Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

General Electric's Plan To Take by Storm The U.S

Caricato da

quinteroudinaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

General Electric's Plan To Take by Storm The U.S

Caricato da

quinteroudinaCopyright:

Formati disponibili

General Electric's Plan To Take By Storm The U.S. Oil And Gas Industry Materializes - Genera...

1 of 9

file:///C:/Users/cquinte1/Desktop/General Electric's Plan To Take By Storm The U.S. Oil And ...

Seeking Alpha

Home |

My Portfolio |

Breaking News |

Latest Articles |

StockTalk |

ALERTS

PRO

David Alton Clark

Long/short equity, tech, banks, oil & gas

Profile| Send Message|

Get real-time alerts (3,305 followers)

Jul. 10, 2014 2:01 AM ET | About: General Electric Company (GE) by: David Alton Clark

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

10-07-2014 11:54

General Electric's Plan To Take By Storm The U.S. Oil And Gas Industry Materializes - Genera...

2 of 9

file:///C:/Users/cquinte1/Desktop/General Electric's Plan To Take By Storm The U.S. Oil And ...

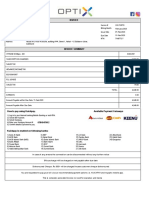

In the third quarter of 2015 GE plans on opening a new $125 million Oil and Gas Technology Center in Oklahoma City.

This will be General Electrics first research facility in the U.S. devoted specifically to the Oil and Gas industry.

General Electrics forward thinking programs such as this will provide income production and capital appreciation for retirement investors for

years to come.

One of General Electric's (GE) most intriguing and possibly most profitable endeavors for the company is

about to come to fruition. Based on a plethora of other news regarding the company this project with vast

potential to improve the bottom line has been overlooked in my opinion. In the following sections I will detail

General Electric's plan to take by storm the burgeoning U.S. oil and gas industry.

The EIA recently published its 2014 Annual Energy Outlook report. The report details a vast increase in oil and

gas production and consumption.

10-07-2014 11:54

General Electric's Plan To Take By Storm The U.S. Oil And Gas Industry Materializes - Genera...

3 of 9

file:///C:/Users/cquinte1/Desktop/General Electric's Plan To Take By Storm The U.S. Oil And ...

(click to enlarge)

(Source: EIA.gov)

The EIA puts out a report each year regarding the organization's outlook for the energy industry. The three main takeaways are as follows:

1. Shale gas provides the largest source of growth in U.S. natural gas supply. A 56% increase is expected in total natural gas production from 2012

to 2040 resulting primarily from increased development of shale gas, tight gas and offshore natural gas resources.

2. Natural gas production is currently growing faster than use. The EIA predicts the U.S. will become a net exporter of natural gas before 2020.

The EIA predicts natural gas production will grow by an average rate of 1.6% per year from 2012 to 2040. This is more than double the 0.8%

annual growth rate of total U.S. consumption over the same period. The growth in production is met by increasing foreign demand. Pipelines

will increase to facilitate certain exports. The United States becomes a net exporter of natural gas before 2020. Growing LNG exports also

support higher natural gas prices.

3. The industrial and electric power sectors will be key drivers of growth in U.S. natural gas consumption. The EIA predicts U.S. total natural gas

consumption will grow from 25.6 trillion cubic feet (Tcf) in 2012 to 31.6 Tcf in 2040. Natural gas use increases in all of the end-use sectors

with the exception of residential. Natural gas use for residential space heating declines as a result of population shifts to warmer regions of the

country and improvements in appliance efficiency.

10-07-2014 11:54

General Electric's Plan To Take By Storm The U.S. Oil And Gas Industry Materializes - Genera...

4 of 9

file:///C:/Users/cquinte1/Desktop/General Electric's Plan To Take By Storm The U.S. Oil And ...

According to a recent Bloomberg report, Bank of America (BAC) stated:

"The U.S. will remain the world's biggest oil producer this year after overtaking Saudi Arabia and Russia as extraction of energy from

shale rock spurs the nation's economic recovery. U.S. production of crude oil, along with liquids separated from natural gas, surpassed

all other countries this year with daily output exceeding 11 million barrels in the first quarter."

