Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

QS16 - Class Exercises Solution

Caricato da

lyk0texDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

QS16 - Class Exercises Solution

Caricato da

lyk0texCopyright:

Formati disponibili

Accounting 225 Quiz Section #16

Chapter 13 Class Exercises Solution

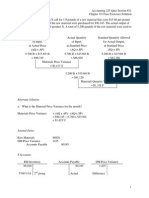

1. The following data concern an investment project:

The working capital will be released for use elsewhere at the conclusion of the project. Compute

the project's net present value.

2. Bradley Company's required rate of return is 14%. The company has an opportunity to be the

exclusive distributor of a very popular consumer item. No new equipment would be needed, but

the company would have to use one-fourth of the space in a warehouse it owns. The warehouse

cost $200,000 new. The warehouse is currently half-empty and there are no other plans to use the

empty space. In addition, the company would have to invest $100,000 in working capital to carry

inventories and accounts receivable for the new product line. The company would have the

distributorship for only 5 years. The distributorship would generate a $17,000 annual net cash

inflow.

What is the net present value of the project at a discount rate of 14 per cent? Should the project

be accepted?

Yes, the distributorship should be accepted since the project has a positive net present value.

Accounting 225 Quiz Section #16

Chapter 13 Class Exercises Solution

3. Monson Company is considering three investment opportunities with cash flows as described

below:

Compute the net present value of each project assuming Monson Company uses a 12% discount

rate.

Accounting 225 Quiz Section #16

Chapter 13 Class Exercises Solution

4. Tranter, Inc., is considering a project that would have a ten-year life and would require a

$1,200,000 investment in equipment. At the end of ten years, the project would terminate and the

equipment would have no salvage value. The project would provide net operating income each

year as follows:

All of the above items, except for depreciation, represent cash flows. The company's required

rate of return is 12%.

a) Compute the project's net present value.

Because depreciation is the only noncash item on the income statement, the annual net cash flow

can be computed by adding back depreciation to net operating income.

b) Compute the project's internal rate of return to the nearest whole percent.

The formula for computing the factor of the internal rate of return (IRR) is:

Factor of the IRR = Investment required Annual net cash inflow

$1,200,000 $300,000 = 4.00 Factor

To the nearest whole percent, the internal rate of return is 21%

Accounting 225 Quiz Section #16

Chapter 13 Class Exercises Solution

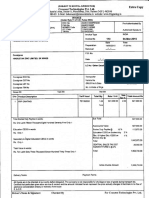

5. The Wisbley Company is contemplating the purchase of a helicopter for its executives to use

in their business trips. This helicopter could be either purchased or leased from the manufacturer.

The useful life of the helicopter is four years. Data concerning these two alternatives follow:

If the helicopter is leased, it would be returned to the manufacturer in four years. Wisbley's

required rate of return is 22%.

a) What would be the present value of all the cash outflows for rental payments, if the

helicopter is leased?

Present value = ($250,000) x 2.494 = ($623,500)

b) What would be the present value of the cash outflows for repairs, assuming the helicopter is

purchased?

Present value = ($6,000 x 0.672) + ($8,000 x 0.551) =$4,032 + $4,408 = $8,440

c) What would be the present value of the salvage value of the helicopter, if the helicopter is

purchased?

Present value = $270,000 x 0.451 = $121,770

d) What is the incremental net present value in favor of leasing rather than purchasing (rounded

off to the nearest hundred dollars)?

The net present value of the cash outflows under the leasing alternative is $623,500 ($250,000 x

2.494). The net present value of the cash outflows under the purchase alternative is $811,610

{$24,940 ($10,000 x 2.494) + $8,440 [($6,000 x 0.672) + ($8,000 x 0.551)] - $121,770

($270,000 x 0.451) + $900,000}. The leasing alternative's net present value of cash outflows is

less than purchase alternative's net present value of cash outflows by $188,110 ($623,500 vs.

$811,610).

Accounting 225 Quiz Section #16

Chapter 13 Class Exercises Solution

6. Bill Anders retires in 8 years. He has $650,000 to invest and is considering a franchise for a

fast-food outlet. He would have to purchase equipment costing $500,000 to equip the outlet and

invest an additional $150,000 for inventories and other working capital needs. Other outlets in

the fast-food chain have an annual net cash inflow of about $160,000. Mr. Anders would close

the outlet in 8 years. He estimates that the equipment could be sold at that time for about 10% of

its original cost. Mr. Anders' required rate of return is 16%.

What is the investment's net present value when the discount rate is 16 percent? Is this an

acceptable investment?

