Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

QS12 - Midterm 2 Review Solution

Caricato da

lyk0texCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

QS12 - Midterm 2 Review Solution

Caricato da

lyk0texCopyright:

Formati disponibili

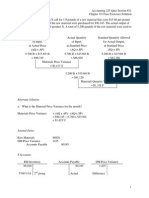

Accounting 225 Quiz Section #12

Midterm 2 Review Class Exercises Solution

1. Data concerning Sonderegger Company's operations last year appear below:

a) Prepare an income statement for the year using absorption costing.

$6 = $2.00 + $1.00 + $1.00 + $140,000/70,000

**$150,000 + 60,000 units x $1.50 per unit

b) Prepare a contribution format income statement for the year using variable costing.

c) Prepare a report reconciling the difference in net operating income between absorption and

variable costing for the year.

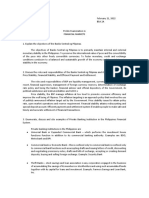

Accounting 225 Quiz Section #12

Midterm 2 Review Class Exercises Solution

2. A sales budget is given below for one of the products manufactured by the Key Co.:

The inventory of finished goods at the end of each month must equal 20% of the next month's

sales. On December 31, the finished goods inventory totaled 4,000 units.

Each unit of product requires three specialized electrical switches. Since the production of these

specialized switches by Key's suppliers is sometimes irregular, the company has a policy of

maintaining an ending inventory at the end of each month equal to 30% of the next month's

production needs. This requirement had been met on January 1 of the current year.

Prepare a budget showing the quantity of switches to be purchased each month for January,

February, and March and in total for the quarter.

The company's production budget is as follows:

The materials purchases budget (based on the above production budget) would be as

follows:

*69,000 x 0.30 =20,700

**38,000 x 3 = 114,000; 114,000 x 0.30 = 34,200

Accounting 225 Quiz Section #12

Midterm 2 Review Class Exercises Solution

3. Lido Company's standard and actual costs per unit for the most recent period, during which

400 units were actually produced, are given below:

From the foregoing information, compute the following variances. Show whether the variance is

favorable (F) or unfavorable (U):

a) & b)

Standard Quantity Allowed for

Actual Quantity

Actual Output,

of Input,

at Standard Price

at Standard Price

(SQ SP)

(AQ SP)

400 2 x $1.50

400 2.1 x $1.50

= $1,200

= $1,260

Materials Quantity Variance

= $60 U

Actual Quantity

of Input,

at Actual Price

(AQ AP)

400 $3.36

= $1,344

400 2.1 x $1.50

= $1,260

Materials Price Variance

= $84 U

Alternate Solution:

a) Materials price variance = AQ(AP - SP) = (2.1 x 400) x ($1.60 - $1.50) = $84 U

Journal Entry:

Raw Materials

1260

DM Price Variance

84

Accounts Payable

T-Accounts:

RM Inventory

1,260

400*2.1*1.50 2nd prong

1344

Accounts Payable

1,344

Actual

DM Price Variance

84

Difference

Accounting 225 Quiz Section #12

Midterm 2 Review Class Exercises Solution

b) Materials quantity variance = SP(AQ - SQ) = $1.50(2.1 x 400 - 2.0 x 400) = $60 U

Journal Entry:

WIP

1200

DM Quantity Variance

Raw Materials

60

1260

T-Accounts:

RM Inventory

1,260

2nd prong

400*2.1*1.5

WIP

1,200

400*2*1.5

DM Quantity Variance

60

Flex

budget

Difference

c)

Standard Hours Allowed

for Actual Output,

Actual Hours of Input,

Actual Hours of Input,

at Standard Rate

at Standard Rate

at Actual Rate

(SH SR)

(AH SR)

(AH AR)

400 hours 1.5 x $6/hour

400 x 1.4 x $6/hour

400 x 1.4 x $6.5/hour

= $3,600

= $3,360

= $3,640

Labor efficiency variance

Labor rate variance

= $240 F

= $280 U

Spending variance = $40 U

Alternate Solution:

Direct labor rate variance = AH(AR - SR) = (1.4 x 400) x ($6.50 - $6.00) = $280 U

Direct labor efficiency variance = SR(AH - SH) = $6.00(1.4 x 400 - 1.5 x 400) = $240 F

Journal Entry:

WIP

3600

DL Rate Variance

280

Wages Payable

DL Efficiency Variance

3640

240

T-Accounts:

WIP

3,600

400*1.5*6 2nd prong

Wages Payable

3,640

Actual

DL Rate Variance

DL Efficiency

Variance

280

240

Difference

Difference

Accounting 225 Quiz Section #12

Midterm 2 Review Class Exercises Solution

d)