Bank of America's Francisco Blanch went on to say:

"The U.S. increase in supply is a very meaningful chunk of oil. The shale boom is playing a key role in the U.S. recovery. If the U.S. didn't

have this energy supply, prices at the pump would be completely unaffordable."

There you have it folks. This is a long-term secular growth story just on the cusp of being realized and General Electric has big plans to capitalize on

it. In the next section I will give a brief review of the recent developments.

Global oil and gas reserves are flourishing but the petrochemicals are stowed away in the most challenging environments on the planet. This is where

General Electric comes in. The company is working with partners around the globe to solve the perplexing issue of how to retrieve the deposits cost

effectively. In the third quarter of 2015 General Electric will open a Global Technology Center in Oklahoma. This global innovation hub's focus will

be to hasten innovation in oil and gas technology with the ability to unlock and retrieve the resources more efficiently. General Electric Global

Research scientists have spent the last year developing breakthrough technologies in four specific areas that may crack the profitability code for these

expensive endeavors. There are four major areas of focus. The improvements come in the way of new technologies such as improved artificial lifts,

subsea electric power, CO2 fracturing and a new 20KSI blowout preventer. See graphic below.

10-07-2014 11:54

General Electric's Plan To Take By Storm The U.S. Oil And Gas Industry Materializes - Genera...

5 of 9

file:///C:/Users/cquinte1/Desktop/General Electric's Plan To Take By Storm The U.S. Oil And ...

(Source: GE.com)

10-07-2014 11:54

General Electric's Plan To Take By Storm The U.S. Oil And Gas Industry Materializes - Genera...

6 of 9

file:///C:/Users/cquinte1/Desktop/General Electric's Plan To Take By Storm The U.S. Oil And ...

The new "waterless" fracturing method for unlocking oil and natural gas from shale with a mixture of liquid CO2 and sand is the most intriguing to

me. General Electric Engineer Mike Bowman recently stated:

"The vast majority of existing fracturing operations now pump in millions of gallons of pressurized water to do the job. But the new

process could one day eliminate the need for it and make fracturing cleaner and more effective."

Bowman currently works at General Electric's research headquarters in Niskayuna, NY. Nonetheless, he will soon join dozens of new colleagues at

General Electric's new global oil and gas technology hub in Oklahoma City.

I see this as just one more example of how General Electric's management is doing a tremendous job of exploiting all the major growth opportunities

in the energy sector today. This is what will be needed to keep the retirements of millions of baby boomers funded for years to come.

I feel General Electric has the type of forward thinking that will keep the company fresh and relevant for many years to come. This is exactly the type

of dividend paying equity people entering retirement should consider. Dividend investing is popular among retirees and those who wish to live on

their savings and are no longer able to work.

With this recent news, General Electric has the potential for both capital gains and income production. The stock is in a well defined uptrend and

trading at the bottom of the uptrend channel.

10-07-2014 11:54

General Electric's Plan To Take By Storm The U.S. Oil And Gas Industry Materializes - Genera...

7 of 9

file:///C:/Users/cquinte1/Desktop/General Electric's Plan To Take By Storm The U.S. Oil And ...

(click to enlarge)

(Source: Finviz.com)

Boomers will be looking for stocks like General Electric that have a track record of increasing dividends, giving them yet another hedge against

inflation. This combination will be necessary to fund the lengthening retirement that comes with the greater life expectancy for people today.

Nonetheless, there are always downside risks.

The Alstom acquisition

General Electric's winning bid for Alstom has many facets. This can cause the acquiring company to overpay based on perceived cost savings that do

not materialize. Alstom has a ton of debt and is currently a tangled web of jumbled joint ventures and partnerships. The current state of affairs allows

for substantial risk of massive unknown unknowns. Once General Electric starts digging into the company, General Electric may find the Alstom

acquisition wasn't such a great deal after all.

10-07-2014 11:54

General Electric's Plan To Take By Storm The U.S. Oil And Gas Industry Materializes - Genera...

