Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Differences Between Islamic Banks

Caricato da

Fatima Ali0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

83 visualizzazioni4 pagineThe key differences between conventional and Islamic banks are:

Conventional banks operate based on man-made principles and provide predetermined interest rates, while Islamic banks operate according to Shariah principles and promote risk-sharing. Islamic banks also aim to maximize profit within Shariah restrictions and serve functions like zakat collection. Instead of interest-based lending, Islamic banks engage in partnership-based financing and give greater attention to project viability. The status of an Islamic bank is as partner rather than creditor, and profits are based on profit/loss sharing rather than fixed interest rates.

Descrizione originale:

Presentation on Islamic Banks

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThe key differences between conventional and Islamic banks are:

Conventional banks operate based on man-made principles and provide predetermined interest rates, while Islamic banks operate according to Shariah principles and promote risk-sharing. Islamic banks also aim to maximize profit within Shariah restrictions and serve functions like zakat collection. Instead of interest-based lending, Islamic banks engage in partnership-based financing and give greater attention to project viability. The status of an Islamic bank is as partner rather than creditor, and profits are based on profit/loss sharing rather than fixed interest rates.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

83 visualizzazioni4 pagineDifferences Between Islamic Banks

Caricato da

Fatima AliThe key differences between conventional and Islamic banks are:

Conventional banks operate based on man-made principles and provide predetermined interest rates, while Islamic banks operate according to Shariah principles and promote risk-sharing. Islamic banks also aim to maximize profit within Shariah restrictions and serve functions like zakat collection. Instead of interest-based lending, Islamic banks engage in partnership-based financing and give greater attention to project viability. The status of an Islamic bank is as partner rather than creditor, and profits are based on profit/loss sharing rather than fixed interest rates.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

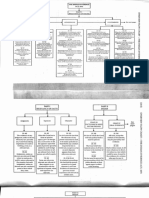

Differences between Conventional &

Islamic Banks

Difference between Conventional and Islamic Banks can be under as: Dors Feline

The

functions

operating

modes

conventional

banks

and

The functions and operating modes of Islamic

banks are based on the principles of Islamic

of

Shariah.

are

based on fully manmade

principles.

The investor is assured of a

predetermined

rate

In contrast, it promotes risk sharing between

provider of capital (investor) and the user of funds

of

(entrepreneur).

interest.

It

aims

profit

at

maximizing

without

It also aims at maximizing profit but subject

to Shariah restrictions.

any

restriction.

It does not deal with Zakat.

In the modern Islamic banking system, it has

become one of the service-oriented functions of the

Islamic banks to be a Zakat Collection Centre and

they also pay out their Zakat.

Lending money and getting

partnership

business

is

the

have to understand our customer's business very

interest is the fundamental

of

in

fundamental function of the Islamic banks. So we

it back with compounding

function

Participation

well.

the

conventional banks.

It can charge additional

The Islamic banks have no provision to charge any

extra money from the defaulters. Only small

money

(penalty

compounded interest)

and

amount of compensation and these proceeds is

in

given to charity. Rebates are give for early

case of defaulters.

settlement at the Bank's discretion.

Very often it results in the

bank's

own

becoming

It gives due importance to the public interest. Its

ultimate aim is to ensure growth with equity.

interest

prominent.

It

makes no effort to ensure

growth with equity.

For

interest-based

commercial

For the Islamic banks, it must be based on a Shariah

approved underlying transaction.

banks,

borrowing from the money

market is relatively easier.

Since income from the

pay greater attention to developing project appraisal

advances is fixed, it gives

little

importance

developing

project

Since it shares profit and loss, the Islamic banks

and evaluations.

to

expertise

appraisal

in

and

evaluations.

The

conventional

banks

The Islamic banks, on the other hand, give greater

emphasis on the viability of the projects.

give greater emphasis on

credit-worthiness

of

the

of

bank,

in

clients.

The

status

conventional

relation to its clients, is that

of creditor and debtors.

The status of Islamic bank in relation to its clients is

that of partners, investors and trader, buyer and

seller.

A conventional bank has to

Islamic bank can only guarantee deposits for

deposit account, which is based on the principle

guarantee all its deposits.

of al-wadiah, thus the depositors are guaranteed

repayment of their funds, however if the account is

based on the mudarabah concept, client have to

share in a loss position..

