Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dodd Frank Visio - Definition of A Swap Dealer 1

Caricato da

IQ3 Solutions GroupTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Dodd Frank Visio - Definition of A Swap Dealer 1

Caricato da

IQ3 Solutions GroupCopyright:

Formati disponibili

1.

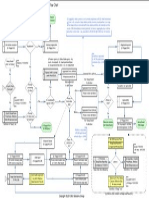

3(ggg)(1) Definition of Swap Dealer - Decision Flow Chart

Apply

Statutory Tests

Excluded Activity

Determination

Apply Activity

Exclusion(s)

Apply Orig. Loan

Exclusion(s)

Apply de minimis

Exemptions

Fail

Fail

Yes

Yes

Yes

Swap

Dealer?

Applicable?

Pass

Disjunctive (ie, engages in

any one of these activities)

Apply Statutory Definition

Apply Statutory

Tests?

Statutory Definitions Tests

Meet Definition

of Exclusion?

Pass

Meet Definition

of Orig. Loan?

No

Excluded Swap Activity

Meet de min.

Exemption?

No

Depository Originating Loans

Not deemed a

Swap Dealer

Scope

Limited?

No

De minimis Exception

Scope of Designation

Interpretive Guidance Part II.A.4

swaps entered into for the purpose

of accommodating counterpartys

needs or demands irrespective

of having a hedging consequence

Holds itself out as...

1.3(ggg)(1)(i)

Makes a market in...

1.3(ggg)(1)(ii)

Regularly enters into...

1.3(ggg)(1)(iii)

Commonly known in...

1.3(ggg)(1)(iv)

Staff element of def. should be

applied in a reasonable manner

Hedging is not dealing activity

Swaps entered into for the purpose of

hedging or mitigating commercial risk

Part II.A.4.a Dealer-Trader

Dealer-trader distinction forms basis

for framework[See: 75 FR 80177]*

Inter-affiliate activities

1.3(ggg)(6)(i)

Cooperative activities

1.3(ggg)(6)(ii)

Insured depository inst.

1.3(ggg)(5)(i)

Considered loan orig.

1.3(ggg)(5)(ii)

Loan shall not include:

1.3(ggg)(5)(iii)

Part II.A.4.c Market Making

Routinely standing ready to enter

into swaps at request/demand...

Part II.A.4.d Regular Business

(i) purpose of satisfying counterparty;

(ii) separate profit center; (iii) staffing

Part II.A.4.e Hedging Physicals

(i) mitigate price risk; (ii) physical

channel; (iii) reduce commercial risk;

(iv) sound practices; (v) not evasive

Part II.A.4.f Floor Traders

(i) registered CFTC Reg 3.11; (ii)

enters into with proprietary funds via

DCM/SEF, clears via DCO; (iii) is not

affiliated with SD; (iv) does not

participate in RFQ process; (v) does

not provide clearing services; (vi)

does not qualify under (ggg)(6)(iii)

or (kkk); (vii) does not participate in

DCM or SEF market making

program; (viii) recordkeeping as if SD

Part II.A.4.g Interpretive Issues

Definition not susceptible to brightline test; multi-factor interpretation

De Minimis Exception

1.3(ggg)(4)

Application to limit...

1.3(ggg)(3)

Each swap entered into...

Part II.A.4.b Holding Out Indicia

Holding itself out as Commonly

known in trade as [See note 187.]

Persons own account...

1.3(ggg)(2) Exception

...not regular business

Hedging physicals

1.3(ggg)(6)(iii)

Registered floor traders

1.3(ggg)(6)(iv)

See discussion 77 FR

at 30610, Part II.A.4.d.

See (ggg)(6)(iv)

Flow Chart

See 1.3(ggg)(4)

Flow Chart

Swap Dealer

All Categories

Apply via registration

Commission shall determine/grant

limited designation of categories

Limited

Designation

See 1.3(ggg)(5)

Flow Chart

See (ggg)(6)(i)

Flow Chart

See (ggg)(6)(ii)

Flow Chart

See (ggg)(6)(iii)

Flow Chart

Commissions interpret reference for its own account to refer to a person who enters into a

swap as a principal, and not as an agent. A person who enters into swaps as an agent for

customers (ie, customers accounts) would be required to register as FCM, IB, CPO or CTA.

Swap Dealer

For own account;

regular business

Non-Dealer

Non-Dealer

Swap Dealer

Counterparty

For own account;

not regular business

Counterparty

Functional Approach: Identify swap dealers as

those persons whose function is to serve as the

points of connection in the swap markets.

