Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

QS07 - Class Exercises Solution

Caricato da

lyk0texDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

QS07 - Class Exercises Solution

Caricato da

lyk0texCopyright:

Formati disponibili

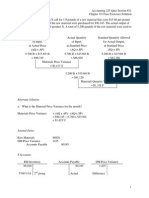

Accounting 225 Quiz Section #7

Midterm1 Review Class Exercises Solutions

1. Rainier Manufacturing uses absorption costing in its job-order costing system. Selected ledger

accounts for the year just ended are presented below. Each question mark (?) represents a debit or credit

that is missing from the account(s). BB = Beginning Balance, EB = Ending Balance.

BB

RM

Purchases

EB

BB

Raw Materials

12,000

? 62,000

58,000

8,000

Finished Goods

15,200

? 167,030

EB

BB

DM

DL

MOH

EB

WIP

7,000

? 55,800

? 167,030

? 40,000

? 74,000

9,770

COGS

? 169,730

Unadjusted

COGS

? 169,730

12,500

Factory Wages Payable

- BB

50,000

46,000

IM

IL

Other

MOH

Total

MOH

? 6,200

? 10,000

? 74,000

55,200

? 71,400

4,000 EB

Additional Information: (I suggest you look over the above accounts carefully and read all the

information below before you start to respond to. any of the items on the next page)

The cost of both direct (DM) and indirect materials (IM) are debited to the Raw Materials

Inventory account when materials are purchased.

Of the raw materials issued to production during the year, 90% were direct materials and 10%

were indirect materials.

Of the factory wages incurred during the year, 80% was for direct labor and 20% was for indirect

labor.

The other MOH of $55,200 indicated in the MOH account includes depreciation, insurance,

utilities, and maintenance costs incurred during the year related to production.

During the year, Rainier applied manufacturing overhead to production using a single, plant-wide

predetermined application rate based on direct labor (DL) cost. Any over- or under-applied

overhead is adjusted directly to cost of goods sold at the end of the year.

The balance of Work in Process (WIP) at the end of the year related to the only job still in

production at that time. Its job cost sheet shows DM of $3,500, DL of $2,200, and MOH applied

(MOHA) of $4,070 as of the end of the year.

Accounting 225 Quiz Section #7

Midterm1 Review Class Exercises Solutions

(a)

The cost of direct materials issued to production was $55,800; indirect materials cost incurred was

$6,200. (See T-accounts)

(b)

The cost of direct labor used in production was $40,000; indirect labor cost incurred was $10,000.

(See T-accounts.)

(c)

The predetermined overhead application rate being used during the year is 185% based on direct

labor cost. (See data re. ending WIP costs)

(d)

Total manufacturing overhead applied during the year was $74,000 (Direct labor $40,000 x

185%)

(e)

Cost of goods manufactured during the year was $167,030 (See account analysis.)

(f)

Was manufacturing overhead over- or under-applied by the end of the year? Over-applied.

Provide the journal entry that would have been necessary to clear the manufacturing overhead

account at the end of the year.

Dr.

MOH

$2,600

Cr.

COGS

$2,600

See MOH T-account on

previous page.

(g)

As a result of the entry you have made in (f) above, operating income will increase/decrease/be

unaffected (circle one) by $2,600 and inventory balances will increase/decrease/be unaffected

(circle one) by $NA

(h)

Specific to Rainiers data for the year, speculate as to whether its production output was equal to,

less than, or greater than (circle one) expected output. What evidence do you have to support

your answer? Explain.

The evidence to support the answer is that MOH was over-applied. Although this could

have been caused by a number of factors, a likely situation is that the amount of direct labor

cost incurred was greater than was anticipated when the predetermined overhead

application rate was computed. This would have happened if actual production exceeded

expected production. Thus, more of the cost driver was used than was expected, and, as a

consequence, 185% of DL cost incurred produced a larger amount of overhead applied than

was anticipated. Also, recall that most of the overhead would be fixed, so the overhead

incurred would not be much higher than overhead estimated, even if production was greater

than planned.

If sales revenue for the year was $250,000, the gross margin reported on Rainiers income

statement for the year was $82,870

$250,000 ($169,730 - $2,600)

(i)

Accounting 225 Quiz Section #7

Midterm1 Review Class Exercises Solutions

2. Parkland Manufacturing applies manufacturing overhead to production on the basis of direct labor

hours. It uses two (2) direct labor hours per unit produced. Direct labor hours and costs at two

different production and sales levels are presented in the table below.

