Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1988-89 Cabinet Paper 6187

Caricato da

SBS_NewsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

1988-89 Cabinet Paper 6187

Caricato da

SBS_NewsCopyright:

Formati disponibili

[1]

CABINET-IN-CONFIDENCE

-

43

Copy No. -

C A B I N E T

M I N U T E

Expenditure Review Committee

Canberra, 28 March 1989

No. 12380 (ER)

Submission No. 6187

Sale of the Commonwealth Uranium

Stockpile

The Committee agreed that:(a)

discussions on the possible sale of the uranium

stockpile to Queensland Mines Ltd (QML)

continue;

(b)

the discussions be conducted by the Department

of Primary Industries and Energy with the

Department of the Prime Minister and Cabinet,

the Department of Finance and the

Attorney-General's Department consulted as

necessary; and

(c)

the Minister for Primary Industries and

Energy bring forward a Submission for

consideration in the 1989-90 Budget context

following the discussions referred to above.

Committee Secretary

This document is the property of the Australian Government and is not to be copied or reproduced

CABINET -IN-CONFIDENCE

[2]

CABINET-I -CO FIDENCE

6187

4_3

Copy No.

..

N

Subm1ss1on o

FOR CABINET

SALE OF THE COMMONWEALTH URANIUM STOCKPILE

Title

The Hon John Kerin MP, Minister for Primary

Industries and Energy & Senator the Hon Peter Walsh,

Minister for Finance

Minister

Purpose/Issues

Minute 12030 required the lodgement of a Submission

addressing the possible sale of the Commonwealth

uranium stockpile

Government policy prohibiting the establishment in

Australia of nuclear power plants and all other

stages of the nuclear fuel cycle except mining,

together with our abundant ore reserves, negates any

requirement to maintain a uranium stockpile in

Australia

Sensitivity /Criticism

Could be some criticism of any Government initiative

to market uranium from the stockpile

No

Legislation

involved

) ency:

critical/significant

dates

The stockpile is a valuable asset for which the

Government has no further use.

Its sale would make a

significant revenue contribution and 'improve the

Balance of Payments position.

1sultation:

M inisters/Depts

consulted

Prime Minister & Cabinet & The Treasury

Is there

agreement?

No. The Minister for Primary Industries and Energy &

Prime Minister & Cabinet support Option <A>. The

Minister for Finance & The Treasury support Option <B>

Consultation cowments Attachment <A> page 7

Timing/handling of

announcement

Cost

N/A

Opportunity costs of maintaining the stockpile in

terms o ~ 0 ~n t- erest fo 7 gone .' S,r ~ore _:!;_han )$9 miAJ1,.qn per

annum ( a'n d could be consi era:Oly higher> . There will

also be maintenance costs (estimated at $0.1 million>

in the medium term. Sale of the stockpile should

result in revenue of at least $70 million over the

next 2-4 years.

This document is the property of the Australian Government and is not to be copied or reproduced

CABINET-IN-CONFIDENCE

[3]

CABINET -IN- ONFIDENCE

BACKGROUND

The stockpile contains 2262 short tons of uranium oxide

accumulated from the Commonwealth's 1960's mining operation at

Rum Jungle.

Stockpile borrowing by Ranger and Nabarlek in the

early 1980's and subsequent repayment has resulted in the

stockpile now largely being made up of Ranger and Nabarlek

material.

2. The stockpile value is around SA70m at current spot prices

<about SA15.50/lb> or some SA160m based on the current floor

price <about SA36/lb, but in the depressed uranium market

Australian producers cannot secure new long term contracts at

the floor price and it is unlikely the Commonwealth would

achieve this price in any sale of the stockpile>.

3. Attempts to sell the stockpile over a number of years via

existing producers have proved unsuccessful, because the price

the Commonwealth has been seeking <comparable with long term

contracts> has not been attractive given the producers' low

production costs, their desire to dispose of their own

production first and their ability to buy any additional

material they require on the spot market at lower prices.

