Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

UT Dallas Syllabus For Aim2302.501 05f Taught by Him-Lai Chan (hlc013000)

Caricato da

UT Dallas Provost's Technology GroupDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

UT Dallas Syllabus For Aim2302.501 05f Taught by Him-Lai Chan (hlc013000)

Caricato da

UT Dallas Provost's Technology GroupCopyright:

Formati disponibili

AIM 2302 – Section 501

Fall 2005

Instructor: Lilian H. Chan

Class Time: Tuesday 7pm – 9:45 pm

Office: SOM4.429

Phone: 972-883-4434

Email: hlc013000@utdallas.edu or via WebCT

Office Hours: Monday 3:00pm – 5:00pm and by appointment

Required Material: Horngren, Sundem, and Stratton, Introduction to Management

Accounting, 13th edition

Course Objectives: This course introduces the field of management accounting, which

has been defined by the Institute of Management Accountants as:

. . . process of planning, designing, measuring and

operating non-financial and financial information systems

that guides management action, motivates behavior, and

supports and creates the cultural values necessary to

achieve an organization’s strategic, tactical and operating

objectives.

While management and financial accounting share some common

ground the emphases are different. Management accounting is

primarily concerned with information for decision-makers within the

organization managers and those who work with them. Financial

accounting provides information for decision-makers outside

(external to) the organization.

One of the main objectives of this course is to familiarize you with

the requisite technical skills for basic business analysis. For

example, you will learn to determine unit product costs, calculate

the costs of goods manufactured, conduct cost-volume-profit

analyses, create budgets, and measure performance against

budgets.

Unless you understand managerial accounting, you cannot have a

thorough understanding of a company’s internal operations. What

you learn in this course will help you understand the operations of

your future employer, and help you understand other companies

you encounter in your role as competitor, consultant, or investor.

Course Operation: Part of the class time will be spent discussing concepts, part will be

spent solving applied problems, and part will be spent answering

questions. You are expected to have read all assigned material for

that class BEFORE attending the lectures. You should take notes

during the lectures.

Working problems is key to your success. Management accounting

is an applied discipline; the more problems you do, the better you

should be at applying your knowledge. Pay attention to the

problems solved in the class and the homework problems. If you

have trouble solving a homework problem, ask about it in the next

class, as others may also have had difficulty.

WebCT: I will post the lecture notes and class handouts on WebCT

(webct.utdallas.edu). You need your UTD username and password

to log in to WebCT. Periodically, I may post extra problems and/or

solutions on WebCT.

Grading: Your final grades will be determined as follows:

1. Attendance: 10%

2. 3 Exams

Exam I: Sept 20th 30%

Exam II: Oct 25th 30%

Exam III: Nov 29th 30%

Attendance: Attendance will be randomly taken.

Exams: There will be 3 exams. The exams are not cumulative and they

will be 90 minutes long. Practice exams will not be distributed

or posted on the internet. The exams are closed book and

closed note. Exams are multiple choice and many questions will

require calculations. Please mark your answers on both the

exam itself and the scantron.

Academic Integrity: In order to ensure fairness and on behalf of the overwhelming

majority of honest students, I will refer anyone suspected of

academic dishonesty to the Office of Student Conduct. There

are no exceptions to this policy under any circumstances. If a

student is found guilty of academic dishonesty by the Office of

Student Conduct, the student will receive an F for the course in

addition to any punishment determined by the Office of Student

Conduct.

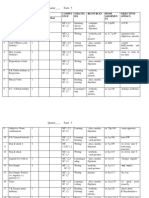

Schedule: The following pages provide a tentative outline of the course. The

chapters listed under "Reading" refer to the textbook.