9,000 Units 15,000 Units

Direct labor hours used

18,000 DLH 30,000 DLH

Total prime manufacturing costs

$135,000

$225,000

Total manufacturing overhead

$72,700

$86,500

Total selling and administrative expenses

$43,700

$51,500

Parkland estimates that $32,000 of its selling and administrative expenses are fixed costs.

(a) Using high-low analysis, determine the cost formula (equation) for estimating manufacturing

overhead. (i.e. Determine estimated variable MOH per direct labor hour and the total estimated

fixed MOH.) Clearly show your work and present a complete answer.

($86,500 - $72,700)/(30,000 18,000 DLH) = $1.15 VC per direct labor hour.

(OR

$72,700

=

$72,700

=

TFC = $52,000

TFC

TFC

+

+

($1.15 x 18,000 DLH)

$20,700

TMOH

=

$86,500

=

$86,500

=

TFC = $52,000)

$52,000 + $1.15X where X is number of direct labor hours

TFC +

($1.15 x 30,000 DLJH)

TFC +

$34,500

(b) Assume Parkland plans to manufacture and sell 13,000 units next year.

(i) What would be the total estimated manufacturing (product) cost at that level of production?

Unit product cost is Prime cost per unit + MOH per unit

Prime cost is $15 per unit. (See data in table. Either $135,000/9,000 units or $225,000/15,000

units)

VMOH per unit is $2.30 ($1.15 per DLH x 2 DLH per unit of output)

Total variable cost per unit is $17.30

$17.30 x 13,000 units of output

Plus fixed MOH

Total manufacturing cost

$224,900

52,000

$276,900

(ii) What would be the estimated manufacturing (product) cost per unit produced next year?

$276,900 -:- 13,000 units = $21.30 per unit. (OR $17.30 VC per unit + $4 FC per unit)

3

Accounting 225 Quiz Section #7

Midterm1 Review Class Exercises Solutions

(c) Suppose, rather than 13,000 units, Parkland plans to manufacture and sell 11,000 units next year.

Would the estimated manufacturing cost per unit be higher/lower/the same (circle one) as your answer to

Part (b.ii)? Explain.

Since fewer units would be produced, unit fixed cost would be higher.

(d) How comfortable would you be using the cost formula you have presented in Part (a) to estimate total

manufacturing overhead if Parkland wanted to product 16,000 units next year? Explain.

Not comfortable.

Production at 16,000 units is outside the relevant range of the data we used in our analysis of cost

structure in (a). Both total fixed costs and variable costs per unit might be different.

(e) What is the variable selling and administrative cost per unit?

Total S&A $43,700 - $32,000 fixed = $11,700 total variable at 9,000 unit level

$11,700/9,000 units = $1.30 per unit

(The same answer could be derived using the S&A data at 15,000 units.)

(f) If Parklands selling price is $30 per unit, what is the contribution margin per unit?

CM = SP - VC

$30 SP ($17.30 variable production cost per unit + $1.30 variable S&A) = $11.40

(g) How many units should Parkland plan to sell if it wants to earn a target profit of $75,000 next year?

(Give your answer rounded up to the next whole unit.)

{($52,000 + $32,000) + $75,000 profits}/$11.40 CM per unit} = 13,948 units

Accounting 225 Quiz Section #7

Midterm1 Review Class Exercises Solutions

3. A company has provided the following data:

If the dollar contribution margin per unit is increased by 10%, total fixed cost is decreased by

20%, and all other factors remain the same, net operating income will:

A. Increase By $61,000.

B. Increase By $20,000.

C. Increase By $3,500.

D. Increase by $11,000.

4. At a break-even point of 400 units sold, variable expenses were $4,000 and fixed expenses

were $2,000. What will the 401st unit sold contribute to profit?

A. $0

B. $5

C. $10

D. $15

Break-even point (units) = Fixed expenses Contribution margin per unit

Substituting:

400 = $2,000 Contribution margin per unit

Contribution margin per unit = $5

Accounting 225 Quiz Section #7

Midterm1 Review Class Exercises Solutions

5. Vaccaro Corporation produces and sells a single product. Data concerning that product appear

below:

Fixed expenses are $293,000 per month. The company is currently selling 3,000 units per month.