Standard Hours Allowed

for Actual Output,

Actual Hours of Input,

Actual Hours of Input,

at Standard Rate

at Standard Rate

at Actual Rate

(SH SR)

(AH SR)

(AH AR)

400 hours 1.5 x $3.40/hour

400 hours 1.4 x $3.40/hour

= $2,040

= $1,904

$1,736

Variable overhead efficiency

Variable overhead rate

variance

variance

= $136 F

= $168 F

Spending variance = $304 F (Over Applied)

Alternate Solution:

Variable overhead rate variance = AH(AR - SR) = (1.4 x 400) x ($3.10 - $3.40) = $168 F

Variable overhead efficiency variance = SR(AH - SH) = $3.40(1.4 x 400 - 1.5 x 400) = $136 F

Total Spending Variance: $304 Favorable.

VMOH is over-applied by $304.

Journal Entry:

VMOH Control

Accounts Payable

WIP

2040

VMOH Control

VMOH Control

VMOH Rate Variance

VMOH Efficiency Variance

1736

1736

2040

304

136

168

T-Accounts:

WIP

2,040

VMOH Control

1736

2,040

Overapplied

304

Actual

Applied

400*1.5*3.40

VMOH Rate Variance

168

Difference

VMOH Efficiency

Variance

136

Difference

Accounting 225 Quiz Section #12

Midterm 2 Review Class Exercises Solution

e)

Close all the variances to Cost of Goods Sold.

COGS

DM Quantity

60

240

Variance

DL Rate Variance

280

168 VMOH Rate Variance

DL Rate Variance

VMOH Efficiency

84

DM Price Variance

136 Variance

120

Accounting 225 Quiz Section #12

Midterm 2 Review Class Exercises Solution

4. The selected information presented in the table below relates to Franklin Corporations output

of 1,800 units of its single product during the month of April, 2012. Note that Franklin applies

manufacturing overhead on the basis of standard direct-labor hours (SDLH).

Standard quantity of direct materials per unit of output.

2.5 lb.

Standard price for materials.

$1.60 per lb.

Standard labor hours (SDLH) allowed per unit of output.

1.25 hours

Standard variable manufacturing overhead application rate per SDLH $3.00

Total variable manufacturing overhead incurred

$5,800

Direct materials on hand, April 1

400 lb.

Cost of 5,000 lb. of materials purchased during April.

$7,400

Direct materials on hand, April 30.

350 lb.

a) The materials price variance for April was $600F

AQ purchased x S price

AQ purchased at A price

5,000 gls. X $1.60

$8,000

$7,400

Materials price variance

$600 F

b) The materials quantity variance for April was $880U

400 lb beg. Inventory + 5,000 lb purchased minus 350 end. Inventory = 5,050 lb used

Sq used x S price

(1,800 units produced x 2.5 lb/unit) X $1.60

$7,200

Aq used at S price

5,050 lb x $1.60

$8,080

Materials quantity variance

$880 U

c) Was variable manufacturing overhead under- or over-applied relative to actual VMOH

incurred for the month? Circle one response and indicate the amount below. [4]

VMOH applied: Sq DL hrs x Sp: (1,800 units x 1.25 DLH) x $3 application rate = $6,750

Variable overhead cost incurred (given), $5,800

$6,750 applied versus $5,800 incurred = $950 over-applied. (Note that this is an overall VMOH

favorable variance.)

Potrebbero piacerti anche

- As-Built Commercial BLDG.1Documento11 pagineAs-Built Commercial BLDG.1John Rom CabadonggaNessuna valutazione finora

- Acc 349 Final ExamDocumento15 pagineAcc 349 Final ExamAnmol NadkarniNessuna valutazione finora

- Management Accounting I 0105Documento29 pagineManagement Accounting I 0105api-26541915100% (1)

- Big Bang Theory EpisodesDocumento24 pagineBig Bang Theory EpisodesBroly dbzNessuna valutazione finora

- QS07 - Class Exercises SolutionDocumento8 pagineQS07 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS14 - Class Exercises SolutionDocumento4 pagineQS14 - Class Exercises Solutionlyk0tex100% (1)

- Quiz#1 MaDocumento5 pagineQuiz#1 Marayjoshua12Nessuna valutazione finora

- QS11 - Class Exercises SolutionDocumento8 pagineQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS11 - Class Exercises SolutionDocumento8 pagineQS11 - Class Exercises Solutionlyk0tex100% (2)