Yes, the outlet is an acceptable investment because its net present value is positive.

Potrebbero piacerti anche

- FinAcc 1 Quiz 6Documento10 pagineFinAcc 1 Quiz 6Kimbol Calingayan100% (1)

- Auditing Problem 2Documento1 paginaAuditing Problem 2jhobs100% (1)

- D15Documento12 pagineD15neo14Nessuna valutazione finora

- MAS - Group 5Documento7 pagineMAS - Group 5beleky watersNessuna valutazione finora

- Quiz-3 Cost2 BSA4Documento6 pagineQuiz-3 Cost2 BSA4Kathlyn Postre0% (1)

- Afar IcpaDocumento6 pagineAfar IcpaAndrea Lyn Salonga CacayNessuna valutazione finora

- Plants, Property and EquipmentDocumento21 paginePlants, Property and EquipmentAna Mae HernandezNessuna valutazione finora

- MA PresentationDocumento6 pagineMA PresentationbarbaroNessuna valutazione finora

- Cup 3 Questions Answer KeyDocumento34 pagineCup 3 Questions Answer KeyDenmarc John AragosNessuna valutazione finora

- HB Quiz 2018-2021Documento3 pagineHB Quiz 2018-2021Allyssa Kassandra LucesNessuna valutazione finora

- Standard Costing 1.1Documento3 pagineStandard Costing 1.1Lhorene Hope DueñasNessuna valutazione finora

- This Study Resource Was: C. P6,050,000 D. P53,900Documento2 pagineThis Study Resource Was: C. P6,050,000 D. P53,900Nah HamzaNessuna valutazione finora

- AcctgDocumento35 pagineAcctgKariz CodogNessuna valutazione finora

- Pup-Ppe6-Src 2-1Documento7 paginePup-Ppe6-Src 2-1hellokittysaranghae0% (2)

- Midterm Exam No. 2Documento1 paginaMidterm Exam No. 2Anie MartinezNessuna valutazione finora

- Quiz 17Documento2 pagineQuiz 17warning urgentNessuna valutazione finora

- Depn CompDocumento3 pagineDepn CompCassandra Dianne Ferolino MacadoNessuna valutazione finora

- The Amount To Be Capitalized by Lessee To Right of Use AssetDocumento1 paginaThe Amount To Be Capitalized by Lessee To Right of Use Assetmax pNessuna valutazione finora

- Finman Midterms Part 1Documento7 pagineFinman Midterms Part 1JerichoNessuna valutazione finora

- Adms 2510 Winter 2007 Final ExaminationDocumento11 pagineAdms 2510 Winter 2007 Final ExaminationMohsin Rehman0% (1)

- Problem 3 LessorDocumento7 pagineProblem 3 LessorGelo Owss33% (9)

- Cost and Management Accounting Framework: Learning ObjectivesDocumento14 pagineCost and Management Accounting Framework: Learning ObjectivesHeart Erica AbagNessuna valutazione finora

- Ans For Decision MakingDocumento5 pagineAns For Decision MakingSellKcNessuna valutazione finora

- Cost AccountingDocumento6 pagineCost Accountingulquira grimamajowNessuna valutazione finora

- Conceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaDocumento2 pagineConceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaJm SevallaNessuna valutazione finora

- 25 Profit-Performance Measurements & Intracompany Transfer PricingDocumento13 pagine25 Profit-Performance Measurements & Intracompany Transfer PricingLaurenz Simon ManaliliNessuna valutazione finora

- AP Problems 2015Documento20 pagineAP Problems 2015Rodette Adajar Pajanonot100% (1)

- First QuizDocumento4 pagineFirst QuizArn HicoNessuna valutazione finora

- Cost Concepts, Classification and Segregation: M.S.M.CDocumento7 pagineCost Concepts, Classification and Segregation: M.S.M.CAllen CarlNessuna valutazione finora

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocumento12 pagineGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNessuna valutazione finora

- Cgu ProblemsDocumento2 pagineCgu ProblemsAlizeyyNessuna valutazione finora

- Quiz FarDocumento4 pagineQuiz Farfrancis dungcaNessuna valutazione finora

- Standard Costs and Variance Analysis Standard Costs and Variance AnalysisDocumento26 pagineStandard Costs and Variance Analysis Standard Costs and Variance Analysischiji chzzzmeowNessuna valutazione finora

- Equity YyyDocumento33 pagineEquity YyyJude SantosNessuna valutazione finora

- CA 04 - Job Order CostingDocumento17 pagineCA 04 - Job Order CostingJoshua UmaliNessuna valutazione finora

