Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Solutions Chapter 3

Caricato da

Timroo HamroDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Solutions Chapter 3

Caricato da

Timroo HamroCopyright:

Formati disponibili

CHAPTER

Exercise Solutions

31

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 32

EXERCISE 3.1

(a)

The required interval estimator is b1 tc se(b1 ) . When b1 = 83.416, tc = t(0.975,38) = 2.024

and se(b1 ) = 43.410, we get the interval estimate:

83.416 2.024 43.410 = (4.46, 171.30)

We estimate that 1 lies between 4.46 and 171.30. In repeated samples, 95% of similarly

constructed intervals would contain the true 1 .

(b)

To test H 0 : 1 = 0 against H1 : 1 0 we compute the t-value

t1 =

b1 1 83.416 0

=

= 1.92

se(b1 )

43.410

Since the t = 1.92 value does not exceed the 5% critical value tc = t(0.975,38) = 2.024 , we do

not reject H 0 . The data do not reject the zero-intercept hypothesis.

(c)

The p-value 0.0622 represents the sum of the areas under the t distribution to the left of t =

1.92 and to the right of t = 1.92. Since the t distribution is symmetric, each of the tail

areas that make up the p-value are p / 2 = 0.0622 2 = 0.0311. The level of significance, ,

is given by the sum of the areas under the PDF for | t |>| tc |, so the area under the curve for

t > tc is / 2 = .025 and likewise for t < tc . Therefore not rejecting the null hypothesis

because / 2 < p / 2, or < p, is the same as not rejecting the null hypothesis because

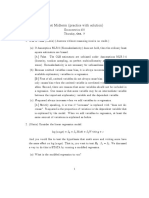

tc < t < tc . From Figure xr3.1(a) we can see that having a p-value > 0.05 is equivalent to

having tc < t < tc .

Figure xr3.1(a) Critical and observed t values for Exercise 3.1(c)

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 33

Exercise 3.1 (continued)

(d)

Testing H 0 : 1 = 0 against H1 : 1 > 0, uses the same t-value as in part (b), t = 1.92.

Because it is a one-tailed test, the critical value is chosen such that there is a probability of

0.05 in the right tail. That is, tc = t(0.95,38) = 1.686 . Since t = 1.92 > tc = 1.69, H 0 is

rejected, the alternative is accepted, and we conclude that the intercept is positive. In this

case p-value = P(t > 1.92) = 0.0311. We see from Figure xr3.1(b) that having the p-value

< 0.05 is equivalent to having t > 1.69.

0.4

Rejection Region

0.3

0.2

0.1

1.92

0.0

-3

-2

-1

tc

Figure xr3.1(b) Rejection region and observed t value for Exercise 3.1(d)

(e)

The term "level of significance" is used to describe the probability of rejecting a true null

hypothesis when carrying out a hypothesis test. The term "level of confidence" refers to

the probability of an interval estimator yielding an interval that includes the true

parameter. When carrying out a two-tailed test of the form H 0 : k = c versus H1 : k c,

non-rejection of H 0 implies c lies within the confidence interval, and vice versa,

providing the level of significance is equal to one minus the level of confidence.

(f)

False. The test in (d) uses the level of significance 5%, which is the probability of a Type

I error. That is, in repeated samples we have a 5% chance of rejecting the null hypothesis

when it is true. The 5% significance is a probability statement about a procedure not a

probability statement about 1 . It is careless and dangerous to equate 5% level of

significance with 95% confidence, which relates to interval estimation procedures, not

hypothesis tests.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 34

EXERCISE 3.2

(a)

The coefficient of EXPER indicates that, on average, a technical artist's quality rating goes

up by 0.076 for every additional year of experience.

3.9

3.8

3.7

RATING

3.6

3.5

3.4

3.3

3.2

3.1

0

EXPER

Figure xr3.2(a) Estimated regression function

(b)

Using the value tc = t(0.975, 22) = 2.074 , the 95% confidence interval for 2 is given by

b2 tc se(b2 ) = 0.076 2.074 0.044 = (0.015, 0.167)

We are 95% confident that the procedure we have used for constructing a confidence

interval will yield an interval that includes the true parameter 2 .

(c)

To test H 0 : 2 = 0 against H1 : 2 0, we use the test statistic t = b2/se(b2) = 0.076/0.044

= 1.727. The t critical value for a two tail test with N 2 = 22 degrees of freedom is 2.074.

Since 2.074 < 1.727 < 2.074 we fail to reject the null hypothesis.

(d)

To test H 0 : 2 = 0 against H1 : 2 > 0, we use the t-value from part (c), namely t = 1.727 ,

but the right-tail critical value tc = t(0.95, 22) = 1.717 . Since 1.727 > 1.717 , we reject H 0 and

conclude that 2 is positive. Experience has a positive effect on quality rating.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 35

Exercise 3.2 (continued)

(e)

The p-value of 0.0982 is given as the sum of the areas under the t-distribution to the left of

1.727 and to the right of 1.727. We do not reject H 0 because, for = 0.05, p-value >

0.05. We can reject, or fail to reject, the null hypothesis just based on an inspection of the

p-value. Having the p-value > is equivalent to having t < tc = 2.074 .

Figure xr3.2(b) P-value diagram

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

36

EXERCISE 3.3

(a)

(b)

(c)

Hypotheses:

Calculated t-value:

Critical t-value:

H 0 : 2 = 0 against H1 : 2 0

t = 0.310 0.082 = 3.78

tc = t(0.995, 22) = 2.819

Decision:

Reject H 0 because t = 3.78 > tc = 2.819.

Hypotheses:

Calculated t-value:

Critical t-value:

H 0 : 2 = 0 against H1 : 2 > 0

t = 0.310 0.082 = 3.78

tc = t(0.99, 22) = 2.508

Decision:

Reject H 0 because t = 3.78 > tc = 2.508.

Hypotheses:

Calculated t-value:

Critical t-value:

H 0 : 2 = 0 against H1 : 2 < 0

t = 0.310 0.082 = 3.78

tc = t(0.05, 22) = 1.717

Decision:

Do not reject H 0 because t = 3.78 > tc = 1.717.

Figure xr3.3 One tail rejection region

(d)

(e)

Hypotheses:

Calculated t-value:

Critical t-value:

H 0 : 2 = 0.5 against H1 : 2 0.5

t = (0.310 0.5) 0.082 = 2.32

tc = t(0.975, 22) = 2.074

Decision:

Reject H 0 because t = 2.32 < tc = 2.074.