Course Outline

Date Reading Topic

Tue 8/23 Ch. 1 Course overview, Introduction to Management Accounting

Tue 8/30 Ch. 2 Cost behavior and cost-volume relationship

Tue 9/6 Ch. 2 Cost-volume relationship (cont’d)

Ch. 3 Measurement of cost behavior

Tue 9/13 Ch. 3 Measurement of cost behavior (cont’d)

Review

Tue 9/20 Exam #1

Tue 9/27 Review Exam #1

Ch. 5 Relevant information and decision making

Tue 10/4 Ch. 5 & 6 Relevant information and decision making (cont’d)

Tue 10/11 Ch. 6 Relevant information and decision making (cont’d)

Ch. 4 Cost management systems and activity-based costing

Tue 10/18 Ch. 4 Cost management systems and activity-based costing (cont’d)

Review

Tue 10/25 Exam #2

Tue 11/1 Review Exam #2

Ch. 13 Accounting for overhead costs

Tue 11/8 Ch. 14 Job-costing and process-costing systems

Tue 11/15 Ch. 14 Job-costing and process-costing systems (Cont’d)

Tue 11/22 Ch. 7 Master budget

Review

Tue 11/29 Final Exam

Potrebbero piacerti anche

- Fundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsDa EverandFundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsNessuna valutazione finora

- UT Dallas Syllabus For Aim2302.002 05f Taught by Celal Aksu (Cxa034000)Documento3 pagineUT Dallas Syllabus For Aim2302.002 05f Taught by Celal Aksu (Cxa034000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- AC 301 Course Outline 2008-9Documento5 pagineAC 301 Course Outline 2008-9Goodluck SumariNessuna valutazione finora

- AFM244-S23 SyllabusDocumento7 pagineAFM244-S23 SyllabushcjycjNessuna valutazione finora

- Strategic Cost Analysis For Decision Making Acc 3416Documento7 pagineStrategic Cost Analysis For Decision Making Acc 3416Paul SchulmanNessuna valutazione finora

- AG920 MA Outline May 2019Documento2 pagineAG920 MA Outline May 2019Tono IndraNessuna valutazione finora

- UT Dallas Syllabus For Aim6202.0g2.07s Taught by Surya Janakiraman (Suryaj)Documento12 pagineUT Dallas Syllabus For Aim6202.0g2.07s Taught by Surya Janakiraman (Suryaj)UT Dallas Provost's Technology GroupNessuna valutazione finora

- MGT223H5F Lec9101Documento8 pagineMGT223H5F Lec9101leonora19990414Nessuna valutazione finora

- Syllabus Corporate FinanceDocumento6 pagineSyllabus Corporate FinanceTara PNessuna valutazione finora

- BUSS244Documento4 pagineBUSS244yugrig01Nessuna valutazione finora

- IE444 Syllabus - Spring 2013Documento3 pagineIE444 Syllabus - Spring 2013Mohammed Al-baitiNessuna valutazione finora

- IE444 Syllabus - Spring 2013Documento3 pagineIE444 Syllabus - Spring 2013Mohammed Al-baitiNessuna valutazione finora

- ECON 007 Course OutlineDocumento4 pagineECON 007 Course OutlineLê Chấn PhongNessuna valutazione finora

- UT Dallas Syllabus For Aim6343.0g1.08s Taught by Mary Beth Goodrich (Goodrich)Documento20 pagineUT Dallas Syllabus For Aim6343.0g1.08s Taught by Mary Beth Goodrich (Goodrich)UT Dallas Provost's Technology GroupNessuna valutazione finora

- Indian Institute of Management Kozhikode Post Graduate Programme in ManagementDocumento4 pagineIndian Institute of Management Kozhikode Post Graduate Programme in ManagementRiturajPaulNessuna valutazione finora

- International Technological University: ACTN 910 Managerial AccountingDocumento7 pagineInternational Technological University: ACTN 910 Managerial AccountinggsdeeepakNessuna valutazione finora

- Updated - Cma - PGP 25 t2 Course OutlineDocumento4 pagineUpdated - Cma - PGP 25 t2 Course OutlineSwati PorwalNessuna valutazione finora

