Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Organic Agriculture and Food Industry

Caricato da

Udhbhav AryanCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Organic Agriculture and Food Industry

Caricato da

Udhbhav AryanCopyright:

Formati disponibili

CAB CALLING

October-December, 2006

Organic Agriculture

and Food Industry:

Trends, Challenges and Opportunities

K. Muthukumaran*

Production

Estimating area under organic agriculture in India

is a difficult task as there is no central agency

that collects and compiles this information.

However, according to National Program for

Organic Production (NPOP), APEDA, the total

area under certified organic cultivation in India

is around 2508826 ha, which includes wild herbs

collection from forest area of Madhya Pradesh

(MP) and Uttar Pradesh (UP) of 2432500 ha. The

current production of organic crops is around

14,000 tons (Garibay S V and Jyoti K, 2003). Out

of this production, tea and rice contribute around

24% each, and fruits and vegetables combine

makes 17%.

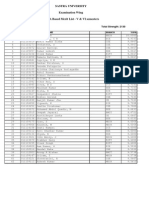

Table: Major products produced in India

by organic farming

Organic Agriculture in India

Type of Product

Products

Organic cultivation is particularly suitable for a

country like India with a huge population of small

farmers who still use traditional methods of farming

with few agricultural inputs. It is estimated that 65%

of the countrys cropped area is organic by default,

as the small farmers have no choice but to farm

without chemical fertilizers and pesticides as they

cannot afford. This default status coupled with Indias

inherent advantages, such as, its varied agro-climatic

regions, local self-sustaining agri-systems, sizeable

number of progressive farmers and ready availability

of inexpensive manpower translate into the potential

to cultivate a vast basket of products organically.

Commodity

Tea, Coffee, Rice, Wheat

Spices

Cardamom, Black pepper, White pepper,

Ginger, Turmeric, Vanilla, Tamarind, Clove,

Cinnamon, Nutmeg, Mace, Chili

Pulses

Red gram, Black gram

Fruits

Mango, Banana, Pineapple, Passion fruit,

Sugarcane, Orange, Cashew nut, Walnut

Vegetables

Okra, Brinjal, Garlic, Onion, Tomato,

Potato

Oil seeds

Mustard, Sesame, Castor, Sunflower

Others

Cotton, Herbal extracts

Source: Org-Marg, 2002 (Field Survey & Publication Organic and

Biodynamic farming, Govt. of India, Planning Commission)

*Chief General Manager, EXIM Bank, Chennai

13

CAB CALLING

October-December, 2006

Export Market

Percentage share of organic products in India

Organic agricultural export market is one of the major drivers

of organic agriculture in India. India exports 31 organic

products. It is estimated that more than 85% of total organic

production, excluding wild herbs from UP and MP, is

exported. India is best known as an exporter of organic tea

and also has great export potential for many other products.

Other organic products for which India has a niche market

are spices and fruits. There is also good response for organic

rice, vegetable, coffee, cashew, oil seed, wheat and pulses.

Among the fruit crops bananas, mangos and oranges are the

most preferred organic products.

Indias organic export products include, tea, honey, cashew,

cotton, processed fruits, coffee, basmati rice, sesame, spices,

walnuts, pulses and wheat. Key organic items of export

importance are fruits and vegetables, sesame, basmati rice,

fruit pulp, fruit juices, spices, cashew, tea, coffee, cotton and

wheat. India has production advantages in most of these

products.

Source: APEDA 2003

Indias products and production areas

14

CAB CALLING

October-December, 2006

Domestic Demand

Constraints and Challenges

The domestic market is nascent but has huge growth potential.

Presently the domestic market for organic products are

estimated at 1,200 tonnes and there are around 2-3 million

potential customers for organic agricultural produce and is

growing.

Though there is rising interest for organic agriculture in India

it is not growing at a pace to enhance its market attractiveness

so as to motivate larger section of farming community to

opt for organic agriculture. The flowchart below provides

some of the key factors limiting organic agriculture in India

in a nutshell.