A 99% interval estimate of the slope is given by

b2 tc se(b2 ) = 0.310 2.819 0.082 = (0.079, 0.541)

We estimate 2 to lie between 0.079 and 0.541 using a procedure that works 99% of the

time in repeated samples.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

37

EXERCISE 3.4

(a)

b1 = t se(b1 ) = 1.257 2.174 = 2.733

24

20

MIM

16

12

8

4

0

0

10

20

30

40

50

60

70

80

90

100

PMHS

Figure xr3.4(a) Estimated regression function

(b)

se(b2 ) = b2 t = 0.180 5.754 = 0.0313

(c)

p-value = 2 (1 P(t < 1.257) ) = 2 (1 0.8926) = 0.2147

Figure xr3.4(b) P-value diagram

(d)

The estimated slope b2 = 0.18 indicates that a 1% increase in males 18 and older, who are

high school graduates, increases average income of those males by $180. The positive sign

is as expected; more education should lead to higher salaries.

(e)

Using tc = t(0.995,49) = 2.68 , a 99% confidence interval for the slope is given by

b2 tc se(b2 ) = 0.180 2.68 0.0313 = (0.096, 0.264)

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

38

Exercise 3.4 (continued)

(f)

For testing H 0 : 2 = 0.2 against H1 : 2 0.2, we calculate

t=

0.180 0.2

= 0.639

0.0313

The critical values for a two-tailed test with a 5% significance level and 49 degrees of

freedom are tc = 2.01. Since t = 0.634 lies in the interval (2.01, 2.01), we do not

reject H 0 . The null hypothesis suggests that a 1% increase in males 18 or older, who are

high school graduates, leads to an increase in average income for those males of $200.

Non-rejection of H 0 means that this claim is compatible with the sample of data.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 39

EXERCISE 3.5

(a)

The linear relationship between life insurance and income is estimated as

n = 6.8550 + 3.8802 INCOME

INSURANCE

( 7.3835 )( 0.1121)

(se)

Figure xr3.5 Fitted regression line and mean

(b)

The relationship in part (a) indicates that, as income increases, the amount of life

insurance increases, as is expected. If taken literally, the value of b1 = 6.8550 implies that

if a family has no income, then they would purchase $6855 worth of insurance. However,

given the lack of data in the region where INCOME = 0 , this value is not reliable.

(i) If income increases by $1000, then an estimate of the resulting change in the amount

of life insurance is $3880.20.

(ii) The standard error of b2 is 0.1121. To test a hypothesis about 2 the test statistic is

b2 2

~t

se ( b2 ) ( N 2 )

An interval estimator for 2 is b2 tc se ( b2 ) , b2 + tc se ( b2 ) , where tc is the critical

value for t with ( N 2) degrees of freedom at the level of significance.

(c)

To test the claim, the relevant hypotheses are H0: 2 = 5 versus H1: 2 5. The alternative

2 5 has been chosen because, before we sample, we have no reason to suspect 2 > 5 or

2 < 5. The test statistic is that given in part (b) (ii) with 2 set equal to 5. The rejection

region (18 degrees of freedom) is | t | > 2.101. The value of the test statistic is

t=

b2 5 3.8802 5

=

= 9.99

se ( b2 )

0.1121

As t = 9.99 < 2.101 , we reject the null hypothesis and conclude that the estimated

relationship does not support the claim.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

40

Exercise 3.5 (continued)

(d)

To test the hypothesis that the slope of the relationship is one, we proceed as we did in

part (c), using 1 instead of 5. Thus, our hypotheses are H0: 2 = 1 versus H1: 2 1. The

rejection region is | t | > 2.101. The value of the test statistic is

t=

3.8802 1

= 25.7

0.1121

Since t = 25.7 > tc = 2.101, we reject the null hypothesis. We conclude that the amount of

life insurance does not increase at the same rate as income increases.

(e)

Life insurance companies are interested in household characteristics that influence the

amount of life insurance cover that is purchased by different households. One likely

important determinant of life insurance cover is household income. To see if income is

important, and to quantify its effect on insurance, we set up the model

INSURANCEi = 1 + 2 INCOMEi + ei

where INSURANCEi is life insurance cover by the i-th household, INCOMEi is

household income, 1 and 2 are unknown parameters that describe the relationship, and ei

is a random uncorrelated error that is assumed to have zero mean and constant variance

2 .

To estimate our hypothesized relationship, we take a random sample of 20 households,

collect observations on INSURANCE and INCOME and apply the least-squares estimation

procedure. The estimated equation, with standard errors in parentheses, is

n = 6.8550 + 3.8802 INCOME

INSURANCE

( se )

( 7.3835)( 0.1121)

The point estimate for the response of life-insurance coverage to an income increase of

$1000 (the slope) is $3880 and a 95% interval estimate for this quantity is ($3645, $4116).

This interval is a relatively narrow one, suggesting we have reliable information about the

response. The intercept estimate is not significantly different from zero, but this fact by

itself is not a matter for concern; as mentioned in part (b), we do not give this value a

direct economic interpretation.

The estimated equation could be used to assess likely requests for life insurance and what

changes may occur as a result of income changes.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

41

EXERCISE 3.6

(a)

A 95% interval estimator for 2 is b2 t(0.975,14) se(b2). Using our sample of data the

corresponding interval estimate is

0.3857 2.145 0.03601 = (0.4629, 0.3085)

If we used the interval estimator in repeated samples, then 95% of interval estimates like

the above one would contain 2. Thus, 2 is likely to lie in the range given by the above

interval.

(b)

We set up the hypotheses H0: 2 = 0 versus H1: 2 < 0. The alternative 2 < 0 is chosen

because we would expect the unit costs of production to decline as cumulative production

increases if there is learning. The test statistic, given H0 is true, is

t=

b2

~ t(14)

se(b2 )

The rejection region is t < 1.761. The value of the test statistic is

t=

0.3857

= 10.71

0.03601

Since t = 10.71 < 1.761, we reject H0 and conclude that learning does exist. We

conclude in this way because 10.71 is an unlikely value to have come from the t

distribution which is valid when there is no learning.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

42

EXERCISE 3.7

(a)

We set up the hypotheses H 0 : j = 1 versus H1 : j 1 . The economic relevance of this

test is to test whether the return on the firms stock is risky relative to the market portfolio.

Each beta measures the volatility of the stock relative to the market portfolio and volatility

is often used to measure risk. A beta value of one indicates that the stocks volatility is the

same as that of the market portfolio. The test statistic given H0 is true, is

t=

bj 1

se ( b j )

~ t(118)

The rejection region is t < 1.980 and t > 1.980 , where t(0.975,118) = 1.980 .