- W24 MGAB02 Course OutlineDocumento12 pagineW24 MGAB02 Course Outlineselahanna2005Nessuna valutazione finora

- Fnce203 - Tu JunDocumento4 pagineFnce203 - Tu JunYing SunNessuna valutazione finora

- ACCY 302 Syllabus - Curtis - Fall 2019 - ColorDocumento14 pagineACCY 302 Syllabus - Curtis - Fall 2019 - ColorhihadNessuna valutazione finora

- Acct 587Documento6 pagineAcct 587socalsurfyNessuna valutazione finora

- UT Dallas Syllabus For Aim4343.501.07f Taught by Ramachandran Natarajan (Nataraj)Documento9 pagineUT Dallas Syllabus For Aim4343.501.07f Taught by Ramachandran Natarajan (Nataraj)UT Dallas Provost's Technology GroupNessuna valutazione finora

- Jaipuria Institute of Management PGDM Trimester Ii Academic Year 2019-20Documento9 pagineJaipuria Institute of Management PGDM Trimester Ii Academic Year 2019-20Sanjana SinghNessuna valutazione finora

- Ais Auditing Adm4346aDocumento16 pagineAis Auditing Adm4346aArienNessuna valutazione finora

- ACCTG222Documento4 pagineACCTG222SyedAshirBukhariNessuna valutazione finora

- HLT7036 Research Methods Portfolio Assessment Brief 22-23Documento6 pagineHLT7036 Research Methods Portfolio Assessment Brief 22-23Saba MalikNessuna valutazione finora

- FINA 3710-91 CO F21 Abdool - Version2Documento4 pagineFINA 3710-91 CO F21 Abdool - Version2Imran AbdoolNessuna valutazione finora

- School of Business & Economics MBA & EMBA ProgramsDocumento3 pagineSchool of Business & Economics MBA & EMBA ProgramsNabila Nawsaba Chowdhury 1935327060Nessuna valutazione finora

- 294 Managerial Accounting - COURSE OUTLINEDocumento5 pagine294 Managerial Accounting - COURSE OUTLINEsilenteyes100% (1)

- Course Outline Cost AccountingDocumento7 pagineCourse Outline Cost AccountingBilal ShahidNessuna valutazione finora

- Stern - Valuation SyllabusDocumento7 pagineStern - Valuation SyllabusBat ManNessuna valutazione finora

- UT Dallas Syllabus For Opre6302.mbc.09s Taught by Divakar Rajamani (dxr020100)Documento6 pagineUT Dallas Syllabus For Opre6302.mbc.09s Taught by Divakar Rajamani (dxr020100)UT Dallas Provost's Technology GroupNessuna valutazione finora

- Ahore Chool OF Conomics: Cost Accounting (ACC-302)Documento8 pagineAhore Chool OF Conomics: Cost Accounting (ACC-302)he20003009Nessuna valutazione finora

- UT Dallas Syllabus For Aim6202.091.10f Taught by Zhonglan Dai (zxd051000)Documento6 pagineUT Dallas Syllabus For Aim6202.091.10f Taught by Zhonglan Dai (zxd051000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- Compben Syllabus2Documento5 pagineCompben Syllabus2Edgar L. AlbiaNessuna valutazione finora

- Course Outline Aacsb Mba 611 Management AccountingDocumento6 pagineCourse Outline Aacsb Mba 611 Management AccountingNishant TripathiNessuna valutazione finora

- Syllabus - FSA - Fall 2020 - Section 004Documento7 pagineSyllabus - FSA - Fall 2020 - Section 004RanjeetaTiwariNessuna valutazione finora

- Financial Planning & Analysis (Ferri) SU2016Documento16 pagineFinancial Planning & Analysis (Ferri) SU2016darwin120% (1)