Low levels of Market information

about organic produces

No designated agency at Central

State & local levels which reaches

farmers with information

No Quality Monitoring

Control Systems in place

Existence of spurious & low

quality brands in market

Low Quality of bio-inputs

Conventional Agri-inputs

considered more effective than

Bio-inputs

Disincentive for traders given

the low penetration of bioinputs market

Non-availability of bio-inputs

Limited Shelf life of bio-inputs

Relatively longtime period needed

for bio inputs to be effective

Time lag & high costs of

conversion of Conventional to

organic farming

Limited

Penetration of

Organic

Agriculture in

India

Subsistence farming by large number

of small & marginal farmers

High Costs involved certification &

limited no. of certifying agencies

Limited positive government

interventions & high negative

subsidies

Price premiums reach more for

Intermediaries than producers

No easy quality

assurance mechanisms

Lack of adequate

transportation facilities

Low levels of networking among

farmers and other stakeholders

Subsidies to commercial inputs

disincentiviaing bio-inputs

Limited financial outlays for

bio-inputs by government

No & limited Storage facilities

Under developed infrastructure

& marketing channels for

green outputs

Limited R & D efforts &

investments on Bio inputs

No strategic attention for

greening agriculture & No

coordinated effort at Centre &

State Level

Small farm holdings

Formal associations of traders,

farmers & others are

not paying adequate attention

Mostly geographically dispersed

organic farmers; Small numbers

with organic produces

Among the constraints listed above, current high levels of transaction costs for getting farms certified as organic is a major

deterrent for enhancing organic production in the country. The certification process is very lengthy and complex and the

cost of certification (refer Table in the next page) is also unaffordable for small farmer.

15

CAB CALLING

October-December, 2006

Table: Cost of inspection and certification

Category

Details

Fees (Rs)

Small farmers and

cooperatives

Travel and inspection report

preparationCertification

12,000/day

5,000 flat fee

5,000/certificate

Estate manufactures and

exporters

Travel and inspection report

preparation Certification

19,200/day

5,000 flat fee

5,000/certificate

Large and medium sized

processors

Travel and inspection report

preparation Certification

16,800/day

5,000 flat fee

5,000/certificate

Source: Org-Marg, 2002

Markets of Organic Food

The organic food industry has been growing remarkably for

the past several years. Against the 2-3% growth in the

conventional food industry, the organic food industry has

been experiencing an annual growth between 17% and 22%

over the past several years. Global retail organic food sales,

valued at USD 25 billion in 2003,

are currently worth USD 31 billion

and growing at over 20% per

annum. The same is estimated to

increase to USD 102 billion by

2020. Organic agriculture is now

practiced in approximately 110

countries and its share of

agricultural land and farm

continues to grow.

The major markets for organic food products are in the United

States, the European Union (Germany, France, Italy, Belgium

and the United Kingdom), and Japan. The annual market

size of natural and organic products in the US is estimated to

be anywhere between USD 16.3 29.7 billion. In 2005,

retail sales of organic food and beverages were approximately

USD 12.8 billion. Growth rate estimates up to 2010 range

between 9% and 16% per annum. A part of the US demand

is met from imports. In 2002, the import of organic foods

into the US was about USD 1.5 billion. The EU organic market

grew rapidly through 1990s by a range 20% and 40% per

annum, but currently the growth has slowed down because

the number of regular organic consumers has stabilized.

Retails sales grew from USD 10.5 billion in 2002 to USD 12

16

billion in 2004, at a growth rate of 5% per annum. Germany

is the second largest market for organic food and drink in the

EU, which accounts for almost 30% of total organic sales

valued at USD 3.7 billion in 2003, followed by the UK, which

achieved estimated retail sales of USD 1.6 billion. Italy and

France organic markets, each valued at approximately USD

1.5 billion. The French and the UK

markets have grown on an average

of more than 40% annually since

2001.