Money is a commodity

Money is not a commodity though it is used as a

besides

medium

of

medium of exchange and store of value. Therefore,

exchange

and

of

it cannot be sold at a price higher than its face value

store

value. Therefore, it can be

or rented out.

sold at a price higher than

its face value and it can

also be rented out.

Time value is the basis for

charging interest on capital.

Interest is charged even in

case

the

Profit on trade of goods or charging on providing

service is the basis for earning profit.

Islamic bank operates on the basis of profit and loss

organization

sharing. In case, the businessman has suffered

suffers losses by using

losses, the bank will share these losses based on the

bank funds. Therefore, it is

mode of finance used (Mudarabah, Musharakah).

not based on profit and loss

sharing.

While

disbursing

cash

The execution of agreements for the exchange of

finance, running finance or

goods & services is a must, while disbursing funds

working capital finance, no

under Murabaha, Salam & Istisna contracts.

agreement for exchange of

goods & services is made.

Conventional banks use

money as a commodity

which leads to inflation.

Islamic banking tends to create link with the real

sectors of the economic system by using trade

related activities. Since, the money is linked with

the real assets therefore it contributes directly in the

economic development.

The End

Potrebbero piacerti anche

- Conventional Bank Vs Islamic BankDocumento2 pagineConventional Bank Vs Islamic BankSyaii Mohamed100% (2)

- Al - Arafah Islami Bank LimitedDocumento23 pagineAl - Arafah Islami Bank LimitedFakhrul Islam RubelNessuna valutazione finora

- Accounting For Musyarakah FinancingDocumento16 pagineAccounting For Musyarakah FinancingHadyan AntoroNessuna valutazione finora

- AAOIFI - Introduction: 2-How AAOIFI Standards Support Islamic Finance IndustryDocumento3 pagineAAOIFI - Introduction: 2-How AAOIFI Standards Support Islamic Finance Industryshahidameen2Nessuna valutazione finora

- Modes of Investment of IBBLDocumento53 pagineModes of Investment of IBBLMussa Ratul100% (2)

- Meezan Bank Internship ReportDocumento32 pagineMeezan Bank Internship ReportRanaAakashAhmadNessuna valutazione finora

- Report On Different Modes of Investment of IBBLDocumento72 pagineReport On Different Modes of Investment of IBBLMickey Nicholson83% (6)

- Prudential Regulations For Corporate / Commercial BankingDocumento73 paginePrudential Regulations For Corporate / Commercial BankingAsma ShoaibNessuna valutazione finora

- Problems and Prospect of Brokerage Houses in BangladeshDocumento29 pagineProblems and Prospect of Brokerage Houses in BangladeshAkter Uz ZamanNessuna valutazione finora

- Islamic & Conventional Banking (F)Documento17 pagineIslamic & Conventional Banking (F)syedtahaaliNessuna valutazione finora

- Islamic Banking QuestionnaireDocumento4 pagineIslamic Banking QuestionnaireMayank Gupta100% (2)

- Internship Report On Meezan BankDocumento11 pagineInternship Report On Meezan Bankkomal mathraniNessuna valutazione finora

- Islamic Banking - Consumer PerspectivesDocumento78 pagineIslamic Banking - Consumer PerspectivesQazim Ali SumarNessuna valutazione finora

- Electronic Banking in BangladeshDocumento19 pagineElectronic Banking in BangladeshjonneymanNessuna valutazione finora

- SJIBL Internship ReportDocumento101 pagineSJIBL Internship ReportsaminbdNessuna valutazione finora

- Differences Between Islamic and Conventional AccountingDocumento4 pagineDifferences Between Islamic and Conventional AccountingAnis SofiaNessuna valutazione finora

- Chapter 16 MGT of Equity CapitalDocumento29 pagineChapter 16 MGT of Equity CapitalRafiur Rahman100% (1)

- Mission of IBBLDocumento19 pagineMission of IBBLTayyaba AkramNessuna valutazione finora

- Faysal BankDocumento113 pagineFaysal BanksaharsaeedNessuna valutazione finora

- Dhaka Bank FinalDocumento95 pagineDhaka Bank FinalAnonymous 8g7BHLNessuna valutazione finora

- Credit Risk Management of Sonali BankDocumento99 pagineCredit Risk Management of Sonali BankMosiur RahmanNessuna valutazione finora

