWireNessuna valutazione finora

- Answer Key ABM2Documento6 pagineAnswer Key ABM2Elle Alorra RubenfieldNessuna valutazione finora

- Customer Relationship ManagementDocumento8 pagineCustomer Relationship Managementavishekmu100% (1)

- Sec 17 of Indian Registration ActDocumento5 pagineSec 17 of Indian Registration ActVivek ReddyNessuna valutazione finora

- Herbalife Investor Presentation August 2016 PDFDocumento38 pagineHerbalife Investor Presentation August 2016 PDFAla BasterNessuna valutazione finora

- Sharpe, Treynor, and Jensen RatioDocumento3 pagineSharpe, Treynor, and Jensen Rationegm8850% (2)

- Dissertation of Cash Flow RatiosDocumento309 pagineDissertation of Cash Flow Ratioszozo001100% (1)

- Short Term Sources of FinanceDocumento17 pagineShort Term Sources of FinancePreyas JainNessuna valutazione finora

- Ketan Parekh Scam CaseDocumento6 pagineKetan Parekh Scam Caseankurmittal2112Nessuna valutazione finora

- DuPont Analysis Excel TemplateDocumento3 pagineDuPont Analysis Excel TemplateMovil MathiasNessuna valutazione finora

- Chapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseDocumento4 pagineChapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseGirlie SisonNessuna valutazione finora

- Cima C01 Samplequestions Mar2013Documento28 pagineCima C01 Samplequestions Mar2013Abhiroop Roy100% (1)

- Comprehensive Ratio AnalysisDocumento8 pagineComprehensive Ratio Analysis9694878Nessuna valutazione finora

- IIFL Nifty ETF PresentationDocumento25 pagineIIFL Nifty ETF Presentationrkdgr87880Nessuna valutazione finora

- Equity Research: Cement Sector/Industry in India: Zankhan Chandarana 18021141028 MBA 2018-2020Documento27 pagineEquity Research: Cement Sector/Industry in India: Zankhan Chandarana 18021141028 MBA 2018-2020PriyalNessuna valutazione finora

- How Does Insertion in Global Value Chains Affect Upgrading in Industrial Clusters? John Humphrey and Hubert SchmitzDocumento17 pagineHow Does Insertion in Global Value Chains Affect Upgrading in Industrial Clusters? John Humphrey and Hubert Schmitzfederico_nacif300Nessuna valutazione finora

- Executive Summary: NPA Management in State Bank of IndiaDocumento62 pagineExecutive Summary: NPA Management in State Bank of IndiaFurkhan Ahmed SamNessuna valutazione finora

- Red Herring Prospectus - South West Pinnacle Exploration LimitedDocumento482 pagineRed Herring Prospectus - South West Pinnacle Exploration LimitedgoyalneerajNessuna valutazione finora

- Lecture 5312312Documento55 pagineLecture 5312312Tam Chun LamNessuna valutazione finora

- BAV Model To Measure Brand EquityDocumento4 pagineBAV Model To Measure Brand EquityElla StevensNessuna valutazione finora

- Jeurissen, Roland - A Hybrid Genetic Algorithm To Track The Dutch AEX-Index (2005)Documento36 pagineJeurissen, Roland - A Hybrid Genetic Algorithm To Track The Dutch AEX-Index (2005)Edwin HauwertNessuna valutazione finora

- Questionnaire For Real Estate - FinalDocumento3 pagineQuestionnaire For Real Estate - Finalsaptarshi_majumdar_5Nessuna valutazione finora