Among the more significant

countries producing organic

products in Asia are China,

Ukraine, India, Indonesia and Israel

(mainly dried and fresh fruits and

vegetables and nuts). Japan is the

largest consumer of organic

products in Asia. The market was estimated at USD 350-450

million in 2003 and is growing at 20% per annum. The

Japanese organic market is characterized as one with high

demand, strong purchasing power, and low domestic supply

of organic products. On the supply side, the value of Chinese

exports grew from less than USD 1 million in 1990s to about

USD 142 million in 2003. By 2003, more than 1,000 Chinese

companies and farms were certified organic.

Challenges and Opportunities

Markets in developed countries are evolving to demand highly

processed organic products as well as raw commodities.

Supply competition is inevitable. As production is

widespread, most of the raw commodities are now available

CAB CALLING

in organic form. In Europe, markets are increasing for readyto-eat meals, frozen foods, baby food, snacks and beverages.

Ingredients needed for organic food processing include juices,

fruit powders, dried fruit, meat, flavourings, essential oils,

herbs and spices and nuts. In Japan, organic consumer goods,

which are in growing demand, include fresh produce, frozen

foods, juice, baked goods, baby food, chicken, sauces and

ready meals. New Zealand has emerged as a significant

supplier of organic foods lately.

Organic Meat: Key Emerging Markets

Market research reports reveal high market growth for the

organic meat sector as consumers fear for food safety raises

demand for organic meats. The BSE scare caused the

Canadian market for organic meat products to expand by

35% in 2003. Similar growth was expected for the US market

from 2004 as organic meat production steps up and as more

volume goes into the retail trade. Organic poultry was the

most

widely

available organic

meat in 2003

with organic beef

and pork rarely

found in retailers.

Currently the

organic meat is

less than 1% of

the overall USD 175 billion US beef market. However,

interests on organic meat are high among the consumers in

US with the Organic Trade Association, in Greenfield,

Massachusetts, projected a 175 % annual growth rate for

organic meat by 2005.

The organic poultry segment dominates the North American

organic meat products market. Relatively short production

cycle, integrated production system, and low price premium

are responsible

for the trend. Organic beef in

comparison is rarely found in

retailers because of small-scale

production,

inadequate

distribution infrastructure, and the

success of competing products like

natural beef. The European organic

meat products market has been

growing at over 20% a year since late

1990s and has lately slowed down to 10%.

The market is becoming increasingly

competitive as many countries are

October-December, 2006

suffering from oversupplies. Organic meats are mostly

marketed under supermarket private labels, which account

for over 80% of fresh cut sales. Brands are more evident on

organic processed meats.

Organic Citrus and Citrus Juices: World Market

Review

Citrus products labelled as organic are those certified as

having been produced through clearly defined organic

production methods.

Fresh Organic Citrus

Production : World production of certified organic citrus in

approximately 30 countries was about 600,000 metric tons

in 2001 accounting for 0.6% of total citrus production.

Organic citrus is produced in a majority of citrus producing

countries in the Americas, the Caribbean, the Mediterranean

rim, Africa and

Asia. The largest

producing

countries are, by

decreasing order

of importance:

Italy, the United

States, Brazil,

Costa

Rica,

Greece and Spain.

Markets : The European Union (EU) market for both certified

organic fruit and vegetables was estimated at US$ 1.7 billion

in 2002, with fresh organic citrus representing 5-7% of all

fresh fruit and vegetables sales and 37% of all organic fruit

sold. However, consumption of fresh organic citrus in the

EU is still relatively low compared with overall fresh fruit

use. Some of the constraints responsible for this trend and

need to be addressed are poor fruit quality, packaging, short

shelf life of organic citrus and inefficiencies in the marketing

chain.

Survey of main markets within the EU reveals that selected

EU countries imported approximately 48-50,000 tonnes of

fresh organic citrus in 2000-01 with Germany, France, the

UK and Austria being major importers. Austria and Denmark

have the highest per capita consumption of organic products

in general. The fresh citrus import market in the Netherlands

is unique because this country is a key entry point, reexporting imported citrus to other EU countries, partially due

to less complicated organic import procedures than other

EU countries.