The results for each company are given in the following table:

Stock

t-value

Decision rule

Disney

t=

0.9593 1

= 0.287

0.1420

Since 1.98 < t < 1.98 , fail to reject H 0

GE

t=

0.9830 1

= 0.162

0.1047

Since 1.98 < t < 1.98 , fail to reject H 0

GM

t=

1.0744 1

= 0.478

0.1558

Since 1.98 < t < 1.98 , fail to reject H 0

IBM

t=

1.2683 1

= 1.726

0.1554

Since 1.98 < t < 1.98 , fail to reject H 0

Microsoft

t=

1.4299 1

= 2.284

0.1882

Since t > 1.98 , reject H 0

Mobil-Exxon

t=

0.4030 1

= 7.256

0.08228

Since t < 1.98 , reject H 0

For Disney, GE, GM and IBM, we failed to reject the null hypothesis, indicating that the

sample data are consistent with the conjecture that the Disney, GE, GM and IBM stocks

have the same volatility as the market portfolio. For Microsoft and Mobil-Exxon, we

rejected the null hypothesis, and concluded that these two stocks do not have the same

volatility as the market portfolio.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

43

Exercise 3.7 (continued)

(b)

We set up the hypotheses H 0 : j 1 versus H1 : j < 1 . The relevant test statistic, given

H0 is true, is

t=

bj 1

se ( b j )

~ t(118)

The rejection region is t < 1.658 where tc = t(0.05,118) = 1.658 . The value of the test

statistic is

t=

0.4030 1

= 7.256

0.08228

Since t = 7.256 < tc = 1.658, we reject H0 and conclude that Mobil-Exxons beta is less

than 1. A beta equal to 1 suggests a stock's variation is the same as the market variation. A

beta less than 1 implies the stock is less volatile than the market; it is a defensive stock.

(c)

We set up the hypotheses H 0 : j 1 versus H1 : j > 1 . The relevant test statistic, given

H0 is true, is

t=

bj 1

se ( b j )

~ t(118)

The rejection region is t > 1.658 where tc = t(0.95,118) = 1.658 . The value of the test statistic

is

t=

1.4299 1

= 2.284

0.1882

Since t = 2.284 > tc = 1.658, we reject H0 and conclude that Microsofts beta is greater

than 1. A beta equal to 1 suggests a stock's variation is the same as the market variation. A

beta greater than 1 implies the stock is more volatile than the market; it is an aggressive

stock.

(d)

A 95% interval estimator for Microsofts beta is b j t(0.975,118) se(b j ) . Using our sample

of data the corresponding interval estimate is

1.4299 1.980 0.1882 = (1.057, 1.803)

Thus we estimate, with 95% confidence, that Microsofts beta falls in the interval 1.057 to

1.803. It is possible that Microsofts beta falls outside this interval, but we would be

surprised if it did, because the procedure we used to create the interval works 95% of the

time. The problem with the interval estimate is that it is wide. We feel sure that Microsoft

is more volatile than the market, but how much more is not known precisely.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

44

Exercise 3.7 (continued)

(e)

The two hypotheses are H0: j = 0 versus H1: j 0. The test statistic, given H0 is true, is

t=

aj

se ( a j )

~ t(118)

The rejection region is t < 1.980 and t > 1.980 , where t(0.975,118) = 1.980 .

The results for each company are given in the following table:

Stock

t-value

Decision rule

Disney

t=

0.0010

= 0.152

0.0067

Since 1.98 < t < 1.98 , fail to reject H 0

GE

t=

0.0059

= 1.199

0.0049

Since 1.98 < t < 1.98 , fail to reject H 0

GM

t=

0.0023

= 0.317

0.0073

Since 1.98 < t < 1.98 , fail to reject H 0

IBM

t=

0.0068

= 0.940

0.0073

Since 1.98 < t < 1.98 , fail to reject H 0

Microsoft

t=

0.0102

= 1.156

0.0088

Since 1.98 < t < 1.98 , fail to reject H 0

Mobil-Exxon

t=

0.0073

= 1.904

0.0039

Since 1.98 < t < 1.98 , fail to reject H 0

We do not reject the null hypothesis for any of the stocks. This indicates that the sample

data is consistent with the conjecture from economic theory that the intercept term equals

0.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

45

EXERCISE 3.8

(a)

We set up the hypotheses H0: 2 = 0 versus H1: 2 < 0. The alternative 2 < 0 is chosen

because an inverse relationship is one where the dependent variable increases as the

independent variable decreases, and visa versa. Thus, a negative 2 suggests an inverse

relationship between variables. The test statistic, given H0 is true, is

t=

b2

~ t(182)

se(b2 )

The rejection region is t < t(0.05,182) = 1.653 . The value of the test statistic is

t=

194.233

= 19.031

10.2061

Since t = 19.03 < 1.653, we reject the null hypothesis that 2 = 0 and accept the

alternative that 2 < 0 . We conclude that there is a statistically significant inverse

relationship between the number of house starts and the 30-year fixed interest rate.

(b)

We set up the hypotheses H 0 : 2 = 150 versus H1 : 2 150 . The test statistic, given

H0 is true, is

t=

b2 2

~ t(182)

se(b2 )

The rejection region is t < 1.973 and t > 1.973 , with t(0.975,182) = 1.973 . The value of the

test statistic is

t=

194.233 + 150

= 4.334

10.2061

Since t = 4.334 < 1.973, we reject the null hypothesis 2 = 150 and accept the

alternative that 2 150 . The data indicate that, if the 30-year fixed interest rate

increases by 1%, house starts will not fall by 150,000.

(c)

A 95% interval estimate of the slope from the regression estimated in part (a) is:

194.233 1.973 10.2061 = (214.4, 174.1)

This interval estimate suggests that, with 95% confidence, an increase in the 30-year fixed

interest rate by 1% will result in a drop in house starts of between 174,100 to 214,400

houses. We would be surprised if the true value of 2 did not lie in this interval.

In part (b) we tested, at a 5% level of significance, whether 2 = 150 , and we came to the

conclusion that 2 150 . This conclusion is consistent with our interval estimate

because at a 95% level of confidence, 150 lies outside the interval. Remember the

relationship between confidence intervals and hypothesis testing: At a (1 ) level of

confidence and an level of significance, we will not reject a null hypothesis for a

hypothesized value if it falls inside the confidence interval.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e

46

EXERCISE 3.9

(a)

We set up the hypotheses H0: 2 = 0 versus H1: 2 > 0 . The alternative 2 > 0 is chosen

because we assume that growth, if it does influence the vote, will do so in a positive way.