- CUHK Business School - The Chinese University of Hong Kong DSME4020AB Decision Modeling and Analytics (First Term, 2018-2019)Documento2 pagineCUHK Business School - The Chinese University of Hong Kong DSME4020AB Decision Modeling and Analytics (First Term, 2018-2019)Wing Hei TongNessuna valutazione finora

- UT Dallas Syllabus For Aim4336.521 06u Taught by Oktay Urcan (Oxu022000)Documento7 pagineUT Dallas Syllabus For Aim4336.521 06u Taught by Oktay Urcan (Oxu022000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- School of Business BUSI0036ABC - Quantitative Analysis For Business Decisions IDocumento4 pagineSchool of Business BUSI0036ABC - Quantitative Analysis For Business Decisions IKwok Chun Piu KennyNessuna valutazione finora

- UT Dallas Syllabus For Aim6343.0g1.08f Taught by Mary Beth Goodrich (Goodrich)Documento21 pagineUT Dallas Syllabus For Aim6343.0g1.08f Taught by Mary Beth Goodrich (Goodrich)UT Dallas Provost's Technology GroupNessuna valutazione finora

- Fin6350 SyllabusF21Documento4 pagineFin6350 SyllabusF21so_levictorNessuna valutazione finora

- CAE 10 CG Strategic Cost ManagementDocumento23 pagineCAE 10 CG Strategic Cost ManagementAmie Jane MirandaNessuna valutazione finora

- Act 474 PDFDocumento8 pagineAct 474 PDFAlex ChanNessuna valutazione finora

- UT Dallas Syllabus For Aim6341.0g1.08f Taught by Mary Beth Goodrich (Goodrich)Documento21 pagineUT Dallas Syllabus For Aim6341.0g1.08f Taught by Mary Beth Goodrich (Goodrich)UT Dallas Provost's Technology GroupNessuna valutazione finora

- Syllabus 5161 MasterDocumento13 pagineSyllabus 5161 Masterhsnpdr365Nessuna valutazione finora

- Opim101 - Low Chee SengDocumento3 pagineOpim101 - Low Chee SengKelvin Lim Wei LiangNessuna valutazione finora

- Business Statistics Course OutlineDocumento9 pagineBusiness Statistics Course OutlineShehnum MoazzamNessuna valutazione finora

- UT Dallas Syllabus For Aim4336.501.07s Taught by Oktay Urcan (Oxu022000)Documento7 pagineUT Dallas Syllabus For Aim4336.501.07s Taught by Oktay Urcan (Oxu022000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- VMBE2014 Managerial Economics Unit Guide Sept2019Documento12 pagineVMBE2014 Managerial Economics Unit Guide Sept2019Prateek GehlotNessuna valutazione finora

- Acc 3202-Syllabus Fall 2019Documento5 pagineAcc 3202-Syllabus Fall 2019Noushin ChowdhuryNessuna valutazione finora

- Course Outline Management AccountingDocumento9 pagineCourse Outline Management AccountingFarah YasserNessuna valutazione finora

- School of Business and Economics Department of Accounting & FinanceDocumento4 pagineSchool of Business and Economics Department of Accounting & FinanceRageeb Kibria GohinNessuna valutazione finora

- Act 360 Course Outline Summer19Documento4 pagineAct 360 Course Outline Summer19Ashak Anowar MahiNessuna valutazione finora

- HRMN4005Documento12 pagineHRMN4005mae ctNessuna valutazione finora

- UT Dallas Syllabus For Opre6302.mbc.10s Taught by Divakar Rajamani (dxr020100)Documento6 pagineUT Dallas Syllabus For Opre6302.mbc.10s Taught by Divakar Rajamani (dxr020100)UT Dallas Provost's Technology GroupNessuna valutazione finora

- Financial Statement AnalysisDocumento4 pagineFinancial Statement Analysisztanga7@yahoo.comNessuna valutazione finora

- Naveen Jindal School of ManagementDocumento9 pagineNaveen Jindal School of ManagementRanjeetaTiwariNessuna valutazione finora