17

CAB CALLING

October-December, 2006

Table - Estimated net imports of fresh organic

citrus in selected EU countries (2000-01)

Importing

Country

Exporting

Country

Metric

tonnes

Austria

Spain, Greece, Israel

7-8,000

Belgium

500 - 1.000

Denmark

Spain, Italy

2,000

France

Italy, Spain, Israel,

South Arica

9,000

Germany

Italy, Spain

13,000

Netherlands

7,000

Sweden

Spain, Italy

500-1,000

UK

Italy, Spain

8,000

Finland

Spain, Italy

500

Ireland

Luxembourg

500

Total

Organic Citrus Juice

48-50,000

Fresh fruit and vegetables are the leading organic food

category in the United States retail food market. Organic

oranges are among the most consumed organic fruit, together

with apples and bananas. The US is a major citrus producer.

Production in 2001-02 was 14.7 million tonnes, however, a

very small share of the citrus harvest is grown organically.

The US imports small quantities of organic citrus mainly from

Mexico (oranges and limes), Honduras (lemons), Guatemala,

Brazil (oranges) and South Africa (oranges and grapefruit).

In general sale of fresh organic fruit and vegetables is very

small in Japanese markets. Japan produces small quantities

of organic mandarins. The lack of domestic supply of organic

citrus is compounded by tough Japanese organic Agricultural

Standard (JAS), phytosanitary restrictions and high ad valorem

tariffs on imports of fresh citrus, currently about 0.1-0.2% of

the total citrus market.

Prices : Fresh organic

citrus prices in EU vary

with

seasonal

availability of fruit,

market location and

type of retail outlet.

Prices of imported citrus

are generally higher

during the off-season for

18

EU citrus production. On an average, fresh organic citrus

sells for 65% higher than conventionally grown citrus,

however, premiums range from 17% in Greece to 144% in

Finland. Organic citrus is also cheaper in countries where a

substantial share of organic produce is sold in supermarkets

rather than smaller health food stores. In the US, the premium

for organic versus conventional fresh produce generally ranges

from 11% to 121% in the conventional stores and from 50 to

167% in the natural food market.

The bulk of organic citrus juice consists of orange juice. Juice

volumes of other organic citrus products such as organic

grapefruit juice (e.g. in Cuba, Israel and the United States)

and lemon juice (Argentina, Spain) have been very low so

far. Orange juice is marketed in two main forms: frozen

concentrated (FCOJ) and not-from-concentrate (NFC), with

recent sales for NFC increasing more than that of FCOJ.

Markets : The main markets for all organic fruit and vegetable

juices combined are the UK, Germany, Italy, France and

Scandinavian countries with retail sales increasing more than

20% per year since 1998. The present EU market for organic

juice in general is only 0.57% of the total EU juice market.

Organic citrus juice accounts for only 0.3% of total citrus

juice consumption. Brazil is the largest supplier of FCOJ for

the EU, followed by the USA, Cuba, Israel and Costa Rica.

Highly competitive in the conventionally produced FCOJ

market, Brazil is expected to maintain this lead in the organic

FCOJ market.

The US is the largest market for orange juice

in the world. The bulk of US orange juice

is produced in Florida, where production

is split almost equally between FCOJ and

NFC juice. In addition to its domestic

supply, the US imports organic citrus

juices, mainly from Mexico and

Brazil. The tariff on concentrated

citrus juice imports ranges

between 34 and 38% in ad

valorem equivalent. The tariff on

non-concentrated citrus juice is

much lower (below 5% in ad

valorem equivalent). Japan is the

third largest market for citrus

juices after the US and the EU.

Japan consumed over 635,000

CAB CALLING

tonnes of citrus juices in 2000, 70% of which was imported.

Japan imports organic FCOJ from Brazil and organic NFC

juice from the US.