Functional Approach (See 77 FR at 30598 and 75 FR at 80177)

Non-Dealer

Note: regulations read exclusion for swap

activities that are not part of a regular

business; not exclusion from definition.

Thus requirement to maintain records

showing activities are excluded.

Counterparty

Copyright 2012 IQ3 Solutions Group

Potrebbero piacerti anche

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKDa EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKNessuna valutazione finora

- Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesDa EverandWealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesNessuna valutazione finora

- tập dịchDocumento252 paginetập dịchNguyễn Thị LuyênNessuna valutazione finora

- Notifiable Transaction 200910Documento107 pagineNotifiable Transaction 200910ailcpNessuna valutazione finora

- tpg 季报Documento105 paginetpg 季报魏xxxappleNessuna valutazione finora

- NIO IncDocumento506 pagineNIO IncMr. JuneNessuna valutazione finora

- SEC Form 20-F of Golden Ocean Group for Fiscal Year 2018Documento141 pagineSEC Form 20-F of Golden Ocean Group for Fiscal Year 2018Pratheesh PrakashNessuna valutazione finora

- Non Current Assets Held For Sale and Discontinued OperationsDocumento42 pagineNon Current Assets Held For Sale and Discontinued OperationsNur HidayahNessuna valutazione finora

- Motorola AR-1 PDFDocumento104 pagineMotorola AR-1 PDFRicha MandyaniNessuna valutazione finora

- Due Diligence ChecklistDocumento13 pagineDue Diligence ChecklistAli Gokhan KocanNessuna valutazione finora

- Nasdaq Trib 2022Documento179 pagineNasdaq Trib 2022bawojat658Nessuna valutazione finora

- NIO IncDocumento930 pagineNIO IncJuclyde Cespedes CababatNessuna valutazione finora

- Genpact Limited: United States Securities and Exchange Commission Form 10-QDocumento200 pagineGenpact Limited: United States Securities and Exchange Commission Form 10-QNaveenNessuna valutazione finora

- Strategic Business Management November 2018 Mark PlanDocumento19 pagineStrategic Business Management November 2018 Mark PlanWongani KaundaNessuna valutazione finora

- Conference Call Credit Presentation: Financial Results For The Quarter Ended March 31, 2008Documento160 pagineConference Call Credit Presentation: Financial Results For The Quarter Ended March 31, 2008billroberts981Nessuna valutazione finora

- Options Rbi Circular 2003Documento6 pagineOptions Rbi Circular 2003Shankar NNessuna valutazione finora

- 2020 - 03 - 23 - Sanofi Report 2019 20F AccessibleDocumento294 pagine2020 - 03 - 23 - Sanofi Report 2019 20F AccessibleJulian HutabaratNessuna valutazione finora

- Strategic Management, Alliances and International Trade: Part-ADocumento4 pagineStrategic Management, Alliances and International Trade: Part-Asks0865Nessuna valutazione finora

- Sears 2018 Bankruptcy ProposalDocumento77 pagineSears 2018 Bankruptcy ProposalAlbuquerque JournalNessuna valutazione finora

- Form 20-F - 2018Documento185 pagineForm 20-F - 2018ok2Nessuna valutazione finora

- Review Questions on Private Placement, Derivatives, and Securities Market RegulationsDocumento4 pagineReview Questions on Private Placement, Derivatives, and Securities Market RegulationsshamiullahNessuna valutazione finora

- Practice Test Paper (Executive) - 1Documento91 paginePractice Test Paper (Executive) - 1isha raiNessuna valutazione finora

- Slides - Module 4Documento48 pagineSlides - Module 4Sunena KumariNessuna valutazione finora

- Securities and Exchange Commission: Vol. 78 Wednesday, No. 162 August 21, 2013Documento85 pagineSecurities and Exchange Commission: Vol. 78 Wednesday, No. 162 August 21, 2013MarketsWikiNessuna valutazione finora

- Report Annuale Goldman Sachs GroupDocumento506 pagineReport Annuale Goldman Sachs GroupMaurizio VetereNessuna valutazione finora

- CRTO - Annual Report 2018Documento172 pagineCRTO - Annual Report 2018ish ishokNessuna valutazione finora

- AC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Documento41 pagineAC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Shawn TayNessuna valutazione finora

- Reading 78 Alternative Investment Features, Methods, and Structures - AnswersDocumento8 pagineReading 78 Alternative Investment Features, Methods, and Structures - AnswersAnuragNessuna valutazione finora