- 07 Task Performance 1 - AuditDocumento5 pagine07 Task Performance 1 - AuditJen DeloyNessuna valutazione finora

- Audit of IntangiblesDocumento2 pagineAudit of IntangiblesJaycee FabriagNessuna valutazione finora

- Intangible Assets SoftwareDocumento3 pagineIntangible Assets SoftwareZerjo CantalejoNessuna valutazione finora

- Acceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting DecisionsDocumento12 pagineAcceptance-or-Rejection Decisions: Decisions. Managers Encounter Two (2) Types of Capital-Budgeting Decisionsstannis69420Nessuna valutazione finora

- MAS - ElimDocumento5 pagineMAS - ElimSVTKhsiaNessuna valutazione finora

- Acctg 100G 02Documento4 pagineAcctg 100G 02lov3m3100% (1)

- SC PracticeDocumento6 pagineSC Practicefatima airis aradais100% (1)

- Intermediate Accounting Exercise 2 FinalsDocumento2 pagineIntermediate Accounting Exercise 2 FinalsJune Maylyn MarzoNessuna valutazione finora

- Q Manacc1 Bep 2019Documento5 pagineQ Manacc1 Bep 2019Deniece RonquilloNessuna valutazione finora

- Quiz 2 - Corp Liqui and Installment SalesDocumento8 pagineQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNessuna valutazione finora

- Repair Cost Probabilit yDocumento2 pagineRepair Cost Probabilit yNicole AguinaldoNessuna valutazione finora

- ProblemsDocumento9 pagineProblemsMark Angelo AlvarezNessuna valutazione finora

- Review Exercise ADocumento5 pagineReview Exercise AFitz Gerald BalbaNessuna valutazione finora

- Quiz (Relevant - Costing) - MT - ContDocumento3 pagineQuiz (Relevant - Costing) - MT - ContExequielCamisaCrusperoNessuna valutazione finora

- Solve Me PDFDocumento1 paginaSolve Me PDFWinona Anne EscarezNessuna valutazione finora

- Cost Accounting Chapter1Documento6 pagineCost Accounting Chapter1Jhon Ariel JulatonNessuna valutazione finora

- P 1Documento27 pagineP 1Mark Lorenz SarionNessuna valutazione finora

- p1 QuizDocumento3 paginep1 QuizEvita Faith LeongNessuna valutazione finora

- 2016 Vol 1 CH 8 Answers - Fin Acc SolManDocumento7 pagine2016 Vol 1 CH 8 Answers - Fin Acc SolManPamela Cruz100% (1)

- Department of Accountancy: Bank Reconciliation and Proof of CashDocumento3 pagineDepartment of Accountancy: Bank Reconciliation and Proof of CashAsterism LoneNessuna valutazione finora

- QS16 - Class ExercisesDocumento5 pagineQS16 - Class Exerciseslyk0texNessuna valutazione finora

- MC AnswerDocumento24 pagineMC AnswerMiss MegzzNessuna valutazione finora

- Capital Budgeting: Key Topics To KnowDocumento11 pagineCapital Budgeting: Key Topics To KnowBernardo KristineNessuna valutazione finora

- MAS Compre Quiz To PrintDocumento3 pagineMAS Compre Quiz To PrintJuly LumantasNessuna valutazione finora

- MAS Midterm Quiz 2Documento4 pagineMAS Midterm Quiz 2Joseph John SarmientoNessuna valutazione finora

- QS15 - Class Exercises SolutionDocumento5 pagineQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS14 - Class Exercises SolutionDocumento4 pagineQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS16 - Class ExercisesDocumento5 pagineQS16 - Class Exerciseslyk0texNessuna valutazione finora

- QS13 - Class Exercises SolutionDocumento2 pagineQS13 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS12 - Midterm 2 Review SolutionDocumento7 pagineQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS11 - Class Exercises SolutionDocumento8 pagineQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS12 - Midterm 2 ReviewDocumento5 pagineQS12 - Midterm 2 Reviewlyk0texNessuna valutazione finora

- QS06 - Class Exercises SolutionDocumento2 pagineQS06 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS09 - Class ExercisesDocumento4 pagineQS09 - Class Exerciseslyk0texNessuna valutazione finora

- QS09 - Class Exercises SolutionDocumento4 pagineQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS08 - Class Exercises SolutionDocumento5 pagineQS08 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS07 - Class Exercises SolutionDocumento8 pagineQS07 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS06 - Class ExercisesDocumento3 pagineQS06 - Class Exerciseslyk0texNessuna valutazione finora