Market Prospects

Fresh Organic Citrus

The EU market for fresh organic oranges, tangerines and

lemons is dominated by Italy and Spain. However, with the

two countries remaining the main supplier of organic citrus

in the EU, other marketing opportunities will fall to those

with preferential trade agreements with the EU, with fruit

available from May to September when EU local production

is low or absent. There are also opportunities for exporting

organic grapefruit and limes which are short in supply. There

are more opportunities for fresh citrus exports to the US and

Japan. Although the US produces organic citrus, demand may

exceed supply and its import tariffs on fresh citrus are very

low. The Japanese market for fresh organic citrus also offers

interesting prospects if exporters can meet the new JAS organic

regulations and the tough phytosanitary requirements. Given

its large population with a relatively high per capita income

and focus on health concerns, conservative estimates predict

Japans organic market for fresh organic citrus fruit could grow

to mature market potential of 3-5% of the total citrus market

by 2010.

Organic Citrus Juice

The market for organic citrus juices is presently extremely

small. FAO has projected the volume of organic citrus juice

consumption in the world until 2010 using 2 different growth

scenarios. Based on the observation of past growth for other

organic product categories, the first scenario assumes the

market for organic orange to grow up to 40% and then

gradually decreases to 10% in 2010. In the second scenario

consumption grows at 20% annually until 2006. Then, annual

growth decreases gradually to reach 10% in 2010.

Brazil is the largest supplier of fresh citrus organic juices

(FCOJ) and is expected to retain its lead in the organic FCOJ

market. For other developing countries located near the main

markets, producing citrus juices and exporting organic NFC

juice, may be a better option. Distance to markets matters

more for NFC juice than for FCOJ due to the higher

transportation costs of NFC. Due to the relatively high tariffs

on orange juice, countries, which enjoy preferential trade

agreements with the major markets, will have a comparative

advantage. However, for exporters seeking to supply organic

citrus and citrus juices to the developed countries major

October-December, 2006

considerations should include (i) ability to meet specific

requirements of the target market (phytosanitory

requirements, quantity and quality, packaging, consistency,

and scheduling deliveries), (ii) profit margins in terms of

production costs and various price premium scenarios, (iii)

targeted market tariffs and preferential market access

agreements, and (iv) target market acceptance of organic

certification.

Key Developments and New Opportunities

Organic farming has been identified as a major spearhead in

the Tenth Five Year Plan (2002-2007) and is expected to be

one of the focus areas to boost agricultural growth in the

Eleventh Five-Year Plan (2007-12) of the Indian government.

In a recent development, Indian organic certifying bodies

will be soon receiving European Commission (EC)

equivalence status exempting Indian organic products from

further certification by European agencies, which likely to

bring down the cost of organic exports and will also result in

savings of Rs.500-1,000 per hectare for certification.

Indian government has designated six organizations to

accredit certifying agencies (international or domestic)

undertaking inspection and certification of organic products.

These are APEDA, the Tea Board, the Spices Board, the Coffee

Board, the Coconut Development Board, and the Directorate

of Cashew and Cocoa. National organic standards have been

established under NPOP. Currently, 11 accredited certifying

agencies are functional in India. IMO (Switzerland),

ECOCERT (Germany), SKAL (The Netherlands), SGS

(Switzerland), and Lacon (Germany) are some of the

International ones. Indocert, based in Kerala, is among the

accredited domestic agencies.

The burgeoning European and US organic markets provide

enormous scope for Indian exporters. US retail sale for organic

product has grown 20-24% per year for the past 12 years

and the same growth trends are expected to continue for

future. Europe is the second largest market of organic

produces in the world and consumes around half of the world

organic produce. European market for organic food is

estimated to be around US$ 9 billion and expected annual

growth rate is of around 20%, depending on the markets.

Japan is the largest organic food market in Asia. Retail sales

of organic food and beverage is around US$ 2.5-3.0 billion

(2003). Of this, imports are estimated to be to the tune of

around US$ 360 million. Though the organic food market is

not more than 0.5% of total food market of Japan but

according to the Japanese Integrated Market Institute, import

19

CAB CALLING

October-December, 2006

of organic products is likely to grow by 40%. Other global

markets for organic products are Saudi Arabia, UAE and South

Africa.

The matrix below reveals that India has demonstrated

capabilities of exporting some key agricultural commodities

to most of the major global markets, where there is a

considerable demand for organically produced commodities

attracting price premiums ranging from 10-100%. The matrix

thus, showcases window of opportunities in these markets

for Indian exporters and producers of organic agricultural

commodities, which are yet to be exploited to maximum

potential.