- Reporting, Prescribes The Requirements For Reporting Financial Information by SegmentDocumento15 pagineReporting, Prescribes The Requirements For Reporting Financial Information by SegmentJoyce Ann Agdippa BarcelonaNessuna valutazione finora

- Apps Stat and Optimization Models Homework 1 Over Chapter 2 Book ProblemsDocumento8 pagineApps Stat and Optimization Models Homework 1 Over Chapter 2 Book ProblemsxandercageNessuna valutazione finora

- CH 11 Quiz KeyDocumento7 pagineCH 11 Quiz KeyMatt ManiscalcoNessuna valutazione finora

- Em FlexicokingDocumento8 pagineEm FlexicokingHenry Saenz0% (1)

- Stochastic ProcessesDocumento264 pagineStochastic Processesmanosmill100% (1)

- Chapter 20 (5) : Variable Costing For Management AnalysisDocumento39 pagineChapter 20 (5) : Variable Costing For Management AnalysisJames BarzoNessuna valutazione finora

- Balance Sheet ProblemsDocumento2 pagineBalance Sheet ProblemsLouiseNessuna valutazione finora

- Ch01 McGuiganDocumento31 pagineCh01 McGuiganJonathan WatersNessuna valutazione finora

- Chapter 1 Answer Cost Accounting PDFDocumento5 pagineChapter 1 Answer Cost Accounting PDFCris VillarNessuna valutazione finora

- Joint Product & By-Product ExamplesDocumento15 pagineJoint Product & By-Product ExamplesMuhammad azeemNessuna valutazione finora

- Score:: (The Following Information Applies To The Questions Displayed Below.)Documento5 pagineScore:: (The Following Information Applies To The Questions Displayed Below.)Srikanth PothiraajNessuna valutazione finora

- MS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingDocumento4 pagineMS11 Decentralization Segment Reporting Responsibility Accounting Performance Evaluation and Transfer PricingMarchelle CaelNessuna valutazione finora

- 7166materials Problems-Standard CostingDocumento14 pagine7166materials Problems-Standard CostingLumina JulieNessuna valutazione finora

- Chapter 2Documento34 pagineChapter 2Ahmed DapoorNessuna valutazione finora

- Solution Manual For Principles of Cost Accounting 16th Edition by VanderbeckDocumento36 pagineSolution Manual For Principles of Cost Accounting 16th Edition by Vanderbecka75590393775% (4)

- Solution 2Documento75 pagineSolution 2Asiful MowlaNessuna valutazione finora

- CVP Analysis and Break Even Point AnalysisDocumento16 pagineCVP Analysis and Break Even Point AnalysisKirito Uzumaki100% (1)

- Module 1.a The Accountancy ProfessionDocumento6 pagineModule 1.a The Accountancy ProfessionJonathanTipay0% (1)

- 6organizational Innovations:total Quality Management Just-In-Time Production SystemDocumento10 pagine6organizational Innovations:total Quality Management Just-In-Time Production SystemAryan LeeNessuna valutazione finora

- Accounting QuestionDocumento8 pagineAccounting QuestionMusa D Acid100% (1)

- Our Lady of The Pillar College - CauayanDocumento5 pagineOur Lady of The Pillar College - CauayanLu CioNessuna valutazione finora

- Incremental Analysis Problems 111320Documento4 pagineIncremental Analysis Problems 111320KHAkadsbdhsgNessuna valutazione finora

- Answers To MCQ BookDocumento2 pagineAnswers To MCQ BookFernando III Perez0% (1)

- Pricing and Costing Final Examination Key To CorrectionDocumento8 paginePricing and Costing Final Examination Key To CorrectionSherwin Francis MendozaNessuna valutazione finora

- Quiz - Module 9Documento12 pagineQuiz - Module 9Alyanna AlcantaraNessuna valutazione finora

- Mock Deparmentals MASQDocumento6 pagineMock Deparmentals MASQHannah Joyce MirandaNessuna valutazione finora

- Revenue Recognition: Long Term ConstructionDocumento2 pagineRevenue Recognition: Long Term ConstructionLee SuarezNessuna valutazione finora

- Chapter 17Documento8 pagineChapter 17rahmiamelianazarNessuna valutazione finora

- Managerial EconomicsDocumento6 pagineManagerial EconomicsSmartblogzNessuna valutazione finora

- 6 BudgetingDocumento2 pagine6 BudgetingClyette Anne Flores BorjaNessuna valutazione finora

- TB21 PDFDocumento33 pagineTB21 PDFJi WonNessuna valutazione finora

- SC PracticeDocumento6 pagineSC Practicefatima airis aradais100% (1)