- Counter Trade HandbookDocumento77 pagineCounter Trade HandbookJose AlbertoNessuna valutazione finora

- Netflix 10 K 2023Documento89 pagineNetflix 10 K 2023Aliceadriana SoimuNessuna valutazione finora

- Topic 30 To 34 AnswerDocumento23 pagineTopic 30 To 34 Answerhamza omarNessuna valutazione finora

- P1.T3. Financial Markets and Products Bionic Turtle FRM Practice Questions Chapter 5. Exchanges and OTC MarketsDocumento14 pagineP1.T3. Financial Markets and Products Bionic Turtle FRM Practice Questions Chapter 5. Exchanges and OTC MarketsChristian Rey MagtibayNessuna valutazione finora

- PUBLIC HEARING ON ART. 122a of EU Directive 2006/48/ECDocumento35 paginePUBLIC HEARING ON ART. 122a of EU Directive 2006/48/ECRob CannonNessuna valutazione finora

- Q4 2017 Form 10 KDocumento164 pagineQ4 2017 Form 10 KRizwan YousafNessuna valutazione finora

- New Taxes 2004 Customizing GuideDocumento20 pagineNew Taxes 2004 Customizing GuideLuiz O. Giordani100% (1)

- BBGO White Paper Provides Overview of Crypto Trading EcosystemDocumento12 pagineBBGO White Paper Provides Overview of Crypto Trading Ecosystemrare thingsNessuna valutazione finora

- Credit Bank'sDocumento25 pagineCredit Bank'sBritneyLovezCandyNessuna valutazione finora

- Instructions For Schedule D (Form 1120S)Documento4 pagineInstructions For Schedule D (Form 1120S)IRSNessuna valutazione finora

- Futures Test 03 AnswersDocumento22 pagineFutures Test 03 AnswersPrachet KulkarniNessuna valutazione finora

- Scribd Documescribd DocumentntDocumento1 paginaScribd Documescribd DocumentntmaggyfinNessuna valutazione finora

- Goog 10 Q q2 2023 4Documento53 pagineGoog 10 Q q2 2023 4Gan ZhiHanNessuna valutazione finora

- Mallinckrodt 10kDocumento191 pagineMallinckrodt 10kkunal butolaNessuna valutazione finora

- Verano 2022 Q2 SEC FilingDocumento64 pagineVerano 2022 Q2 SEC FilingTony LangeNessuna valutazione finora

- Montreal Exchange, Equity Options Tax Regime.Documento16 pagineMontreal Exchange, Equity Options Tax Regime.el.reto.50x50Nessuna valutazione finora

- 2020 Annual Report On Form 10 KDocumento176 pagine2020 Annual Report On Form 10 KAida NotiNessuna valutazione finora

- Thoughtworks Holding Inc. 10-Q 2022-03-31 EnglishDocumento38 pagineThoughtworks Holding Inc. 10-Q 2022-03-31 EnglishVikas KumarNessuna valutazione finora

- Customizing ISS PIS COFINS For Classic V1 3Documento18 pagineCustomizing ISS PIS COFINS For Classic V1 3Piyali BiswasNessuna valutazione finora

- Gripping Guide to IFRS Revenue RecognitionDocumento26 pagineGripping Guide to IFRS Revenue Recognitionwakemeup143Nessuna valutazione finora

- Annual Reports Fy21 22Documento219 pagineAnnual Reports Fy21 22Atul SinghNessuna valutazione finora

- Elective Useless NotesDocumento24 pagineElective Useless NotesNishadNessuna valutazione finora

- TRIMs Agreement Bans Local Content RulesDocumento10 pagineTRIMs Agreement Bans Local Content RulesTanuNessuna valutazione finora

- Q. Explain The Difference Between Domestic and International Business. Also Discuss The Nature and Scope of International BusinessDocumento9 pagineQ. Explain The Difference Between Domestic and International Business. Also Discuss The Nature and Scope of International BusinessSARIKANessuna valutazione finora

- Alphabet 10QDocumento66 pagineAlphabet 10QAdamNessuna valutazione finora

- ACTS (Actions Semiconductor Co. LTD.) (20-F) 2011-04-22Documento154 pagineACTS (Actions Semiconductor Co. LTD.) (20-F) 2011-04-22Juan Angel RuizNessuna valutazione finora

- Frontline AR 2009Documento136 pagineFrontline AR 2009Shawn LaiNessuna valutazione finora