Conventional agricultural products & their export market

and prospective market for Indian organic products

Existing conventional export

market for Indian producers

for particular product

Prospective market for

Indian organic products.

Organic - A Primer -Continued from page 12

The IFOAM Basic Standards are a set of standards for

standards. They are established through a democratic and

international process and reflect the current state of the art

for organic production and processing. They are best seen

as a work in progress to lead the continued development

of organic practices worldwide. They provide a framework

for national and regional standard-setting and certification

bodies to develop detailed certification standards that are

responsive to local conditions.

Legislated standards are established at the national level,

and vary from country to country. In recent years, many

countries have legislated organic production, including the

EU nations (1990s), Japan (2001), and the US (2002). Nongovernmental national and international associations also

have their own production standards. In countries where

production is regulated, these agencies must be accredited

by the government. Since 1993 when EU Council

Regulation 2092/91 became effective, organic food

production has been strictly regulated in the UK.

commercial use of the term organic. Farmers and food

processors must comply with the NOP in order to use the

word.

Organic Certification

Organic certification is a certification process for producers

of organic food and other organic agricultural products. In

general, any business directly involved in food production

can be certified, including seed suppliers, farmers, food

processors, retailers and restaurants. Requirements vary from

country to country, and generally involve a set of production

standards for growing, storage, processing, packaging and

shipping that include:

A

A

A

avoidance of synthetic chemical inputs (e.g. fertilizer,

pesticides, antibiotics, food additives, etc) and

genetically modified organisms;

use of farmland that has been free from chemicals for

a number of years (often, three or more);

keeping detailed written production and sales records

(audit trail);

maintaining strict physical separation of organic

products from non-certified products;

undergoing periodic on-site inspections.

In India, standards for organic agriculture were announced

in May 2001, and the National Programme on Organic

Production (NPOP) is administered under the Ministry of

Commerce. (http://: www.apeda.com/organic/quality.html)

In 2002, the United States Department of Agriculture

(USDA) established production standards, under the

National Organic Program (NOP), which regulate the

Certified organic producers are also subject to the same

agricultural, food safety and other government regulations

that apply to non-certified producers.

Continued on Page 41

20

Potrebbero piacerti anche

- Chapter 15 Exam Questions - 8th EdDocumento8 pagineChapter 15 Exam Questions - 8th EdUdhbhav AryanNessuna valutazione finora

- Assignment 2 CarZumaDocumento4 pagineAssignment 2 CarZumaUdhbhav AryanNessuna valutazione finora

- Chapter 14 Exam Questions - 8th EdDocumento11 pagineChapter 14 Exam Questions - 8th EdUdhbhav Aryan100% (1)

- UNIDO Guide To Suppler DevelopmentDocumento44 pagineUNIDO Guide To Suppler DevelopmentUdhbhav AryanNessuna valutazione finora

- Mckinsey & Co. Managing Knowledge and LearningDocumento15 pagineMckinsey & Co. Managing Knowledge and LearningVibhorSrivastava100% (1)

- Avantgarde Case StudyDocumento7 pagineAvantgarde Case StudyUdhbhav AryanNessuna valutazione finora

- MPX ManualDocumento230 pagineMPX ManualUdhbhav AryanNessuna valutazione finora

- FM Assignment1 Group9Documento3 pagineFM Assignment1 Group9Udhbhav Aryan100% (1)

- Downloads News 2010 Aug Dean List 2 V & VI SEMESTERDocumento1 paginaDownloads News 2010 Aug Dean List 2 V & VI SEMESTERUdhbhav AryanNessuna valutazione finora

- Cadbury V 1.0Documento6 pagineCadbury V 1.0Udhbhav AryanNessuna valutazione finora

- Strategy and Society: The Link Between Competitive Advantage and Corporate Social ResponsibilityDocumento23 pagineStrategy and Society: The Link Between Competitive Advantage and Corporate Social ResponsibilityUdhbhav AryanNessuna valutazione finora

