Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

QS12 - Class Exercises Solution

Caricato da

lyk0tex100%(1)Il 100% ha trovato utile questo documento (1 voto)

100 visualizzazioni2 pagineACCTG225

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoACCTG225

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

100 visualizzazioni2 pagineQS12 - Class Exercises Solution

Caricato da

lyk0texACCTG225

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

Accounting 225 Quiz Section #12

Chapter 10A Class Exercises Solution

1. Lincoln Company uses a standard cost system where manufacturing overhead expense is

applied on the basis of direct labor hours. Management is trying to determine if the company did

a good job controlling fixed overhead costs last month and the following information is

available. Actual unit production was 1,100 units and actual direct labor hours were 4,500 hours.

Standards state that it takes 4 direct labor hours to make one unit. The predetermined overhead

application rate for Lincoln is $15 per direct labor hour. Last month the production volume

variance (PVV) was $6,000 favorable and the total fixed overhead variance was $3,000

favorable.

a) How much fixed overhead cost was applied last month?

FOH applied = actual output x std. DLH per unit x PDOAR

1,100 actual units x 4 DLH per unit x $15 per DLH

FOH applied = $66,000

b) What was the planned level of unit output?

FOH applied

Less: favorable variance

Equals budgeted FOH

$66,000

($6,000)

$60,000

Denominator level of activity = 4,000 direct labor hours

c) How much was the actual fixed overhead expense and what was the spending variance?

$66,000 applied FOH minus $3,000 Total favorable variance = $63,000 actual FOH expense.

PVV + Spending Var = Total Variance

$6,000 F + ? = $3,000 F so the spending variance must equal $3,000 unfavorable.

d) Did management do a good job controlling cost?

Not really. The total variance was favorable by $3,000 but this was due to $6,000 of favorable

PVV. PVV arises solely due to changes in actual production from the planned level of

production and does not indicate any kind of cost control. However, the spending variance was

unfavorable by $3,000 indicating some concern that management may have done an inadequate

job managing FOH expenses last month.

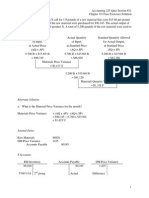

Fixed Overhead variances:

P1

Applied

PVV

P2

Budget

Spending

Variance

P3

Actual

$66,000

$6,000 F

$60,000

$3,000 U

$63,000

Total FOH Var: $3,000 F

Accounting 225 Quiz Section #12

Chapter 10A Class Exercises Solution

2. Sucher Company uses a standard cost system in which manufacturing overhead costs are

applied to units of product on the basis of standard machine-hours. The company's standards are

based on variable manufacturing overhead of $3 per machine-hour and fixed manufacturing

overhead of $300,000 per year. The denominator level of activity is 30,000 machine-hours.

Standards call for 2.5 machine-hours per unit of output. Actual activity and manufacturing

overhead costs for the year are given below:

a) What are the standard hours allowed for the output?

12,800 units x 2.5 machine hours per unit = 32,000 machine hours

b) What was the variable overhead rate variance?

Rate variance = (AH x AR) - (AH x SR)

= ($96,000) - (31,600 x $3) = $1,200 U

c) What was the variable overhead efficiency variance?

Rate variance = (AH x SR) - (SH x SR)

= (31,600 x $3) - (32,000 x $3) = $1,200 F

d) What was the fixed manufacturing overhead budget variance?

Budget variance = Actual fixed manufacturing overhead - Budgeted Fixed overhead

= $297,000 - $300,000 = $3,000 F

e) What was the fixed manufacturing overhead volume variance?

Volume variance = Fixed portion of predetermined overhead rate x

(Denominator hours - Standard hours allowed)

= $10* x (30,000 - 32,000)

= $20,000 F

*$300,000

30,000 MH = $10 per MH

Potrebbero piacerti anche

- QS16 - Class Exercises SolutionDocumento5 pagineQS16 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS15 - Class Exercises SolutionDocumento5 pagineQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS16 - Class ExercisesDocumento5 pagineQS16 - Class Exerciseslyk0texNessuna valutazione finora

- QS13 - Class Exercises SolutionDocumento2 pagineQS13 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS14 - Class Exercises SolutionDocumento4 pagineQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS11 - Class Exercises SolutionDocumento8 pagineQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS12 - Midterm 2 Review SolutionDocumento7 pagineQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS09 - Class Exercises SolutionDocumento4 pagineQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS09 - Class ExercisesDocumento4 pagineQS09 - Class Exerciseslyk0texNessuna valutazione finora

- QS12 - Midterm 2 ReviewDocumento5 pagineQS12 - Midterm 2 Reviewlyk0texNessuna valutazione finora

- QS07 - Class Exercises SolutionDocumento8 pagineQS07 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS08 - Class Exercises SolutionDocumento5 pagineQS08 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS02 - Class ExercisesDocumento3 pagineQS02 - Class Exerciseslyk0texNessuna valutazione finora