- 10q Sep18Documento101 pagine10q Sep18Daniel KwanNessuna valutazione finora

- 2022 ENB Annual Report ENGDocumento189 pagine2022 ENB Annual Report ENGAbdoulaye DialloNessuna valutazione finora

- Non-Current Assets Held For Sale and Discontinued OperationsDocumento51 pagineNon-Current Assets Held For Sale and Discontinued OperationsDudz Aquino SantosNessuna valutazione finora

- Form20 FDocumento66 pagineForm20 FsubmarinoaguadulceNessuna valutazione finora

- Customizing ISS PIS COFINS For Classic V1 2Documento19 pagineCustomizing ISS PIS COFINS For Classic V1 2renatopennaNessuna valutazione finora

- Dodd Frank Visio - Definition of A Swap Dealer 2Documento1 paginaDodd Frank Visio - Definition of A Swap Dealer 2IQ3 Solutions GroupNessuna valutazione finora

- Dodd-Frank Act - Final and Proposed Rules Compliance Matrix and CalendarDocumento1 paginaDodd-Frank Act - Final and Proposed Rules Compliance Matrix and CalendarIQ3 Solutions GroupNessuna valutazione finora

- CFTC Final Rule on Prohibitions and Restrictions on Proprietary Trading and Certain Interests in Hedge Funds and Private Equity FundsDocumento1.058 pagineCFTC Final Rule on Prohibitions and Restrictions on Proprietary Trading and Certain Interests in Hedge Funds and Private Equity FundsIQ3 Solutions GroupNessuna valutazione finora

- Dodd Frank Visio - Swap Dealer de Minimis ExceptionDocumento1 paginaDodd Frank Visio - Swap Dealer de Minimis ExceptionIQ3 Solutions GroupNessuna valutazione finora

- EDM Council - FIBO Semantics InitiativeDocumento32 pagineEDM Council - FIBO Semantics InitiativeIQ3 Solutions GroupNessuna valutazione finora

- Does Regulation Substitute or Complement GovernanceDocumento50 pagineDoes Regulation Substitute or Complement GovernanceIQ3 Solutions GroupNessuna valutazione finora

- The Real Option Model - Evolution and ApplicationsDocumento35 pagineThe Real Option Model - Evolution and ApplicationsIQ3 Solutions GroupNessuna valutazione finora

- A Real Option Analysis of An Oil Refinery ProjectDocumento14 pagineA Real Option Analysis of An Oil Refinery ProjectIQ3 Solutions Group100% (1)

- Dependency Management in A Large Agile EnvironmentDocumento6 pagineDependency Management in A Large Agile EnvironmentIQ3 Solutions GroupNessuna valutazione finora

- 77 FR 21278 - Customer Clearing Documentation, Timing of Acceptance For Clearing, and Clearing Member Risk ManagementDocumento33 pagine77 FR 21278 - Customer Clearing Documentation, Timing of Acceptance For Clearing, and Clearing Member Risk ManagementIQ3 Solutions GroupNessuna valutazione finora

- Regulating OTC Derivatives - Transatlantic (Dis) Harmony After EMIR and Dodd-FrankDocumento14 pagineRegulating OTC Derivatives - Transatlantic (Dis) Harmony After EMIR and Dodd-FrankIQ3 Solutions GroupNessuna valutazione finora

- ISDA SIFMA V US CFTC - Civil Action 11-Cv-2146 - Memorandum OpinionDocumento50 pagineISDA SIFMA V US CFTC - Civil Action 11-Cv-2146 - Memorandum OpinionIQ3 Solutions GroupNessuna valutazione finora

- Canadian Oil Sands - Investor Expectations For Improving Environmental Social PerformanceDocumento10 pagineCanadian Oil Sands - Investor Expectations For Improving Environmental Social PerformanceIQ3 Solutions GroupNessuna valutazione finora

- CFTC No-Action Letter No 12-23 - Section 4m (1) - Request For CPO Registration ReliefDocumento3 pagineCFTC No-Action Letter No 12-23 - Section 4m (1) - Request For CPO Registration ReliefIQ3 Solutions GroupNessuna valutazione finora

- SEC Release No. 34-68080 - Clearing Agency StandardsDocumento254 pagineSEC Release No. 34-68080 - Clearing Agency StandardsIQ3 Solutions GroupNessuna valutazione finora

- EMIR Regulation of OTC CCPDocumento24 pagineEMIR Regulation of OTC CCPIQ3 Solutions GroupNessuna valutazione finora