- Strauss & Corbin'a Approach Example VGDocumento7 pagineStrauss & Corbin'a Approach Example VGUdhbhav AryanNessuna valutazione finora

- The PeopleSoft ContestDocumento9 pagineThe PeopleSoft ContestUdhbhav AryanNessuna valutazione finora

- ONMITELDocumento5 pagineONMITELUdhbhav AryanNessuna valutazione finora

- SBI: Organizational Design and Technology: Project ProposalDocumento4 pagineSBI: Organizational Design and Technology: Project ProposalUdhbhav AryanNessuna valutazione finora

- Huella Online Travel Group-7Documento10 pagineHuella Online Travel Group-7Udhbhav AryanNessuna valutazione finora

- Kellogg Consulting ClubDocumento12 pagineKellogg Consulting ClubCaroline KimNessuna valutazione finora

- Attention Outgone StudentsDocumento1 paginaAttention Outgone StudentsUdhbhav AryanNessuna valutazione finora

- Tribes and Mentoring ArticleDocumento20 pagineTribes and Mentoring ArticleUdhbhav AryanNessuna valutazione finora

- Downloads News 2010 Aug Dean List 2 V & VI SEMESTERDocumento1 paginaDownloads News 2010 Aug Dean List 2 V & VI SEMESTERUdhbhav AryanNessuna valutazione finora

- ActionverbsDocumento2 pagineActionverbsapi-241737054Nessuna valutazione finora

- Tribes and Mentoring ArticleDocumento20 pagineTribes and Mentoring ArticleUdhbhav AryanNessuna valutazione finora

- Chapter 14Documento26 pagineChapter 14owaishazaraNessuna valutazione finora

- Histogarm EqDocumento2 pagineHistogarm EqUdhbhav AryanNessuna valutazione finora

- Chandan KumarDocumento2 pagineChandan KumarUdhbhav AryanNessuna valutazione finora

- Grammar Googly 1Documento6 pagineGrammar Googly 1Udhbhav AryanNessuna valutazione finora

- Problem StatementDocumento2 pagineProblem StatementUdhbhav AryanNessuna valutazione finora

- WECDocumento4 pagineWECUdhbhav AryanNessuna valutazione finora

- Chan Mri Ud Appo: TotalDocumento8 pagineChan Mri Ud Appo: TotalUdhbhav AryanNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Nmhs Horticulture 1 - 2Documento57 pagineNmhs Horticulture 1 - 2api-279806117Nessuna valutazione finora

- Motel Morris Brunch and Lunch MenusDocumento2 pagineMotel Morris Brunch and Lunch MenusEaterNessuna valutazione finora

- Melt and Pour Soap RecipesDocumento19 pagineMelt and Pour Soap RecipesFlorbela Graça50% (2)

- The Big Bean CommentsDocumento4 pagineThe Big Bean CommentsAe R ONNessuna valutazione finora

- Dwnload Full Criminal Justice Today An Introductory Text For The 21st Century 13th Edition Schmalleger Test Bank PDFDocumento36 pagineDwnload Full Criminal Justice Today An Introductory Text For The 21st Century 13th Edition Schmalleger Test Bank PDFrosannpittervip100% (15)

- Foster 2000 - Groundwater in Rural Development Facing The Challenges of Supply and Resource SustainabilityDocumento120 pagineFoster 2000 - Groundwater in Rural Development Facing The Challenges of Supply and Resource SustainabilityTania Milagros Mego JimenezNessuna valutazione finora

- The Meat Buyer's GuideDocumento339 pagineThe Meat Buyer's Guideskoiper100% (11)

- The Madmullah of Somaliland 1916 1921Documento386 pagineThe Madmullah of Somaliland 1916 1921Khadar Hayaan Freelancer100% (1)

- Duckery Unit EXP 401 (0+5) Integrated Farming System: P.Sundra Vigneshwar 2015001128Documento31 pagineDuckery Unit EXP 401 (0+5) Integrated Farming System: P.Sundra Vigneshwar 2015001128Sundra VigneshwarNessuna valutazione finora