4. Factors influencing the decision to sell through existing

producers included:

<a>

the higher price obtainable for a long term supplier,

as opposed to a one-off sale;

(b)

the possibility of assisting producers in obtaining

contracts <Olympic Dam Marketing was interested in some

stockpile material in order to tender for deliveries

commencing before Olympic Dam came on stream>;

<c>

the producers' concern that the Commonwealth should not

compete against them or undercut them by selling at a

price below the floor price; and

<d>

consistency with the existing three mines policy.

CABINE -IN-CONFIDENCE

[4]

CABINET -IN- CONFIDENCE

5. The Commonwealth informally invited further offers for the

stockpile from existing producers in 1987.

Queensland Mines

Ltd <QML> was the only company to submit a proposal, based at

near spot prices at that time, and for delivery over a number

of years.

QML's interest flows from its desire to be seen as a

continuing long term supplier of uranium.

Treatment at its

Nabarlek plant has ceased and access to the stockpile <together

with some material of its own> would allow QML to continue to

operate in the market until it discovered other deposits which

i t envisages would allow it to keep the Nabarlek mill in

operation <were further development approved by the Government>.

6. The Minister for Primary Industries and Energy authorised

his Department to have discussions with QML to confirm that

under existing policy the Government's floor price would apply

to any exports of stockpile material, and to seek to narrow the

gap between QML's purchase offer and current export prices.

OPTIONS

7. There are three basic options for disposal of the stockpile:

<a>

continue discussions with QML with a view to concluding

a sale;

call for expressions of interest, both in Australia and

<b>

from overseas, for purchase of the stockpile; or

<c>

maintain the stockpile for later sale in the

expectation that prices generally will improve over the

next 4-5 years .

-----CONSIDERATION OF THE OPTIONS

Option A

8. Option A is favoured by the Minister for Primary Industries

and Energy because it would avoid:

<a>

conflict with Government policy <floor price and three

named mines>; and

CABINET -IN-CONFIDENCE

[5]

CABINET-IN- ONFIDENCE

<b>

depressing an already depressed uranium market <the

stockpile would equal about half the annual spot market

turnover>, resulting in a poor return to the

Commonwealth and an adverse impact on the forthcoming

ERA contract renewal negotiations covering over half

Australia's annual uranium exports.

9. There is an incentive for QML to acquire the stockpile in

order for it to be seen to remain in the market as a long term

supplier, and therefore, in concluding any sale the

Commonwealth would expect to better QML's present offer <at

around spot price> thereby maximising overall returns to the

Commonwealth.

The only disadvantage of option A is that

returns to the Commonwealth would be spread over a number of

years.

On the other hand, QML would assume immediate

responsibility for maintenance costs.

10. If option A is accepted, following on from earlier

discussions, the next step would be the commencement of

detailed negotiations between QML and the Department of Primary

Industries and Energy (DPIE> with officers from the Prime

Minister's Department, Attorney-General's and the Department of

Finance also being consulted as necessary.

Cabinet approval

would be sought for any deal which might be negotiated with QML.

Option B

11. Option B is favoured by the Minister for Finance, who

considers that the Commonwealth should not restrict itself to

one potential buyer in seeking to dispose of the stockpile.

Unless and until market reactions to the proposed sale are

seriously tested, there can be no certainty that any deal which

might be negotiated with QML is the most satisfactory to the

Government - either in terms of price or wider uranium policy

considerations.

The proposal to invite expressions of interest

in purchasing the stockpile, both in Australia and from

overseas, would not necessarily rule out the eventual sale of

CABINET -IN -CONFIDENCE

[6]

CABINET -IN- ONFIDENCE

the stockpile to QML should the Government consider that to be

the most appropriate course to follow after expressions of

interest have been received and evaluated.