Management is considering using a new component that would increase the unit variable cost by

$13. Since the new component would increase the features of the company's product, the

marketing manager predicts that monthly sales would increase by 400 units. What should be the

overall effect on the company's monthly net operating income of this change?

A. Increase of $600

B. Increase of $39,600

C. Decrease of $600

D. Decrease of $39,600

Increase in net operating income: $43,600 - $43,000 = $600

Accounting 225 Quiz Section #7

Midterm1 Review Class Exercises Solutions

6. Similien Corporation produces and sells a single product. Data concerning that product appear

below:

Fixed expenses are $300,000 per month. The company is currently selling 5,000 units per month.

The marketing manager would like to cut the selling price by $14 and increase the advertising

budget by $17,000 per month. The marketing manager predicts that these two changes would

increase monthly sales by 1,400 units. What should be the overall effect on the company's

monthly net operating income of this change?

A. Increase Of $64,200

B. Increase Of $215,400

C. Decrease Of $64,200

D. Decrease of $5,800

Decrease in net operating income: $60,000 - $54,200 = $5,800

Accounting 225 Quiz Section #7

Midterm1 Review Class Exercises Solutions

7. Moloney Corporation produces and sells a single product. Data concerning that product appear

below:

Fixed expenses are $898,000 per month. The company is currently selling 9,000 units per month.

The marketing manager would like to introduce sales commissions as an incentive for the sales

staff. The marketing manager has proposed a commission of $16 per unit. In exchange, the sales

staff would accept a decrease in their salaries of $117,000 per month. (This is the company's

savings for the entire sales staff.) The marketing manager predicts that introducing this sales

incentive would increase monthly sales by 100 units. What should be the overall effect on the

company's monthly net operating income of this change?

A. Increase Of $115,400

B. Decrease Of $16,600

C. Decrease Of $250,600

D. Increase Of $1,063,400

Decrease in net operating income: $182,000 - $165,400 = $16,600

Potrebbero piacerti anche

- Corporate Financial Analysis with Microsoft ExcelDa EverandCorporate Financial Analysis with Microsoft ExcelValutazione: 5 su 5 stelle5/5 (1)

- Mastering Forex Fundamentals: A Comprehensive Guide in 2 HoursDa EverandMastering Forex Fundamentals: A Comprehensive Guide in 2 HoursValutazione: 5 su 5 stelle5/5 (1)

- Exam 1 - VI SolutionsDocumento9 pagineExam 1 - VI Solutionssyeda hifzaNessuna valutazione finora

- Chapter 01Documento31 pagineChapter 01Vanitha Thiagaraj100% (1)

- Money MarketDocumento25 pagineMoney MarketVaidyanathan RavichandranNessuna valutazione finora

- Notes On Risk ManagementDocumento54 pagineNotes On Risk ManagementSimphiwe NkosiNessuna valutazione finora

- Based On Session 5 - Responsibility Accounting & Transfer PricingDocumento5 pagineBased On Session 5 - Responsibility Accounting & Transfer PricingMERINANessuna valutazione finora

- International FinanceDocumento181 pagineInternational FinanceadhishsirNessuna valutazione finora

- Feasibility Study ReportDocumento41 pagineFeasibility Study ReportGail IbayNessuna valutazione finora

- ICMA Questions Apr 2011Documento55 pagineICMA Questions Apr 2011Asadul HoqueNessuna valutazione finora

- CMA April - 14 Exam Question SolutionDocumento55 pagineCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Lecture 9 M17EFA - Company Valuation 2 1Documento48 pagineLecture 9 M17EFA - Company Valuation 2 1822407Nessuna valutazione finora

- Accounts and Statistics 4Documento41 pagineAccounts and Statistics 4BrightonNessuna valutazione finora

- Time Value of MoneyDocumento10 pagineTime Value of MoneyAnu LundiaNessuna valutazione finora

- Equity Valuation-1Documento37 pagineEquity Valuation-1Disha BakshiNessuna valutazione finora

- QP March2012 p1Documento20 pagineQP March2012 p1Dhanushka Rajapaksha100% (1)

- NPV Practice CompleteDocumento5 pagineNPV Practice CompleteShakeel AslamNessuna valutazione finora