- UT Dallas Syllabus For Huas6391.501.10f Taught by Greg Metz (Glmetz)Documento7 pagineUT Dallas Syllabus For Huas6391.501.10f Taught by Greg Metz (Glmetz)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For Mech4110.101.11f Taught by Mario Rotea (Mar091000)Documento4 pagineUT Dallas Syllabus For Mech4110.101.11f Taught by Mario Rotea (Mar091000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For hdcd6315.001.11f Taught by Cherryl Bryant (clb015400)Documento6 pagineUT Dallas Syllabus For hdcd6315.001.11f Taught by Cherryl Bryant (clb015400)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For cs1336.501.11f Taught by Feliks Kluzniak (fxk083000)Documento8 pagineUT Dallas Syllabus For cs1336.501.11f Taught by Feliks Kluzniak (fxk083000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For Stat1342.001.11f Taught by Qiongxia Song (qxs102020)Documento6 pagineUT Dallas Syllabus For Stat1342.001.11f Taught by Qiongxia Song (qxs102020)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For cs6322.501.11f Taught by Sanda Harabagiu (Sanda)Documento6 pagineUT Dallas Syllabus For cs6322.501.11f Taught by Sanda Harabagiu (Sanda)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For cs6320.001.11f Taught by Sanda Harabagiu (Sanda)Documento5 pagineUT Dallas Syllabus For cs6320.001.11f Taught by Sanda Harabagiu (Sanda)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For Opre6335.001.11f Taught by Alain Bensoussan (Axb046100)Documento7 pagineUT Dallas Syllabus For Opre6335.001.11f Taught by Alain Bensoussan (Axb046100)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For cs6390.001.11f Taught by Kamil Sarac (kxs028100)Documento5 pagineUT Dallas Syllabus For cs6390.001.11f Taught by Kamil Sarac (kxs028100)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)Documento8 pagineUT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)Documento8 pagineUT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For Math4301.001.11f Taught by Wieslaw Krawcewicz (wzk091000)Documento7 pagineUT Dallas Syllabus For Math4301.001.11f Taught by Wieslaw Krawcewicz (wzk091000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For Mech3120.102.11f Taught by Fatemeh Hassanipour (fxh091000)Documento4 pagineUT Dallas Syllabus For Mech3120.102.11f Taught by Fatemeh Hassanipour (fxh091000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- UT Dallas Syllabus For cs3341.001.11f Taught by Pankaj Choudhary (pkc022000)Documento7 pagineUT Dallas Syllabus For cs3341.001.11f Taught by Pankaj Choudhary (pkc022000)UT Dallas Provost's Technology GroupNessuna valutazione finora

- Language 1 Module 3 Performance Task 1.1 (October 6 and 7 Day 1 and 2)Documento18 pagineLanguage 1 Module 3 Performance Task 1.1 (October 6 and 7 Day 1 and 2)Jake Floyd G. FabianNessuna valutazione finora

- Sociolinguistic Investigation of Language and EducationDocumento29 pagineSociolinguistic Investigation of Language and EducationMarciano Ken HermieNessuna valutazione finora

- What Makes A Helpful Online Review? A Study of Customer Reviews OnDocumento17 pagineWhat Makes A Helpful Online Review? A Study of Customer Reviews OnBreak HabitNessuna valutazione finora

- Writing, Embodiment, Deferral: Merleau-Ponty and Derrida On: The Origin of GeometryDocumento22 pagineWriting, Embodiment, Deferral: Merleau-Ponty and Derrida On: The Origin of GeometrymaximumfishNessuna valutazione finora

- Human Resource Management StrategyDocumento41 pagineHuman Resource Management StrategymmzeeshanNessuna valutazione finora

- Managing A Phone Call: Lingua House Lingua HouseDocumento2 pagineManaging A Phone Call: Lingua House Lingua HouseSarah GordonNessuna valutazione finora