12. The Minister for Finance notes this was the procedure

followed by the ptevious Government when it decided to sell the

Ranger uranium mine in 1979.

13. The Minister for Finance further believes that having

regard to previous unsuccessful attempts to sell the stockpile

and consistent with CM 12030, this sale is sufficiently out of

the ordinary to benefit from the expertise of the Task Force on

Asset Sales <TFAS> which should be given primary responsibility

for disposing of the stockpile.

A representative of DPIE

should be seconded to work full-time with the Task Force to

provide any necessary expertise

requ~red

with regard to uranium

markets generally and the Government's uranium policy in

particular.

Option C

14. Prices for uranium both for long-term contracts and spot

sales are at their lowest levels for many years, reflecting the

continued availability of low priced supplies from a variety of

sources.

Prices are expected to firm in the early/mid 1990's

as current high inventory levels of uranium are run down and

demand increases, giving the prospect of a better return to the

Commonwealth if the stockpile were to be retained until that

time.

However, this possibility has to be balanced against the

certain costs involved in keeping the stockpile.

These include

the opportunity costs of at least $9 million per annum <and

possibly considerably more, depending on the sale price

achievable> as well as maintenance costs <nil at present but

expected to increase to $0.1 million in the medium term>.

CA BINET -IN- CONFIDENCE

[7]

CABINET -IN -CONFIDENCE

6

RECOMMENDATIONS

15. The Minister for Primary Industries and Energy recommends

that Cabinet agree that:

<a>

discussions on the possible sale of the uranium

stockpile to Queensland Mines Ltd <QML> be continued;

<b>

these discussions be conducted by DPIE, with officers

from the Departments of Prime Minister and Cabinet, the

Attorney-General and Finance being consulted, as

necessary; and

(c)

the matter be referred back to Cabinet for decision in

the light of the outcome of discussions with QML.

l6. The Minister for Finance recommends that Cabinet agree that:

<a>

responsibility for handling the proposed sale of the

uranium stockpile be transferred to TFAS, with an

officer from DPIE being seconded to assist the Task

Force in the sale process, if this is desired;

<b>

the TFAS be authorised to invite expressions of

interest, both within Australia and from overseas, in

the possible purchase of the uranium stockpile; and

<c>

the matter be referred back to Cabinet for decision in

the light of the expressions of interest received.

JOHN KERIN

8 December 1988

PETER WALSH

CABINET -IN- CONFIDENCE

[8]

CABINET -IN -CONFIDENCE

7

ATTACHMENT A

CONSULTATION

The Treasury

The Treasury Department supports the recommendations by the

Minister for Finance.

Prime Minister and Cabinet

2. The Department of Prime Minister and Cabinet supports the

continuation of discussions between Department of Primary

Industries and Energy and QML on the possible sale of the

uranium stockpile, with consultation with relevant departments

as outlined in recommendations lS<a> and <b>. The Department

notes that the Minister will refer the matter back to Cabinet

for a final decision in the light of the outcome of those

discussions.

CABINET -IN- CONFIDENCE

Potrebbero piacerti anche

- Minutes of The Sixth Annual Coal Forum Meeting 10 Feb 2016Documento5 pagineMinutes of The Sixth Annual Coal Forum Meeting 10 Feb 2016Kyla MandelNessuna valutazione finora

- Cameroon Update: Released: 09 May 2022 12:00Documento2 pagineCameroon Update: Released: 09 May 2022 12:00Cyrille MBOUDOUNessuna valutazione finora

- Hon Ian Macfarlane MP Shadow Minister For Energy and Resources Futuregas Conference - Brisbane 29-03-12Documento14 pagineHon Ian Macfarlane MP Shadow Minister For Energy and Resources Futuregas Conference - Brisbane 29-03-12api-95352340Nessuna valutazione finora

- Captive Coal Mining FinalDocumento22 pagineCaptive Coal Mining FinalAnand RawatNessuna valutazione finora