- QS04 - Class ExercisesDocumento3 pagineQS04 - Class Exerciseslyk0texNessuna valutazione finora

- QS06 - Class ExercisesDocumento3 pagineQS06 - Class Exerciseslyk0texNessuna valutazione finora

- QS06 - Class Exercises SolutionDocumento2 pagineQS06 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS05 - Class Exercises SolutionDocumento3 pagineQS05 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS04 - Class Exercises SolutionDocumento3 pagineQS04 - Class Exercises Solutionlyk0texNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Sheryl D. Tomas, Mba: Program Chair-Bachelor of Science in EntrepreneurshipDocumento20 pagineSheryl D. Tomas, Mba: Program Chair-Bachelor of Science in EntrepreneurshipIam MaroseNessuna valutazione finora

- Dark Side of EntrepreneurshipDocumento5 pagineDark Side of EntrepreneurshipSaunak DeNessuna valutazione finora

- 99 Inspirational Quotes For EntrepreneursDocumento3 pagine99 Inspirational Quotes For EntrepreneursvipulguptaNessuna valutazione finora

- Final IdpDocumento7 pagineFinal IdpNihalAgarwalNessuna valutazione finora

- Transcorp Announces Industry Veterans To Lead TeamDocumento3 pagineTranscorp Announces Industry Veterans To Lead TeamTransnational Corporation of Nigeria PLCNessuna valutazione finora

- Case Study - Coca Cola A Transnational CorporationDocumento2 pagineCase Study - Coca Cola A Transnational CorporationVikram SanthanamNessuna valutazione finora

- Vadodara Manufacturers1Documento23 pagineVadodara Manufacturers1Kiran VadherNessuna valutazione finora

- The Nature of Small BusinessDocumento8 pagineThe Nature of Small BusinessRae MorganNessuna valutazione finora

- Entrepreneurship Vs IntrapreneurshipDocumento4 pagineEntrepreneurship Vs IntrapreneurshipOckouri Barnes100% (1)

- Procurement and Sourcing: Moving From Tactical To StrategicDocumento22 pagineProcurement and Sourcing: Moving From Tactical To StrategicpaulshikleejrNessuna valutazione finora

- Geog IT Industry EssayDocumento1 paginaGeog IT Industry EssayRachel AuNessuna valutazione finora

- Application Forms PDFDocumento2 pagineApplication Forms PDFsnhd_swprNessuna valutazione finora

- EntrepDocumento4 pagineEntrepBOBOKONessuna valutazione finora

- China Environmental Protection Equipment Market ReportDocumento11 pagineChina Environmental Protection Equipment Market ReportAllChinaReports.comNessuna valutazione finora

- Illy AnalysisDocumento3 pagineIlly AnalysisLaura Mercado50% (4)

- Sample Purchase Order Format For Corporate TrainerDocumento2 pagineSample Purchase Order Format For Corporate Trainerseeraj4uraj0% (1)

- Pamela Hartigan - The Challenge For Social Entrepreneurship 2004Documento4 paginePamela Hartigan - The Challenge For Social Entrepreneurship 2004New Zealand Social Entrepreneur Fellowship - PDF Library100% (2)

- The Entrepreneur in Oil and Gas IndustryDocumento34 pagineThe Entrepreneur in Oil and Gas IndustryrosemaryNessuna valutazione finora

- Anti Competetive AgreemetsDocumento5 pagineAnti Competetive AgreemetsSwathy SonyNessuna valutazione finora

- Jehangir Ratanji Dadabhai TataDocumento3 pagineJehangir Ratanji Dadabhai Tatatulasinad1230% (1)

- 1967-72 AccetDocumento87 pagine1967-72 AccetkgrdNessuna valutazione finora

- News Release - DRT Expands Into The USDocumento1 paginaNews Release - DRT Expands Into The USEffNowNessuna valutazione finora

- Sinhgad Management Institutes: Career ObjectiveDocumento3 pagineSinhgad Management Institutes: Career Objectivecharkhasanket123Nessuna valutazione finora

- The Satsuma Zaibatsu by Thomas SchalowDocumento28 pagineThe Satsuma Zaibatsu by Thomas Schalowapi-260432934Nessuna valutazione finora

- Business Studies HomeworkDocumento10 pagineBusiness Studies Homeworkapi-248004746100% (1)

- ISB Placement ReportDocumento20 pagineISB Placement ReportSreekantNessuna valutazione finora

- 18 Nature and Characteristics of Entrepreneurship (Explained) - GooglesirDocumento17 pagine18 Nature and Characteristics of Entrepreneurship (Explained) - GooglesirAbinash KumarNessuna valutazione finora

- The ISB Governing Board: Grooming Generation NextDocumento2 pagineThe ISB Governing Board: Grooming Generation NextsudhitNessuna valutazione finora

- Chapter 17 Process CostingDocumento21 pagineChapter 17 Process CostingpchakkrapaniNessuna valutazione finora

- Woman As EntrepreneurDocumento10 pagineWoman As EntrepreneurjustingosocialNessuna valutazione finora