- QS05 - Class Exercises SolutionDocumento3 pagineQS05 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS04 - Class ExercisesDocumento3 pagineQS04 - Class Exerciseslyk0texNessuna valutazione finora

- QS04 - Class Exercises SolutionDocumento3 pagineQS04 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS02 - Class ExercisesDocumento3 pagineQS02 - Class Exerciseslyk0texNessuna valutazione finora

- Fundamentals of AccountingDocumento5 pagineFundamentals of AccountingJayelleNessuna valutazione finora

- mgm3180 1328088793Documento12 paginemgm3180 1328088793epymaliNessuna valutazione finora

- CH 12Documento27 pagineCH 12DewiRatihYunusNessuna valutazione finora

- Groen BPP-40E Tilt SkilletDocumento2 pagineGroen BPP-40E Tilt Skilletwsfc-ebayNessuna valutazione finora

- Targeting and Positioning in Rural MarketDocumento17 pagineTargeting and Positioning in Rural MarketPallavi MittalNessuna valutazione finora

- Chp14 StudentDocumento72 pagineChp14 StudentChan ChanNessuna valutazione finora

- Case Study 1 - GilletteDocumento1 paginaCase Study 1 - GilletteLex JonesNessuna valutazione finora

- FRBM Act: The Fiscal Responsibility and Budget Management ActDocumento12 pagineFRBM Act: The Fiscal Responsibility and Budget Management ActNaveen DsouzaNessuna valutazione finora

- Lorenzo Shipping V ChubbDocumento1 paginaLorenzo Shipping V Chubbd2015member0% (1)

- Managenet AC - Question Bank SSDocumento18 pagineManagenet AC - Question Bank SSDharshanNessuna valutazione finora

- Case Study 2 ContinentalDocumento2 pagineCase Study 2 ContinentalSandeep Konda100% (2)

- HZL 4100070676 Inv Pay Slip PDFDocumento12 pagineHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniNessuna valutazione finora

- 2016 04 1420161336unit3Documento8 pagine2016 04 1420161336unit3Matías E. PhilippNessuna valutazione finora

- Answer Scheme Question 1 (30 Marks) A.: Bkam3023 Management Accounting IiDocumento14 pagineAnswer Scheme Question 1 (30 Marks) A.: Bkam3023 Management Accounting IiTeh Chu LeongNessuna valutazione finora

- Valeant Case SummaryDocumento2 pagineValeant Case Summaryvidhi100% (1)

- 3 Sem EcoDocumento10 pagine3 Sem EcoKushagra SrivastavaNessuna valutazione finora

- Problem Set3Documento4 pagineProblem Set3Jack JacintoNessuna valutazione finora

- Capital Project AccountingDocumento2 pagineCapital Project AccountingDhaval GandhiNessuna valutazione finora

- Dolly Madison Zingers (Devil's Food)Documento2 pagineDolly Madison Zingers (Devil's Food)StuffNessuna valutazione finora

- Types of Sewing MachinesDocumento12 pagineTypes of Sewing MachinesShireen KhanNessuna valutazione finora

- Barwani PDFDocumento13 pagineBarwani PDFvishvarNessuna valutazione finora

- Reverse Pricing ProcedureDocumento4 pagineReverse Pricing ProcedureAnonymous 13sDEcwShTNessuna valutazione finora

- Continue or Eliminate AnalysisDocumento3 pagineContinue or Eliminate AnalysisMaryNessuna valutazione finora

- TFG Manuel Feito Dominguez 2015Documento117 pagineTFG Manuel Feito Dominguez 2015Yenisel AguilarNessuna valutazione finora

- 32N50C3 Mos PDFDocumento11 pagine32N50C3 Mos PDFHưng HQNessuna valutazione finora

- RSKMGT NIBM Module Operational Risk Under Basel IIIDocumento6 pagineRSKMGT NIBM Module Operational Risk Under Basel IIIKumar SkandaNessuna valutazione finora

- CLIL Module "In The Kitchen" Class III C CucinaDocumento9 pagineCLIL Module "In The Kitchen" Class III C Cucinanancy bonforteNessuna valutazione finora

- Key Result Area Account ManagerDocumento7 pagineKey Result Area Account ManagerR Shinde100% (1)

- Variable & Absorption CostingDocumento23 pagineVariable & Absorption CostingRobin DasNessuna valutazione finora

- Month To Go Moving ChecklistDocumento9 pagineMonth To Go Moving ChecklistTJ MehanNessuna valutazione finora