- By Adv. Jatin Kumar: in Pari Delicto?Documento3 pagineBy Adv. Jatin Kumar: in Pari Delicto?divyaniNessuna valutazione finora

- Greenpeace On The NDADocumento4 pagineGreenpeace On The NDAAwlakiNessuna valutazione finora

- KIS2012 Oil Gas Exploration Minister For EnergyDocumento25 pagineKIS2012 Oil Gas Exploration Minister For EnergyPrince AliNessuna valutazione finora

- For Public RegisterDocumento39 pagineFor Public RegisterMatthew KellyNessuna valutazione finora

- T1 Site - Economic Alternatives ReportDocumento8 pagineT1 Site - Economic Alternatives ReportMatthew KellyNessuna valutazione finora

- 4904 Ccs Roadmap Storage StrategyDocumento9 pagine4904 Ccs Roadmap Storage StrategyRashidNessuna valutazione finora

- Annual Report 2010-11 Highlights Major Coal Mining Policy InitiativesDocumento13 pagineAnnual Report 2010-11 Highlights Major Coal Mining Policy InitiativesHandcrafting BeautiesNessuna valutazione finora

- Alliance of CSOs Statement On AmeriDocumento4 pagineAlliance of CSOs Statement On AmeriFuaad DodooNessuna valutazione finora

- Total Gas Marketing LTD v. ARCO British LTD and Others (1998) UKHL 22 (20th May, 1998)Documento23 pagineTotal Gas Marketing LTD v. ARCO British LTD and Others (1998) UKHL 22 (20th May, 1998)JenaNessuna valutazione finora

- 2018 - UK Gov - Response - To - Unabated - Coal - Consultation - and - Statement - of - PolicyDocumento15 pagine2018 - UK Gov - Response - To - Unabated - Coal - Consultation - and - Statement - of - Policydr_akanNessuna valutazione finora

- BCCL SWOT analysis coking coal production strengths weaknessesDocumento3 pagineBCCL SWOT analysis coking coal production strengths weaknessesavani singhNessuna valutazione finora

- India's Growing Coal Demand and Import NeedsDocumento13 pagineIndia's Growing Coal Demand and Import NeedsNaman RawatNessuna valutazione finora

- Wa0006.Documento4 pagineWa0006.kalyanirathod0403Nessuna valutazione finora

- Group-4 - CBM & ShaleDocumento18 pagineGroup-4 - CBM & ShaleAnkit MeenaNessuna valutazione finora

- Southern Natural Gas Company and Southern Energy Company v. Federal Energy Regulatory Commission, 780 F.2d 1552, 11th Cir. (1986)Documento11 pagineSouthern Natural Gas Company and Southern Energy Company v. Federal Energy Regulatory Commission, 780 F.2d 1552, 11th Cir. (1986)Scribd Government DocsNessuna valutazione finora

- NLC seeks coal assets abroadDocumento7 pagineNLC seeks coal assets abroadVarun AgarwalNessuna valutazione finora

- Feeder 9 Reopener Submission PublicDocumento105 pagineFeeder 9 Reopener Submission PublicajibolaadamNessuna valutazione finora

- Achieving Energy SecurityDocumento54 pagineAchieving Energy SecurityGeorge LernerNessuna valutazione finora

- Sawyer Challenge CoastalGasLinkProject NEBDocumento19 pagineSawyer Challenge CoastalGasLinkProject NEBThe NarwhalNessuna valutazione finora

- Finak c1 Assessing The Need For CoalDocumento17 pagineFinak c1 Assessing The Need For Coalapi-232778813Nessuna valutazione finora

- Underground Drilling Access - Consultation May 2014Documento33 pagineUnderground Drilling Access - Consultation May 2014api-277736988Nessuna valutazione finora

- CINERGY COAL OPTIMIZATIONDocumento25 pagineCINERGY COAL OPTIMIZATIONabdul6683Nessuna valutazione finora