- The Structure of Financial System of BangladeshDocumento9 pagineThe Structure of Financial System of BangladeshHn SamiNessuna valutazione finora

- Chapter 1: Introduction 1.0 PreludeDocumento18 pagineChapter 1: Introduction 1.0 PreludeAbu siddiqNessuna valutazione finora

- Bank Alfalah Internship ReportDocumento22 pagineBank Alfalah Internship Reportmemon_maryam786Nessuna valutazione finora

- MCB IslamicDocumento21 pagineMCB IslamicSadia ArslanNessuna valutazione finora

- Definition of Investment and Investment MechanismDocumento12 pagineDefinition of Investment and Investment MechanismShaheen Mahmud50% (2)

- Management Term Paper On Al Arafah Bank's HR Practice Term PaperDocumento25 pagineManagement Term Paper On Al Arafah Bank's HR Practice Term Paperratulbinmuzib100% (3)

- Faysal Bank Internship ReportDocumento84 pagineFaysal Bank Internship Reportimran_greenplus100% (3)

- Ch-3 Financial Market in BangladeshDocumento8 pagineCh-3 Financial Market in Bangladeshlabonno350% (1)

- Internship Report NBPDocumento55 pagineInternship Report NBPSidra NaeemNessuna valutazione finora

- Case Studies For Discussion PDF For IBFDocumento16 pagineCase Studies For Discussion PDF For IBFAmna Naseer100% (1)

- Islamic Banking and FinanceDocumento83 pagineIslamic Banking and Financeanon_879522740Nessuna valutazione finora

- How BNM Supervising Conventional and Islamic BankingDocumento36 pagineHow BNM Supervising Conventional and Islamic BankingZulaihaAmariaNessuna valutazione finora

- Summary Chapter 8Documento6 pagineSummary Chapter 8Zahidul AlamNessuna valutazione finora

- IBBL Internship OpportunityDocumento6 pagineIBBL Internship OpportunityTakia FerdousNessuna valutazione finora

- Report Meezan BankDocumento17 pagineReport Meezan BankAli AamirNessuna valutazione finora

- Iwm Customer 2Documento9 pagineIwm Customer 2irfan sururiNessuna valutazione finora

- Sme Financing of FSIBLDocumento60 pagineSme Financing of FSIBLKhan Jewel100% (4)

- Financial Performance Analysis On Dhaka Bank LTDDocumento15 pagineFinancial Performance Analysis On Dhaka Bank LTDনূরুল আলম শুভNessuna valutazione finora

- Overview of Credit AppraisalDocumento14 pagineOverview of Credit AppraisalAsim MahatoNessuna valutazione finora

- Deposit MobiliziationDocumento454 pagineDeposit MobiliziationperkisasNessuna valutazione finora

- Foreign Exchange Policy of Export Import Bank ofDocumento76 pagineForeign Exchange Policy of Export Import Bank ofMd MostakNessuna valutazione finora

- Al Arafah Islamic BankDocumento33 pagineAl Arafah Islamic BankhossaingoniNessuna valutazione finora

- Islami Bank Bangladesh LimitedDocumento82 pagineIslami Bank Bangladesh Limitedrbkshuvo0% (1)

- Benefits of Islamic BankingDocumento2 pagineBenefits of Islamic Bankingazamkha100% (1)

- Internship Report On Credit Adminitraation of Mutual Trust BankDocumento140 pagineInternship Report On Credit Adminitraation of Mutual Trust BankNazmul Amin AqibNessuna valutazione finora

- Prudential Regulations For Corporate BankingDocumento97 paginePrudential Regulations For Corporate BankingWaqas ShaikhNessuna valutazione finora

- Foreign Exchange Operation of Commercial BankDocumento24 pagineForeign Exchange Operation of Commercial BankShawon100% (1)

- Meezan Bank Products: Islamic BankingDocumento6 pagineMeezan Bank Products: Islamic BankingHammad AhmedNessuna valutazione finora

- Internship ReportDocumento34 pagineInternship ReportFaisal RayhanNessuna valutazione finora

- Foreign Exchange Transaction in Sonali Bank Limited.Documento69 pagineForeign Exchange Transaction in Sonali Bank Limited.Himadri Himu0% (1)

- Foreign Exchange On First Security Islami Bank LTDDocumento60 pagineForeign Exchange On First Security Islami Bank LTDAhadul Islam100% (2)