8 of 9

file:///C:/Users/cquinte1/Desktop/General Electric's Plan To Take By Storm The U.S. Oil And ...

Geopolitical Risks

Geopolitical uncertainty remains on the rise. The Russia/Ukraine conflict appears to be spiraling out of control along with a new flare up in Middle

East tensions. In some ways this underpins General Electric's endeavor, yet if the global economy is sunk due to all-out war, no equity will be safe

from a correction.

Europe is not out of the woods yet

The global recovery is in its infancy and will require constant nurturing from central bankers. Nevertheless, the ECB has been reluctant to embark on

a similar plan as the Fed's QE program. Furthermore, the Fed can't keep rates at zero forever. The green shoots we see now may turn brown once the

support of the Fed evaporates.

The market is at all-time highs

The market is currently sitting at all-time highs just as we enter the summer doldrums. This is an extremely precarious position to be in. You could

even say the market is priced for perfection right now. Any hiccup in macroeconomic indicators could bring the markets tumbling down in an instant,

not to mention the potential downside created by a negative geopolitical event. It may be time to tread lightly.

I think General Electric is making all the right moves to continue as a going concern in the future. Furthermore, you get paid a 3.34% dividend yield

to boot. Many of the downside risks are not going to go away anytime soon. Moreover, the downside would most likely be transitory in nature and

simply offer an excellent buying opportunity. Factor this in with the fact that historically, dividend-paying stocks have outperformed non-dividendpaying stocks, and you have a recipe for outstanding returns. I see general Electric as one of the best total return plays out there currently.

Nevertheless, always layer in to positions over time to reduce risk.

Share this article with a colleague

Tweet

Share

0

You'll Love Our Free

GE Analysis

My name FUNDS

is Tracey Ryniec and I'm

INCOME

giving you a detailed report on GE

from Zacks

Investment

Research.

Franklin

Square

Investments

10-07-2014 11:54

General Electric's Plan To Take By Storm The U.S. Oil And Gas Industry Materializes - Genera...

9 of 9

file:///C:/Users/cquinte1/Desktop/General Electric's Plan To Take By Storm The U.S. Oil And ...

It predicts

where that

stock will head in 1 to 3

About

, Managers

, Strategy

months.The report applies our earnings-based

system that

nearly tripledFunds

the market since 1988.

Nuveen

Closed-End

Performance

, Fact

Sheet

, Holdings

But GE might

not be

your

best choice. So you will

also receive a second report, 5 Stocks to Double with

my compliments.

Get up to $500 in commission rebates

Get free GE analysis and 5 Stocks to Double

TOP AUTHORS: The Opinion Leaders

TOP USERS: StockTalkers | Instablogs

Mobile Apps | RSS Feeds | Sitemap | About Us | Contact Us

Terms of Use | Privacy | Xignite quote data | 2014 Seeking Alpha

10-07-2014 11:54

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- E-Ticket 7242130546036Documento2 pagineE-Ticket 7242130546036VincentNessuna valutazione finora

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Springer Finance SeriesDocumento2 pagineSpringer Finance SeriesMatt LaurdNessuna valutazione finora

- California Tenant and Landlord Rights and ResponsibilitiesDocumento62 pagineCalifornia Tenant and Landlord Rights and Responsibilitiesjr_raffy5895100% (1)

- Solution Manual For Intermediate Accounting 19th Edition by Stice PDFDocumento18 pagineSolution Manual For Intermediate Accounting 19th Edition by Stice PDFADNessuna valutazione finora

- Prezentacja Inwestorska enDocumento35 paginePrezentacja Inwestorska enquinteroudinaNessuna valutazione finora

- Influence of Feed Size on AG/SAG Mill PerformanceDocumento6 pagineInfluence of Feed Size on AG/SAG Mill PerformancequinteroudinaNessuna valutazione finora

- 2014 Cost of Living Survey - MercerDocumento7 pagine2014 Cost of Living Survey - MercerquinteroudinaNessuna valutazione finora

- Cerro Corona InfoDocumento30 pagineCerro Corona InfoquinteroudinaNessuna valutazione finora