- Decommissioning Insight 2016Documento74 pagineDecommissioning Insight 2016arkeios100% (1)

- Coal Bad Methane PakistanDocumento11 pagineCoal Bad Methane Pakistanmuki10Nessuna valutazione finora

- Policy Analysis - CMSPA 2015Documento8 paginePolicy Analysis - CMSPA 2015Anilabh GuheyNessuna valutazione finora

- Sub258 - Simon Holmes A CourtDocumento6 pagineSub258 - Simon Holmes A Courtsimon100% (1)

- Pak-Qatar LNGDocumento14 paginePak-Qatar LNGShahzaib KhanNessuna valutazione finora

- Supreme CourtDocumento13 pagineSupreme CourtJus EneroNessuna valutazione finora

- T N E B: R A O P: HE Ational Nergy Oard Egulation of Ccess To IL IpelinesDocumento39 pagineT N E B: R A O P: HE Ational Nergy Oard Egulation of Ccess To IL IpelinesIbrahimDewaliNessuna valutazione finora

- Howe Robinson LNG UpdateDocumento1 paginaHowe Robinson LNG UpdateBobby QuintosNessuna valutazione finora

- Wiki Leaks Cable 09 RANGOON 20, BURMA: SALE OF IVANHOE MINE DELAYEDDocumento2 pagineWiki Leaks Cable 09 RANGOON 20, BURMA: SALE OF IVANHOE MINE DELAYEDPugh JuttaNessuna valutazione finora

- A UK Vision For Carbon Capture and Storage FINALDocumento36 pagineA UK Vision For Carbon Capture and Storage FINALmkmusaNessuna valutazione finora

- Press Release Rangarajan ReportDocumento2 paginePress Release Rangarajan ReportBipin SachdevaNessuna valutazione finora

- How BP Secretly Renegotiated Its Iraqi Oil Contract PDFDocumento21 pagineHow BP Secretly Renegotiated Its Iraqi Oil Contract PDFOilmanGHNessuna valutazione finora

- Update On Petroleum Sector Activities - A Brief To The Parliament of UgandaDocumento16 pagineUpdate On Petroleum Sector Activities - A Brief To The Parliament of UgandaAfrican Centre for Media ExcellenceNessuna valutazione finora

- Statutory Notifications (S. R 0) : Islamabad, TH 23rd Ma 2011Documento10 pagineStatutory Notifications (S. R 0) : Islamabad, TH 23rd Ma 2011Sadaqat islamNessuna valutazione finora

- Guide to Offshore Wind Farm DevelopmentDocumento72 pagineGuide to Offshore Wind Farm DevelopmentJoe Dagner100% (1)

- Escalation Clause Necessary Dealing With Price Fluctuations in Dredging Contracts Terra Et Aqua 125 1Documento7 pagineEscalation Clause Necessary Dealing With Price Fluctuations in Dredging Contracts Terra Et Aqua 125 1fhsn84Nessuna valutazione finora

- Yemen Gas To Power Options Report PDFDocumento59 pagineYemen Gas To Power Options Report PDFmardiradNessuna valutazione finora

- Coal and Power Related Issues SummaryDocumento3 pagineCoal and Power Related Issues SummaryRahul MathurNessuna valutazione finora

- Regulatory Issues in PipelineDocumento21 pagineRegulatory Issues in PipelineAjinkya DateNessuna valutazione finora

- Economic News 2Documento1 paginaEconomic News 2Pistol SamNessuna valutazione finora

- Executive SummaryDocumento3 pagineExecutive SummaryVijay BawejaNessuna valutazione finora

- Oil and Gas Contracts in Trinidad and Tobago Heidi WongDocumento32 pagineOil and Gas Contracts in Trinidad and Tobago Heidi WongAdian AndrewsNessuna valutazione finora