The test statistic, given H0 is true, is

t=

b2

~ t(29)

se(b2 )

The rejection region is t > 1.699 = t(0.95,29) . The value of the test statistic is

t=

0.6599

= 4.0460

0.1631

Since t = 4.0460 > 1.699, we reject the null hypothesis that 2 = 0 and accept the

alternative that 2 > 0 . We conclude that economic growth has a positive effect on the

percentage vote.

(b)

A 95% interval estimate for 2 from the regression in part (a) is:

b2 t(0.975,29) se(b2 ) = 0.6599 2.045 0.1631 = (0.3264, 0.9934)

This interval estimate suggests that, with 95% confidence, the true value of 2 is between

0.3264 and 0.9934. Since 2 represents the change in percentage vote due to economic

growth, we expect that a 1% increase in the growth rate will increase the percentage vote

by an amount between 0.3264 to 0.9934 percent.

(c)

We set up the hypotheses H0: 2 = 0 versus H1: 2 < 0 . The alternative 2 < 0 is chosen

because we assume that inflation, if it does influence the vote, will do so in a negative

way. The test statistic, given H0 is true, is

t=

b2

~ t(29)

se(b2 )

The rejection region is t < 1.699 = t(0.05,29) . The value of the test statistic is

t=

0.4450

= 0.856

0.5197

Since 0.856 > 2.045 , we do not reject the null hypothesis. There is not enough evidence

to suggest inflation has a negative effect on the vote.

(d)

A 95% interval estimate for 2 from the regression in part (c) is:

b2 t(0.975,29) se(b2 ) = 0.4450 2.045 0.5197 = ( 1.508, 0.618)

This interval estimate suggests that, with 95% confidence, the true value of 2 is between

1.508 and 0.618. It suggests that a 1% increase in the inflation rate could increase or

decrease or have no effect on the percentage vote.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 47

EXERCISE 3.10

(a)

The coefficient 2 represents the increase in price from an extra square foot of living area.

We can refer to it as the marginal price per square foot.

(i) A 95% interval estimate of 2 for all houses is:

b2 t(0.975,1078) se(b2 ) = 92.747 1.962 2.4105 = (88.02, 97.48)

We estimate, with 95% confidence, that the marginal price per square foot for all

houses lies between $88.02 and $97.48.

(ii) A 95% interval estimate of 2 for town houses is:

b2 t(0.975,68) se(b2 ) = 55.585 1.995 7.0999 = (41.42, 69.75)

We estimate, with 95% confidence, that the marginal price per square foot for town

houses lies between $41.42 and $69.75.

(iii) A 95% interval estimate of 2 for French style houses is:

b2 t(0.975,95) se(b2 ) = 184.167 1.985 10.1626 = (163.99, 204.34)

We estimate, with 95% confidence, that the marginal price per square foot for French

style houses lies between $163.99 and $204.34.

These confidence interval estimates tell us that town houses have a lower marginal price

per square foot compared to the average, and also that French style houses have a much

higher marginal price per square foot than all houses. Furthermore, we see that the

narrowest confidence interval is that for all houses, reflecting the fact that the larger

sample size provides more information, leading to a smaller standard error and more

precise estimation.

(b)

The results for testing the hypotheses H0: 2 = 80 versus H1: 2 80 are given in the

following table. In each case the test statistic is t = (b2 80) se(b2 ) which has a t( N 2)

distribution if H 0 is true. The rejection region is t < tc and t > tc where tc = t(0.975, N 2) .

Sample

t-value

N 2

tc

Decision rule

All

houses

t=

92.7473 80

= 5.29

2.4105

1078

1.962

t > 1.962, reject H 0

Town

houses

t=

55.5853 80

= 3.44

7.0999

68

1.995

t < 1.995 , reject H 0

French

Style

t=

184.1667 80

= 10.25

10.1626

95

1.985

t > 1.985, reject H 0

All cases lead to the rejection of the null hypothesis. We conclude that an additional

square foot does not add $80 to the average sale price of all houses, the sale price of town

houses, nor the sale price of French style houses.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 48

EXERCISE 3.11

(a)

For all houses in sample:

Hypotheses:

H 0 : 2 = 80 against H1 : 2 80

t = (81.3890 80) 1.9185 = 0.724

Calculated t-value:

Critical t-value:

tc = t(0.975,878) = 1.963

Decision:

Do not reject H 0 because 1.963 < 0.724 < 1.963 .

We conclude that the data is consistent with the conjecture that an additional square foot

of living space is associated with an increase in the sale price of the house by $80.

(b)

For houses that are vacant at time of sale:

H 0 : 2 = 80 against H1 : 2 80

Hypotheses:

t = (69.9080 80) 2.2675 = 4.45

Calculated t-value:

Critical t-value:

tc = t(0.975, 463) = 1.965

Decision:

Reject H 0 because 4.45 < 1.965

We conclude that, for houses that are vacant at time of sale, an additional square foot of

living space is not associated with an increase in the sale price of the house by $80.

(c)

For houses that are occupied at time of sale:

Hypotheses:

H 0 : 2 = 80 against H1 : 2 80

t = (89.2588 80) 3.0394 = 3.05

Calculated t-value:

tc = t(0.975, 413) = 1.966

Critical t-value:

Decision:

Reject H 0 because 3.05 > 1.966 .

We conclude that, for houses that are occupied at time of sale, an additional square foot of

living space is not associated with an increase in the sale price of the house by $80.

(d)

For houses that are occupied at time of sale:

Hypotheses:

H 0 : 2 80 against H1 : 2 > 80

t = (89.2588 80) 3.0394 = 3.05

Calculated t-value:

tc = t(0.95, 413) = 1.649

Critical t-value:

Decision:

Reject H 0 because 3.05 > 1.649

We conclude that, for houses that are occupied at time of sale, an additional square foot of

living space increases the sale price of the house by more than $80.