- SoftLogix 5800 Installation InstructionsDocumento14 pagineSoftLogix 5800 Installation InstructionsquinteroudinaNessuna valutazione finora

- Upgrading Integration Operational Platform in Codelco - AndinaDocumento1 paginaUpgrading Integration Operational Platform in Codelco - AndinaquinteroudinaNessuna valutazione finora

- Bottom Line Automation Matrikon Summit 2007 Mike Brown Michel Ruel May 7Documento24 pagineBottom Line Automation Matrikon Summit 2007 Mike Brown Michel Ruel May 7quinteroudinaNessuna valutazione finora

- Table of Contents and Key Papers on Process Control and OptimisationDocumento4 pagineTable of Contents and Key Papers on Process Control and OptimisationcbqucbquNessuna valutazione finora

- Process Control in Metallurgical Plants: Towards OperationalDocumento48 pagineProcess Control in Metallurgical Plants: Towards Operationalquinteroudina50% (2)

- Sugar Cane Mills Control PDFDocumento25 pagineSugar Cane Mills Control PDFquinteroudinaNessuna valutazione finora

- Citrixfaq FAQDocumento10 pagineCitrixfaq FAQquinteroudinaNessuna valutazione finora

- Honeywell Castelijns Advanced Control MonitoringDocumento62 pagineHoneywell Castelijns Advanced Control MonitoringquinteroudinaNessuna valutazione finora

- Robotic Tecnology: A Way Towards An Intelligent Mining: Luis F. Ramírez S ., Luis Baeza, Juan C. BarrosDocumento1 paginaRobotic Tecnology: A Way Towards An Intelligent Mining: Luis F. Ramírez S ., Luis Baeza, Juan C. BarrosquinteroudinaNessuna valutazione finora

- Improvement in The Performance of Online Control Applications and OptimizeIT ABB Suite For APCDocumento27 pagineImprovement in The Performance of Online Control Applications and OptimizeIT ABB Suite For APCquinteroudinaNessuna valutazione finora

- Cerro Corona InfoDocumento30 pagineCerro Corona InfoquinteroudinaNessuna valutazione finora

- Tues 11.00 XyzOP J LoveDocumento38 pagineTues 11.00 XyzOP J LovequinteroudinaNessuna valutazione finora

- 1.applications of Dynamic SimulationDocumento13 pagine1.applications of Dynamic SimulationEdier Briceño AranguriNessuna valutazione finora

- Gold OptimizationDocumento5 pagineGold OptimizationquinteroudinaNessuna valutazione finora

- Belt Weightometer VOA 2Documento5 pagineBelt Weightometer VOA 2cbqucbquNessuna valutazione finora

- Belt Weightometer VOADocumento6 pagineBelt Weightometer VOAquinteroudinaNessuna valutazione finora

- Hydrocarbon Engineering Nov 2004Documento4 pagineHydrocarbon Engineering Nov 2004quinteroudinaNessuna valutazione finora

- Evolution of Algorithms For Industrial Model Predictive ControlDocumento25 pagineEvolution of Algorithms For Industrial Model Predictive ControlquinteroudinaNessuna valutazione finora

- Table of Contents and Key Papers on Process Control and OptimisationDocumento4 pagineTable of Contents and Key Papers on Process Control and OptimisationcbqucbquNessuna valutazione finora

- Gold OptimizationDocumento5 pagineGold OptimizationquinteroudinaNessuna valutazione finora

- Table of Contents and Key Papers on Process Control and OptimisationDocumento4 pagineTable of Contents and Key Papers on Process Control and OptimisationcbqucbquNessuna valutazione finora

- Have You Hugged Your APC Lately? A Look at The Value of APC RevampingDocumento3 pagineHave You Hugged Your APC Lately? A Look at The Value of APC RevampingquinteroudinaNessuna valutazione finora

- The Future of - EmploymentDocumento72 pagineThe Future of - EmploymentgottsundaNessuna valutazione finora

- He Jan2006 State Space ControllerDocumento4 pagineHe Jan2006 State Space ControllerquinteroudinaNessuna valutazione finora