- 5Documento46 pagine5Navindra JaggernauthNessuna valutazione finora

- Management Advisory Services QuestionnaireDocumento12 pagineManagement Advisory Services QuestionnaireSteven Mark MananguNessuna valutazione finora

- Specialized Industries Airlines: Name: Jayvan Ponce Subject: Pre 4 Auditing and Assurance: Specialized IndustryDocumento10 pagineSpecialized Industries Airlines: Name: Jayvan Ponce Subject: Pre 4 Auditing and Assurance: Specialized IndustryCaptain ObviousNessuna valutazione finora

- 1231231231231231Documento11 pagine1231231231231231JV De VeraNessuna valutazione finora

- AcctgDocumento35 pagineAcctgKariz CodogNessuna valutazione finora

- Funds and Other Investment ActivitiesDocumento7 pagineFunds and Other Investment Activitiesjoong wanNessuna valutazione finora

- Variable Costing - Lecture NoteDocumento2 pagineVariable Costing - Lecture NoteCrestu JinNessuna valutazione finora

- 85184767Documento9 pagine85184767Garp BarrocaNessuna valutazione finora

- Chapter 2-Multi-Product CVP AnalysisDocumento53 pagineChapter 2-Multi-Product CVP AnalysisAyeNessuna valutazione finora

- Case 7-20 Contact Global Our Analysis-FinalsDocumento11 pagineCase 7-20 Contact Global Our Analysis-FinalsJenny Malabrigo, MBANessuna valutazione finora

- Cost Terminology and Cost Behaviors: Learning ObjectivesDocumento17 pagineCost Terminology and Cost Behaviors: Learning ObjectivesJonnah ArriolaNessuna valutazione finora

- Acc Chap 1Documento17 pagineAcc Chap 1adahung23Nessuna valutazione finora

- 202E10Documento33 pagine202E10Ashish BhallaNessuna valutazione finora

- Narrative Report GovernmentAccountingDocumento2 pagineNarrative Report GovernmentAccountingNiña Blanca LagonNessuna valutazione finora

- Chapter 11 Shareholders' 2Documento13 pagineChapter 11 Shareholders' 2Thalia Rhine AberteNessuna valutazione finora

- True/False Questions: labor-intensive (cần nhiều nhân công)Documento31 pagineTrue/False Questions: labor-intensive (cần nhiều nhân công)Ngọc MinhNessuna valutazione finora

- AE 18 Financial Market Prelim ExamDocumento3 pagineAE 18 Financial Market Prelim ExamWenjunNessuna valutazione finora

- Abc 2Documento2 pagineAbc 2Kath LeynesNessuna valutazione finora

- Intacc2 - Assignment 3Documento4 pagineIntacc2 - Assignment 3KHAkadsbdhsgNessuna valutazione finora

- Statement of Changes in Comprehensive IncomeDocumento33 pagineStatement of Changes in Comprehensive Incomeellyzamae quiraoNessuna valutazione finora

- Chap 001Documento56 pagineChap 001Louie De La TorreNessuna valutazione finora

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Documento7 pagineRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNessuna valutazione finora

- Question 1 (Accounting)Documento2 pagineQuestion 1 (Accounting)David DavidNessuna valutazione finora

- Standard Costing ExercisesDocumento6 pagineStandard Costing ExercisesVatchdemonNessuna valutazione finora

- Chapter 7 PPT Version 2Documento61 pagineChapter 7 PPT Version 2islamasifNessuna valutazione finora

- Management Accounting Sample QuestionsDocumento14 pagineManagement Accounting Sample QuestionsMarjun Segismundo Tugano IIINessuna valutazione finora

- QS16 - Class Exercises SolutionDocumento5 pagineQS16 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS16 - Class ExercisesDocumento5 pagineQS16 - Class Exerciseslyk0texNessuna valutazione finora

- QS15 - Class Exercises SolutionDocumento5 pagineQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS13 - Class Exercises SolutionDocumento2 pagineQS13 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS09 - Class ExercisesDocumento4 pagineQS09 - Class Exerciseslyk0texNessuna valutazione finora

- QS12 - Midterm 2 ReviewDocumento5 pagineQS12 - Midterm 2 Reviewlyk0texNessuna valutazione finora

- QS08 - Class Exercises SolutionDocumento5 pagineQS08 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS09 - Class Exercises SolutionDocumento4 pagineQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS06 - Class ExercisesDocumento3 pagineQS06 - Class Exerciseslyk0texNessuna valutazione finora

- QS02 - Class ExercisesDocumento3 pagineQS02 - Class Exerciseslyk0texNessuna valutazione finora

- QS04 - Class ExercisesDocumento3 pagineQS04 - Class Exerciseslyk0texNessuna valutazione finora