- NBFI Lectures PDFDocumento4 pagineNBFI Lectures PDFSamantha IslamNessuna valutazione finora

- Characteristics of Traditional Group InsuranceDocumento8 pagineCharacteristics of Traditional Group Insurancechsureshkumar1985Nessuna valutazione finora

- Case Studies in Islamic Banking and FinanceDocumento2 pagineCase Studies in Islamic Banking and FinanceMahfuz An-NurNessuna valutazione finora

- Ibf Case StudyDocumento17 pagineIbf Case StudyAyesha HamidNessuna valutazione finora

- Diffrence Between Conventional Bank and Islamic BankDocumento1 paginaDiffrence Between Conventional Bank and Islamic BankChowdhury Mahin Ahmed100% (1)

- Rehan Dhami Fa16 Bba 151Documento5 pagineRehan Dhami Fa16 Bba 151Rehan DhamiNessuna valutazione finora

- Islamic BankingDocumento3 pagineIslamic BankingmuneebalamNessuna valutazione finora

- Ready To Go Lessons For Maths Stage 5 AnswersDocumento10 pagineReady To Go Lessons For Maths Stage 5 AnswersRohitasva ChandramohanNessuna valutazione finora

- HRM Case Study and Suggested SolutionsDocumento6 pagineHRM Case Study and Suggested SolutionsNaafac Yuusuf MuxumedNessuna valutazione finora

- Islamic PresentationDocumento66 pagineIslamic PresentationFatima AliNessuna valutazione finora

- Islamic PresentationDocumento66 pagineIslamic PresentationFatima AliNessuna valutazione finora

- GAT Analytical ReasoningDocumento272 pagineGAT Analytical ReasoningMuzaffar Iqbal90% (10)

- Ready To Go Lessons For Maths Stage 5 AnswersDocumento10 pagineReady To Go Lessons For Maths Stage 5 AnswersRohitasva ChandramohanNessuna valutazione finora

- Chapter 6 Lecture NotesDocumento15 pagineChapter 6 Lecture NotesFatima AliNessuna valutazione finora

- (15-19) A Study of Merger and Acquisition of Selected Telecom Companies Outside IndiaDocumento5 pagine(15-19) A Study of Merger and Acquisition of Selected Telecom Companies Outside IndiaFatima AliNessuna valutazione finora

- Principles of Management in IslamDocumento3 paginePrinciples of Management in IslamFatima AliNessuna valutazione finora

- Lesson 8 (Excel)Documento39 pagineLesson 8 (Excel)A.YOGAGURUNessuna valutazione finora

- (15-19) A Study of Merger and Acquisition of Selected Telecom Companies Outside IndiaDocumento5 pagine(15-19) A Study of Merger and Acquisition of Selected Telecom Companies Outside IndiaFatima AliNessuna valutazione finora

- Presentation 1Documento39 paginePresentation 1Hassan Mahmood KhawajaNessuna valutazione finora

- PESTEL FrameworkDocumento13 paginePESTEL FrameworkFatima AliNessuna valutazione finora

- Arabic & English Text of Ziyarat AshuraDocumento8 pagineArabic & English Text of Ziyarat AshuraMohammed ArshadNessuna valutazione finora

- CC C C C CC C C CCDocumento3 pagineCC C C C CC C C CCFatima AliNessuna valutazione finora

- Internship ReportDocumento33 pagineInternship ReportFatima AliNessuna valutazione finora

- Introduction of HBLDocumento16 pagineIntroduction of HBLFatima AliNessuna valutazione finora

- Service MixDocumento31 pagineService MixFatima Ali100% (3)

- CC C C C CC C C CCDocumento3 pagineCC C C C CC C C CCFatima AliNessuna valutazione finora

- IT Presentation (Glimpse On Latest Technologies)Documento41 pagineIT Presentation (Glimpse On Latest Technologies)Fatima AliNessuna valutazione finora

- Interpersonal Conflict Management StylesDocumento39 pagineInterpersonal Conflict Management StylesFatima AliNessuna valutazione finora

- Robert BrowningDocumento10 pagineRobert BrowningFatima AliNessuna valutazione finora

- Ting Vs Central Bank of The PhilippinesDocumento6 pagineTing Vs Central Bank of The PhilippinesRelmie TaasanNessuna valutazione finora