- 357 SavuDocumento6 pagine357 SavuquinteroudinaNessuna valutazione finora

- MrcInvoicesFebruary2023371784 PDFDocumento1 paginaMrcInvoicesFebruary2023371784 PDFIrfan RazaNessuna valutazione finora

- Case Study of Itc LimitedDocumento3 pagineCase Study of Itc LimitedMohanrajNessuna valutazione finora

- Lloyds Steel Industries LTDDocumento20 pagineLloyds Steel Industries LTDRohit JohnNessuna valutazione finora

- Intacc Ass 7Documento7 pagineIntacc Ass 7Pixie CanaveralNessuna valutazione finora

- WhatsApp Chat With SPACE MUSICDocumento114 pagineWhatsApp Chat With SPACE MUSIC10k subscribers without any Videos ChallengeNessuna valutazione finora

- All Values in The Economic System Are Measured in Terms of MoneyDocumento2 pagineAll Values in The Economic System Are Measured in Terms of MoneyYayank Emilia Darma100% (2)

- IGI Holdings Annual Report 2017: Letting Go to Let GrowDocumento195 pagineIGI Holdings Annual Report 2017: Letting Go to Let GrowAttaullah ShahNessuna valutazione finora

- Study Case Chapter 6 IrfanDocumento5 pagineStudy Case Chapter 6 IrfanMuhammad Irfan Salahuddin100% (1)

- SFAD Case SolutionDocumento6 pagineSFAD Case SolutionMuhammad Shariq SiddiquiNessuna valutazione finora

- MSCI Feb11 IndexCalcMethodologyDocumento103 pagineMSCI Feb11 IndexCalcMethodologybboyvnNessuna valutazione finora

- Case Study of Ross Abernathy ANANYA AM1911Documento7 pagineCase Study of Ross Abernathy ANANYA AM1911Soumya SahuNessuna valutazione finora

- Abyssinia Bank Charts Noteworthy Profit, Dividend ClimbDocumento7 pagineAbyssinia Bank Charts Noteworthy Profit, Dividend ClimbBernabasNessuna valutazione finora

- Sanction For PGP BooksDocumento1 paginaSanction For PGP BooksJaya Simha ReddyNessuna valutazione finora

- Problem Set 3Documento14 pagineProblem Set 3mariaNessuna valutazione finora

- Rapid Academy of Competitive Exams: R. A. C. EDocumento16 pagineRapid Academy of Competitive Exams: R. A. C. EMuthuvel RajaNessuna valutazione finora

- It o Calculus:, T) Depending On TwoDocumento13 pagineIt o Calculus:, T) Depending On TwoTu ShirotaNessuna valutazione finora

- Screenshot 2022-08-25 at 11.49.54 AMDocumento2 pagineScreenshot 2022-08-25 at 11.49.54 AMRAHUL VERMANessuna valutazione finora

- 10 Redington ImmunizationDocumento13 pagine10 Redington ImmunizationderNessuna valutazione finora

- Peak Garage Doors Sales Growth StrategyDocumento2 paginePeak Garage Doors Sales Growth StrategyVikasBhatNessuna valutazione finora

- Accountancy Chapters - NIOSDocumento1 paginaAccountancy Chapters - NIOSJayNessuna valutazione finora

- FSA For DummiesDocumento53 pagineFSA For DummiesnicolepetrescuNessuna valutazione finora

- Get Your Financial Life On Track PDFDocumento35 pagineGet Your Financial Life On Track PDFkapoor_mukesh4uNessuna valutazione finora

- "FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Documento2 pagine"FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Snehasish PadhyNessuna valutazione finora

- 04 TP FinancialDocumento4 pagine04 TP Financialbless erika lendroNessuna valutazione finora

- FM Mid Term Notes SajinJDocumento25 pagineFM Mid Term Notes SajinJVishnu RC VijayanNessuna valutazione finora

- Format - Issuance of Duplicate Cheque by MDIndiaDocumento3 pagineFormat - Issuance of Duplicate Cheque by MDIndiabasheer_vthuNessuna valutazione finora