- Adv - Acc Mock Exam With SolutionsDocumento8 pagineAdv - Acc Mock Exam With SolutionsGiorgio AtanasovNessuna valutazione finora

- Chapter 6Documento16 pagineChapter 6Novrika DaniNessuna valutazione finora

- Cma Tax PaperDocumento760 pagineCma Tax Paperritesh shrinewarNessuna valutazione finora

- Trading AccountDocumento3 pagineTrading AccountRirin GhariniNessuna valutazione finora

- Chapter 7 Asset Investment Decisions and Capital RationingDocumento31 pagineChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNessuna valutazione finora

- Lecturer Contact Information: Twilamae - Logan@uwmona - Edu.jmDocumento9 pagineLecturer Contact Information: Twilamae - Logan@uwmona - Edu.jmSta KerNessuna valutazione finora

- 11 Financial Forecasting and Planning (Session 24)Documento23 pagine11 Financial Forecasting and Planning (Session 24)creamellzNessuna valutazione finora

- Linear Programming (LINDO Output) (Assignment Question 2 and 3)Documento8 pagineLinear Programming (LINDO Output) (Assignment Question 2 and 3)UTTAM KOIRALANessuna valutazione finora

- PracticeExam MA1 GarrisonDocumento15 paginePracticeExam MA1 GarrisoncompuhpNessuna valutazione finora

- F3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Documento31 pagineF3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Md Enayetur Rahman100% (1)

- Assignment 14Documento7 pagineAssignment 14Satishkumar NagarajNessuna valutazione finora

- BUS 5110 Managerial Accounting - Written Assignment Unit 7Documento7 pagineBUS 5110 Managerial Accounting - Written Assignment Unit 7LaVida LocaNessuna valutazione finora

- Question (Apr 2012)Documento49 pagineQuestion (Apr 2012)Monirul IslamNessuna valutazione finora

- THREE-5548-Banking Law and PracticeDocumento8 pagineTHREE-5548-Banking Law and PracticeMisbha AliNessuna valutazione finora

- 2014 December Management Accounting L2Documento17 pagine2014 December Management Accounting L2Dixie CheeloNessuna valutazione finora

- Sales Tax QuestionDocumento3 pagineSales Tax QuestionKhushi SinghNessuna valutazione finora

- MGT705 - Advanced Cost and Management Accounting Midterm 2013Documento1 paginaMGT705 - Advanced Cost and Management Accounting Midterm 2013sweet haniaNessuna valutazione finora

- Essay Part 1Documento56 pagineEssay Part 1Sachin KumarNessuna valutazione finora

- Couresot LineDocumento2 pagineCouresot LineSeifu BekeleNessuna valutazione finora

- How To Set Up and Run A Honeymoon Finch Trading AccountDocumento8 pagineHow To Set Up and Run A Honeymoon Finch Trading AccountCarlos RodriguezNessuna valutazione finora

- Chapter 13 Return, Risk and Security Market LineDocumento44 pagineChapter 13 Return, Risk and Security Market LineFahmi Ahmad FarizanNessuna valutazione finora

- Problems Sub-IfDocumento11 pagineProblems Sub-IfChintakunta PreethiNessuna valutazione finora

- Hedging 1Documento28 pagineHedging 1Sadaquat HusainNessuna valutazione finora

- Capital BudgetingDocumento44 pagineCapital Budgetingarian2026Nessuna valutazione finora

- Depreciation AccountingDocumento42 pagineDepreciation AccountingGaurav SharmaNessuna valutazione finora

- Advanced Management AccountingDocumento10 pagineAdvanced Management AccountingKhalid AhmedNessuna valutazione finora

- What Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsDocumento10 pagineWhat Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsLucky ChaudhryNessuna valutazione finora

- Assignment 1 - Investment AnalysisDocumento5 pagineAssignment 1 - Investment Analysisphillimon zuluNessuna valutazione finora

- Major Financial Statements: - Corporate Shareholder Annual and Quarterly Reports Must IncludeDocumento90 pagineMajor Financial Statements: - Corporate Shareholder Annual and Quarterly Reports Must Includentpckaniha100% (1)

- Non Current Asset Questions For ACCADocumento11 pagineNon Current Asset Questions For ACCAAiril RazaliNessuna valutazione finora

- Capital BudgetingDocumento8 pagineCapital BudgetingVarsha KastureNessuna valutazione finora