(e)

For houses that are vacant at time of sale:

Hypotheses:

H 0 : 2 80 against H1 : 2 < 80

t = (69.9080 80) 2.2675 = 4.45

Calculated t-value:

tc = t(0.05, 463) = 1.648

Critical t-value:

Decision:

Reject H 0 because 4.45 < 1.648

We conclude that, for houses that are vacant at time of sale, an additional square foot of

living space increases the sale price by less than $80.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 49

Exercise 3.11 (continued)

(f)

(i) A 95% interval estimate for 2 from the full sample is given by

b2 t(0.975,878) se(b2 ) = 81.389 1.963 1.9185 = (77.62, 85.15)

(ii) A 95% interval estimate for 2 for houses vacant at the time of sale is given by

b2 t(0.975, 463) se(b2 ) = 69.908 1.965 2.2675 = (65.45, 74.36)

(iii) A 95% interval estimate for 2 for houses occupied at the time of sale is given by

b2 t(0.975, 413) se(b2 ) = 89.259 1.966 3.039 = (83.28, 95.23)

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 50

EXERCISE 3.12

(a)

Estimated equation:

n = 8.6658 + 0.0824 EXPER

WAGE

(se)

(t )

( 0.3787 ) ( 0.0173)

( 22.88) ( 4.77 )

The estimated equation tells us that with every year of experience the associated increase

in hourly wage is $0.0824. Furthermore, it tells us that the average wage for those without

experience is $8.6658. The relatively large t-values suggest that the least squares

estimates are statistically significant at a 5% level of significance.

70

60

WAGE

50

40

30

20

10

0

0

10

20

30

40

50

60

EXPER

Figure xr3.12(a) Fitted regression line and observations

(b)

Hypotheses: H 0 : 2 = 0 against H1 : 2 > 0

The test statistic, given H0 is true, is

t=

b2

~ t(998)

se(b2 )

Calculated t-value: t = (0.0824) 0.0173 = 4.769

Critical t-value: tc = t(0.95,998) = 1.646

Decision: Reject H 0 because 4.769 > 1.646

We conclude that the slope of the relationship, 2 , is statistically significant. There is a

positive relationship between the hourly wage and a workers experience.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 51

Exercise 3.12 (continued)

(c)

(i) For females, the estimated equation is:

n = 8.4747 + 0.0209 EXPER

WAGE

(se)

(t )

( 0.4797 ) ( 0.0218)

(17.67 ) ( 0.958)

With every extra year of experience the associated increase in average hourly wage for

females is $0.0209. This estimate is not significantly different from zero, however. The

average wage for females without experience is $8.4747.

50

WAGE

40

30

20

10

0

0

10

15

20

25

30

35

40

45

EXPER

Figure xr3.12(b) Fitted regression line and observations for females

(ii) For males, the estimated equation is:

n = 8.8200 + 0.1448 EXPER

WAGE

(se)

(t )

( 0.5549 ) ( 0.0254 )

(15.89 ) ( 5.698)

With every extra year of experience, the associated increase in average hourly wage for

males is $0.1448. The average wage for males without experience is $8.8200.

70

60

50

WAGE

(c)

40

30

20

10

0

0

10

20

30

40

50

EXPER

Figure xr3.12(c) Fitted regression line and observations for males

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 52

Exercise 3.12(c) (continued)

(c)

(iii) For blacks, the estimated equation is:

n = 6.0054 + 0.1197 EXPER

WAGE

( se )

(t )

( 0.9973) ( 0.0461)

( 6.022 ) ( 2.594 )

With every extra year of experience, the associated increase in average hourly wage for

blacks is $0.1197. The average wage for blacks without experience is $6.0054.

28

24

WAGE

20

16

12

8

4

0

0

10

20

30

40

50

EXPER

Figure xr3.12(d) Fitted regression line and observations for blacks

(iv) For white males, the estimated equation is:

n = 9.0315 + 0.1451EXPER

WAGE

(se)

(t )

( 0.5808) ( 0.0266 )

(15.55) ( 5.452 )

With every extra year of experience the associated increase in average hourly wage for

white males is $0.1451. The average wage for white males without experience is $9.0315.

70

60

50

WAGE

(c)

40

30

20

10

0

0

10

20

30

40

50

60

EXPER

Figure xr3.12(e) Fitted regression line and observations for white males

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 53

Exercise 3.12(c) (continued)

(c)

Comparing the estimated wage equations for the four categories, we find that experience

counts the most, or leads to the largest increase in wages, for white males. The effect is

only slightly less for males in general. It is less for blacks and very small for females. For

those with no experience the wage ranking is white males, males, females, blacks.

(d)

Residual plots

50

40

RESID

30

20

10

0

-10

0

10

20

30

40

50

60

EXPER

Figure xr3.12(f) Plotted residuals for full sample regression

40

RESID

30

20

10

-10

0

12 16 20 24 28 32 36 40 44 48

EXPER

Figure xr3.12(g) Plotted residuals for female regression

50

40

RESID

30

20

10

0

-10

-20

0

10

20

30

40

50

60

EXPER

Figure xr3.12(h) Plotted residuals for male regression

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 54

Exercise 3.12(d) (continued)

(d)

20

15

RESID

10

5

0

-5

-10

0

10

20

30

40

50

60

EXPER

Figure xr3.12(i) Plotted residuals for black regression

50

40

RESID

30

20

10

0

-10

-20

0

10

20

30

40

50

60

EXPER

Figure 3.12(j) Plotted residuals for white male regression

The main observation that can be made from all the residual plots is that the pattern of

positive residuals is quite different from the pattern of negative residuals. There are very

few negative residuals with an absolute magnitude larger than 10, whereas the positive

residuals are often larger than 10, with a few very large ones, and one over 40. These

characteristics suggest a distribution of the errors that is not normally distributed, but

skewed to the right.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 55

EXERCISE 3.13

(a)

Estimated equation:

n = 8.5837 + 0.0842 EXPER

WAGE

(se)

(t )

( 0.1738) ( 0.0078)

( 49.40 ) (10.76 )

With every extra year of experience the associated increase in hourly wage is $0.0842.

The average wage for those without experience is $8.5837. The relatively large t-values

imply the least squares estimates are statistically significant at a 5% level of significance.

80

70

60

WAGE

50

40

30

20

10

0

0

10

20

30

40

50

EXPER

Figure xr3.13(a) Fitted regression line and observations using all data

(b)

Hypotheses: H 0 : 2 = 0 against H1 : 2 > 0 . The test statistic, given H0 is true, is

t=

b2

~ t(4731)

se(b2 )

Calculated t-value: t = (0.0842) 0.0078 = 10.76

Critical t-value: tc = t(0.95, 4731) = 1.645

Decision: Reject H 0 because t = 10.76 > tc = 1.645

We conclude that the slope of the relationship, 2 , is statistically significant. There is a

positive relationship between the hourly wage and a workers experience.