- Case 1 Ocean CarrierDocumento15 pagineCase 1 Ocean CarrierAngeline WangNessuna valutazione finora

- Group TRD Tanzania Limited: Proposal To Invest in Katewaka Coal Mine Ludewa-NjombeDocumento20 pagineGroup TRD Tanzania Limited: Proposal To Invest in Katewaka Coal Mine Ludewa-NjombePatrick MwisuaNessuna valutazione finora

- General Agreement On Ac/I/Add.Ô Tariffs and TradeDocumento2 pagineGeneral Agreement On Ac/I/Add.Ô Tariffs and TradeYatendra KumarNessuna valutazione finora

- UK OSW Foundations Strategic Capability Assessment 2019 v04.03Documento42 pagineUK OSW Foundations Strategic Capability Assessment 2019 v04.03Philip AMCNessuna valutazione finora

- August Airport Forum NotesDocumento5 pagineAugust Airport Forum NotesBellvistaCommunityNessuna valutazione finora

- The Economic Non Viability of The Adani Galilee Basin ProjectDocumento15 pagineThe Economic Non Viability of The Adani Galilee Basin ProjectAnh Quân TạNessuna valutazione finora

- ME Assignment-1Documento2 pagineME Assignment-1Manoj NagNessuna valutazione finora

- Petrojack ASA Initial Public OfferingDocumento38 paginePetrojack ASA Initial Public Offeringshenaz10Nessuna valutazione finora

- Case Study 1Documento9 pagineCase Study 1kalpana0210Nessuna valutazione finora

- Offshore Energy and Jobs Act (H. R. 2231; 113th Congress)Da EverandOffshore Energy and Jobs Act (H. R. 2231; 113th Congress)Nessuna valutazione finora

- Conservation Through Engineering Extract from the Annual Report of the Secretary of the InteriorDa EverandConservation Through Engineering Extract from the Annual Report of the Secretary of the InteriorNessuna valutazione finora

- International Arbitration of Renewable Energy DisputesDa EverandInternational Arbitration of Renewable Energy DisputesNessuna valutazione finora

- Metropolitan Melbourne Roadmap Out of LockdownDocumento12 pagineMetropolitan Melbourne Roadmap Out of LockdownSBS_NewsNessuna valutazione finora

- Victoria's Roadmap Out of LockdownDocumento1 paginaVictoria's Roadmap Out of LockdownSBS_NewsNessuna valutazione finora

- Referendum Council Final ReportDocumento183 pagineReferendum Council Final ReportSBS_NewsNessuna valutazione finora

- Common Scenarios Trans and Gender Diverse Inclusion in SportDocumento2 pagineCommon Scenarios Trans and Gender Diverse Inclusion in SportSBS_NewsNessuna valutazione finora

- Australia - Marriage Law Sample SurveyDocumento1 paginaAustralia - Marriage Law Sample SurveySBS_NewsNessuna valutazione finora

- J G Pairman in Which We Serve - Conversations With Some Who Did and One Who Still DoesDocumento6 pagineJ G Pairman in Which We Serve - Conversations With Some Who Did and One Who Still DoesSBS_NewsNessuna valutazione finora

- Joint Statement On Deal Struck by Australia, Timor-Leste On Maritime DisputeDocumento3 pagineJoint Statement On Deal Struck by Australia, Timor-Leste On Maritime DisputeSBS_NewsNessuna valutazione finora

- NT Health Factsheet On HTLV-1 For CliniciansDocumento2 pagineNT Health Factsheet On HTLV-1 For CliniciansSBS_NewsNessuna valutazione finora

- The Security Intelligence Planning Document 1994Documento57 pagineThe Security Intelligence Planning Document 1994SBS_News100% (1)

- Dementia Social Stigma Report 2017Documento4 pagineDementia Social Stigma Report 2017SBS_NewsNessuna valutazione finora