- CMA Part 1 - Section CDocumento82 pagineCMA Part 1 - Section CAqeel HanjraNessuna valutazione finora

- FIN323 Exam 2 SolutionsDocumento7 pagineFIN323 Exam 2 SolutionskatieNessuna valutazione finora

- Practice Questions - Ratio AnalysisDocumento2 paginePractice Questions - Ratio Analysissaltee100% (5)

- MarketDocumento26 pagineMarketTushar BallabhNessuna valutazione finora

- Chapter 11 - Cost of Capital - Text and End of Chapter Questions PDFDocumento63 pagineChapter 11 - Cost of Capital - Text and End of Chapter Questions PDFNbua AhmadNessuna valutazione finora

- Capital BudgetingDocumento74 pagineCapital BudgetingAaryan RastogiNessuna valutazione finora

- Multinational Business Finance 10th Edition Solution ManualDocumento8 pagineMultinational Business Finance 10th Edition Solution ManualrspkamalgmailcomNessuna valutazione finora

- MICROFINANCEDocumento2 pagineMICROFINANCEYkeOluyomi OlojoNessuna valutazione finora

- Unit 2 Capital Budgeting Technique ProblemsDocumento39 pagineUnit 2 Capital Budgeting Technique ProblemsAshok KumarNessuna valutazione finora

- The Exchange Rate in a Behavioral Finance FrameworkDa EverandThe Exchange Rate in a Behavioral Finance FrameworkNessuna valutazione finora

- QS17 - Class Exercises SolutionDocumento4 pagineQS17 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS16 - Class Exercises SolutionDocumento5 pagineQS16 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS14 - Class ExercisesDocumento4 pagineQS14 - Class Exerciseslyk0texNessuna valutazione finora

- QS15 - Class ExercisesDocumento4 pagineQS15 - Class Exerciseslyk0texNessuna valutazione finora

- QS16 - Class ExercisesDocumento5 pagineQS16 - Class Exerciseslyk0texNessuna valutazione finora

- QS17 - Class ExercisesDocumento4 pagineQS17 - Class Exerciseslyk0texNessuna valutazione finora

- QS15 - Class Exercises SolutionDocumento5 pagineQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS14 - Class Exercises SolutionDocumento4 pagineQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS12 - Midterm 2 Review SolutionDocumento7 pagineQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS11 - Class ExercisesDocumento5 pagineQS11 - Class Exerciseslyk0texNessuna valutazione finora

- QS13 - Class Exercises SolutionDocumento2 pagineQS13 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS12 - Midterm 2 ReviewDocumento5 pagineQS12 - Midterm 2 Reviewlyk0texNessuna valutazione finora

- QS13 - Class ExercisesDocumento2 pagineQS13 - Class Exerciseslyk0texNessuna valutazione finora

- QS12 - Class Exercises SolutionDocumento2 pagineQS12 - Class Exercises Solutionlyk0tex100% (1)

- QS09 - Class Exercises SolutionDocumento4 pagineQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS12 - Class ExercisesDocumento2 pagineQS12 - Class Exerciseslyk0texNessuna valutazione finora

- QS11 - Class Exercises SolutionDocumento8 pagineQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS09 - Class ExercisesDocumento4 pagineQS09 - Class Exerciseslyk0texNessuna valutazione finora

- QS06 - Class ExercisesDocumento3 pagineQS06 - Class Exerciseslyk0texNessuna valutazione finora

- QS10 - Class ExercisesDocumento1 paginaQS10 - Class Exerciseslyk0texNessuna valutazione finora

- QS10 - Class Exercises SolutionDocumento2 pagineQS10 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS08 - Class Exercises SolutionDocumento5 pagineQS08 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS08 - Class ExercisesDocumento4 pagineQS08 - Class Exerciseslyk0texNessuna valutazione finora

- QS07 - Class ExercisesDocumento8 pagineQS07 - Class Exerciseslyk0texNessuna valutazione finora

- QS05 - Class Exercises SolutionDocumento3 pagineQS05 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS04 - Class ExercisesDocumento3 pagineQS04 - Class Exerciseslyk0texNessuna valutazione finora

- QS05 - Class ExercisesDocumento2 pagineQS05 - Class Exerciseslyk0texNessuna valutazione finora