- QS06 - Class Exercises SolutionDocumento2 pagineQS06 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS05 - Class Exercises SolutionDocumento3 pagineQS05 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS04 - Class Exercises SolutionDocumento3 pagineQS04 - Class Exercises Solutionlyk0texNessuna valutazione finora

- Weg CFW500 Enc PDFDocumento32 pagineWeg CFW500 Enc PDFFabio Pedroso de Morais100% (1)

- Comparitive Study of Fifty Cases of Open Pyelolithotomy and Ureterolithotomy With or Without Double J Stent InsertionDocumento4 pagineComparitive Study of Fifty Cases of Open Pyelolithotomy and Ureterolithotomy With or Without Double J Stent InsertionSuril VithalaniNessuna valutazione finora

- Sanskrit Lessons: �丘��恆� � by Bhikshuni Heng HsienDocumento4 pagineSanskrit Lessons: �丘��恆� � by Bhikshuni Heng HsiendysphunctionalNessuna valutazione finora

- Rs2-Seamanship (Inc Anchoring, Mooring, Berthing, Pilot Ladder)Documento19 pagineRs2-Seamanship (Inc Anchoring, Mooring, Berthing, Pilot Ladder)Mdpn. Salvador67% (3)

- FDD Spindle Motor Driver: BA6477FSDocumento12 pagineFDD Spindle Motor Driver: BA6477FSismyorulmazNessuna valutazione finora

- SKF Shaft Alignment Tool TKSA 41Documento2 pagineSKF Shaft Alignment Tool TKSA 41Dwiki RamadhaniNessuna valutazione finora

- Modified Airdrop System Poster - CompressedDocumento1 paginaModified Airdrop System Poster - CompressedThiam HokNessuna valutazione finora

- Work Site Inspection Checklist 1Documento13 pagineWork Site Inspection Checklist 1syed hassanNessuna valutazione finora

- C++ Program To Create A Student Database - My Computer ScienceDocumento10 pagineC++ Program To Create A Student Database - My Computer ScienceSareeya ShreNessuna valutazione finora

- Asu 2019-12Documento49 pagineAsu 2019-12janineNessuna valutazione finora

- List of Olympic MascotsDocumento10 pagineList of Olympic MascotsmukmukkumNessuna valutazione finora

- Catalogue of Archaeological Finds FromDocumento67 pagineCatalogue of Archaeological Finds FromAdrinaNessuna valutazione finora

- VLSI Implementation of Floating Point AdderDocumento46 pagineVLSI Implementation of Floating Point AdderParamesh Waran100% (1)

- Angelo (Patrick) Complaint PDFDocumento2 pagineAngelo (Patrick) Complaint PDFPatLohmannNessuna valutazione finora

- The Serious Student of HistoryDocumento5 pagineThe Serious Student of HistoryCrisanto King CortezNessuna valutazione finora

- Paper II - Guidelines On The Use of DuctlessDocumento51 paginePaper II - Guidelines On The Use of DuctlessMohd Khairul Md DinNessuna valutazione finora

- Channel & Lomolino 2000 Ranges and ExtinctionDocumento3 pagineChannel & Lomolino 2000 Ranges and ExtinctionKellyta RodriguezNessuna valutazione finora

- MQXUSBDEVAPIDocumento32 pagineMQXUSBDEVAPIwonderxNessuna valutazione finora

- Ethiopian Airlines-ResultsDocumento1 paginaEthiopian Airlines-Resultsabdirahmanguray46Nessuna valutazione finora

- Topic 1 - ICT Tools at USP - Theoretical Notes With Google AppsDocumento18 pagineTopic 1 - ICT Tools at USP - Theoretical Notes With Google AppsAvantika PrasadNessuna valutazione finora

- Thermodynamic c106Documento120 pagineThermodynamic c106Драгослав БјелицаNessuna valutazione finora

- User ManualDocumento96 pagineUser ManualSherifNessuna valutazione finora

- Nature of Science-Worksheet - The Amoeba Sisters HWDocumento2 pagineNature of Science-Worksheet - The Amoeba Sisters HWTiara Daniel25% (4)

- Lifting PermanentmagnetDocumento6 pagineLifting PermanentmagnetShekh Muhsen Uddin Ahmed100% (1)

- English 2nd Quarter Week 7 Connotation DenotationDocumento28 pagineEnglish 2nd Quarter Week 7 Connotation DenotationEdward Estrella GuceNessuna valutazione finora

- CL200 PLCDocumento158 pagineCL200 PLCJavierRuizThorrensNessuna valutazione finora