- Guideline Trans and Gender Diverse Inclusion in SportDocumento24 pagineGuideline Trans and Gender Diverse Inclusion in SportSBS_NewsNessuna valutazione finora

- The Basics Trans and Gender Diverse Inclusion in SportDocumento4 pagineThe Basics Trans and Gender Diverse Inclusion in SportSBS_NewsNessuna valutazione finora

- Inquest Into The Death of Shona HookeyDocumento45 pagineInquest Into The Death of Shona HookeySBS_News0% (1)

- Multicultural AustraliaDocumento16 pagineMulticultural AustraliaSBS_NewsNessuna valutazione finora

- Analysis of Impact of PPL Cuts - WWRG - 27 10 2016 - FinalDocumento12 pagineAnalysis of Impact of PPL Cuts - WWRG - 27 10 2016 - FinalSBS_NewsNessuna valutazione finora

- UAC Explains ATARDocumento5 pagineUAC Explains ATARSBS_NewsNessuna valutazione finora

- Parent Visa Discussion Paper (September 2016)Documento14 pagineParent Visa Discussion Paper (September 2016)SBS_NewsNessuna valutazione finora

- Partnership Visa BookletDocumento58 paginePartnership Visa BookletSBS_News86% (14)

- Statement by The Hon. Kevin RuddDocumento2 pagineStatement by The Hon. Kevin RuddSBS_NewsNessuna valutazione finora

- DPP V Jordan DallwitzDocumento13 pagineDPP V Jordan DallwitzSBS_NewsNessuna valutazione finora

- Manus Island Immigration Detention Centre To CloseDocumento1 paginaManus Island Immigration Detention Centre To CloseSBS_NewsNessuna valutazione finora

- Unwanted AustraliansDocumento21 pagineUnwanted AustraliansSBS_NewsNessuna valutazione finora

- High Court DecisionDocumento1 paginaHigh Court DecisionSBS_NewsNessuna valutazione finora

- 2012 and 2013 Victoria's Mothers, Babies and ChildrenDocumento106 pagine2012 and 2013 Victoria's Mothers, Babies and ChildrenSBS_NewsNessuna valutazione finora

- The DecisionDocumento34 pagineThe DecisionSBS_NewsNessuna valutazione finora

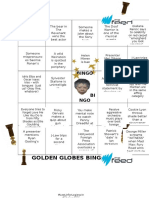

- The Feed's Golden Globes BingoDocumento3 pagineThe Feed's Golden Globes BingoSBS_NewsNessuna valutazione finora

- Immigration Detention Statistics SummaryDocumento12 pagineImmigration Detention Statistics SummarySBS_NewsNessuna valutazione finora

- High Court Judgment On Legality of Offshore DetentionDocumento137 pagineHigh Court Judgment On Legality of Offshore DetentionSBS_NewsNessuna valutazione finora

- Notice To SBS TVDocumento2 pagineNotice To SBS TVSBS_NewsNessuna valutazione finora

- The Feed's Golden Globes BingoDocumento3 pagineThe Feed's Golden Globes BingoSBS_NewsNessuna valutazione finora

- Conference Report JG16Documento16 pagineConference Report JG16LoloaNessuna valutazione finora

- Clutch Auto PDFDocumento52 pagineClutch Auto PDFHarshvardhan KothariNessuna valutazione finora

- LearnEnglish Reading B2 The Sharing Economy PDFDocumento4 pagineLearnEnglish Reading B2 The Sharing Economy PDFKhaled MohmedNessuna valutazione finora

- AEO Programs Handbook - 0 PDFDocumento52 pagineAEO Programs Handbook - 0 PDFAsni IbrahimNessuna valutazione finora

- HARRIS Suites fX Sudirman Room Reservation and RatesDocumento3 pagineHARRIS Suites fX Sudirman Room Reservation and RatesMTCNessuna valutazione finora