- QS06 - Class Exercises SolutionDocumento2 pagineQS06 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS04 - Class Exercises SolutionDocumento3 pagineQS04 - Class Exercises Solutionlyk0texNessuna valutazione finora

- Family Must KnowDocumento16 pagineFamily Must KnowKhalilahmad Khatri83% (6)

- Serena Lee ProfileDocumento3 pagineSerena Lee ProfileAnonymous 0vb8ZQ0% (1)

- GFGC - K. R. Pet - Preliminary Exam For Business Quiz - 2019Documento2 pagineGFGC - K. R. Pet - Preliminary Exam For Business Quiz - 2019Kiran A SNessuna valutazione finora

- 10 Pages Directors' Summary - by CA Harsh GuptaDocumento10 pagine10 Pages Directors' Summary - by CA Harsh Guptagovarthan1976Nessuna valutazione finora

- 2019-2015 PRM Syllabus CrossmapDocumento48 pagine2019-2015 PRM Syllabus CrossmapBiswajit Sikdar100% (1)

- Chapter 1: A Simple Market ModelDocumento8 pagineChapter 1: A Simple Market ModelblillahNessuna valutazione finora

- Comprehensive Exam BDocumento14 pagineComprehensive Exam Bjdiaz_646247Nessuna valutazione finora

- Sap Fico TutorialDocumento7 pagineSap Fico TutorialgirirajNessuna valutazione finora

- Pas 7Documento11 paginePas 7Princess Jullyn ClaudioNessuna valutazione finora

- Quizzer #8 PPEDocumento13 pagineQuizzer #8 PPEAseya CaloNessuna valutazione finora

- Final POA PDFDocumento6 pagineFinal POA PDFGautam BhadadraNessuna valutazione finora

- Enge 1013 Week 2Documento19 pagineEnge 1013 Week 2Denise Magdangal0% (1)

- Auditing The Investing and Financing Cycles PDFDocumento6 pagineAuditing The Investing and Financing Cycles PDFGlenn TaduranNessuna valutazione finora

- Ecuador Bondholder Groups Release Revised Terms - July 13, 2020Documento5 pagineEcuador Bondholder Groups Release Revised Terms - July 13, 2020Daniel BasesNessuna valutazione finora

- SPM Chapter 7Documento5 pagineSPM Chapter 7Rika KartikaNessuna valutazione finora

- CIR Vs Procter and Gamble 1Documento1 paginaCIR Vs Procter and Gamble 1JVLNessuna valutazione finora

- Invt Chapter 2Documento29 pagineInvt Chapter 2Khadar MaxamedNessuna valutazione finora

- Post Test AK2Documento51 paginePost Test AK2thalita najellaNessuna valutazione finora

- Q 029 We 4 UDocumento11 pagineQ 029 We 4 UxjammerNessuna valutazione finora

- Banking Maths ProjectDocumento7 pagineBanking Maths ProjectSarthak Chauhan58% (62)

- Sample Final Exam Larkin AnswersDocumento18 pagineSample Final Exam Larkin AnswersLovejot SinghNessuna valutazione finora

- Insurance-2 Dyuti RainaDocumento10 pagineInsurance-2 Dyuti Rainavinay sharmaNessuna valutazione finora

- Business 9 Week 1 2nd Term Chapter 1 Part 3Documento17 pagineBusiness 9 Week 1 2nd Term Chapter 1 Part 3cecilia capiliNessuna valutazione finora

- SITXFIN004 - Prepare and Monitor BudgetDocumento5 pagineSITXFIN004 - Prepare and Monitor BudgetAnaya Ranta50% (4)

- TAX-CREBA VS Executive Secretary RomuloDocumento2 pagineTAX-CREBA VS Executive Secretary RomuloJoesil Dianne100% (2)

- Employee Benefits: Accounting Standard (AS) 15Documento67 pagineEmployee Benefits: Accounting Standard (AS) 15hanumanthaiahgowdaNessuna valutazione finora

- 9706 s04 MsDocumento20 pagine9706 s04 Msroukaiya_peerkhanNessuna valutazione finora

- Template For Loan AgreementDocumento3 pagineTemplate For Loan AgreementlegallyhungryblueNessuna valutazione finora

- Problem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andDocumento4 pagineProblem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andIvan BorresNessuna valutazione finora

- Mutual FundDocumento18 pagineMutual FundAnkit Chhabra100% (2)