- Summer Training Report: IILM Academy of Higher Learning, LucknowDocumento47 pagineSummer Training Report: IILM Academy of Higher Learning, LucknowSuman JaiswalNessuna valutazione finora

- Functions of Central BankDocumento7 pagineFunctions of Central BankJohn RobertsonNessuna valutazione finora

- Financial Markets and Institutions: Ninth EditionDocumento59 pagineFinancial Markets and Institutions: Ninth EditionShahmeer KamranNessuna valutazione finora

- Tertiary sector servicesDocumento2 pagineTertiary sector servicesDaniel RandolphNessuna valutazione finora

- 70 07 Key Metrics Ratios AfterDocumento16 pagine70 07 Key Metrics Ratios Aftermerag76668Nessuna valutazione finora

- Book1 Group Act5110Documento9 pagineBook1 Group Act5110SAMNessuna valutazione finora

- Accttheory Chap01Documento26 pagineAccttheory Chap01muudeyNessuna valutazione finora

- 13 - Findings and Suggestion PDFDocumento9 pagine13 - Findings and Suggestion PDFKhushboo GuptaNessuna valutazione finora

- Digest of Filipinas Life Assurance Co. v. Pedrosa (G.R. No. 159489)Documento1 paginaDigest of Filipinas Life Assurance Co. v. Pedrosa (G.R. No. 159489)Rafael Pangilinan100% (1)

- GubadDocumento117 pagineGubadMohit JamwalNessuna valutazione finora

- A Conceptual Framework For Financial Accounting and ReportingDocumento70 pagineA Conceptual Framework For Financial Accounting and ReportingAyesha ZakiNessuna valutazione finora

- Solutions Week 12 - Intangible AssetsDocumento6 pagineSolutions Week 12 - Intangible AssetsjoseluckNessuna valutazione finora

- MBA - SyllabusDocumento56 pagineMBA - SyllabusPreethi GopalanNessuna valutazione finora

- Clothing Manufacturer Business Plan ExampleDocumento32 pagineClothing Manufacturer Business Plan ExampleAshu BlueNessuna valutazione finora

- Annexure II CP 14-13-14 PDFDocumento381 pagineAnnexure II CP 14-13-14 PDFவேணிNessuna valutazione finora

- HST Solar-Slide DeckDocumento5 pagineHST Solar-Slide DeckSaad YoussefiNessuna valutazione finora

- Parking MemoDocumento13 pagineParking MemojaneprendergastNessuna valutazione finora

- CH 23Documento16 pagineCH 23Madiyar Mambetov100% (1)

- SamsungDocumento13 pagineSamsungGaurav KumarNessuna valutazione finora

- Financial Statement: Why Do We Need Financial Information To Make Business Decision?Documento19 pagineFinancial Statement: Why Do We Need Financial Information To Make Business Decision?steven johnNessuna valutazione finora

- Case Study On Ashoka Spintex: Submitted By: Sumeet Bhatere Sameer Garg Rumi Hajong Seema Behera Shabnam KerkettaDocumento6 pagineCase Study On Ashoka Spintex: Submitted By: Sumeet Bhatere Sameer Garg Rumi Hajong Seema Behera Shabnam KerkettaPOOJA GUPTANessuna valutazione finora

- FINANCIAL SERVICES TITLEDocumento9 pagineFINANCIAL SERVICES TITLEBrian StanleyNessuna valutazione finora

- Morning InsightDocumento4 pagineMorning InsightNiravMakwanaNessuna valutazione finora

- Mba Eco v6 e F ADocumento108 pagineMba Eco v6 e F AantonamalarajNessuna valutazione finora

- FINMAN - Exercises - 4th and 5th Requirements - PimentelDocumento10 pagineFINMAN - Exercises - 4th and 5th Requirements - PimentelOjuola EmmanuelNessuna valutazione finora

- 12 Economics Balance of Payment Impq 1Documento2 pagine12 Economics Balance of Payment Impq 1RitikaNessuna valutazione finora

- Westminsterresearch: Eva and Shareholder Value Creation: An Empirical Study Wajeeh ElaliDocumento195 pagineWestminsterresearch: Eva and Shareholder Value Creation: An Empirical Study Wajeeh Elalijafar11Nessuna valutazione finora

- Option GreeksDocumento2 pagineOption GreeksajjupNessuna valutazione finora

- Cape Chemical Cash ManagementDocumento11 pagineCape Chemical Cash ManagementSeno Patih0% (2)

- Lorenzo Ona V CIRDocumento1 paginaLorenzo Ona V CIREryl YuNessuna valutazione finora