- Basic Services To Urban Poor (BSUP)Documento17 pagineBasic Services To Urban Poor (BSUP)Neha KumawatNessuna valutazione finora

- Foreign Exchange Arithmetic WorksheetDocumento4 pagineForeign Exchange Arithmetic WorksheetViresh YadavNessuna valutazione finora

- Planning Commission and NITI AayogDocumento5 paginePlanning Commission and NITI AayogsuprithNessuna valutazione finora

- Piyush TahkitDocumento44 paginePiyush TahkitPankaj VishwakarmaNessuna valutazione finora

- Jio Fiber Tax Invoice TemplateDocumento5 pagineJio Fiber Tax Invoice TemplatehhhhNessuna valutazione finora

- ADMS 3585 Course Outline Fall 2019 Keele CampusDocumento16 pagineADMS 3585 Course Outline Fall 2019 Keele CampusjorNessuna valutazione finora

- Key Words: Lean Banking, Continuous Improvement, United Bank of Africa, Competitively, ITIL 3. Problem StatementDocumento9 pagineKey Words: Lean Banking, Continuous Improvement, United Bank of Africa, Competitively, ITIL 3. Problem StatementJuan Luis GarvíaNessuna valutazione finora

- Reporting and Analyzing Operating IncomeDocumento59 pagineReporting and Analyzing Operating IncomeHazim AbualolaNessuna valutazione finora

- Tax Invoice for Designing & Adaptation ChargesDocumento1 paginaTax Invoice for Designing & Adaptation ChargesPrem Kumar YadavalliNessuna valutazione finora

- Inequality NotesDocumento5 pagineInequality NotesShivangi YadavNessuna valutazione finora

- Introduction and Company Profile: Retail in IndiaDocumento60 pagineIntroduction and Company Profile: Retail in IndiaAbhinav Bansal0% (1)

- Fundamentals of AccountingDocumento56 pagineFundamentals of AccountingFiza IrfanNessuna valutazione finora

- Trade Data Structure and Basics of Trade Analytics: Biswajit NagDocumento33 pagineTrade Data Structure and Basics of Trade Analytics: Biswajit Nagyashd99Nessuna valutazione finora

- Introduction To Internal Control SystemDocumento35 pagineIntroduction To Internal Control SystemStoryKingNessuna valutazione finora

- 05b5aea126563e - Ch-1 - Kiran - Production Planning & ControlDocumento22 pagine05b5aea126563e - Ch-1 - Kiran - Production Planning & ControlRonaldo FlorezNessuna valutazione finora

- Role of Commercial BanksDocumento10 pagineRole of Commercial BanksKAAVIYAPRIYA K (RA1953001011009)Nessuna valutazione finora

- Nepal Telecom's recruitment exam questionsDocumento16 pagineNepal Telecom's recruitment exam questionsIvan ClarkNessuna valutazione finora

- 6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDocumento2 pagine6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDeopito BarrettNessuna valutazione finora

- Scope Statement: Project Name Date Project Number Project ManagerDocumento3 pagineScope Statement: Project Name Date Project Number Project ManagerKamal BhatiaNessuna valutazione finora

- AssignmentDocumento18 pagineAssignmentIttehad TradersNessuna valutazione finora

- ISO 9004:2018 focuses on organizational successDocumento3 pagineISO 9004:2018 focuses on organizational successAmit PaulNessuna valutazione finora

- MFAP Performance Summary ReportDocumento17 pagineMFAP Performance Summary ReportKhizar Hayat JiskaniNessuna valutazione finora

- ENGG951 - Group T1-2 - Assessment 5 ADocumento9 pagineENGG951 - Group T1-2 - Assessment 5 Akumargotame7Nessuna valutazione finora

- TradeacademyDocumento32 pagineTradeacademyapi-335292143Nessuna valutazione finora

- Accounting Cycle Work SheetDocumento32 pagineAccounting Cycle Work SheetAbinash MishraNessuna valutazione finora