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 56

Exercise 3.13 (continued)

(c)

(i) For females, the estimated equation is:

n = 8.0375 + 0.0501EXPER

WAGE

(se)

(t )

( 0.2285 ) ( 0.0103)

( 35.18) ( 4.856 )

With every extra year of experience the associated increase in average hourly wage for

females is $0.0501. The average wage for females without experience is $8.0375.

80

70

60

WAGE

50

40

30

20

10

0

0

10

20

30

40

50

EXPER

Figure 3.13(b) Fitted regression line and observations for females

(ii) For males, the estimated equation is:

n = 9.1170 + 0.1153EXPER

WAGE

(se)

(t )

( 0.2510 ) ( 0.0113)

( 36.32 ) (10.216 )

With every extra year of experience the associated increase in average hourly wage for

males is $0.1153. The average wage for males without experience is $9.1170.

80

70

60

50

WAGE

(c)

40

30

20

10

0

0

10

20

30

40

50

EXPER

Figure xr3.13(c) Fitted regression line and observations for males

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 57

Exercise 3.13(c) (continued)

(c)

(iii) For blacks, the estimated equation is:

n = 7.3825 + 0.0667 EXPER

WAGE

(se)

(t )

( 0.5002 ) ( 0.0233)

(14.76 ) ( 2.860 )

With every extra unit of experience the associated increase in average hourly wage for

blacks is $0.0667. The average wage for blacks without experience is $7.3825.

40

WAGE

30

20

10

0

0

10

20

30

40

50

EXPER

Figure xr3.13(d) Fitted regression line and observations for blacks

(iv) For white males, the estimated equation is:

n = 9.2606 + 0.1164 EXPER

WAGE

(se)

(t )

( 0.2644 ) ( 0.0118 )

( 35.02 ) ( 9.847 )

With every extra year of experience the associated increase in average hourly wage for

white males is $0.1164. The average wage for white males without experience is $9.2606.

80

70

60

50

WAGE

(c)

40

30

20

10

0

0

10

20

30

40

50

60

EXPER

Figure xr3.13(e) Fitted regression line and observations for white males

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 58

Exercise 3.13(c) (continued)

(c)

Comparing the estimated wage equations for the four categories, we find that experience

counts the most, or leads to the largest increase in wages, for white males. The effect is

only slightly less for males in general. For blacks experience is worth slightly more than

half of what it is for white males. For females experience is worth slightly less than half of

what it is for white males. For those with no experience the wage ranking is white males,

males, females, blacks.

(d)

Residual plots

70

60

50

RESID

40

30

20

10

0

-10

-20

0

10

20

30

40

50

60

EXPER

Figure xr3.13(f) Plotted residuals for full sample regression

70

60

50

RESID

40

30

20

10

0

-10

0

10

20

30

40

50

60

EXPER

Figure xr3.13(g) Plotted residuals for female regression

Chapter 3, Exercise Solutions, Principles of Econometrics, 3e 59

Exercise 3.13(d) (continued)

(d)

70

60

50

RESID

40

30

20

10

0

-10

-20

0

10

20

30

40

50

60

EXPER

Figure xr3.13(h) Plotted residuals for male regression

40

RESID

30

20

10

-10

0

10

20

30

40

50

60

EXPER

Figure xr3.13(i) Plotted residuals for black regression

70

60

50

RESID

40

30

20

10

0

-10

-20

0

10

20

30

40

50

60

EXPER

Figure xr3.13(j)

Plotted residuals for white male regression

In all residual plots the pattern of positive residuals is quite different from the pattern of

negative residuals. There are very few negative residuals with an absolute magnitude

larger than 10, whereas the positive residuals are often larger than 10, with a few very

large ones, and one over 40. These characteristics suggest a distribution of the errors that

is not normally distributed, but skewed to the right.

Potrebbero piacerti anche

- CH 03Documento21 pagineCH 03HOSSEIN POORKHADEM NAMINNessuna valutazione finora

- 16 CH11a-isbe11Documento135 pagine16 CH11a-isbe11tomNessuna valutazione finora

- Assignment On Chapter-10 (Maths Solved) Business Statistics Course Code - ALD 2104Documento32 pagineAssignment On Chapter-10 (Maths Solved) Business Statistics Course Code - ALD 2104Sakib Ul-abrarNessuna valutazione finora

- ECON310 Q1 - KeyDocumento5 pagineECON310 Q1 - KeyRefiye ÇakmakNessuna valutazione finora

- Final Exam ReviewDocumento6 pagineFinal Exam Reviewgunjand1994Nessuna valutazione finora

- Answer Chapter 4 - Basic Estimation TechniquesDocumento2 pagineAnswer Chapter 4 - Basic Estimation Techniquesdylla ningsihNessuna valutazione finora

- FRM Quantitative Analysis Test 1 SolutionsDocumento4 pagineFRM Quantitative Analysis Test 1 SolutionsConradoCantoIIINessuna valutazione finora

- Intervalos de Confianza y Pruebas de HipótesisDocumento16 pagineIntervalos de Confianza y Pruebas de HipótesisANDRES100% (1)

- Answer To The Question No 1Documento3 pagineAnswer To The Question No 1Santo SahaNessuna valutazione finora

- Chapter 14 SolutionsDocumento11 pagineChapter 14 SolutionsDonna StampsNessuna valutazione finora

- Design of Experiments. Montgomery DoEDocumento6 pagineDesign of Experiments. Montgomery DoEstudycamNessuna valutazione finora

- HomeworkDocumento25 pagineHomeworkPhuong Uyen Du NgocNessuna valutazione finora

- Econometrics Assignment 1Documento6 pagineEconometrics Assignment 1Jovias KelvinsunNessuna valutazione finora

- Chapter 3-Multiple Regression ModelDocumento26 pagineChapter 3-Multiple Regression ModelMuliana SamsiNessuna valutazione finora

- Multiple Regression Models: Ey X X XDocumento27 pagineMultiple Regression Models: Ey X X Xsamspeed7Nessuna valutazione finora

- Lecture 10 Test TDocumento4 pagineLecture 10 Test TbravotolitsNessuna valutazione finora

- AP Statistics - Chapter 14 Review Name - Part I - Multiple Choice (Questions 1-7) - Circle The Answer of Your ChoiceDocumento3 pagineAP Statistics - Chapter 14 Review Name - Part I - Multiple Choice (Questions 1-7) - Circle The Answer of Your ChoiceChristine Mae TorrianaNessuna valutazione finora