- 1 Ptot07awDocumento40 pagine1 Ptot07awSanket RoutNessuna valutazione finora

- Subcontract For ScaffoldingDocumento23 pagineSubcontract For ScaffoldingSarin100% (1)

- Panitia Quran Borang Hafazan 1-5Documento11 paginePanitia Quran Borang Hafazan 1-5Khairiah IsmailNessuna valutazione finora

- Inter Regional Transfer FormDocumento2 pagineInter Regional Transfer FormEthiopian Best Music (ፈታ)Nessuna valutazione finora

- Luminous PrayersDocumento23 pagineLuminous PrayersRiaz Mohamed RasheedNessuna valutazione finora

- Reid v. Covert, 354 U.S. 1 (1957)Documento65 pagineReid v. Covert, 354 U.S. 1 (1957)Scribd Government DocsNessuna valutazione finora

- Open 20 The Populist ImaginationDocumento67 pagineOpen 20 The Populist ImaginationanthrofilmsNessuna valutazione finora

- Companies Act: Unit 1 Introduction To CompanyDocumento13 pagineCompanies Act: Unit 1 Introduction To CompanyPunith Kumar ReddyNessuna valutazione finora

- Iit Jam - Emt 2021 PDFDocumento5 pagineIit Jam - Emt 2021 PDFNishit DasNessuna valutazione finora

- ROXAS Vs DE LA ROSADocumento1 paginaROXAS Vs DE LA ROSALiaa AquinoNessuna valutazione finora

- Relevancy of Facts: The Indian Evidence ACT, 1872Documento3 pagineRelevancy of Facts: The Indian Evidence ACT, 1872Arun HiroNessuna valutazione finora

- Ebook Concepts in Federal Taxation 2018 25Th Edition Murphy Test Bank Full Chapter PDFDocumento67 pagineEbook Concepts in Federal Taxation 2018 25Th Edition Murphy Test Bank Full Chapter PDFbeckhamquangi9avb100% (10)

- Addition Worksheet2Documento2 pagineAddition Worksheet2JoyceNessuna valutazione finora

- Employee Fraud PDFDocumento15 pagineEmployee Fraud PDFmanzoorNessuna valutazione finora

- I. Definitions 1. "Agreement" Means This Settlement Agreement and Full and Final ReleaseDocumento27 pagineI. Definitions 1. "Agreement" Means This Settlement Agreement and Full and Final Releasenancy_sarnoffNessuna valutazione finora

- Kumari Bank Internship ReportDocumento54 pagineKumari Bank Internship ReportBhatta GAutam69% (16)

- JD CorpoDocumento3 pagineJD Corpojobelle barcellanoNessuna valutazione finora

- Oracle Receivables An OverviewDocumento69 pagineOracle Receivables An OverviewmanukleoNessuna valutazione finora

- Lupang Hinirang - WikipediaDocumento46 pagineLupang Hinirang - WikipediaYmeri ResonableNessuna valutazione finora

- Cyber LawsDocumento19 pagineCyber LawsAnonymous vH4lUgV9Nessuna valutazione finora

- Manual Survey Pro For RangerDocumento337 pagineManual Survey Pro For RangerIni ChitozNessuna valutazione finora

- Bus Math Grade 11 q2 m2 w2Documento7 pagineBus Math Grade 11 q2 m2 w2Ronald AlmagroNessuna valutazione finora

- The Astonishing Rise of Angela Merkel - The New YorkerDocumento87 pagineThe Astonishing Rise of Angela Merkel - The New YorkerveroNessuna valutazione finora

- Code of Ethics BSEEDocumento3 pagineCode of Ethics BSEEVánz Zeidlegor Sanchez VillanezoNessuna valutazione finora

- Culasi, AntiqueDocumento10 pagineCulasi, AntiquegeobscribdNessuna valutazione finora

- Memorial Drafting and Judgement Writing Competition 2022Documento14 pagineMemorial Drafting and Judgement Writing Competition 2022Naila JabeenNessuna valutazione finora

- Example in ElectrostaticsDocumento36 pagineExample in ElectrostaticsJoseMiguelDomingo75% (4)

- Nestle Multinational CompanyDocumento3 pagineNestle Multinational CompanyShebel AgrimanoNessuna valutazione finora

- Site MappingDocumento74 pagineSite MappingLina Michelle Matheson BrualNessuna valutazione finora