- Work Ethics of The Proficient Teachers: Basis For A District Learning Action Cell (LAC) PlanDocumento11 pagineWork Ethics of The Proficient Teachers: Basis For A District Learning Action Cell (LAC) PlanJohn Giles Jr.Nessuna valutazione finora

- Displaced Accents and PolyrhythmsDocumento2 pagineDisplaced Accents and PolyrhythmsJéssicaReisNessuna valutazione finora

- Guidance Action Plan 2012Documento7 pagineGuidance Action Plan 2012Nyssa Diaz75% (4)

- Kaizen Habits by Jordan ArbuckleDocumento156 pagineKaizen Habits by Jordan ArbuckleAnonymous wu6RXuNessuna valutazione finora

- Module 9 Assessment of Learning 1Documento6 pagineModule 9 Assessment of Learning 1Angeline PonteresNessuna valutazione finora

- Attendance Monitoring System and Information Dissemination With Sms Dissemination"Documento4 pagineAttendance Monitoring System and Information Dissemination With Sms Dissemination"Emmanuel Baccaray100% (1)

- Unit 6 - WritingDocumento8 pagineUnit 6 - Writingtoannv8187Nessuna valutazione finora

- Communicative and Strategic Approaches For Organizing of Independent Work of Students in English Language LessonsDocumento3 pagineCommunicative and Strategic Approaches For Organizing of Independent Work of Students in English Language LessonsAcademic JournalNessuna valutazione finora

- Evidence-Based PracticesDocumento8 pagineEvidence-Based Practicesapi-525863960Nessuna valutazione finora

- The Lexical ApproachDocumento63 pagineThe Lexical Approachfru123100% (2)

- Classification With WEKA: Data Mining Lab 2Documento8 pagineClassification With WEKA: Data Mining Lab 2haristimuñoNessuna valutazione finora

- 4-5-6 Cdi13Documento84 pagine4-5-6 Cdi13Novelyn LumboyNessuna valutazione finora

- Grade 5...Documento19 pagineGrade 5...Nurkyz ZairovaNessuna valutazione finora

- MIL 1Q ExaminationDocumento4 pagineMIL 1Q ExaminationMaria Rizza LuchavezNessuna valutazione finora

- (DR Kate Pahl, Ms Jennifer Rowsell) Literacy and EDocumento193 pagine(DR Kate Pahl, Ms Jennifer Rowsell) Literacy and EDesi SurlitasariNessuna valutazione finora

- ABM - AE12 Ia D 9.1Documento2 pagineABM - AE12 Ia D 9.1Glaiza Dalayoan FloresNessuna valutazione finora

- Dap PaperDocumento7 pagineDap Paperapi-339989449Nessuna valutazione finora

- Interview QuestionsDocumento5 pagineInterview QuestionsCharles SavarimuthuNessuna valutazione finora

- Reciprocal Teaching by Akashdeep KaurDocumento21 pagineReciprocal Teaching by Akashdeep KaurakashNessuna valutazione finora

- Winfried Nöth - Habits, Habit Change, and The Habit of Habit Change According To PeirceDocumento29 pagineWinfried Nöth - Habits, Habit Change, and The Habit of Habit Change According To PeircepastorisilliNessuna valutazione finora

- Most 50 Important Interview QuestionsDocumento6 pagineMost 50 Important Interview Questionsengjuve0% (1)

- Ethics - Module 3Documento20 pagineEthics - Module 3Dale CalicaNessuna valutazione finora

- "Pro Patria Et Jure: For Country and Law", MLQU Alumna of 1962 From The School of Law, AttyDocumento2 pagine"Pro Patria Et Jure: For Country and Law", MLQU Alumna of 1962 From The School of Law, Attyichu73Nessuna valutazione finora

- Extensive ReadingDocumento8 pagineExtensive ReadingRia WiniamsyahNessuna valutazione finora