- Econ107 Assignment 1 PrepDocumento9 pagineEcon107 Assignment 1 Prepjusleen.sarai03Nessuna valutazione finora

- PLDocumento5 paginePLMy SpotifyNessuna valutazione finora

- yit = β0 + β1xit,1 + β2xit,2 + β3xit,3 + β4xit,4 + uit ,x ,x ,x ,β ,β ,β ,βDocumento10 pagineyit = β0 + β1xit,1 + β2xit,2 + β3xit,3 + β4xit,4 + uit ,x ,x ,x ,β ,β ,β ,βSaad MasoodNessuna valutazione finora

- CH 3 SolutionsDocumento10 pagineCH 3 SolutionsAndy LeeNessuna valutazione finora

- ECON7310: Elements of Econometrics: Research Project 2Documento29 pagineECON7310: Elements of Econometrics: Research Project 2Saad MasoodNessuna valutazione finora

- Quess 2: The 95% Confidence Interval For The Population Proportion P Is (0.1608, 0.2392)Documento7 pagineQuess 2: The 95% Confidence Interval For The Population Proportion P Is (0.1608, 0.2392)Tajinder SinghNessuna valutazione finora

- 2Documento4 pagine2SagarNessuna valutazione finora

- EC404 - Monsoon 2016 - Introduction To Statistics and Econometrics Archana Aggarwal Problem Set 2 Answers 7, 8 9, 13. 307, SSS-IIDocumento2 pagineEC404 - Monsoon 2016 - Introduction To Statistics and Econometrics Archana Aggarwal Problem Set 2 Answers 7, 8 9, 13. 307, SSS-IITania SahaNessuna valutazione finora

- Aplikasi Statistika & Probabilitas - GroupA - Ade Klarissa MartantiDocumento17 pagineAplikasi Statistika & Probabilitas - GroupA - Ade Klarissa MartantiMartanti Aji PangestuNessuna valutazione finora

- Simple RegressionDocumento35 pagineSimple RegressionHimanshu JainNessuna valutazione finora

- Econ 466 HW 7Documento5 pagineEcon 466 HW 7Patrick AndrewNessuna valutazione finora

- + LNC + Lni + LNG +: GDP Growth Rate F (Consumption, Fdi, Government)Documento14 pagine+ LNC + Lni + LNG +: GDP Growth Rate F (Consumption, Fdi, Government)فايز زينيNessuna valutazione finora

- Assignment02 - 60162020005 - Daud Wahyu Imani - Tugas Uji HipotesisDocumento27 pagineAssignment02 - 60162020005 - Daud Wahyu Imani - Tugas Uji HipotesisDaud WahyuNessuna valutazione finora

- Cifre Semnificative KawDocumento7 pagineCifre Semnificative KawOctavian MihaiNessuna valutazione finora

- Bith212 Unit 1 IntegersDocumento35 pagineBith212 Unit 1 IntegersAntonateNessuna valutazione finora

- 4818 Exam2aDocumento5 pagine4818 Exam2aMaliha JahanNessuna valutazione finora

- Chapter 14 - Multiple RegressionDocumento17 pagineChapter 14 - Multiple RegressionNew Account AngNessuna valutazione finora

- EE4 Ch04 Solutions ManualDocumento12 pagineEE4 Ch04 Solutions ManualKavya SanjayNessuna valutazione finora

- Lecture 6Documento3 pagineLecture 6Syeda Umyma FaizNessuna valutazione finora

- Ch02 SolutionDocumento38 pagineCh02 SolutionSharif M Mizanur Rahman90% (10)

- Hypothesis Testing (WithSolutions)Documento32 pagineHypothesis Testing (WithSolutions)Martina ManginiNessuna valutazione finora

- Statistics The Second.Documento8 pagineStatistics The Second.Oliyad KondalaNessuna valutazione finora

- 02 Measuring ErrorDocumento6 pagine02 Measuring ErrorJet GamezNessuna valutazione finora

- MAT 540 Statistical Concepts For ResearchDocumento24 pagineMAT 540 Statistical Concepts For Researchnequwan79Nessuna valutazione finora

- Introduction To Data Analysis SolutionsDocumento5 pagineIntroduction To Data Analysis SolutionsOumaima ZiatNessuna valutazione finora

- First Midterm (Practice With Solution)Documento3 pagineFirst Midterm (Practice With Solution)umutNessuna valutazione finora

- Tugas 1 EkmanDocumento8 pagineTugas 1 EkmanTata Winda LesmanaNessuna valutazione finora

- Unit 6 Hypothesis Testing Ex 1Documento4 pagineUnit 6 Hypothesis Testing Ex 1hyotbnNessuna valutazione finora

- Econometrics HomeworkDocumento11 pagineEconometrics HomeworkkmbibireddyNessuna valutazione finora

- 10 - Regression 1Documento58 pagine10 - Regression 1ruchit2809Nessuna valutazione finora

- Running Head: Problem Solving AssignmentDocumento11 pagineRunning Head: Problem Solving AssignmentKashémNessuna valutazione finora

- Goldman IsaacHW#6Documento4 pagineGoldman IsaacHW#6Isaac GNessuna valutazione finora

- Answered Sheets CombinedDocumento52 pagineAnswered Sheets CombinedrayanmaazsiddigNessuna valutazione finora

- MHA 610 Week 4 AssignmentDocumento7 pagineMHA 610 Week 4 Assignmentthis hihiNessuna valutazione finora

- Probability and Statistics Homework - Point Estimation Chapter 7. Statistical Intervals Based On A Single SampleDocumento3 pagineProbability and Statistics Homework - Point Estimation Chapter 7. Statistical Intervals Based On A Single SampleTrương ThắngNessuna valutazione finora

- 2010 Mock SolutionsDocumento7 pagine2010 Mock SolutionsS.L.L.CNessuna valutazione finora

- ISOM2500 Spring 2019 Assignment 3 Suggested SolutionDocumento3 pagineISOM2500 Spring 2019 Assignment 3 Suggested SolutionChing Yin HoNessuna valutazione finora

- POQ:quizDocumento10 paginePOQ:quizHarsh ShrinetNessuna valutazione finora

- Poe AnswersDocumento78 paginePoe AnswersNguyen Xuan Nguyen100% (2)

- Solutions Manual to accompany Introduction to Linear Regression AnalysisDa EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisValutazione: 1 su 5 stelle1/5 (1)

- Review Material BSDocumento55 pagineReview Material BSTimroo HamroNessuna valutazione finora