- GRE Bible WordlistDocumento31 pagineGRE Bible Wordlistabrah019Nessuna valutazione finora

- Analysis of Consumer Behaviour Towards Sudha Ice-CreamDocumento56 pagineAnalysis of Consumer Behaviour Towards Sudha Ice-CreamSupriya_kamna100% (1)

- Domestic Pig Andaman NicobarDocumento26 pagineDomestic Pig Andaman NicobarDino MozardienNessuna valutazione finora

- Faber Peak Wedding Price List Package ROMDocumento10 pagineFaber Peak Wedding Price List Package ROMmirabella johnsonNessuna valutazione finora

- Ge Animal ScienceDocumento8 pagineGe Animal ScienceLambaco Earl AdamNessuna valutazione finora

- August 16 Committee Report - Cooperatives and Accreditation of NGOsDocumento19 pagineAugust 16 Committee Report - Cooperatives and Accreditation of NGOsmimisabaytonNessuna valutazione finora

- 2593 Topper 21 101 1 21 7321 Pastoralists in The Modern World Up201507161636 1437044800 7556Documento5 pagine2593 Topper 21 101 1 21 7321 Pastoralists in The Modern World Up201507161636 1437044800 7556Deepa MundadaNessuna valutazione finora

- Major Problems of Agricultural Sector of PakistanDocumento11 pagineMajor Problems of Agricultural Sector of PakistanFahad Mukhtar100% (1)

- Brown Lowery Park NotesDocumento2 pagineBrown Lowery Park NotesmgipsohnNessuna valutazione finora

- Environmental Case Study: Reintroducing Wolves To YellowstoneDocumento2 pagineEnvironmental Case Study: Reintroducing Wolves To YellowstoneKevin LawrenceNessuna valutazione finora

- CannabisDocumento5 pagineCannabisIoannis Georgilakis100% (1)

- 1.1 Minimum Wage - PhilippinesDocumento6 pagine1.1 Minimum Wage - PhilippinesInhenyero TsupiteroNessuna valutazione finora

- Lunch Specials Starters: 4505 Liberty Avenue Pittsburgh, PA. 151224 Fax. (412) 681 - 0430Documento2 pagineLunch Specials Starters: 4505 Liberty Avenue Pittsburgh, PA. 151224 Fax. (412) 681 - 0430api-280803016Nessuna valutazione finora

- Mitsubishi Forklift Fb20pnt Service ManualDocumento23 pagineMitsubishi Forklift Fb20pnt Service Manualdianadavies021288taz100% (120)

- Questions Over Bean Field and VillageDocumento3 pagineQuestions Over Bean Field and VillageKevin DualNessuna valutazione finora

- Excerpt From Cooking My Way Back Home by Mitchell Rosenthal and Jon PultDocumento24 pagineExcerpt From Cooking My Way Back Home by Mitchell Rosenthal and Jon PultThe Recipe Club67% (3)

- Unit Early State Formation in South India (Tamilaham) : StructureDocumento5 pagineUnit Early State Formation in South India (Tamilaham) : StructureManasi SharmaNessuna valutazione finora

- Nutrients: Contaminants in Grain-A Major Risk For Whole Grain Safety?Documento23 pagineNutrients: Contaminants in Grain-A Major Risk For Whole Grain Safety?Anakin SkywalkerNessuna valutazione finora

- IG 1125-2019-042 - 2019 Second Quarter Corn Production in Davao OrientalDocumento1 paginaIG 1125-2019-042 - 2019 Second Quarter Corn Production in Davao OrientalDilg DavaoOrientalNessuna valutazione finora

- (Surprisingly) : The Quiet Bison HuntDocumento5 pagine(Surprisingly) : The Quiet Bison HuntScooterMNessuna valutazione finora

- Keep Up With Feeding And/or Pasture Management. You Cannot Raise Cattle If You Have Nothing To Feed Them orDocumento8 pagineKeep Up With Feeding And/or Pasture Management. You Cannot Raise Cattle If You Have Nothing To Feed Them orMarie Lyca Dela CruzNessuna valutazione finora