- Implan Pro Manual v2 3rd EditionDocumento438 pagineImplan Pro Manual v2 3rd EditionTimroo HamroNessuna valutazione finora

- Annotated Bibliography Free Market EnvironmentalismDocumento17 pagineAnnotated Bibliography Free Market EnvironmentalismTimroo HamroNessuna valutazione finora

- Applied Multivariate Statistical Analysis 6E【课后习题答案】Documento369 pagineApplied Multivariate Statistical Analysis 6E【课后习题答案】xyunchao81% (80)

- Cond ExpDocumento8 pagineCond ExpWaseem AbbasNessuna valutazione finora

- Principles of Econometrics 3 Ed - CH 2 Exercise SolutionsDocumento30 paginePrinciples of Econometrics 3 Ed - CH 2 Exercise SolutionsStephen DowningNessuna valutazione finora

- The Impact of Career Planning and Career Satisfaction On Employees Turnover IntentionDocumento16 pagineThe Impact of Career Planning and Career Satisfaction On Employees Turnover IntentionBhavya ShrivastavaNessuna valutazione finora

- The Application of Environmental Management Accounting On Financial Performance of Cement Industry in Uganda PDFDocumento67 pagineThe Application of Environmental Management Accounting On Financial Performance of Cement Industry in Uganda PDFCheska VergaraNessuna valutazione finora

- Program Schedule Phase 2Documento2 pagineProgram Schedule Phase 2priya dharshiniNessuna valutazione finora

- The Effectiveness of Using Quipper School Teaching Materials Towards StudentsDocumento44 pagineThe Effectiveness of Using Quipper School Teaching Materials Towards StudentsLyn LynNessuna valutazione finora

- Implementasi Evidence Based Nursing Pada Pasien Dengan Stroke Non-Hemoragik: Studi KasusDocumento7 pagineImplementasi Evidence Based Nursing Pada Pasien Dengan Stroke Non-Hemoragik: Studi KasusHerman HermanNessuna valutazione finora

- Models Relating Mixture Composition To The Density and Strength of Foam Concrete Using Response Surface Methodology - Nambiar & Ramamurthy 2006 PDFDocumento9 pagineModels Relating Mixture Composition To The Density and Strength of Foam Concrete Using Response Surface Methodology - Nambiar & Ramamurthy 2006 PDFalexnlima852Nessuna valutazione finora

- Mr. Narasareddy P B I Year M.Sc. Nursing, Child Health Nursing Akshaya College of Nursing, 2 Cross, Ashok Nagar, TumkurDocumento15 pagineMr. Narasareddy P B I Year M.Sc. Nursing, Child Health Nursing Akshaya College of Nursing, 2 Cross, Ashok Nagar, TumkurAsha JiluNessuna valutazione finora

- ML Studio OverviewDocumento1 paginaML Studio OverviewFulga BogdanNessuna valutazione finora

- Little's Law*: *J. D. C. Little, A proof of the queueing formula: L = λW,Documento25 pagineLittle's Law*: *J. D. C. Little, A proof of the queueing formula: L = λW,Mariam MassaȜdehNessuna valutazione finora

- Edinburgh University Geography DissertationDocumento4 pagineEdinburgh University Geography DissertationCustomNotePaperCanada100% (1)

- Alvan Feinstein - Multivariable Analysis - An Introduction-Yale University Press (1996)Documento629 pagineAlvan Feinstein - Multivariable Analysis - An Introduction-Yale University Press (1996)Maria Gabriela AponteNessuna valutazione finora

- From Intentions To ActionsDocumento29 pagineFrom Intentions To ActionsYoga wahyu aji PradanaNessuna valutazione finora

- Encyclopedia of Clinical Pharmacy PDFDocumento958 pagineEncyclopedia of Clinical Pharmacy PDFMichael J George100% (2)

- Topic 7 - Building Powerful Marketing PlanDocumento42 pagineTopic 7 - Building Powerful Marketing PlanAgnes TeoNessuna valutazione finora

- BRM AssignmentsDocumento3 pagineBRM Assignmentsbbsmu25% (4)

- Câu hỏi và đáp ánDocumento2 pagineCâu hỏi và đáp ánMai Trâm TốngNessuna valutazione finora

- Carbon Footprint: Senior High School Students' Level of Environmental Knowledge and Its Relationship To Their Environmental SensitivityDocumento28 pagineCarbon Footprint: Senior High School Students' Level of Environmental Knowledge and Its Relationship To Their Environmental SensitivityJuliet Ileto Villaruel - AlmonacidNessuna valutazione finora

- Approximation Models in Optimization Functions: Alan D Iaz Manr IquezDocumento25 pagineApproximation Models in Optimization Functions: Alan D Iaz Manr IquezAlan DíazNessuna valutazione finora

- AVT Project SoftDocumento89 pagineAVT Project SoftStenu Joseph Johny67% (3)

- Crime Scene Search MethodDocumento16 pagineCrime Scene Search MethodSherry MalikNessuna valutazione finora

- Theories of LeadershipDocumento24 pagineTheories of Leadershipsija-ekNessuna valutazione finora

- Project Profile Information FormDocumento2 pagineProject Profile Information Formgeza_szabo5001Nessuna valutazione finora

- Tips For Structuring Better Brainstorming Sessions - InspireUXDocumento7 pagineTips For Structuring Better Brainstorming Sessions - InspireUXJonathan Bates0% (1)

- Grade 12 Holiday HWDocumento19 pagineGrade 12 Holiday HWVed PanickerNessuna valutazione finora

- CSE Policy Brief - BangladeshDocumento20 pagineCSE Policy Brief - BangladeshTasnia DiaNessuna valutazione finora

- Organizational Learning Capability (1998)Documento230 pagineOrganizational Learning Capability (1998)Sara Kožić100% (1)

- PHD Dissertation Topics in Human Resource ManagementDocumento5 paginePHD Dissertation Topics in Human Resource ManagementWriteMyPaperCanadaSingaporeNessuna valutazione finora

- STF38 Reliability Data For Control and Safety Systems 1998Documento47 pagineSTF38 Reliability Data For Control and Safety Systems 1998Sara ZaedNessuna valutazione finora

- Binder (1998) - RQFA - 11 111-137Documento27 pagineBinder (1998) - RQFA - 11 111-137nira_110Nessuna valutazione finora

- Research Proposal of Role of Cooperatives On Women EmpowermentDocumento9 pagineResearch Proposal of Role of Cooperatives On Women EmpowermentSagar SunuwarNessuna valutazione finora